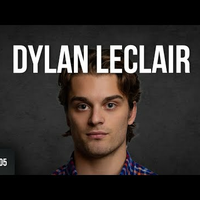

College Dropout, Student of #Bitcoin.

On-Chain Analytics & Financial Markets at @BitcoinMagazine.

Co-Founder http://21stParadigm.com.

20.

Podcast episode

May 11, 2021

Video

Dec 1, 2022

Podcast episode

Dec 2, 2021

Podcast episode

Jan 13, 2023

Podcast episode

Dec 6, 2022

Podcast episode

Apr 11, 2022