Thread

What the hell is going on in financial markets?

A thread on stocks & bonds, volatility, and #bitcoin.

🧵🧵

A thread on stocks & bonds, volatility, and #bitcoin.

🧵🧵

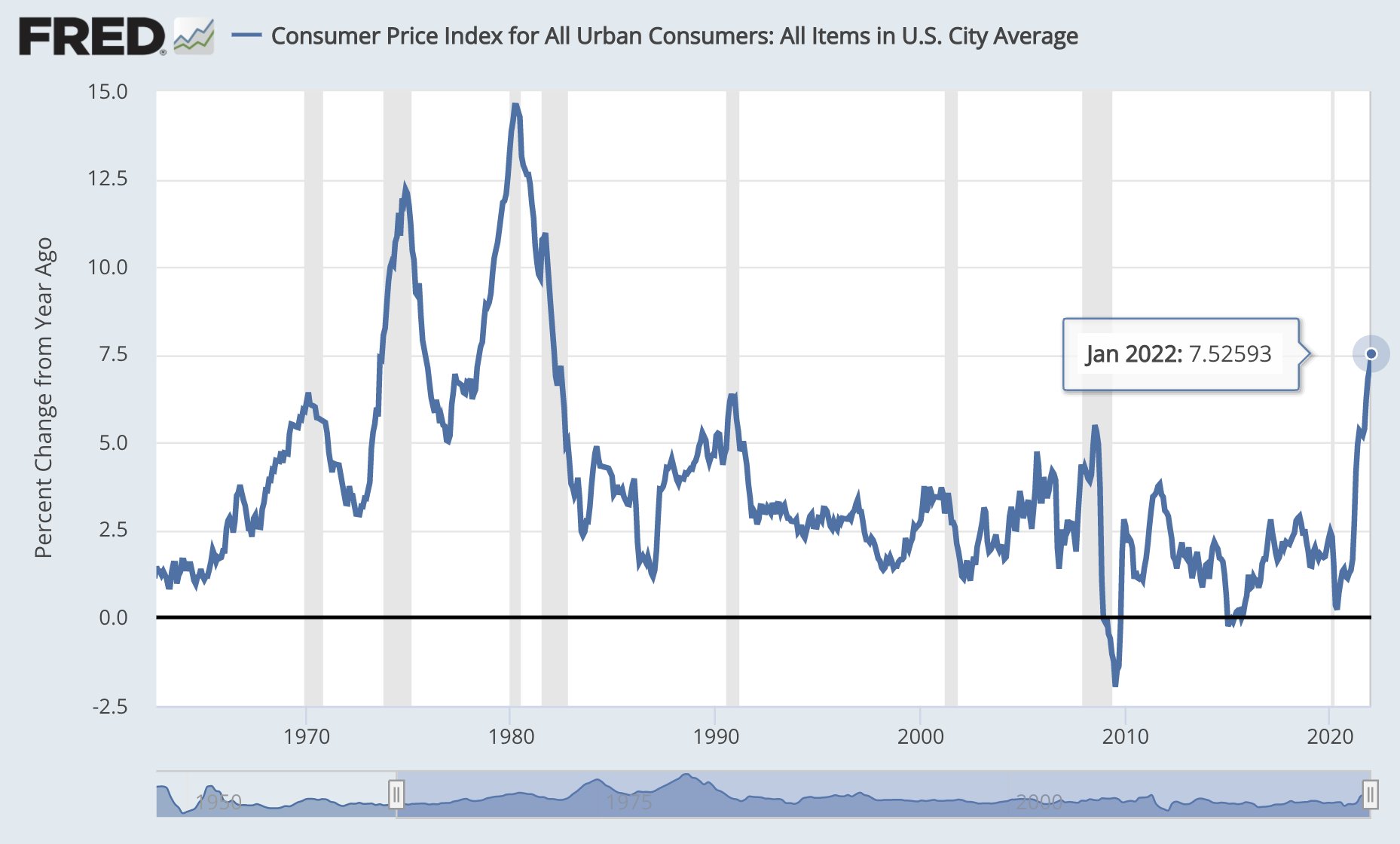

You know the story:

Year over year consumer price inflation is at its highest level since the mid 1970s at a time when the Fed Funds rate is still at 0%.

The Fed's aggressive easing policies amidst rising inflation directly incentivized the largest debt binge in history.

1/

Year over year consumer price inflation is at its highest level since the mid 1970s at a time when the Fed Funds rate is still at 0%.

The Fed's aggressive easing policies amidst rising inflation directly incentivized the largest debt binge in history.

1/

Fiscal + Monetary Policy in tandem to create a global demand shock while supply chains were in shambles due to economic lockdowns created a massive inflationary impulse.

Occam's Razor.

More money was chasing the same amount (or even less) goods = prices increase.

2/

Occam's Razor.

More money was chasing the same amount (or even less) goods = prices increase.

2/

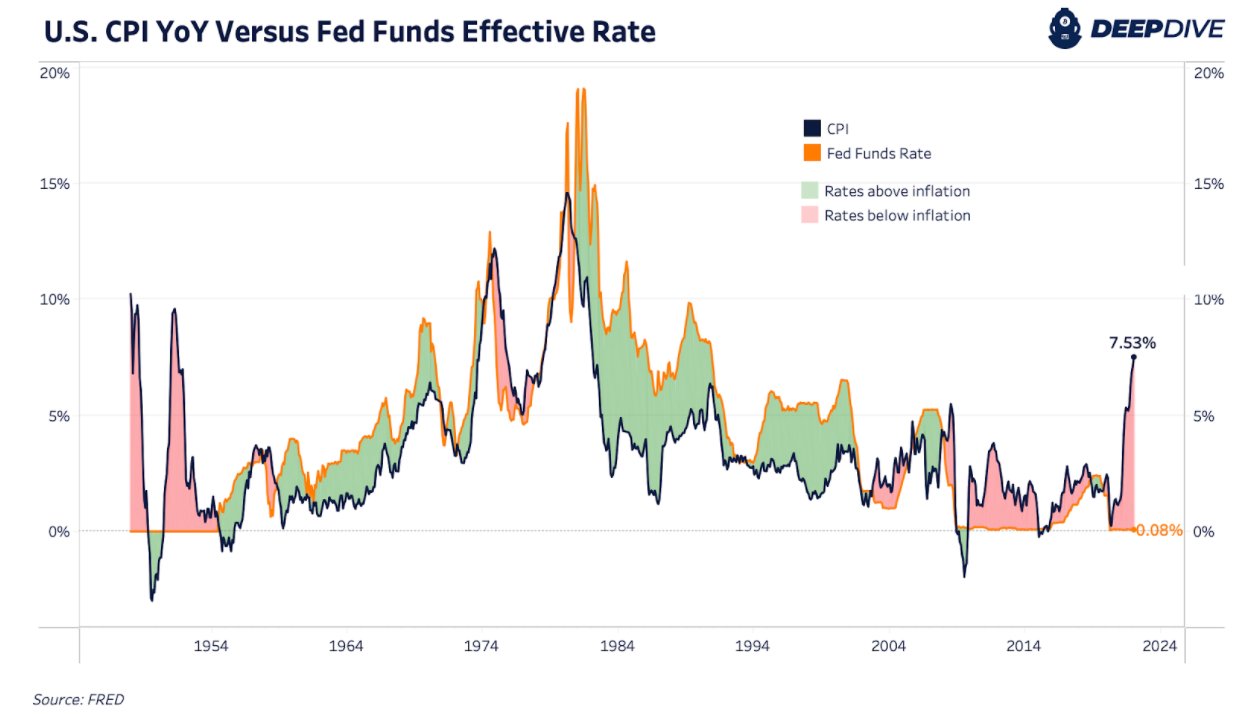

Here is the history of CPI and the Fed Funds Rate, with red showing periods of negative real yields.

What are the second order effects of over a decade of negative real yields (increasingly so following 2020)?

3/

What are the second order effects of over a decade of negative real yields (increasingly so following 2020)?

3/

The everything bubble, where $ is a liability, debt is an asset, & the valuations of everything go to the moon as risk on is encoded into every investor.

Neg real yields transfer purchasing power from creditors to debtors - debtors use cheap capital to invest in more assets.

4/

Neg real yields transfer purchasing power from creditors to debtors - debtors use cheap capital to invest in more assets.

4/

So where do we find ourselves now? Risk assets have been selling off since late November, with the Nasdaq 17% off the high.

But it's not just equities, credit is selling off, bitcoin is 40% off the highs, and real estate markets are beginning to turn.

5/

But it's not just equities, credit is selling off, bitcoin is 40% off the highs, and real estate markets are beginning to turn.

5/

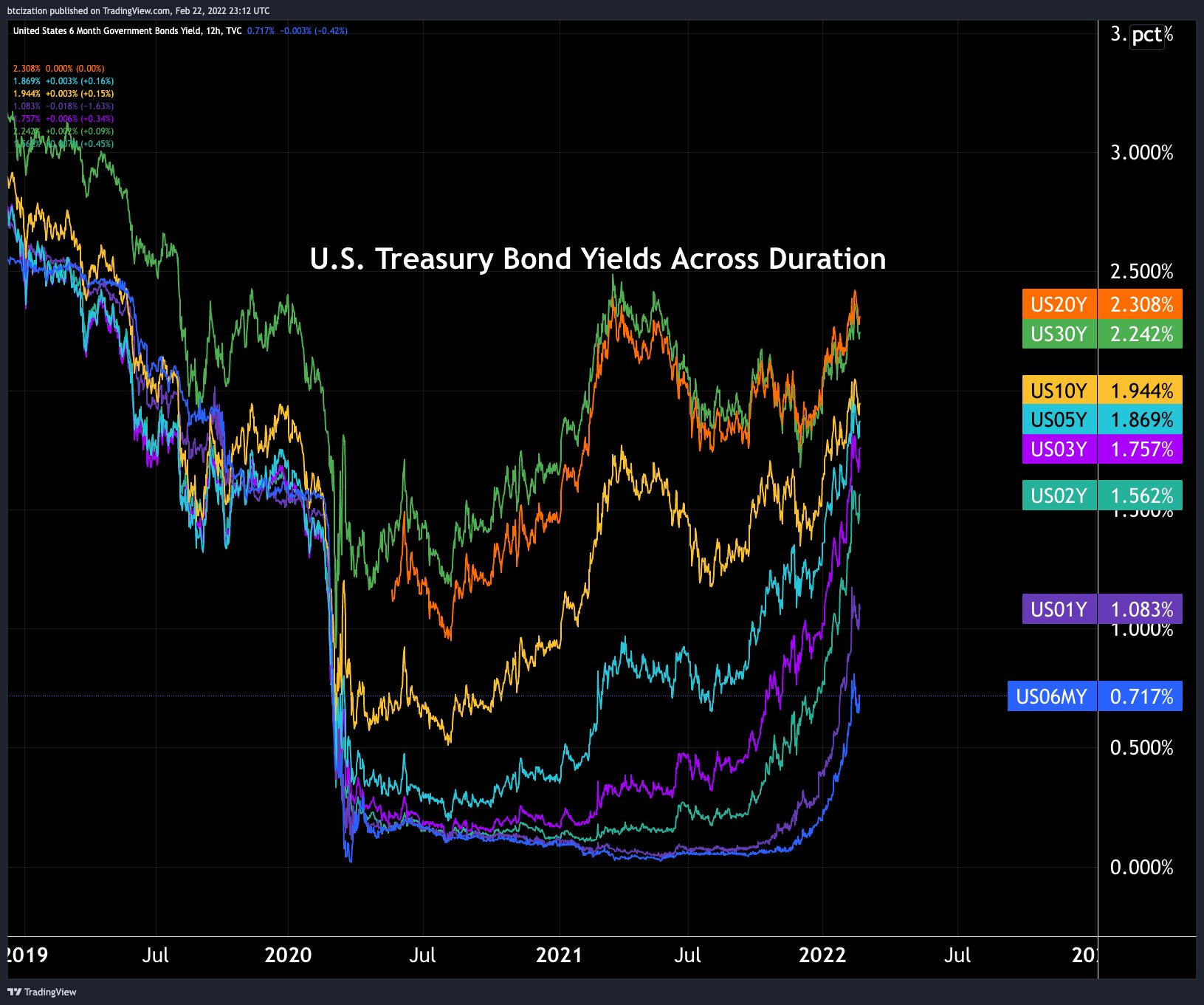

While equities get all the attention, the real driving force globally is fixed income.

Since Nov yields have been rising dramatically - bond investors begun to realize that w/ inflation at 40 year highs, they are sitting in contracts programmed to decline in purchasing power

6/

Since Nov yields have been rising dramatically - bond investors begun to realize that w/ inflation at 40 year highs, they are sitting in contracts programmed to decline in purchasing power

6/

Bonds yielded their worst returns in 40 years in 2021, but the underperformance shouldn't surprise you.

In 2011 the IMF released a paper titled: "The Liquidation of Government Debt"

The paper outlines how govts can erode debt by capping rates w/ a "steady dose of inflation"

7/

In 2011 the IMF released a paper titled: "The Liquidation of Government Debt"

The paper outlines how govts can erode debt by capping rates w/ a "steady dose of inflation"

7/

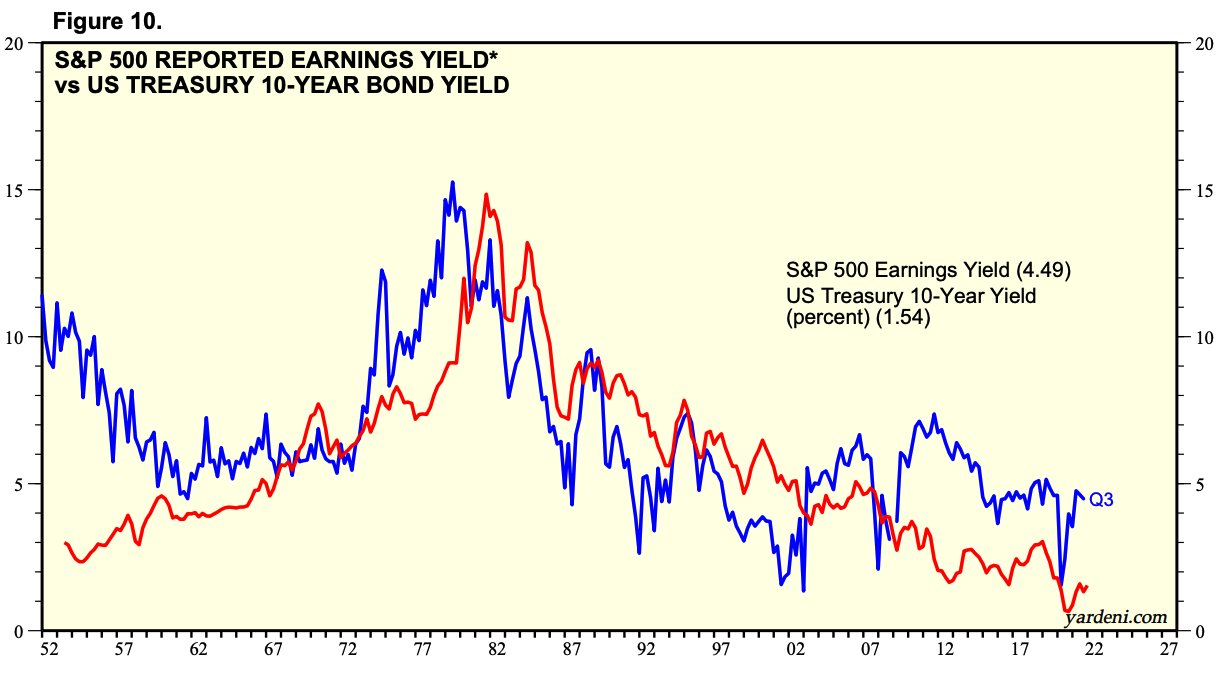

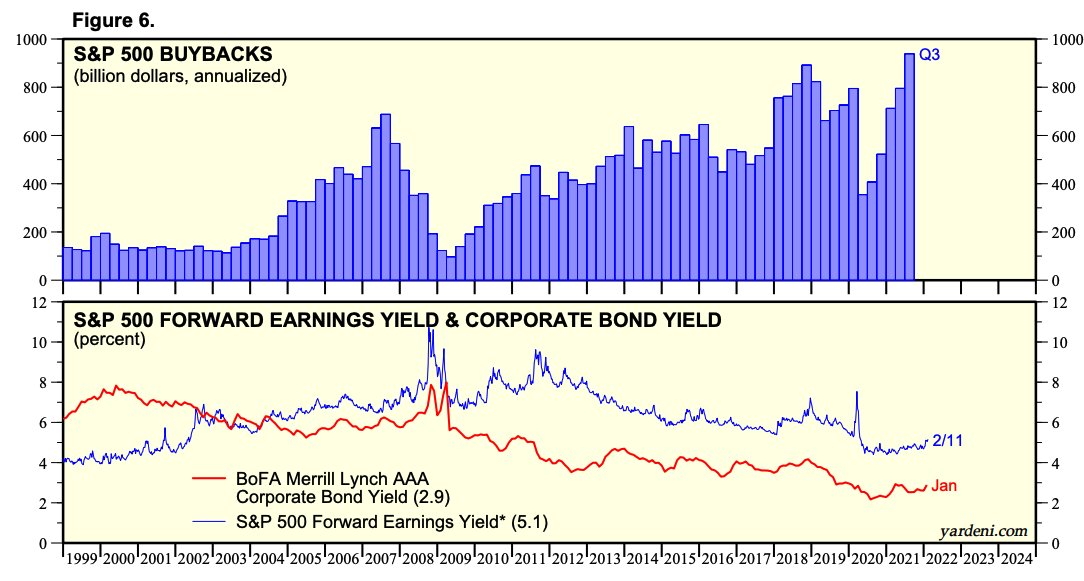

Rising rates (even if still negative in real terms) has broad implications for financial markets; among the largest is plummeting equity market valuations.

Displayed below is $SPX earnings yield (inverse of P/E ratio). Rising rates = Lower earnings multiples = stocks down

8/

Displayed below is $SPX earnings yield (inverse of P/E ratio). Rising rates = Lower earnings multiples = stocks down

8/

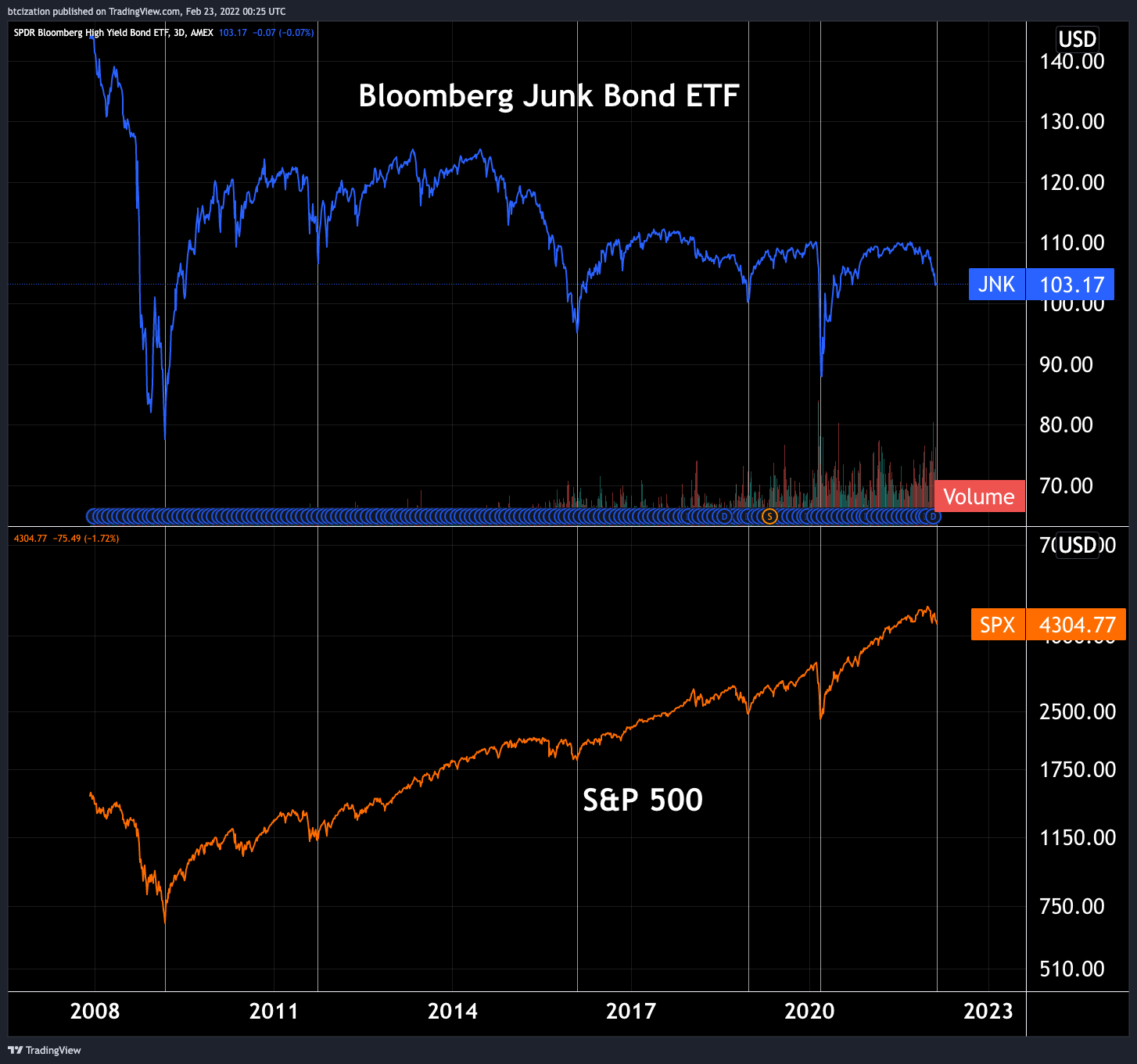

Another implication of rising rates is financing costs for corporates. Here is $JNK, an index of high yield corporate bonds and $SPX since 2008.

Junk bonds selling off = higher financing costs for corporates = lower earnings and greater insolvency risk

9/

Junk bonds selling off = higher financing costs for corporates = lower earnings and greater insolvency risk

9/

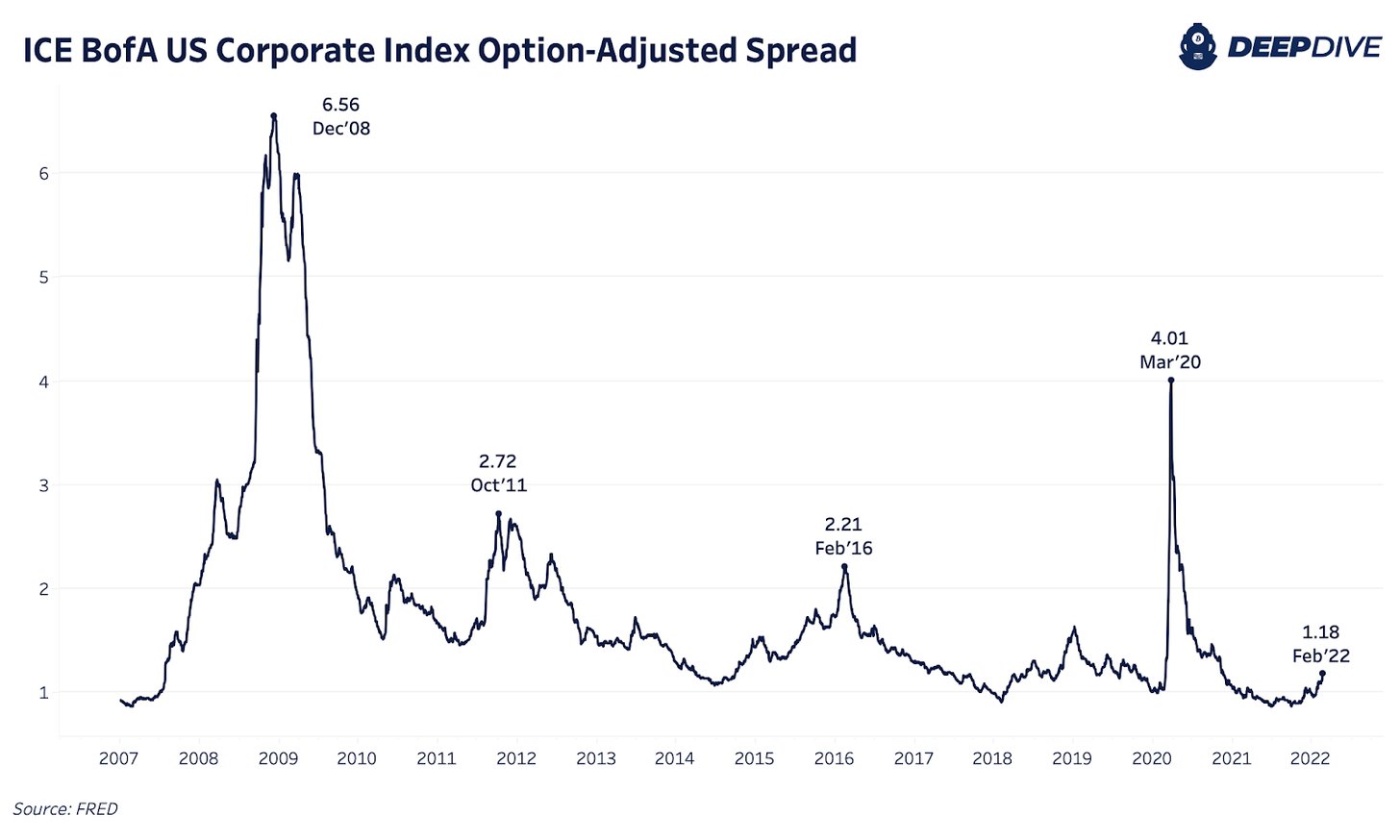

Here's investment grade corporate credit spreads (yield difference relative to treasuries).

You see how financing costs are rising relative to treasuries at the same time that yields on treasuries are aggressively rising?

Rising credit spreads often is reflexive to upside

10/

You see how financing costs are rising relative to treasuries at the same time that yields on treasuries are aggressively rising?

Rising credit spreads often is reflexive to upside

10/

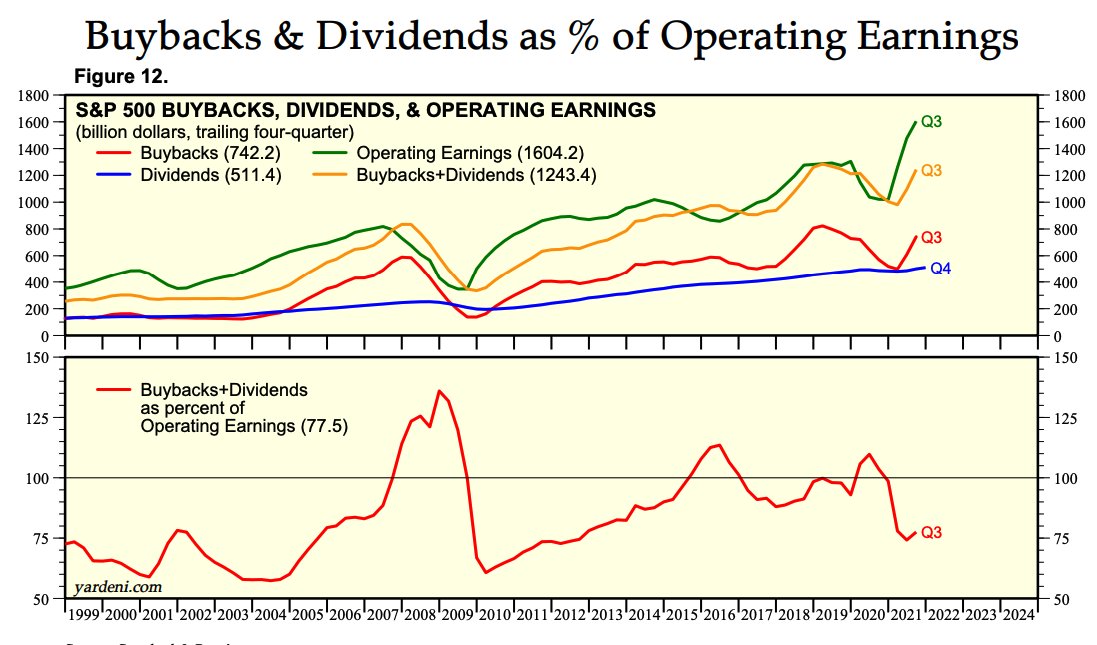

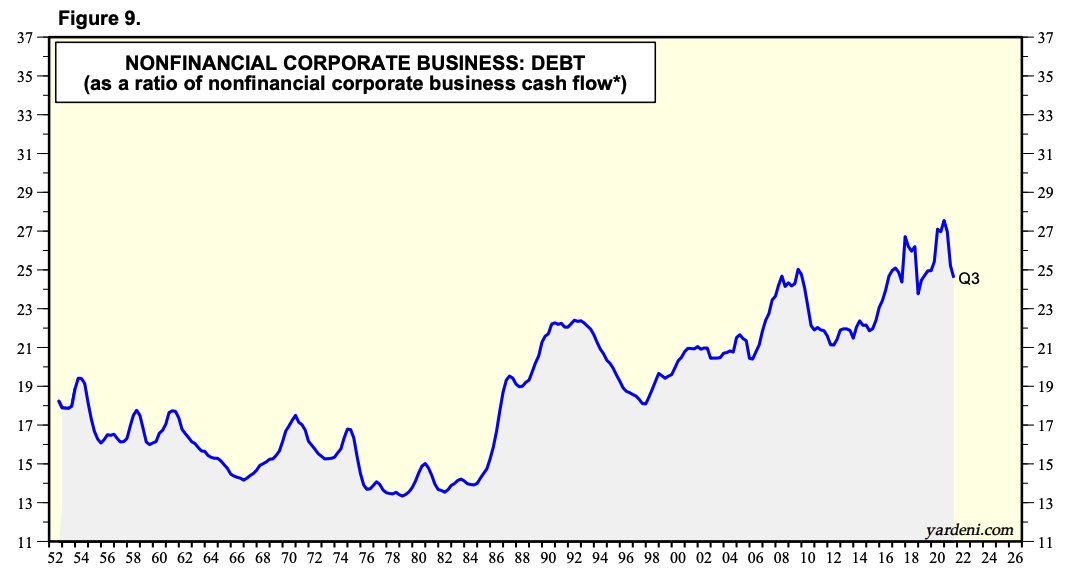

Remember the incentive of negative real yields? Lever up, and that's what corporates did in the 2010s.

Corps used easy credit conditions to engorge in a historic debt binge while buybacks & divis as a % of earnings surpassed 100% on multiple occasions over the past decade.

11/

Corps used easy credit conditions to engorge in a historic debt binge while buybacks & divis as a % of earnings surpassed 100% on multiple occasions over the past decade.

11/

Why invest in a business operations or R&D when you can use historically cheap money to boost your stock price?

CFOs that didn't engage in financial engineering were scrapped by shareholders for ones that did.

12/

CFOs that didn't engage in financial engineering were scrapped by shareholders for ones that did.

12/

This has led corporate debt relative to cashflow to ATHs.

So not only are equity valuations falling due to a higher discount rates but financing costs are rising with historic levels of indebtedness => A death blow.

13/

So not only are equity valuations falling due to a higher discount rates but financing costs are rising with historic levels of indebtedness => A death blow.

13/

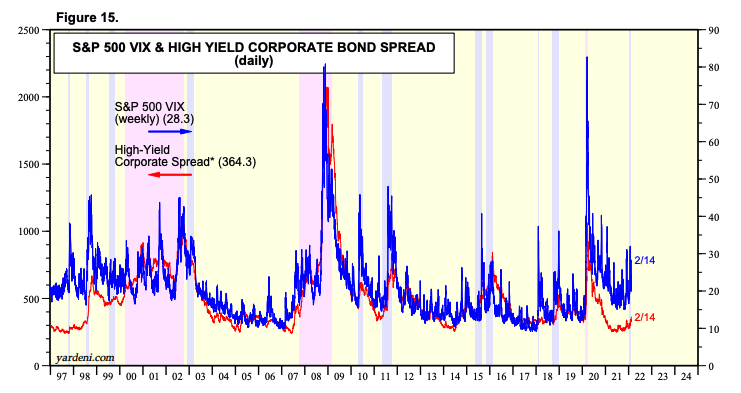

What does this all mean going forward? Volatility, and lot's of it.

Here is $VIX (S&P 500 volatility index) and high yield corporate credit spreads over time.

Market volatility (or lack thereof) is a direct result of credit market liquidity.

14/

Here is $VIX (S&P 500 volatility index) and high yield corporate credit spreads over time.

Market volatility (or lack thereof) is a direct result of credit market liquidity.

14/

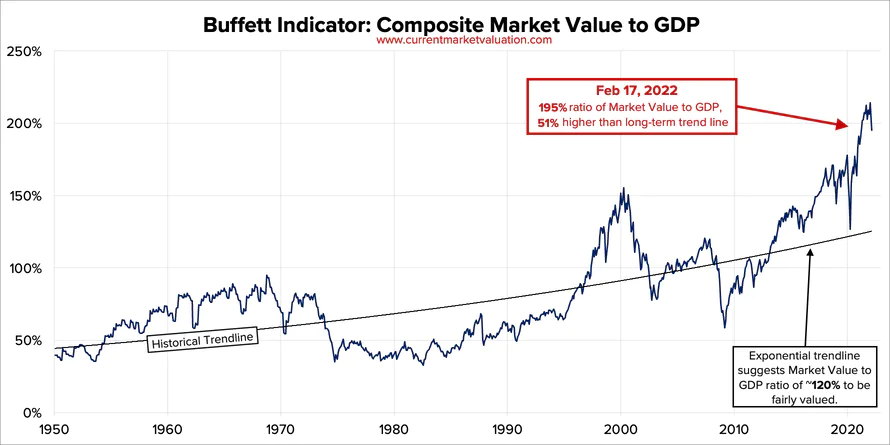

All of this is occurring while the domestic equity market in the U.S. is worth 195% of GDP, w/ all time high levels being reached in 2020

Equities were unofficially 'monetized' by investors during the past decade of neg real yields, as cash & credit become quasi liabilities

15/

Equities were unofficially 'monetized' by investors during the past decade of neg real yields, as cash & credit become quasi liabilities

15/

The Keynesian paradox is that increasing stimulus and credit expansion do not fix a debt bubble, but rather exacerbate it.

This is why it is probable that gets ugly (read: volatile) in the not distant future.

Deflationary credit contagion is closer than most think.

16/

This is why it is probable that gets ugly (read: volatile) in the not distant future.

Deflationary credit contagion is closer than most think.

16/

What's the endgame?

Like an Ouroboros, the incumbent debt based monetary system will continue to cannibalize itself.

As liquidity risk turns into solvency risk, policy makers and bankers will again turn to flooding the system with increasing amounts of (cheaper) debt.

17/

Like an Ouroboros, the incumbent debt based monetary system will continue to cannibalize itself.

As liquidity risk turns into solvency risk, policy makers and bankers will again turn to flooding the system with increasing amounts of (cheaper) debt.

17/

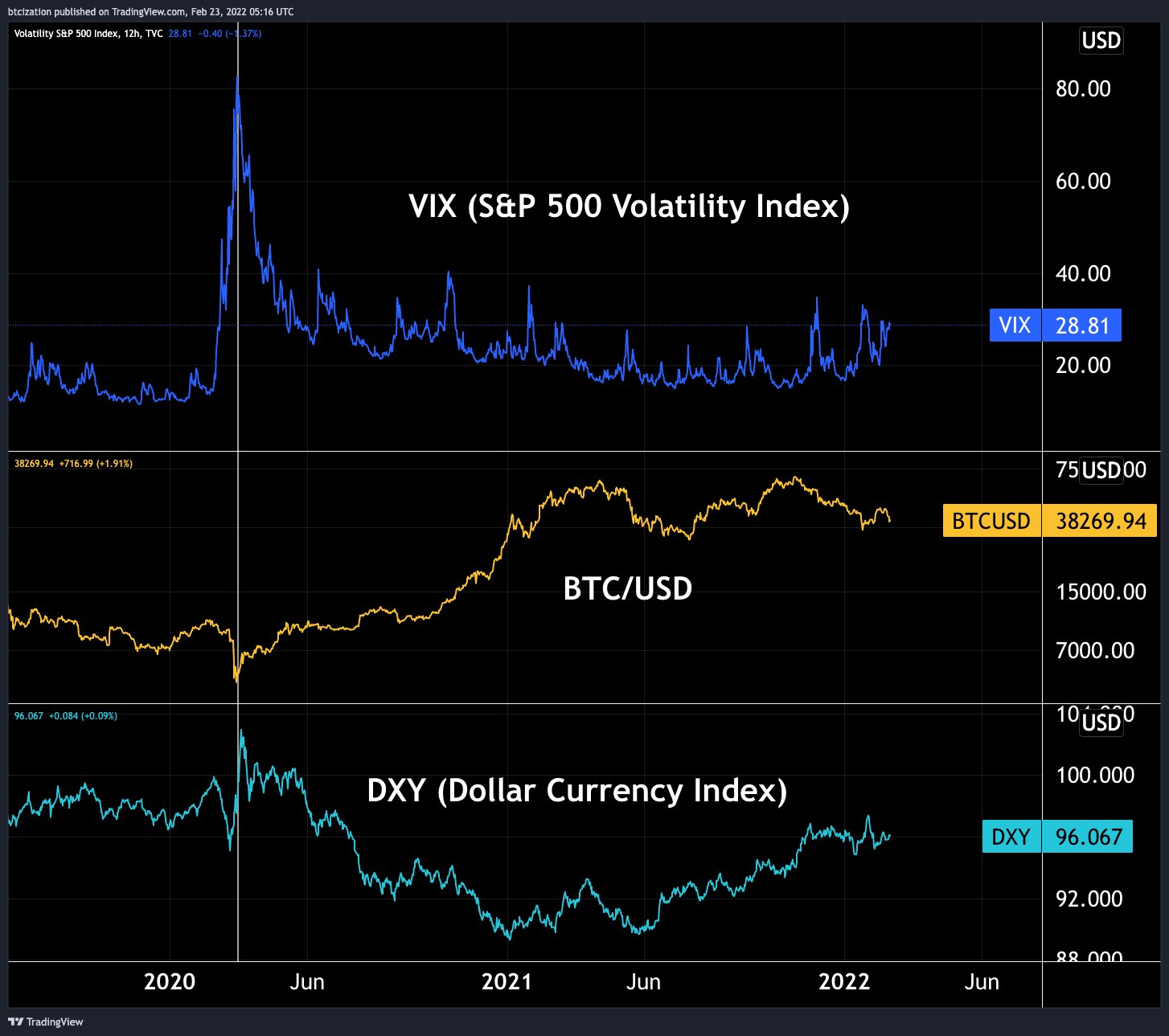

During a credit unwind does $BTC get hit?

Absolutely.

The mechanics of a credit unwind are essentially a short squeeze on the deflating (appreciating) fiat currency.

Given the USD denomination of BTC in global markets, a selloff is probable during periods of USD strength.

18/

Absolutely.

The mechanics of a credit unwind are essentially a short squeeze on the deflating (appreciating) fiat currency.

Given the USD denomination of BTC in global markets, a selloff is probable during periods of USD strength.

18/

Yet, I own quite a lot of #bitcoin, more than ever. Why?

Because in an increasingly digital world, $BTC is absolutely scarce bearer asset with native property rights inherent to the network itself.

You can't print more bitcoin. You also can't have any of mine.

19/

Because in an increasingly digital world, $BTC is absolutely scarce bearer asset with native property rights inherent to the network itself.

You can't print more bitcoin. You also can't have any of mine.

19/

The marginal production cost of BTC is trending towards infinity. Inelastic supply issuance combined with the difficulty adjustment. Most don't understand this.

Financial incentives to mine w/ lowest marginal cost energy drives prod. cost -> ♾

20/

Financial incentives to mine w/ lowest marginal cost energy drives prod. cost -> ♾

20/

Just reached max twitter thread length, so I'll call it here.

A share on this thread would be appreciated if you found any of this info valuable.

I publish The Deep with @BitcoinMagazine on the market daily, so check that out as well.

✌️✌️

deepdivebtc.substack.com/welcome

A share on this thread would be appreciated if you found any of this info valuable.

I publish The Deep with @BitcoinMagazine on the market daily, so check that out as well.

✌️✌️

deepdivebtc.substack.com/welcome

Mentions

See All

Lawrence Lepard @LawrenceLepard

·

Feb 23, 2022

Excellent thread. 👇