Thread

For those missing some context, it looks to be highly probable that Alameda/FTX has loans collateralized with FTT (FTX exchange tokens), of which they own a vast majority of the free float for.

CZ is responding by unloading all of Binance’s stake.

CZ is responding by unloading all of Binance’s stake.

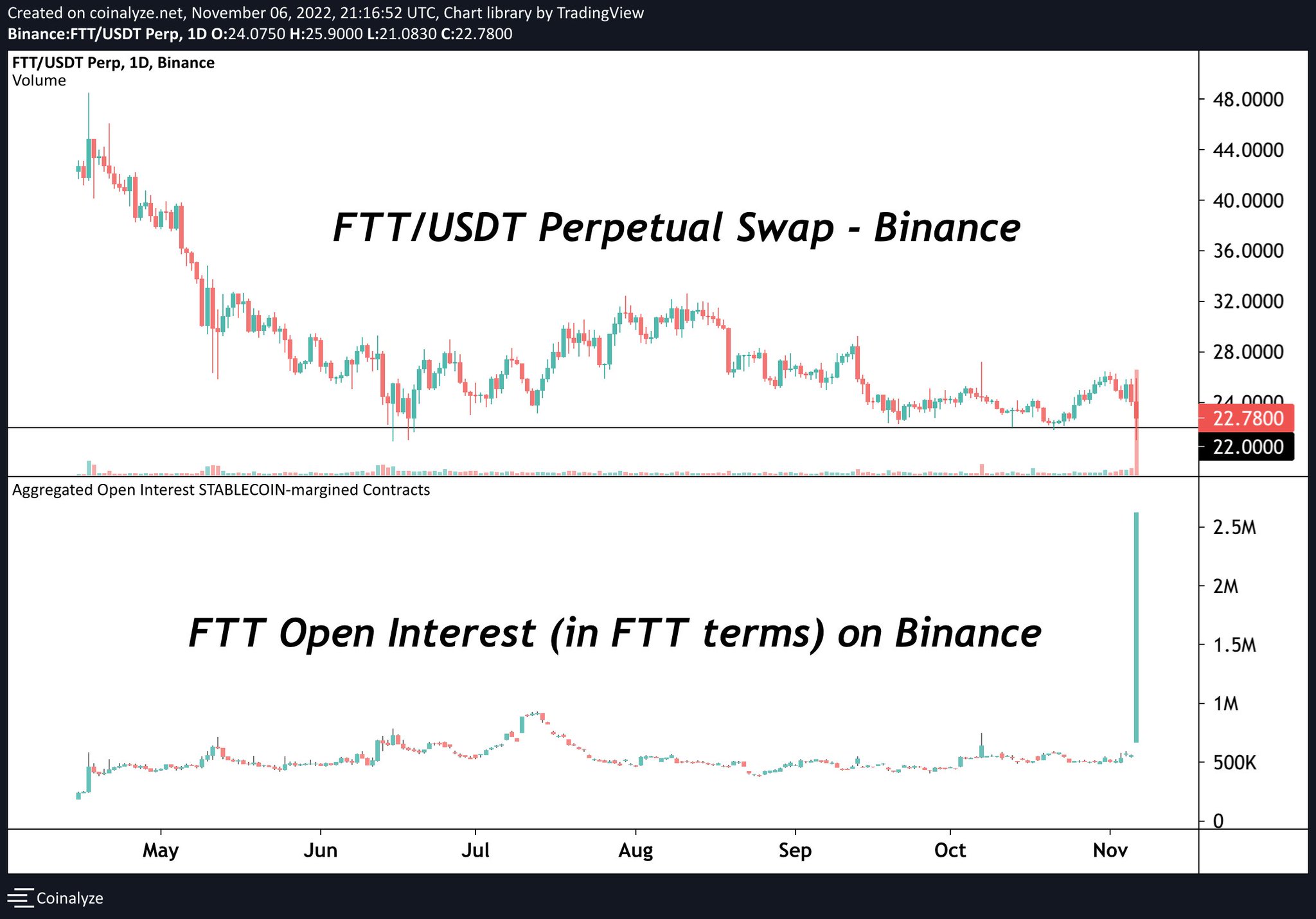

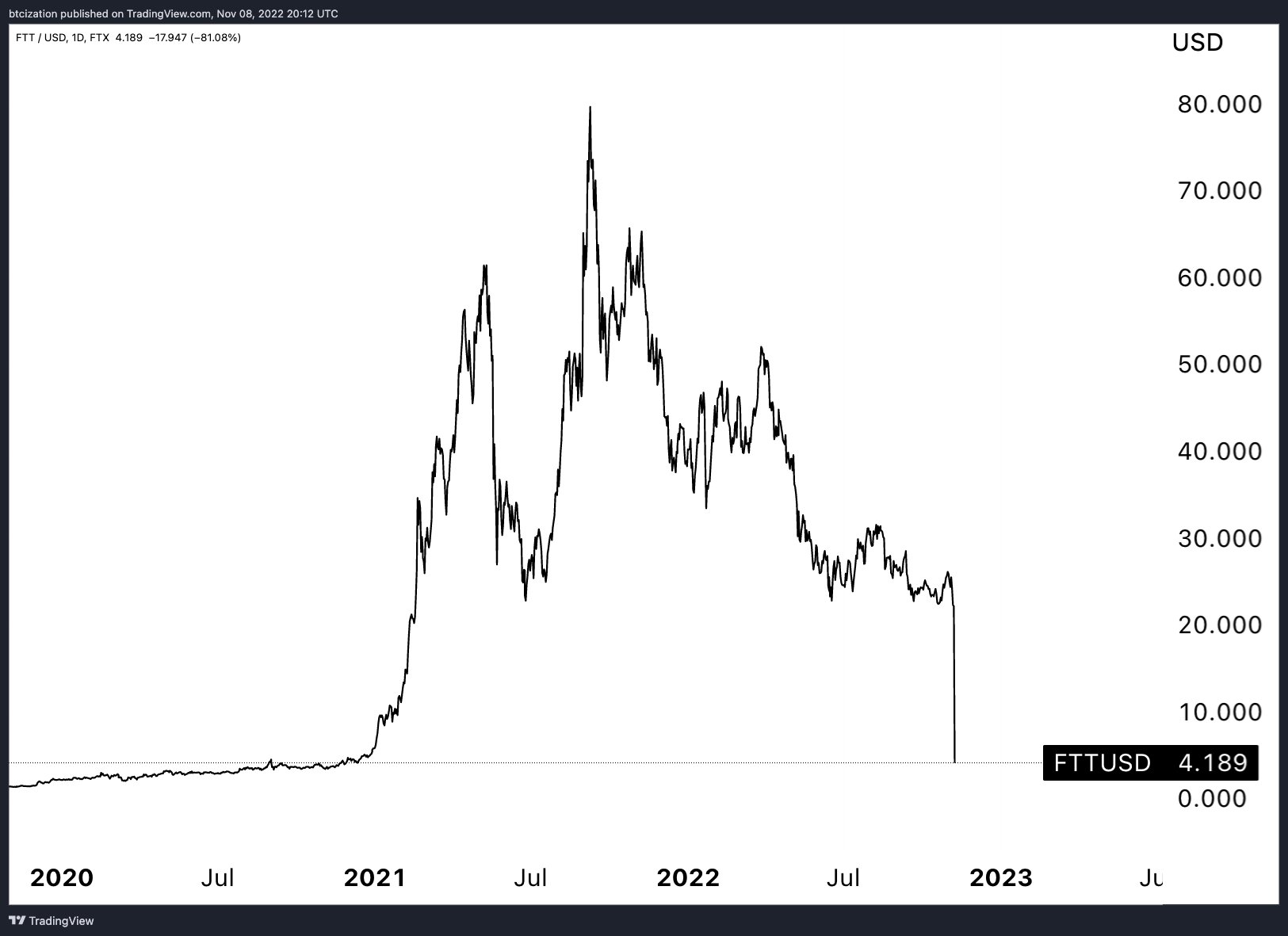

Ask yourself why Alameda has a vested interest in not letting the mark to market FTT price go any lower than $22?

You should be happy to let the price go as low as possible to buy at a discount, unless you're leveraged...

You should be happy to let the price go as low as possible to buy at a discount, unless you're leveraged...

It's almost like using your own native exchange token of which you own >50% of the circulating supply (a generous understatement) to borrow in a collateralized fashion when you are the only natural buyer and market maker is an absolutely terrible idea...

The apparent show of strength reeks of desperation.

That $22 level seems oddly specific doesn't it?

Steady lads, deploying more capital (using collateralized loans with illiquid ponzi altcoins).

That $22 level seems oddly specific doesn't it?

Steady lads, deploying more capital (using collateralized loans with illiquid ponzi altcoins).

The irony of having the ability to go to the derivatives market in an attempt to hedge your massively outsized position only to have little to no buy side liquidity because YOU served as the primary market maker...

CZ knows all it takes is fat finger market sell order or two around $22 and things gets real interesting.

We can all see the chart, and we can all clearly see the shell game show of strength to keep the market above that level...

We can all see the chart, and we can all clearly see the shell game show of strength to keep the market above that level...

I literally can't believe she tweeted out the exact $22 level 🤣🤣🤣

20 month support with nothing but air below...

20 month support with nothing but air below...

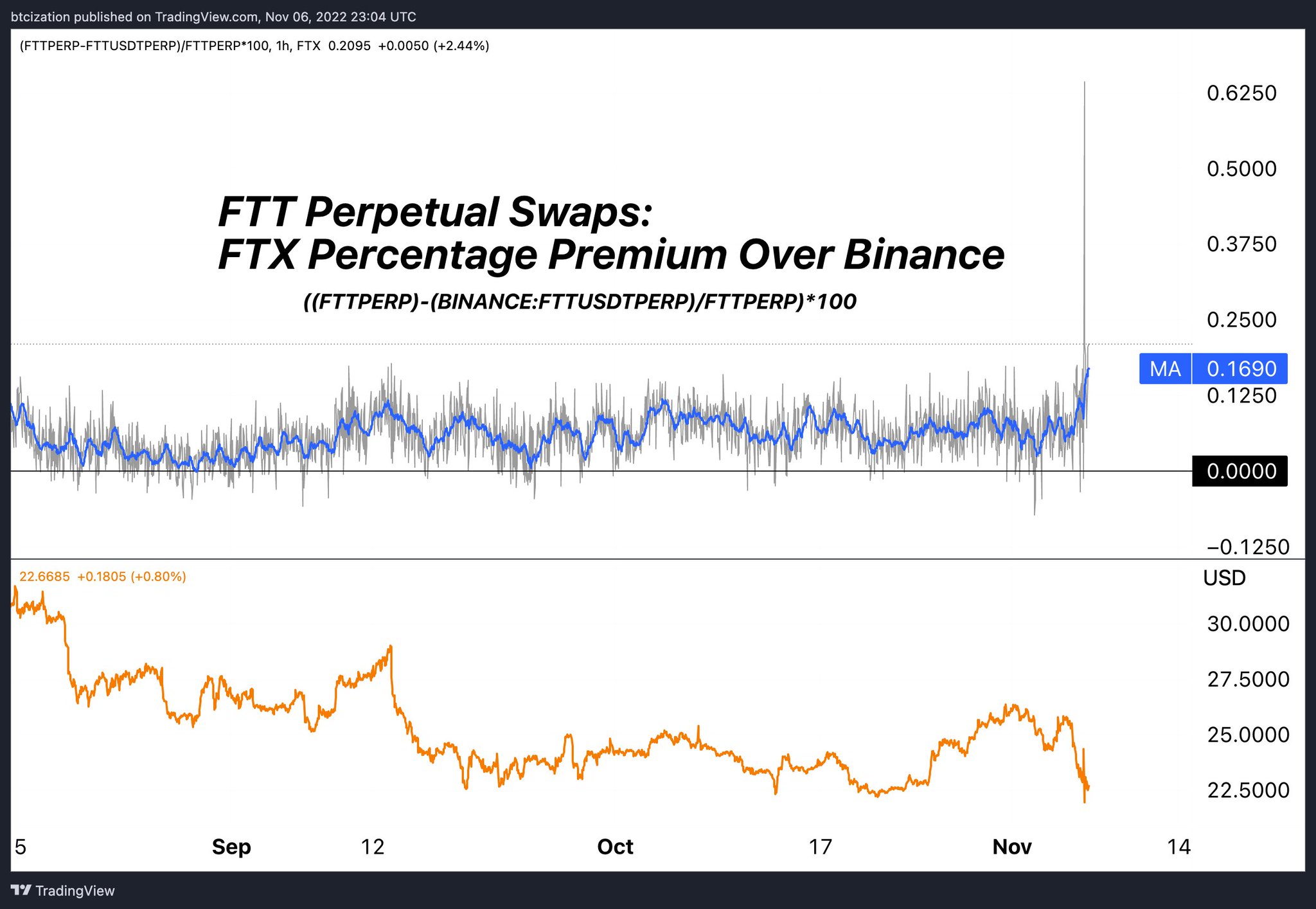

FTT perpetual futures on FTX keeps inching higher than on Binance as price sends lower...

Steady lads...

Steady lads...

What's the best case for Alameda here?

Ok, so you deploy your war chest to defend where you'd get margin called, & you're succesful. You defend against the speculative attack (shorts piling in via futures).

Now what? You own more of a worthless token with no natural buyers???

Ok, so you deploy your war chest to defend where you'd get margin called, & you're succesful. You defend against the speculative attack (shorts piling in via futures).

Now what? You own more of a worthless token with no natural buyers???

I don't doubt Alameda/FTX's ability to defend the line on their own home turf.

Alameda/FTX can attempt to cross margin lever up on their own books until they go bust.

But remember, CZ owns a decent casino himself...

Alameda/FTX can attempt to cross margin lever up on their own books until they go bust.

But remember, CZ owns a decent casino himself...

Altcoin perpetual swaps allow for weaponized financial leverage. Alameda/FTX can defend endlessly if they are the only mark to market exchange rate.

But Binance has the most deeply liquid leveraged markets in crypto, with an endless amount of degenerate speculators.

But Binance has the most deeply liquid leveraged markets in crypto, with an endless amount of degenerate speculators.

Thinking out loud, I imagine Alameda has their FTT posted as collateral with a lending desk of sorts.

They then take the ~9-10 figures of USD and can bully as the largest FTX market maker with all the proprietary data.

But how do they defend against both of:

CONTD 👇

They then take the ~9-10 figures of USD and can bully as the largest FTX market maker with all the proprietary data.

But how do they defend against both of:

CONTD 👇

1) $500m+ of spot selling from CZ.

2) Potentially hundreds of millions of short selling via speculative attack in the perpetual swap market NOT on your own native exchange.

If you are leveraged, why would you ever draw your line in the sand?

2) Potentially hundreds of millions of short selling via speculative attack in the perpetual swap market NOT on your own native exchange.

If you are leveraged, why would you ever draw your line in the sand?

Steady lads

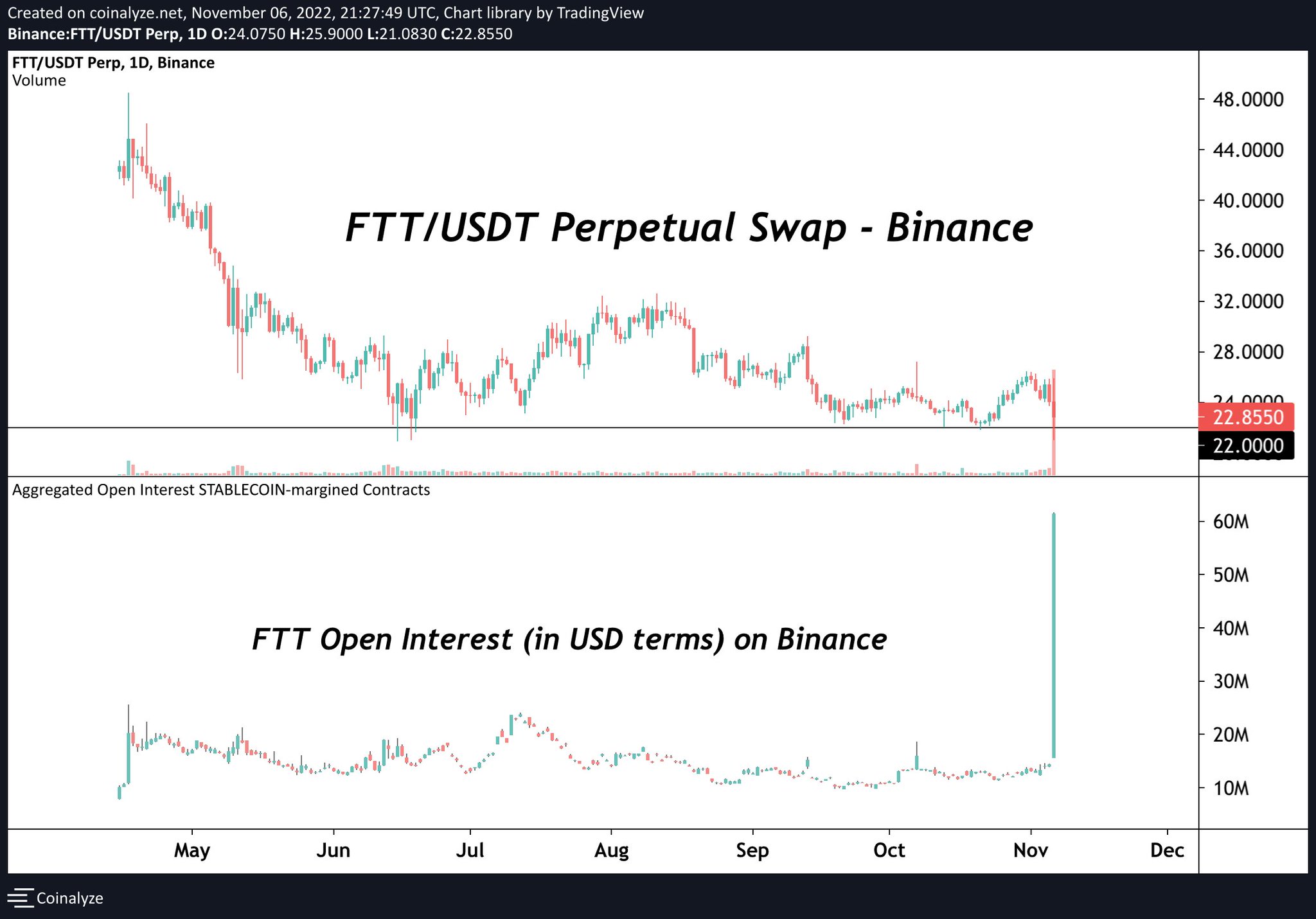

Large speculative attacks are being conducted. That excessive leverage can be used to short too.

$FTT open interest has 2.5x in last 24 hours, +$100m or so for a small spot market, illiquid free float and more spot selling (CZ) arriving soon.

$FTT open interest has 2.5x in last 24 hours, +$100m or so for a small spot market, illiquid free float and more spot selling (CZ) arriving soon.

Update: $FTT open interest has reached 10M, (~$222m USD).

It's like when a central bank announces they will defend a peg, speculators just pile on and make them back it up.

They'll have to absorb CZ's spot selling and tens/hundreds of millions worth of short positions...

It's like when a central bank announces they will defend a peg, speculators just pile on and make them back it up.

They'll have to absorb CZ's spot selling and tens/hundreds of millions worth of short positions...

Just weird vibes all around.

Mentions

See All

Saifedean Ammous @saifedean

·

Nov 6, 2022

Good live commentary from Dylan