Thread

WOW

Per CoinDesk, Alameda research has $14.6 billion of assets, against $8b of liabilities.

For assets: $3.66b FTT, $2.16b “FTT collateral”, $3.37b crypto ($292m SOL, $863m “locked SOL”), $134m USD & $2b “equity securities.

Most net equity tied in completely illiquid altcoins.

Per CoinDesk, Alameda research has $14.6 billion of assets, against $8b of liabilities.

For assets: $3.66b FTT, $2.16b “FTT collateral”, $3.37b crypto ($292m SOL, $863m “locked SOL”), $134m USD & $2b “equity securities.

Most net equity tied in completely illiquid altcoins.

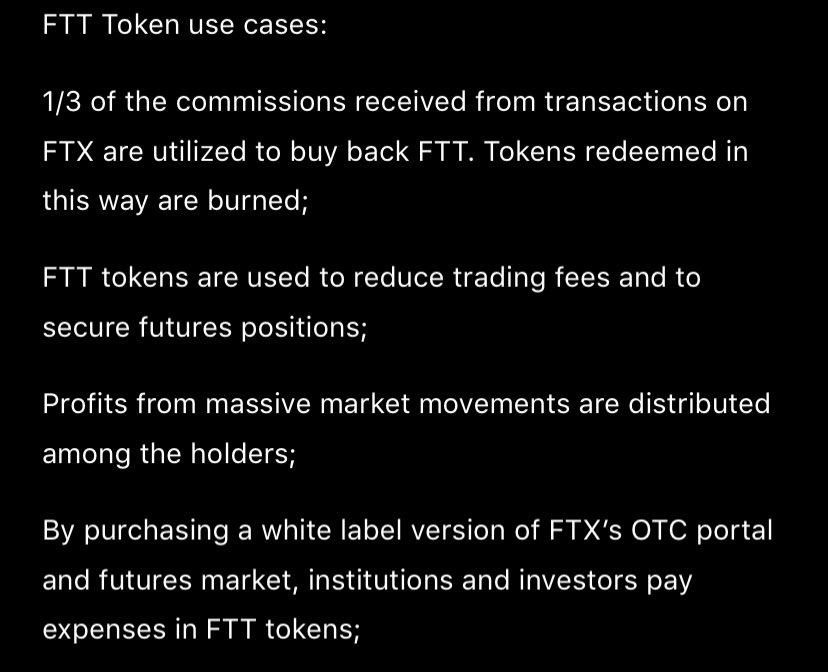

For those unaware, FTT is the token issued by FTX for discounts of exchange fees.

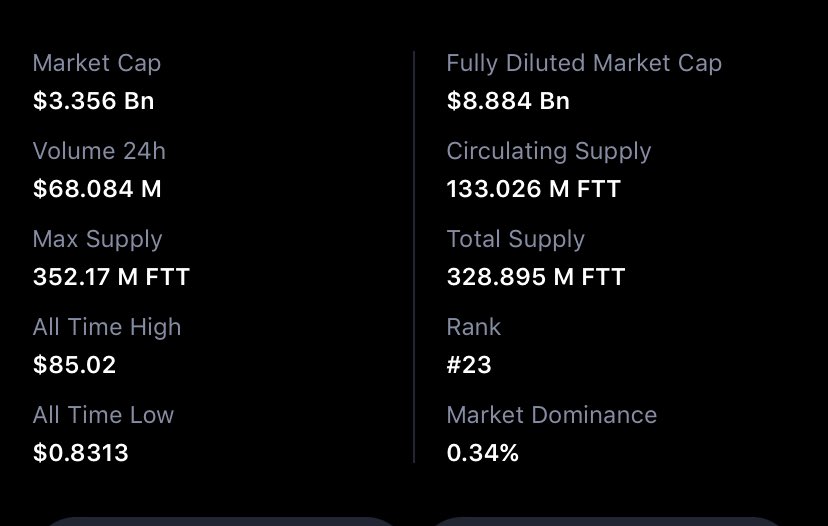

The total market cap of FTT is $3.35b, & the fully diluted market cap is $8.8b.

You couldn’t sell $1m of this thing without pushing the market significantly lower.

SRM, MAPS, OXY, and FIDA? lol

The total market cap of FTT is $3.35b, & the fully diluted market cap is $8.8b.

You couldn’t sell $1m of this thing without pushing the market significantly lower.

SRM, MAPS, OXY, and FIDA? lol

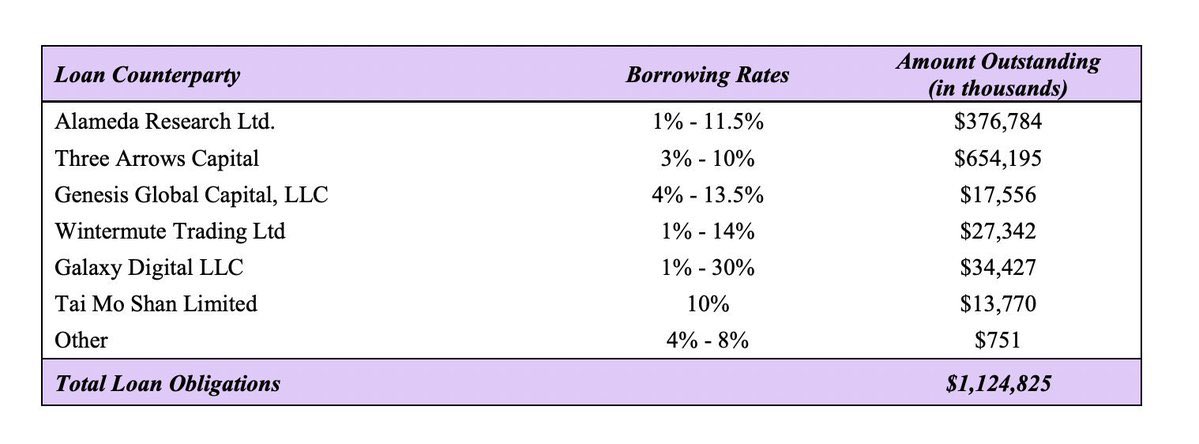

We don’t have insight into what the liabilities are denominated in. If it’s primarily USD, Alameda is in DEEP trouble. The asset side of their BS is entirely illiquid.

If it’s loans denominated in ‘crypto’, it’s better, but still not great.

If it’s loans denominated in ‘crypto’, it’s better, but still not great.

We do know that Alameda was a debtor to Voyager at the time of the 3AC bankruptcy, to the tune of $370 million.

Just how much USD denominated liabilities do they have against that illiquid pile of assets…

Just how much USD denominated liabilities do they have against that illiquid pile of assets…

Not looking good folks. FTX/Alameda puffed their feathers out in a big way at the bottom of the summer deleveraging…

Were they really just swimming naked this entire time?

I don’t know, but these are questions that deserve to be asked.

Were they really just swimming naked this entire time?

I don’t know, but these are questions that deserve to be asked.

Reported Alameda assets:

$5.82b of FTT

FTT current marketcap: $3.35b

Steady lads 🫡🫡🫡🫡🫡

$5.82b of FTT

FTT current marketcap: $3.35b

Steady lads 🫡🫡🫡🫡🫡

Here’s the source. Wish we had the actual balance sheet to examine, but CoinDesk beat reporting is trustworthy enough to make due.

I don’t think we’ve heard the last of all of this…

www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-tradin...

I don’t think we’ve heard the last of all of this…

www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-tradin...

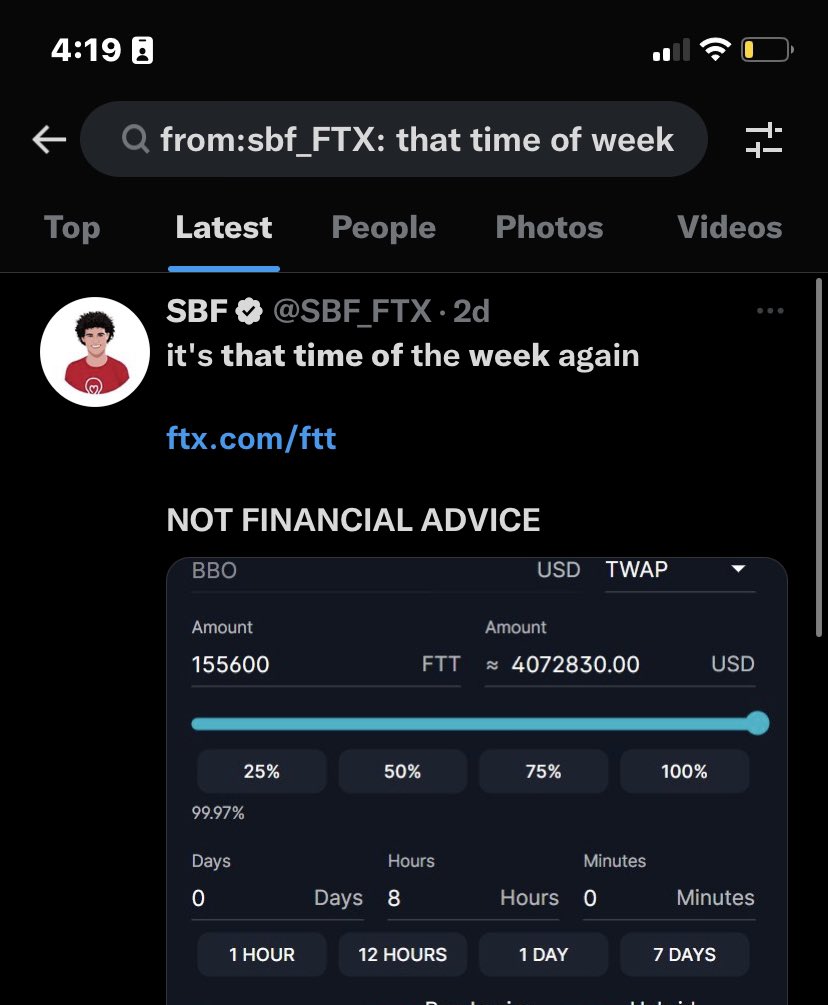

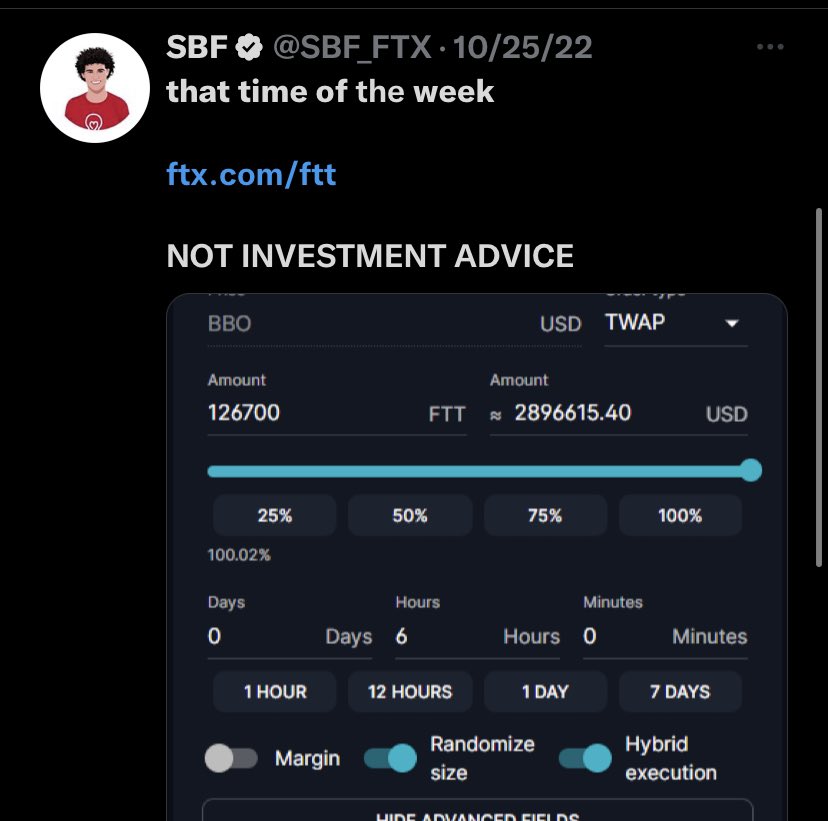

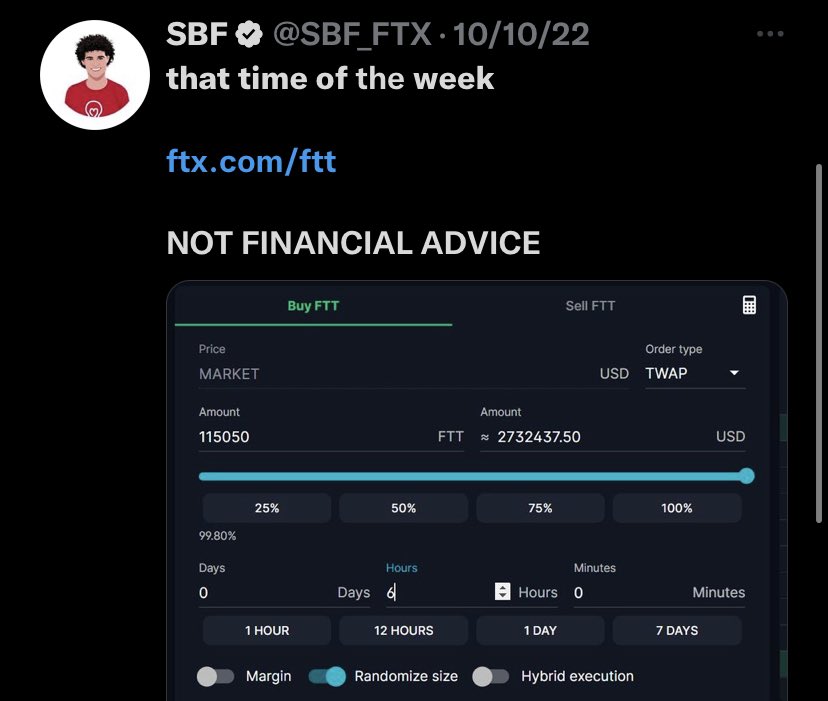

I guess it makes a whole lot more sense why SBF trots out to twitter on a weekly basis promoting his FTT TWAP orders…