Thread

$TWTR capital structure thread 🧵

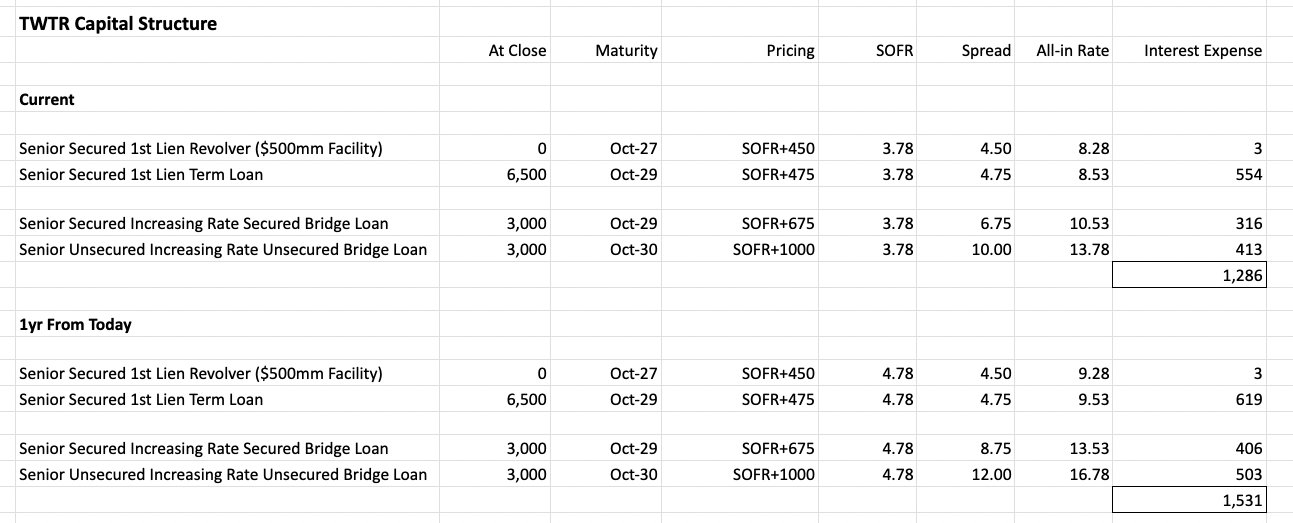

Elon had commitments for $13 billion in credit facilities to help finance the Twitter buyout

They are shown here. $12.5 billion was likely funded at close with undrawn $500mil revolver

1/

Elon had commitments for $13 billion in credit facilities to help finance the Twitter buyout

They are shown here. $12.5 billion was likely funded at close with undrawn $500mil revolver

1/

The are floating rate loans. Its noteworthy that SOFR (Secured Overnight Financing Rate) was 0.3% when the deal was announced

Just the move in SOFR from announcement in April to close in Oct cost Elon an extra $435 million per year in interest

2/

Just the move in SOFR from announcement in April to close in Oct cost Elon an extra $435 million per year in interest

2/

Total interest expense appears to be $1.286 billion today, but all of the loans are subject to increases in SOFR which Elon will bear unless he swapped rates (my gut says he didn't)

2 of the tranches also have punitive margin escalation/ratchets

3/

2 of the tranches also have punitive margin escalation/ratchets

3/

If you assume SOFR increases by 100 bps over the next year due to Fed rate increases and bake in the 50bps increase in spread on the 2nd lien and unsecured tranches, interest expense will be $1.53 billion in a year at a minimum, but it likely gets worse

4/

4/

- The revolver and $6.5 billion term loan share in the collateral / security on a 1st lien basis

- Security is effectively the stock of subsidiaries, with guarantees from the subs also provided

- Revolver has 50 bps undrawn fee that is paid whether the facility is used or not

5/

- Security is effectively the stock of subsidiaries, with guarantees from the subs also provided

- Revolver has 50 bps undrawn fee that is paid whether the facility is used or not

5/

- The term loans have NO financial covenants

- The Revolver has a max 1st lien leverage ratio that is set at 40% cushion to the acquisition model and only tested if RC > 35% drawn

6/

- The Revolver has a max 1st lien leverage ratio that is set at 40% cushion to the acquisition model and only tested if RC > 35% drawn

6/

In credit, you can have contractual seniority or structural seniority.

Here, the $3 billion secured term loan shares in the security the RC and $6.5b term loan get but there is an intercreditor agreement that makes the $3 billion secured term loan contractually subordinate

7/

Here, the $3 billion secured term loan shares in the security the RC and $6.5b term loan get but there is an intercreditor agreement that makes the $3 billion secured term loan contractually subordinate

7/

- So the $3 billion secured term loan is effectively 2nd lien

- Then there is a $3 billion unsecured term loan

So from priority of payment

1. RC + $6.5 billion term loan

2. $3 billion term loan

3. $3 billion term loan

8/

- Then there is a $3 billion unsecured term loan

So from priority of payment

1. RC + $6.5 billion term loan

2. $3 billion term loan

3. $3 billion term loan

8/

There is an accordion feature to add another $1.7 billion debt, which seems comical on its face

The $3b secured and $3b unsecured term loans have 1-yr initial maturity at which time they convert at the lenders option into extended TLs or exchange notes

9/

The $3b secured and $3b unsecured term loans have 1-yr initial maturity at which time they convert at the lenders option into extended TLs or exchange notes

9/

These two facilities are classic bridge loans, the rate/spread increases by 50 bps every 3 months to incentivize a cap markets take-out/refi

BUT if the loans term out, the rate then goes to the "Secured Total Cap" and the "Unsecured Total Cap"

10/

BUT if the loans term out, the rate then goes to the "Secured Total Cap" and the "Unsecured Total Cap"

10/

The cap rates are not provided publicly (side fee letter), but the caps would likely be a premium to final rate ratchet so lets say 15% for the 2nd lien and 20% for the unsecured

If converted into exchange notes (likely), the notes are NC3, they cannot be called for 3yrs

11/

If converted into exchange notes (likely), the notes are NC3, they cannot be called for 3yrs

11/

At the assumed 15/20% rates on the 2nd lien and unsecured exchange notes, interest expense is > $1.7 billion a year, nearly $1b more than in April when deal inked!!!!

In 2019/2020 TWTR did $3.5 and $3.7 billion in revenue

12/

In 2019/2020 TWTR did $3.5 and $3.7 billion in revenue

12/

If we normalize ad revenue back to those levels but assume Elon's antics cause a 30% loss in ad revenue, the PF run rate revenue is $2.5 billion +/-

Compare that with $1.7 billion in annual interest

13/

Compare that with $1.7 billion in annual interest

13/

This thing is going to bleed cash. I am unsure how much cash they closed with and the revolver is there for additional liquidity, but more equity will be needed down the road.

How quick depends on how much cash they closed with

14/

How quick depends on how much cash they closed with

14/

There were media reports that the term loans were bid at 60. I did not see if that was the $6.5 billion 1st lien or the subordinate tranches

Rough math but 40 points over 7yrs equates into 575 bps of additional spread to maturity and 500 bps over 8 years

15/

Rough math but 40 points over 7yrs equates into 575 bps of additional spread to maturity and 500 bps over 8 years

15/

At forward SOFR and spreads, the term loans at 60 equate into the following yields

1st lien = 15%

2nd lien = 19%

Unsecured = 22%

16/

1st lien = 15%

2nd lien = 19%

Unsecured = 22%

16/

My guess is the 60 bid was for the 1st lien, which means the bid on 2L and unsecured papers likely sub-50 cts on dollar

So how do you inject equity if the debt is trading there?

Not easily

17/

So how do you inject equity if the debt is trading there?

Not easily

17/

Any equity to repay debt wouldn't come in at the prior $44 billion valuation, only an idiot would do that

So new money comes in at lower valuation and would - through that mark - likely wipe out most of the prior equity commitment

18/

So new money comes in at lower valuation and would - through that mark - likely wipe out most of the prior equity commitment

18/

Said differently, any new equity would likely come in at just above the value of the debt stack, re-pricing the value of TWTR down to 15b +/-

Poof. Elon's money and all co-investors money is gone in that scenario

19/

Poof. Elon's money and all co-investors money is gone in that scenario

19/

Think about that unsecured tranche

Who is going to touch that at less than 25-30% yield?

To get that yield the paper has to be trading at close to 0

20/

Who is going to touch that at less than 25-30% yield?

To get that yield the paper has to be trading at close to 0

20/

The banks holding this paper have massive incentive to get it off their books, but can they?

The losses will be massive

What is the plan to get to FCF, how long will the ad---> subscription conversion take?

Nobody knows

21/

The losses will be massive

What is the plan to get to FCF, how long will the ad---> subscription conversion take?

Nobody knows

21/

So VERY high chance today that the 2L and unsecured term out and at that point cant be refi'd for 3 years

Elon is very fortunate the 1L doesn't have rate ratchets

But he is fighting the Fed on those pieces

22/

Elon is very fortunate the 1L doesn't have rate ratchets

But he is fighting the Fed on those pieces

22/

Lets say revenue does dip to 2.5b.... COGS has been about 35% of sales, so at that level, gross profit is $1.625 billion - les than fwd annual interest

The jobs cuts - below that line - will help but its just moving chairs on the titanic

23/

The jobs cuts - below that line - will help but its just moving chairs on the titanic

23/

So all Twitter users should expect a massive push into subscription revenue, its the only salvation

But can Elon grow subscriptions fast enough and keep the spirit of Twitter alive?

Will be seriously threading a needle if he pulls off

24/

But can Elon grow subscriptions fast enough and keep the spirit of Twitter alive?

Will be seriously threading a needle if he pulls off

24/

TLDR

The cap structure is a mess and interest expense has explosive upside

Hit me up if you want help out of this mess @elonmusk

end/

The cap structure is a mess and interest expense has explosive upside

Hit me up if you want help out of this mess @elonmusk

end/

Mentions

See All

Venkatesh Rao @vgr

·

Nov 13, 2022

Excellent thread to the extent I could follow it. Can’t wait for @matt_levine to ELI5. I rarely look at corp balance sheets. At most I look at P/L. If the balance sheet is too “interesting” the company is not in the stated business but in the financial engineering business.