Thread

Yesterday I discovered something so major that I thought it needs to reach people beyond my paid subscribers.

I re-visited our analysis on the factors behind global market liquidity from 2018 👇 and found something very disturbing.

Thread. 1/19

gnseconomics.com/2018/10/12/the-ominous-problem-with-global-liquidity/

I re-visited our analysis on the factors behind global market liquidity from 2018 👇 and found something very disturbing.

Thread. 1/19

gnseconomics.com/2018/10/12/the-ominous-problem-with-global-liquidity/

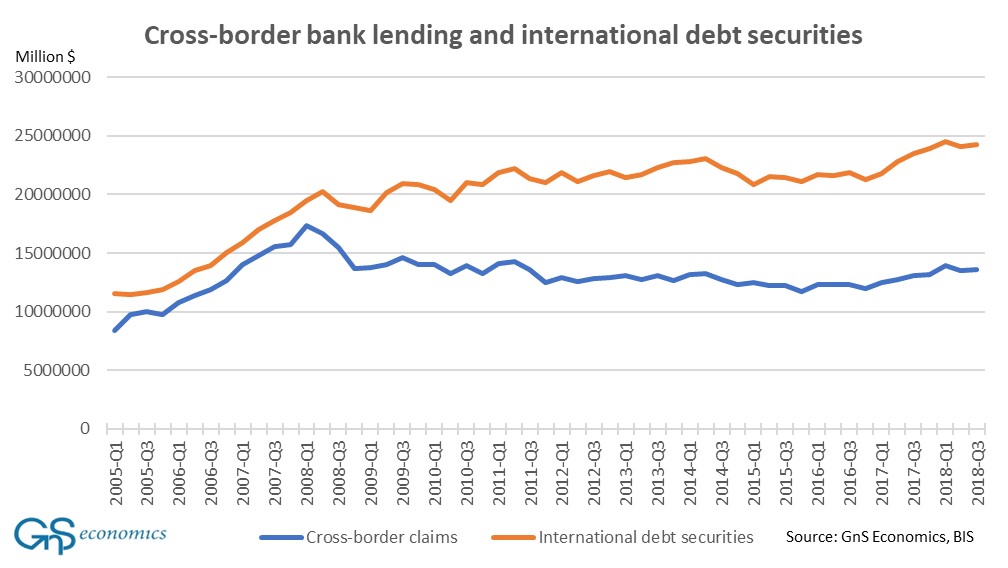

In 2018, we found three 'facture lines' from global financial architecture:

1) Global outside-US dollar denominated debt has risen to a record.

2) The role of non-bank institutions on providing funding has increased.

2/

1) Global outside-US dollar denominated debt has risen to a record.

2) The role of non-bank institutions on providing funding has increased.

2/

3) The composition of international credit has shifted from bank loans to debt securities.

We concluded that:

"Combined with the asset purchase programs of central banks (QE) these developments have far-reaching consequences for the global economy."

3/

We concluded that:

"Combined with the asset purchase programs of central banks (QE) these developments have far-reaching consequences for the global economy."

3/

And continued:

"QE-programs have had the biggest effect on government bond markets. The prices of sovereign bonds have been relentlessly driven up (yields have collapsed) to unprecedented levels across the globe."

4/

"QE-programs have had the biggest effect on government bond markets. The prices of sovereign bonds have been relentlessly driven up (yields have collapsed) to unprecedented levels across the globe."

4/

"This in turn has fueled the expansion of debt issuance in international credit markets and which has made it possible for non-bank sources to increase their role in the economy."

At that time global QT was starting, which lead us to conclude the following.

5/

At that time global QT was starting, which lead us to conclude the following.

5/

"What follows the onset of global QT, which seems imminent, is a chaotic correction towards the true market pricing of risk (a crash).

Because capital markets carry a larger burden of global finance than before (see Figure 2), their collapse would..."

6/

Because capital markets carry a larger burden of global finance than before (see Figure 2), their collapse would..."

6/

"... immediately eliminate funding for companies, households, and even governments globally. Such a dramatic reduction in global liquidity implies an instant recession."

At the turn of the year 2018/2019 this almost occurred.

7/

At the turn of the year 2018/2019 this almost occurred.

7/

The complete collapse of global liquidity and thus capital markets was saved only by the now infamous 'pivot' of the #FederalReserve at the start of the year 2019.

This was driven by serious cracks (illiquidity) appearing in the credit markets. #FOMC pivoted, because...

8/

This was driven by serious cracks (illiquidity) appearing in the credit markets. #FOMC pivoted, because...

8/

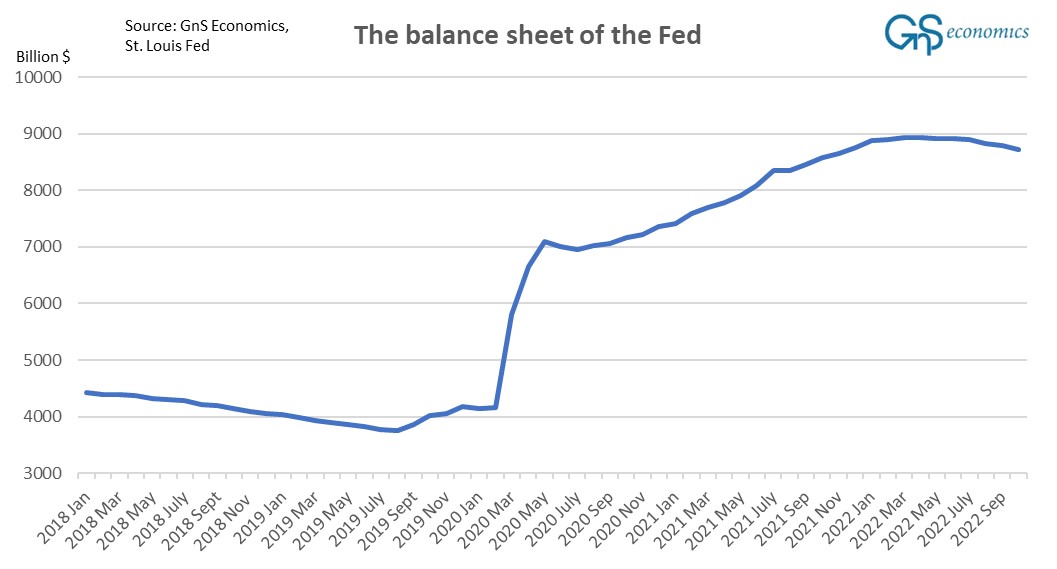

...they saw a catastrophe approaching.

Now they are trying to empty their balance sheet with much faster speed and from a much higher level than in 2018 (good luck with that!) 🤦♂️😬

9/

Now they are trying to empty their balance sheet with much faster speed and from a much higher level than in 2018 (good luck with that!) 🤦♂️😬

9/

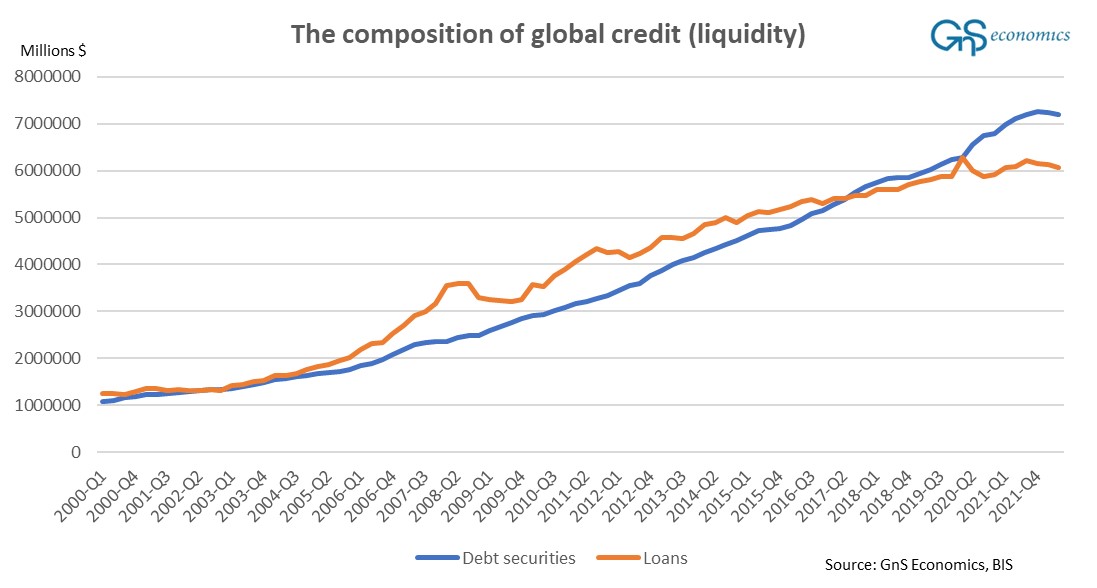

Moreover, central bankers are facing an even more drastic situation than in late 2018.

I gathered this data, showing the composition of global credit, from the Bank of International Settlements (BIS).

It provides some intriguing and very worrying information.

10/

I gathered this data, showing the composition of global credit, from the Bank of International Settlements (BIS).

It provides some intriguing and very worrying information.

10/

The figure clearly shows the massive increase in the role of banks before the GFC and the collapse of it after the Panic of 2008.

The effects of the debt crisis of the Eurozone in 2010-2012, which actually was a banking crisis, also show as a decline in credit creation. 11/

The effects of the debt crisis of the Eurozone in 2010-2012, which actually was a banking crisis, also show as a decline in credit creation. 11/

Most importantly, the figure shows debt securities passing bank loans in global credit creation in early 2017, and the collapse (decline/stagnation) of bank loan creation after the Corona shock of early 2020 accompanied with the massive increase in the debt securities.

12/

12/

This, quite straight-forwardly, implies that the banking sector took a "mortal hit" during the Corona lockdowns, as we correctly assumed.👇

Banks and especially the European banks have been kept standing only through a series of support measures.

13/

gnseconomics.com/2020/08/24/the-anatomy-of-a-financial-crisis/

Banks and especially the European banks have been kept standing only through a series of support measures.

13/

gnseconomics.com/2020/08/24/the-anatomy-of-a-financial-crisis/

Alas, we entered another global banking crisis already in 2020, but it was covered (hidden in plain sight, essentially) by the authorities!

The increased role of debt securities also implies that the non-regulated, or "shadow", banking sector has taken a bigger...

#Banks

14/

The increased role of debt securities also implies that the non-regulated, or "shadow", banking sector has taken a bigger...

#Banks

14/

...role in global credit creation.

Moreover, the increased role of debt securities also implies that corporations have been turning more on the capital markets in their search for funding.

This is no surprise, as their yields have been extremely low, but now they are not.

15/

Moreover, the increased role of debt securities also implies that corporations have been turning more on the capital markets in their search for funding.

This is no surprise, as their yields have been extremely low, but now they are not.

15/

If (when) 'zombified' corporations start to fail, en masse, due to rapidly rising interest rates and a recession, we could (would) see a sudden collapse in liquidity in capital markets affecting both corporations and governments.

But there's more.

16/

But there's more.

16/

The #FederalReserve is draining global dollar-liquidity at an increasing speed putting pressure on the global financial system, which has ‘piled up’ on dollars like no time before.

Financial leverage is being unwound rapidly, and fire-sales of shadow bank assets await.

17/

Financial leverage is being unwound rapidly, and fire-sales of shadow bank assets await.

17/

Alas, an epic collapse in global market liquidity threatens, which would lead to an outright collapse of the financial markets, and thus, to the drying up of funding for corporations and governments, and the emergence of a global banking crisis, all at once. 😱

18/

18/

It's needless to say that I start to be rather worried, where all this leads to.

We (the world) are, quite literally, sitting on a financial powder keg, and the fuse it lit! 🥶

/End

#liquidity #markets #FederalReserve

mtmalinen.substack.com/p/global-liquidity-collapse-approaches

We (the world) are, quite literally, sitting on a financial powder keg, and the fuse it lit! 🥶

/End

#liquidity #markets #FederalReserve

mtmalinen.substack.com/p/global-liquidity-collapse-approaches