Thread

The U.S dollar is wreaking havoc globally, and it's only just starting to pick up momentum. You'd have thought by now that other nations would have bailed from its hegemony. But in reality, there's no way out... 1/

Right now, the consensus belief is that global liquidity has been deteriorating rapidly, and intervention by the Federal Reserve will come shortly when "something breaks". But since nobody can decide what that "something" might be, this shows fear remains in its early innings...

With record-high consumer loans, commercial loans, wage growth, and net worths, plus trillions of dollars of liquidity still swashing around the financial system, the infamous Fed Pivot™ remains a pipe dream...

Plus, as officials become more like vigilantes, the Fed is likely to raise rates higher than anyone expects. Cleveland Fed President Loretta Mester recently revealed the Fed would raise rates "even in a recession".

Worse still...

Worse still...

The Fed doesn't seem to care much that additional interest rate rises will inflict significant pain on the rest of the world. In a move that will likely make the history books, the United Nations warned the Federal Reserve to stop raising interest rates further...

In response, Federal Reserve Chairman Jerome Powell responded with a resounding "no", prioritizing the Fed's domestic anti-inflation agenda over the financial health of emerging nations. These are countries starting to again feel the burden of living in the U.S dollar hegemony...

If the Fed continues hiking, dollar strength will almost certainly intensify. Rate differentials will widen, and dollar-denominated debt will grow more costly to service, inflicting extra financial pain outside America's borders...

Meanwhile, however, on US shores, the outlook is looking much rosier. "Something breaking" could take longer than most anticipate. If Concoda is correct about an abundance of liquidity in money markets, the threat of looming breakage lies in the most unsuspecting of places...

After the Fed, with varied success, has spent just over a decade trying to create stability in money markets (details on this in the thread below), imminent peril has now been transferred to, none other than, the U.S. Treasury market...

Recent Treasury market data from TRACE (FINRA's Trade Reporting and Compliance Engine) does show trading volumes in the Treasury market reaching recent highs, just as 10-year yields have fallen back below 4%...

But this won't last. Even with a deep liquid bond market (a luxury only the U.S can enjoy), increased periods of illiquidity will emerge as the Fed's merciless rate hikes continue well into next year...

It will be surprising to most that a major goal of rate hikes is not only to set the price of money but to DEVALUE (or destroy the value of) government bonds. When the Fed signals rate hikes, higher yields follow, and the price of Treasury securities plummet...

Investors who hold these securities don't just feel the pain of a loss in principal (the bond's value). If they want to sell, they must face a bond market that's entered what Concoda calls an "illiquidity spiral"...

When Treasury market makers expect increased volatility via rate hikes, they price in wider bid-and-ask spreads. In this climate, "price impact" rises. Investors bear a higher average loss when they sell and pay a loftier price when buying Treasuries...

As the Fed reduces Treasury market liquidity, volatility creates more illiquidity, and illiquidity leads to more volatility, resulting in a doom loop that eventually gets too much for most market participants to endure...

In practice, the three segments of the secondary Treasury market (interdealer broker, dealer-to-dealer, and dealer-to-client) start to break down. Participants unwind trades and hoard collateral en masse. When this occurs, intervention by central planners is a question of when...

The recent carnage in the U.K was only a warm-up. Even without the bad response to U.K Prime Minister Truss's fiscal plans, Britain's bond market was destined for the illiquidity spiral that unfolded. Now, facing a similar scenario, the U.S edition will hit our screens shortly...

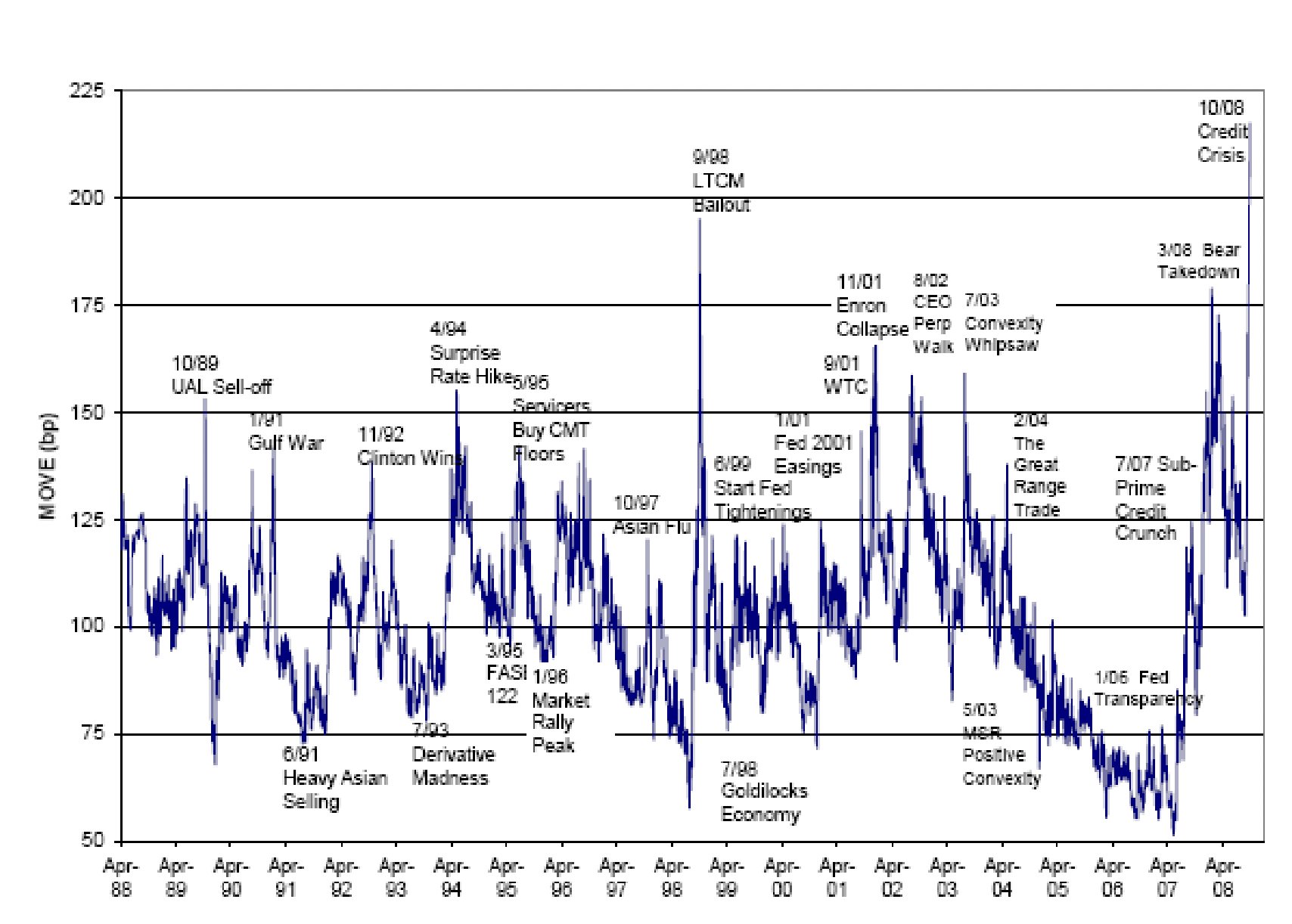

The MOVE index, which measures short-term Treasury market volatility, has been grinding toward all-time highs. Liquidity has diminished, but slowly, without panic...

For now, we're not near the extremes. During the LTCM bailout, the MOVE index skyrocketed to just under a reading of 200. This was a feat only surpassed by the 2008 financial crisis, as Treasury vol climbed to a whopping 217 as Lehman Brothers tumbled...

Soon enough, though, we'll hit a breaking point. When the U.S can issue an endless supply of government paper, which only a finite number of market participants can absorb, an illiquidity spiral is likely the endgame. The Fed will respond and "come to the rescue"...

With all these hazards, it must be difficult to believe how countries have put so must trust in the U.S dollar and its many derivatives (say Treasuries). But as Concoda has noted, finance is a RELATIVE game played on a GLOBAL stage...

Countries want to leave, but leaving requires unimaginable pain. Abandoning the U.S means abandoning the only power capable of creating stable capital markets. America is the sole region possessing the continuity and economies of scale that attracts a large investor base...

In a world where America plays this seemingly eternal role of "global cashier", maintaining liquidity takes priority over financial sensibility. Over time, the monetary paradigm has shifted so we desire liquidity above all else. We've turned finance into monetary alchemy...

So the world now demands America not only intervene when the dollar becomes too strong but when the price of Treasuries becomes too volatile to handle. Most loans globally are secured against Treasury paper. The repo market does over $3 trillion daily, and that's one market...

Since Bretton Woods in 1944, the U.S Dollar system has risen to unrivaled dominance, now consisting of over 26 unique marketplaces for funding. From FX swaps to Eurodollars to cross-border loans to cross-currency basis swaps, the Dollar Market™ is the ultimate one-stop shop...

Most commentators mention that countries USE the dollar system, but this understates just how institutionalized the dollar has become globally. Countries aren't simply using the U.S. dollar system. They have become essential parts, powering its internals...

The dollar has become such a cornerstone in global finance that countries have evolved to become essential components of a machine that would fail without them. The interconnectedness is truly remarkable but ominous and complex...

This is why China has been saying it wants to ditch the Greenback for decades now, but the Asian superpower has found no conceivable escape valve. When it comes to ditching the dollar, saying you will and actually following through is a different story...

Each country provides a particular set of functions of the dollar system that others cannot. If certain nations decide one day that they no longer want to play ball, the dollar system quickly falls apart. Of course, so will the country that tries to exit...

It sounds bizarre to say, but if Australia suddenly stopped supplying FX swaps to its European counterparts, disastrous outcomes would follow...

Meanwhile, in Europe, French financial institutions are large lenders in the FX swaps market and act as major repo market intermediaries for the rest of Europe and, get this, Japan and Canada...

If French banks pulled out, European banks would not only suffer a severe dollar shortage but Japanese and Canadian banks would too. With no stable access to dollars, Japan and Canada's financial system would quickly run into trouble...

This interconnectedness can be also observed on U.S shores. Needing to reduce leverage at the end of each quarter to comply with regulation, U.S banks' European branches de-lever and send spare Eurodollars back home into the Fed's RRP (reverse repo facility) for extra yield...

This complex global financial machine only works well, however, when U.S dollars remain in abundance. When dollar liquidity dries up, for whatever reason, you can only call the Federal Reserve for a bailout...

As fellow dollar fatalist (and milkshake enthusiast) Brent Johnson articulated, when central banks issue currency, they do it for themselves. But if the Fed increases the supply of dollars, they do it for themselves and the world — eventually, though...

When the finances of entities outside America start falling apart, the most painless solution is to wait for America's financial utilities to rescue them. The alternative? Financial collapse, isolation, and uncertainty...

Since America’s allies and rivals are incapable of escaping its financial grasp, the dollar’s decline must stem from either geopolitics or innovation. In our view, America's fall from hyperpower status will not emanate from financial collapse, nor from opposing military might...

China will be beholden to the U.S dollar, while its military lags behind the U.S in almost every regard. For context, the Asian superpower has only two aircraft carriers in active service, compared to America’s (technologically superior) eleven...

With this advantage, the U.S can always park its superior warships in the straits of Malacca, Lombok, and Makassar, blocking 80% of oil imports from reaching Chinese shores. A few months later, hunger sets in...

And with the U.S realigning its gaze toward Taiwan and the Indo-Pacific region, the majority of America's firepower will be stationed near its biggest adversary, China.

That leaves the only feasible way to topple the U.S dollar: producing the next game-changing innovation...

That leaves the only feasible way to topple the U.S dollar: producing the next game-changing innovation...

Like the Ancient Egyptians falling to the Canaan natives who mastered desert-based transportation, or like the Portuguese toppling the Ottomans via deepwater navigation, America will likely only lose its reserve currency status through an innovative breakthrough...

But until then, the U.S-led order will prevail, supplying as many dollars as needed to keep its global hegemony running. With each increasingly frequent crisis, dollar dominance will grow. The exit door has already vanished for nations who've sold their soul to the U.S dollar...

Withdraw, and watch your nation fall apart. Remain, and watch your dollar dependency rise and your debt burden expand. The latter choice, despite its numerous downsides, reigns supreme, for now.

Thanks for reading!

If you enjoyed this, feel free to retweet the opening tweet of this thread and follow @concodanomics for more.

You can also subscribe below to receive free in-depth articles about geopolitics, finance, and economics in your inbox.

concoda.substack.com/subscribe

If you enjoyed this, feel free to retweet the opening tweet of this thread and follow @concodanomics for more.

You can also subscribe below to receive free in-depth articles about geopolitics, finance, and economics in your inbox.

concoda.substack.com/subscribe

Article version concoda.substack.com/p/the-us-dollar-endgame-could-take

Mentions

See All

Raoul Pal @RaoulPal

·

Oct 10, 2022

Exceptional thread. Thank you