Thread

The Power of The Dollar 🧵

[a thread for normies -like me]

[a thread for normies -like me]

Long periods of #dollar-strength often ended with massive financial dislocations like the Latin American #debt crisis of the 80s and the Asian crisis of the 90s.

Oppositely, long periods of a weakening dollar came with strong markets like between 2003-2007.

1/20

Oppositely, long periods of a weakening dollar came with strong markets like between 2003-2007.

1/20

Although the #USdollar is not itself an asset, cash is.

The dollar is the most common currency in which assets are quoted and exchanged in #financialmarkets and the economy.

It's the world's reserve currency (for now at least...) 2/ 20

The dollar is the most common currency in which assets are quoted and exchanged in #financialmarkets and the economy.

It's the world's reserve currency (for now at least...) 2/ 20

A stronger dollar is usually bad for global risk:

Financial conditions tighten and dollars are harder to come by, making things difficult for businesses and countries that rely on dollars for #investments, #commerce, and their #economy... 3/20

Financial conditions tighten and dollars are harder to come by, making things difficult for businesses and countries that rely on dollars for #investments, #commerce, and their #economy... 3/20

What's the big deal with the dollar if the US only accounts for ~16% of global #GDP?

- Up to 40% of trade invoices by non-US countries are in $USD

- 60%+ of #centralbank reserves are in USD (the 2nd is the $EUR with ~20%)

- Global derivatives transactions are priced in USD. 4/20

- Up to 40% of trade invoices by non-US countries are in $USD

- 60%+ of #centralbank reserves are in USD (the 2nd is the $EUR with ~20%)

- Global derivatives transactions are priced in USD. 4/20

Debt factor:

Many countries and non-US corporations have issued #debt in USD.

It's estimated that there are 13+ trillion dollars in cross-border debt (without counting off-balance sheet transactions)... 5/20

Many countries and non-US corporations have issued #debt in USD.

It's estimated that there are 13+ trillion dollars in cross-border debt (without counting off-balance sheet transactions)... 5/20

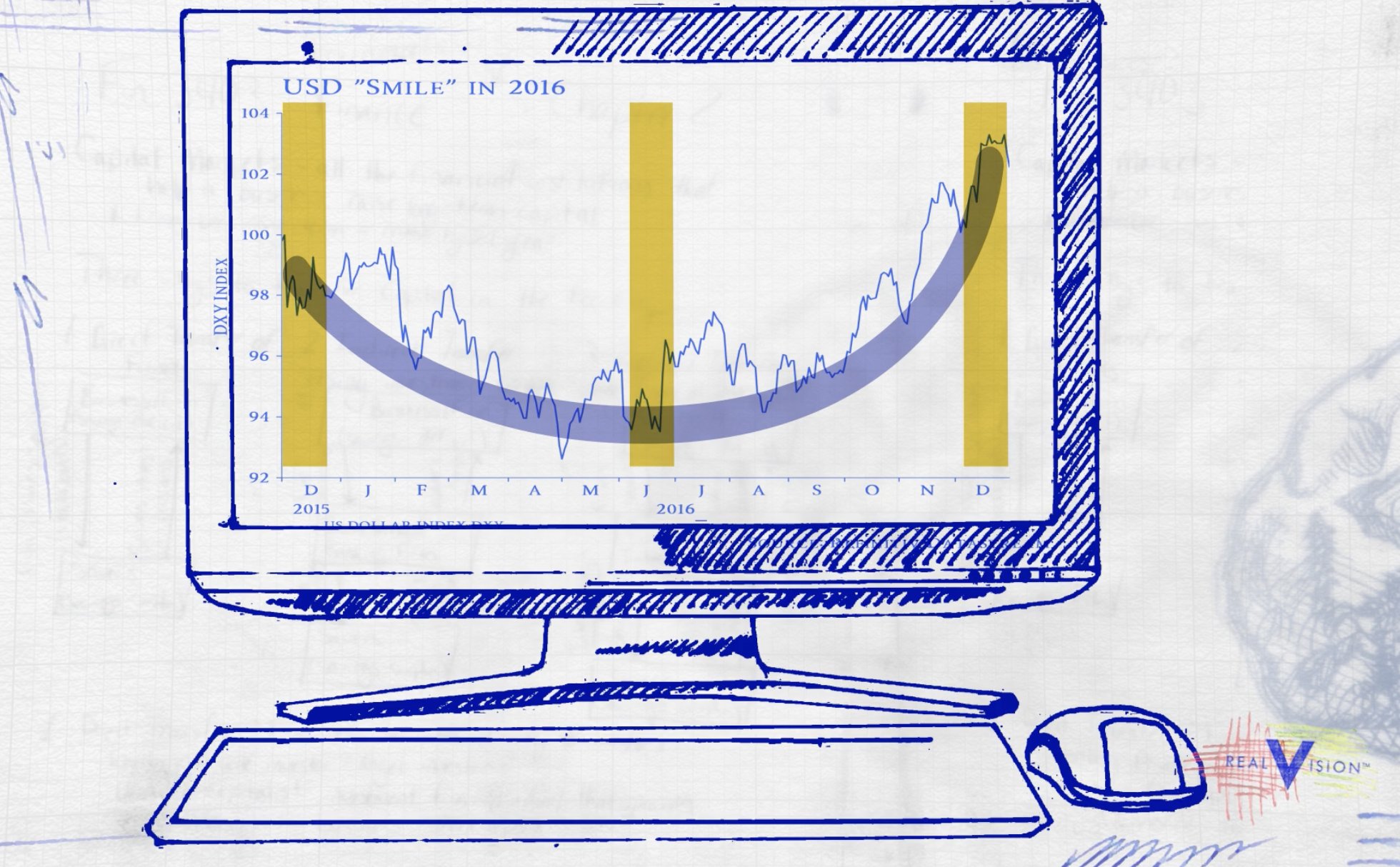

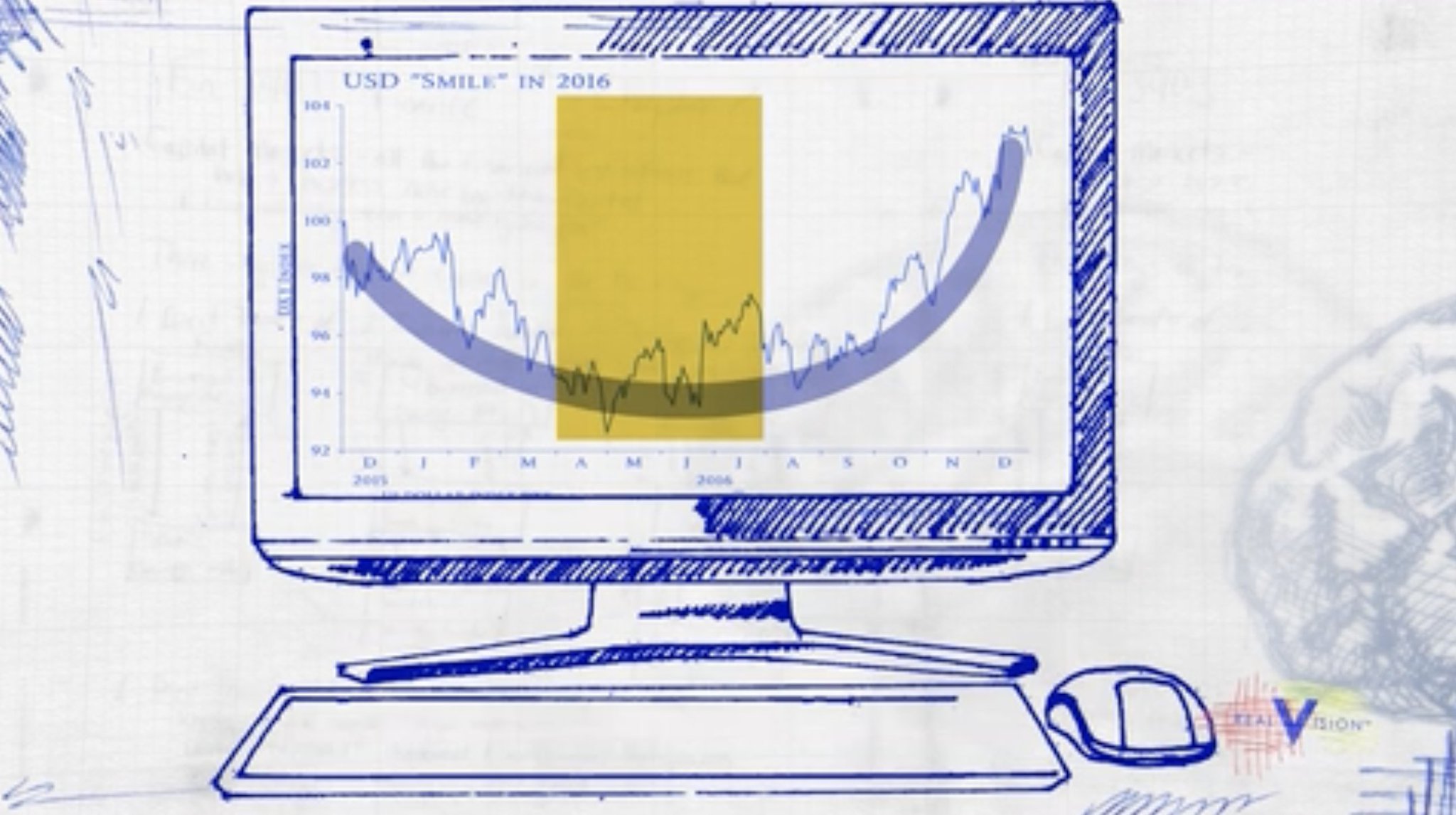

One way to analyze the relationship between the dollar and the markets is through Li Jen's #USDollar smile:

$DXY smile shows a strong dollar on both extremities and a weak dollar in its middle. 2016 is a great example of this framework... 6/20

$DXY smile shows a strong dollar on both extremities and a weak dollar in its middle. 2016 is a great example of this framework... 6/20

The dollar is strong during periods of uncertainty & #riskoff (late 2015 and early 2016).

The USD is weak in periods of global coordinated growth, making #emergingmarkets & commodity currencies outperform (mid-2016 when China injected lots of credit)... 7/20

The USD is weak in periods of global coordinated growth, making #emergingmarkets & commodity currencies outperform (mid-2016 when China injected lots of credit)... 7/20

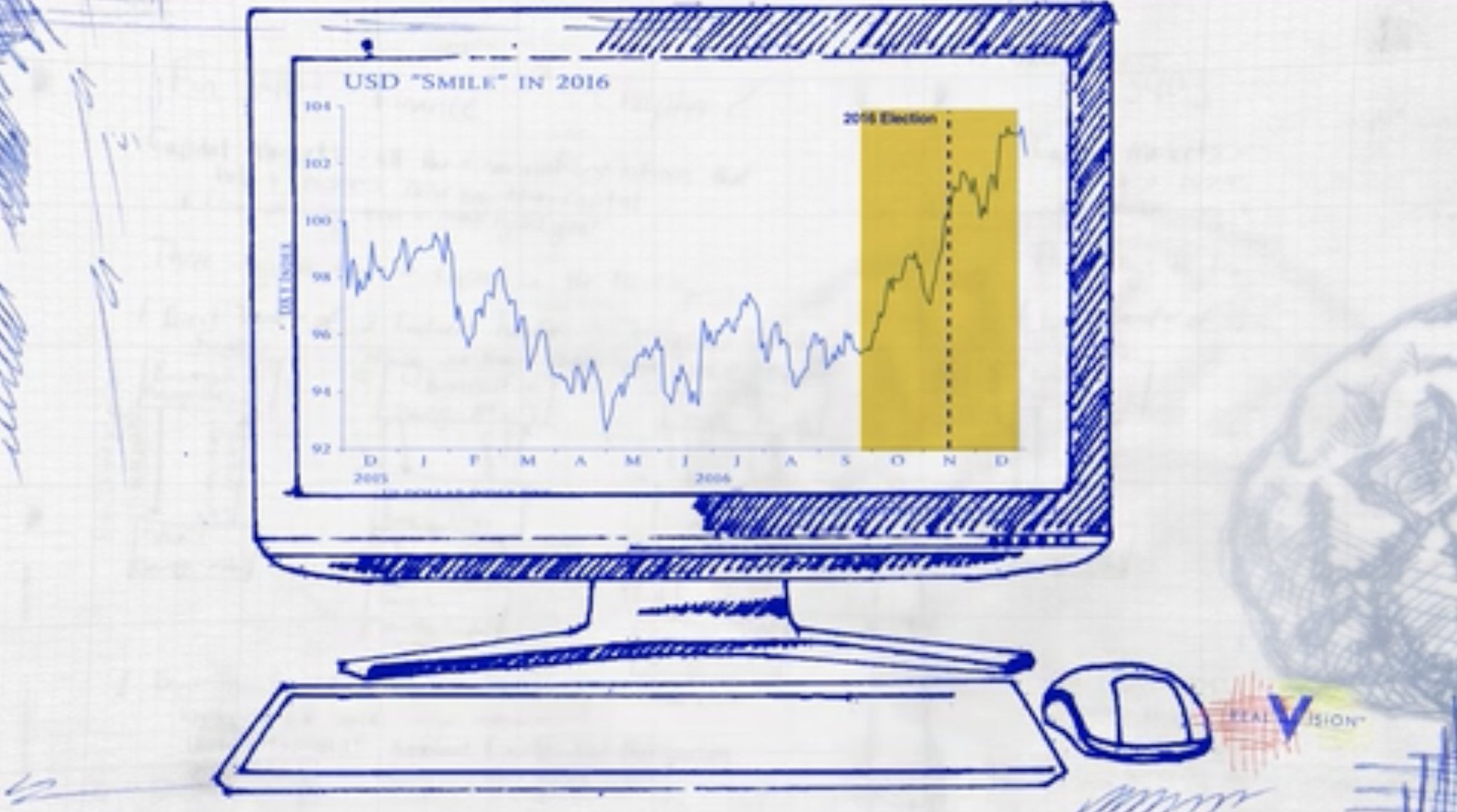

The other side of the smile is a return to dollar strength (end of 2016 after the election of Donald Trump).

In fact, that period in late 2016 marked the peak in this $DXY cycle.

The dollar smile is a basic framework and the impact of the dollar goes deeper than this... 8/20

In fact, that period in late 2016 marked the peak in this $DXY cycle.

The dollar smile is a basic framework and the impact of the dollar goes deeper than this... 8/20

What happens in a real risk-off event where there's a mad scramble for dollars? 97's Asia crisis 👇

Asian #equitymarkets collapsed as the USD surged against their currencies. The contagion sent Russia into a #debtcrisis, which led to Long-Term Capital Management's downfall. 9/20

Asian #equitymarkets collapsed as the USD surged against their currencies. The contagion sent Russia into a #debtcrisis, which led to Long-Term Capital Management's downfall. 9/20

Emerging markets hold fewer dollars than in '97 but it's increasing due to China's dollar debt after a decade of credit-fueled growth and dollar-denominated corporate debt.

These two plus the increase of US #interestrates are putting some pressure on these positions... 10/20

These two plus the increase of US #interestrates are putting some pressure on these positions... 10/20

The source of the investment funds matters as much as the performance of the underlying market.

When the USD rises, returns from emerging market shares fall. US #investors start losing and begin to repatriate their capital even if the local economy is doing well... 11/20

When the USD rises, returns from emerging market shares fall. US #investors start losing and begin to repatriate their capital even if the local economy is doing well... 11/20

What about #commodities?

If they're priced in dollars, they become more expensive in their local currencies when the dollar strengthens, lowering demand.

On the other hand, when commodities are in demand, resource-rich emerging market economies perform well... 12/20

If they're priced in dollars, they become more expensive in their local currencies when the dollar strengthens, lowering demand.

On the other hand, when commodities are in demand, resource-rich emerging market economies perform well... 12/20

Remember that a rising USD becomes a headache for markets that are reliant on accessing cheap dollars.

Alternately, back in the mid-2000's when #crudeoil was around $150 and dollars were relatively cheap, leverage was easy, and #China was sucking up all #rawmaterials... 13/20

Alternately, back in the mid-2000's when #crudeoil was around $150 and dollars were relatively cheap, leverage was easy, and #China was sucking up all #rawmaterials... 13/20

The last time a surging dollar coincided with high oil prices was in 2014, which was one of the dynamics that led to the US profits #recession of 2015... 14/20

So what the hell is going on with the #USD? The "wrecking ball cycle" as explained by .@RaoulGMI 15/20

Are you new to Brent Johnson's (.@SantiagoAuFund) '#Dollar Milshake Theory'?

A central bank-led vicious spiral that could quickly destabilize #financialmarkets...

👇 Masterfully explained on .@RealVision 16/20

www.youtube.com/watch?v=xxzy3sLs4Bs

A central bank-led vicious spiral that could quickly destabilize #financialmarkets...

👇 Masterfully explained on .@RealVision 16/20

www.youtube.com/watch?v=xxzy3sLs4Bs

Creepy how accurately it is unfolding...

Curious for more?

👇Full theory by .@SantiagoAuFund himself 17/20

www.youtube.com/watch?v=vDr3lRZ01Zo

Curious for more?

👇Full theory by .@SantiagoAuFund himself 17/20

www.youtube.com/watch?v=vDr3lRZ01Zo

#Assets in general tend to perform better with a weak dollar. This is called #reflation and it comes in 2 types

1. Dollar-led: Commodities react to a weaker USD and perform well

2. Synchronized global growth: Emerging markets outperform, pulling capital away from the US... 18/20

1. Dollar-led: Commodities react to a weaker USD and perform well

2. Synchronized global growth: Emerging markets outperform, pulling capital away from the US... 18/20

It's often the rate of change of the #dollar that matters most

A rapidly falling $USD can also have negative consequences; If dollars are easy to acquire, #investors borrow too many, creating a future problem

But usually, a rapidly rising dollar causes the most problems.. 19/20

A rapidly falling $USD can also have negative consequences; If dollars are easy to acquire, #investors borrow too many, creating a future problem

But usually, a rapidly rising dollar causes the most problems.. 19/20

The demise of the $USD as the global reserve currency?

It's different from a decline in the #dollar level

Dollar hegemony will be eroded gradually rather than lost suddenly

Will #Bitcoin do it? #CBDCs?

In the meantime, the #USDollar will continue to rise & fall... 20/20

It's different from a decline in the #dollar level

Dollar hegemony will be eroded gradually rather than lost suddenly

Will #Bitcoin do it? #CBDCs?

In the meantime, the #USDollar will continue to rise & fall... 20/20

Thank you for reading! If you liked this thread please RT the first tweet ⬇️

Credit to the great #InvestorTutorials series on .@RealVision. I’m learning this to be prepared for what’s coming.

Follow me @PaulGrra and I’ll keep sharing more as I learn.

Credit to the great #InvestorTutorials series on .@RealVision. I’m learning this to be prepared for what’s coming.

Follow me @PaulGrra and I’ll keep sharing more as I learn.