Thread

This is an encyclopedic and must-read essay from @LynAldenContact about the nature and politics of money.

Here are some highlights 🧵

www.lynalden.com/what-is-money

Here are some highlights 🧵

www.lynalden.com/what-is-money

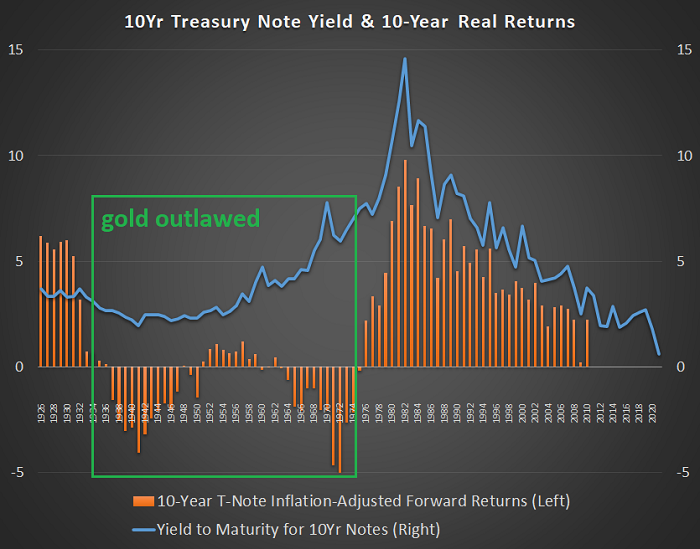

On the death of the gold standard, Lyn notes that even though gold's critics called it a "barbarous relic," that it "had to be confiscated and pushed out of use by the threat of imprisonment, and hoarded only by the government during a period of intentional currency devaluation"

"If it were truly such a relic," she says, "it would have fallen out of usage on its own and the government would have had little need to own any."

Obviously, this wasn't the case.

Obviously, this wasn't the case.

Lyn notes that post-1933, "the main release valve that [Americans] could turn to instead of cash or Treasuries as savings assets, was made illegal to them"

Great visualization here.

FWIW, Satoshi considered the gold ban and FDR's executive order 6102 in the design of Bitcoin

Great visualization here.

FWIW, Satoshi considered the gold ban and FDR's executive order 6102 in the design of Bitcoin

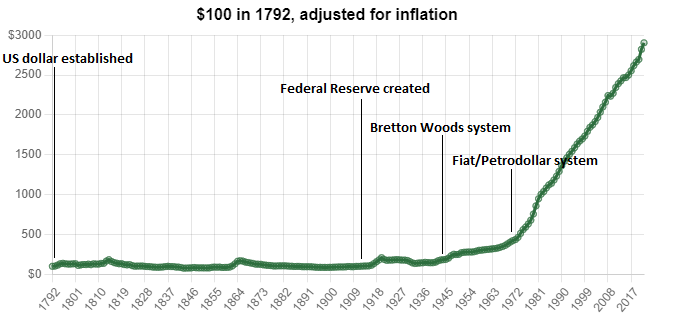

"From 1944-1971," she says, "the US drew down its gold reserves in order to maintain the Bretton Woods dollar system, whereas from 1974-present, the US instead drew down its industrial base to maintain the petrodollar system.

This policy choice is seen in staggering terms here

This policy choice is seen in staggering terms here

"Never before," she says, "in thousands of years of human history, has the entire world been using a money that has no resource cost or constraint.

It’s an experiment, in other words, and we’re five decades into it."

It’s an experiment, in other words, and we’re five decades into it."

"The fiat/petrodollar standard," she says, "is only four times older than bitcoin, and only two times older than the first internet browser.

That’s pretty recent when you think about it like that."

Indeed.

That’s pretty recent when you think about it like that."

Indeed.

"One of the results of fiat currency," she says, "especially towards the later stages of this five decade experiment since the 1970s, is that more people have begun to treat cash like a hot potato."

As cash loses its SoV properties, people begin to use other things as SoVs.

As cash loses its SoV properties, people begin to use other things as SoVs.

"We instinctively monetize other things, like art, stocks, home equity, or gold.

The ratio of home prices to median income has gone up a lot, as well as the ratio of the S&P 500 to median income, or a top-notch piece of art to median income."

The ratio of home prices to median income has gone up a lot, as well as the ratio of the S&P 500 to median income, or a top-notch piece of art to median income."

"For lack of good money in this fiat currency petrodollar era," she says, "especially in the post-2009 era with interest rates below inflation rates, we monetize other things with higher stock-to-flow ratios and treat them as stores of value."

"We plow a percentage of each paycheck into broad equity indices without analyzing companies or doing any sort of due diligence, treating that basket of stocks as simply a better store of value than cash regardless of what is inside."

Something worth reflecting on.

Something worth reflecting on.

"From 1792-1913, $ purchasing power oscillated mildly around the same value, with over 120 years of relative stability.

From 1913 onward, the policy changed and the $ has been in perpetual decline, especially after it completely dropped the gold peg in 1971"

Eye-popping chart:

From 1913 onward, the policy changed and the $ has been in perpetual decline, especially after it completely dropped the gold peg in 1971"

Eye-popping chart:

"And it’s actually worse today," she says, "than during most of this 1971-2022 Fiat/Petrodollar period, because interest rates aren’t keeping up with inflation rates anymore."

In the US, today's official CPI is ~8% and the bedrock interest rate is ~0%.

Financial repression.

In the US, today's official CPI is ~8% and the bedrock interest rate is ~0%.

Financial repression.

"The fiat system is getting less stable due to so much debt being in the system, which disallows policymakers from raising interest rates higher than the prevailing inflation rate"

As I recently wrote, low rates are a big US national security priority:

bitcoinmagazine.com/culture/how-the-fed-hides-costs-of-war

As I recently wrote, low rates are a big US national security priority:

bitcoinmagazine.com/culture/how-the-fed-hides-costs-of-war

"From a developing market standpoint the fiat/petrodollar standard contributes to massive booms and busts because a lot of their debt is denominated in $, and that debt fluctuates wildly in strength depending on the actions of US policymakers"

DC determines the fate of the world

DC determines the fate of the world

"The fiat/petrodollar system can be considered a form of neocolonialism; we push most of the costs of the system out into the developing countries in order to maximize the stability for the developed world."

I've explored this tragic reality in my writing as well.

I've explored this tragic reality in my writing as well.

"Fiat currency," Lyn points out, "tends to incentivize running bigger deficits (since spending doesn’t necessarily need to be taxed for), and generally requires some degree of hard or soft coercion in order to get people to use it over harder monies..."

"although that coercion is often rather invisible to most people most of the time, until things go wrong. Its ability to be diluted can allow for longer wars, selective bailouts for influential groups, and other forms of government spending aren’t always transparent to citizens"

Another point she makes is on the events of the last few weeks:

"The vast majority of sovereign official reserves, are permissioned assets rather than permissionless assets.

They are non-sovereign; able to be frozen by foreign nations.

War crystalizes this fact."

"The vast majority of sovereign official reserves, are permissioned assets rather than permissionless assets.

They are non-sovereign; able to be frozen by foreign nations.

War crystalizes this fact."

"Europe froze $400+ billion in Russian fiat assets in response to Russia’s invasion of Ukraine, which is equivalent to over 20% of Russian GDP and over five years of Russian military spending; an utterly massive economic confiscation"

The weaponization of FX reserves is historic

The weaponization of FX reserves is historic

Lyn looks at digital assets on the rise as a result of the flaws of the fiat system.

With regard to proof-of-stake cryptocurrencies, she notes their risk is that "they tend to centralize over time into an oligopoly."

With regard to proof-of-stake cryptocurrencies, she notes their risk is that "they tend to centralize over time into an oligopoly."

"Since it doesn’t require ongoing resource inputs to maintain your stake and to grow it over time, wealth tends to compound into more wealth, which they can then use to influence the system to give themselves even more wealth, and so on."

"What makes proof-of-stake blockchains inherently equity-like is that they require some form of ongoing governance, whereas proof-of-work blockchains (especially ones decentralized enough that they can’t really change their monetary policies) are more commodity-like"

100%

100%

Bitcoin's proof-of-work system, on the other hand, is beyond politics.

This allows and will continue to allow it to be used, as Lyn notes, by people even in places like Venezuela, Syria, Iran, Nigeria, China, Ukraine, and beyond.

This allows and will continue to allow it to be used, as Lyn notes, by people even in places like Venezuela, Syria, Iran, Nigeria, China, Ukraine, and beyond.

"At the end of the day, bitcoin is more of an anti-authoritarian monetary technology than it is a “left” or “right” monetary technology."

I couldn't agree more.

The whole essay is worth your time!

I couldn't agree more.

The whole essay is worth your time!

Mentions

See All

Lawrence Lepard @LawrenceLepard

·

Mar 13, 2022

Epic thread 👇