Thread

1/ Anti-money laundering groupthink - hostile to reality, increasingly weaponized against citizens - is the result of not facing the elephant in the room. AML/KYC is profoundly ineffective in its supposed goal, yet systematically ignored, for decades.

🧵

🧵

2/ AML has long been described as “a strategy for globalizing an extremely expensive new regulatory order” with derisory impact on its supposed goal, serious crime.

3/ This thread is part of a new series summarizing academic research at the intersection of anti-money laundering discourse and effectiveness/outcomes science, a surprisingly rare confluence. doi.org/10.1080/25741292.2020.1725366

4/ Bizarrely, the modern anti-money laundering movement operated unchallenged and unchanged for two decades, deeply ineffective, before its puny impact was exposed by the ultimate insider whistle-blower, the United Nations, outlined in an earlier thread.

5/ Oddly, despite the UN’s blunt warning, AML failure remains unaddressed today. Does groupthink sap curiosity, critical analysis, leadership for outcomes? Clues lie in a trail of earlier warnings, repeatedly ignored or overlooked since at least 1994.

doi.org/10.1177/00187267211070680

doi.org/10.1177/00187267211070680

6/ If history is any guide for the future, many warnings were ignored or overlooked more than a decade before the UN tried to blow the whistle. This thread summarizes just one, also ignored, as long ago as 2000, with findings chillingly prescient. [With direct quotes].

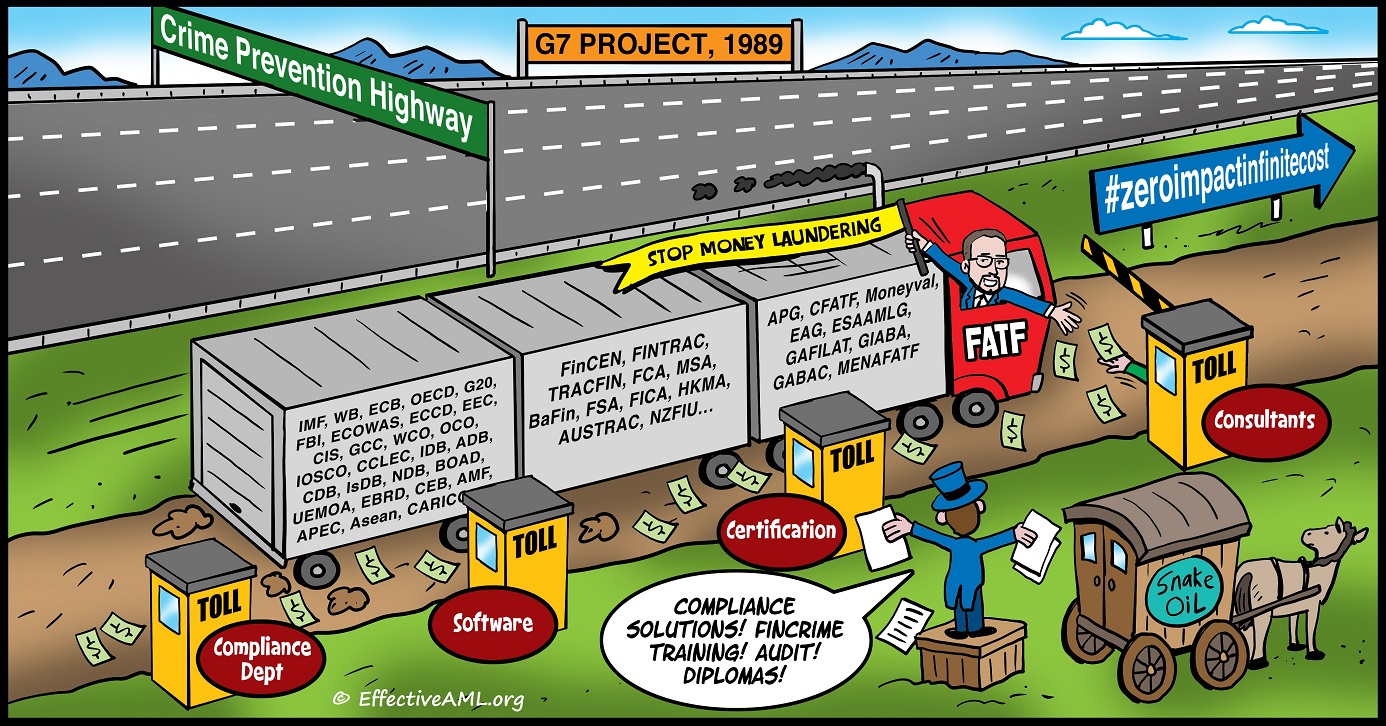

7/ 2000: “In pushing for the globalization of financial regulation, the US’ highest priority has not been uniform accountancy standards, harmonizing tax, macroeconomic policy coordination, nor even capital adequacy for banks. It has been money laundering.”

8/ “The domestic priority of tackling the drug trade and the political attractions of blaming foreigners has made money laundering the top US priority.”

9/ “…national security objectives are bundled into the issue: the war on drugs has been a useful weapon against the likes of General Noriega, and the CIA has an interest in being a major launderer of dirty money itself, while making it harder for the competition to do it.”

10/ “By 1990 only six states had modelled the US approach of making money laundering a specific criminal offense. The US drafted the Basel Statement [on money laundering], [and] the Vienna Convention against [drug trafficking, created] obligations…to criminalize…laundering.”

11/ “The most important initiative was taken at a [G7 Summit, which] invited eight [other countries] to join a Financial Action Task Force (FATF). By 1994, this club had expanded to more than thirty invitees.”

12/ “States join the FATF when they are ready to be subjected to peer review on implementation of [compliance with FATF’s 40 recommendations]”

13/ In practical terms, “members check FATF…reports before renewing or granting a bank a new licence to enter their market.”

14/ “It is now impossible for a bank to become a player in major economies unless it has a money laundering compliance officer reporting [transactions], promoting a [KYC] culture, and moving the bank towards [FATF] compliance.”

15/ [The result is that] “compliance with global money laundering standards is…more intensively monitored than other financial standards.”

16/“[I]t is somewhat shocking that international regulatory monitoring to catch money laundering by drug dealers is more rigorous than [bank] capital adequacy and risk management,…considering that the simultaneous collapse of a few minor ones could cause a systemic crisis.”

17/ “The global strategy has been to build…a wider…community of money laundering compliance… It may not have worked in eliminating money laundering, but it has worked as a strategy for globalizing an extremely expensive new regulatory order.”

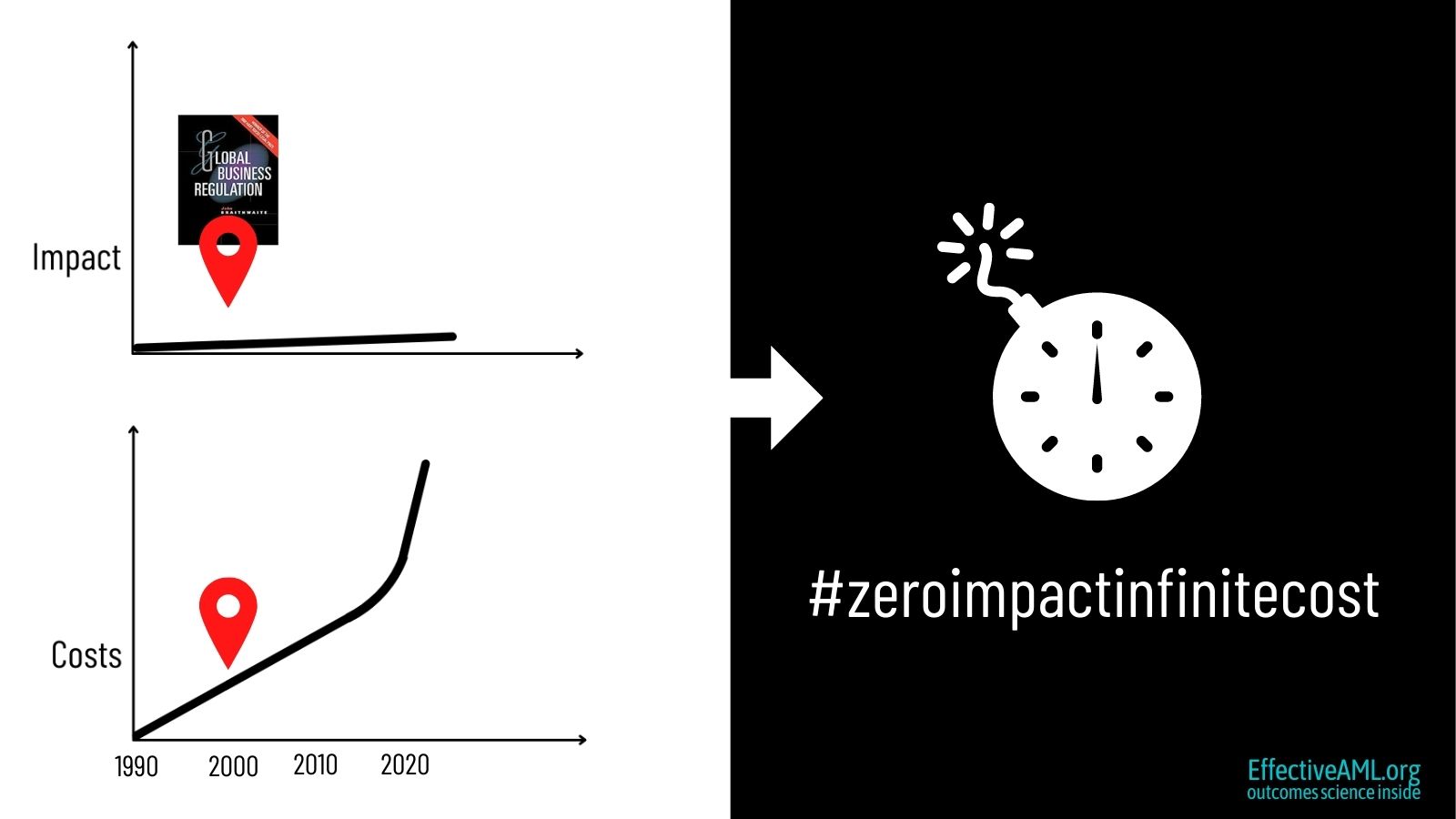

18/ Since the authors described “an extremely expensive new regulatory order” that "may not have worked in eliminating money laundering", later research found costs exploded, while the anti-money laundering movement remains profoundly ineffective. bit.ly/3sKUo09

19/ The AML complex repeatedly overlooks its effectiveness gap (👇), so with top-down change unlikely, a few scientists began work on innovative strategies for a country, industry, bank to slash crime, harm, regulatory risk & compliance costs, risk-free.

www.effectiveaml.org/this-is-bob/

www.effectiveaml.org/this-is-bob/

20/ In the meantime, systematically ignoring repeated warnings over three decades – from scientists, Europol, Canadian Senate, United Nations, and common sense – the modern anti-money laundering juggernaut is fast approaching the impossibility of #zeroimpactinfinitecost.

21/ Next in this series, the latest research on AML effectiveness, which also brought costs into the effectiveness equation, both fiercely resisted by the AML establishment.

22/ Please join the conversation, contribute to this work, or get some fun stuff for you or colleagues:

Subscribe:

www.effectiveaml.org/

Cartoons, mugs, caps, more:

www.effectiveaml.org/images/

Tip, donate, sponsor:

www.effectiveaml.org/donate/

Gitcoin grant:

gitcoin.co/grants/3380/effectiveamlorg-decentralize-knowledge

Subscribe:

www.effectiveaml.org/

Cartoons, mugs, caps, more:

www.effectiveaml.org/images/

Tip, donate, sponsor:

www.effectiveaml.org/donate/

Gitcoin grant:

gitcoin.co/grants/3380/effectiveamlorg-decentralize-knowledge

Mentions

See All

Sam Callahan @samcallah

·

Mar 10, 2022

Must read When I study CBDCs, central bank papers, or regulator reports, they always justify the weaponization of the financial system against its own citizens in the name of fighting illicit finance or money laundering. The problem? They’ve failed at stopping it for decades.