Thread by Christoph Trebesch

Thread

📢New paper on China's role in global finance and the difficulties of the Belt and Road. Sebastian Horn, @carmenmreinhart, Brad Parks and I show that China has created a new global system of rescue lending to countries in debt distress (large bailouts) 👇This is what we find, a🧵

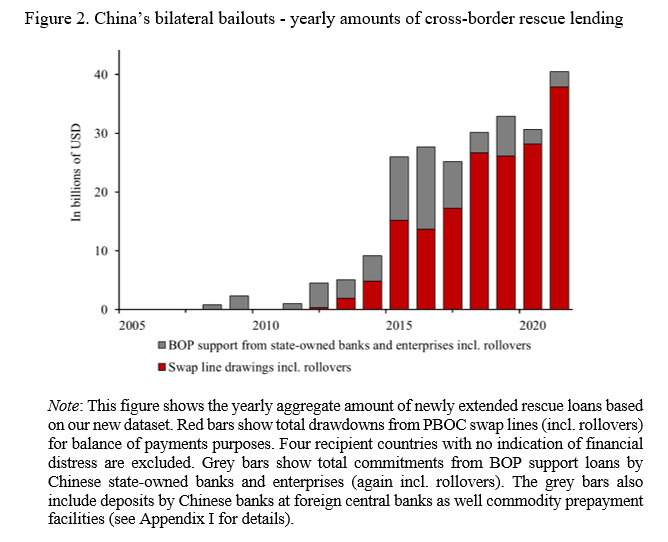

We know that China’s BRI went from boom to bust. Fresh lending is down; debt distress & restructurings are up. This papers now shows that Chinese creditors also reacted by extending large bailouts to crisis countries (new hand-coded dataset 2000-21). The system has 2 pillars

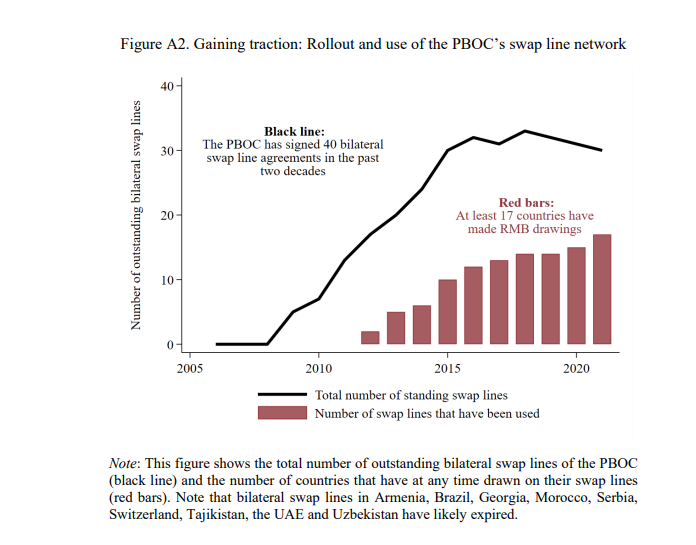

The first pillar is the global swap line network created by the People’s Bank of China. Officially, the purpose is to foster trade and investment in RMB. We code the actual drawings (for the first time) and find that this money is actually going to crisis countries in distress

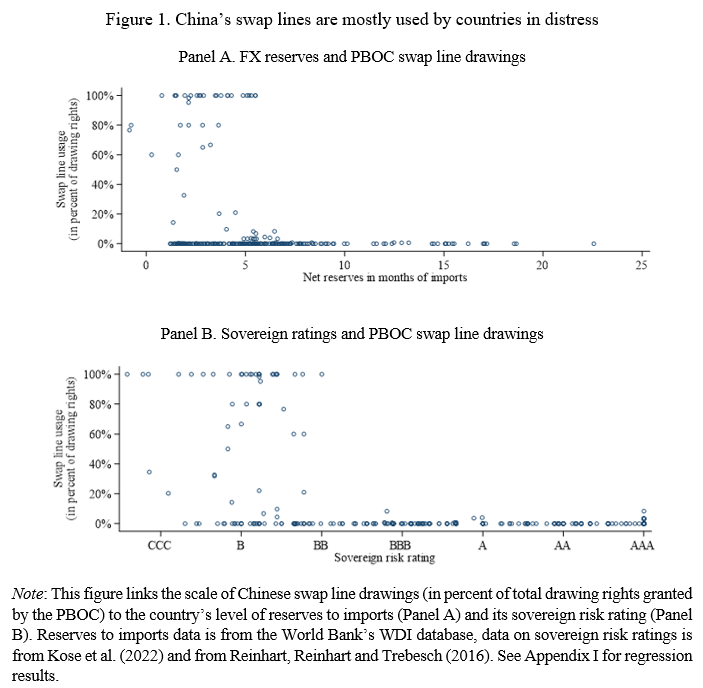

Countries with (i) low liquidity levels and (ii) low ratings are those drawing most from the PBOC (thus bolstering their gross reserves) 👇. This is in line with the literature (eg @JavierBianchi7 et al.), showing that countries prop up reserves to avoid rollover crisis & default

The take away: PBOC swap lines have become an important tool of China’s overseas crisis management. In total USD 170 billion of swaps have been extended (in RMB). This includes repeated rollovers (de facto maturity is 3 years, a very different animal than the Fed’s short swaps)

The second pillar are classic, bilateral rescue loans, meaning balance of payment support from Chinese state-owned banks (>70 billion USD). We also identify indirect bailouts to crisis countries by Chinese state oil & gas companies, which provide large cash advances

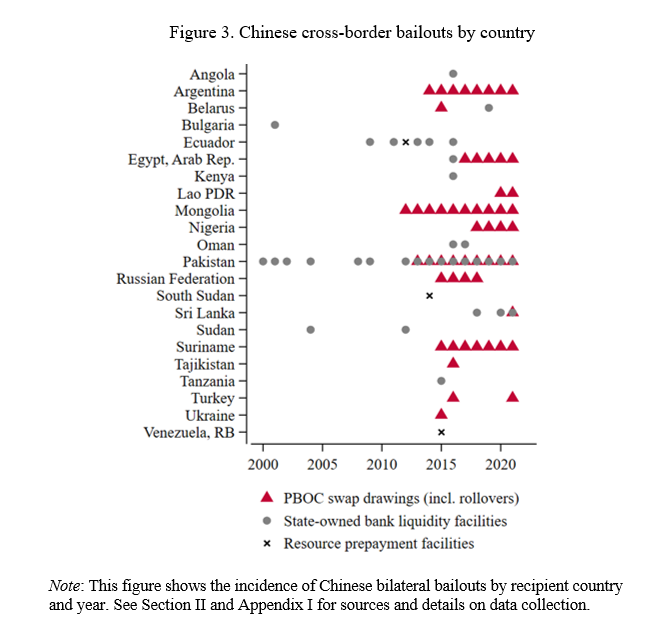

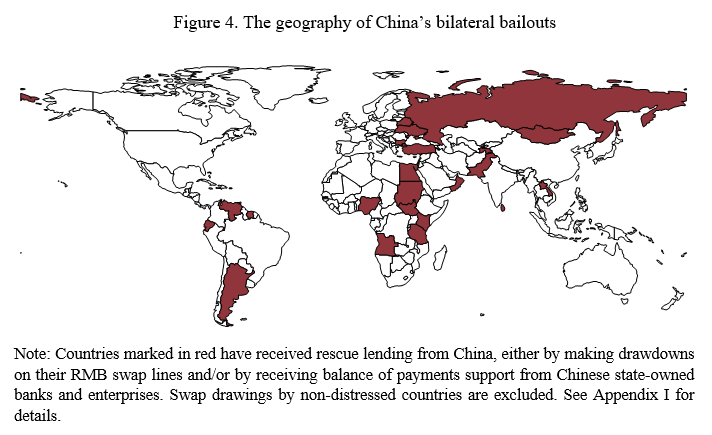

In total, 20+ debtor countries received >240 billion USD in Chinese rescue lending since 2000. Most of that (185 billion USD) was extended in the past five years (2016-2021). Over the past decade the sum corresponds to 20% of total IMF lending. So this is large and growing fast

However, China should not be seen as a new “international lender of last resort” with deep pockets, like the IMF. The IMF’s global lending portfolio is 5x times larger and more global in nature, while US Fed swaps to advanced economies dwarf the size of Chinese PBOC swaps

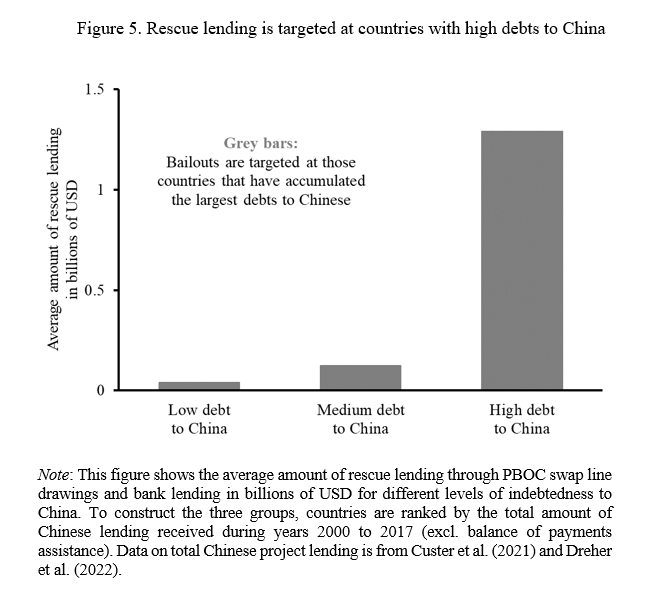

China's rescue activities are more reminiscent of a regional bailout scheme, like the European ESM or the US bailouts in Latin America in the 1980s. We therefore call this “Bailouts on the Belt and Road”. Indeed, rescue loans mostly go to countries with high debts owed to China👇

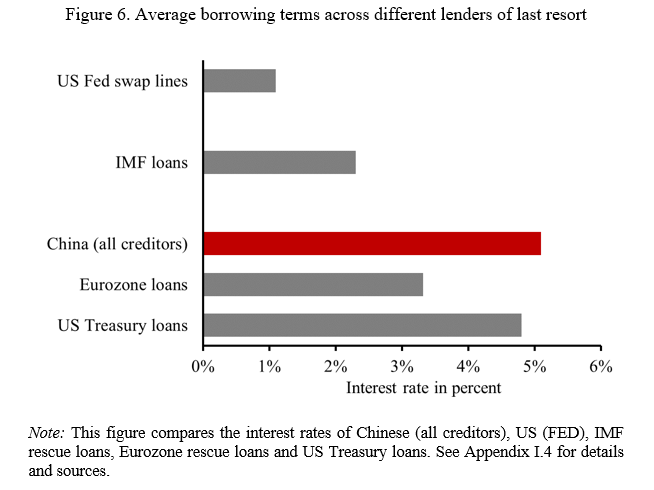

Interestingly, the interest rates charged on Chinese bailout loans (including PBOC swaps) are comparatively high. This is in line with our previous findings (/w Horn/Reinhart) that China charges higher interest rates than other bilateral lenders, or the IMF/World Bank

The paper can be accessed here www.ifw-kiel.de/fileadmin/Dateiverwaltung/IfW-Publications/-ifw/Kiel_Working_Paper/2023/KWP_2244_Chin...

We also uploaded the full database for public use, see here: www.aiddata.org/data/china-as-an-international-lender-of-last-resort-dataset-version-1-0

For further insights on China’s expanding role in global currency and debt markets I really recommend the research agenda by Saleem Bahaj and @R2Rsquared e.g. tinyurl.com/3s4vur35, as well as the work by @m_maggiori, @JSchreger et al, e.g. www.nber.org/papers/w30336

Of course also follow @Brad_Setser, @michaelxpettis, @D_Brautigam, @fuchs_andreas, @DreherAxel, @AustinMStrange, @MikeTierneyIR, @KevinPGallagher, @daniel_mcdowell on these issues (among several others I am forgetting, sorry & suggestions welcome)

Mentions

See All

Alex Gladstein @gladstein

·

Mar 28, 2023

Interesting thread 🧵