Thread

Remember when Amazon bought Whole Foods in 2017?

Lina Khan warned the merger would expand Amazon's "fief." Yes. Amazon is a feudal lord in this worldview.

As the Khan crew gets ready to rewrite the merger guidelines, let's look back at their predictive powers in the past:

Lina Khan warned the merger would expand Amazon's "fief." Yes. Amazon is a feudal lord in this worldview.

As the Khan crew gets ready to rewrite the merger guidelines, let's look back at their predictive powers in the past:

Khan wasn't alone in her dire predictions about Amazon/Whole Foods.

Tim Wu called it a "super-monopoly." Apparently, Whole Foods had a grocery monopoly?? Barry Lynn said, "Amazon is monopolizing commerce in the United States."

Monopolizing commerce. All commerce. Full stop 🙄

Tim Wu called it a "super-monopoly." Apparently, Whole Foods had a grocery monopoly?? Barry Lynn said, "Amazon is monopolizing commerce in the United States."

Monopolizing commerce. All commerce. Full stop 🙄

What exactly would be hurt by the merger? Khan predicted in the NYT that the deal “would allow Amazon to potentially thwart future innovations.”

"Potentially" is a possible out.

But has the grocery industry stagnated?

"Potentially" is a possible out.

But has the grocery industry stagnated?

If anything, others had to match the Amazon model of easy, online shopping with quick delivery.

For example, Walmart's changes to match:

- Grocery pickup announced in 2017, but real push in 2019

- Acquires Parcel in fall 2017

- Same-day delivery introduced in 2018

For example, Walmart's changes to match:

- Grocery pickup announced in 2017, but real push in 2019

- Acquires Parcel in fall 2017

- Same-day delivery introduced in 2018

👆 is in addition to Amazon's changes: cashierless stores, Amazon locker, and cutting Whole Foods prices.

Maybe it's overhyped, but what innovation did we see pre-2017?

This isn't rigorous, causal evidence, but it's hard to see how the grocery market's innovation has stagnated.

Maybe it's overhyped, but what innovation did we see pre-2017?

This isn't rigorous, causal evidence, but it's hard to see how the grocery market's innovation has stagnated.

Let's take another merger: Google-Fitbit.

Another prediction: Google's acquisition of Fitbit would allow it to use biometric data to target ads better and maintain its monopoly.

They are tracking your heart rate to sell you medication!!! 🙀

cepr.org/voxeu/blogs-and-reviews/googlefitbit-review-privacy-competition-issue

Another prediction: Google's acquisition of Fitbit would allow it to use biometric data to target ads better and maintain its monopoly.

They are tracking your heart rate to sell you medication!!! 🙀

cepr.org/voxeu/blogs-and-reviews/googlefitbit-review-privacy-competition-issue

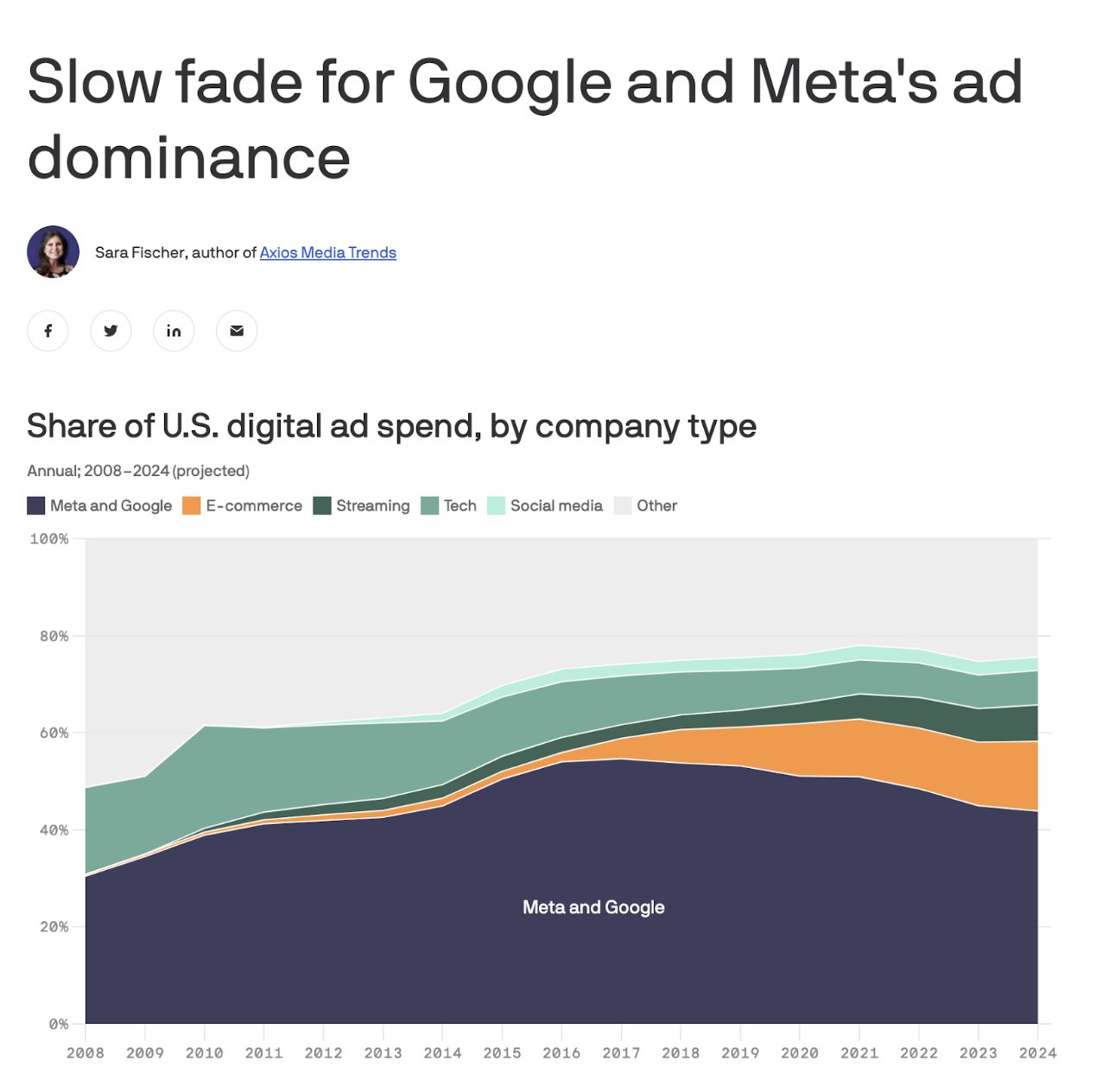

Reality: No evidence of that. Google has constantly been losing market share in digital ads. Fitbit remains a tiny (and shrinking) player in an expanding wearable tech market.

We have a history of false positives: predicting destruction that didn't occur. We also have false negatives.

Take Facebook/Instagram. Many people today point to it as the one that got away, but none of the usual voices worried in 2012

(TBF, some of us were still in college.)

Take Facebook/Instagram. Many people today point to it as the one that got away, but none of the usual voices worried in 2012

(TBF, some of us were still in college.)

At the time, The Guardian asked several commentators about the deal. No one mentioned anticompetitive behavior.

The reactions are funny to read in retrospect. Think about Google+! www.theguardian.com/commentisfree/cifamerica/2012/apr/09/facebook-instagram-1bn-storify

The reactions are funny to read in retrospect. Think about Google+! www.theguardian.com/commentisfree/cifamerica/2012/apr/09/facebook-instagram-1bn-storify

You see similar failed predictions among the headling grabbing mergers: Coors-Miller, Bayer-Monsanto, Ticketmaster-Live Nation.

In a recent @LawEconCenter white paper, myself, @AuerDirk, @ericfruits, and @geoffmanne do a whirlwind tour of these mergers

laweconcenter.org/resources/doomsday-mergers-a-retrospective-study-of-false-alarms/?doing_wp_cron=167...

In a recent @LawEconCenter white paper, myself, @AuerDirk, @ericfruits, and @geoffmanne do a whirlwind tour of these mergers

laweconcenter.org/resources/doomsday-mergers-a-retrospective-study-of-false-alarms/?doing_wp_cron=167...

It's hard to see how reality matches the rhetoric.

We don't claim this is rigorous econometric evidence, but we cite it when it is available.

The paper is more of a sanity check against the wildest claims in antitrust. The sky hasn't been falling. We are not feudal serfs.

We don't claim this is rigorous econometric evidence, but we cite it when it is available.

The paper is more of a sanity check against the wildest claims in antitrust. The sky hasn't been falling. We are not feudal serfs.

As the FTC/DOJ update the merger guidelines, we urge humility.

The strongest voices haven't been accurate, so let's not get caught up in their rhetoric.

We have a rigorous review process for a reason. Don't replace that with #vibes around some people's hatred of Big Tech.

The strongest voices haven't been accurate, so let's not get caught up in their rhetoric.

We have a rigorous review process for a reason. Don't replace that with #vibes around some people's hatred of Big Tech.

Mentions

See All

Alex Tabarrok @ATabarrok

·

Mar 28, 2023

Excellent thread.