Thread by Ram Ahluwalia, crypto CFA

- Tweet

- Mar 19, 2023

- #Finance

Thread

1/ SVB's decline started with a 'slow motion' bank run in 2022, management missteps, and a botched equity raise led by Goldman Sachs.

There are many lessons beyond duration mismatch.

There's also fallout for $GS: potentially locked out of bank capital raises for a few years.

There are many lessons beyond duration mismatch.

There's also fallout for $GS: potentially locked out of bank capital raises for a few years.

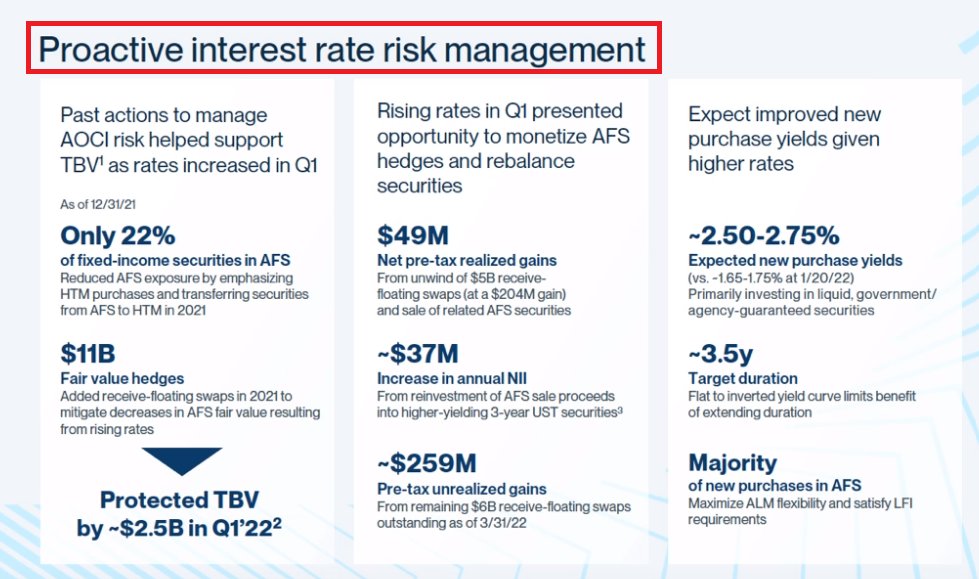

2/ Contrary to popular belief, SVB *did* anticipate an inverted yield curve.

This slide, titled 'proactive interest rate risk management' was published one year ago.

Same quarter the Fed just started rate hikes.

There was time to act... ALCO?

This slide, titled 'proactive interest rate risk management' was published one year ago.

Same quarter the Fed just started rate hikes.

There was time to act... ALCO?

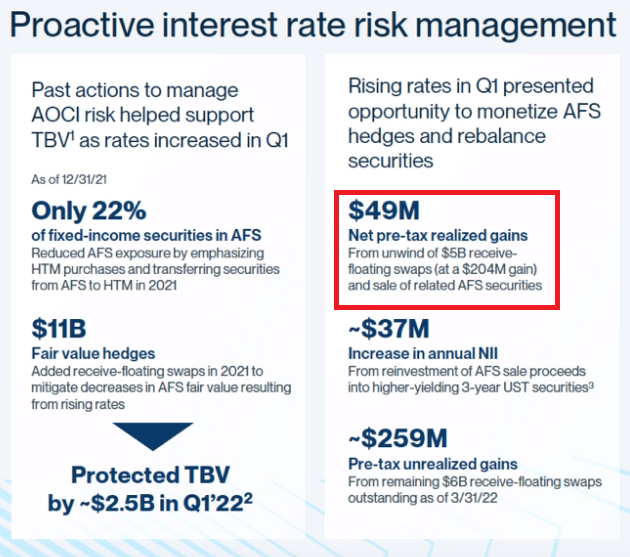

3/ SVB *did* have hedges.

This slide from Q1 '22 describes how SVB monetized in-the-money hedges as rates rose.

When rate expectations increased, the hedges increased in value.

Suggest SVB used hedges, a risk-management device, as a quarterly earnings management tool.

This slide from Q1 '22 describes how SVB monetized in-the-money hedges as rates rose.

When rate expectations increased, the hedges increased in value.

Suggest SVB used hedges, a risk-management device, as a quarterly earnings management tool.

4/ Regardless though, the size of the hedges were insufficient to protect the tangible book value of the bank.

The hedges covered a small fraction of tangible book value ($2.5 Bn - not nearly enough).

(Note: Hedges would not be n'ecy if duration was right-sized to begin with)

The hedges covered a small fraction of tangible book value ($2.5 Bn - not nearly enough).

(Note: Hedges would not be n'ecy if duration was right-sized to begin with)

5/ SVB was was targeting a more reasonable duration of 3.5 years as early as last year.

In the last 12 months, there was no material pivot of the balance sheet or capital raise - despite statements to shareholders.

In the last 12 months, there was no material pivot of the balance sheet or capital raise - despite statements to shareholders.

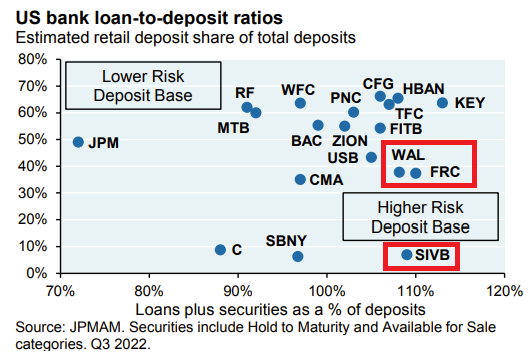

6/ It's well-known that SVB's asset liability mismatch was an outlier to the rest of the banking sector

Less known is that SVB's 'loans plus securities'-to-deposit ratio was also an egregious outlier.

Less known is that SVB's 'loans plus securities'-to-deposit ratio was also an egregious outlier.

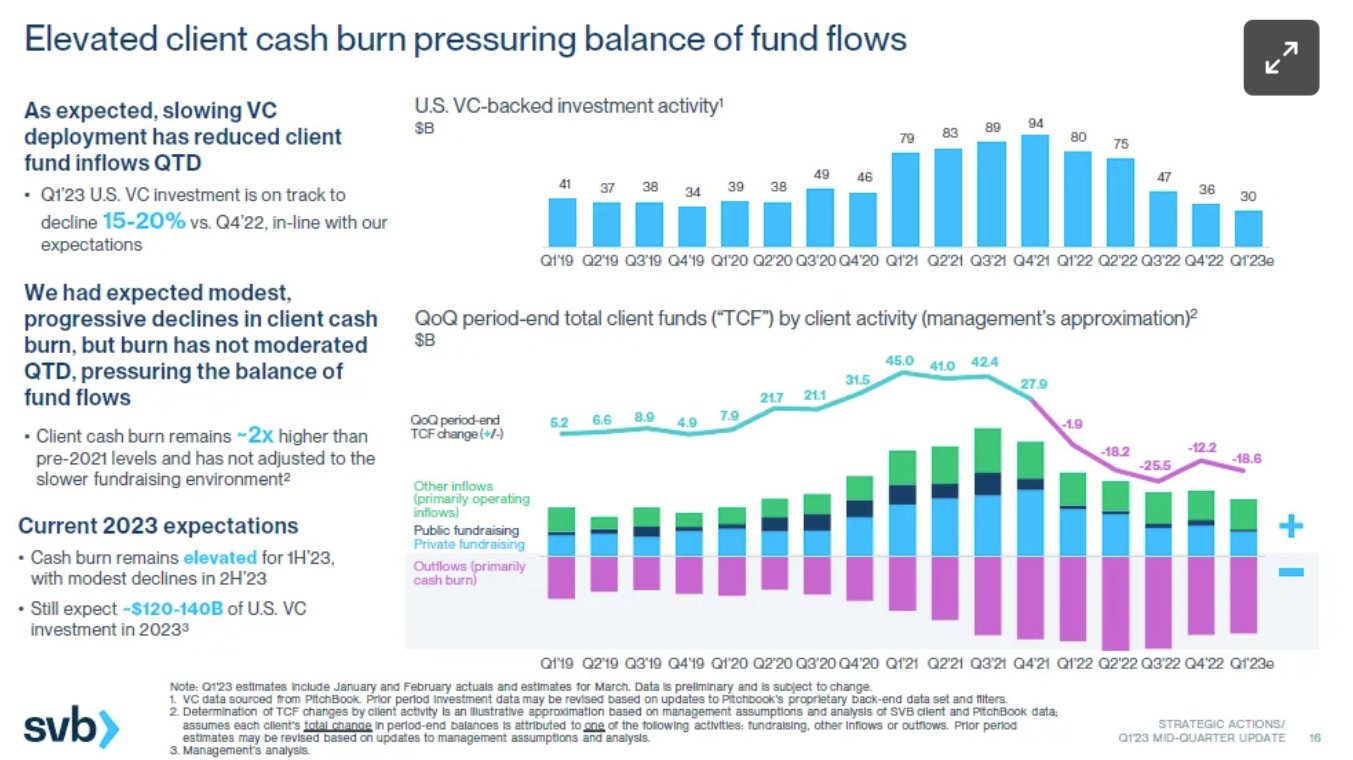

7/ The main issue: SVB was financing (illiquid) loans and (long duration) securities with *hot money* deposits from cash burning startups

In '22 net deposits declined due to:

(i) high startup burn-rates (more deposits out)

(ii) reduced startup fundraising (less deposits in)

In '22 net deposits declined due to:

(i) high startup burn-rates (more deposits out)

(ii) reduced startup fundraising (less deposits in)

8/ The 'hot money' nature of SVB's deposit base means that SVB's CFO/Treasurer need to be *even more* skewed to shorter duration.

Instead, SVB went the other way and reached on the far end of the duration curve.

SVB reports the cash burn of its deposit base draining deposits.

Instead, SVB went the other way and reached on the far end of the duration curve.

SVB reports the cash burn of its deposit base draining deposits.

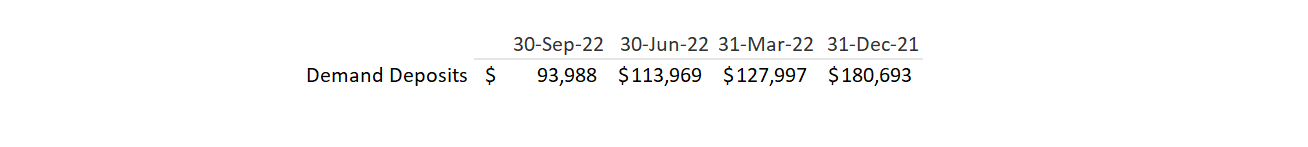

9/ SVB started as a slow motion bank run one year in the making

In under 9 months, *demand deposits declined ~50%*

(Side Note: Other regionals, such as Signature also had this slow motion bank run at work. Signature lost 20% of deposits in 1 year...)

In under 9 months, *demand deposits declined ~50%*

(Side Note: Other regionals, such as Signature also had this slow motion bank run at work. Signature lost 20% of deposits in 1 year...)

10/ Fast forward one year.

No cap raise, no balsht pivot.

Instead, SVB moves bonds out of the AFS portfolio into the HTM portfolio.

This is like stuffing all your kids toys & laundry into the closet before the guests arrive.

The mess is still there, even if you hide it.

No cap raise, no balsht pivot.

Instead, SVB moves bonds out of the AFS portfolio into the HTM portfolio.

This is like stuffing all your kids toys & laundry into the closet before the guests arrive.

The mess is still there, even if you hide it.

11/ SVB starts a capital raise process.

SVB gets notice that Moody's is imminently about to downgrade the bonds.

SVB chooses to raise before the downgrade.

SVB gets notice that Moody's is imminently about to downgrade the bonds.

SVB chooses to raise before the downgrade.

12/ Moody's downgrade expected the day after capital raise

SVB discloses a $1.8 Bn loss.

SVB decides to 'gun it' thru the yellow light before the downgrade.

Terrible bookending.

Silvergate announces it is shutting down in the middle of the raise 🤦♂️

www.wsj.com/articles/bond-losses-push-silicon-valley-bank-parent-to-raise-capital-125e89d4?mod=articl...

SVB discloses a $1.8 Bn loss.

SVB decides to 'gun it' thru the yellow light before the downgrade.

Terrible bookending.

Silvergate announces it is shutting down in the middle of the raise 🤦♂️

www.wsj.com/articles/bond-losses-push-silicon-valley-bank-parent-to-raise-capital-125e89d4?mod=articl...

13/ The equity raise was botched. Goldman Sachs was the lead advisor.

In the weeks leading up to the capital raise, Goldman agrees to a 'committed financing at market price'.

Read that over again. When is a commitment not a commitment?

In the weeks leading up to the capital raise, Goldman agrees to a 'committed financing at market price'.

Read that over again. When is a commitment not a commitment?

14/ A commitment to 'market price' is whatever price clears the market.

In other words, there is no commitment to a specific price.

Just a commitment to raise money.

It's nice work if you can get it!

Notably, SVB had an in-house investment banking team. Were they consulted?

In other words, there is no commitment to a specific price.

Just a commitment to raise money.

It's nice work if you can get it!

Notably, SVB had an in-house investment banking team. Were they consulted?

15/ General Atlantic soft commits to about 1/3 of the equity round.

That means if the funds are not raised, GA is not on the hook.

GA has an option to invest.

GA is providing 'signaling value' as a lead. It only represents 1/3 of the book - there is deal execution risk.

That means if the funds are not raised, GA is not on the hook.

GA has an option to invest.

GA is providing 'signaling value' as a lead. It only represents 1/3 of the book - there is deal execution risk.

16/ WSJ reports that time is running out to line up more investors to supply the remaining $1.75 billion that SVB is seeking.

SVB executives weren’t ready to give investors the information they needed to get everyone on board.

www.wsj.com/articles/how-goldmans-plan-to-shore-up-silicon-valley-bank-crumbled-96bb44bb?mod=djemMone...

SVB executives weren’t ready to give investors the information they needed to get everyone on board.

www.wsj.com/articles/how-goldmans-plan-to-shore-up-silicon-valley-bank-crumbled-96bb44bb?mod=djemMone...

17/ Mistake #5: GS should have hard-circled and marketed the offering earlier to big PE firms that understand banks (like Warburg Pincus, StonePoint).

Warburg droped out in the middle of the raise - they needed more time, but neither $SIVB or $GS has planned for enough time.

Warburg droped out in the middle of the raise - they needed more time, but neither $SIVB or $GS has planned for enough time.

18/ It's Thursday March 9th

The capital raise has failed. Deposit outflows accelerate. Social Media & VC chatter doesn't help.

SVB is required to disclose the bank run to investors.

SVB CEO Gary Becker has a call with bank customers.

The capital raise has failed. Deposit outflows accelerate. Social Media & VC chatter doesn't help.

SVB is required to disclose the bank run to investors.

SVB CEO Gary Becker has a call with bank customers.

20/ Another key management mistake...

The front-line account executives are not trained with reassuring messaging.

The AEs are themselves shaken. That hurts customer confidence.

The state regulator and FDIC place SVB in receivership on Friday.

The front-line account executives are not trained with reassuring messaging.

The AEs are themselves shaken. That hurts customer confidence.

The state regulator and FDIC place SVB in receivership on Friday.

21/ Present Day:

SVB 2.0 ('Silicon Valley Bridge Bank') has unlimited deposit insurance.

New CEO, Tim Mayopoulos, brings together FinTech, Venture, and Banking.

Let's root for SVB's continued independences - a storied tech banking institution.

SVB 2.0 ('Silicon Valley Bridge Bank') has unlimited deposit insurance.

New CEO, Tim Mayopoulos, brings together FinTech, Venture, and Banking.

Let's root for SVB's continued independences - a storied tech banking institution.

22/ Summary of SVB's mistakes:

(1) Duration mismatch (known)

(2) Board oversight?

(3) Bank run started in '22...

(4) Insufficient hedges

(5) Treating AFS/HTM as an earnings tool

(6) Raises too little, too late

(7) Poor execution of capital raise

(8) Poor front-line AE messaging

(1) Duration mismatch (known)

(2) Board oversight?

(3) Bank run started in '22...

(4) Insufficient hedges

(5) Treating AFS/HTM as an earnings tool

(6) Raises too little, too late

(7) Poor execution of capital raise

(8) Poor front-line AE messaging