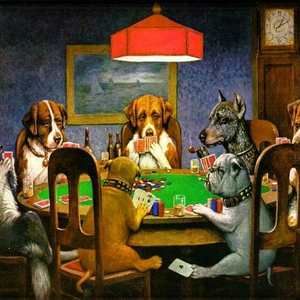

Statistically Speaking, You Are The Patsy

- Article

- Mar 14, 2023

- #Economics #Statistics #Investment

When analyzing individual companies, there is a disconnect between our expectations and this base rate of performance.

Consider how investors value companies. We are trained to thi...

Show More