Thread

After the #SVB collapse businesses are reassessing their corp treasury & #BTC

You don't have to be large like @blocks or @MicroStrategy to hold #BTC on your balance sheet.

Over 400 businesses use @SwanBitcoin for this.

Some things to consider for your Corp Treasury

A 🧵👇🏾

You don't have to be large like @blocks or @MicroStrategy to hold #BTC on your balance sheet.

Over 400 businesses use @SwanBitcoin for this.

Some things to consider for your Corp Treasury

A 🧵👇🏾

“Failure comes from a failure to imagine failure"

As a risk manager, your primary goal is to avoid ruin at all costs.

With the majority of asset classes, your probability of ruin is directly correlated to the amount of counterparty risk you hold within those assets.

As a risk manager, your primary goal is to avoid ruin at all costs.

With the majority of asset classes, your probability of ruin is directly correlated to the amount of counterparty risk you hold within those assets.

#BTC is a fundamentally unique asset because it's an asset that can be owned & verified without the trust of:

- an unelected body of leaders

- a nation-state

- a company, government, or corporation

It's for this reason, that most businesses should have a reasonable amount

- an unelected body of leaders

- a nation-state

- a company, government, or corporation

It's for this reason, that most businesses should have a reasonable amount

of #BTC on their balance sheet. With bitcoin, you can avoid total ruin and absolute collapse because it is an asset without counterparty risk.

You can exchange #BTC 24/7/365 🌎... even on a weekend when the traditional banking sector is closed or collapsing.

You can exchange #BTC 24/7/365 🌎... even on a weekend when the traditional banking sector is closed or collapsing.

"How do I account for BTC at my company?"

#BTC is considered an indefinite intangible asset. Currently under the IAS 38, intangible assets are measured at cost on initial recognition and subsequently measured at fair value less accumulated

amortization and impairment losses.

#BTC is considered an indefinite intangible asset. Currently under the IAS 38, intangible assets are measured at cost on initial recognition and subsequently measured at fair value less accumulated

amortization and impairment losses.

The Financial Accounting Standards Board is considering changes that allows companies to mark up the value of #BTC when it increases, not just listing impairment losses when the price decreases.

@jameslavish has a great 🧵on this

@jameslavish has a great 🧵on this

"Get Off Zero. Your Allocation Grows With Your Education"

The best time to plant a tree was yesterday and the second best time is now. Most people believe that you need to go "all-in" on crypto to get started.

Buy your first #BTC on a Bitcoin-only exchange and learn why

The best time to plant a tree was yesterday and the second best time is now. Most people believe that you need to go "all-in" on crypto to get started.

Buy your first #BTC on a Bitcoin-only exchange and learn why

the technology is revolutionary. Here are three great books to get you started:

www.swanbitcoin.com/inventing-bitcoin/

www.swanbitcoin.com/whybitcoin/

www.swanbitcoin.com/21lessons/

I just re-read @BillGates "The Internet Tidal Wave". He said the internet was the most important tech of this century.

www.swanbitcoin.com/inventing-bitcoin/

www.swanbitcoin.com/whybitcoin/

www.swanbitcoin.com/21lessons/

I just re-read @BillGates "The Internet Tidal Wave". He said the internet was the most important tech of this century.

#Bitcoin is similarly novel in its innovation and it's importance in our digital world. It's a fascinating memo to read if you haven't read it.

lettersofnote.com/2011/07/22/the-internet-tidal-wave/

lettersofnote.com/2011/07/22/the-internet-tidal-wave/

"How do other businesses buy?"

New research coming out from @samcallah @rapha_at_swan that buying in lump sums is equally as viable as a DCA strategy because #BTC

New research coming out from @samcallah @rapha_at_swan that buying in lump sums is equally as viable as a DCA strategy because #BTC

spends so much time going sideways or down you inherit more annualized volatility & downside risk through DCA.

The main purpose isn't whether your DCA or BTD, it's that you have a meaningful amount of a NCA... a non-correlated asset relative to your other ones.

The main purpose isn't whether your DCA or BTD, it's that you have a meaningful amount of a NCA... a non-correlated asset relative to your other ones.

Service businesses with high recurring revenues and low fixed costs like tax firms & accountants typically have high net profit margins and are usually DCA'ing and allocating anywhere from 20-50% of these profits to their treasury with Swan. Why?

Their business is their expertise. They have lean operations and can always raise more cash with their time.

As they look to sell their businesses at low multiples cash is trash. Several of them are realizing their business is more attractive with BTC than not.

As they look to sell their businesses at low multiples cash is trash. Several of them are realizing their business is more attractive with BTC than not.

The next type of business is the small business with high-labor costs but low fixed costs... these are contractors... Plumbing, Construction, HVAC cos... these businesses are seasonal. They rarely DCA.

They typically buy in lump sums based on how well they did that quarter.

They typically buy in lump sums based on how well they did that quarter.

They keep guys/gals on payroll year around to avoid turnover (which is typically high), but they're only making huge cash when they have lots of work.

They invest in large chunks, and are opportunisitc buyers after quarter end.

Many of them are offering #BTC as a benefit

They invest in large chunks, and are opportunisitc buyers after quarter end.

Many of them are offering #BTC as a benefit

to reduce turnover & increase retention rates through our BBP product.

Some provide Bitcoin as a monthly benefit to all employees. Some offer it for performance bonuses or even Christmas gifts. We make it easy.

www.swanbitcoin.com/benefit/

Some provide Bitcoin as a monthly benefit to all employees. Some offer it for performance bonuses or even Christmas gifts. We make it easy.

www.swanbitcoin.com/benefit/

The last and smallest group I speak with is the unprofitable upstart.

Their treasury strategy is typically dictated by their liabilities & negative cash flows.

We're usually talking about ways they can integrate #BTC into their business strategy & revenue model.

Their treasury strategy is typically dictated by their liabilities & negative cash flows.

We're usually talking about ways they can integrate #BTC into their business strategy & revenue model.

Can they implement #Lightning or Value4Value?

Can they begin accepting #BTC as payment through vendors like @PoweredbyIBEX or @ZapriteApp?

Can they begin accepting #BTC as payment through vendors like @PoweredbyIBEX or @ZapriteApp?

"Practice The Procedures Of Your Policy Before It's Crunch Time"

You don't rise to the level of the moment but fall to the level of your training.

You don't rise to the level of the moment but fall to the level of your training.

Most people panic in times of crisis, because they haven't trained themselves to execute under pressure.

You want to be certain that you're comfortable with your custody before a crisis hits, not during.

We encourage everyone at Swan to take custody of their #BTC

You want to be certain that you're comfortable with your custody before a crisis hits, not during.

We encourage everyone at Swan to take custody of their #BTC

We make it easy for all business accounts to do automatic free withdrawals to any wallet off Swan.

The best risk managers I speak with don't just withdraw their #BTC, they have practiced authorizing a transaction from a multi-signature contract with others on their team.

The best risk managers I speak with don't just withdraw their #BTC, they have practiced authorizing a transaction from a multi-signature contract with others on their team.

They have a policy for backup/recovery. They have implemented withdrawal freezes at the Account level or even the UTXO level w/ @SpecterWallet .

They have done the work and as a result, when a crisis hits, they and their team will be able to access liquidity & safety.

They have done the work and as a result, when a crisis hits, they and their team will be able to access liquidity & safety.

Like Bezos said in his 2000 Shareholder letter. It's Day 1. Bitcoin is heavier today than it's ever been.

s2.q4cdn.com/299287126/files/doc_financials/annual/00ar_letter.pdf

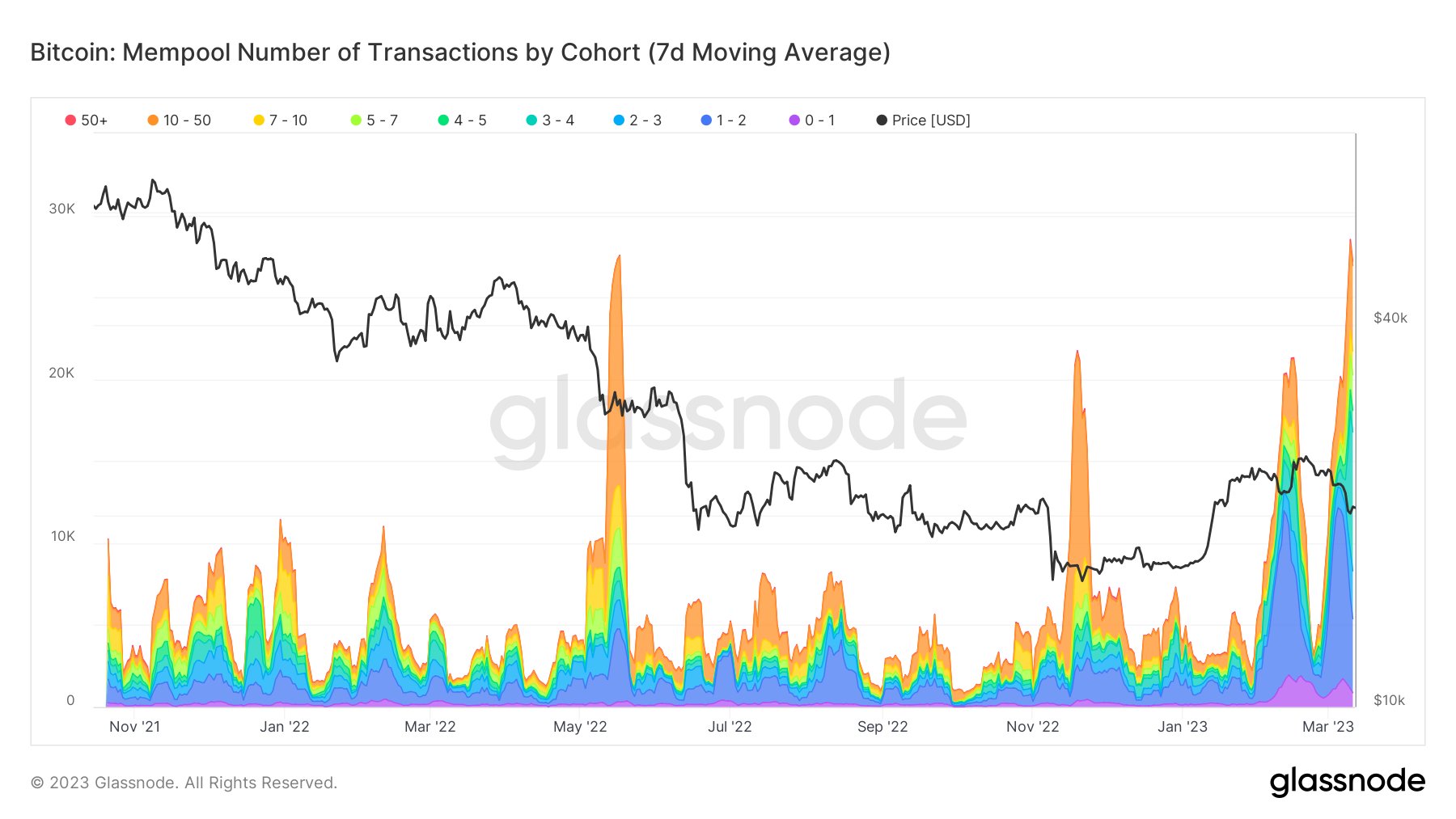

As banks are closed and face collapse, the Bitcoin Mempool has cleared a multi-year high in transactions without skipping a beat.

s2.q4cdn.com/299287126/files/doc_financials/annual/00ar_letter.pdf

As banks are closed and face collapse, the Bitcoin Mempool has cleared a multi-year high in transactions without skipping a beat.

If you have questions about adding #BTC to your corporate balance sheet, I'm happy to chat. You can get create a corporate account in less than two business days at swanbitcoin.com/business.