Thread

OK, some very early morning thoughts on SVB, and why it probably isn't a harbinger for the banking system as a whole — why this is unlikely to be another Lehman moment 1/

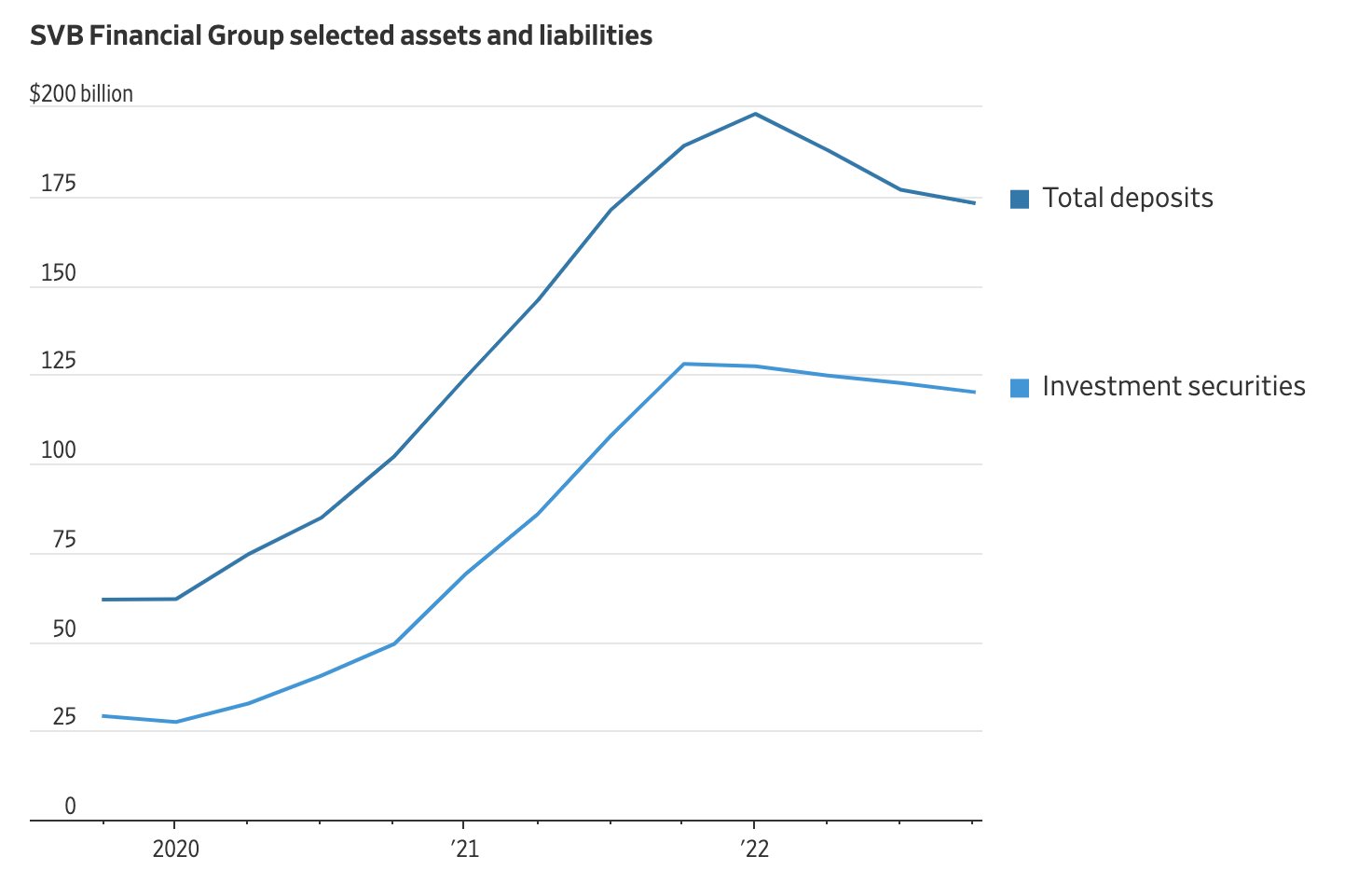

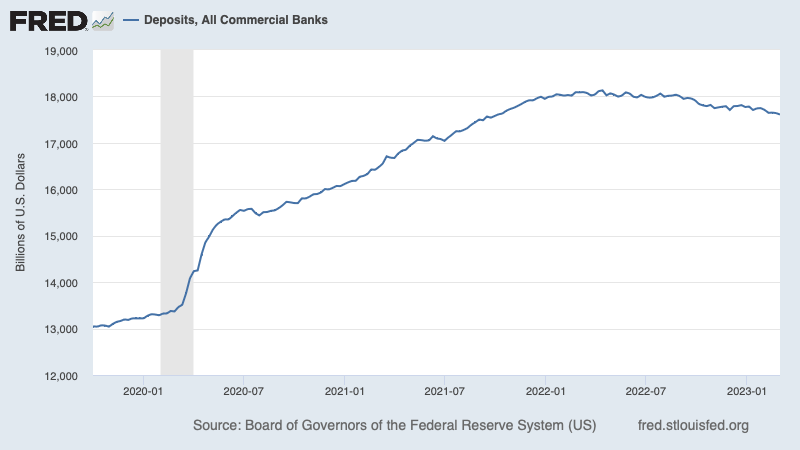

SVB was founded 40 years ago, but its big expansion is much more recent; deposits surged during the pandemic 2/

So what was SVB selling? As far as I can tell, it was just unusually good at cultivating relationships with, um, Silicon Valley, specifically VC. Maybe it should have been called Schmoozing and Vibes Bank 4/

There were two problems with this business model. First, the bank attracted big accounts, far larger than the 250K insured by the FDIC, making it vulnerable to a classic bank run. Second, it didn't really have any expertise in putting that money to work 5/

Conventional banks make money in part because they know something about/have special relationships with their borrowers. They lend money to businesses and consumers, at above market rates bc there's default risk, which they think they can manage. 6/

Conventional banks also earn money from credit card balances, which is similar but even more so, with a lot of inertia in the customer base 7/

SVB had little of this. It was sitting on a huge pile of cash, without good places to put it to work. So what it did was put a lot of money into long-term securities, which at the time were paying much higher interest than short-term assets, incl deposits 8/

So it was basically a kind of carry trade. The problem is that there was a reason long-term rates were higher than short-term. Wrote about it back in 2008: strongly upward-sloping yield curve is inevitable when short rates are near the zero lower bound 9/ archive.nytimes.com/krugman.blogs.nytimes.com/2008/12/27/the-yield-curve-wonkish/

The reason is option value: short rates can go up but not down. Which means that betting on the spread is risky. If and when short rates go up, you're in trouble. They did, and SVB was. 10/

It's not at all clear whether SVB was inherently insolvent. The market value of its investments fell when long rates rose, but its earnings may still have been enough to cover interest on its deposits. But big deposits made it vulnerable to a classic bank run 11/

Maybe the important point is that all of this looks fairly sui generis. Other banks like SVB could be in the same fix — but which are these similar banks? Probably doesn't herald a wave of bank runs 12/

And because SVB was basically buying agencies and Treasuries, which are safe assets, its failure won't cause anything like the crash in MBS and run on repo that followed the Lehman collapse. Systemic issues much less obvious 13/

What I don't have a sense of is how much this will damage the VC financial ecosystem — or how much the rest of us should care. But — hoping these aren't famous last words — this looks at most like a fairly narrow sectoral crisis 14/

Mentions

See All

Noah Smith @NoahSmith

·

Mar 11, 2023

Helpful thread.