Thread

Why this sudden meltdown in bank stocks?

A couple of interesting theories and charts are doing the rounds, so let's have a look under the hood.

A thread.

1/

A couple of interesting theories and charts are doing the rounds, so let's have a look under the hood.

A thread.

1/

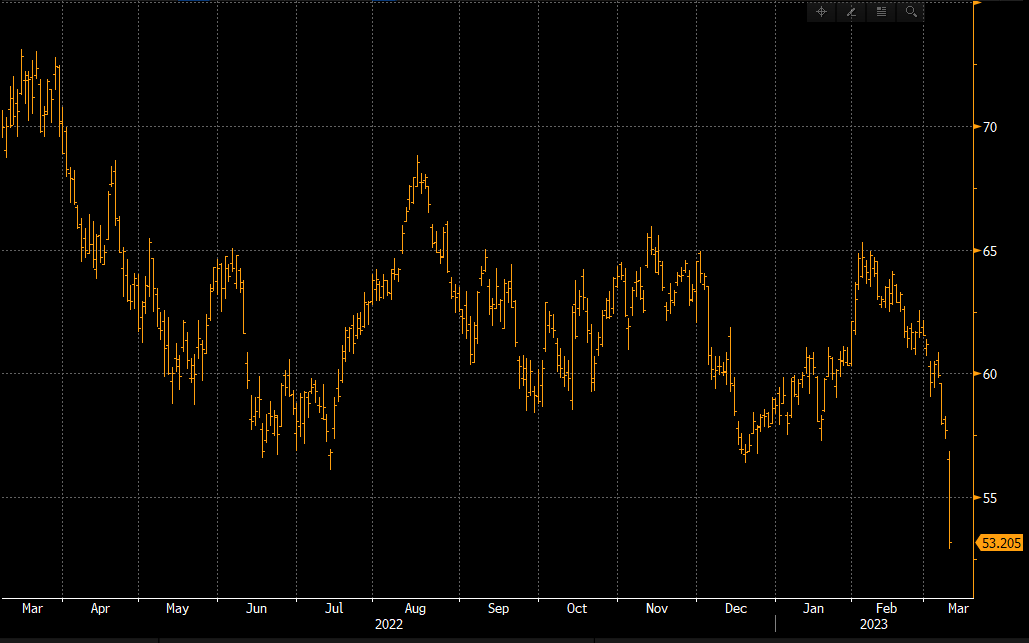

KRE - the US regional bank ETF - is blowing up today with a ~3 standard deviation move down

The immediate catalyst behind this seems to be Silicon Valley Bank, which all of a sudden faces shortage of capital and needs urgent backup

The issue appears more systemic though...

2/

The immediate catalyst behind this seems to be Silicon Valley Bank, which all of a sudden faces shortage of capital and needs urgent backup

The issue appears more systemic though...

2/

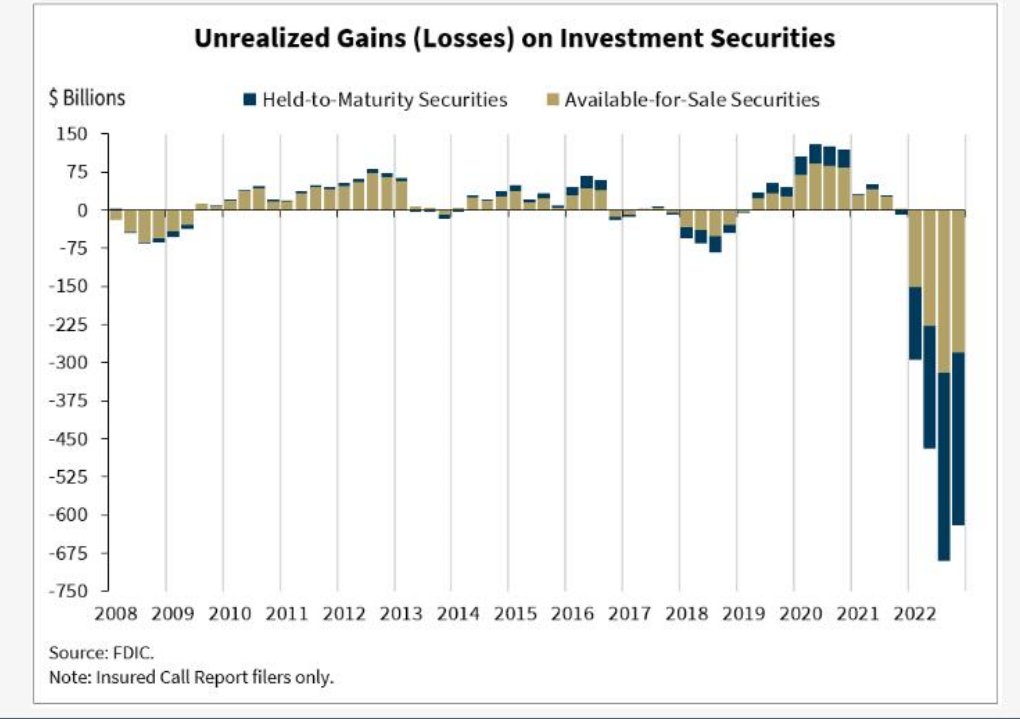

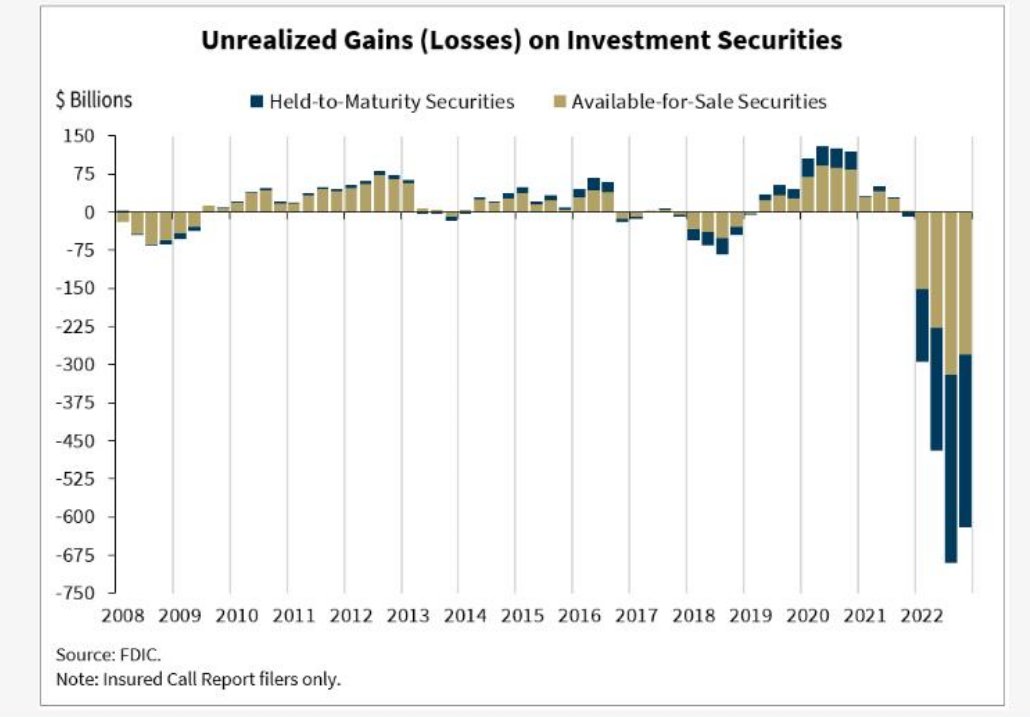

...with one of the scary charts going around showing the large extent of unrealized losses in bonds sitting in books classified as ''Held To Maturity'' at US banks at the end of 2022

What does this mean?

Banks enjoy a very favorable accounting regime

Let's see how it works

3/

What does this mean?

Banks enjoy a very favorable accounting regime

Let's see how it works

3/

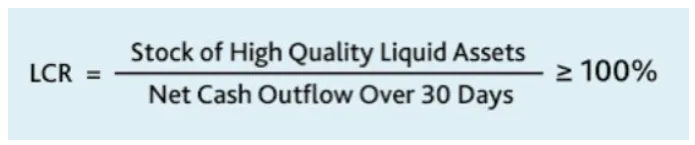

Post GFC, commercial banks were asked to keep a Liquidity Coverage Ratio (LCR) above 100%.

This means they always must have enough High Quality Liquid Assets (HQLA) to meet deposit outflows in a stressed scenario.

4/

This means they always must have enough High Quality Liquid Assets (HQLA) to meet deposit outflows in a stressed scenario.

4/

This effectively means that banks around the world are forced to keep around 10-15% of the asset side of their balance sheet invested in HQLA.

That’s big!

And guess what qualifies for HQLA?

Reserves at the Fed and...you guessed it, bonds.

5/

That’s big!

And guess what qualifies for HQLA?

Reserves at the Fed and...you guessed it, bonds.

5/

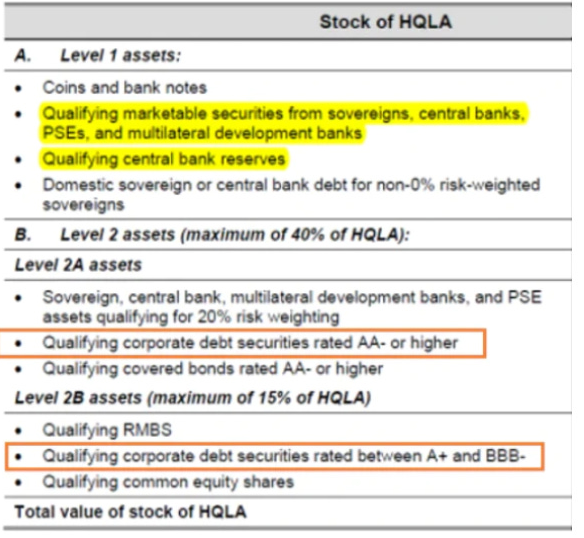

Effectively, banks were asked to own a large amount of liquid assets and were told bonds were the only game in town due to regulation.

What bonds?

Mostly government bonds, but be aware: also corporate bonds and mortgage-backed securities can qualify!

6/

What bonds?

Mostly government bonds, but be aware: also corporate bonds and mortgage-backed securities can qualify!

6/

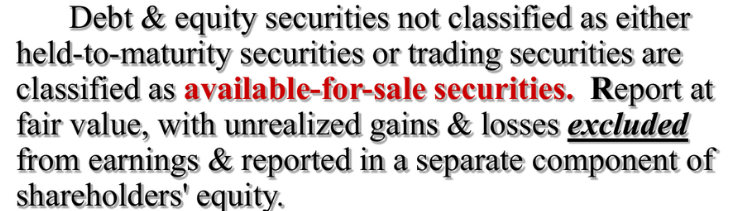

When regulators force you to own tons of bonds, they also force you to swallow a lot of P&L volatility - and banks don't like that

That's why regulators allow bank treasuries to park bonds in two accounting-friendly books: Available-For-Sale (AFS) and Held-To-Maturity (HTM)

7/

That's why regulators allow bank treasuries to park bonds in two accounting-friendly books: Available-For-Sale (AFS) and Held-To-Maturity (HTM)

7/

In both cases, if Treasuries or corporate/MBS bonds lose value...

...the bank's P&L does not (!) record the loss immediately.

The unrealized gains and losses of securities held in AFS hits the capital position of the bank, not its P&L.

But the true banger...

8/

...the bank's P&L does not (!) record the loss immediately.

The unrealized gains and losses of securities held in AFS hits the capital position of the bank, not its P&L.

But the true banger...

8/

...is that bonds booked in Held-To-Maturity (HTM) books are reported at amortized cost, or in other words the unrealized losses basically..

..do NOT show up in banks' financial statements

This creates an incentive scheme to park as many bonds in these accounting category..

9/

..do NOT show up in banks' financial statements

This creates an incentive scheme to park as many bonds in these accounting category..

9/

..as you earn coupons over time and don't face P&L volatility.

The flipside is when you need liquidity.

Banks can only sell a small portion of HTM bonds before being ''tainted'' as non-compliant from regulators.

The large extent of HTM hidden losses is worrying some.

10/

The flipside is when you need liquidity.

Banks can only sell a small portion of HTM bonds before being ''tainted'' as non-compliant from regulators.

The large extent of HTM hidden losses is worrying some.

10/

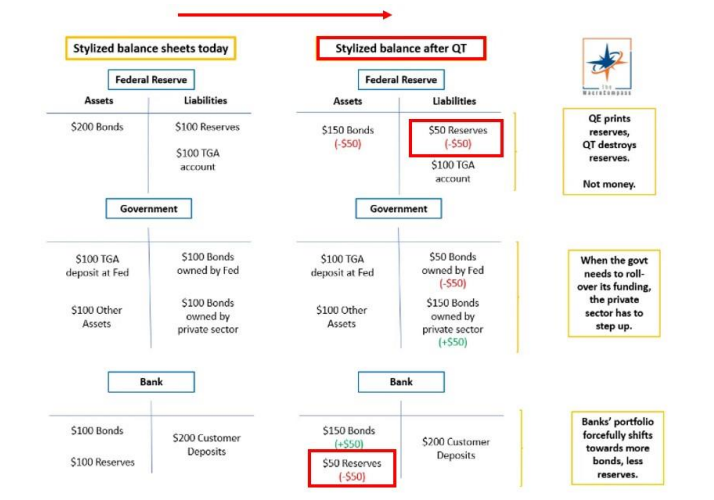

To me, there is a more important story going on: liquidity & funding are becoming tougher for small banks

QT is reducing the balance sheet of the Fed

On the asset side, QT shrinks the amount of bonds the Fed owns.

On the liabilities side it could be RRP, TGA or reserves..

11/

QT is reducing the balance sheet of the Fed

On the asset side, QT shrinks the amount of bonds the Fed owns.

On the liabilities side it could be RRP, TGA or reserves..

11/

...and the example above shows the standard way QT operates, which is by reducing bank reserves.

Bank reserves are money for banks: they use them to settle transactions with each other, including in the repo market

Imagine reserves as the lubricant of the financial system

12/

Bank reserves are money for banks: they use them to settle transactions with each other, including in the repo market

Imagine reserves as the lubricant of the financial system

12/

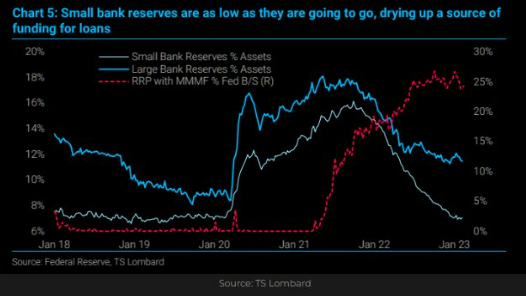

Well, you are drying the system up slowly but surely

The thing is reserves are not going down in an equal fashion for large banks and small banks

Small banks are seeing reserves shrink much faster.

They have less readily available ''financial money''.

Less ''liquditiy''.

13/

The thing is reserves are not going down in an equal fashion for large banks and small banks

Small banks are seeing reserves shrink much faster.

They have less readily available ''financial money''.

Less ''liquditiy''.

13/

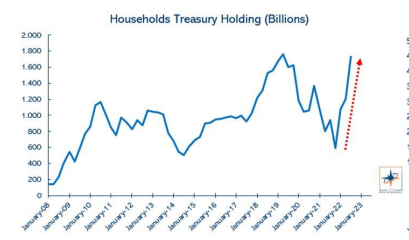

Now, consider also that the funding landscape is getting more competitive.

US households can earn 5%+ risk-free interest rate with less risk (!) by buying T-bills rather than depositing money at banks.

One could argue small banks are even more exposed to this dynamic.

14/

US households can earn 5%+ risk-free interest rate with less risk (!) by buying T-bills rather than depositing money at banks.

One could argue small banks are even more exposed to this dynamic.

14/

In other words, small banks face a double whammy:

- Less ''financial liquidity'' (reserves) in the system, disproportionately affecting them

- A tougher funding landscape, with plenty of safer and higher-yielding alternatives for depositors

This is the real issue, imho.

15/

- Less ''financial liquidity'' (reserves) in the system, disproportionately affecting them

- A tougher funding landscape, with plenty of safer and higher-yielding alternatives for depositors

This is the real issue, imho.

15/

Enjoyed this thread and want to read more?

I covered US Liquidity in depth in January for subscribers of The Macro Compass, and will be releasing a timely piece tomorrow on the Bank of Japan and labor market data.

Consider subscribing to TMC: TheMacroCompass.com/subscribe

16/16

I covered US Liquidity in depth in January for subscribers of The Macro Compass, and will be releasing a timely piece tomorrow on the Bank of Japan and labor market data.

Consider subscribing to TMC: TheMacroCompass.com/subscribe

16/16

Mentions

See All

Preston Pysh @PrestonPysh

·

Mar 10, 2023

Outstanding thread by Alf.

Lyle Pratt @lylepratt

·

Mar 10, 2023

good thread here