Thread

The HARDEST thing in business, is driving consistent performance.

But consistency is IMPOSSIBLE without a great FP&A cycle

Here’s what you need to know about FP&A:

But consistency is IMPOSSIBLE without a great FP&A cycle

Here’s what you need to know about FP&A:

FP&A is short for Financial Planning & Analysis.

It is a set of finance processes that work together to improve future business performance.

Those processes differ by business. But in every business there are 5 core anchors which FP&A is built on.

I call them the ‘Sacred 5’

It is a set of finance processes that work together to improve future business performance.

Those processes differ by business. But in every business there are 5 core anchors which FP&A is built on.

I call them the ‘Sacred 5’

Each of the Sacred 5 is a vital cog in a big machine.

Individually they are important. But together?

That's where the real magic happens.

Let's start from the start...

Note: I saved the best bit for last, so you need to read the whole thread to see this all work together.

Individually they are important. But together?

That's where the real magic happens.

Let's start from the start...

Note: I saved the best bit for last, so you need to read the whole thread to see this all work together.

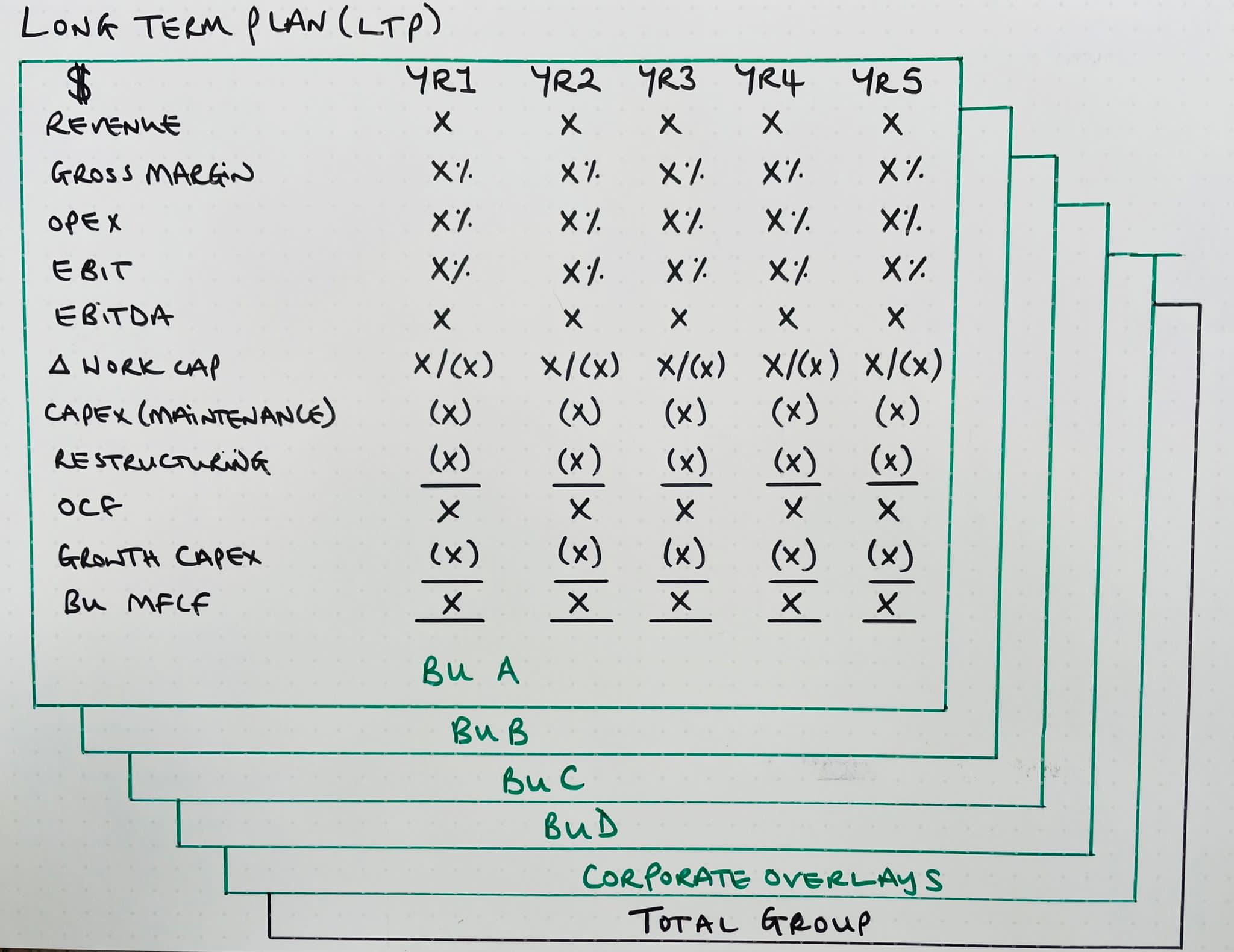

1. The Long Term Plan (LTP).

Here we go.

The start of a new financial planning cycle.

This is where you'll set financial guardrails for the business for the years ahead.

Where do you invest? Where do you drive for cash? Do you borrow to grow? Is it the right time for M&A?

Here we go.

The start of a new financial planning cycle.

This is where you'll set financial guardrails for the business for the years ahead.

Where do you invest? Where do you drive for cash? Do you borrow to grow? Is it the right time for M&A?

These are the sort of questions you answer through the LTP process.

It should typically cover 3,4, or 5 years.

The LTP is a summary financialization of the strategy.

The output should be quite high level, for each business unit, and in total.

It should typically cover 3,4, or 5 years.

The LTP is a summary financialization of the strategy.

The output should be quite high level, for each business unit, and in total.

The tension point in the LTP is the allocation of capital.

There are normally more good projects than good money.

That's ok.

It's a sign you are working in a business not short of ideas on how to improve performance.

Your job as CFO though is to prioritize...

There are normally more good projects than good money.

That's ok.

It's a sign you are working in a business not short of ideas on how to improve performance.

Your job as CFO though is to prioritize...

That often means several iterations.

Capital allocation in year 1, will influence cash generation in year 2, which will influence capital allocation in year 2 and so on.

Likewise if you choose to raise debt to invest, that will influence future cash generation too.

Capital allocation in year 1, will influence cash generation in year 2, which will influence capital allocation in year 2 and so on.

Likewise if you choose to raise debt to invest, that will influence future cash generation too.

Staying on top of that circularity and steering the business to a grown up answer is the hard bit.

Whilst this can feel like 3D chess, often you only have 2-4 'real options'.

Identify these options, work the scenarios all the way through.

Facilitate the board discussion.

Whilst this can feel like 3D chess, often you only have 2-4 'real options'.

Identify these options, work the scenarios all the way through.

Facilitate the board discussion.

A good LTP will:

- Agree capital allocation between parts of the business.

- Set business unit and corporate target performance

- Give credibility to the strategy (i.e. financialize it, can we afford it)

- Base for investor expectations

- Provide direction to the budget (year 1)

- Agree capital allocation between parts of the business.

- Set business unit and corporate target performance

- Give credibility to the strategy (i.e. financialize it, can we afford it)

- Base for investor expectations

- Provide direction to the budget (year 1)

Now you've got a board approved Long Term Plan in place.

The CEO is still moaning that the Board didn't support their bold acquisition strategy, but they'll get over it.

And they'll need to quickly.

We've got a new financial year to plan for ...

The CEO is still moaning that the Board didn't support their bold acquisition strategy, but they'll get over it.

And they'll need to quickly.

We've got a new financial year to plan for ...

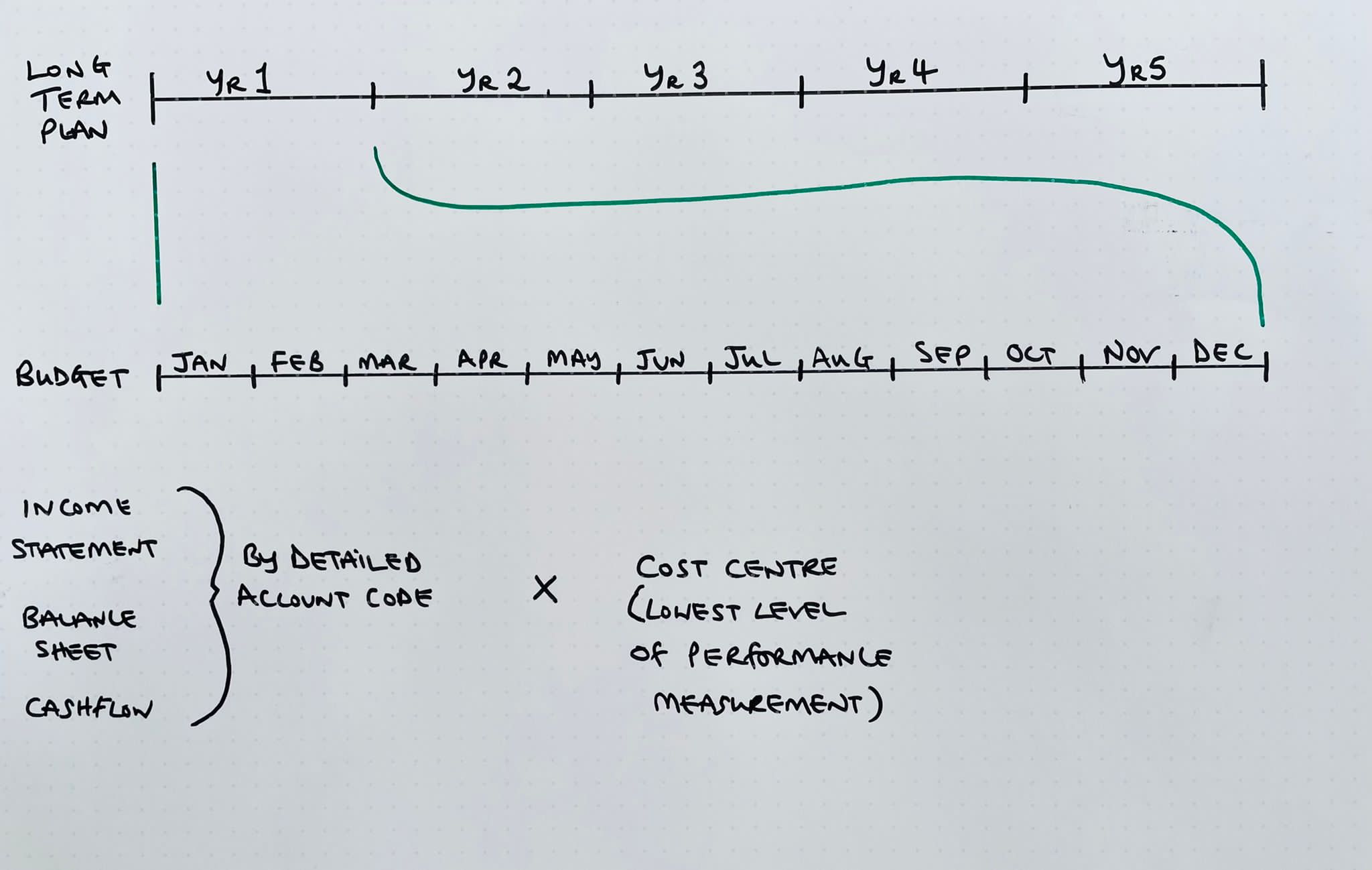

2. Budget

The LTP does a great job of setting direction and parameters. But it's very high level.

It's useful for executives (corporate, BU leadership) to set the 'top down' financial targets.

But it is of no use at all to anyone else.

That's where the budget comes in...

The LTP does a great job of setting direction and parameters. But it's very high level.

It's useful for executives (corporate, BU leadership) to set the 'top down' financial targets.

But it is of no use at all to anyone else.

That's where the budget comes in...

Budget setting is about exploding year 1 of the LTP into a detailed financial budget by month/week.

Rather than a top down exercise, this is a 'bottoms up' build of the financials for the new year.

It will form the anchor for all planning for the next 12 months.

Rather than a top down exercise, this is a 'bottoms up' build of the financials for the new year.

It will form the anchor for all planning for the next 12 months.

The output will be a full Income Statement (down to account level), balance sheet and cashflow.

For an engineer working on an automative assembly line...

The budget will tell them how much spend they’re allocated for maintenance spend by week or month.

For an engineer working on an automative assembly line...

The budget will tell them how much spend they’re allocated for maintenance spend by week or month.

It will also tell a national account manager their sales and margins target by customer /channel.

How much will I reduce overdue debts by this year? The budget's got the answer.

The budget touches every corner of the business. It's a massive aggregation exercise...

How much will I reduce overdue debts by this year? The budget's got the answer.

The budget touches every corner of the business. It's a massive aggregation exercise...

Making that bottom up 'budget' balance with year 1 of a top down LTP is the hardest part of the process.

Spoiler: it never does first time. Or second... Or third.

Another exercise of rapid iteration. But it's worth the effort...

Spoiler: it never does first time. Or second... Or third.

Another exercise of rapid iteration. But it's worth the effort...

A good budget will:

- Validate assumptions in LTP Yr 1

- Set targets for OKR/KPI system for whole business for next 12 months

- Thread that bind business wide buy-in to plan

- Determines targets and triggers for bonus and incentive pay out

- Drive profit AND cashflow

- Validate assumptions in LTP Yr 1

- Set targets for OKR/KPI system for whole business for next 12 months

- Thread that bind business wide buy-in to plan

- Determines targets and triggers for bonus and incentive pay out

- Drive profit AND cashflow

This process must plug into the business, it can't be a finance only exercise.

Anyway, you've got your budget now.

Time to stop p*ssing around and talking about what you are going to do.

Time to get on and deliver it...

Anyway, you've got your budget now.

Time to stop p*ssing around and talking about what you are going to do.

Time to get on and deliver it...

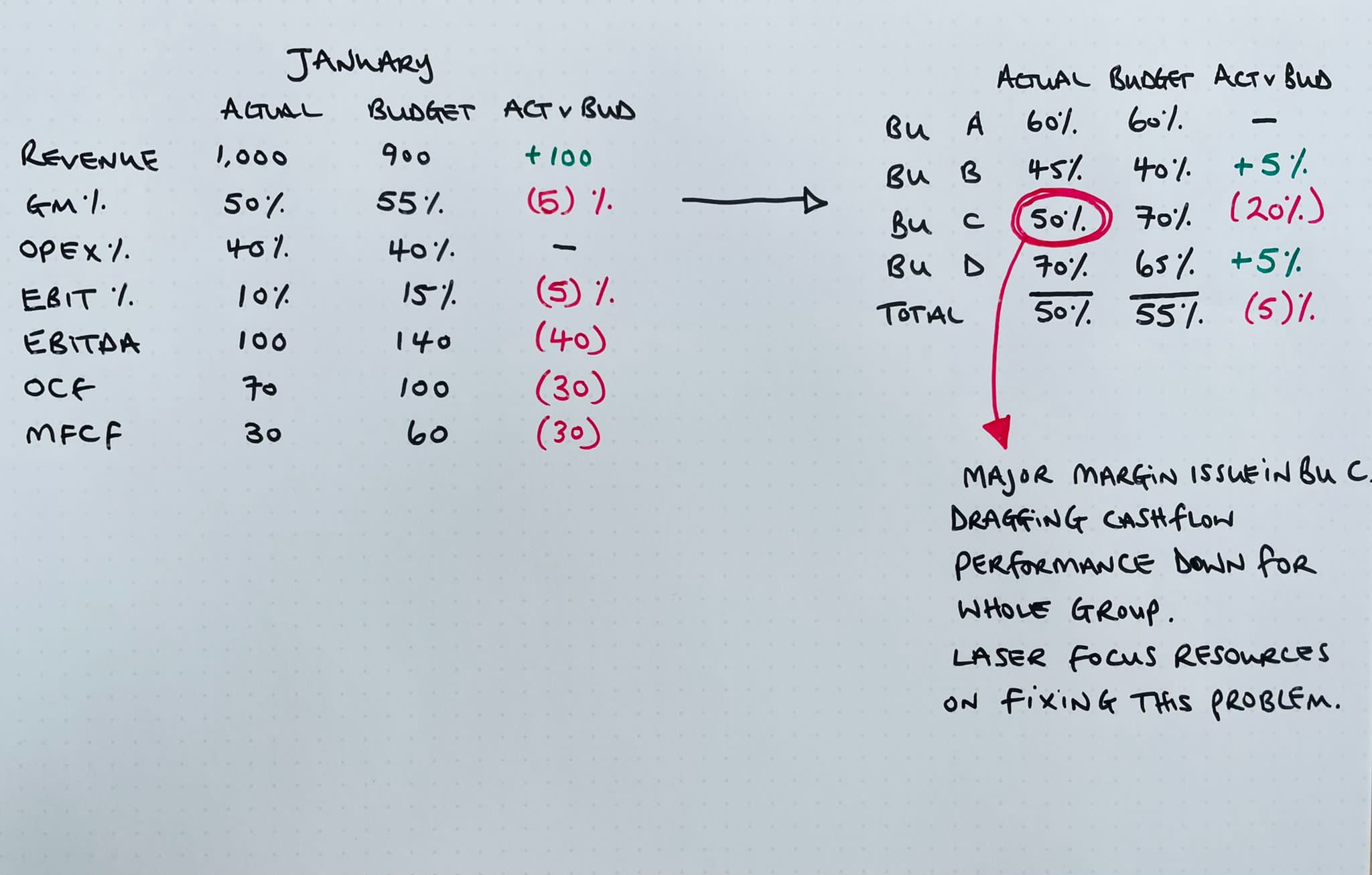

3. Management Accounts

So, you've got our budget for the year.

You've stood in front of the Board alongside the CEO and pinned your credibility to delivering it.

Don't f*ck this up.

So, you've got our budget for the year.

You've stood in front of the Board alongside the CEO and pinned your credibility to delivering it.

Don't f*ck this up.

Here's the bad news...

Stuff will go wrong. Most of the time.

Your job is to identify the issues, very fast.

Then hold the mirror up to the business so it can see the grim reality of the day's issues.

That mirror = Management Accounts

Stuff will go wrong. Most of the time.

Your job is to identify the issues, very fast.

Then hold the mirror up to the business so it can see the grim reality of the day's issues.

That mirror = Management Accounts

The management accounts tells me if we did what we said we would in the budget.

They are produced monthly following the end of the financial period.

Ideally as quickly as possible.

<5 days is good

They are produced monthly following the end of the financial period.

Ideally as quickly as possible.

<5 days is good

Fast feedback loops are important to jump on issues quickly.

Management accounts are the feedback loop on financial performance vs budget.

From my experience, sh*t businesses always have a sloppy month end close.

Tighten that loop.

Management accounts are the feedback loop on financial performance vs budget.

From my experience, sh*t businesses always have a sloppy month end close.

Tighten that loop.

Opening your management accounts each month should feel like Christmas morning.

They are wrapped beautifully (there'll be another thread / LECTURE on the importance of aesthetics in finance).

And most importantly, you can't wait to find out what you got...

They are wrapped beautifully (there'll be another thread / LECTURE on the importance of aesthetics in finance).

And most importantly, you can't wait to find out what you got...

And like an excited child, you go straight for the most exciting present...

Did you deliver your cashflow targets for the month?

Did you deliver your cashflow targets for the month?

Good management accounts will:

- clearly show the + and - vs budget (& yoy)

- show where in the P&L / Cashflow they are driven

- run to 10 clear and thoughtful pages (15 max)

- will be so well presented the issues can be found in < 30 seconds

- use commentary powerfully

- clearly show the + and - vs budget (& yoy)

- show where in the P&L / Cashflow they are driven

- run to 10 clear and thoughtful pages (15 max)

- will be so well presented the issues can be found in < 30 seconds

- use commentary powerfully

Then you dive deeeeep. What are the drivers?

Which cashflow lines landed and which didn't. Did your EBIT come in on plan?

Did that purge on overdue debts yield the working capital benefit you were looking for?

And more importantly where? Which BUs delivered, and which didn't?

Which cashflow lines landed and which didn't. Did your EBIT come in on plan?

Did that purge on overdue debts yield the working capital benefit you were looking for?

And more importantly where? Which BUs delivered, and which didn't?

As CFO you should circulate the Management Accounts to the Exec / Board.

This is an enormous power.

The power of the pen.

Your commentary and presentation of the management accounts will set the tone for every performance conversation in the business for the next four weeks.

This is an enormous power.

The power of the pen.

Your commentary and presentation of the management accounts will set the tone for every performance conversation in the business for the next four weeks.

You want to shine a light on the issues that need fixing.

Ideally no more than 3.

Use the power of radical independence to create tension.

Then let ego do the work.

Ideally no more than 3.

Use the power of radical independence to create tension.

Then let ego do the work.

No BU CEO will want to be called out for their business being a sh*tshow in that forum.

This is uber powerful.

Use this effectively and you will have set up the next part of the process beautifully.

It's also my favourite part ....

This is uber powerful.

Use this effectively and you will have set up the next part of the process beautifully.

It's also my favourite part ....

4. Monthly Performance Reviews (MPR)

In the management accounts you called out the issues.

Made them super clear to all corners of the business.

Unignorable.

You dirty little snitch.

Now you get into what exactly has gone wrong and how to fix it...

In the management accounts you called out the issues.

Made them super clear to all corners of the business.

Unignorable.

You dirty little snitch.

Now you get into what exactly has gone wrong and how to fix it...

Each business unit has an MPR as soon as possible once the management accounts are published.

Getting those accounts out quickly is important.

In the MPR each Business Unit Exec (led by the BU CEO & CFO) will present the performance in the month to Group CEO & CFO

Getting those accounts out quickly is important.

In the MPR each Business Unit Exec (led by the BU CEO & CFO) will present the performance in the month to Group CEO & CFO

Did they hit or miss their targets; Revenue, EBIT, OCF?

If they hit, are there any emerging issues that could hurt future performance?

If not, well done management.

If it's well done every month. The targets were too soft.

Remember that for next year's budget...

If they hit, are there any emerging issues that could hurt future performance?

If not, well done management.

If it's well done every month. The targets were too soft.

Remember that for next year's budget...

If they missed parts of the plan, why?

What are the drivers?

Is it a timing issue that will reverse in a future period?

Is it a structural performance issue?

What part of the IS?

What is being done about it? Will it fix the problem?

The 5 Why's can work well here...

What are the drivers?

Is it a timing issue that will reverse in a future period?

Is it a structural performance issue?

What part of the IS?

What is being done about it? Will it fix the problem?

The 5 Why's can work well here...

A good MPR will:

- Identify root cause of performance issues

- Agree the clear actions required

- Reaffirm commitment to the budget

- Track delivery of previous actions

- Track risks and opportunities to budget

- Identify root cause of performance issues

- Agree the clear actions required

- Reaffirm commitment to the budget

- Track delivery of previous actions

- Track risks and opportunities to budget

You must leave the MPR with a clear and agreed list of agreed actions that directly address the BU performance issues.

They should be circulated, what, who, when, how much, immediately following the meeting.

They won't want to turn up next month without having done their bit.

They should be circulated, what, who, when, how much, immediately following the meeting.

They won't want to turn up next month without having done their bit.

Quick note on re-forecasts.

As a rule, I don't like them. Especially rolling forecasts.

My experience is that businesses that over use them, spend too much time living in the past or future.

That is a distraction from the operational reality of delivering today.

As a rule, I don't like them. Especially rolling forecasts.

My experience is that businesses that over use them, spend too much time living in the past or future.

That is a distraction from the operational reality of delivering today.

Budget delivery is made or lost in the details of day to day execution.

Not spending all day in complex models perpetually replanning.

What I do believe in though... the importance in keeping track of the things that can derail the full year budget.

Not spending all day in complex models perpetually replanning.

What I do believe in though... the importance in keeping track of the things that can derail the full year budget.

This is done via Risks & Opportunities tracking versus full year budget (EBIT & OCF)

Very Important.

It should be led by the BU CFO. They are close to the action in the BU and know what's really going on (powered by their FP&A team)

Be hand in glove with your BU CFO

Very Important.

It should be led by the BU CFO. They are close to the action in the BU and know what's really going on (powered by their FP&A team)

Be hand in glove with your BU CFO

Good BU teams will also run the same MPR process in their business at the next level down, and their teams will do the same.

That is the magic thread.

That is the magic thread.

If the MPR process goes well, then the BU teams will run off and deliver performance improvements with the white hot fury of 1,000 suns.

Making sure they aren't on the sh!tlist for the next mgmt accs distribution.

In the mean time you can keep tabs via the weekly flash…

Making sure they aren't on the sh!tlist for the next mgmt accs distribution.

In the mean time you can keep tabs via the weekly flash…

5. Weekly Flash

The final part is how you keep track between the periods.Simple headline Revenue, EBIT and Cash v Budget (with month to date tracking) is enough at a corporate level weekly.

BU teams will need more as they need to respond daily and weekly to operational issues.,

The final part is how you keep track between the periods.Simple headline Revenue, EBIT and Cash v Budget (with month to date tracking) is enough at a corporate level weekly.

BU teams will need more as they need to respond daily and weekly to operational issues.,

But on a weekly basis you are just looking for indicators of something coming off plan in a major way across each of the BUs.

Something that can't wait for the next monthly cycle.

Not much more to say here ... it's important, but also simple.

Something that can't wait for the next monthly cycle.

Not much more to say here ... it's important, but also simple.

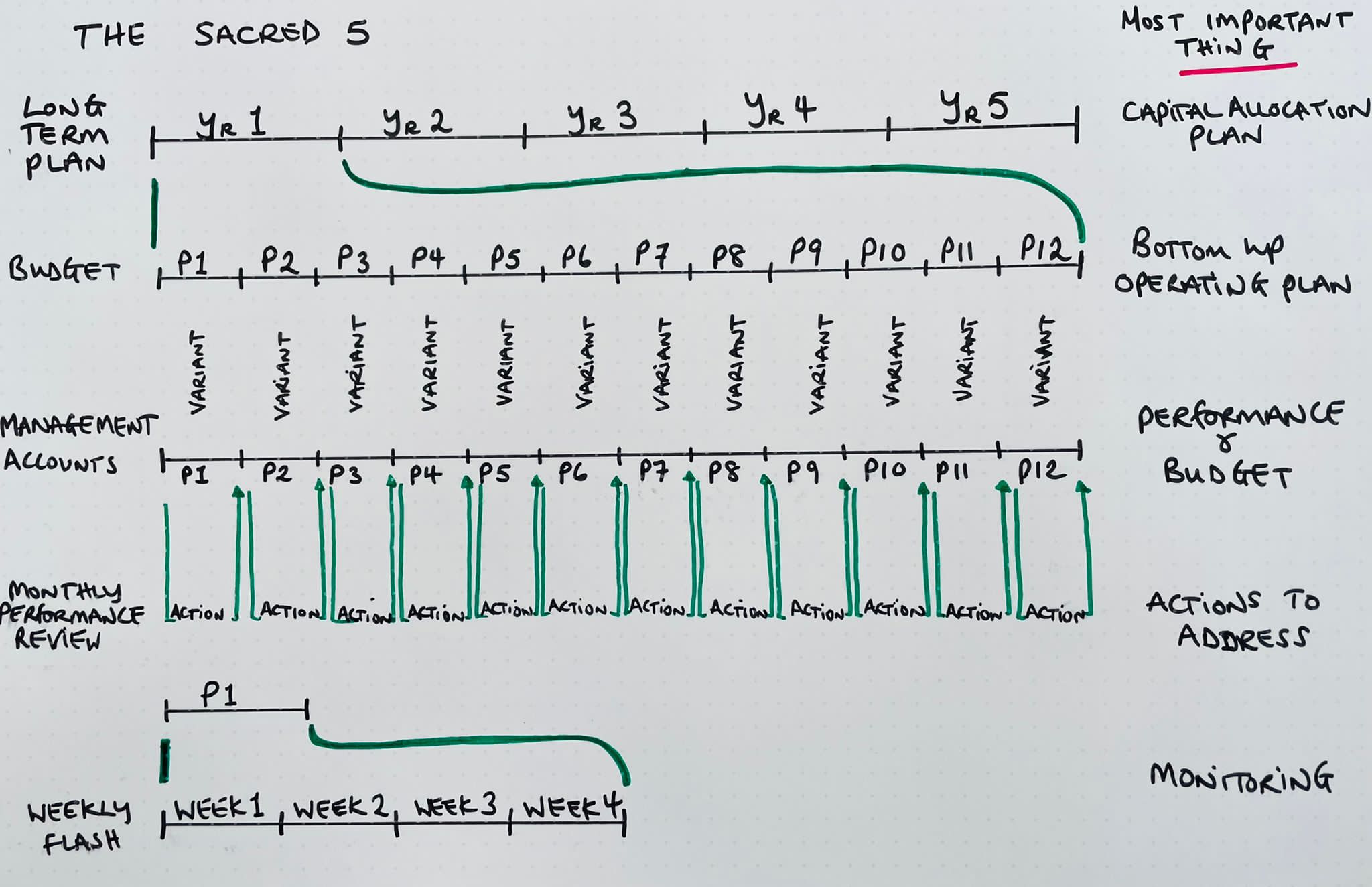

Anyway, they are the Sacred 5.

But ... if you made it this far I have a treat for you.

I saved the best until last.

A diagram that shows how this all works together.

As I said up front each process individually important. But it when they are put together magic happens.

But ... if you made it this far I have a treat for you.

I saved the best until last.

A diagram that shows how this all works together.

As I said up front each process individually important. But it when they are put together magic happens.

TLDR

Sacred 5 Corporate FP&A Processes

1. Long Term Plan (3-5 Yrs)

2. Annual Budget (Monthly, Full IS, BS, CF)

3. Management Accounts (Radical Transparency)

4. Monthly Performance Reviews (Action)

5. Weekly Flash

But it’s where they overlap that the real skill is needed

Sacred 5 Corporate FP&A Processes

1. Long Term Plan (3-5 Yrs)

2. Annual Budget (Monthly, Full IS, BS, CF)

3. Management Accounts (Radical Transparency)

4. Monthly Performance Reviews (Action)

5. Weekly Flash

But it’s where they overlap that the real skill is needed

If you enjoyed this, please follow @secretcfo and RT the original tweet to spread the word.