Thread

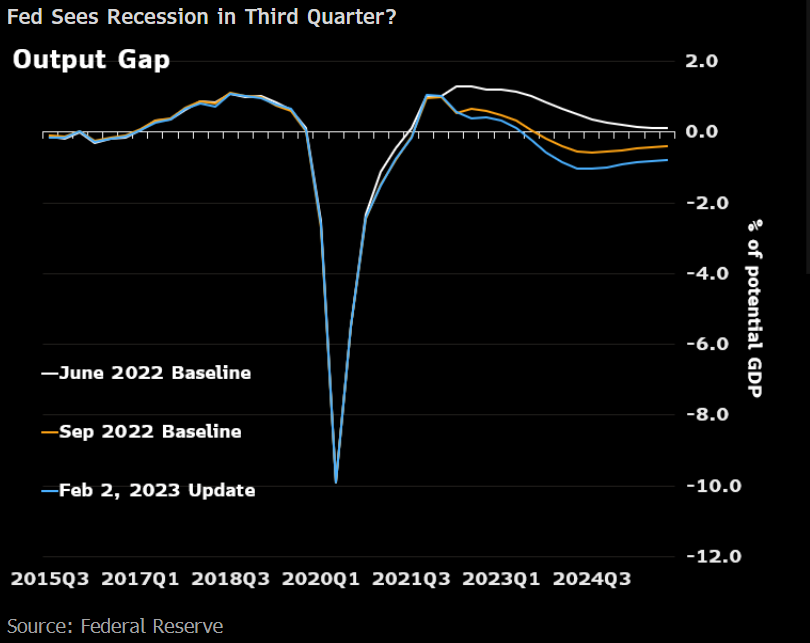

A 🧵on what Fed minutes won't tell you but FRB/US model baseline (also published by Fed, but quietly, after Feb 1 meeting) does. 1) the staff model revised down output gap. Now it falls to negative in 3Q 2023 (recession, anyone?)

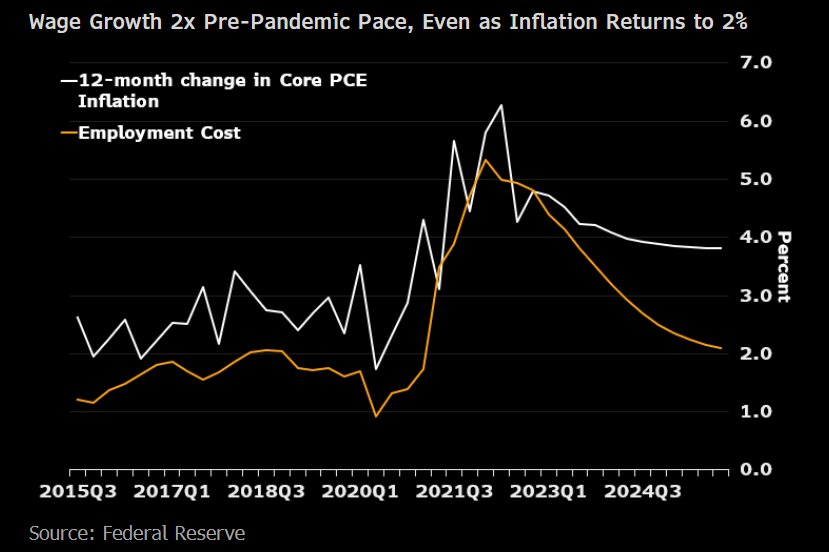

2) Fed model sees PCE inflation returning to 2% even with wages permanently doubled the pace of pre-pandemic. (you might ask, WHAT?!@?)

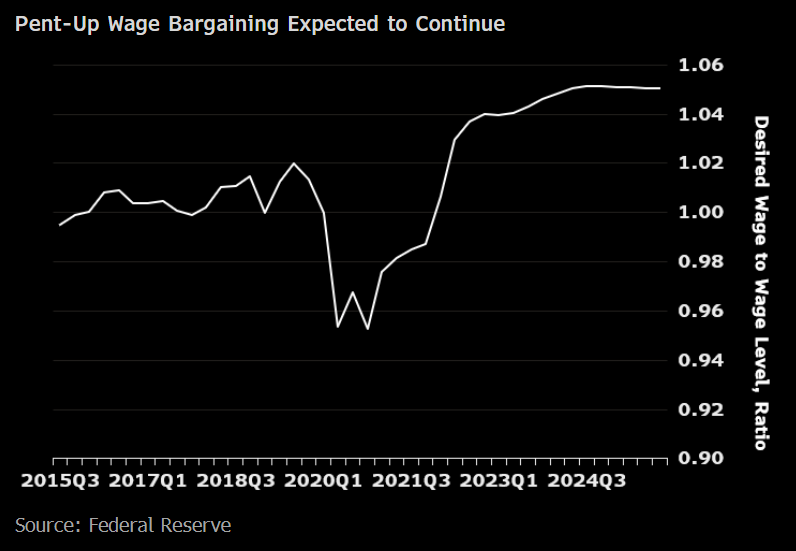

3.) Model uses the new keynesian phillips curve, which assumes sticky wages. Hence there is this pent up wage bargaining pressure. People want more wage growth than actual wage growth.

Astute readers may wonder how the model can reconcile back-to-target inflation with a permanently higher pace of wage growth? The answer — a faster decline in inflation in everything else.

Bottomline: Success of returning inflation to target in Fed model is predicated on firms not passing through strong wage growth to final prices, which implies massive profit drops / hence recession / hence output gap closing. Does that make sense to you?