Thread

1/ @avalancheavax enabled native $BTC via the Avalanche bridge June 2022 🔺

Since then $BTC growth on $AVAX has been unimpeded.

An exploration. 🧵👇

Since then $BTC growth on $AVAX has been unimpeded.

An exploration. 🧵👇

2/ What is $BTC.b

As opposed to the commonly seen $WBTC, issued on $ETH by Bitgo.

BTC.b is native bitcoin bridged directly to @avalancheavax from the @Bitcoin blockchain.

The purpose is to allow Bitcoin holders to enjoy DeFi while being able to hold $BTC.

As opposed to the commonly seen $WBTC, issued on $ETH by Bitgo.

BTC.b is native bitcoin bridged directly to @avalancheavax from the @Bitcoin blockchain.

The purpose is to allow Bitcoin holders to enjoy DeFi while being able to hold $BTC.

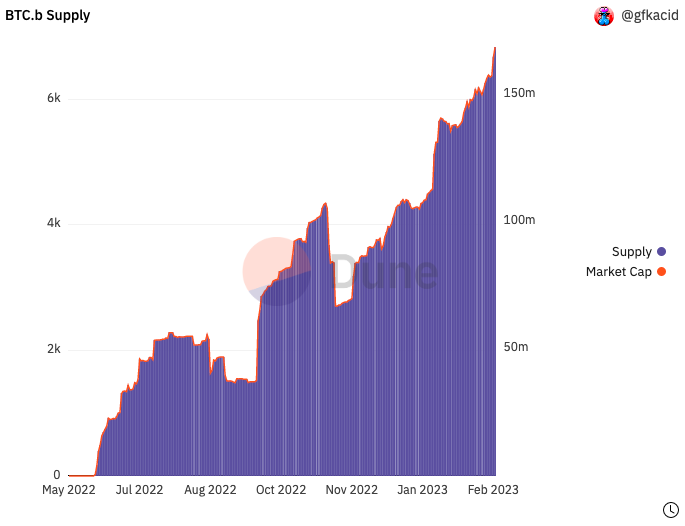

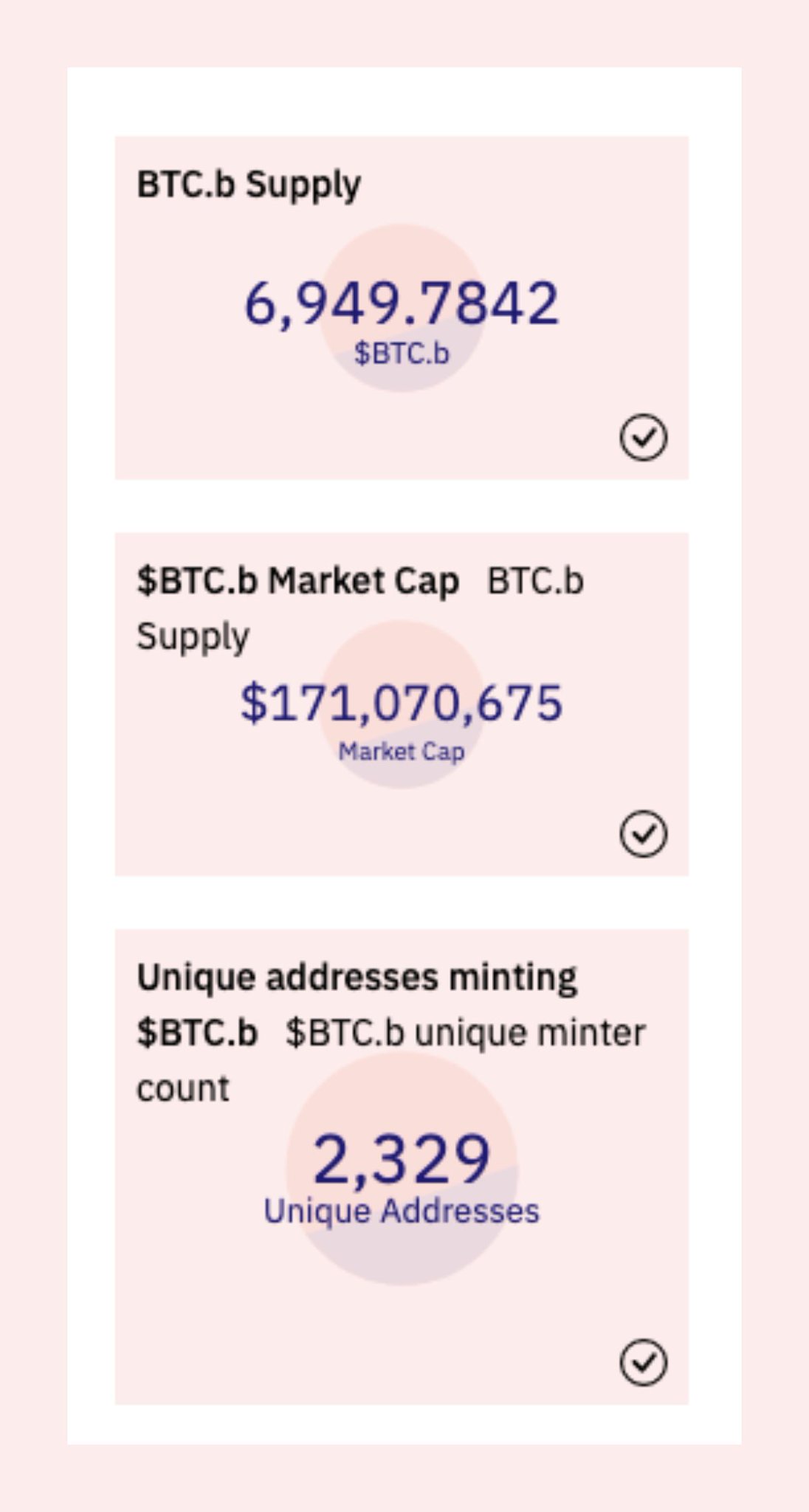

3/ Since its launch, volume has gone parabolic. 📈

Growing from 21 $BTC.b to now almost 7K in less than a year.

Whats more impressive is growth has actually accelerated throughout the market downturn.

Growing from 21 $BTC.b to now almost 7K in less than a year.

Whats more impressive is growth has actually accelerated throughout the market downturn.

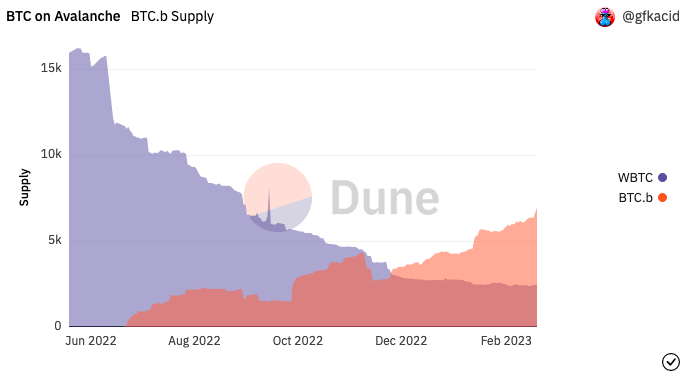

4/ The inverse correlation between $WBTC and $BTC.b has only continued to accelerate.

As such, a flippening has occurred between the two assets

As such, a flippening has occurred between the two assets

5/ To date the trend has continued with the two assets and their respective marketcap.

$BTC.b - $171M

$WBTC - $68M

$BTC.b - $171M

$WBTC - $68M

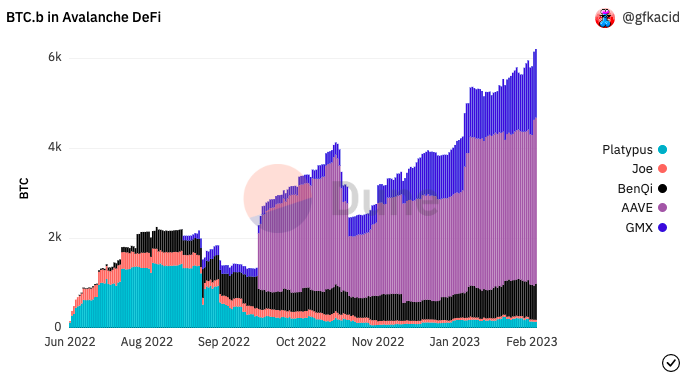

6/ This can be seen within @avalancheavax most prominent DeFi applications.

A breakdown of $BTC.b TVL by dApp:

- @AaveAave - 20%

- @GMX_IO - 21%

- @traderjoe_cs - 8%

- @Platypusdefi - 11%

- @BenqiFinance - 13%

A breakdown of $BTC.b TVL by dApp:

- @AaveAave - 20%

- @GMX_IO - 21%

- @traderjoe_cs - 8%

- @Platypusdefi - 11%

- @BenqiFinance - 13%

7/ Adoption in this case has been spurred due to a superior product offering.

$BTC.b offers users:

-Seamless transfers between Bitcoin and @avalancheavax

- Cost effective yield on BTC reserves

- Protection from price volatility often seen on WBTC.

$BTC.b offers users:

-Seamless transfers between Bitcoin and @avalancheavax

- Cost effective yield on BTC reserves

- Protection from price volatility often seen on WBTC.

8/ Less than a year since $AVAX enabled $BTC DeFi.

- 6950 $BTC.b

- 171M in TVL

- 2329 Unique addresses.

Imagine how these numbers will look within a year 🤯

- 6950 $BTC.b

- 171M in TVL

- 2329 Unique addresses.

Imagine how these numbers will look within a year 🤯

10/ I hope you've found this thread helpful.

Follow me @Flowslikeosmo for more.

Be sure to Like/Retweet the first tweet below 👇

Follow me @Flowslikeosmo for more.

Be sure to Like/Retweet the first tweet below 👇