Thread

claim that US derisking state can organise decarbonisation via IRA subsidies for private capital is now article of faith in bon pensant circles

but the way in which the derisking state organises support for business matters, and raises two difficulties

www.ft.com/content/e0b55820-3a16-4018-a417-0e7c91737ffd

but the way in which the derisking state organises support for business matters, and raises two difficulties

www.ft.com/content/e0b55820-3a16-4018-a417-0e7c91737ffd

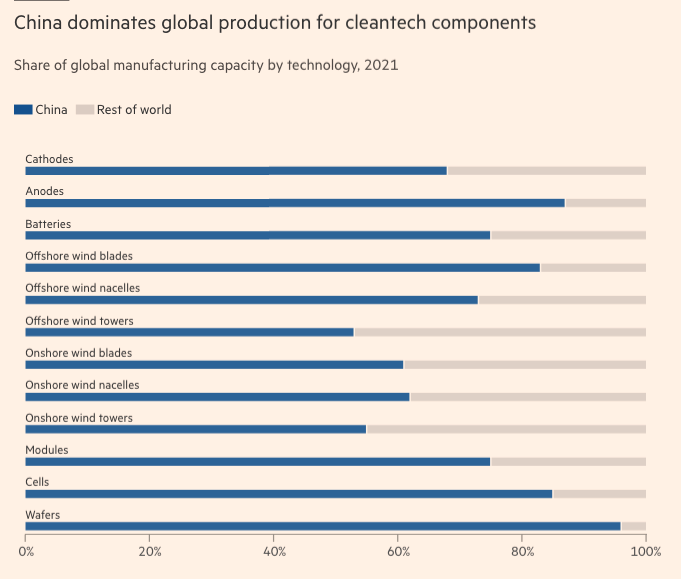

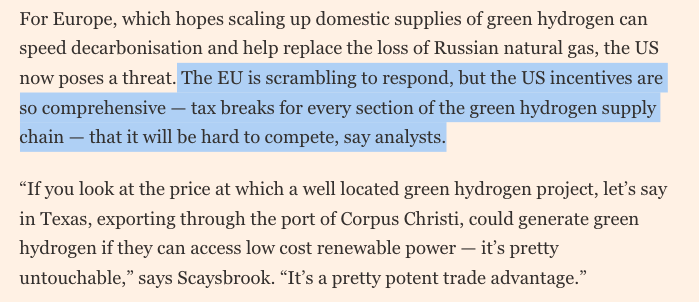

first, the idea that you can beat China's cleantech dominance with tax measures that adjust price signals is optimistic - historically, successful industrial policy needed a more supportive macrofinancial regime

bigger obstacle: green industrial policy is different from other industrial policies. It must penalise carbon capital for decarbonisation to work

BUT derisking state premised on partnernship w private capital that precludes discipline - eg 2022 fossil superprofits

BUT derisking state premised on partnernship w private capital that precludes discipline - eg 2022 fossil superprofits

a weak industrial policy whose premise is 'tons of carrots, very few sticks' is also vulnerable to private lobbies to rollback the handful of sticks

again because fundamentally the derisking logic anchors the state to the price signal

again because fundamentally the derisking logic anchors the state to the price signal

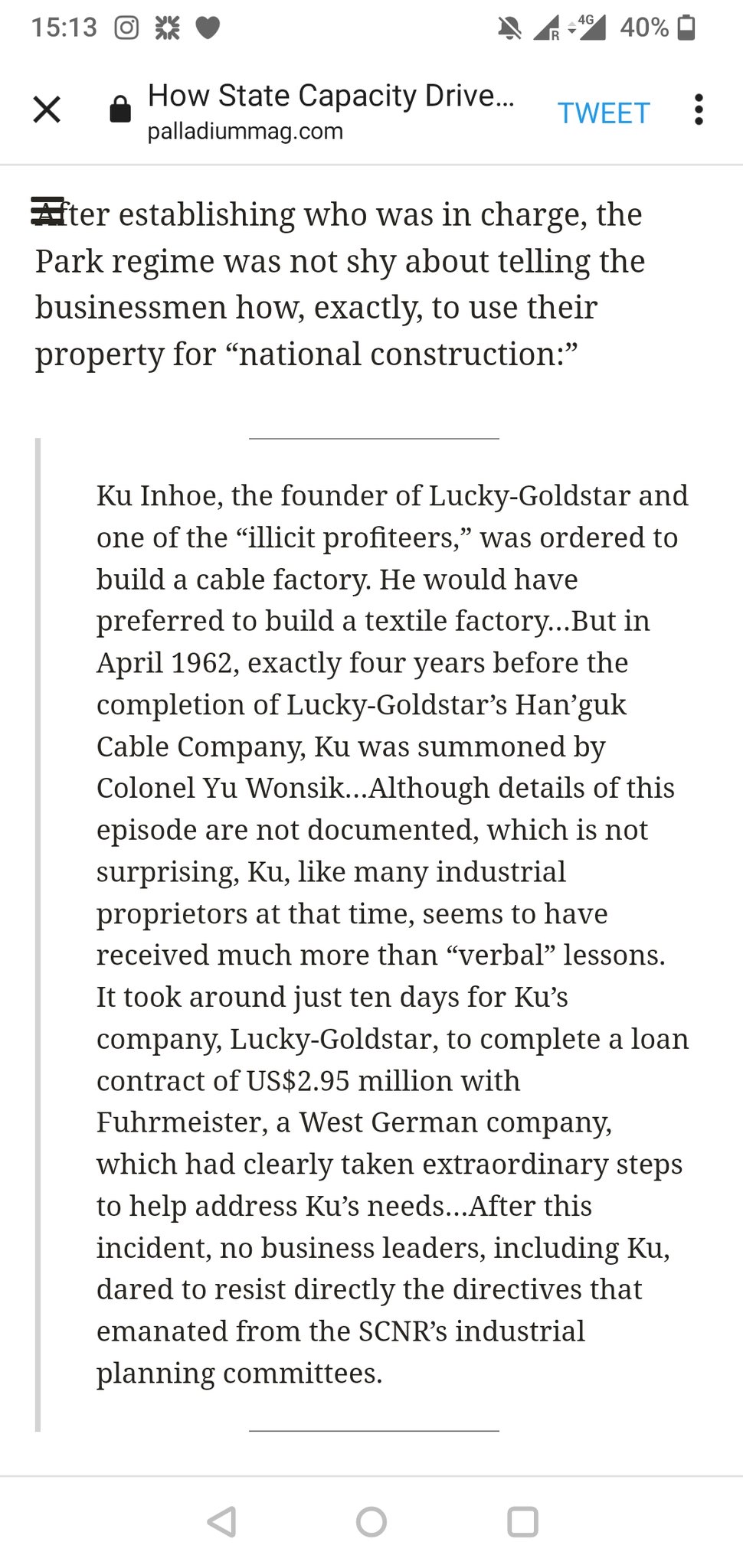

We often forget that authoritarian East Asian states didn't just heavily repress labour, but also disciplined local capital into industrialisation priorities

and for the literal-minded, discipline of local capital can take different forms, and I am not advocating for torture to be one of them

(also Space Karen has ruined mentions/replies, so apologies if I dont answer, there is some randomness in getting them)