Thread by Sam Callahan

- Tweet

- Feb 16, 2023

- #CentralBank #Security(finance)

Thread

One benefit you'll often hear from Central Bank Digital Currency advocates is how CBDCs will promote financial inclusion.

It sure sounds good - but this couldn't be further from the truth.

CBDCs would create more barriers to financial inclusion, not less. Allow me to explain.🧵

It sure sounds good - but this couldn't be further from the truth.

CBDCs would create more barriers to financial inclusion, not less. Allow me to explain.🧵

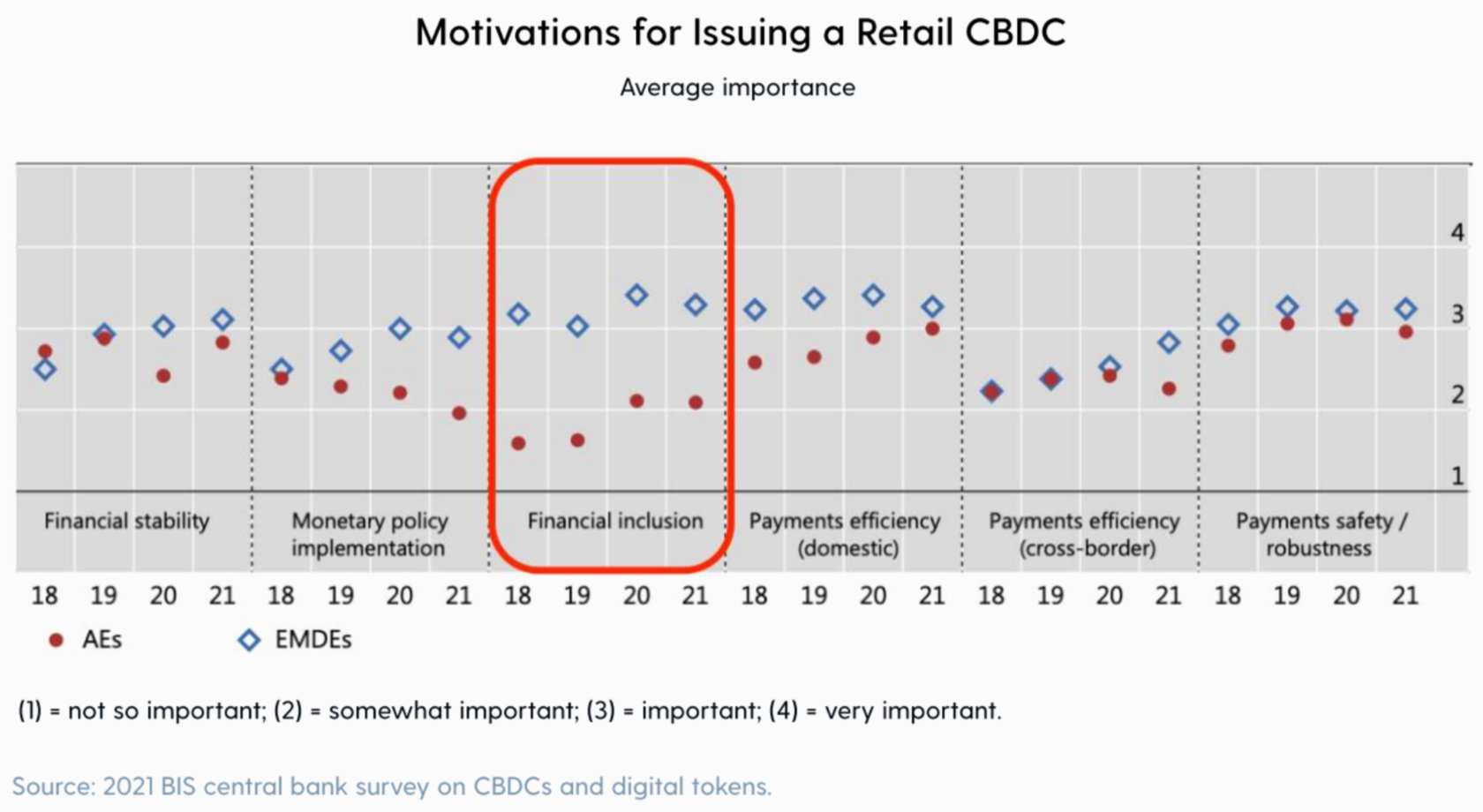

Improving financial inclusion is cited as one of the main reasons why central banks worldwide are motivated to launch a retail CBDC.

This is especially true in Emerging Markets where this issue was deemed an "important" reason for issuing a CBDC.

This is especially true in Emerging Markets where this issue was deemed an "important" reason for issuing a CBDC.

This alleged CBDC benefit is heavily advertised because promoting financial inclusion is a noble cause that few would argue against.

If CBDC proponents can convince the public that a CBDC accomplishes this honorable goal, then more people will be open to the issuance of a CBDC.

If CBDC proponents can convince the public that a CBDC accomplishes this honorable goal, then more people will be open to the issuance of a CBDC.

Below are quotes from officials at major central banks and the World Economic Forum, all peddling the narrative that a CBDC would help promote financial inclusion.

But would a CBDC actually help improve financial inclusion as these central banks and other institutions claim?

To answer this question, we need to ask ourselves why people are excluded from the financial system in the first place...

To answer this question, we need to ask ourselves why people are excluded from the financial system in the first place...

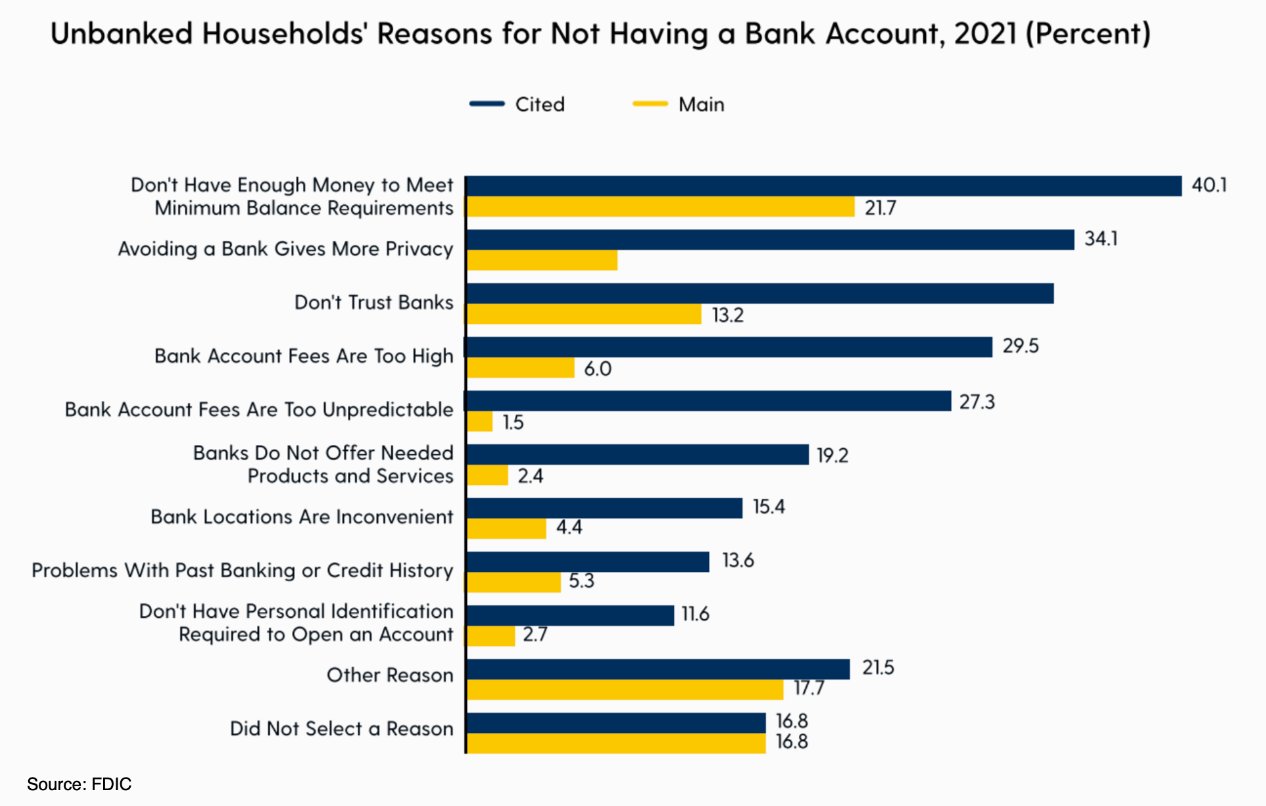

4.5% of American households remain unbanked, and 14.1% are underbanked today.

A recent FDIC survey concluded that the main reasons why these households remain unbanked are:

#1 - Costs of opening a bank account

#2 - Privacy concerns

#3 - They don't trust banks

#4 - High Fees

A recent FDIC survey concluded that the main reasons why these households remain unbanked are:

#1 - Costs of opening a bank account

#2 - Privacy concerns

#3 - They don't trust banks

#4 - High Fees

Note how a CBDC would do nothing to fix the main reasons why American households remain excluded from the financial system today.

These problems cannot be solved with new technology like a CBDC. In fact, a CBDC would only exacerbate these problems for consumers.

These problems cannot be solved with new technology like a CBDC. In fact, a CBDC would only exacerbate these problems for consumers.

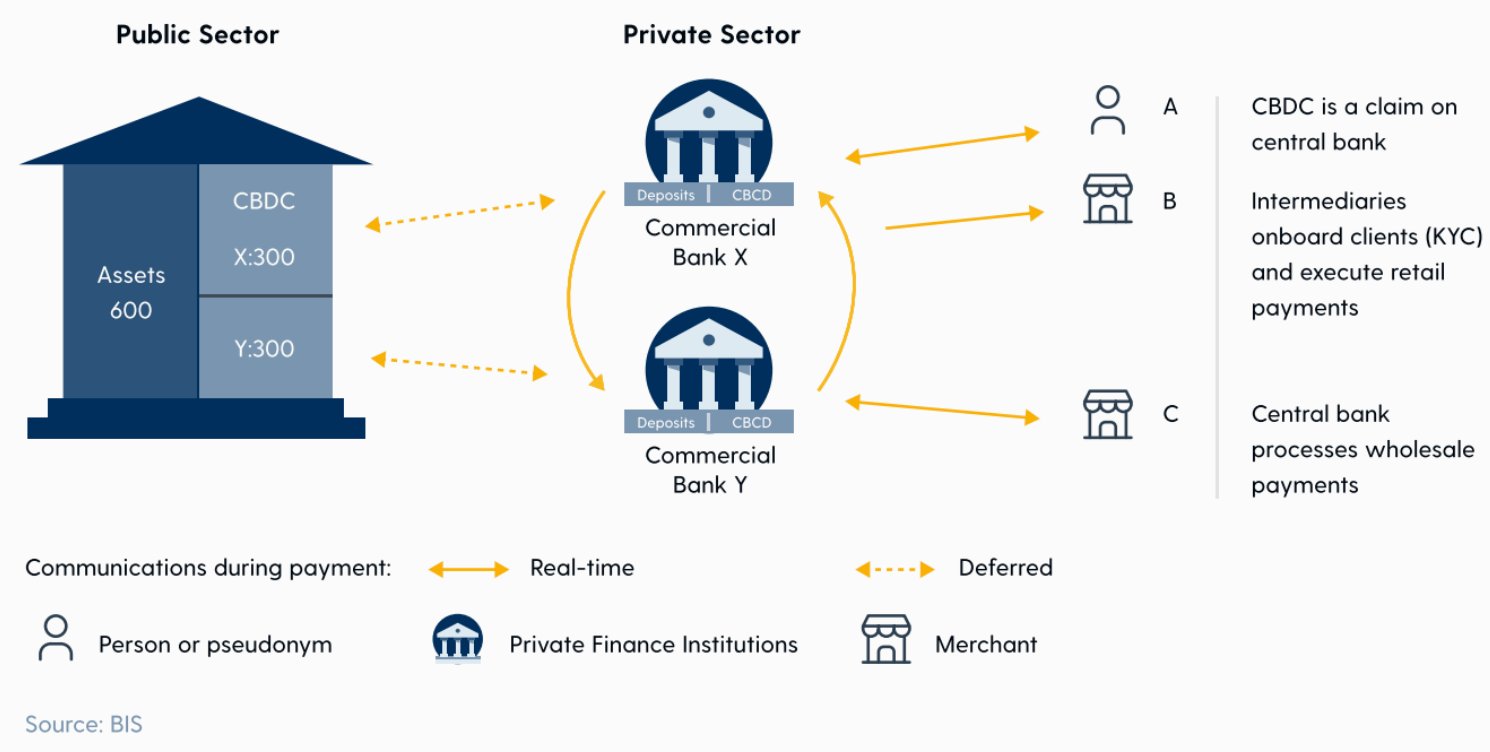

This is because the leading design for a CBDC only recreates the existing financial system that relies on intermediaries.

The central bank would issue a CBDC and supervise the system, while commercial banks would handle everything else.

Below is the intermediated CBDC system.

The central bank would issue a CBDC and supervise the system, while commercial banks would handle everything else.

Below is the intermediated CBDC system.

In this CBDC system, the commercial banks would perform all the customer-facing duties like account openings, custody services, managing CBDC holdings and payments, identity management, data security, and enforcing AML/KYC rules.

In other words, the same system we already have.

In other words, the same system we already have.

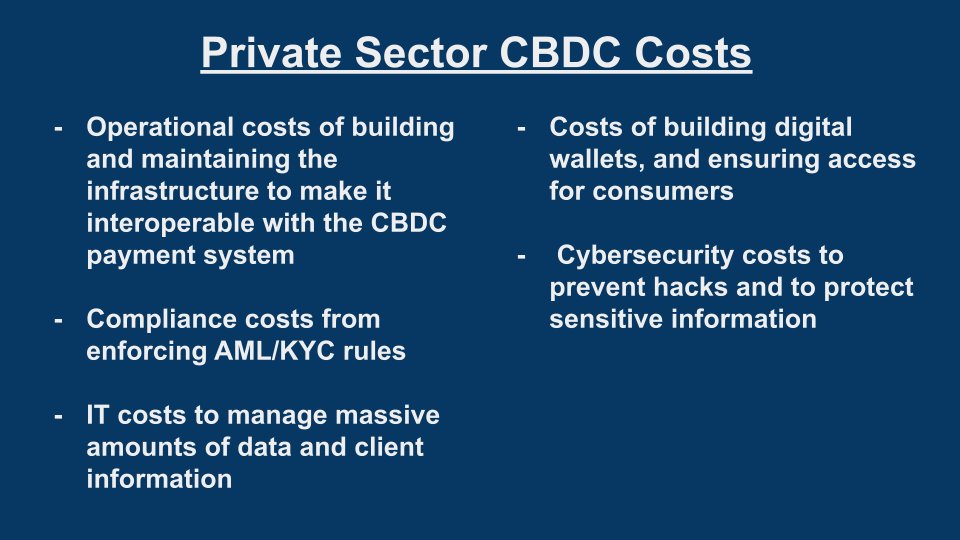

The takeaway here is all of the same problems would persist with a CBDC, except now the private sector would need to provide new services for a CBDC system, which would come with significant costs.

Below is a list of potential costs that the private sector would need to cover 👇

Below is a list of potential costs that the private sector would need to cover 👇

The logical conclusion is that these CBDC costs will be pushed onto consumers through higher fees, causing financial EXclusion.

It seems incredibly obtuse to believe that a costly CBDC system that would depend on fees to operate is the best way to promote financial inclusion.

It seems incredibly obtuse to believe that a costly CBDC system that would depend on fees to operate is the best way to promote financial inclusion.

This sentiment was shared by the Independent Community Bankers of America, who published their opinion on whether or not they think a CBDC would promote financial inclusion...

These community bankers do not like CBDCs, and it’s easy to understand why.

Because of the costs and technological complexity of offering CBDC services, smaller banks are less likely to have the technical capabilities or profit margins to offer them compared to larger banks.

Because of the costs and technological complexity of offering CBDC services, smaller banks are less likely to have the technical capabilities or profit margins to offer them compared to larger banks.

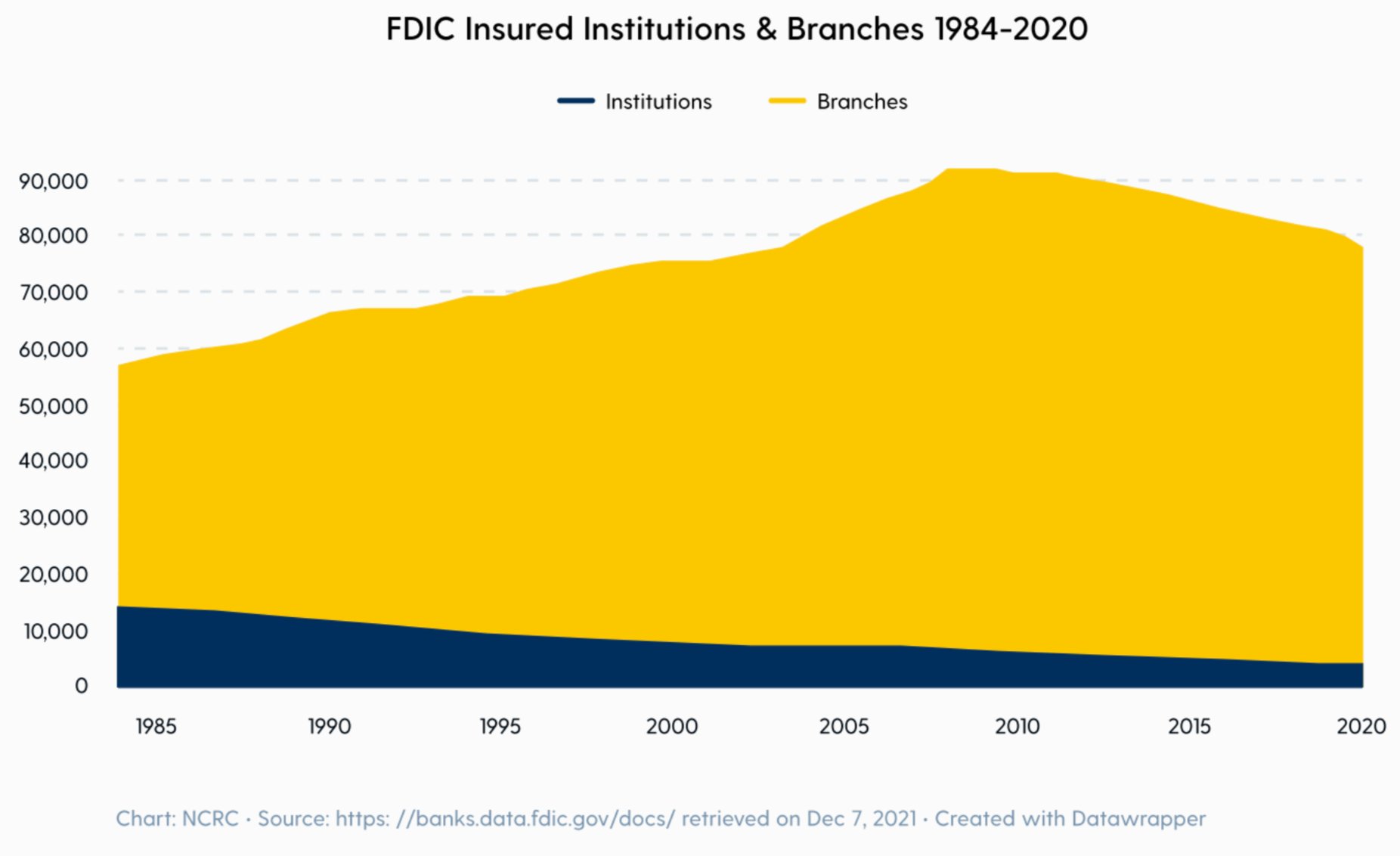

Thus, a CBDC would lead to small bank closures and consolidation of the banking industry. This consolidation would limit competition and harm consumers because they would have fewer choices and face higher costs and fees, leading to further financial exclusion.

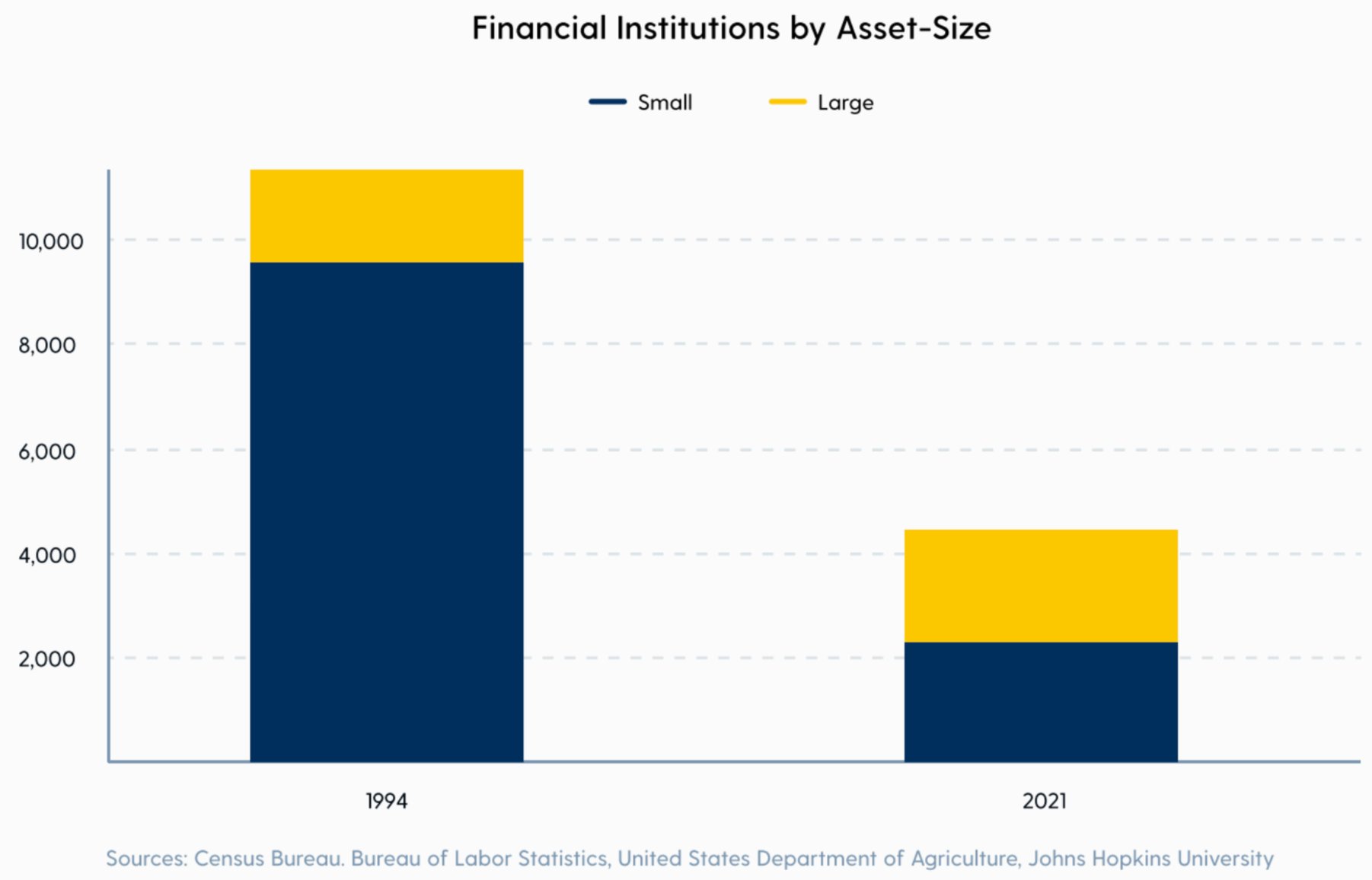

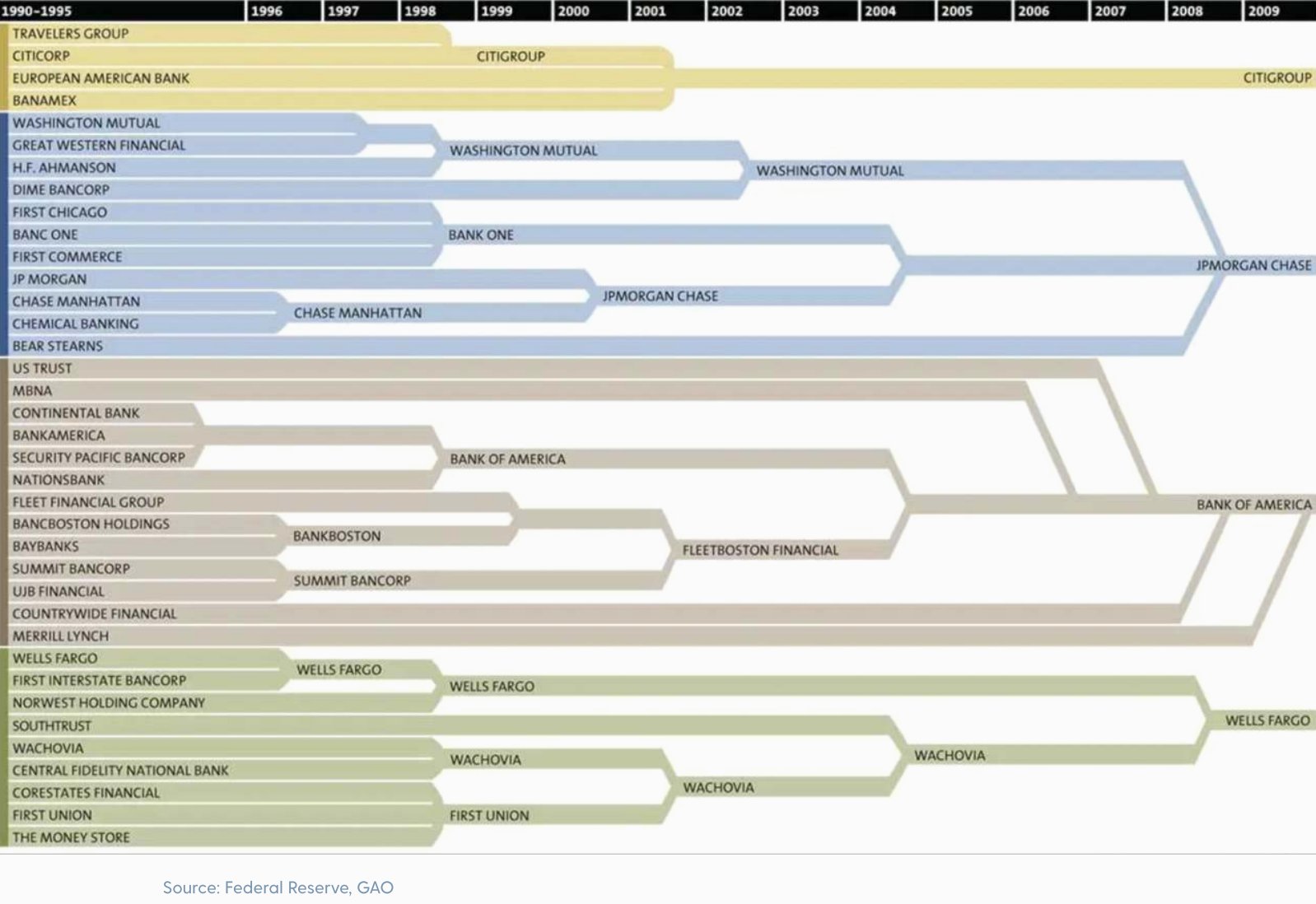

This is an ongoing trend. The number of FDIC-insured institutions peaked in 1984 at 17,811 and has been in steady decline since, with 4,897 institutions functioning in 2021.

The main reasons for this decline are small bank closures or small banks getting acquired by large banks.

The main reasons for this decline are small bank closures or small banks getting acquired by large banks.

This consolidation accelerated rapidly after the Global Financial Crisis in 2008.

While big banks were deemed too-big-to-fail, small institutions were deemed too-small-to-save. Of the 414 insured U.S. banks that failed in the aftermath of the GFC, 85% were small institutions.

While big banks were deemed too-big-to-fail, small institutions were deemed too-small-to-save. Of the 414 insured U.S. banks that failed in the aftermath of the GFC, 85% were small institutions.

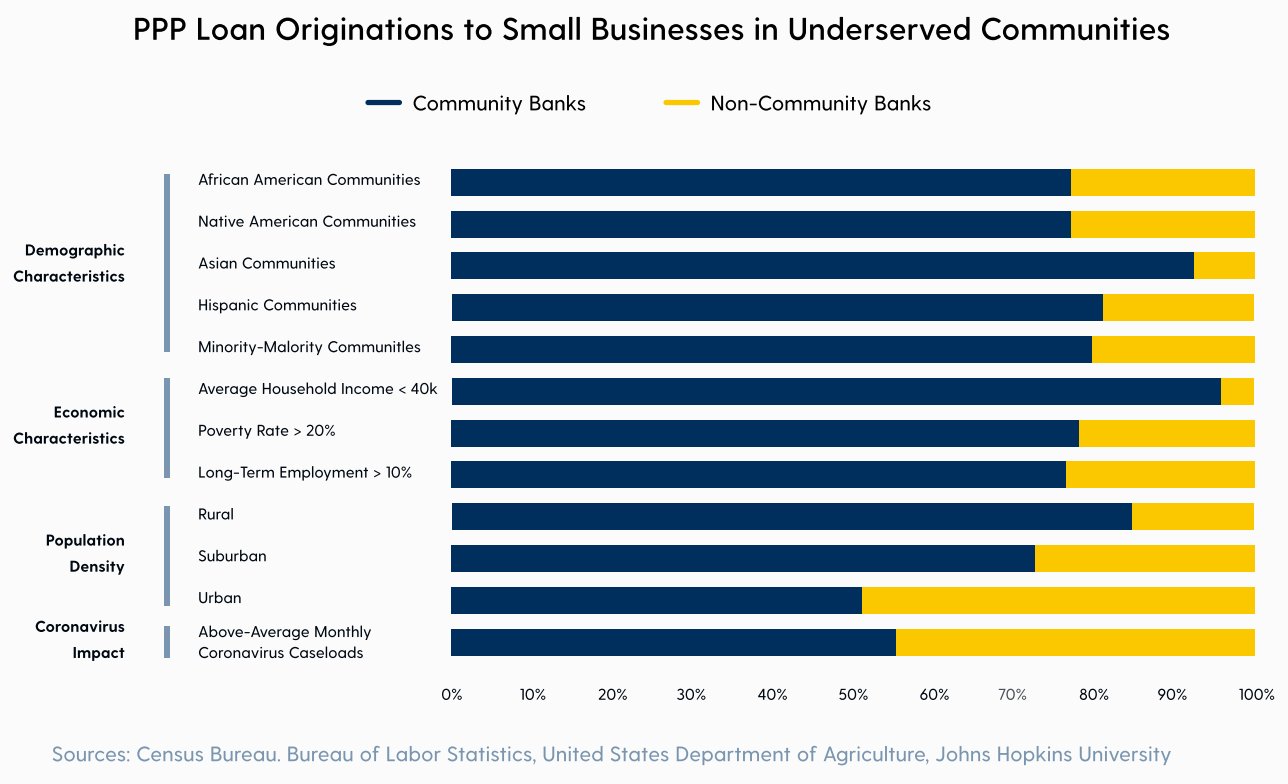

This is important because small banks are absolutely critical to providing underserved communities with basic financial services today.

A CBDC would disproportionately harm small banks and lead to more bank consolidation, devastating underserved communities in the process.

A CBDC would disproportionately harm small banks and lead to more bank consolidation, devastating underserved communities in the process.

To give you a sense of how important community banks are to underserved communities, despite holding only 15% of total industry loans, community banks hold 36% of small business loans and 31% of the industry's agricultural loans.

Farmers and small businesses depend on them.

Farmers and small businesses depend on them.

The importance of community banks to underserved communities was evident during the pandemic.

Community banks made 60% of all PPP loans, 90% of loans to communities with an avg household income of <$40,00 per year, and >75% of loans to those with a poverty rate of at least 20%.

Community banks made 60% of all PPP loans, 90% of loans to communities with an avg household income of <$40,00 per year, and >75% of loans to those with a poverty rate of at least 20%.

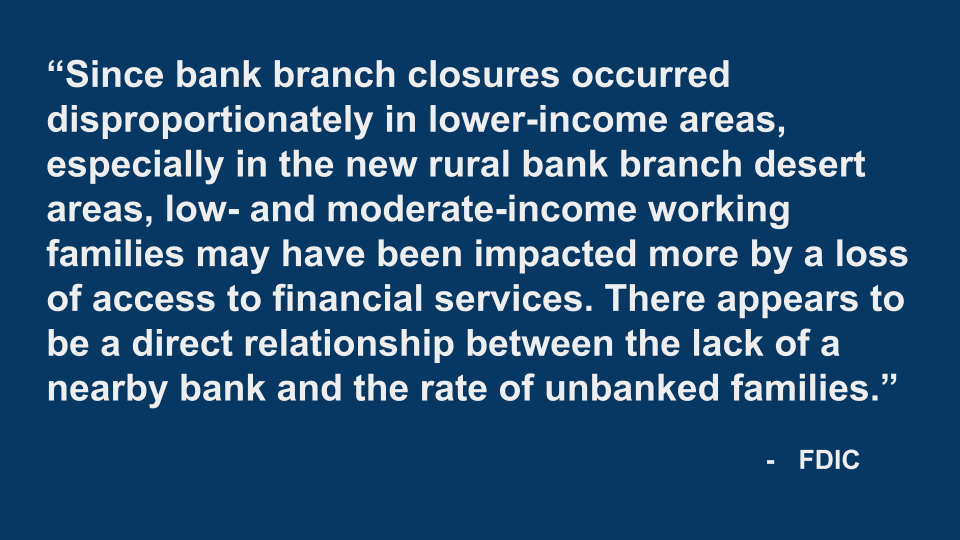

Small bank closures would increase financial exclusion. The FDIC confirmed a direct relationship between the number of community banks and the number of unbanked households.

An 8-year FDIC study concluded that bank closures hurt the most vulnerable populations among us.👇

An 8-year FDIC study concluded that bank closures hurt the most vulnerable populations among us.👇

A CBDC would lead to an increased regulatory burden and create technological hurdles that would disproportionately challenge small banks compared to large banks.

It would lead to increased consumer costs and put small banks at risk, harming underserved communities the most.

It would lead to increased consumer costs and put small banks at risk, harming underserved communities the most.

Not only would a CBDC increase costs and fees for consumers, exacerbating some of the top reasons Americans remain unbanked today, but it would also do nothing to address the second and third main reasons why they remain unbanked:

1) privacy concerns

2) lack of trust in banks.

1) privacy concerns

2) lack of trust in banks.

A CBDC would require MORE trust in banks. The same intermediaries that have blatantly breached the public's trust over the last 20 yrs. The financial services industry has paid >$347B in penalties since 2000.

It’s no wonder Americans don’t trust them!

Satoshi said it best.👇

It’s no wonder Americans don’t trust them!

Satoshi said it best.👇

American households do not trust banks because the banks have shown they don't deserve to be trusted.

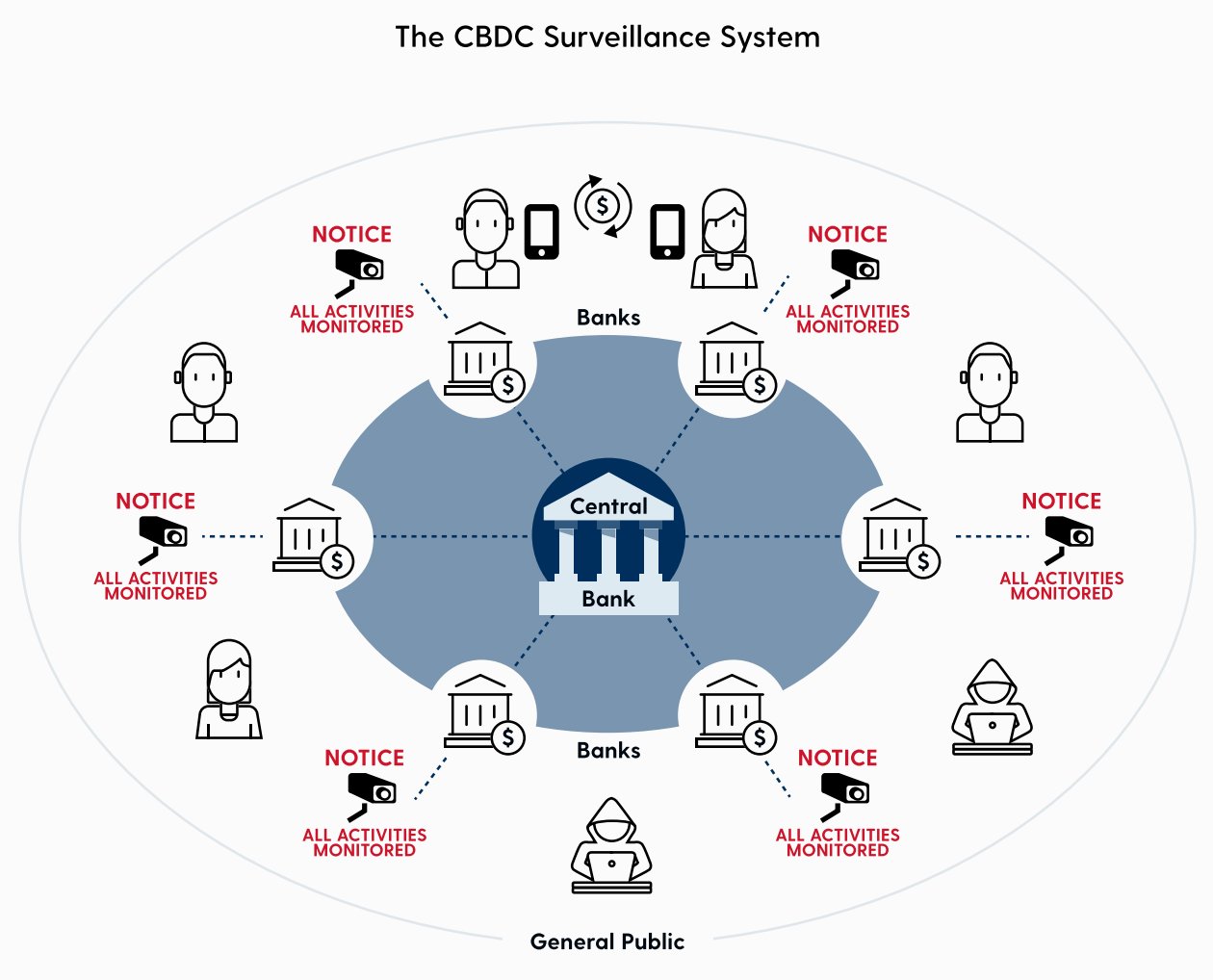

It’s not hard to see why a CBDC would not address these problems of trust and privacy. In fact, a CBDC would worsen them and risks becoming a tool for surveillance and control.

It’s not hard to see why a CBDC would not address these problems of trust and privacy. In fact, a CBDC would worsen them and risks becoming a tool for surveillance and control.

A CBDC would allow governments to track all financial activity in the economy at a much more granular level than they can today.

It could collect massive amounts of data on every financial transaction in the economy, threatening the rights and freedoms of law-abiding Americans.

It could collect massive amounts of data on every financial transaction in the economy, threatening the rights and freedoms of law-abiding Americans.

So does a CBDC really sound like the best way to address some of these underlying issues causing American households to remain unbanked today?

No. It would create a complete surveillance state.

Below is a CBDC design graphic pulled from the BIS, albeit slightly modified.

No. It would create a complete surveillance state.

Below is a CBDC design graphic pulled from the BIS, albeit slightly modified.

Major central banks have already made it clear that full privacy will not be afforded to users of a CBDC due to interference with AML/KYC policies.

Therefore, a CBDC would not lead to better privacy, would not improve trust in banks, and would not promote financial inclusion.

Therefore, a CBDC would not lead to better privacy, would not improve trust in banks, and would not promote financial inclusion.

Where the research above shows why CBDCs will actually worsen financial inclusion, Bitcoin shows great promise in its ability to address some of the underlying reasons why American households remain unbanked today.

Households that don’t trust banks or intermediaries will have no problem trusting Bitcoin because it removes the need for intermediaries altogether.

One can trust the Bitcoin protocol specifically because it is trustless.

One can trust the Bitcoin protocol specifically because it is trustless.

Bitcoin is an open monetary protocol accessible to anyone with a smartphone and internet connection.

There are no minimal costs to open a Bitcoin "account," no documentation is required, and the fees are much lower and more transparent than the traditional banking system.

There are no minimal costs to open a Bitcoin "account," no documentation is required, and the fees are much lower and more transparent than the traditional banking system.

Lastly, Bitcoin allows individuals to transact pseudonymously.

Privacy is much more protected compared to a CBDC with built-in digital identification.

Furthermore, the Lightning Network, Bitcoin’s second-layer payment protocol, offers even better privacy guarantees.

Privacy is much more protected compared to a CBDC with built-in digital identification.

Furthermore, the Lightning Network, Bitcoin’s second-layer payment protocol, offers even better privacy guarantees.

All in all, Bitcoin is our best hope at promoting financial inclusion, not CBDCs.

Central banks continue to ignore Bitcoin despite it being a promising solution and are instead wasting their time and resources developing a CBDC that would only exacerbate existing problems.

Central banks continue to ignore Bitcoin despite it being a promising solution and are instead wasting their time and resources developing a CBDC that would only exacerbate existing problems.

If central banks were serious about promoting financial inclusion, they would stop wasting their time with CBDCs and start embracing Bitcoin.

If you support financial inclusion, then you should support Bitcoin too.

Here's a clip explaining why Bitcoin is the solution here.

If you support financial inclusion, then you should support Bitcoin too.

Here's a clip explaining why Bitcoin is the solution here.

/the end. Thanks for reading. 🙏

If you want to start supporting a real solution for promoting financial inclusion, then I recommend @SwanBitcoin. (Full disclosure: I work there)

You can find my full article with all the references in the link below. www.swanbitcoin.com/why-a-cbdc-will-not-promote-financial-inclusion/

If you want to start supporting a real solution for promoting financial inclusion, then I recommend @SwanBitcoin. (Full disclosure: I work there)

You can find my full article with all the references in the link below. www.swanbitcoin.com/why-a-cbdc-will-not-promote-financial-inclusion/

Mentions

See All

Jeff Booth @JeffBooth

·

Feb 17, 2023

Great thread @samcallah