Thread

Tech employees from private "growth stage" companies ($1B to $10B+ valuations) are in a tricky position with their stock options/grants

Most public market comparisons have dropped > 50%+ over the past year

What should these employees be thinking and doing with their equity?

Most public market comparisons have dropped > 50%+ over the past year

What should these employees be thinking and doing with their equity?

Benchmarks have shifted—there are public companies doing $100s of millions in revenue that are now valued at less than $1B

The market has shifted. For how long? We do not know

Nonetheless, employees still _need_ to make decisions

The market has shifted. For how long? We do not know

Nonetheless, employees still _need_ to make decisions

In some cases, they need to exercise their options before they expire otherwise they will miss out on all of their earnings (potentially millions of dollars)

So should you exercise your stock options now while the 409A is potentially lower to minimize your tax obligation?

Should you leave your company because you no longer believe there will ever be a successful outcome?

Should you try and sell your shares now in a secondary market?

Should you leave your company because you no longer believe there will ever be a successful outcome?

Should you try and sell your shares now in a secondary market?

There is no *right* answer to these questions (and we recommend you consult with a professional to chat through them. We @compound can help)

But remember that NOT making a decision is still a decision (with major implications)

So what should you do?

But remember that NOT making a decision is still a decision (with major implications)

So what should you do?

Consider the following framework—consider yourself an investor of your time and money

You want a return

That return is a combination of things (money, learning, fun, impact, prestige, etc.)

Compare your current situation's return with your opportunity cost

Make a decision

You want a return

That return is a combination of things (money, learning, fun, impact, prestige, etc.)

Compare your current situation's return with your opportunity cost

Make a decision

To do this, first figure out your expected return from your startup

The financial impact stuff is math (though a helpful reminder that predicting the future is a hard job)

We suggest you talk to a professional and we can help @compound

The financial impact stuff is math (though a helpful reminder that predicting the future is a hard job)

We suggest you talk to a professional and we can help @compound

In most cases, you will need to confront the reality that *most all startups* are not "get rich quick schemes"

They take time, hard work, discipline, and endurance

Your company will take years to grow into its valuation (and that is okay!—consider that is _the_ opportunity)

They take time, hard work, discipline, and endurance

Your company will take years to grow into its valuation (and that is okay!—consider that is _the_ opportunity)

But ask yourself (and your partner/family if relevant)—are you prepared for that?

Prepared == financially prepared from a cash flow perspective, emotionally prepared from an endurance perspective

Prepared == financially prepared from a cash flow perspective, emotionally prepared from an endurance perspective

Consider asking your leadership team—who is our public competitor? What is our business plan? Why will we win? How long will it take?

(Startups will not have perfect answers to these questions—that's also okay)

(Startups will not have perfect answers to these questions—that's also okay)

The non-financial stuff is far less straightforward

Write yourself a memo (literally) answering the following questions:

- What do you think of your current job?

- Are you learning the right things?

- Do you believe in your company?

This thread can help:

Write yourself a memo (literally) answering the following questions:

- What do you think of your current job?

- Are you learning the right things?

- Do you believe in your company?

This thread can help:

Once you do this, write yourself another memo trying to figure out your opportunity cost:

How else could I invest my time? Starting a company? Joining another company? Doing nothing?

How will this impact the things I care about?

How else could I invest my time? Starting a company? Joining another company? Doing nothing?

How will this impact the things I care about?

Perfecting this memo can be a big distraction

Any time you spend exploring the opportunity cost _may_ hurt the expected return of your current situation

Would not spend *too much time* going down this rabbit hole—unless something is up

Any time you spend exploring the opportunity cost _may_ hurt the expected return of your current situation

Would not spend *too much time* going down this rabbit hole—unless something is up

You have seen the headlines—layoffs, efficiency, in person work, etc.

Most employees are _losing leverage_

Not as easy to get a job as it was 2 years ago

(Perhaps you are not in the category of "most employees", though)

Most employees are _losing leverage_

Not as easy to get a job as it was 2 years ago

(Perhaps you are not in the category of "most employees", though)

Once you have the analysis of your current situation and you are able to compare it to your opportunity cost, you generally have a decision (or set of decisions) to make

This is a blend of art and science—a leap of faith is often involved

This is a blend of art and science—a leap of faith is often involved

We suggest running a "best case" and "worst case" analysis on all of your scenarios

Stress testing will help you figure out where you will be happiest (and saddest)

(People forget that often the worst case is actually working at a job you hate and being sad)

Stress testing will help you figure out where you will be happiest (and saddest)

(People forget that often the worst case is actually working at a job you hate and being sad)

VCs diversify their portfolios. It is much harder to diversify your time

"Life is not a dress rehearsal"

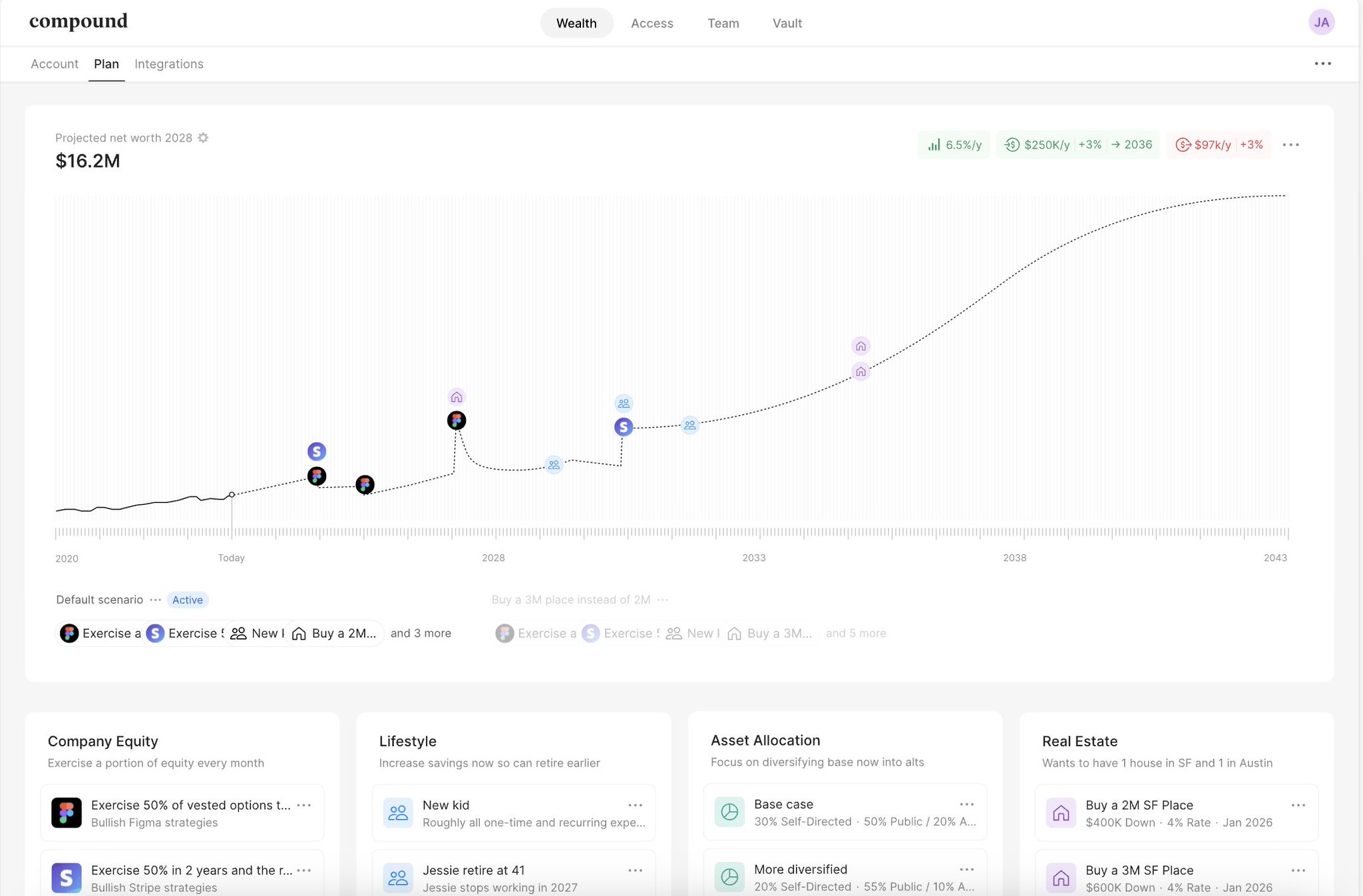

Our mission @compound is to help you not have to worry about money so you can focus on what matters most

"Life is not a dress rehearsal"

Our mission @compound is to help you not have to worry about money so you can focus on what matters most

Mentions

See All

Romeen Sheth @RomeenSheth

·

Feb 7, 2023

Really good (and timely) thread