Thread

Here is everything you need to know about Gross Margin in 3 minutes:

(With a bit of help from Larry David)

(With a bit of help from Larry David)

1/ To understand gross margin we are going to use an example:

A coffee shop.

We’ll call it ‘Latte Larrys’.

That’s right folks … we’re opening a spite store.

A coffee shop.

We’ll call it ‘Latte Larrys’.

That’s right folks … we’re opening a spite store.

2/ Latte Larry’s serves one product; the humble Latte.

And it’s going to have to be good.

We’ve gotta beat the competitor next door; asshole Mocha Joe.

May the best man’s gross margin win.

And it’s going to have to be good.

We’ve gotta beat the competitor next door; asshole Mocha Joe.

May the best man’s gross margin win.

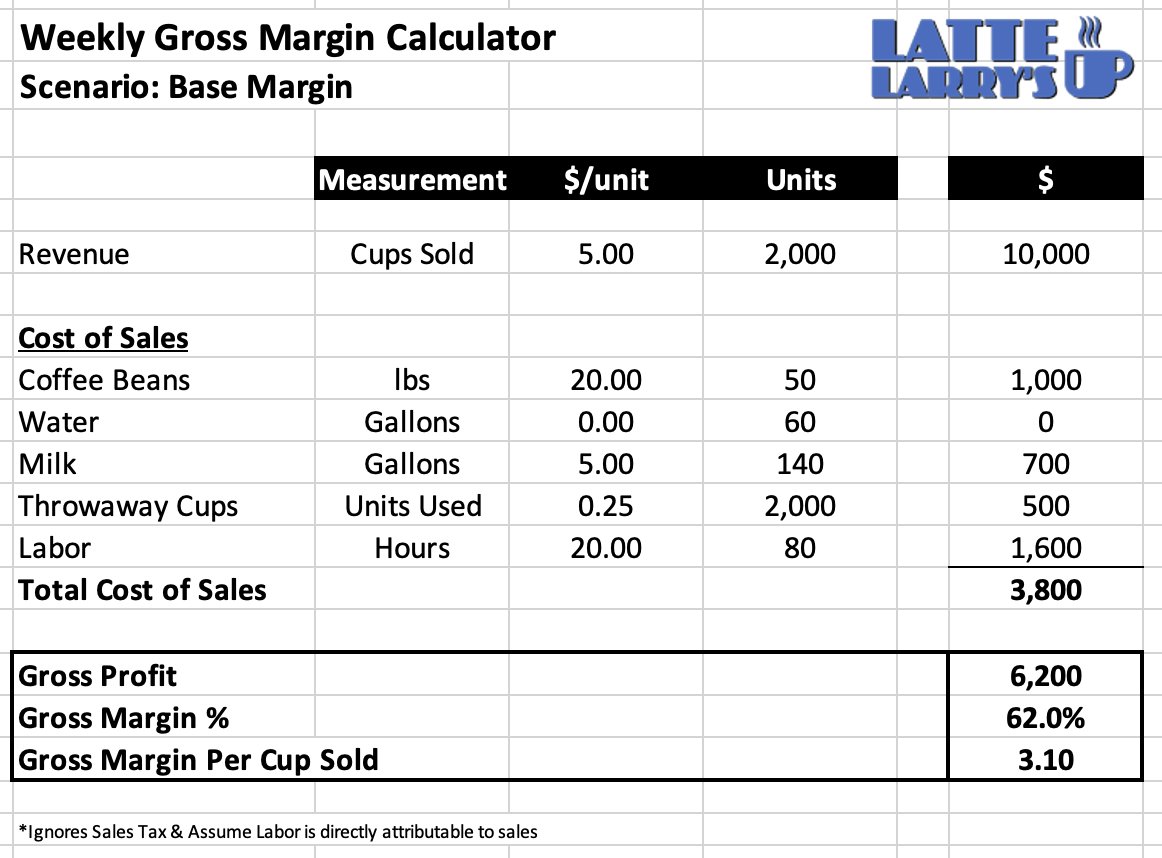

3/ Larry is serving up the best Latte’s, using the finest Mexican beans.

He’s selling 2,000 cups per week for a price of $5 per cup.

A good start against that asshole Mocha Joe.

But what does his gross margin look like?

He’s selling 2,000 cups per week for a price of $5 per cup.

A good start against that asshole Mocha Joe.

But what does his gross margin look like?

4/ Pretty, pretty, prettaaaaay good.

Gross Margin: 62%. Or $3.10 per cup.

No way Mocha Joe is commanding that sort of margin.

Asshole.

Gross Margin: 62%. Or $3.10 per cup.

No way Mocha Joe is commanding that sort of margin.

Asshole.

5/ Quick primer:

Gross Margin = Gross Profit / Revenue

Gross Profit = Revenue - Cost of Sales

Cost of Sales: Costs directly attributable costs of producing a product or delivering a service.

We’ll dive into the nuance of what’s directly attributable or not in a future thread.

Gross Margin = Gross Profit / Revenue

Gross Profit = Revenue - Cost of Sales

Cost of Sales: Costs directly attributable costs of producing a product or delivering a service.

We’ll dive into the nuance of what’s directly attributable or not in a future thread.

6/ So we’ve got a base gross margin of 62%.

But what can we do to drive it further, and really kick Mocha Joe in the dick?

But what can we do to drive it further, and really kick Mocha Joe in the dick?

7/ There are 4 levers to improving gross margin:

i) Selling prices

ii) Input cost prices

iii) Sales Mix

iv) Gross Margin Conversion

Most people ignore the forth point… stay tuned, because it’s where the gold is.

i) Selling prices

ii) Input cost prices

iii) Sales Mix

iv) Gross Margin Conversion

Most people ignore the forth point… stay tuned, because it’s where the gold is.

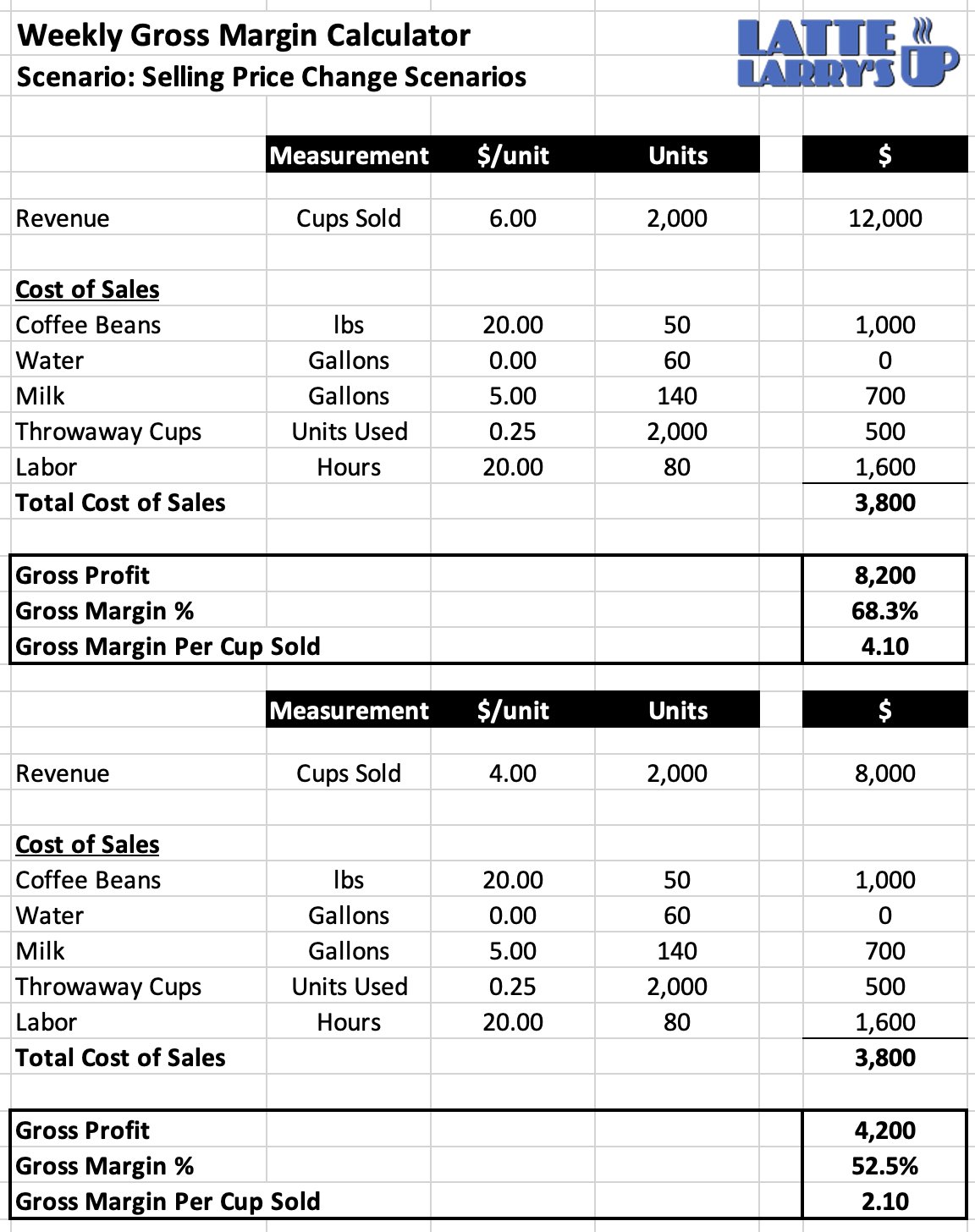

8/ i) Selling Prices

Turns out Mocha Joe is charging $5 for a Latte too.

Larry’s doesn’t want his Latte’s compared directly to that asshole.

Two options:

A) Raise prices to $6 to signal the quality differential through the brand

B) Cut the price to $4 and crush him on price

Turns out Mocha Joe is charging $5 for a Latte too.

Larry’s doesn’t want his Latte’s compared directly to that asshole.

Two options:

A) Raise prices to $6 to signal the quality differential through the brand

B) Cut the price to $4 and crush him on price

9/ Increase the price to $6, takes gross margin up to 68.3% ($4.10 per cup)

Reduce the price to $4, takes gross margin down to 52.5% ($2.10 per cup)

In practice, a big price movement like this would affect sales (price elasticity), but we’ll tackle this in a follow up thread.

Reduce the price to $4, takes gross margin down to 52.5% ($2.10 per cup)

In practice, a big price movement like this would affect sales (price elasticity), but we’ll tackle this in a follow up thread.

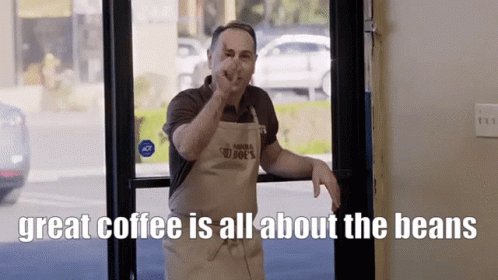

10/ ii) Input Cost Prices

The most expensive ingredient in the coffee is the beans.

Larry’s been to Mexico to get the best beans. The BEST.

Mocha Joe would never put that sort of work in.

The most expensive ingredient in the coffee is the beans.

Larry’s been to Mexico to get the best beans. The BEST.

Mocha Joe would never put that sort of work in.

11/ But they are expensive. He needs them cheaper.

There are 2 ways to secure a better cost price

A) Negotiate a better deal for the current beans

B) Change beans to a cheaper alternative.

There are 2 ways to secure a better cost price

A) Negotiate a better deal for the current beans

B) Change beans to a cheaper alternative.

12/ Larry sends his buddy Leon into negotiate.

Leon gently encourages the suppplier to discount the cost per lb from $20 to $15.

Nice work Leon … that was worth an extra 250 basis points of margin (62% up to 64.5%).

Leon gently encourages the suppplier to discount the cost per lb from $20 to $15.

Nice work Leon … that was worth an extra 250 basis points of margin (62% up to 64.5%).

13/ iii) Sales Mix

Mocha Joe starts selling muffins but branding them as scones.

Larry’s pissed.

So he starts selling scones himself. REAL scones.

He pulls in the pastry chef from the Waldorf to help.

Mocha Joe starts selling muffins but branding them as scones.

Larry’s pissed.

So he starts selling scones himself. REAL scones.

He pulls in the pastry chef from the Waldorf to help.

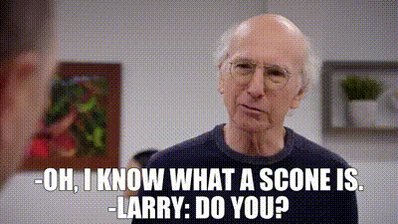

14/ Buying them in for $1 per unit, and selling them for $5.

80% GM on the scones.

So, for every scone sold, it will drag the total margin up.

Larry sells 500 scones per week, and the margin moves from 62% to 65.6%, by 360 margin points.

80% GM on the scones.

So, for every scone sold, it will drag the total margin up.

Larry sells 500 scones per week, and the margin moves from 62% to 65.6%, by 360 margin points.

15/ That 360 point improvement is the positive mix effect.

You can see as you add more products in with varying margins, mix effects can get pretty complex.

You can see as you add more products in with varying margins, mix effects can get pretty complex.

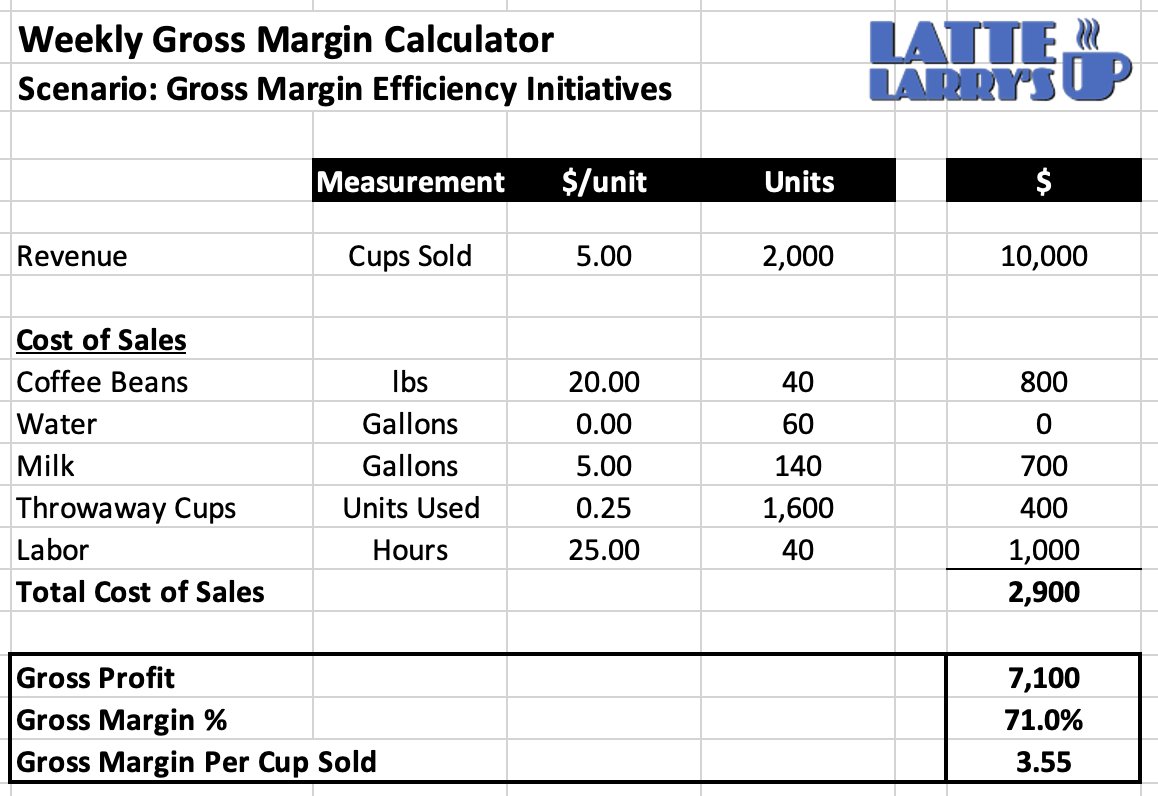

16/ iv) Gross Margin Conversion

Larry notices that he is wasting 10lb of coffee beans every week.

He puts in new SOPs to eliminate this waste.

This means he can make the same number of cups with fewer beans and save on his most expensive material.

Larry notices that he is wasting 10lb of coffee beans every week.

He puts in new SOPs to eliminate this waste.

This means he can make the same number of cups with fewer beans and save on his most expensive material.

17/ At the same time Leon is becoming quite the barista; a Beanmeister.

Larry thinks Leon could run the operation on his own, if he gives him a raise to $25 per hour.

Larry also launches a scheme for customers to use their own reusable cup. 20% take up the scheme.

Larry thinks Leon could run the operation on his own, if he gives him a raise to $25 per hour.

Larry also launches a scheme for customers to use their own reusable cup. 20% take up the scheme.

18/ Now, see what has happened here.

Larry has improved his gross margin from the base 62% to 71%.

But crucially he has done so, without changing the product, mix, input price or selling prices. Just by doing more with less.

Making the inputs go further.

Larry has improved his gross margin from the base 62% to 71%.

But crucially he has done so, without changing the product, mix, input price or selling prices. Just by doing more with less.

Making the inputs go further.

19/ This is the power of gross margin conversion factors. And this is often where the hidden gold is in margin.

The most disciplined and successful businesses have great operations teams focused optimizing gross margin efficiency every day.

The most disciplined and successful businesses have great operations teams focused optimizing gross margin efficiency every day.

20/ Every business will have different conversion factors.

And they should feature as KPIs for the Operations Team.

I’ll run a separate thread on gross margins conversion factors as there is a lot of ground to cover here.

And they should feature as KPIs for the Operations Team.

I’ll run a separate thread on gross margins conversion factors as there is a lot of ground to cover here.

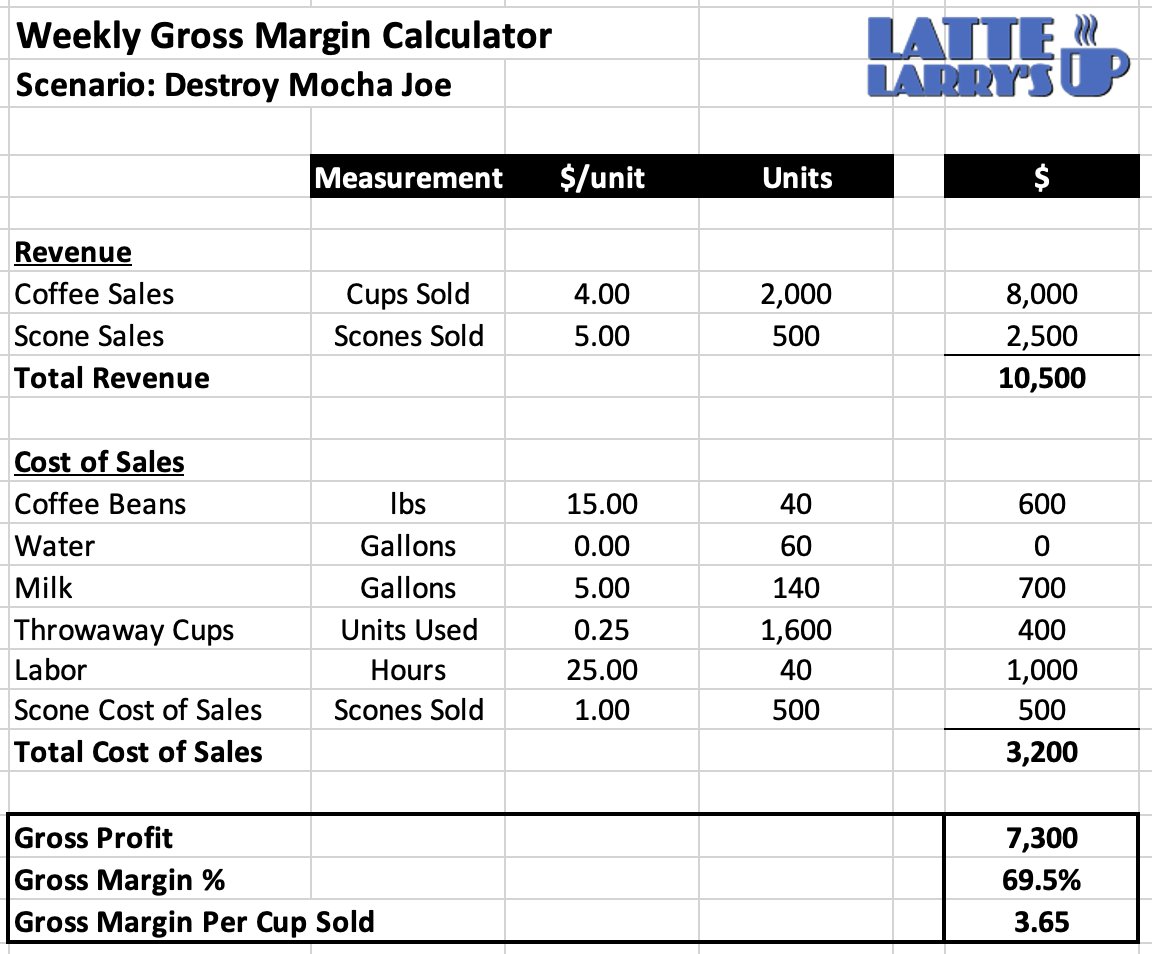

21/ So those are the 4 gross margin levers.

But now lets put this together into a plan for Larry:

- $5 per lb bean price reduction

- launch the scones

- Eliminate the bean waste

- Give Leon the $5 raise and go from 2 staff to 1

- Reduced disposable cups by 20%

But now lets put this together into a plan for Larry:

- $5 per lb bean price reduction

- launch the scones

- Eliminate the bean waste

- Give Leon the $5 raise and go from 2 staff to 1

- Reduced disposable cups by 20%

22/ By doing these things, he has improved his margin to 69.5% AND reduced his price to undercut his competition by $1.

Now he’s gonna crush Mocha Joe.

Asshole.

Now he’s gonna crush Mocha Joe.

Asshole.

23/ What could go wrong?

Joey Funkhouser. That’s what.

I guess there are some things gross margin can’t fix.

Joey Funkhouser. That’s what.

I guess there are some things gross margin can’t fix.

TLDR

Drivers of Gross Margin:

i) Selling Prices

ii) Input Cost Prices

iii) Sales Mix

iv) Gross Margin Conversion

Drivers of Gross Margin:

i) Selling Prices

ii) Input Cost Prices

iii) Sales Mix

iv) Gross Margin Conversion

If you enjoyed this, please follow @secretcfo and RT the original tweet to spread the word.

Mentions

See All

Kurtis Hanni @KurtisHanni

·

Feb 2, 2023

Pretty, prettaaaaay good thread!