Thread

Passenger trains are unprofitable and require subsidies.

Wrong! Maybe….

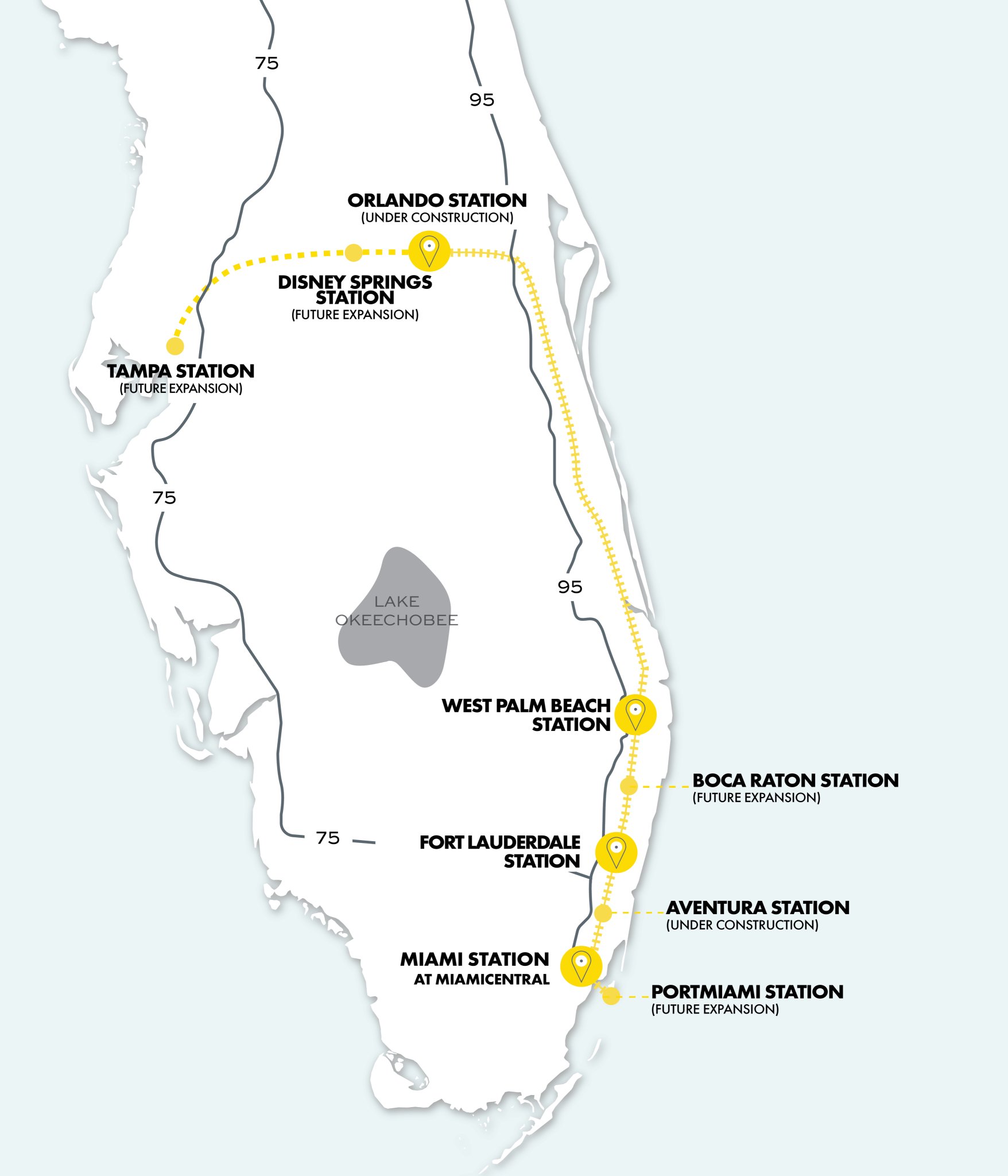

Brightline is a for-profit company building a rail system from Miami to Orlando Airport, opening in 2022. The line will extend to Disney World by 2023, and potentially Tampa in the future.

🧵

Wrong! Maybe….

Brightline is a for-profit company building a rail system from Miami to Orlando Airport, opening in 2022. The line will extend to Disney World by 2023, and potentially Tampa in the future.

🧵

This isn’t just a concept. The company is currently building 150+ miles of railroad track.

When the Miami to Orlando segment is complete next year, it will take 3 hours 15 min. That's approx same travel time as driving (without traffic), an way better than driving in traffic.

The following year (2023), Brightline will open an extension to Disney Springs. This will allow people from South Florida (and MCO) to get to Disney World without driving.

Trains will operate at 125 mph max, faster than non-Acela Amtrak (79 mph) but slower than true high-speed trains (180 mph+).

So far, cool transit project. But I was fascinated by the for-profit angle here. This will be the only for-profit intercity rail service in America.

My questions...

1⃣ Who are these people?

2⃣ How are they financing construction?

3⃣ And how will they make money?

My questions...

1⃣ Who are these people?

2⃣ How are they financing construction?

3⃣ And how will they make money?

1⃣ Who are these people?

Brightline is owned by Fortress Investments, a private equity firm. Fortress, in turn, is owned by Softbank (tech people: 🤣, what isn't?)

The owners have invested approximately $1.65 billion in equity in the project so far.

atypicalworkday.com/fortress-investment-group/

Brightline is owned by Fortress Investments, a private equity firm. Fortress, in turn, is owned by Softbank (tech people: 🤣, what isn't?)

The owners have invested approximately $1.65 billion in equity in the project so far.

atypicalworkday.com/fortress-investment-group/

2⃣ How are they financing construction?

Beyond the $1.65B in equity, Brightline has financed the buildout of their system in three unique ways…

Beyond the $1.65B in equity, Brightline has financed the buildout of their system in three unique ways…

First, they raised debt at a lower cost. The DOT allows private transportation companies to issue “Private Activity Bonds”, which are tax-exempt (similar to municipal bonds). Brightline has borrowed $2.7 billion via these bonds.

www.transportation.gov/buildamerica/financing/private-activity-bonds

www.transportation.gov/buildamerica/financing/private-activity-bonds

Second is a more indirect form of financing: Brightline pays relatively little for the land its railroad will use (though details are sketchy).

They have perpetual rights to operate and upgrade trackage on the FECR (a local freight railroad). Fortress (Brightline’s owner) used to own FECR, but they spun it out in 2017.

FECR trackage covers ~80% of the route to Orlando.

FECR trackage covers ~80% of the route to Orlando.

The remaining ~20% of the route to Orlando is on government land (mostly highways).

Brightline has negotiated leases and easements with a few government agencies in Florida. I suspect costs are fairly low for these (indirect support for a public good).

Brightline has negotiated leases and easements with a few government agencies in Florida. I suspect costs are fairly low for these (indirect support for a public good).

Third source of financing: local governments pay for additional stations in their cities.

Brightline will add 3 stations on its existing line (Aventura, Boca Raton, Miami cruise port)

$141M cost to build extra stations and track

$89M will be covered by government grants

Brightline will add 3 stations on its existing line (Aventura, Boca Raton, Miami cruise port)

$141M cost to build extra stations and track

$89M will be covered by government grants

Craziest fact about those infill stations: Brightline expects these three stations to contribute 2M+ incremental passengers and $60M in incremental EBIDTA!

That's a payback period less than one year!

That's a payback period less than one year!

3⃣ And how will they make money?

All we have are projections from Brightline. For 2024 (first full year) they assume:

💵$792M Revenue

💵$243M Opex

💵$549M EBITDA

💵$289M cash flow after debt

🧑🤝🧑5.4M pax short-haul at ~$35 avg fare

🧑🤝🧑4.5M pax Orlando-South FL at ~$105 avg fare

All we have are projections from Brightline. For 2024 (first full year) they assume:

💵$792M Revenue

💵$243M Opex

💵$549M EBITDA

💵$289M cash flow after debt

🧑🤝🧑5.4M pax short-haul at ~$35 avg fare

🧑🤝🧑4.5M pax Orlando-South FL at ~$105 avg fare

These top-line numbers are mostly driven by passenger transportation (including obvious ancillaries like bundled vacation packages and food purchases onboard).

But there are two other revenue sources that Brightline can leverage (and are not included in these numbers).

But there are two other revenue sources that Brightline can leverage (and are not included in these numbers).

First source of “ancillary” revenue: Brightline can charge local transit agencies to use Brightline's track for commuter rail service (Brightline's focus is intercity service)

In 2020, Miami-Dade county committed to paying Brightline an upfront $50 million plus $12 million/year for access to their rails and the right to build 5 additional commuter stations on the track.

Brightline believes other counties (Broward, Palm Beach, and Orlando) are interested in doing the same.

This revenue is pure profit, since transit agencies will operate their trains and pay for any necessary infrastructure upgrades.

This revenue is pure profit, since transit agencies will operate their trains and pay for any necessary infrastructure upgrades.

Second source of “ancillary” revenue is off balance sheet (I think). Brightline’s owner holds real estate assets arounds the train stations. As the land around those stations becomes better-connected and more desirable, it will become more valuable.

So, what are the lessons from Brightline?

🪙 "Private" still requires gov support (tax-free bonds, track on public land, local govs build stations)

🚅Good pax rail requires dedicated track for speed and frequency

💨They're faster than public agencies (compare to CA HSR 😓)

🪙 "Private" still requires gov support (tax-free bonds, track on public land, local govs build stations)

🚅Good pax rail requires dedicated track for speed and frequency

💨They're faster than public agencies (compare to CA HSR 😓)

We won’t know if Brightline is a success until 2024, but I’ll be rooting for them.

They've set their sights on the LA-Las Vegas and teased other routes too.

Success in Florida will build investor confidence in privately-developed passenger rail.

They've set their sights on the LA-Las Vegas and teased other routes too.

Success in Florida will build investor confidence in privately-developed passenger rail.

Main source for this information was a (very long 🤓) bond prospectus from @GoBrightline

emma.msrb.org/P31404863-P31092183-P31501205.pdf

emma.msrb.org/P31404863-P31092183-P31501205.pdf