Thread

Having served 5 yrs as a Bitcoin pleb, I will pick apart this garbage thread tweet-by-tweet from a former Chief of the SEC who held a leadership position at the agency during a time when it repeatedly missed one of the largest financial frauds in all of history, Bernie Madoff.👇

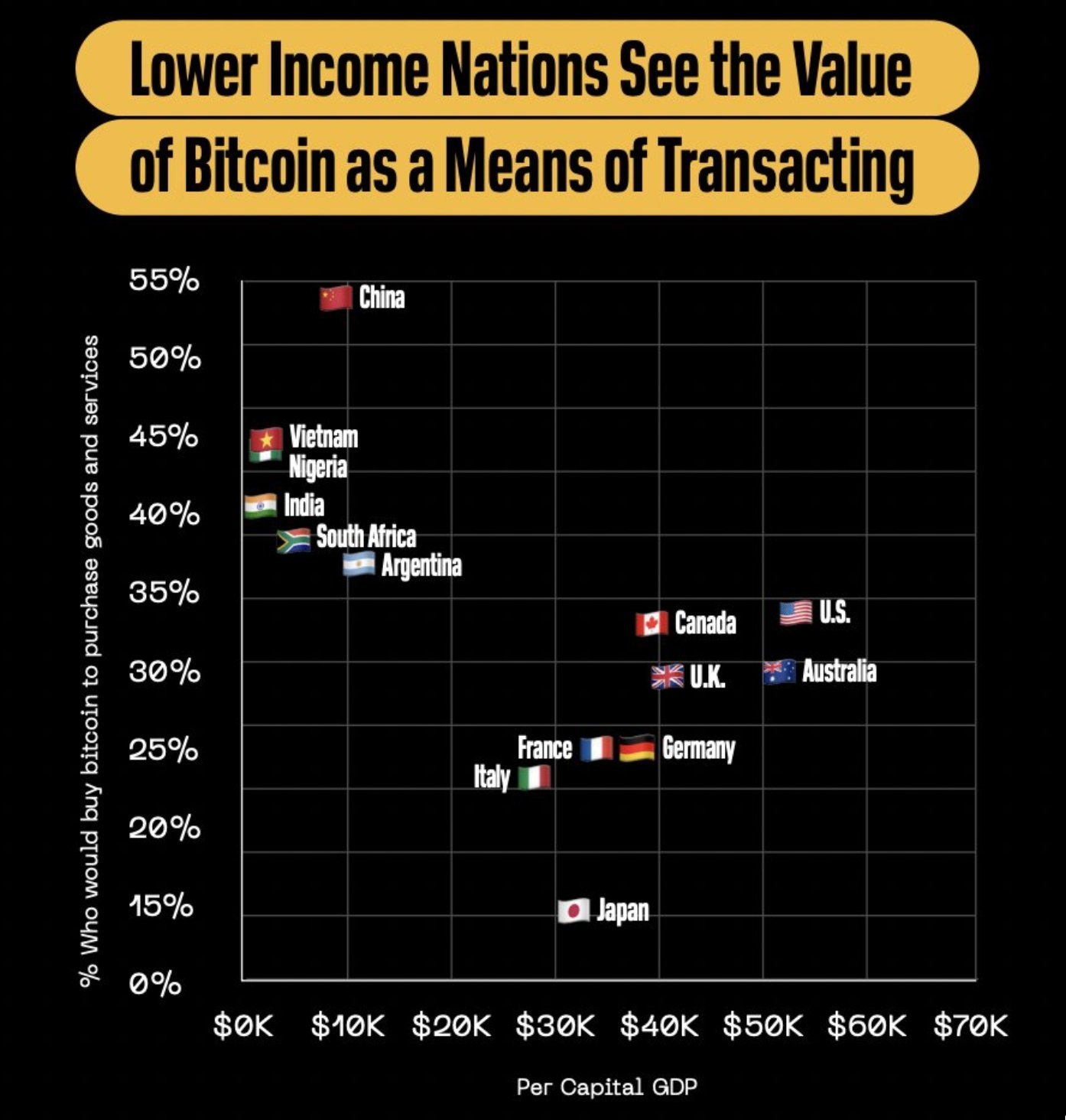

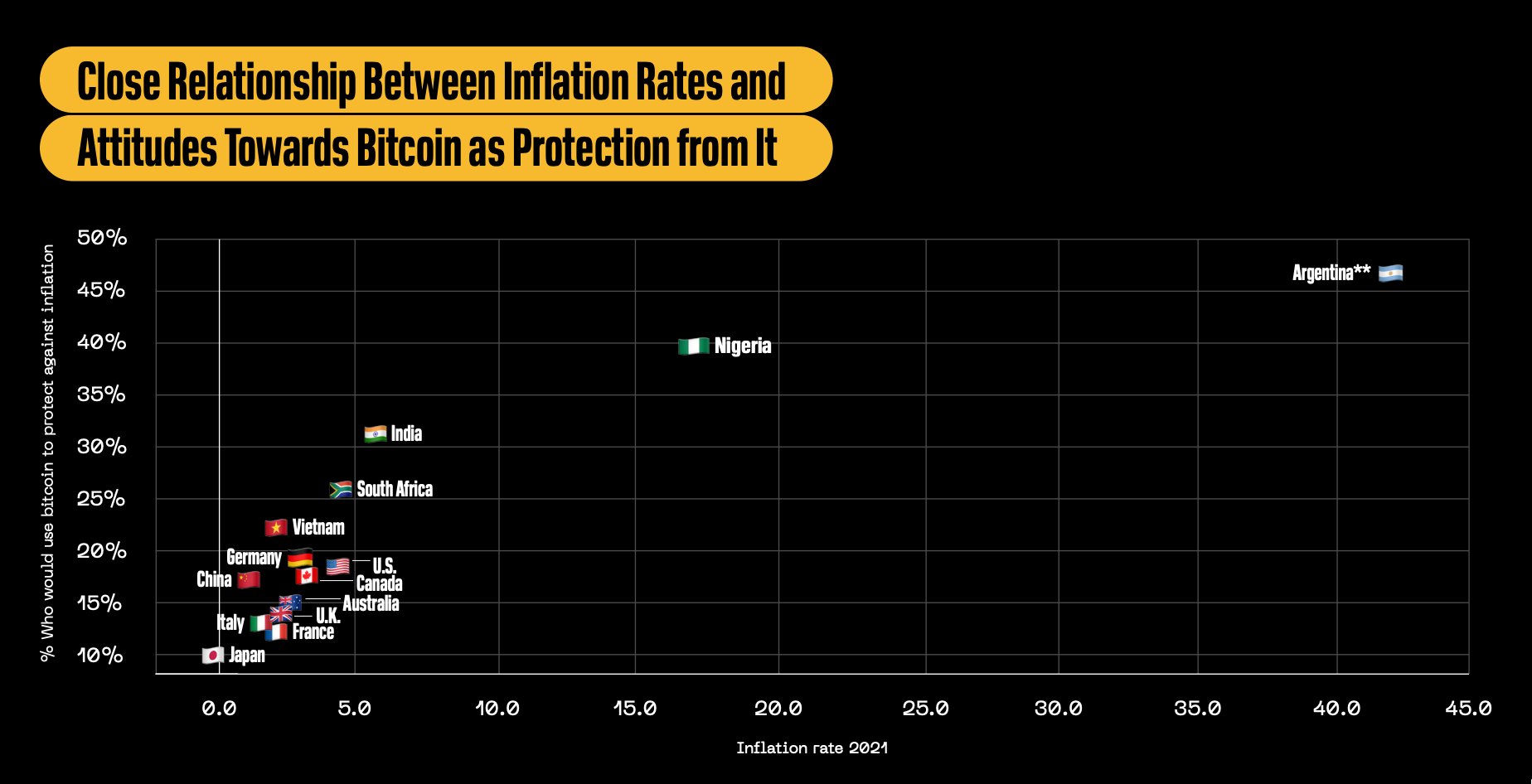

Bitcoin has been helping people worldwide due to its unique properties of censorship resistance & decentralization. It's a monetary protocol that requires no permission to send value, and allows people to save in jurisdictions w/ high rates of debasement.

As the rate of debasement grows & censorship increases, Bitcoin will continue to serve as a lifeline for people.

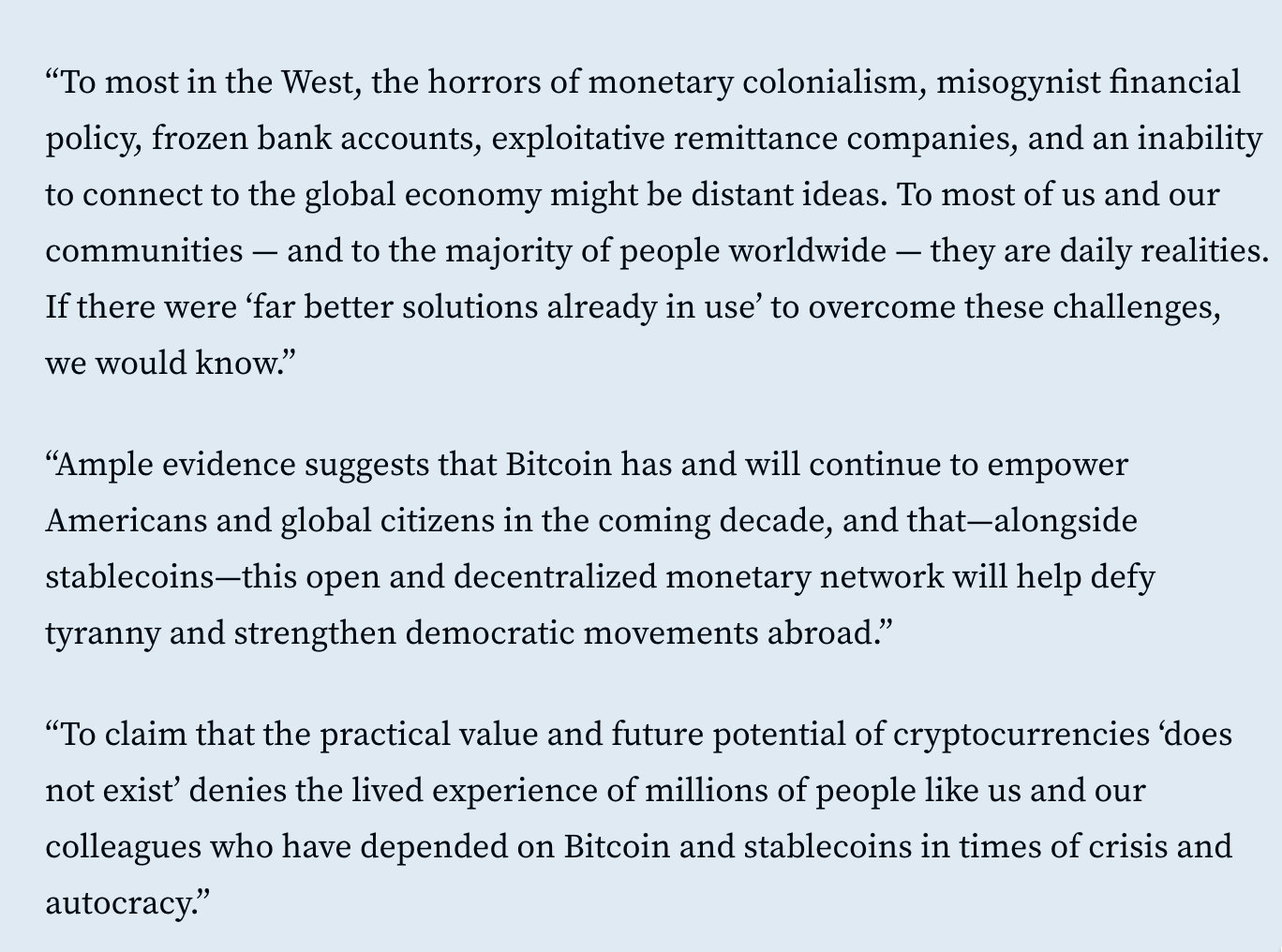

Don't take it from me though, take it from 20 human rights leaders who penned a letter to Congress saying just this. www.financialinclusion.tech/

Here are some excerpts:

Don't take it from me though, take it from 20 human rights leaders who penned a letter to Congress saying just this. www.financialinclusion.tech/

Here are some excerpts:

"Legitimate" currencies are displacing themselves. Bitcoin is just here to pick up the pieces as central banks and governments destroy the value of their currencies. No amount of guardrails can protect users from the ill efffects of their harmful policies.

Regulators' oversight and protections have done nothing to stop crime and instead have increaed costs and resulted in the mass survelliance of the financial activity of innocent civilians, and created honeypots of data for hackers.

AML has impacted <0.05% of criminal finances.

AML has impacted <0.05% of criminal finances.

Yes, the current iteration of DeFi was in fact highly centralized, which led to rampant fraud and exploitation.

You identified the problem, centralization. Good job!

You identified the problem, centralization. Good job!

Just like banks in the traditional system, these centralized crypto exchanges and cryptocurrencies were rife with fraud.

Only Bitcoin is leaderless & decentralized. Only Bitcoin offers people an amazing opportunity to benefit from the freedom & censorship resistance it enables.

Only Bitcoin is leaderless & decentralized. Only Bitcoin offers people an amazing opportunity to benefit from the freedom & censorship resistance it enables.

This we can agree. "Blockchain" is not a game-changer. It's an inefficient, expensive to maintain, difficult to upgrade database. Is only useful if you want something to be decentralized + immutable. Something like digital money. Something like Bitcoin.

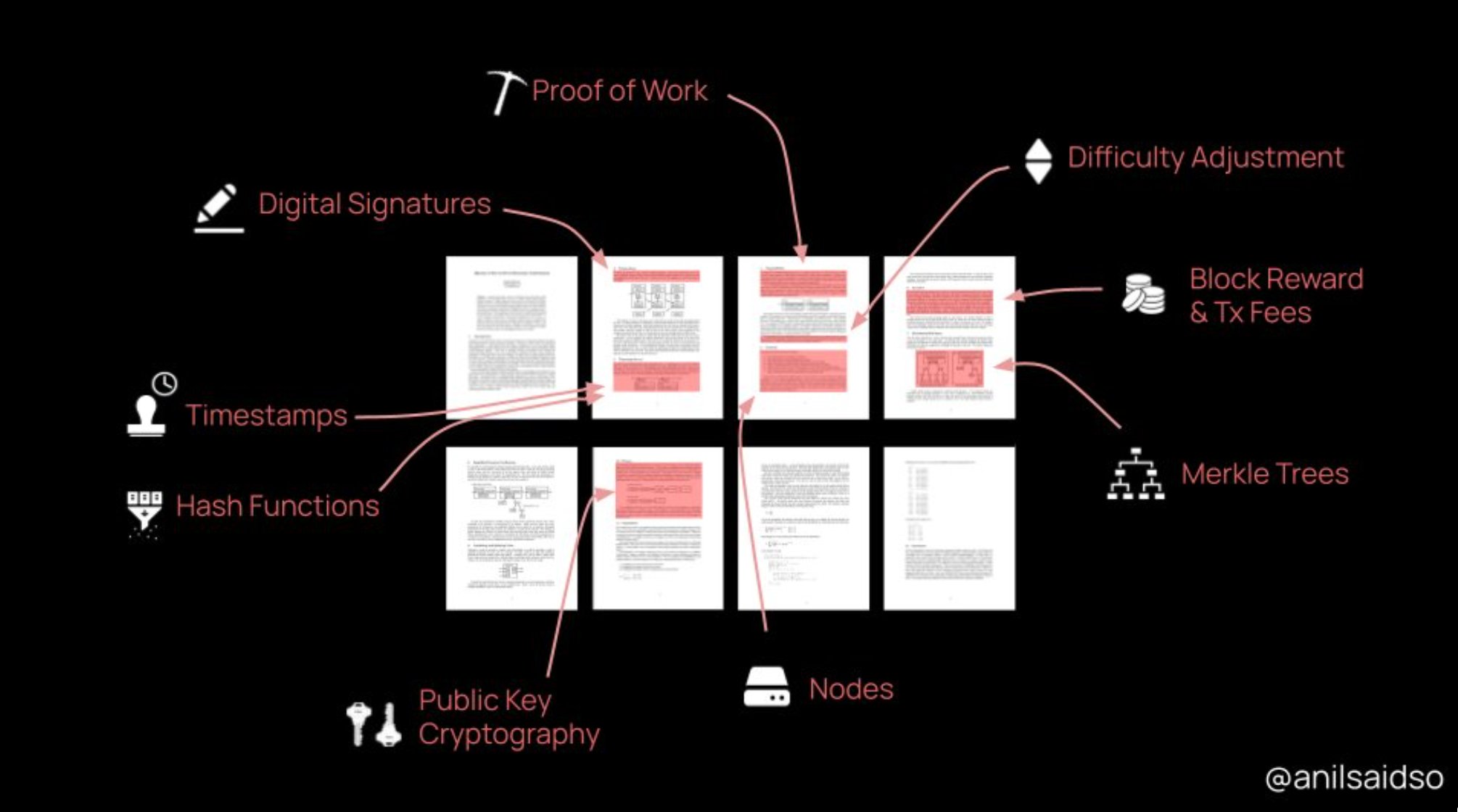

Only Bitcoin's blockchain, when combined with other technological breakthroughs like Proof of Work, results in a decentralized, immutable ledger.

For the first time ever, we have a historical record that is practically tamperproof.

Bitcoin is the innovation, not Blockchain.

For the first time ever, we have a historical record that is practically tamperproof.

Bitcoin is the innovation, not Blockchain.

Stability in the value of Bitcoin will only be realized over time as mass adoption occurs. In the interim, volatility is the natural function of price discovery as individuals make sense of this new money that can't be debased or controlled by anyone.

You ask how can anyone accept payment in Bitcoin?

Well, if you couldn't send or recieve money because your bank account was frozen or you can't save because it's being rapidly debased, maybe you would understand better, John.

I agree with you..."crypto" is filled with risks.

Well, if you couldn't send or recieve money because your bank account was frozen or you can't save because it's being rapidly debased, maybe you would understand better, John.

I agree with you..."crypto" is filled with risks.

See previous tweet regarding the ineffectiveness of AML/KYC policies in stopping financial crimes. All they do is open up users to survelliance, hacks, and increase compliance costs for banks, which get passed on to their customers.

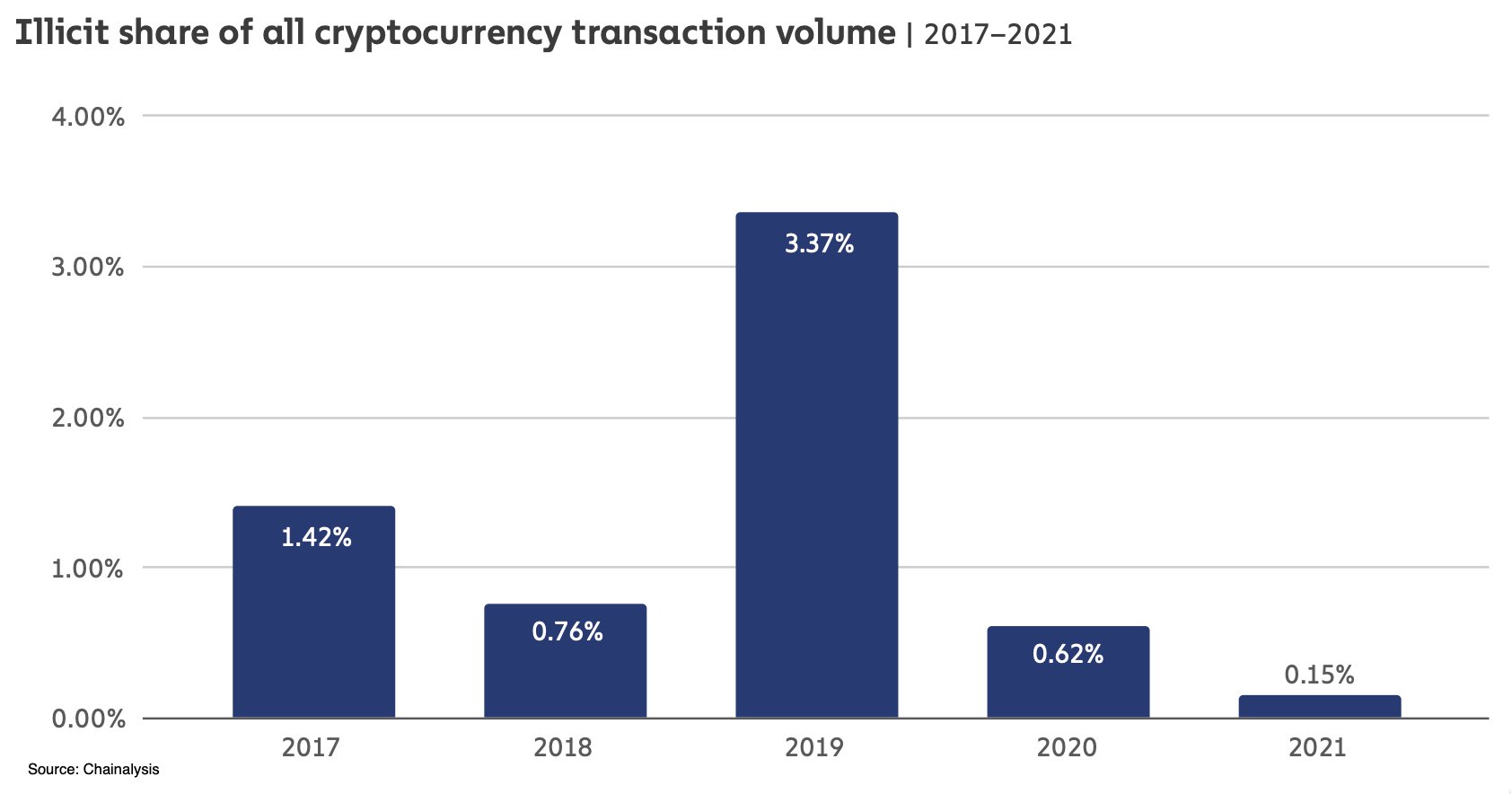

Criminial activity is miniscule in crypto compared to the traditional financial system, and makes up a tiny amount of total cryptocurreny transaction volume.

Real criminals prefer to use opaque banks and dollars to launder their money and finance their criminal operations.

Real criminals prefer to use opaque banks and dollars to launder their money and finance their criminal operations.

This dude shares a link to an article quoting Peter Schiff lol 💀

Bitcoin is a good store of value over time. This can be proven by simply looking at its chart over the last 10 years.

Bitcoin's intrinsic value is in its superior monetary properities.

Bitcoin is a good store of value over time. This can be proven by simply looking at its chart over the last 10 years.

Bitcoin's intrinsic value is in its superior monetary properities.

If people didn't find utility in a monetary protocol that allows them to send value anywhere at anytime, without permission, free of censorship or debasement, then Bitcon's price wouldn't be sitting at $22k today.

If people didn't find value in it, it wouldn't demand this price.

If people didn't find value in it, it wouldn't demand this price.

Again, I'll refer back to previous tweets. Regulatory agencies and global financial police like the Financial Asset Task Force do NOTHING to stop financial crimes.

The policies used are all costs, no benefit. Doesn't matter if it's crypto or dollars.

The policies used are all costs, no benefit. Doesn't matter if it's crypto or dollars.

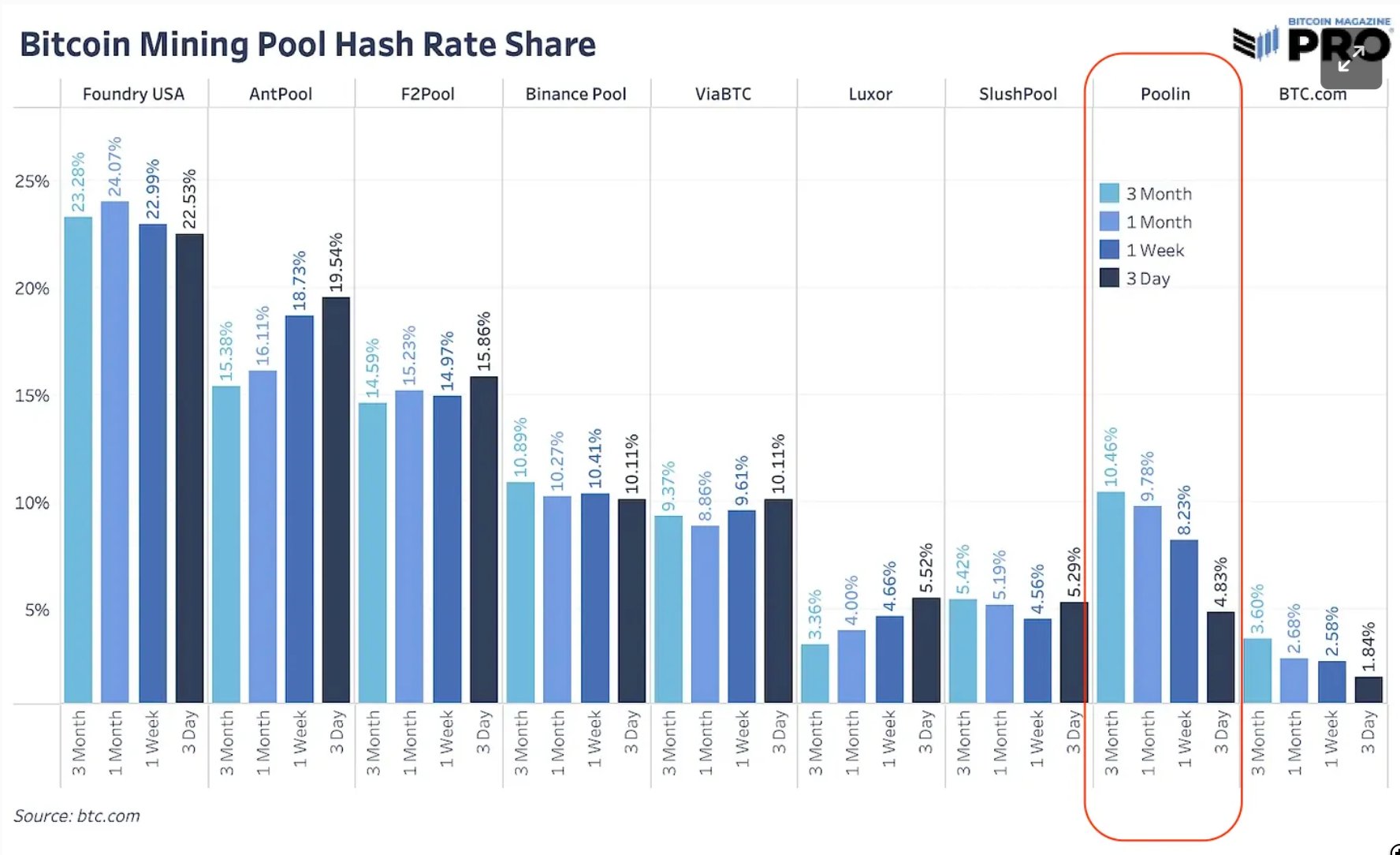

This is where you show your true colors, John. This shows a fundamental misunderstanding of how Bitcoin mining and mining pools work. It's evident you are talking out of your ass.

Pools don't control the hash or own the underlying ASICs, miners do.

Pools don't control the hash or own the underlying ASICs, miners do.

Miners can point their hash rate towards any mining pools they want. So in the event that a mining pool were to act dishonestly or against the interest of the network, it’s trivial for miners to switch to honest pools by changing a single line of configuration.

In fact, this just played out in Bitcoin several months ago when the Poolin mining pool froze withdrawals after experiencing liquidity issues.

After this action, Poolin’s hash rate was cut in half essentially overnight as Bitcoin miners shifted their hash rate elsewhere.

After this action, Poolin’s hash rate was cut in half essentially overnight as Bitcoin miners shifted their hash rate elsewhere.

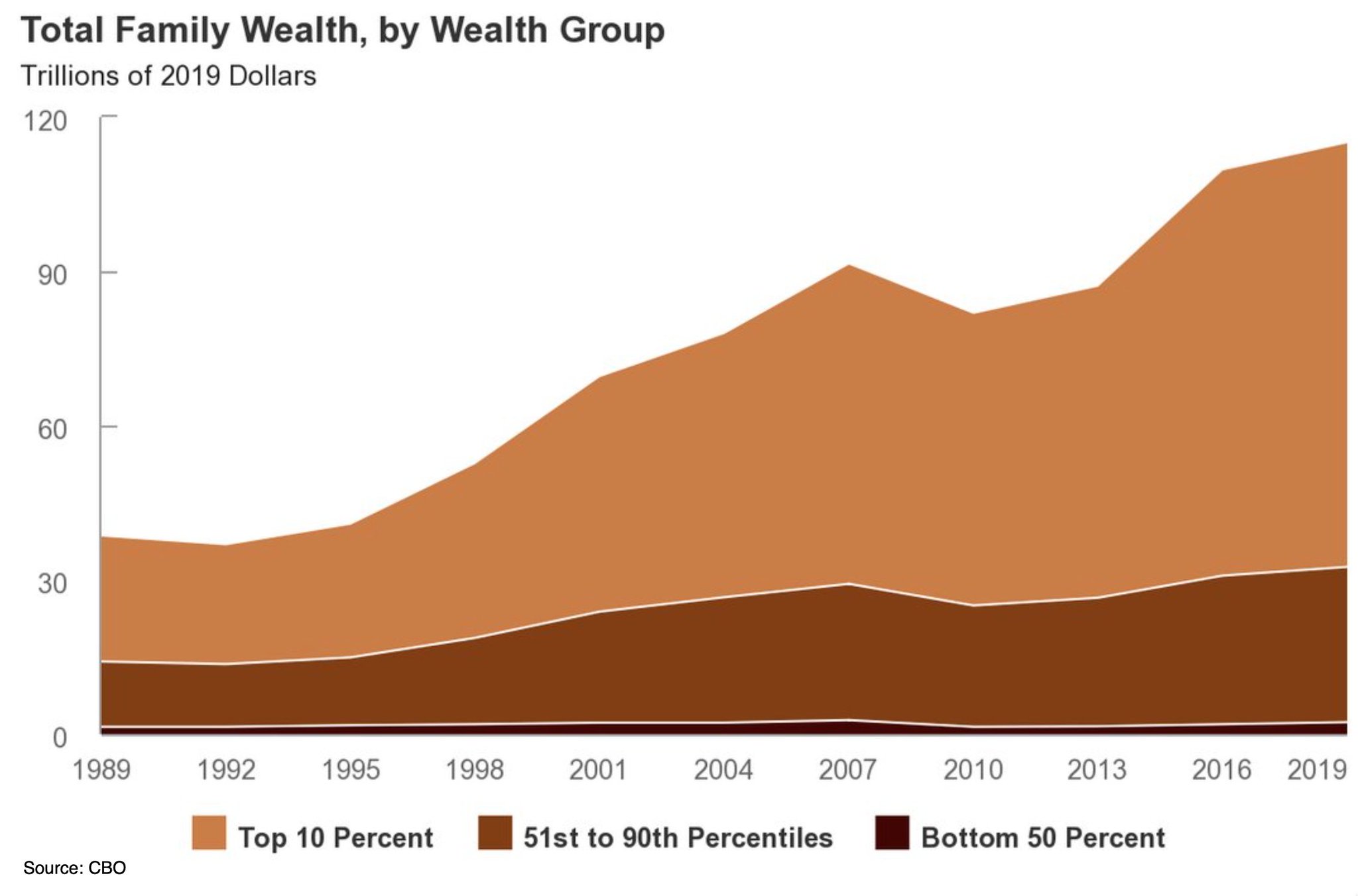

Wealth concentrationin Bitcoin is overexaggerated due to conflating exchange addresses for individual addreses. Wealth in Bitcoin continues to distribute over time.

The relative amount of BTC held by smaller entities has been growing over the course of Bitcoin's lifetime.

The relative amount of BTC held by smaller entities has been growing over the course of Bitcoin's lifetime.

Contrast this to the TradFi system where wealth continues to concentrate to the top 10% cuz of the Cantillon Effect. There's no Cantillon Effect in Bitcoin.

Most importantly, a person who owns a lot of bitcoin has no ability to manipulate the rules of the system in their favor.

Most importantly, a person who owns a lot of bitcoin has no ability to manipulate the rules of the system in their favor.

This is another problem with centralized crypto casinos. I've long argued market cap is a dumb metric cuz it doesn't take into account liquidity.

But on-chain Bitcoin transactions are as reliable, accurate and trustworthy as it gets. Just run a node!

But on-chain Bitcoin transactions are as reliable, accurate and trustworthy as it gets. Just run a node!

*sigh* -- again, refer back to previous tweets. It's not even a debate that fiat is used more for financial crimes than cryptocurrencies today.

What the hell are you smoking, John?

What the hell are you smoking, John?

Some evidence:

“By utterly failing to prevent large-scale corrupt transactions, financial institutions have abandoned their roles as front-line defenses against money laundering,” - Paul Pelletier, Former senior DOJ official & financial crimes prosecutor

www.icij.org/investigations/fincen-files/global-banks-defy-u-s-crackdowns-by-serving-oligarchs-crimin...

“By utterly failing to prevent large-scale corrupt transactions, financial institutions have abandoned their roles as front-line defenses against money laundering,” - Paul Pelletier, Former senior DOJ official & financial crimes prosecutor

www.icij.org/investigations/fincen-files/global-banks-defy-u-s-crackdowns-by-serving-oligarchs-crimin...

John's someone who thinks his previous position of authority gives him credibility on subjects he obviously knows little about. This leads him to spewing misinformation on things like Bitcoin, a tool for economic empowerment & freedom. Don't be like John.

Lesson learned: always use screenshots when calling out nonsensical FUD threads.

Remember, these are not honest actors interested in finding truth. They are here to spread misinformation and to chase clout.

Remember, these are not honest actors interested in finding truth. They are here to spread misinformation and to chase clout.

Mentions

See All

Troy Cross @thetrocro

·

Jan 24, 2023

Terrific thread, Sam!