Thread

Everything goes to zero, new projects emerge, unprecedented returns:

What the early Internet teaches us about the next months and years in the NFT Space🧵👇

(1/23)

What the early Internet teaches us about the next months and years in the NFT Space🧵👇

(1/23)

NFTs as a technology are still young. Older than many think, but still young.

When do you think the first NFT was minted? 2020? 2019 perhaps? Or even 2017?

Wrong, the first NFT, "Quantum" was minted back in 2014 by Kevin McCoy and sold for over a million USD in 2021:

(2/23)

When do you think the first NFT was minted? 2020? 2019 perhaps? Or even 2017?

Wrong, the first NFT, "Quantum" was minted back in 2014 by Kevin McCoy and sold for over a million USD in 2021:

(2/23)

That makes the technology about nine years old.

However, it took until 2021 for real hype to break out for the first time.

In retrospect, many would probably call it a bubble: Inflated prices, unrealistic expectations, and gold-rush sentiment.

(3/23)

However, it took until 2021 for real hype to break out for the first time.

In retrospect, many would probably call it a bubble: Inflated prices, unrealistic expectations, and gold-rush sentiment.

(3/23)

Will the NFT space ever recover? Or was it a one-hit wonder that is now slowly but surely fading into nothingness?

Fortunately, we don't have to guess, but can simply look into the past: The early Internet.

(4/23)

Fortunately, we don't have to guess, but can simply look into the past: The early Internet.

(4/23)

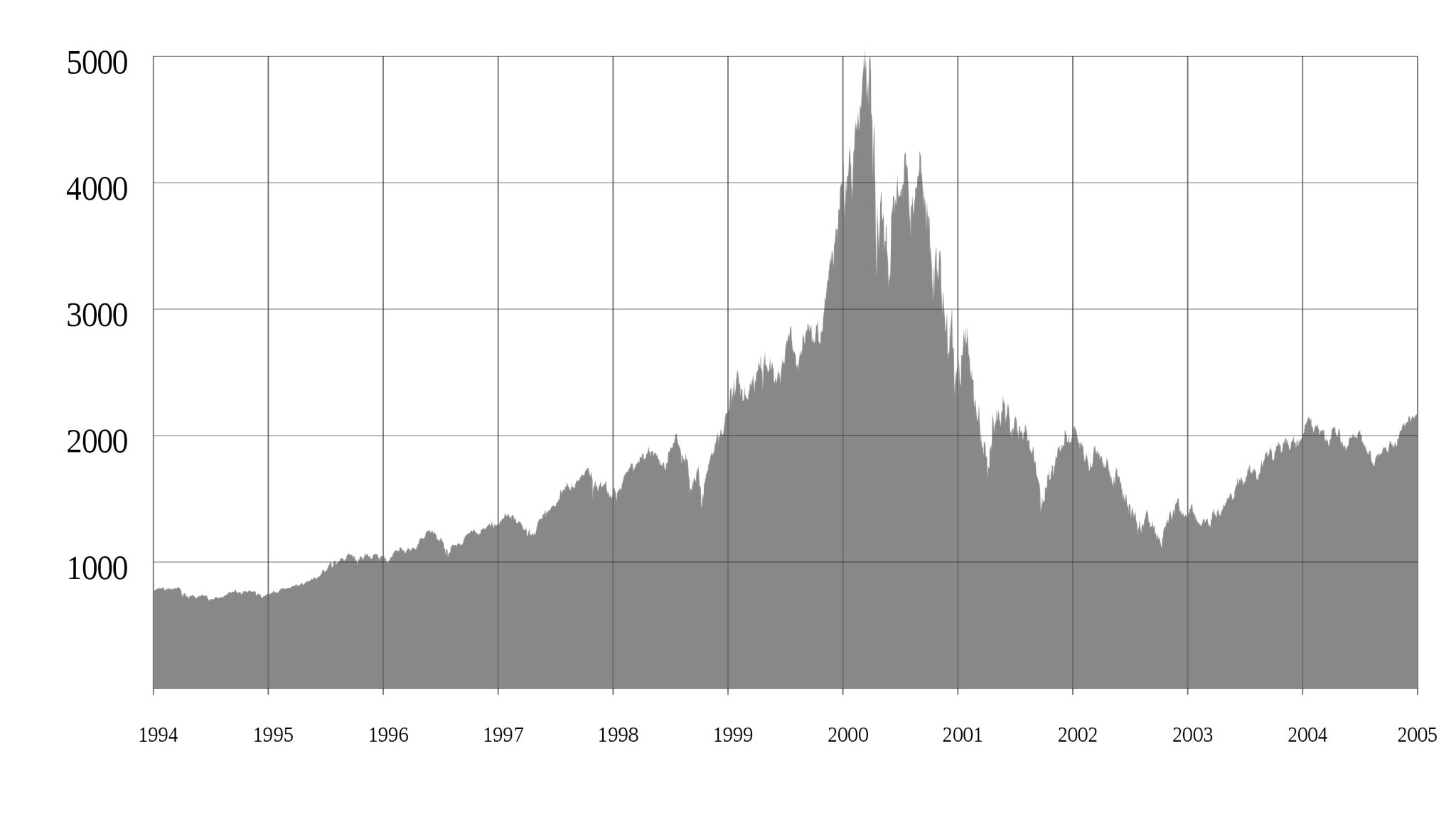

The Internet itself was "invented" in 1983 and resulted in the great dot-com boom in the late 1990s.

At that time, too high expectations and inflated prices led to a huge bubble, companies raised hundreds of millions of USD in capital while writing net operating losses.

(5/23)

At that time, too high expectations and inflated prices led to a huge bubble, companies raised hundreds of millions of USD in capital while writing net operating losses.

(5/23)

Then, too, many factors came together that led to the bursting of the bubble.

Just like today, the FED raised interest rates, and with the news that Japan was going into recession a perfect storm developed that led to a sell-off.

(6/23)

Just like today, the FED raised interest rates, and with the news that Japan was going into recession a perfect storm developed that led to a sell-off.

(6/23)

Within two years, the NASDAQ-100, the tech index in the US, was down 78% from its ATH.

In the aftermath, many companies went bankrupt. Few were profitable during the dot-com bubble, then when venture capital became less, they had to shut down operations.

(7/23)

In the aftermath, many companies went bankrupt. Few were profitable during the dot-com bubble, then when venture capital became less, they had to shut down operations.

(7/23)

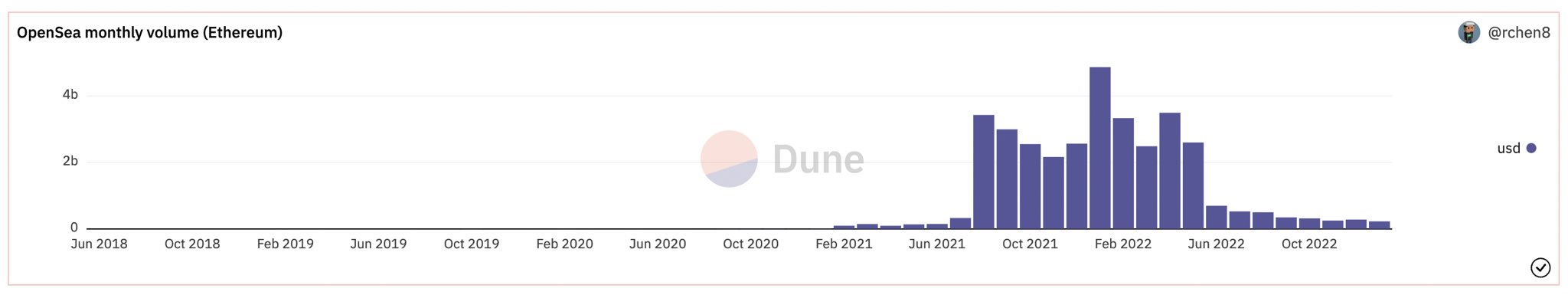

If we look again at NFTs, this also seems obvious for our space: With less investors buying in, less volume and secondary royalties, one of the main revenue sources of many projects is gone.

(8/23)

(8/23)

In addition, they can charge much less for new drops than during the bubble. A 3 ETH mint like Pixelmon did, for example, would be unthinkable today.

And yet we haven't seen many bankruptcies of well-known NFT projects.

(9/23)

And yet we haven't seen many bankruptcies of well-known NFT projects.

(9/23)

And that's despite the fact that many don't have any funding channels aside from royalties & VC.

Very few NFT projects today have a sustainable business model. In my thread about dilution I pointed out that issuing and selling new NFTs cannot go on forever either:

(10/23)

Very few NFT projects today have a sustainable business model. In my thread about dilution I pointed out that issuing and selling new NFTs cannot go on forever either:

(10/23)

So I think that in this bear market, which I am sure will be with us for a while, we will see more and more NFT projects trying to build a real business with which they can generate revenue.

(11/23)

(11/23)

Be it metaverses like Otherside, platforms that are free for holders but require subscriptions from non holders like PROOF might be building with Highrise, fashion empires like RTFKT or completely different business models.

Those that don't adapt will go to zero.

(12/23)

Those that don't adapt will go to zero.

(12/23)

To his credit, @garyvee has been saying this for years: 99% of NFT projects today will go to zero because neither the IP nor the business is strong enough.

What the early 2000s also showed us tho is that the projects that do survive can deliver unprecedented returns.

(13/23)

What the early 2000s also showed us tho is that the projects that do survive can deliver unprecedented returns.

(13/23)

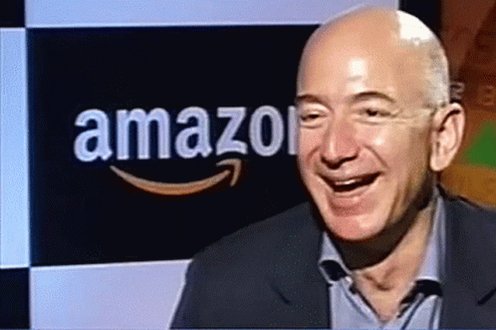

Amazon, for example, lost more than 80% of its stock price value when the dot-com bubble burst.

However, when you zoom out, it is hardly noticeable, because from the ATL to the ATH in 2021, the stock price has risen by more than 20,000%.

(14/23)

However, when you zoom out, it is hardly noticeable, because from the ATL to the ATH in 2021, the stock price has risen by more than 20,000%.

(14/23)

So there will be NFT projects that will emerge from this bear market in the next 5, 10, 20 years as the big winners and deliver incredible returns.

But who that will be is completely unclear.

(15/23)

But who that will be is completely unclear.

(15/23)

If you look at the Opensea floor prices today you might think it's obvious: Punks, BAYC, Azuki, Doodles, Moonbirds, Clones, DeGods, Pudgy Penguins.

But a look at the past shows us that it's not so simple here either:

(16/23)

But a look at the past shows us that it's not so simple here either:

(16/23)

True, the most valuable Internet companies of the late 1990s included companies that are still successful today: The aforementioned Amazon, for example.

However, most companies that were thought to be the dominant ones back then have slowly but surely disappeared.

(17/23)

However, most companies that were thought to be the dominant ones back then have slowly but surely disappeared.

(17/23)

AOL, for example, or Yahoo, one of the most powerful Internet companies at the time, did not survive the bursting of the dot-com bubble.

Meanwhile, many of today's big Internet companies like Google only really came into the limelight with their IPO after the bubble.

(18/23)

Meanwhile, many of today's big Internet companies like Google only really came into the limelight with their IPO after the bubble.

(18/23)

Google had its IPO in 2004, during the bubble, however, they were kinda under the radar.

Does that mean all of today's bluechips are doomed and some projects that are lesser-known today will dominate the market in two, five, ten years?

Yes but also no.

(19/23)

Does that mean all of today's bluechips are doomed and some projects that are lesser-known today will dominate the market in two, five, ten years?

Yes but also no.

(19/23)

There is no doubt in my mind that some of today's bluechips will not be among the top projects in 5 years.

That none of them will survive is unlikely, just as not all known tech companies from the 1990s failed. But many have.

(20/23)

That none of them will survive is unlikely, just as not all known tech companies from the 1990s failed. But many have.

(20/23)

It is also not clear to me that BAYC will be number 1 forever either.

Yahoo has shown that. Successful, large companies can fail, especially if they are not profitable or make mistakes along the way.

(21/23)

Yahoo has shown that. Successful, large companies can fail, especially if they are not profitable or make mistakes along the way.

(21/23)

So where does that leave us?

I think the best thing you can do is bet on the teams you think can build a successful business over the next decade.

There will be a Web3 Amazon. But to identify it you have to find the Web3 Jeff Bezos.

(22/23)

I think the best thing you can do is bet on the teams you think can build a successful business over the next decade.

There will be a Web3 Amazon. But to identify it you have to find the Web3 Jeff Bezos.

(22/23)

Unprofitable NFT projects with less capable teams will go to zero. Not only will they perform poorly, but they will shut down operations completely.

This has hardly ever happened with larger NFT projects so far. But that will change.

(23/23)

This has hardly ever happened with larger NFT projects so far. But that will change.

(23/23)

Mentions

See All

J777Crypto @J777Crypto

·

Jan 18, 2023

Appreciate the great thread king 👑