Thread

There’s a very lengthy backstory to Nadhim Zahawi’s HMRC settlement, and lots of people have been asking me to summarise it. Here goes:

www.taxpolicy.org.uk/zahawi_story

www.taxpolicy.org.uk/zahawi_story

6 July 2022: press reports that Zahawi had been the subject of an investigation by the NCA, the SFO and HMRC, and that the Cabinet Office had raised a “red flag” about Zahawi’s tax affairs. www.theguardian.com/uk-news/2022/jul/09/revealed-officials-raised-flag-over-nadim-zahawis-tax-affairs...

7 July 2022: I spot a filing error in the accounts of an unrelated company, Crowd2Fund Limited, which proves that Balshore Investments Limited, a Gibraltar company previously linked to Zahawi, is held by a trust controlled by Zahawi’s parents.

9 July 2022: I conclude that, when Zahawi established YouGov in 2000, he arranged for the founder shares that would have been his to go to Balshore. It paid nothing for the shares. The only plausible reason for this is tax avoidance.

I check my conclusions carefully and speak to tax accountants, solicitors, QCs and retired HMRC inspectors, as well as entrepreneurs familiar with startup formation. I'm stunned by the unanimity of opinion: this stinks.

10 July 2022: I publish. I've calculated the tax I think Zahawi avoided - it's mostly the gain on the YouGov shares which would have been subject to CGT had Zahawi held them, but is tax free in Gibraltar. The figure is £3.7m. www.taxpolicy.org.uk/2022/07/10/zahawi/

11 July 2022: Zahawi is interviewed by Kay Burley. He says: “There have been claims I benefit from an offshore trust. Again let me be clear, I do not benefit from an offshore trust. Nor does my wife. We don’t benefit at all from that.”

13 July 2022: Zahawi's people say Balshore got the shares because his father provided startup capital. I go through all the documents and accounts again, and confirm it's false. I say so, and challenge Zahawi to correct me if I've gotten it wrong. I know his people see this.

14 July 2022: Zahawi's people respond by seamlessly jumping to a new explanation: that Balshore got the shares because Zahawi "had no experience of running a business at the time and so relied heavily on the support and guidance of his father, who was an experienced entrepreneur"

There is nothing in any documentation I could find, or in the publically known history of YouGov, to support this story.

16 July 2022, 8am: An investigation by The Times suggests the new explanation is false - YouGov itself, and people present at its founding, say his father wasn't involved in the business. www.thetimes.co.uk/article/nadhim-zahawi-may-have-avoided-millions-in-tax-with-trust-0n8mt7kj7

Zahawi is able to rustle up two people who say they met his father and he was helpful. I'm pretty helpful - nobody hands me a 40% shareholding in their startup.

16 July 2022, 8.40am: I conclude this all means Zahawi's first explanation, that his father provided startup capital, was a lie. It is provably false, and the ease with which he slipped to a new explanation suggests it was deliberately false. I tweet this.

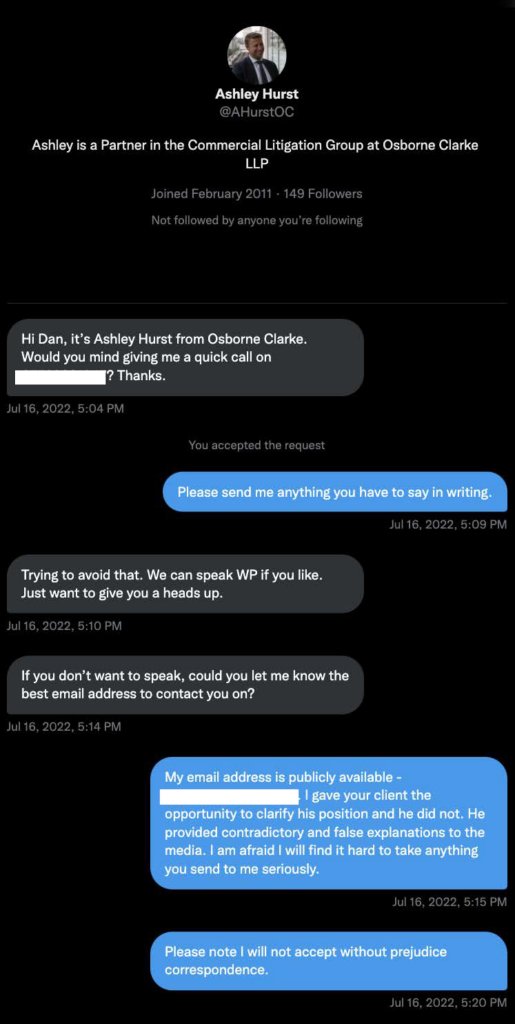

16 July 2022, 5pm: I receive a Twitter direct message from Osborne Clarke, Zahawi's libel lawyers, asking to speak. I tell him to put anything he has to say in writing, and that I won't accept "without prejudice" correspondence (which is normally kept private):

16 July 2022, 7pm: I receive an email from Osborne Clarke, labelled "without prejudice". It tells me I cannot publish or even refer to it, and that would be a "serious matter".

It requires me to retract my allegation of lies by the end of the day, or they will write to me on an "open basis" (which usually means: they will send a "letter before action" threatening to sue me).

The email is a confused mess, accusing me of saying Zahawi's second explanation was a lie, when in fact I said his first explanation was a lie. Seems like pure bluster. No need to react.

17 July 2022: I do some more analysis. A chance company law error means YouGov IPO documents disclosed that a £99,000 dividend from Balshore was redirected to Zahawi. His claim to not have benefited from the trust is false.

The obvious inference is that there were many gifts; it's just happenstance we see this one. A forensic accountant working with me identifies almost £30m of unsecured loans going into Zahawi's property company. Another obvious inference: some of this may be the YouGov money.

19 July 2022, 8am: I receive a letter from Osborne Clarke. This time it addresses what I actually said, but tells two fibs. First, it says that Balshore paid £7,000 for the shares in 2000. I'm reasonably confident it didn't (a form was back-dated two years later)

Second, it claims that £7,000 was "startup capital" - just daft. Why is he saying things that clearly aren't true? Why are his lawyers repeating them? Again I'm warned I can't publish the letter.

19 July 2022, 9am: I realise what the letter doesn't contain: a statement that Zahawi's taxes have been fully reported and paid to HMRC. I publish my analysis from the 17th. www.taxpolicy.org.uk/2022/07/19/zahawi_questions/

20 July 2022: I keep hearing that other people are receiving threatening letters from Osborne Clarke, containing warnings not to publish. Time to think about whether these warnings are true.

I'm not an expert in confidentiality law, but I know enough to get by, and their claim feels like nonsense. And it's outrageous that Zahawi thinks he can not only use libel law to shut people up, and do it in secret.

I call a contact who is a leading expert in confidentiality law, and he snorts with derision down the line. I call a few more, just to be cautious - lots of snorting.

22 July 2022: I publish the Osborne Clarke letters, and explain why legally I am entitled to. The Times reports it. www.taxpolicy.org.uk/2022/07/22/letters/

This goes slightly viral. The Tax Policy Associates website normally gets a few thousand readers a day - today we got 400,000. Turns out people don't like the Chancellor of the Exchequer secretly stopping people writing about his tax avoidance.

25 July 2022: I write to the Solicitors Regulation Authority, asking them to end the practice of libel lawyers sending threatening letters which they falsely claim can't be published (or even mentioned). www.taxpolicy.org.uk/2022/07/25/sra/

1 August 2022. At this point I've reached an impasse. I think I've proven that Zahawi has lied about the YouGov structure - that and everything else makes me reasonably certain that he has avoided around £3.7m in tax. But there's been little media interest.

Why? Partly Zahawi firing out libel threats. But I think mostly that we've been overwhelmed by politics, and scandal, and this just didn't break through. All I can do is keep plugging away.

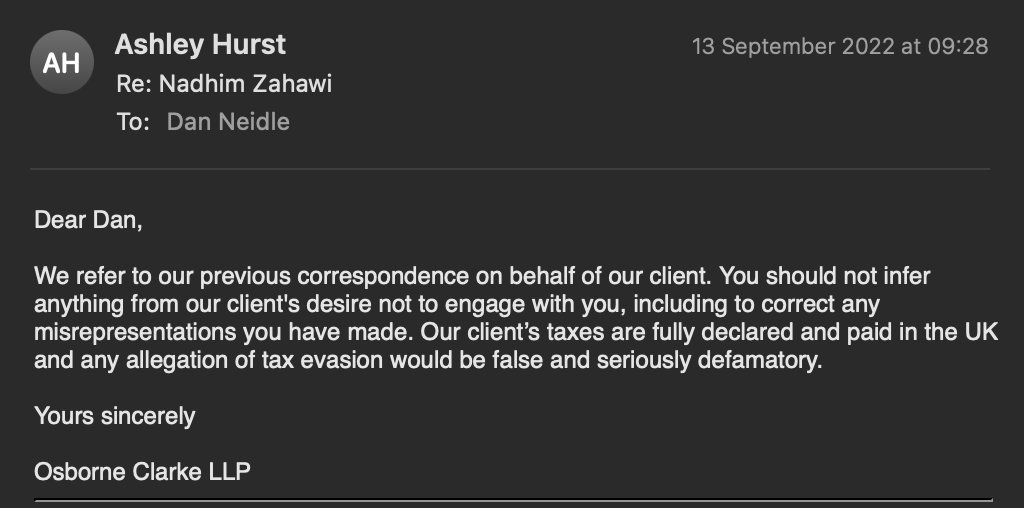

24 August 2022. I ask Zahawi, through his lawyers, why he told Kay Burley he doesn't benefit from the trust, when we know he received £99,000 from it. They duck the question. But they tell me Zahawi's taxes are "fully declared and paid in the UK".

6 September 2022: Zahawi steps down as Chancellor.

We now know that, at about this time, his accountants probably approached HMRC to settle his unpaid YouGov taxes - likely the same taxes I said he'd tried to avoid.

Why now? Because settlements take time. If everything was finalised in early January, then he must have approached HMRC in early Autumn. And for several weeks before that (at least) his accountants must have been preparing their approach.

So we can't be sure exactly when - but it's likely that at some point around this date, Zahawi knew that his tax was not fully declared and paid, and that what I'd written in July was in substance correct.

13 September 2022. More evasion from Osborne Clarke. But one clear statement: "Our client's taxes are fully declared and paid in the UK".

15 October 2022. A second libel threat from a second set of lawyers acting for Zahawi. I posted an innocuous tweet referring to the Independent report that Zahawi had been investigated by the NCA and HMRC. www.taxpolicy.org.uk/2022/10/15/slapp2/

The threat looks like an automated mailshot - it doesn't refer to my previous correspondence with Zahawi, and doesn't seem to realise I am a tax lawyer. It's amateur hour.

29 November 2022. A great response from the SRA. They issue a warning for solicitors to stop sending libel letters which falsely claim to be confidential, and say they can't be published. Lawyers can't lie. www.taxpolicy.org.uk/2022/11/29/stopsecret/

1 December 2022: yet another evasive non-response from Osborne Clarke to my questions. But again one clear statement: "[Zahawi's] taxes are properly declared and paid in the United Kingdom":

(At this point it seems highly likely that Zahawi was deep into settlement discussions with HMRC, and therefore he knew that this statement was false)

2 December 2022. Given the clear statement from the SRA, I refer Zahawi's lawyers, Osborne Clarke, to the SRA. Lying and bullying should have consequences. www.taxpolicy.org.uk/2022/12/02/sra_oc/

3 December 2022: At this point the Zahawi story looks dead. His strategy of saying nothing seems to have won out.

15 January 2023. Everything changes. An absolute scoop from @AArmstrong_says in The Sun on Sunday. Zahawi paid millions in tax to settle a dispute.

There's a hilarious non-denial denial from Zahawi that he "never had to instruct any lawyers to deal with HMRC on his behalf". Later that day, that line is dropped - he doesn't deny the story, he just refuses to comment.

The obvious conclusion: Zahawi responded to my July analysis by instructing accountants to seek a "contractual settlement" with HMRC before an enquiry could be raised. www.taxpolicy.org.uk/2023/01/15/zahawi_pay_up/

This isn't a dispute in the usual sense ("taxpayer says X, HMRC says Y"). It's an admission that tax that was due wasn't paid. These settlements are confidential. Zahawi was trying to make it all go away, quickly and quietly.

16 January 2022. There is now a flurry of press interest. The Times. The FT. BBC online. LBC. Five Live. Radio 4 pm. The Independent. Sky News. More. I link to them all here: www.taxpolicy.org.uk/2023/01/19/zahawi_story

Zahawi puts out a statement: his taxes are "properly declared and paid in the UK". This can only be true in the most hyper-literal sense: today, his taxes (maybe) are properly declared in the UK. When he approached HMRC for a settlement, they certainly weren't.

18 January 2023, 12pm: Rishi Sunak is asked about Zahawi's settlement at Prime Minister's questions. I've the highest regard for Sunak's probity. I know people who worked with him - they've no doubt as to his intelligence and his honesty. So it's disappointing to hear this:

18 January 2022, 10:30pm: Zahawi provides a clear statement to Newsnight (report starts at 13:25) that his tax affairs "were and are fully up to date". No more games with tenses. www.bbc.co.uk/iplayer/episode/m001h9gk/newsnight-18012023

If/when the settlement details come out, we'll know for sure this was a lie. And we'll know that all the denials his lawyers issued to me were a lie - because at the time they were made, Zahawi was negotiating a settlement to quietly cover up the fact he'd avoided millions in tax

End of mamooth thread. All in a more readable form here taxpolicy.org.uk/zahawi_story

And if you'd like updates as soon as I have them, you can subscribe here taxpolicy.org.uk/subscribe

Lots of kind offers to support our work. We don't accept donations... but TaxAid does - it's a wonderful charity that provides free tax advice to people on low incomes. You'll support my aims by supporting them. taxaid.org.uk/