Thread by Adam Cochran (adamscochran.eth)

- Tweet

- Jan 18, 2023

Thread

1/268

It's the moment you've waited for, desired and above all else feared.

It's time for the 2023 shopping list!

(Which is also supporting public goods funding! Woo

It's the moment you've waited for, desired and above all else feared.

It's time for the 2023 shopping list!

(Which is also supporting public goods funding! Woo

2/268

If you really hate threads, there is a link to a substack version, where I'll be posting these prior to Twitter from time to time.

adamscochran.substack.com/

If you really hate threads, there is a link to a substack version, where I'll be posting these prior to Twitter from time to time.

adamscochran.substack.com/

3/268

Before we dive into the shopping list, let's do two things.

First, recap what a shopping list is.

Second, review last year's shopping list.

Before we dive into the shopping list, let's do two things.

First, recap what a shopping list is.

Second, review last year's shopping list.

4/268

My shopping list strategy is based on the idea, that during every big spike down in the markets, you don't have time to research individual assets, or else you will miss a buying opportunity.

My shopping list strategy is based on the idea, that during every big spike down in the markets, you don't have time to research individual assets, or else you will miss a buying opportunity.

5/268

Every shopping list starts with establishing a thesis, and a buying plan.

Your thesis is what catalysts you think will drive the markets in the next 3-5 years.

Your buying plan is how much scale to buy of each asset, and what conditions to buy under.

Every shopping list starts with establishing a thesis, and a buying plan.

Your thesis is what catalysts you think will drive the markets in the next 3-5 years.

Your buying plan is how much scale to buy of each asset, and what conditions to buy under.

6/268

Each year I share my shopping list and discuss the catalysts that I think could drive assets on that list.

I don't share my buying plan, because those are always personal based on an individuals circumstances, risk tolerance and timeline.

Each year I share my shopping list and discuss the catalysts that I think could drive assets on that list.

I don't share my buying plan, because those are always personal based on an individuals circumstances, risk tolerance and timeline.

7/268

As a long term investor, I expect the potential of large drawdowns and having to hold for multiple years.

I also expect that some assets will go to absolute zero, and that's ok, if I size my bets accordingly.

As a long term investor, I expect the potential of large drawdowns and having to hold for multiple years.

I also expect that some assets will go to absolute zero, and that's ok, if I size my bets accordingly.

8/268

With a shopping list, you should never over concentrate into a few assets, or buy all at once.

And, your shopping list should be assets *YOU* believe in.

I share mine based on what I think will perform. You should focus on evaluating if you agree with those catalysts.

With a shopping list, you should never over concentrate into a few assets, or buy all at once.

And, your shopping list should be assets *YOU* believe in.

I share mine based on what I think will perform. You should focus on evaluating if you agree with those catalysts.

9/268

Overall, remember, this isn't investment advice.

A purchase that is right for me, may not be one that is right for you.

And any asset purchased could be a good purchase one day, and a bad purchase the next.

Overall, remember, this isn't investment advice.

A purchase that is right for me, may not be one that is right for you.

And any asset purchased could be a good purchase one day, and a bad purchase the next.

10/268

A shopping list also isn't static.

You need to reevaluate it on a monthly basis, think of it in the context of the global macro, shifting industry events and new developments.

In investing, being static is a death wish.

A shopping list also isn't static.

You need to reevaluate it on a monthly basis, think of it in the context of the global macro, shifting industry events and new developments.

In investing, being static is a death wish.

11/268

I always aim for "Strong Opinions; Loosely Held" (SOLH) which means I have conviction & reason behind my choices, but I'm not afraid to adjust when new information comes along.

Last year, this meant shorting as a war broke out and the Fed failed to respond to inflation.

I always aim for "Strong Opinions; Loosely Held" (SOLH) which means I have conviction & reason behind my choices, but I'm not afraid to adjust when new information comes along.

Last year, this meant shorting as a war broke out and the Fed failed to respond to inflation.

12/268

Hedging downside with contracts allowed me to continue spot buying assets that I felt were important for the future.

With all that in mind, let's talk about last year:

Hedging downside with contracts allowed me to continue spot buying assets that I felt were important for the future.

With all that in mind, let's talk about last year:

13/268

Here's the link to last years shopping list:

Here's the link to last years shopping list:

14/268

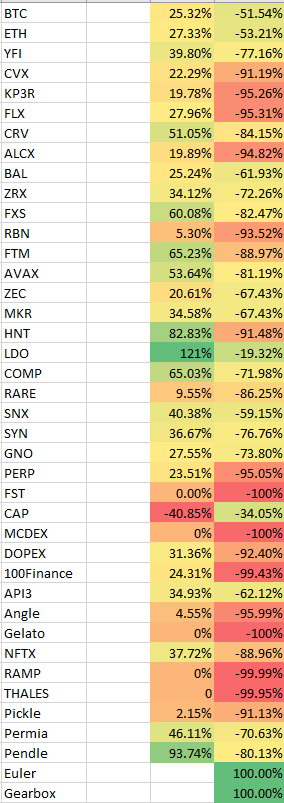

2022 was a tough year. You've probably seen the "Shitcoin Minimalist's" tweet outlining that if you bought all the assets one the day it was posted, the average return was -83.9% - woo!

2022 was a tough year. You've probably seen the "Shitcoin Minimalist's" tweet outlining that if you bought all the assets one the day it was posted, the average return was -83.9% - woo!

15/268

But, if we look at the top 130 assets by marketcap after this rally, the average one year draw down was -72% and the average drawdown of my list? -71.16%

And these tokens had an average 30.86% rebound from the lows, beating out BTC and ETH on the recovery.

But, if we look at the top 130 assets by marketcap after this rally, the average one year draw down was -72% and the average drawdown of my list? -71.16%

And these tokens had an average 30.86% rebound from the lows, beating out BTC and ETH on the recovery.

16/268

Obviously it was a rough year, lets not pretend it wasn't; but the asset list did outperform the average index, and in many cases their peers.

It didn't win out against holding BTC or ETH, which you wouldn't expect, but those won't deliver huge multipliers either.

Obviously it was a rough year, lets not pretend it wasn't; but the asset list did outperform the average index, and in many cases their peers.

It didn't win out against holding BTC or ETH, which you wouldn't expect, but those won't deliver huge multipliers either.

17/268

Now lets dive into this years shopping list.

A few things to note:

1. Disclaimer: I own most of these assets, I'm absolutely talking my book and if I didn't believe in the asset enough to buy it, it wouldn't be on my list.

Now lets dive into this years shopping list.

A few things to note:

1. Disclaimer: I own most of these assets, I'm absolutely talking my book and if I didn't believe in the asset enough to buy it, it wouldn't be on my list.

18/268

2. If people stupidly ape into I certainly may rebalance some positions, but I think these are long term winners. But, if you blow it out 100x in a day, look, I'mma dump on you and rebuy afterwards and so will other holders.

3. Custom AI art for each asset cause fun.

2. If people stupidly ape into I certainly may rebalance some positions, but I think these are long term winners. But, if you blow it out 100x in a day, look, I'mma dump on you and rebuy afterwards and so will other holders.

3. Custom AI art for each asset cause fun.

19/268

4. This year I've also taken sponsorship and affiliate links which the revenue from will be going to Gitcoin grants. This is only for outbound links. Projects could not pay to get on the list.

4. This year I've also taken sponsorship and affiliate links which the revenue from will be going to Gitcoin grants. This is only for outbound links. Projects could not pay to get on the list.

20/268

This years thesis summary:

-Real external revenue continues to be the most important factor.

-But, assets are so depressed that there are some 'growth' style tokens that have a good r:r

-Focus on real revenue catalysts, novel infrastructure and UX plays.

This years thesis summary:

-Real external revenue continues to be the most important factor.

-But, assets are so depressed that there are some 'growth' style tokens that have a good r:r

-Focus on real revenue catalysts, novel infrastructure and UX plays.

21/268

Real revenue refers to projects that users external to the project use and generate revenue for, especially in cases where it isn't supported by on going emission incentives which ultimately cost users.

Real revenue refers to projects that users external to the project use and generate revenue for, especially in cases where it isn't supported by on going emission incentives which ultimately cost users.

22/268

The other important highlight is UX plays.

This isn't just design, this is anything that makes it simple for users to use blockchain technology.

Just like a web browser or a search engine makes the internet easy to use, we need tools that make crypto easy to use.

The other important highlight is UX plays.

This isn't just design, this is anything that makes it simple for users to use blockchain technology.

Just like a web browser or a search engine makes the internet easy to use, we need tools that make crypto easy to use.

23/268

These can be bridges, multchain apps, automation tools, smart wallets, etc.

Anything that makes the complicated system of fractured liquidity easier to use or to build on.

With that in mind, lets dive in:

These can be bridges, multchain apps, automation tools, smart wallets, etc.

Anything that makes the complicated system of fractured liquidity easier to use or to build on.

With that in mind, lets dive in:

24/268

S-Class:

#1 Ethereum:

Ethereum really needs no justification for being on the top list.

It's got the most users, its deflationary when in use, and it has a dozen upcoming scaling solutions.

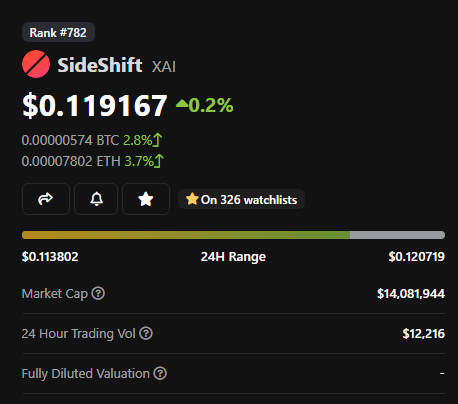

Buy on Sideshift: sideshift.ai/a/shifts

S-Class:

#1 Ethereum:

Ethereum really needs no justification for being on the top list.

It's got the most users, its deflationary when in use, and it has a dozen upcoming scaling solutions.

Buy on Sideshift: sideshift.ai/a/shifts

25/268

I think staking ETH long term is like buying up internet infrastructure after the dot-com crash.

Everything across this industry is in pain and likely oversold long term, but that doesn't mean it isn't useful.

I think staking ETH long term is like buying up internet infrastructure after the dot-com crash.

Everything across this industry is in pain and likely oversold long term, but that doesn't mean it isn't useful.

26/268

My personal take is that one day the Ethereum blockchain will be a ubiquitous data layer, and staking Ethereum will be a rare opportunity for participants to create multi-generational wealth.

Modern day Vanderbilts are being born right now.

My personal take is that one day the Ethereum blockchain will be a ubiquitous data layer, and staking Ethereum will be a rare opportunity for participants to create multi-generational wealth.

Modern day Vanderbilts are being born right now.

27/268

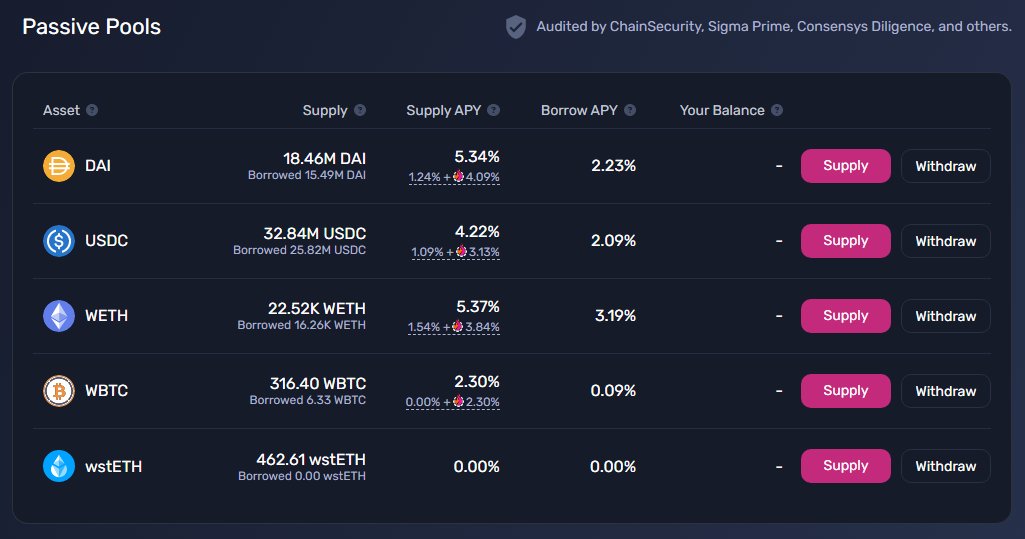

#2

@RDNTCapital - $RDNT

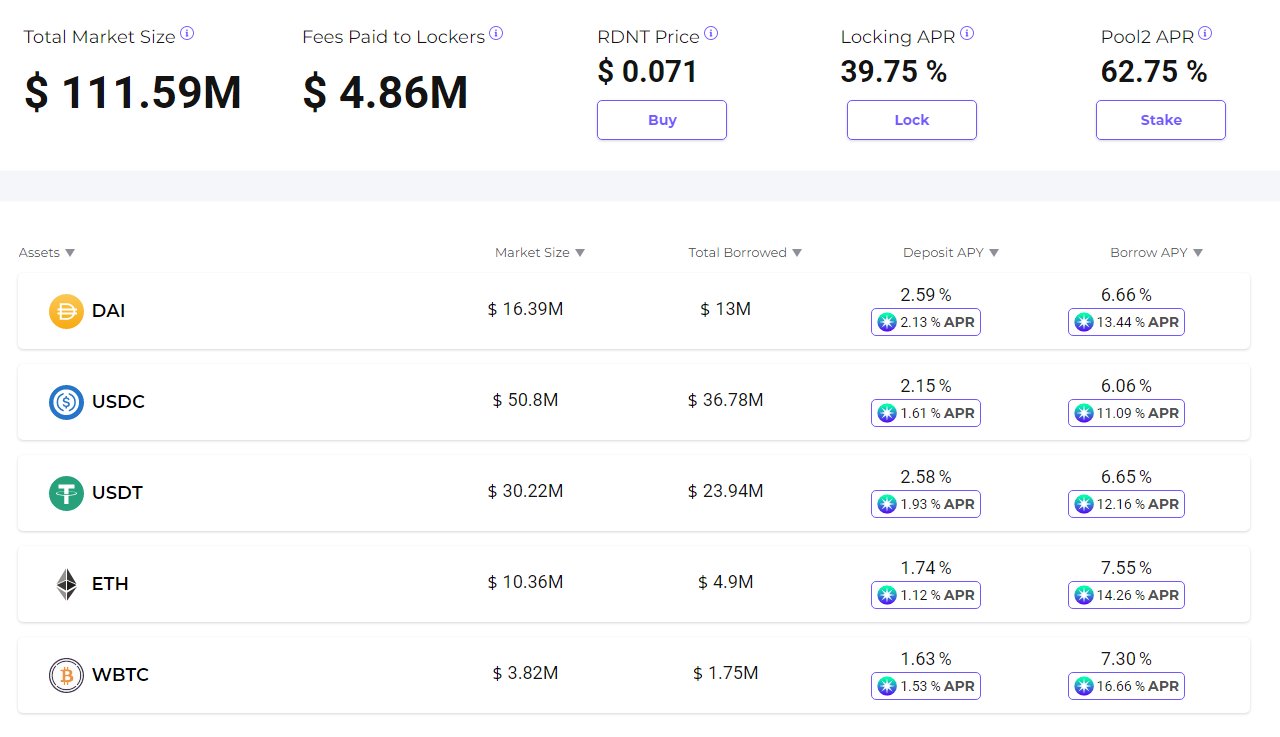

Radiant Capital is one of the new projects from this cycle that I'm most excited about.

It takes the existing money market model, build it cross chain natively, and make it entirely community operated.

Buy on Sushi: app.sushi.com/swap?inputCurrency=0x0c4681e6c0235179ec3d4f4fc4df3d14fdd96017&outputCurrency=0x82af4944...

#2

@RDNTCapital - $RDNT

Radiant Capital is one of the new projects from this cycle that I'm most excited about.

It takes the existing money market model, build it cross chain natively, and make it entirely community operated.

Buy on Sushi: app.sushi.com/swap?inputCurrency=0x0c4681e6c0235179ec3d4f4fc4df3d14fdd96017&outputCurrency=0x82af4944...

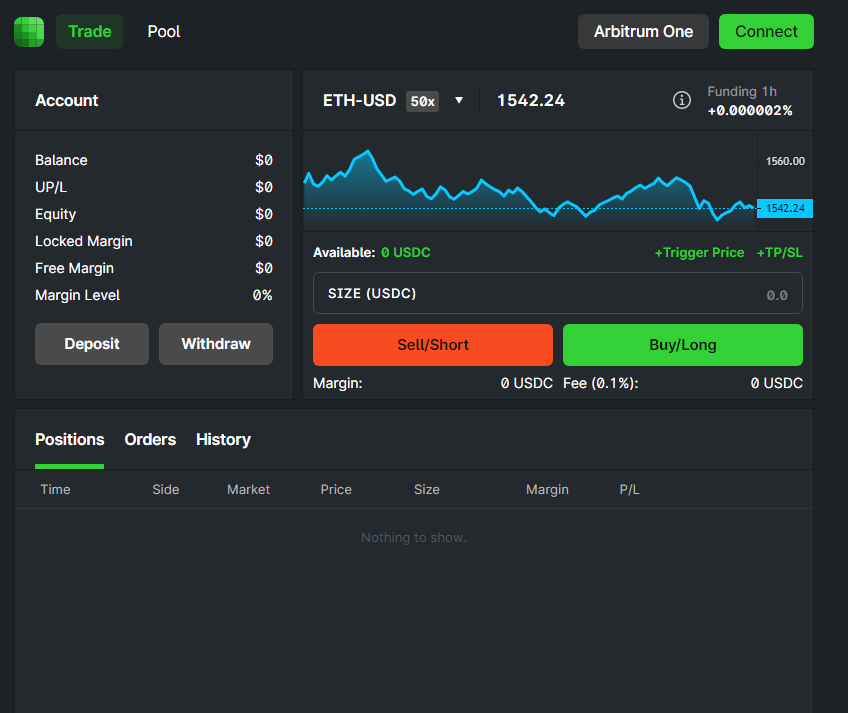

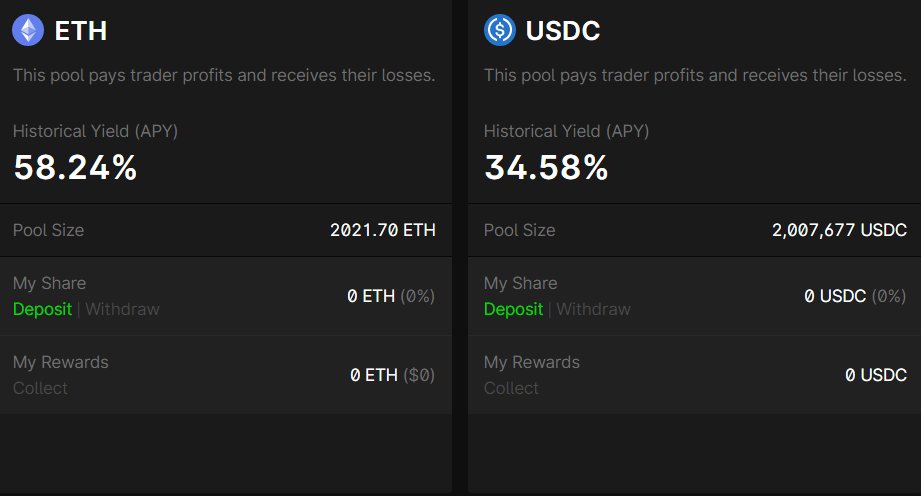

28/268

Having launched first on Arbitrum, Radiant Capital is built on top of LayerZero (a project that only isn't on this list because it's had such a successful run up recently) which will allow it to have native crosschain markets

Having launched first on Arbitrum, Radiant Capital is built on top of LayerZero (a project that only isn't on this list because it's had such a successful run up recently) which will allow it to have native crosschain markets

29/268

Users will be able to deposit collateral on one network, and borrow on another seamlessly.

Stake your native tokens on Arbitrum, and borrow on Polygon to ape into the next farm.

Use your OP token as collateral to borrow USDC for mainnet farming.

Users will be able to deposit collateral on one network, and borrow on another seamlessly.

Stake your native tokens on Arbitrum, and borrow on Polygon to ape into the next farm.

Use your OP token as collateral to borrow USDC for mainnet farming.

30/268

Users will be able to borrow, settle and pay fees cross market.

The team is entirely bootstrapped with no VC raise or seed round, and unlike Aave or Compound which take the fees for their developers, Radiant's protocol rewards it all to stakers.

Users will be able to borrow, settle and pay fees cross market.

The team is entirely bootstrapped with no VC raise or seed round, and unlike Aave or Compound which take the fees for their developers, Radiant's protocol rewards it all to stakers.

31/268

That means stakers are getting good APYs (right now 39.75%) but instead of that all coming from a diluting token, it's coming from real use cases, and paid out in real valuable assets, the bulk of it coming in the form of USDC.

That means stakers are getting good APYs (right now 39.75%) but instead of that all coming from a diluting token, it's coming from real use cases, and paid out in real valuable assets, the bulk of it coming in the form of USDC.

32/268

In terms of valuation, RDNT is currently only at a $2M valuation and a $70M FDV, although with the bulk of that FDV being paid over time to stakers, the dilution really isn't equivalent.

In terms of valuation, RDNT is currently only at a $2M valuation and a $70M FDV, although with the bulk of that FDV being paid over time to stakers, the dilution really isn't equivalent.

33/268

Considering Compound has a marketcap of $365M (FDV $529M), and Aave is $1.2B (FDV $1.3B) there is a lot of room for growth here.

But, what's more, even though Aave and Compound are multichain, their liquidity is fractured.

Considering Compound has a marketcap of $365M (FDV $529M), and Aave is $1.2B (FDV $1.3B) there is a lot of room for growth here.

But, what's more, even though Aave and Compound are multichain, their liquidity is fractured.

34/268

And while Aave hopes to launch "Portals" with its V3, they aren't live yet, and will be limited by Aave's structure.

Whereas, Radiant is building from the ground up with crosschain design in mind.

And while Aave hopes to launch "Portals" with its V3, they aren't live yet, and will be limited by Aave's structure.

Whereas, Radiant is building from the ground up with crosschain design in mind.

35/268

I think there is easily a $5B+ opportunity for whichever team can capture a strong marketshare of crosschain lending, and Radiant is off to a strong start.

This market has been hard to break into, so the risk:reward upside is large if they can pull it off.

I think there is easily a $5B+ opportunity for whichever team can capture a strong marketshare of crosschain lending, and Radiant is off to a strong start.

This market has been hard to break into, so the risk:reward upside is large if they can pull it off.

36/268

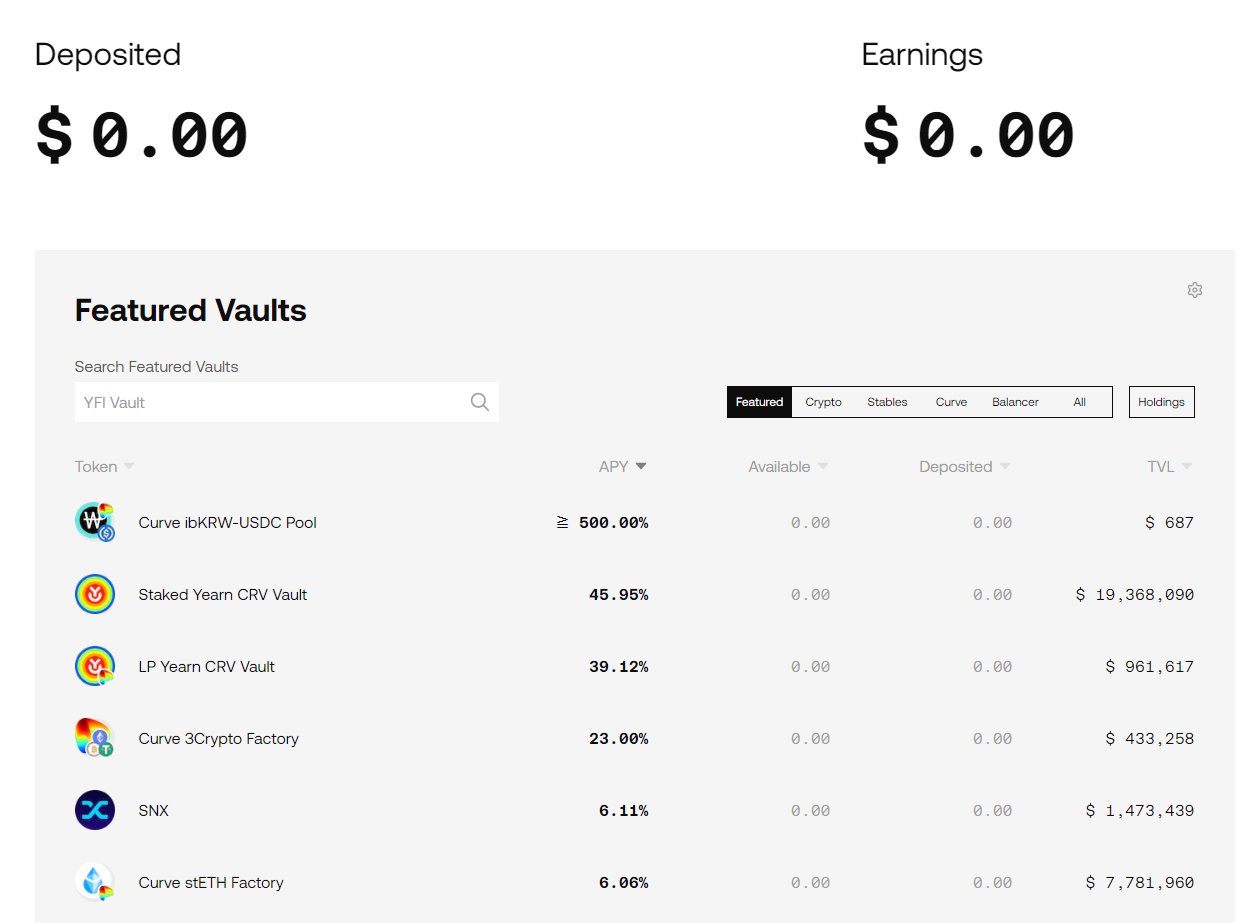

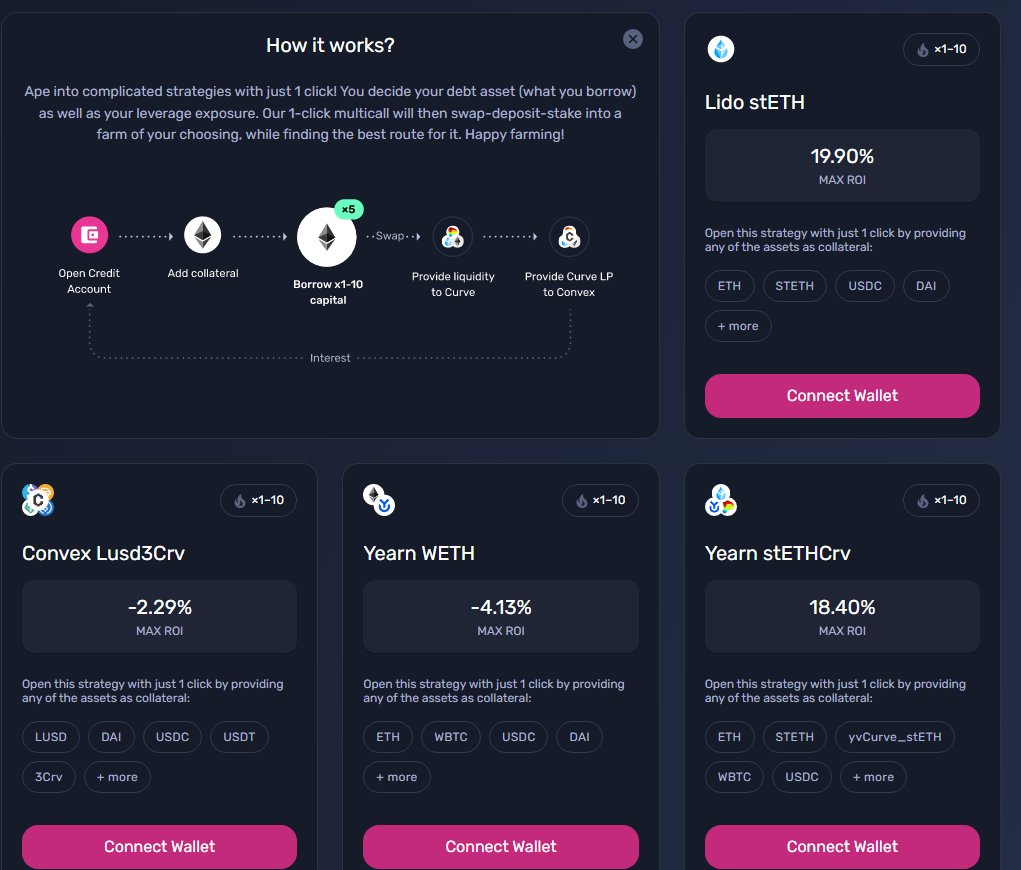

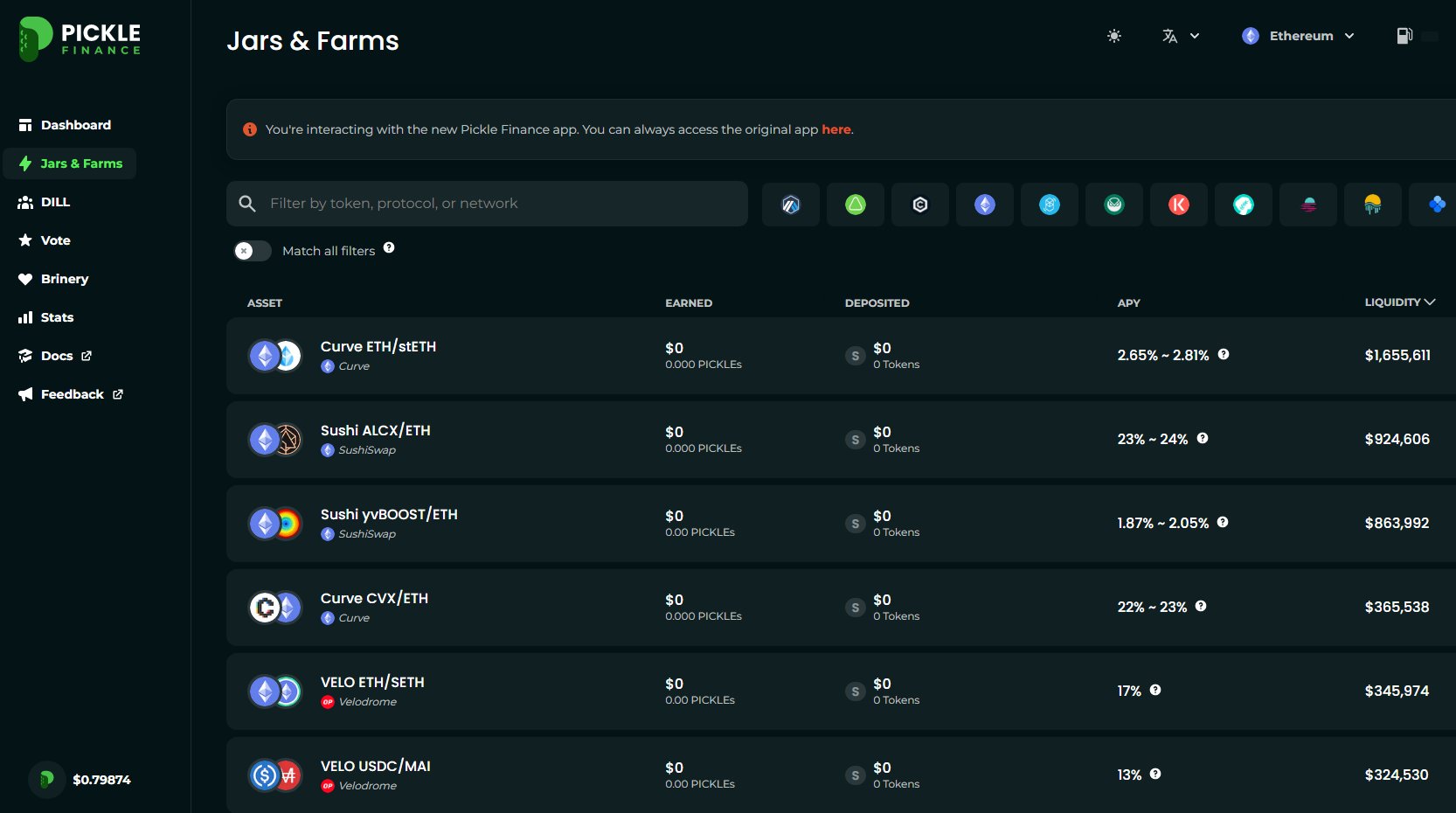

# 3 - @iearnfinance $YFI:

Yearn is the irrefutable leader of Yield automation and vaults, and more importantly has gone through a major transformation in terms of its competitive offering.

Buy on Sideshift: sideshift.ai/a/shifts

# 3 - @iearnfinance $YFI:

Yearn is the irrefutable leader of Yield automation and vaults, and more importantly has gone through a major transformation in terms of its competitive offering.

Buy on Sideshift: sideshift.ai/a/shifts

37/268

Yearn has recently entirely rebuilt their offering, including:

-A new site

-Supporting new chains

-Making much cheaper fees

-Reworking their CRV integration

-Remodeling the YFI token

Yearn has recently entirely rebuilt their offering, including:

-A new site

-Supporting new chains

-Making much cheaper fees

-Reworking their CRV integration

-Remodeling the YFI token

38/268

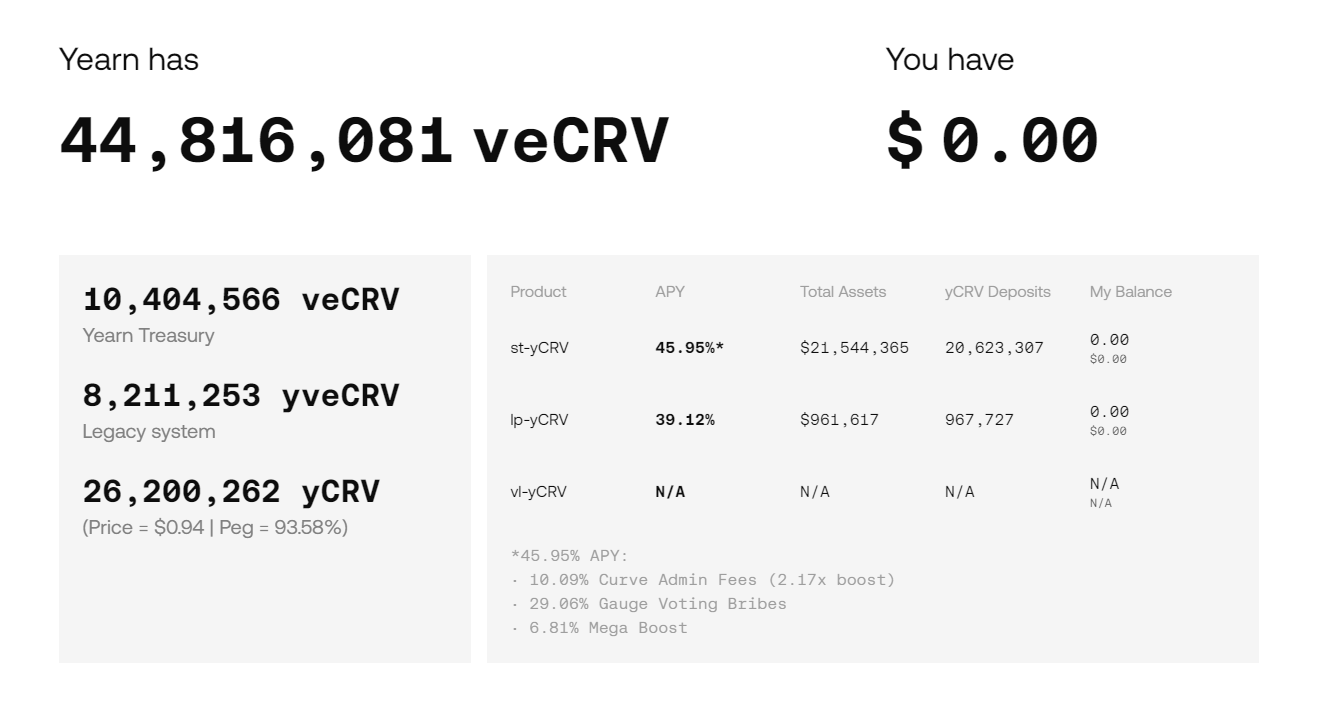

One thing you have to understand is that Yearn owns a lot of CRV, in fact the own 44M locked CRV, making them one of the largest Curve holders in the ecosystem.

That incredibly amount of voting power is used to help them get higher returns on their strategy vaults.

One thing you have to understand is that Yearn owns a lot of CRV, in fact the own 44M locked CRV, making them one of the largest Curve holders in the ecosystem.

That incredibly amount of voting power is used to help them get higher returns on their strategy vaults.

39/268

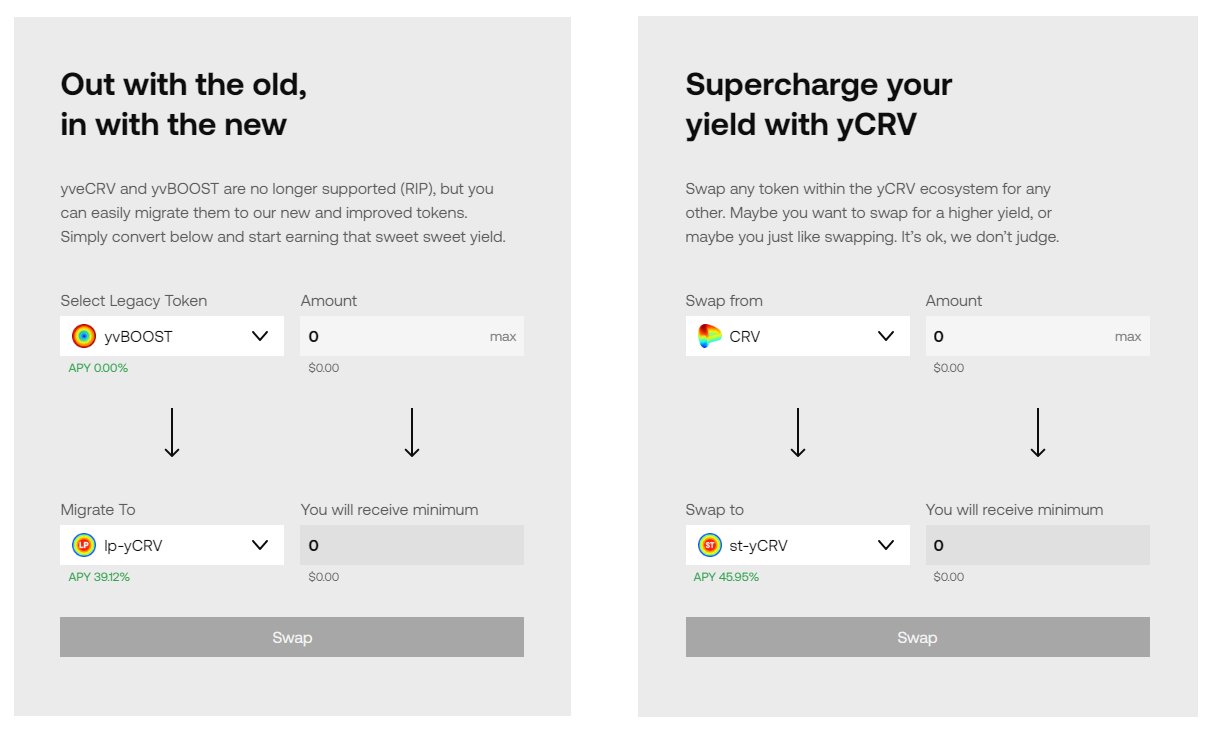

Under their previous model, the way they acquired and rewarded their CRV lockup was inefficient, and so they converted their old 'yBoost' to a new model of yCRV which currently pays out up to 45% APY when staked.

Under their previous model, the way they acquired and rewarded their CRV lockup was inefficient, and so they converted their old 'yBoost' to a new model of yCRV which currently pays out up to 45% APY when staked.

40/268

But, what's even more interesting is that your locked veYFI will be able to vote on gauges to decide which vaults get that voting power allocated to them AND which vaults get $YFI rewards direct to them.

But, what's even more interesting is that your locked veYFI will be able to vote on gauges to decide which vaults get that voting power allocated to them AND which vaults get $YFI rewards direct to them.

41/268

You can kind of imagine this like Convex's Votium, but integrated directly into the system, and instead of earning yield from one place, it earns from three:

-The Yearn Vault

-YFI emissions that Yearn bought back

-CRV rewards

You can kind of imagine this like Convex's Votium, but integrated directly into the system, and instead of earning yield from one place, it earns from three:

-The Yearn Vault

-YFI emissions that Yearn bought back

-CRV rewards

42/268

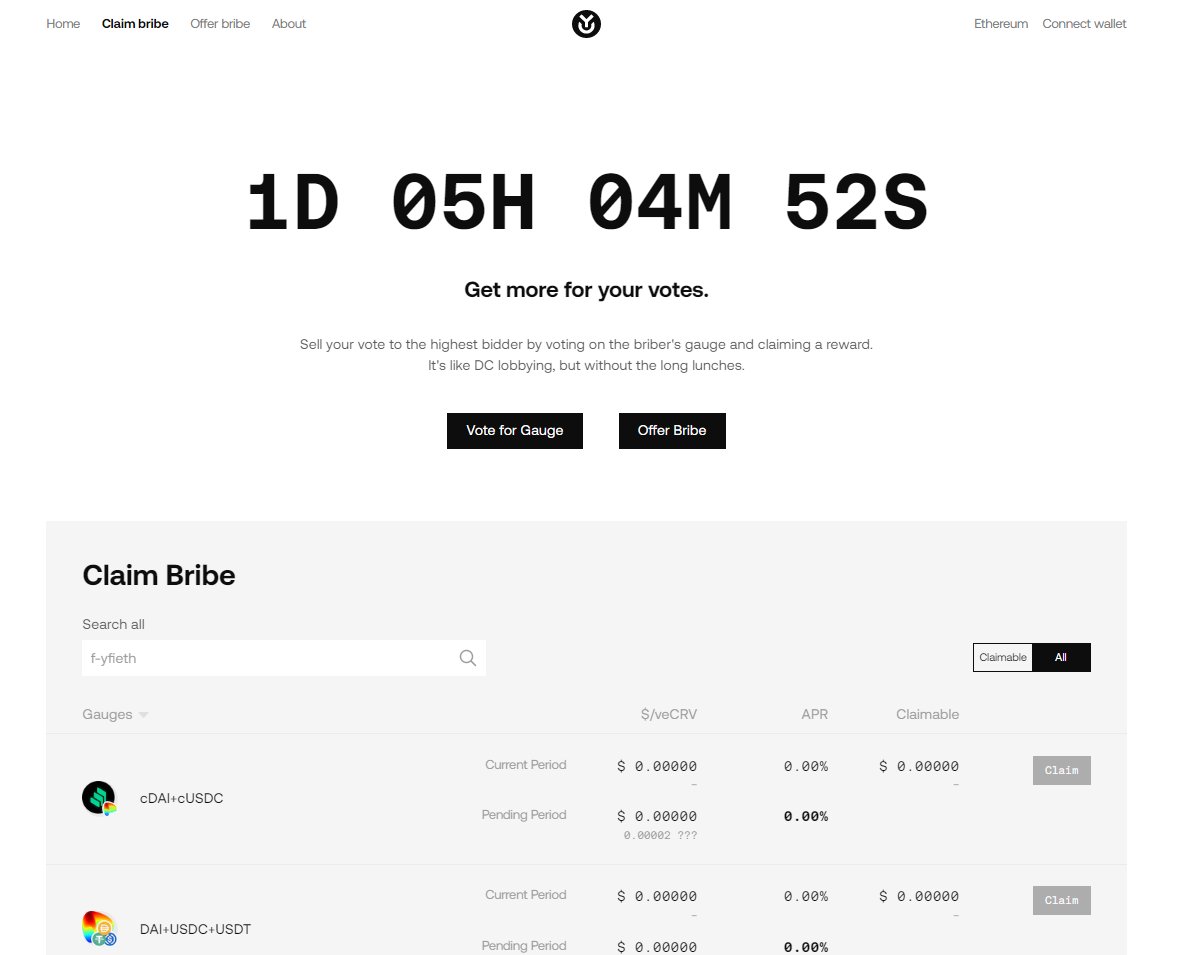

The bribing has just started and it seems people are unaware of it entirely, because the participation has been low, which means it would take very few votes to increase your vault rewards.

The bribing has just started and it seems people are unaware of it entirely, because the participation has been low, which means it would take very few votes to increase your vault rewards.

43/268

Yearn also has started to create automated factories that allow any project to deploy automated yield vaults for their pools, and set bribes toward that pool.

As the number of templates expand, Yearn will be able to automate a large number of vaults for any project.

Yearn also has started to create automated factories that allow any project to deploy automated yield vaults for their pools, and set bribes toward that pool.

As the number of templates expand, Yearn will be able to automate a large number of vaults for any project.

44/268

Yearn vaults have always been a key component of DeFi infrastructure, but now they'll be scalable, bribeable, and lucrative for projects to integrate with.

Just like the last cycle's Curve wars, it will become standard practice to deploy a Yearn gauge and acquire YFI.

Yearn vaults have always been a key component of DeFi infrastructure, but now they'll be scalable, bribeable, and lucrative for projects to integrate with.

Just like the last cycle's Curve wars, it will become standard practice to deploy a Yearn gauge and acquire YFI.

45/268

#4: @synthetix_io $SNX

Home of the Spartans, Synthetix is one of the defi ogs and has continued to evolve.

Synthetix allows for the creation of synthetic liquidity backed by asset debt.

Buy on Sideshift: sideshift.ai/a/shifts

#4: @synthetix_io $SNX

Home of the Spartans, Synthetix is one of the defi ogs and has continued to evolve.

Synthetix allows for the creation of synthetic liquidity backed by asset debt.

Buy on Sideshift: sideshift.ai/a/shifts

46/268

What started as a simple borrowing protocol that allowed you to stake $SNX and borrow $sUSD, has evolved to include "Atomic Swaps", a perpetual futures engine, and soon a permissionless market to build such protocols.

What started as a simple borrowing protocol that allowed you to stake $SNX and borrow $sUSD, has evolved to include "Atomic Swaps", a perpetual futures engine, and soon a permissionless market to build such protocols.

47/268

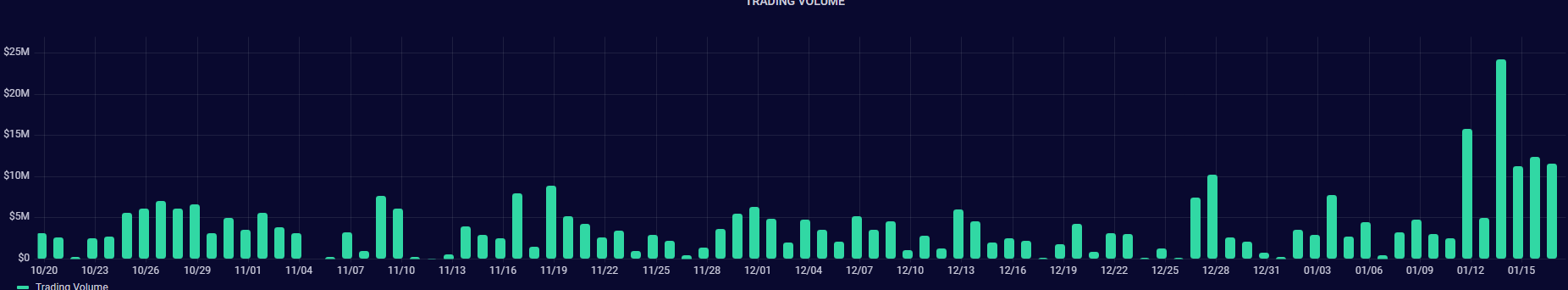

With integrations into Curve, 1Inch and other major players, Synthetix V2 atomic swaps generate huge volume, and you can see how their V2 adjustments led to a volume spike even in the bear market:

With integrations into Curve, 1Inch and other major players, Synthetix V2 atomic swaps generate huge volume, and you can see how their V2 adjustments led to a volume spike even in the bear market:

48/268

In the last bullrun, the V1 of atomic swaps was doing >$100M/day in volume.

The current one is doing that monthly in the bear market, but between atomic swaps and perpetuals, this still means a 70%+ APY for Synthetix stakers in the current market conditions

In the last bullrun, the V1 of atomic swaps was doing >$100M/day in volume.

The current one is doing that monthly in the bear market, but between atomic swaps and perpetuals, this still means a 70%+ APY for Synthetix stakers in the current market conditions

49/268

The current version of Synthetix is also only on mainnet and Optimism, but V3 which aims to launch sometime late Q1/early Q2 will have multichain support, allowing partners like 1Inch to instantly use it on any chain to provide trade liquidity.

The current version of Synthetix is also only on mainnet and Optimism, but V3 which aims to launch sometime late Q1/early Q2 will have multichain support, allowing partners like 1Inch to instantly use it on any chain to provide trade liquidity.

50/268

Right now, all the markets come from a single collateral, and single source, but V3's new model will allow anyone to build their own protocol on top of Synthetix.

They'll decide the collateral, the assets, the model and the rewards.

Right now, all the markets come from a single collateral, and single source, but V3's new model will allow anyone to build their own protocol on top of Synthetix.

They'll decide the collateral, the assets, the model and the rewards.

51/268

They can opt in to issuing Synthetix's own $sUSD and using secure vaults managed by Synthetix, or they can build their own system against the Synthetix debt pool and decide which collaterals to accept.

They can opt in to issuing Synthetix's own $sUSD and using secure vaults managed by Synthetix, or they can build their own system against the Synthetix debt pool and decide which collaterals to accept.

52/268

Users can then decide which pools to stake against, allowing any protocol to build a debt secured system.

Money markets like Aave, perpetuals like Kwenta or GMX, AMMs like Uniswap and anything else you can dream of, Synthetix's will provide liquidity as a service.

Users can then decide which pools to stake against, allowing any protocol to build a debt secured system.

Money markets like Aave, perpetuals like Kwenta or GMX, AMMs like Uniswap and anything else you can dream of, Synthetix's will provide liquidity as a service.

53/268

The goal is for Synthetix to abstract down the complexity of these deployments so that it can have templated versions that make launching your own defi protocol as simple as running a WordPress site or deploying a Shopify store.

The goal is for Synthetix to abstract down the complexity of these deployments so that it can have templated versions that make launching your own defi protocol as simple as running a WordPress site or deploying a Shopify store.

54/268

SNX aims to be the liquidity layer underpinning all of defi.

At first, it will be a slow start, limited to technical users, but I have extremely high hopes for what this community can achieve by being one of the first dapp-to-dapp protocols.

SNX aims to be the liquidity layer underpinning all of defi.

At first, it will be a slow start, limited to technical users, but I have extremely high hopes for what this community can achieve by being one of the first dapp-to-dapp protocols.

55/268

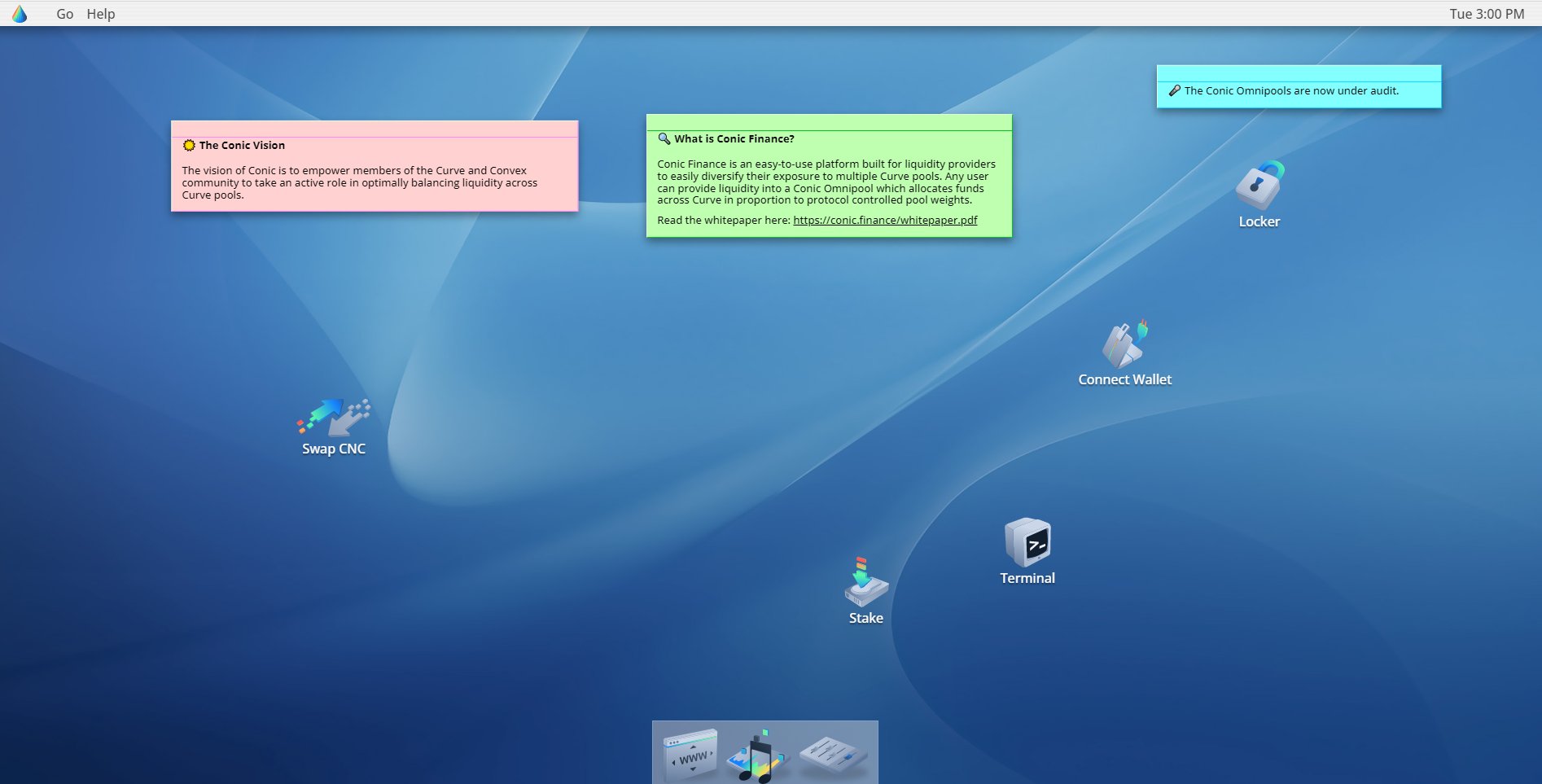

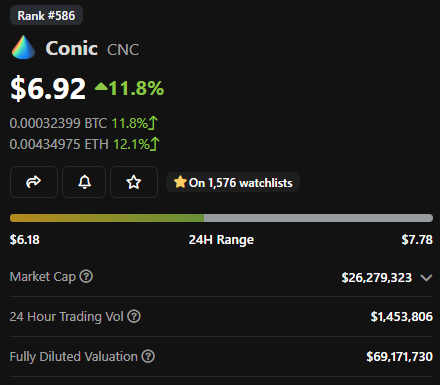

#5 @ConicFinance - $CNC

Conic, the all mighty cone. It may end up being one of the most important ecosystem projects you've never heard of.

Conic is a key part of the Curve ecosystem bringing omnipool balancing.

Buy on Curve: curve.fi/

#5 @ConicFinance - $CNC

Conic, the all mighty cone. It may end up being one of the most important ecosystem projects you've never heard of.

Conic is a key part of the Curve ecosystem bringing omnipool balancing.

Buy on Curve: curve.fi/

56/268

Conic creates "omnipools" which allow users to deposit their assets into Curve and spread them out across different pools to optimize the APY per dollar.

But, that's only a small part of the magic.

Conic creates "omnipools" which allow users to deposit their assets into Curve and spread them out across different pools to optimize the APY per dollar.

But, that's only a small part of the magic.

57/268

In order for Curve to launch its crvUSD and take on diverse collateral, it's pools would need to be able to easily soak up liquidations.

Not something you can do if a pool has light liquidity, that'd pose a huge manipulation risk.

In order for Curve to launch its crvUSD and take on diverse collateral, it's pools would need to be able to easily soak up liquidations.

Not something you can do if a pool has light liquidity, that'd pose a huge manipulation risk.

58/268

And that's where Conic comes in. By creating a slush fund of capital that can move from pool to pool seeking out the highest yield.

It means if some sort of collateral on crvUSD is set to be liquidated the omnipool can redirect to that pool to soak up rewards.

And that's where Conic comes in. By creating a slush fund of capital that can move from pool to pool seeking out the highest yield.

It means if some sort of collateral on crvUSD is set to be liquidated the omnipool can redirect to that pool to soak up rewards.

59/268

This will allow Conic to become the layer for optimized rewards, and for enabling assets to be onboarded as collateral into the crvUSD system.

Unlike competitors in the CurveWars, Conic is also the only responsive system that will reweight dynamically to drive fees.

This will allow Conic to become the layer for optimized rewards, and for enabling assets to be onboarded as collateral into the crvUSD system.

Unlike competitors in the CurveWars, Conic is also the only responsive system that will reweight dynamically to drive fees.

60/268

What's more, looking at their website, which is designed like a Mac UI desktop, seeing the complicated infra they are building, and their deep knowledge about why omnipools would be needed for crvUSD, I can't help but think Conic's team has to include Curve team members?

What's more, looking at their website, which is designed like a Mac UI desktop, seeing the complicated infra they are building, and their deep knowledge about why omnipools would be needed for crvUSD, I can't help but think Conic's team has to include Curve team members?

61/268

Now, Conic is pre-launch, so it is risky.

But, I like the opportunity when I compare it's low marketcap to other defi products that have captured CRV vote or done automatic fee balancing:

Now, Conic is pre-launch, so it is risky.

But, I like the opportunity when I compare it's low marketcap to other defi products that have captured CRV vote or done automatic fee balancing:

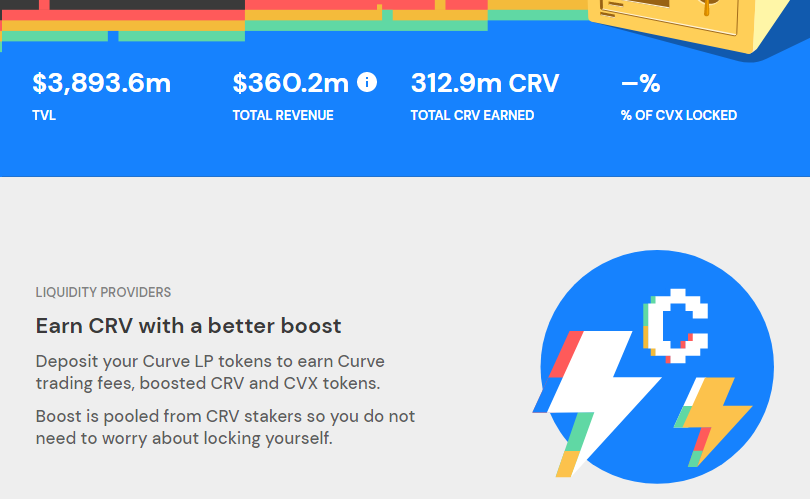

62/268

Consider that right now Convex has about $3.8B in TVL, and even in this down market is bringing in $9.7M/month in revenue.

Giving it a valuation of $370M, roughly 3x it's annual revenue.

Consider that right now Convex has about $3.8B in TVL, and even in this down market is bringing in $9.7M/month in revenue.

Giving it a valuation of $370M, roughly 3x it's annual revenue.

63/268

If Conic is able to capture that TVL, there is a 10x growth opportunity even in the bear market, and even if CRV doesn't grow in value.

But, Conic could steal marketshare from any project that holds a large CRV reserve or involves vote bribes for Curve.

If Conic is able to capture that TVL, there is a 10x growth opportunity even in the bear market, and even if CRV doesn't grow in value.

But, Conic could steal marketshare from any project that holds a large CRV reserve or involves vote bribes for Curve.

64/268

Right now, even in the bear market, there are around $1M/week in vote bribes paid out on Votium, which alone could result in a valuation of $156M for Conic right off the bat.

Lots of risk, but lots of opportunity, and it helps strengthen crvUSD.

Right now, even in the bear market, there are around $1M/week in vote bribes paid out on Votium, which alone could result in a valuation of $156M for Conic right off the bat.

Lots of risk, but lots of opportunity, and it helps strengthen crvUSD.

65/268

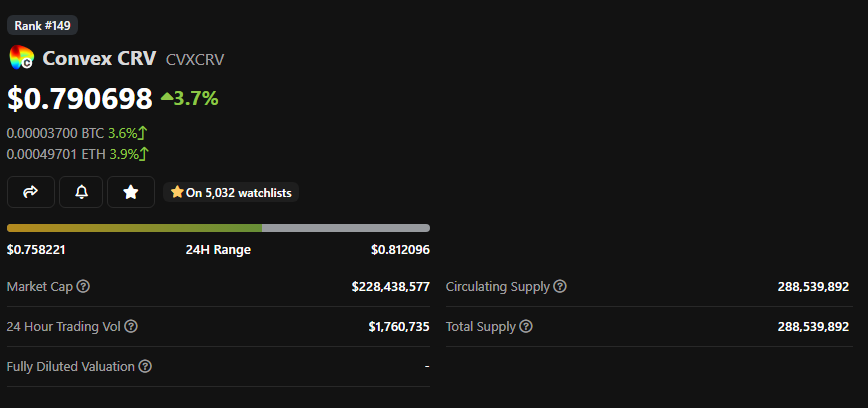

#6: @ConvexFinance - $CVX

Convex, the master of the pools.

As you can tell from my view on Conic, I think Curve is one of the most important protocols in the space and that its value will only continue to grow.

Which means Convex is right there along with it.

#6: @ConvexFinance - $CVX

Convex, the master of the pools.

As you can tell from my view on Conic, I think Curve is one of the most important protocols in the space and that its value will only continue to grow.

Which means Convex is right there along with it.

66/268

While I think Yearn and Conic will continue to eat away at the dominance of Convex, there is one thing that cannot be ignored.

Convex owns 288.5M locked CRV that can never be taken away from it.

While I think Yearn and Conic will continue to eat away at the dominance of Convex, there is one thing that cannot be ignored.

Convex owns 288.5M locked CRV that can never be taken away from it.

67/268

Even if Convex stopped issuing new rewards, or lost marketshare to new entrants, that voting power can never be taken away and will continue to earn rewards overtime.

Right now cvxCRV is also trading at a 20%+ discount to CRV.

Even if Convex stopped issuing new rewards, or lost marketshare to new entrants, that voting power can never be taken away and will continue to earn rewards overtime.

Right now cvxCRV is also trading at a 20%+ discount to CRV.

68/268

As we go towards crvUSD people are wanting to cash out their locked cvxCRV into CRV creating this gap.

My personal hunch is that the CVX team will be pushing their crvUSD rewards to cvxUSD to help close this gap.

As we go towards crvUSD people are wanting to cash out their locked cvxCRV into CRV creating this gap.

My personal hunch is that the CVX team will be pushing their crvUSD rewards to cvxUSD to help close this gap.

69/268

Which means at current pricing, you'd be getting 20%+ more reward power by buying cvxCRV over CRV.

And right now, dollar for dollar, buying CVX and locking for $vlCVX earns more votes per dollar than raw CRV, and gets a 24% APY from bribes on Llama.airforce

Which means at current pricing, you'd be getting 20%+ more reward power by buying cvxCRV over CRV.

And right now, dollar for dollar, buying CVX and locking for $vlCVX earns more votes per dollar than raw CRV, and gets a 24% APY from bribes on Llama.airforce

70/268

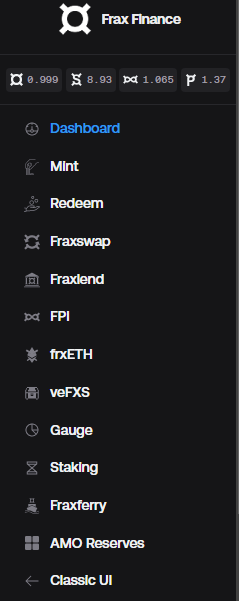

#7 - @fraxfinance : $FXS

Frax, the consumer of all!

Frax is getting tough to place into any one category, it's becoming a monster of defi that attempts to consume all verticals in its path.

Buy on Sideshift: sideshift.ai/a/shifts

#7 - @fraxfinance : $FXS

Frax, the consumer of all!

Frax is getting tough to place into any one category, it's becoming a monster of defi that attempts to consume all verticals in its path.

Buy on Sideshift: sideshift.ai/a/shifts

71/268

Frax started off as an algorithm stablecoin, and one of only a few in existence to survive multiple up and down markets.

Being a battle tested algo stable is impressive in its own right, but Frax hasn't stopped there.

Frax started off as an algorithm stablecoin, and one of only a few in existence to survive multiple up and down markets.

Being a battle tested algo stable is impressive in its own right, but Frax hasn't stopped there.

72/268

Instead Frax decided they were going to do just about everything.

From their own swapping AMM, to their own lending market, Frax slowly expanded sector by sector into other defi markets.

Instead Frax decided they were going to do just about everything.

From their own swapping AMM, to their own lending market, Frax slowly expanded sector by sector into other defi markets.

73/268

Most people who have tried that approach like Sushiswap have had it come back to bite them, spreading themselves too thin. But Frax has done a great job of tying it all back to the core market.

Most people who have tried that approach like Sushiswap have had it come back to bite them, spreading themselves too thin. But Frax has done a great job of tying it all back to the core market.

74/268

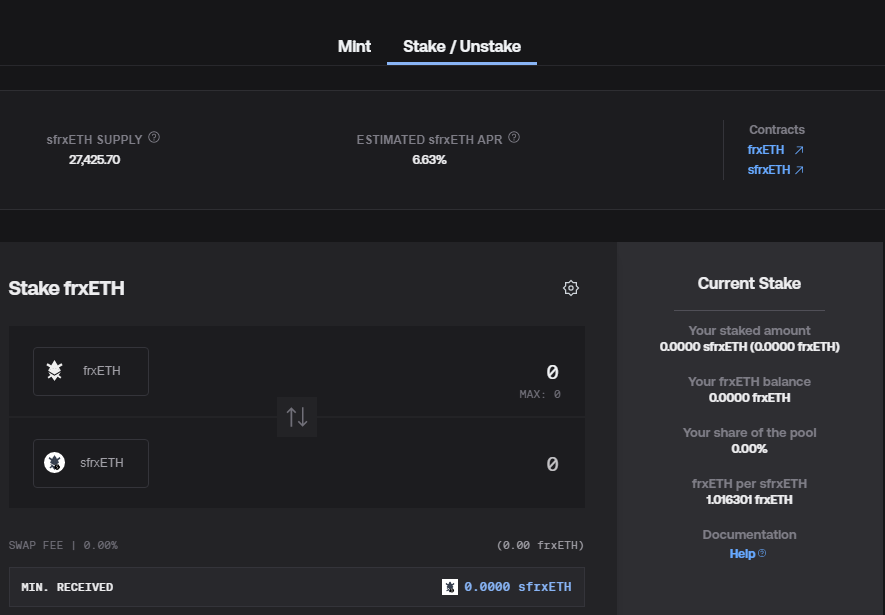

Frax is also a large owner of Curve voting power - which you'll notice is on trend this year.

They intend to use that Curve voting power to increase the APY yield on their liquid staking ETH product frxETH

Frax is also a large owner of Curve voting power - which you'll notice is on trend this year.

They intend to use that Curve voting power to increase the APY yield on their liquid staking ETH product frxETH

75/268

This competes with the likes of $cbETH and $stETH who can only provide the base ETH yields minus fees.

By redirecting their rewards, even short term to frxETH, Frax should be able to capture a large portion of the marketshare in liquid staking over time.

This competes with the likes of $cbETH and $stETH who can only provide the base ETH yields minus fees.

By redirecting their rewards, even short term to frxETH, Frax should be able to capture a large portion of the marketshare in liquid staking over time.

76/268

Unlike some other projects here, Frax already clocks in at a fairly large valuation, and has had a pretty large run up in the past few weeks due to the narratives around liquidate staking protocols.

Unlike some other projects here, Frax already clocks in at a fairly large valuation, and has had a pretty large run up in the past few weeks due to the narratives around liquidate staking protocols.

77/268

I was accumulating in the last dip, and may wait for a bit of a cooling here before continuing to buy, but I think Frax continues to have an outsized addressable market, where its shown it can deliver best in class products by creating interconnected protocols.

I was accumulating in the last dip, and may wait for a bit of a cooling here before continuing to buy, but I think Frax continues to have an outsized addressable market, where its shown it can deliver best in class products by creating interconnected protocols.

78/268

#8 @CurveFinance $CRV

Curve - The Great Redirector

The ebb and flow of defi is powered by Curve. CRV votes can change the tides of any project in an instance, giving life to a project or vanquishing it entirely.

#8 @CurveFinance $CRV

Curve - The Great Redirector

The ebb and flow of defi is powered by Curve. CRV votes can change the tides of any project in an instance, giving life to a project or vanquishing it entirely.

79/268

Curve may have started as the most efficient swapping protocol for like-kind pairs, but it quickly evolved into a giant of the industry by being the place for incentivized liquidity for young projects starting out.

Curve may have started as the most efficient swapping protocol for like-kind pairs, but it quickly evolved into a giant of the industry by being the place for incentivized liquidity for young projects starting out.

80/268

This model created the "Curve Wars" where other protocols raced to collect as much CRV as they could to incentivize their own pools.

Then Curve launched its V2 pools to take on AMMs like Uniswap in having regular trading pairs.

This model created the "Curve Wars" where other protocols raced to collect as much CRV as they could to incentivize their own pools.

Then Curve launched its V2 pools to take on AMMs like Uniswap in having regular trading pairs.

81/268

While V2 pools have grown a lot, it's my hunch that these can still be further scaled up to deliver even higher flow through.

But, I think Curve's current catalyst is two-fold.

While V2 pools have grown a lot, it's my hunch that these can still be further scaled up to deliver even higher flow through.

But, I think Curve's current catalyst is two-fold.

82/268

First, Curve and 1Inch working together integrate Synthetix's Atomic Swap protocol allowing them to mint synthetic assets and swap them in and out of Curve pools to get better virtual liquidity where it doesn't currently exist.

First, Curve and 1Inch working together integrate Synthetix's Atomic Swap protocol allowing them to mint synthetic assets and swap them in and out of Curve pools to get better virtual liquidity where it doesn't currently exist.

83/268

This gives the opportunity for new trade routes that regular AMMs can't compete on.

As Synthetix scales up the assets in this offering, Curve V2 pools will benefit, allowing users to make large liquid trades across complex routes.

This gives the opportunity for new trade routes that regular AMMs can't compete on.

As Synthetix scales up the assets in this offering, Curve V2 pools will benefit, allowing users to make large liquid trades across complex routes.

84/268

Second, Curve is finally expected to release their long awaited stablecoin "crvUSD" sometime this month.

Rather than be a regular liquidation based protocol the system uses an automatic liquidation method called LLAMA

Second, Curve is finally expected to release their long awaited stablecoin "crvUSD" sometime this month.

Rather than be a regular liquidation based protocol the system uses an automatic liquidation method called LLAMA

85/268

This self liquidating AMM runs through Curve's pools, meaning that liquidation fees will automatically accrue to the various LPs on Curve, along with the borrowing fees going to $veCRV holders (which in turn benefits Convex, Conic, Yearn and Frax as well)

This self liquidating AMM runs through Curve's pools, meaning that liquidation fees will automatically accrue to the various LPs on Curve, along with the borrowing fees going to $veCRV holders (which in turn benefits Convex, Conic, Yearn and Frax as well)

86/268

So why is a Curve stablecoin more interesting than other stablecoins?

In part because Curve drives some of the largest demand for stables in the space.

Every stablecoin pair on Curve is paired against Curve's "3Pool"

So why is a Curve stablecoin more interesting than other stablecoins?

In part because Curve drives some of the largest demand for stables in the space.

Every stablecoin pair on Curve is paired against Curve's "3Pool"

87/268

The 3Pool drives almost $600M of demand for stablecoins even in a down market.

But, there is no reason that 3Pool has to have these assets, or that the base pair has to be the current 3Pool.

The 3Pool drives almost $600M of demand for stablecoins even in a down market.

But, there is no reason that 3Pool has to have these assets, or that the base pair has to be the current 3Pool.

88/268

Curve DAO voters could vote to switch 3Pool from holding $DAI to holding $crvUSD, or even better could vote that the base pair for gauge eligible stablecoins is now $crvUSD instead of $3Pool, which would instantly generate $600M in demand for $crvUSD

Curve DAO voters could vote to switch 3Pool from holding $DAI to holding $crvUSD, or even better could vote that the base pair for gauge eligible stablecoins is now $crvUSD instead of $3Pool, which would instantly generate $600M in demand for $crvUSD

89/268

While it looks like Curve will be starting with just $ETH as collateral, the LLAMA system is an elegant way to ensure diverse collateral. As long as Curve has a V2 pool for an asset, and is supported by Conic omnipools, they can confidently liquidate most assets.

While it looks like Curve will be starting with just $ETH as collateral, the LLAMA system is an elegant way to ensure diverse collateral. As long as Curve has a V2 pool for an asset, and is supported by Conic omnipools, they can confidently liquidate most assets.

90/268

What's more, the value here is reflexive - as more demand is created for $crvUSD, more rewards go to $veCRV holders, which makes $CRV more valuable, which means more projects want to control $CRV votes, which increases demand for $crvUSD, and the flywheel continues.

What's more, the value here is reflexive - as more demand is created for $crvUSD, more rewards go to $veCRV holders, which makes $CRV more valuable, which means more projects want to control $CRV votes, which increases demand for $crvUSD, and the flywheel continues.

91/268

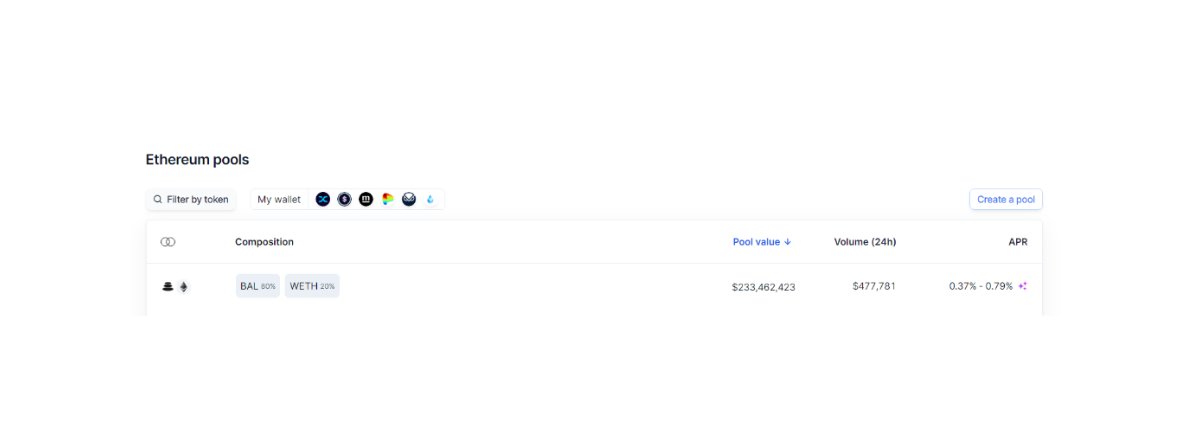

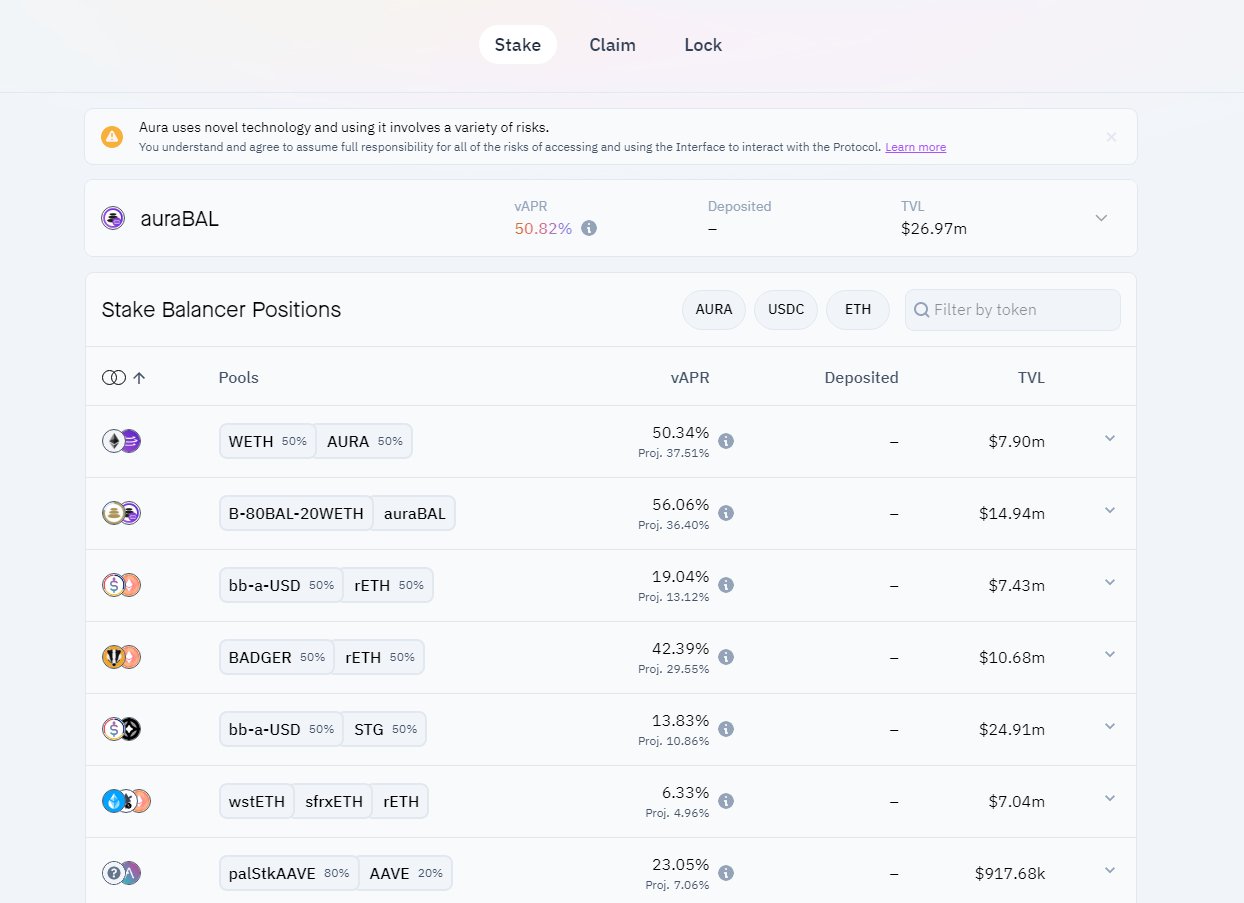

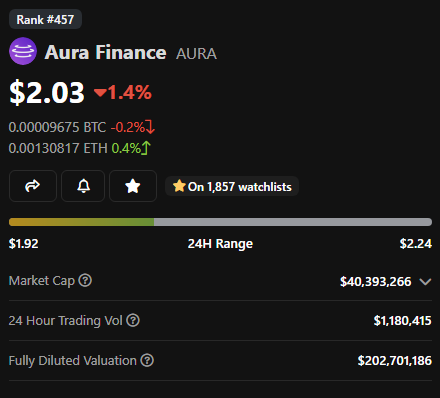

#9 @Balancer $BAL

Balancer: The Great Equalizer

Balancer has always been a leader in novel mechanics, but it has two key features that I think will grow in value

#9 @Balancer $BAL

Balancer: The Great Equalizer

Balancer has always been a leader in novel mechanics, but it has two key features that I think will grow in value

92/268

Balancer is often overlooked - because lets face it, who goes directly to trade on Balancer? No one.

But who has used a Balancer LBP pool, been routed through Balancer or used an 80/20 pool? Probably anyone who is seriously in defi, even if they don't know it.

Balancer is often overlooked - because lets face it, who goes directly to trade on Balancer? No one.

But who has used a Balancer LBP pool, been routed through Balancer or used an 80/20 pool? Probably anyone who is seriously in defi, even if they don't know it.

93/268

Balancer's unique models make it an underpinning for defi, and I think what we're seeing develop is that the 80/20 pool is going to be the core value offering that underpins the next wave of defi.

Balancer's unique models make it an underpinning for defi, and I think what we're seeing develop is that the 80/20 pool is going to be the core value offering that underpins the next wave of defi.

94/268

A lot of teams are realizing that their locked token models like xSushi or veCRV are problematic - because while locked tokens create scarcity and upward mobility, they also create a lack of liquidity for new large buyers, and weak floors in bear markets.

A lot of teams are realizing that their locked token models like xSushi or veCRV are problematic - because while locked tokens create scarcity and upward mobility, they also create a lack of liquidity for new large buyers, and weak floors in bear markets.

95/268

At the same time, you can't ask users to stake a regular AMM pair, as the IL would destroy their yield, or the position would get so incredibly concentrated that your asset would never really move up or down and would be a dud.

At the same time, you can't ask users to stake a regular AMM pair, as the IL would destroy their yield, or the position would get so incredibly concentrated that your asset would never really move up or down and would be a dud.

96/268

So what are you to do?

That's where balances 80/20 - its something that Balancer themselves use.

By having a user stake in mostly their own token and 20% ETH, they ensure robust liquidity but with an upward tilt and lower IL for users.

So what are you to do?

That's where balances 80/20 - its something that Balancer themselves use.

By having a user stake in mostly their own token and 20% ETH, they ensure robust liquidity but with an upward tilt and lower IL for users.

97/268

Of the teams I've talked to lately, about a dozen of them are undergoing major tokenomic redesigns, and 8 of those teams are talking about using 80/20 pools - which is something that right now, only Balancer really offers.

Of the teams I've talked to lately, about a dozen of them are undergoing major tokenomic redesigns, and 8 of those teams are talking about using 80/20 pools - which is something that right now, only Balancer really offers.

98/268

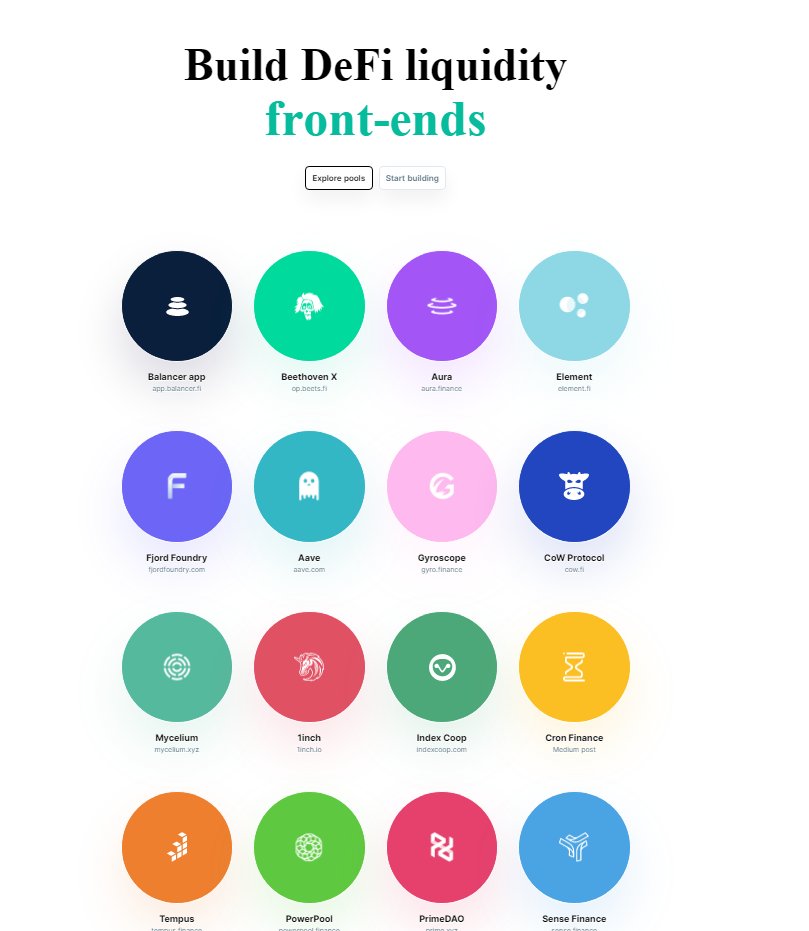

I mentioned in my 2022 thread last year that I view Balancer as a B2B protocol to empower other partners with unique liquidity offerings - and they've really leaned into that.

Their front page now leads to a partner landing page rather than a trading one

I mentioned in my 2022 thread last year that I view Balancer as a B2B protocol to empower other partners with unique liquidity offerings - and they've really leaned into that.

Their front page now leads to a partner landing page rather than a trading one

99/268

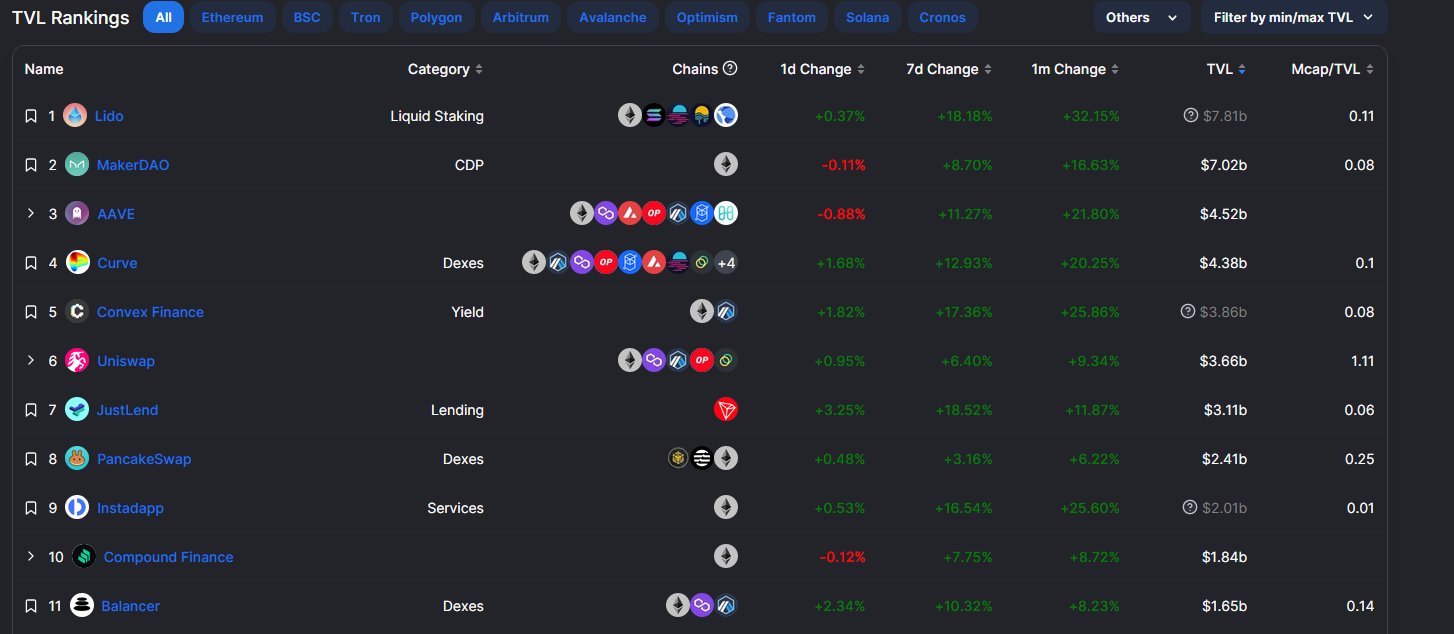

It's also clearly working for them, with almost 20 new partners Balancer has been on a tear, and growing in marketshare.

For the first time ever, they are close to cracking the top 10 by TVL in Defi

It's also clearly working for them, with almost 20 new partners Balancer has been on a tear, and growing in marketshare.

For the first time ever, they are close to cracking the top 10 by TVL in Defi

100/268

And they've retained a better hold of their TVL than most projects even during the crash, because it came from adding new partners and not just new users.

And they've retained a better hold of their TVL than most projects even during the crash, because it came from adding new partners and not just new users.

101/268

People will laugh when I suggest Balancer, because they themselves never use it.

But as I said last year, I think Balancer wins when you use it without knowing, because its such a core infrastructure piece.

People will laugh when I suggest Balancer, because they themselves never use it.

But as I said last year, I think Balancer wins when you use it without knowing, because its such a core infrastructure piece.

102/268

Balancer is a long play, a real slow burn that either becomes a core pillar of defi or fizzles out.

But right now, they are doing great at slowly chipping away at new partners and unique integrations, and so I continue to be a buyer.

Balancer is a long play, a real slow burn that either becomes a core pillar of defi or fizzles out.

But right now, they are doing great at slowly chipping away at new partners and unique integrations, and so I continue to be a buyer.

103/268

Click through to part 2:

Click through to part 2:

104/268

#10 - @cosmos $ATOM

Cosmos - the galactic wizard

Cosmos is a network of interconnected blockchains that make it easy to design custom interoperable implementations.

Buy on Sideshift: sideshift.ai/a/shifts

#10 - @cosmos $ATOM

Cosmos - the galactic wizard

Cosmos is a network of interconnected blockchains that make it easy to design custom interoperable implementations.

Buy on Sideshift: sideshift.ai/a/shifts

105/268

When it comes to other L1s, I'm pretty skeptical.

There is a high bar of novel that is needed to get me onboard with the idea, and it can't simply be a better, quicker, mouse trap.

It needs to bring a unique offering.

When it comes to other L1s, I'm pretty skeptical.

There is a high bar of novel that is needed to get me onboard with the idea, and it can't simply be a better, quicker, mouse trap.

It needs to bring a unique offering.

106/268

Cosmos does that through an easy modular SDK that allows anyone to build small custom blockchains, with interconnected standards around communication and tooling.

Cosmos does that through an easy modular SDK that allows anyone to build small custom blockchains, with interconnected standards around communication and tooling.

107/268

This means you can create a niche blockchain that is designed to be a dedicated AMM like Osmosis, or a bridge chain like Gravity Well, or hosting like Akash, and all these blockchains have standard ways to communicate and interact natively.

This means you can create a niche blockchain that is designed to be a dedicated AMM like Osmosis, or a bridge chain like Gravity Well, or hosting like Akash, and all these blockchains have standard ways to communicate and interact natively.

108/268

I personally think that the race for the monolithic blockchain that is going to act as the core settlement layer is over.

Ethereum won that race.

The next races are:

1) Who wins out on L2s

2) Who wins out on niche app chains

I personally think that the race for the monolithic blockchain that is going to act as the core settlement layer is over.

Ethereum won that race.

The next races are:

1) Who wins out on L2s

2) Who wins out on niche app chains

109/268

A lot of competitors in the appchain space (Avax, Polygon and BSC) are building appchains that are designed in standard ways, really they are better labelled as "microchains" than appchains, and Polkadot's Parachains had major early challenges that really hurt them

A lot of competitors in the appchain space (Avax, Polygon and BSC) are building appchains that are designed in standard ways, really they are better labelled as "microchains" than appchains, and Polkadot's Parachains had major early challenges that really hurt them

110/

Cosmos on the other hand focuses on building simple tooling, and standard ways to connect, but beyond that tries to keep components modular and not box in the creative power of builders.

That's really powerful.

Cosmos on the other hand focuses on building simple tooling, and standard ways to connect, but beyond that tries to keep components modular and not box in the creative power of builders.

That's really powerful.

111/268

Outside of Ethereum's ecosystem, we don't see a lot of innovation, we often see only incremental improvements.

But Cosmos is one of the few places where we do see exciting experiments and novel implementations popping up

Outside of Ethereum's ecosystem, we don't see a lot of innovation, we often see only incremental improvements.

But Cosmos is one of the few places where we do see exciting experiments and novel implementations popping up

112/268

So I think there is a good chance that it is one of the only places where we'll end up seeing any specific non-Ethereum winners popping up.

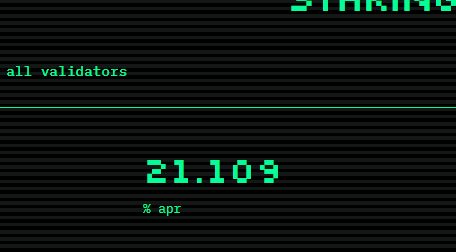

It's also an ecosystem that is ripe with staking opportunities.

So I think there is a good chance that it is one of the only places where we'll end up seeing any specific non-Ethereum winners popping up.

It's also an ecosystem that is ripe with staking opportunities.

113/268

In fact, if you're a staking provider who wants to drop into my DMs about whitelabel staking services, lets chat, because there are a lot of small Cosmos chains out there that I would happily stake for and share with others!

In fact, if you're a staking provider who wants to drop into my DMs about whitelabel staking services, lets chat, because there are a lot of small Cosmos chains out there that I would happily stake for and share with others!

114/268

#11 @thekeep3r $KP3R

Keeper the Keymaster

Keeper is important automation tooling that underpins a large portion of defi.

#11 @thekeep3r $KP3R

Keeper the Keymaster

Keeper is important automation tooling that underpins a large portion of defi.

115/268

I'm not going to lie, K3PR had a tough year.

Beyond just Andre disappearing into the sunset to go become a regulation maxi, and the challenges getting Fixed Forex rewards working again it was a rough time for the Keeper protocol.

I'm not going to lie, K3PR had a tough year.

Beyond just Andre disappearing into the sunset to go become a regulation maxi, and the challenges getting Fixed Forex rewards working again it was a rough time for the Keeper protocol.

116/268

That's part of why its a little lower on my list this year, but I still believe that its in the hands of talented builders and will continue to be core DAO infrastructure.

The main reason continuing to be that they are the only functioning at scale automation protocol.

That's part of why its a little lower on my list this year, but I still believe that its in the hands of talented builders and will continue to be core DAO infrastructure.

The main reason continuing to be that they are the only functioning at scale automation protocol.

117/268

Keepers automate smart contract calls, and basically act as a Cron Job for Solidity.

You can think of it as:

Keepers are to automation, as Chainlink Oracles are to pricing.

They are an underlying tool that anyone can permissionlessly integrate.

Keepers automate smart contract calls, and basically act as a Cron Job for Solidity.

You can think of it as:

Keepers are to automation, as Chainlink Oracles are to pricing.

They are an underlying tool that anyone can permissionlessly integrate.

118/268

In a smart contract, you simply outline a function that says under what conditions a Keeper should call another function, and what reward there is for doing so (if any)

When those conditions are met, a decentralized network of keepers will race to execute the function.

In a smart contract, you simply outline a function that says under what conditions a Keeper should call another function, and what reward there is for doing so (if any)

When those conditions are met, a decentralized network of keepers will race to execute the function.

119/268

Meaning a protocol doesn't need to rely on any centralized team, multisig, or EoA holder to execute commands on a smart contract.

This allows teams to scale their systems without scaling contract overhead.

Meaning a protocol doesn't need to rely on any centralized team, multisig, or EoA holder to execute commands on a smart contract.

This allows teams to scale their systems without scaling contract overhead.

120/268

For example, Yearn strategies (of which there are hundreds) need to call the `harvest()` function on a regular basis (sometimes daily) in order for vaults to have users constantly earning their rewards.

For example, Yearn strategies (of which there are hundreds) need to call the `harvest()` function on a regular basis (sometimes daily) in order for vaults to have users constantly earning their rewards.

121/268

Rather than rely on permissioned signers having to log in each day, most Yearn strategies outline time and profitability thresholds for a Keeper to trigger the harvest reward for them, allowing vaults to run in an automated fashion.

Rather than rely on permissioned signers having to log in each day, most Yearn strategies outline time and profitability thresholds for a Keeper to trigger the harvest reward for them, allowing vaults to run in an automated fashion.

122/268

As you can tell, that's absolutely critical infrastructure for decentralization.

My hunch is this cycle, we're going to see a lot of older defi teams flame out, and their apps will grind to a halt because there isn't anyone running regular functions anymore.

As you can tell, that's absolutely critical infrastructure for decentralization.

My hunch is this cycle, we're going to see a lot of older defi teams flame out, and their apps will grind to a halt because there isn't anyone running regular functions anymore.

123/268

With decentralized Keepers, Yearn vaults would continue to run even if all the Yearn contributors disappeared tomorrow, as long as the vaults remained profitable, Keepers would keep calling the harvest function and distributing rewards.

With decentralized Keepers, Yearn vaults would continue to run even if all the Yearn contributors disappeared tomorrow, as long as the vaults remained profitable, Keepers would keep calling the harvest function and distributing rewards.

124/268

Keeper isn't flashy, and it's not something that 99% of participants in the ecosystem have ever thought about having to deal with.

But as we continue to build more advanced crosschain products and improving decentralization it has a key roll to play.

Keeper isn't flashy, and it's not something that 99% of participants in the ecosystem have ever thought about having to deal with.

But as we continue to build more advanced crosschain products and improving decentralization it has a key roll to play.

125/268

Others like Chainlink and OZ Defender have their own automation tooling - but so far nothing has the adoption and the breadth of decentralized participants that the Keeper network has, and so I continue to think this will be a long term winner.

Others like Chainlink and OZ Defender have their own automation tooling - but so far nothing has the adoption and the breadth of decentralized participants that the Keeper network has, and so I continue to think this will be a long term winner.

126/268

#12 @agoric $BLD -

Agoric, the hardened cube.

Agoric is a Cosmos based chain that implements unique design patterns for security and accessibility.

#12 @agoric $BLD -

Agoric, the hardened cube.

Agoric is a Cosmos based chain that implements unique design patterns for security and accessibility.

127/268

Unlike most protocols in the space, that rely on smart contracts taking custody of your assets, Agoric is built from the ground up so that users can interact with DeFi while keeping assets in their own wallet.

Unlike most protocols in the space, that rely on smart contracts taking custody of your assets, Agoric is built from the ground up so that users can interact with DeFi while keeping assets in their own wallet.

128/268

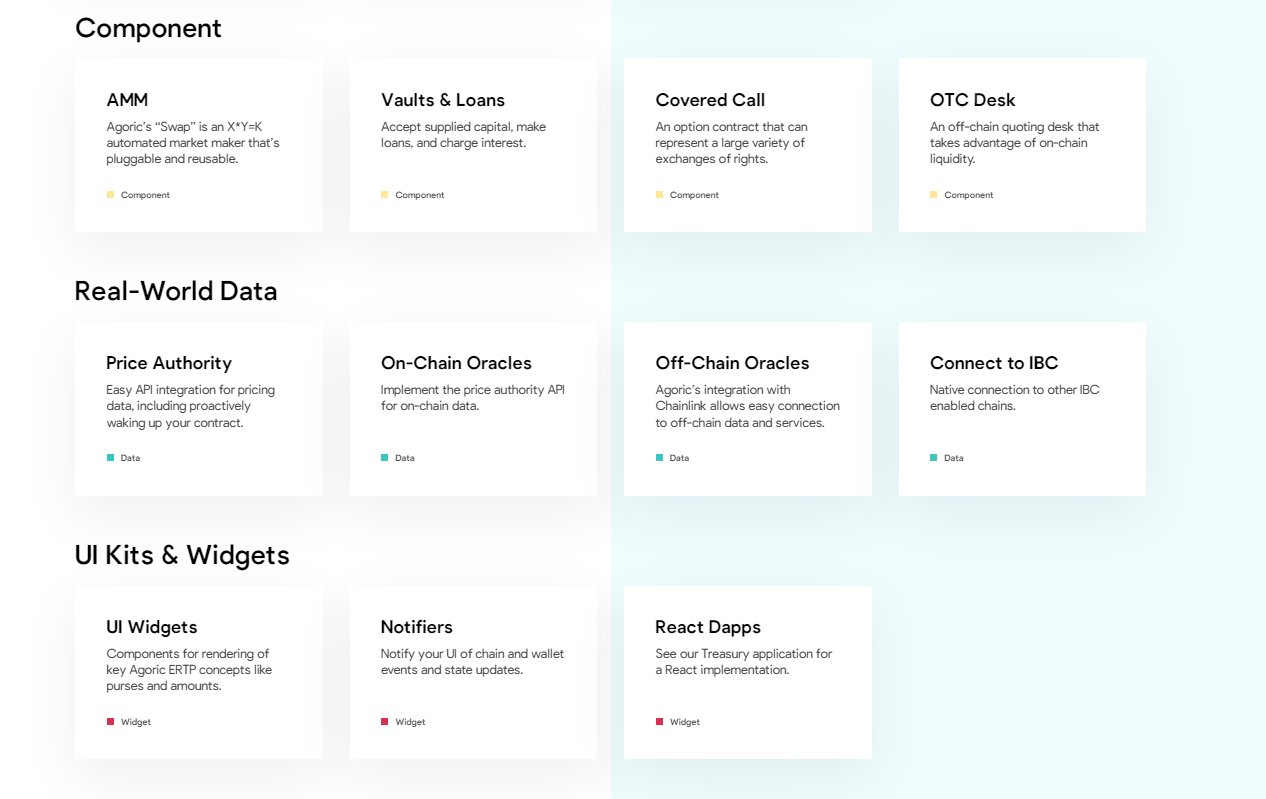

Instead of running Solidity, it runs on its own strictly defined implementation of 'hardened javascript' with design patterns specifically made for defi, and it maintains a compatible library of compossible professionally designed code.

Instead of running Solidity, it runs on its own strictly defined implementation of 'hardened javascript' with design patterns specifically made for defi, and it maintains a compatible library of compossible professionally designed code.

129/268

Their prebuilt library of components have the core tools that builders need to dive in and build quickly and securely, and help it to create unique design patterns surrounding connectivity.

Their prebuilt library of components have the core tools that builders need to dive in and build quickly and securely, and help it to create unique design patterns surrounding connectivity.

130/268

I'll be setting up a validator for Agoric shortly, so if you're interested in delegating to a validator that has a low fee make sure to sign up on my newsletter. Right now, staking yields a 12% APY that doesn't factor in upward price potential adamscochran.substack.com/

I'll be setting up a validator for Agoric shortly, so if you're interested in delegating to a validator that has a low fee make sure to sign up on my newsletter. Right now, staking yields a 12% APY that doesn't factor in upward price potential adamscochran.substack.com/

131/268

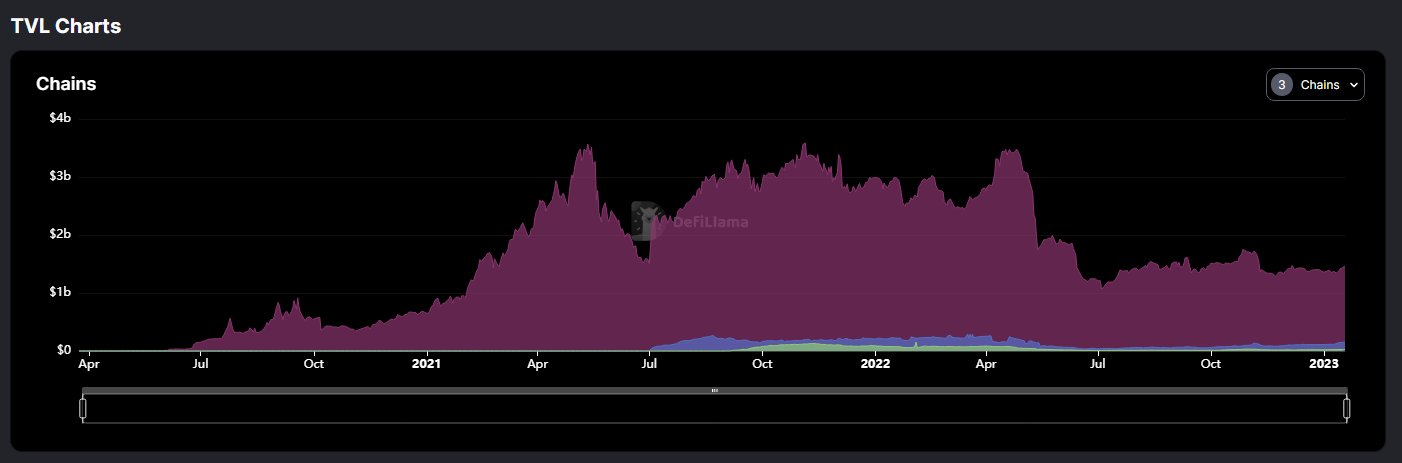

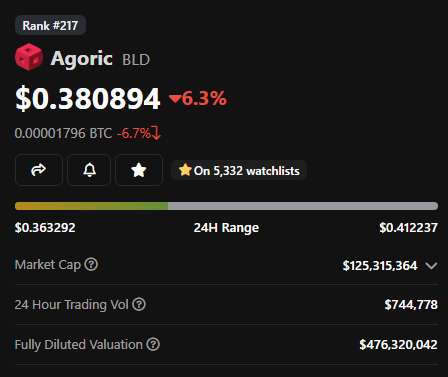

Agoric currently sits at a marketcap of $125M (FDV of $476M)

Compare that to something like NEAR which has almost no usage and sits just shy of a $2B marketcap.

Agoric has a lot of room to run, and could be a unique and competitive L1 offering.

Agoric currently sits at a marketcap of $125M (FDV of $476M)

Compare that to something like NEAR which has almost no usage and sits just shy of a $2B marketcap.

Agoric has a lot of room to run, and could be a unique and competitive L1 offering.

132/268

#13 - @zcash $ZEC

ZCash: The hidden hand

The most secure privacy coin, shifting to become a platform.

Buy on Sideshift: sideshift.ai/a/shifts

#13 - @zcash $ZEC

ZCash: The hidden hand

The most secure privacy coin, shifting to become a platform.

Buy on Sideshift: sideshift.ai/a/shifts

133/268

In the past, ZCash took a lot of flack due to people confusing transparent addresses and shielded addresses, considering them privacy optional.

As the protocol migrates to unified addresses with shielding by default wallets, this helps to overcome this UX challenge.

In the past, ZCash took a lot of flack due to people confusing transparent addresses and shielded addresses, considering them privacy optional.

As the protocol migrates to unified addresses with shielding by default wallets, this helps to overcome this UX challenge.

134/268

ZCash has also taken a beating due to:

A) Being a Barry coin

B) Having high ongoing mining rewards

C) Being a standalone coin and not a platform

And, all of these things are about to change.

ZCash has also taken a beating due to:

A) Being a Barry coin

B) Having high ongoing mining rewards

C) Being a standalone coin and not a platform

And, all of these things are about to change.

135/268

ZCash is moving to proof-of-stake, just like Ethereum did, and while the timelines are still moving targets my guess is that sometime late this year/early next is when this move will take place and dramatically change the supply demand for Zcash.

ZCash is moving to proof-of-stake, just like Ethereum did, and while the timelines are still moving targets my guess is that sometime late this year/early next is when this move will take place and dramatically change the supply demand for Zcash.

136/268

ZCash's community is also deep in explorations about letting other tokens issue on the ZCash platform and using ZEC as gas.

Once users are able to migrate tokens to Zcash this quickly unlocks new defi opportunities.

ZCash's community is also deep in explorations about letting other tokens issue on the ZCash platform and using ZEC as gas.

Once users are able to migrate tokens to Zcash this quickly unlocks new defi opportunities.

137/268

While the Ethereum community is racing to perfect zero-knowledge proofs for L2s, its something that the Zcash community has been working on since day one.

Their current transfer proof is so light weight that it can be run on a phone in seconds.

While the Ethereum community is racing to perfect zero-knowledge proofs for L2s, its something that the Zcash community has been working on since day one.

Their current transfer proof is so light weight that it can be run on a phone in seconds.

138/268

Compare that to something like Polygon's zkEVM which currently needs a prover with 1TB of RAM and 128 CPU cores.

It's an entirely different ballgame.

Compare that to something like Polygon's zkEVM which currently needs a prover with 1TB of RAM and 128 CPU cores.

It's an entirely different ballgame.

139/268

Now while Zcash doesn't have a full Turing complete system, it does have proofs, signatures and a memo field - and that's actually more than enough to build defi.

After all "Omni" ran on Bitcoin using less than 512 bytes of design space.

Now while Zcash doesn't have a full Turing complete system, it does have proofs, signatures and a memo field - and that's actually more than enough to build defi.

After all "Omni" ran on Bitcoin using less than 512 bytes of design space.

140/268

My hunch, is that once we see the ability to track balances, we'll see clever ZK circuits designed that leverage the ZCash memo space to allow lightweight basic defi like swapping, staking and vesting - allowing for fast, private transactions on mobile devices.

My hunch, is that once we see the ability to track balances, we'll see clever ZK circuits designed that leverage the ZCash memo space to allow lightweight basic defi like swapping, staking and vesting - allowing for fast, private transactions on mobile devices.

141/268

As we start to look at decentralized L2s, the reality is that there will either be robust centralized provers, or provers as a service that leave out the bulk of the population from being able to partake in that part of the validation process.

As we start to look at decentralized L2s, the reality is that there will either be robust centralized provers, or provers as a service that leave out the bulk of the population from being able to partake in that part of the validation process.

142/268

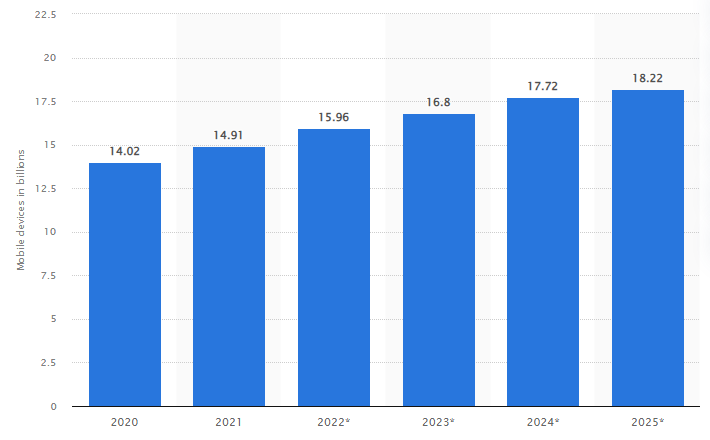

By 2025, it's estimated that mobile devices (phones, ipads, smart watches, etc) will outnumber people more than 2.5:1 - someone is going to be the winner of mobile crypto.

I think ZEC's fast payments that can be done offline with proofs & support defi have a chance

By 2025, it's estimated that mobile devices (phones, ipads, smart watches, etc) will outnumber people more than 2.5:1 - someone is going to be the winner of mobile crypto.

I think ZEC's fast payments that can be done offline with proofs & support defi have a chance

143/268

Imagine being able to transfer and trade, no matter where you are in the world, even with limited connectivity, on simple low end devices, in a matter of seconds, and doing so all privately.

Imagine being able to transfer and trade, no matter where you are in the world, even with limited connectivity, on simple low end devices, in a matter of seconds, and doing so all privately.

144/268

That's the dream that a lot of crypto has been pursuing and ZCash is on a pretty clear path to being able to make it happen.

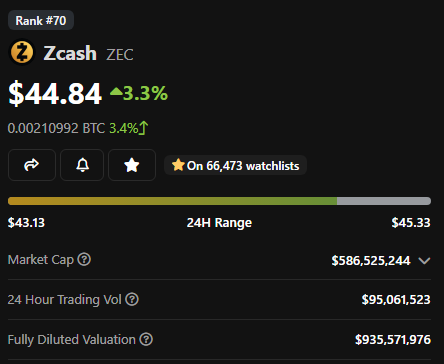

While sitting at a marketcap of only $586M (FDV $935M)

That's the dream that a lot of crypto has been pursuing and ZCash is on a pretty clear path to being able to make it happen.

While sitting at a marketcap of only $586M (FDV $935M)

145/268

Compare that to the largest privacy coin Monero sitting at $3.1B and there is an easy 6x in marketshare potential, even if the markets didn't rise.

And Monero isn't e platform either. So factoring in L1 value there is an even higher potential.

Compare that to the largest privacy coin Monero sitting at $3.1B and there is an easy 6x in marketshare potential, even if the markets didn't rise.

And Monero isn't e platform either. So factoring in L1 value there is an even higher potential.

146/268

#14 @AlchemixFi - $ALCX

Alchemist: The Transmuter

Alchemix broke the mold with designing the first self-repaying loans.

#14 @AlchemixFi - $ALCX

Alchemist: The Transmuter

Alchemix broke the mold with designing the first self-repaying loans.

147/268

But, then markets tanked, yields tanked, and loans would take forever to repay, and they were kind of stuck.

But, Alchemix has done a great job in redesigning a V2 that has gained decent traction even in a bear market.

But, then markets tanked, yields tanked, and loans would take forever to repay, and they were kind of stuck.

But, Alchemix has done a great job in redesigning a V2 that has gained decent traction even in a bear market.

148/268

Their V2 now allows you to take on self-repaying, non-liquidating loans against up to 50% of your collateral.

Meaning if I had $100k of ETH, I could borrow $50k of ETH without ever worrying about liquidation.

Their V2 now allows you to take on self-repaying, non-liquidating loans against up to 50% of your collateral.

Meaning if I had $100k of ETH, I could borrow $50k of ETH without ever worrying about liquidation.

149/268

That's made possible as the underlying collateral is staked into a vault that earns yield, and the yield is automatically used over time to pay down my debt.

Being dependent on external yield in a bear market sucks - it really hamstringed their growth potential.

That's made possible as the underlying collateral is staked into a vault that earns yield, and the yield is automatically used over time to pay down my debt.

Being dependent on external yield in a bear market sucks - it really hamstringed their growth potential.

150/268

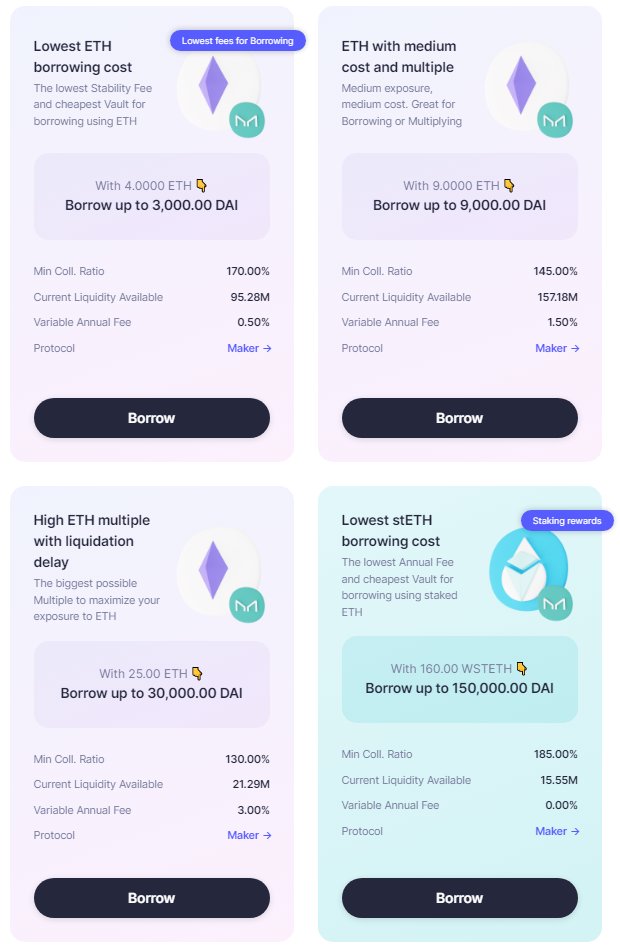

But as markets (maybe) begin to see a slight light of day again, there is a huge potential for Alchemix to capture marketshare.

Imagine you're long term bullish ETH, but in a high volatility environment, does it make sense to borrow from Maker?

But as markets (maybe) begin to see a slight light of day again, there is a huge potential for Alchemix to capture marketshare.

Imagine you're long term bullish ETH, but in a high volatility environment, does it make sense to borrow from Maker?

151/268

No really, because in a large wick environment you could be easily liquidated on your entire position.

But on Alchemix you won't be liquidated if the market goes down, it would just take longer to get your principal back.

No really, because in a large wick environment you could be easily liquidated on your entire position.

But on Alchemix you won't be liquidated if the market goes down, it would just take longer to get your principal back.

152/268

This means Alchemix lets me take on up to 50% loan to value with minimal risk.

And, as the value of my collateral rises, and APYs from vault strategies rise again, my loan pays off more quickly.

This means Alchemix lets me take on up to 50% loan to value with minimal risk.

And, as the value of my collateral rises, and APYs from vault strategies rise again, my loan pays off more quickly.

153/268

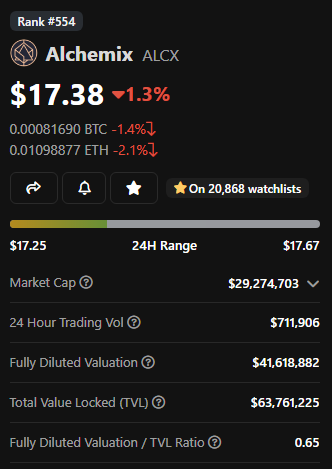

And at a marketcap of only $30M (FDV of $40M) it has a TVL of more than 3x its mcap even in a bear market.

My hunch, is that while general users use self-repaying loans in a bull market, smart buyers use it in a bear to pick up discounted assets.

And at a marketcap of only $30M (FDV of $40M) it has a TVL of more than 3x its mcap even in a bear market.

My hunch, is that while general users use self-repaying loans in a bull market, smart buyers use it in a bear to pick up discounted assets.

154/268

I think as APY vault rates continue to recover, Alchemix expands onto other chains, and integrates continued new strategies, that there is a really strong potential for this team long term.

Especially if the expand the number of assets they cover.

I think as APY vault rates continue to recover, Alchemix expands onto other chains, and integrates continued new strategies, that there is a really strong potential for this team long term.

Especially if the expand the number of assets they cover.

155/268

I can see a future where they've got deployments on each chain, offering an easy way to take a leveraged borrow against the native asset on that chain.

alOP, alARB, alMATIC, etc.

I can see a future where they've got deployments on each chain, offering an easy way to take a leveraged borrow against the native asset on that chain.

alOP, alARB, alMATIC, etc.

156/268

Alchemix isn't a sure thing, they are really at the whim of the market APY rates, and the team really needs to expand their footprint to capture the large amount of locked up capital that exists.

But if they can, I can see potential for a 20x+ here long term.

Alchemix isn't a sure thing, they are really at the whim of the market APY rates, and the team really needs to expand their footprint to capture the large amount of locked up capital that exists.

But if they can, I can see potential for a 20x+ here long term.

157/268

This is one of those cases where I'm really getting into the high risk:reward setups.

There is a good chance that Alchemix doesn't gain more ground and just continues where its at, because it will take a lot of effort to pull itself back up.

This is one of those cases where I'm really getting into the high risk:reward setups.

There is a good chance that Alchemix doesn't gain more ground and just continues where its at, because it will take a lot of effort to pull itself back up.

158/268

But what is irrefutable is that Alchemix is uniquely positioned to offer a novel value proposition and rapidly scale it to access locked up capital on multiple chains.

But what is irrefutable is that Alchemix is uniquely positioned to offer a novel value proposition and rapidly scale it to access locked up capital on multiple chains.

160/268

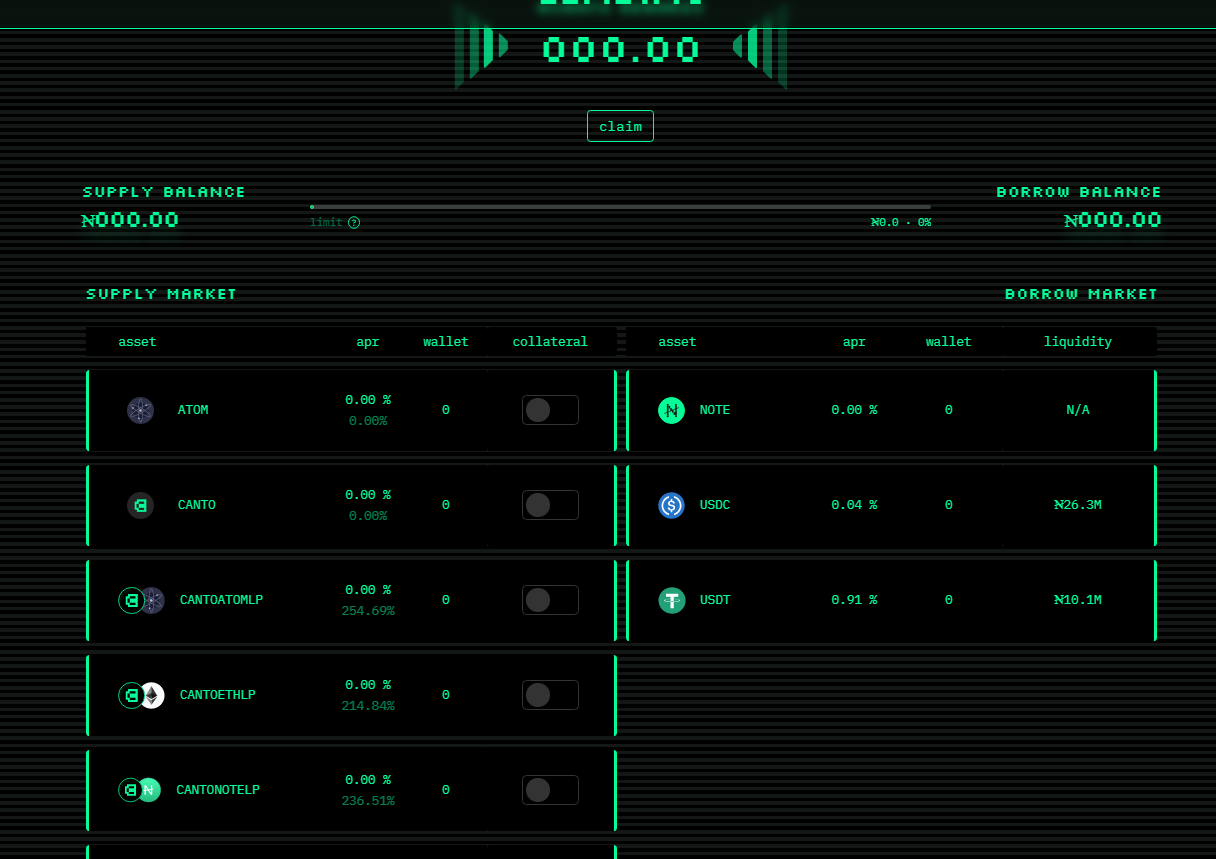

Canto is a Cosmos based EVM chain that is taking a radical design approach to public goods.

Canto aims to replace fee extracting infrastructure with designs that help reward decentralized public goods.

Such as having its own built in native lending protocol and AMM

Canto is a Cosmos based EVM chain that is taking a radical design approach to public goods.

Canto aims to replace fee extracting infrastructure with designs that help reward decentralized public goods.

Such as having its own built in native lending protocol and AMM

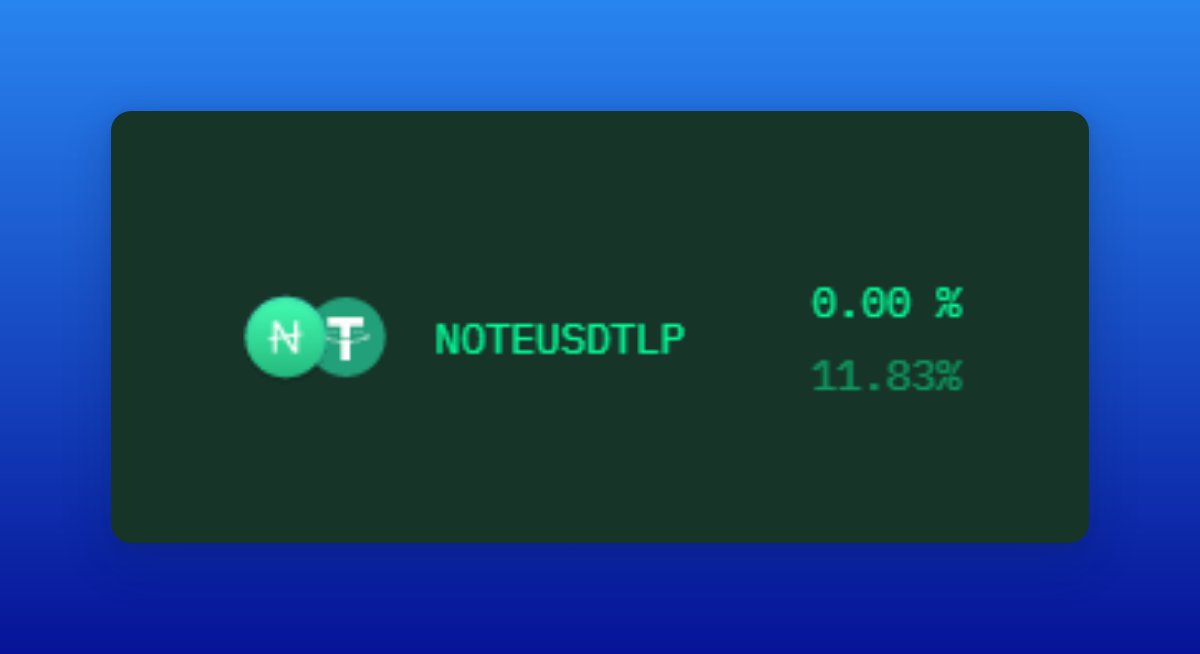

161/268

These built in systems take no fees other than those used for the base incentives for LPs.

It also has its own native stablecoin ($NOTE) which is built into the lending market and managed via rate control.

These built in systems take no fees other than those used for the base incentives for LPs.

It also has its own native stablecoin ($NOTE) which is built into the lending market and managed via rate control.

162/268

But the real unique design principle that I think will have Canto be a success is its model around fee rewards.

In future releases, when you deploy a smart contract, that contract will have a unique NFT attached to it.

But the real unique design principle that I think will have Canto be a success is its model around fee rewards.

In future releases, when you deploy a smart contract, that contract will have a unique NFT attached to it.

163/268

That NFT will receive a portion of all the $CANTO used in gas rewards associated with your contract.

This means protocols will get monetized based on their volume usage rather than having a set fee model.

That NFT will receive a portion of all the $CANTO used in gas rewards associated with your contract.

This means protocols will get monetized based on their volume usage rather than having a set fee model.

164/268

This encourages developers to design protocols and systems that benefit the public good, rather than just ones that can extract the most in fees.

This encourages developers to design protocols and systems that benefit the public good, rather than just ones that can extract the most in fees.

165/268

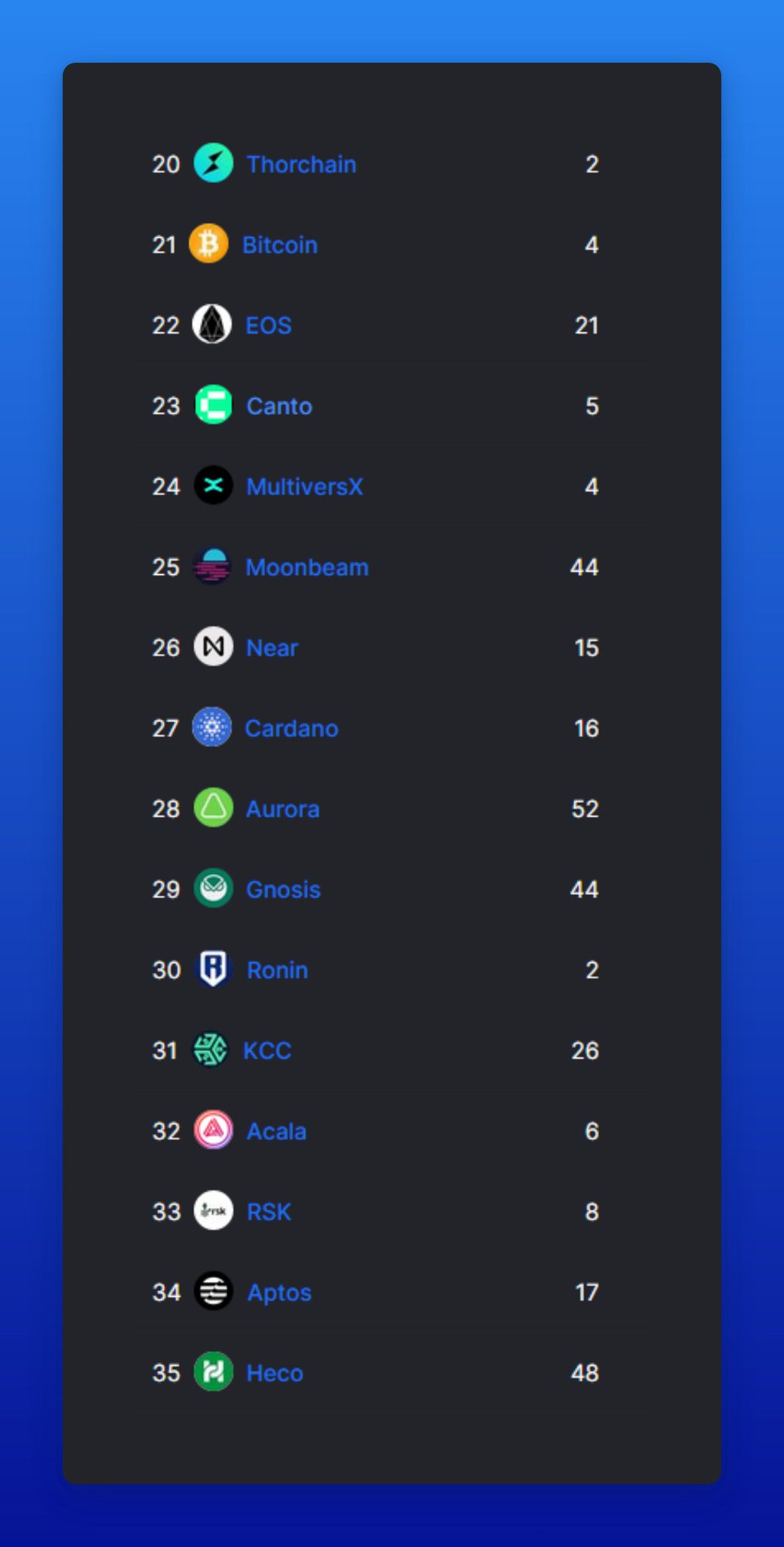

It's a major reimagining of the system but it seems to be working, as right now $CANTO has more TVL than many other much larger chains, far ahead of Near, Cardano, Gnosis and Aptos, all of which are multi-billion dollar marketcaps.

It's a major reimagining of the system but it seems to be working, as right now $CANTO has more TVL than many other much larger chains, far ahead of Near, Cardano, Gnosis and Aptos, all of which are multi-billion dollar marketcaps.

166/268

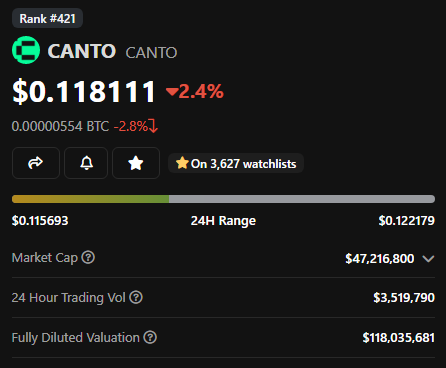

Meanwhile the Canto marketcap clocks in at $47M (FDV of $118M)

Which means even if it had the marketcap of it's closest competitor Near at $1.8B, then you're looking at a 40x

At Cardano price levels, that'd be a 261x.

Meanwhile the Canto marketcap clocks in at $47M (FDV of $118M)

Which means even if it had the marketcap of it's closest competitor Near at $1.8B, then you're looking at a 40x

At Cardano price levels, that'd be a 261x.

167/268

Building a new L1 is hard.

Keeping users engaged with a diversity of new protocols is hard (especially if those protocols compete against no-fee built in protocols)

Canto will need to heavily rely on its gas rewards program to keep this momentum.

Building a new L1 is hard.

Keeping users engaged with a diversity of new protocols is hard (especially if those protocols compete against no-fee built in protocols)

Canto will need to heavily rely on its gas rewards program to keep this momentum.

168/268

You'll lose out on different AMMs competing heavily for marketshare for example, due to a native one being built in.