Thread by Miles Deutscher

- Tweet

- Jan 22, 2023

- #Business #Cryptocurrency

Thread

Many of next cycle's top performers haven't been released yet.

These projects have potential to 50-100x next bull run.

The next $SOL or $MATIC could be sitting right in front of you.

🧵: Here are the top 13 unreleased projects I'm most looking forward to. 👇

These projects have potential to 50-100x next bull run.

The next $SOL or $MATIC could be sitting right in front of you.

🧵: Here are the top 13 unreleased projects I'm most looking forward to. 👇

In this thread, I'll break down my favourite unreleased layer 1s, layer 2s, interoperability protocols and dApps that I've got my eye on for next cycle.

At the end, I'll give you 4 steps to take advantage, as none of these projects have tokens *yet*.

Let's dive in!

At the end, I'll give you 4 steps to take advantage, as none of these projects have tokens *yet*.

Let's dive in!

-- LAYER 1s --

1. @SuiNetwork

Sui is a high performance L1 which uses the Move programming language.

It was founded by former FaceBook engineers, who worked on the now defunct Diem project.

Here's all you need to know:

1. @SuiNetwork

Sui is a high performance L1 which uses the Move programming language.

It was founded by former FaceBook engineers, who worked on the now defunct Diem project.

Here's all you need to know:

Some view it as superior to its relative, Aptos - which also uses Move.

Move's benefits (memory, speed of testing, expressiveness) vs other languages like Solidity make it a compelling proposition.

Sui's high throughput + low latency are its major selling points.

Move's benefits (memory, speed of testing, expressiveness) vs other languages like Solidity make it a compelling proposition.

Sui's high throughput + low latency are its major selling points.

2. @SeiNetwork

Sei is built on Cosmos, and is the first sector-specific L1 blockchain, specialised for trading to "give exchanges an unfair advantage".

It is the first order-book-focused L1 blockchain, designed to be faster and more reliable than other types of blockchains.

Sei is built on Cosmos, and is the first sector-specific L1 blockchain, specialised for trading to "give exchanges an unfair advantage".

It is the first order-book-focused L1 blockchain, designed to be faster and more reliable than other types of blockchains.

The blockchain is built upon 5 key pillars.

1. Native order matching engine

2. Twin-turbo consensus (improves throughput and latency)

3. Breaking Tendermint (time-to-finality of ~600ms)

4. Market-based parallelisation

5. Frontrunning protection

1. Native order matching engine

2. Twin-turbo consensus (improves throughput and latency)

3. Breaking Tendermint (time-to-finality of ~600ms)

4. Market-based parallelisation

5. Frontrunning protection

Sei's goal is to become the "Decentralised Nasdaq" by allowing smart contracts to access shared liquidity.

In my opinion, its unique approach to addressing a specific use case makes it an exciting project to watch.

In my opinion, its unique approach to addressing a specific use case makes it an exciting project to watch.

3. @CelestiaOrg

Celestia is a modular network, enabling anyone to easily deploy their own blockchain with minimal overhead.

@ThorHartvigsen wrote a great thread explaining how modular blockchains work, and why they're exciting.

Celestia is a modular network, enabling anyone to easily deploy their own blockchain with minimal overhead.

@ThorHartvigsen wrote a great thread explaining how modular blockchains work, and why they're exciting.

Celestia's modular approach allows it to:

• Offer both consensus and data availability

• Enable the use of sovereign rollups

This thread does a great job of breaking down why Celestia is one of crypto's most promising recent innovations. 👇

• Offer both consensus and data availability

• Enable the use of sovereign rollups

This thread does a great job of breaking down why Celestia is one of crypto's most promising recent innovations. 👇

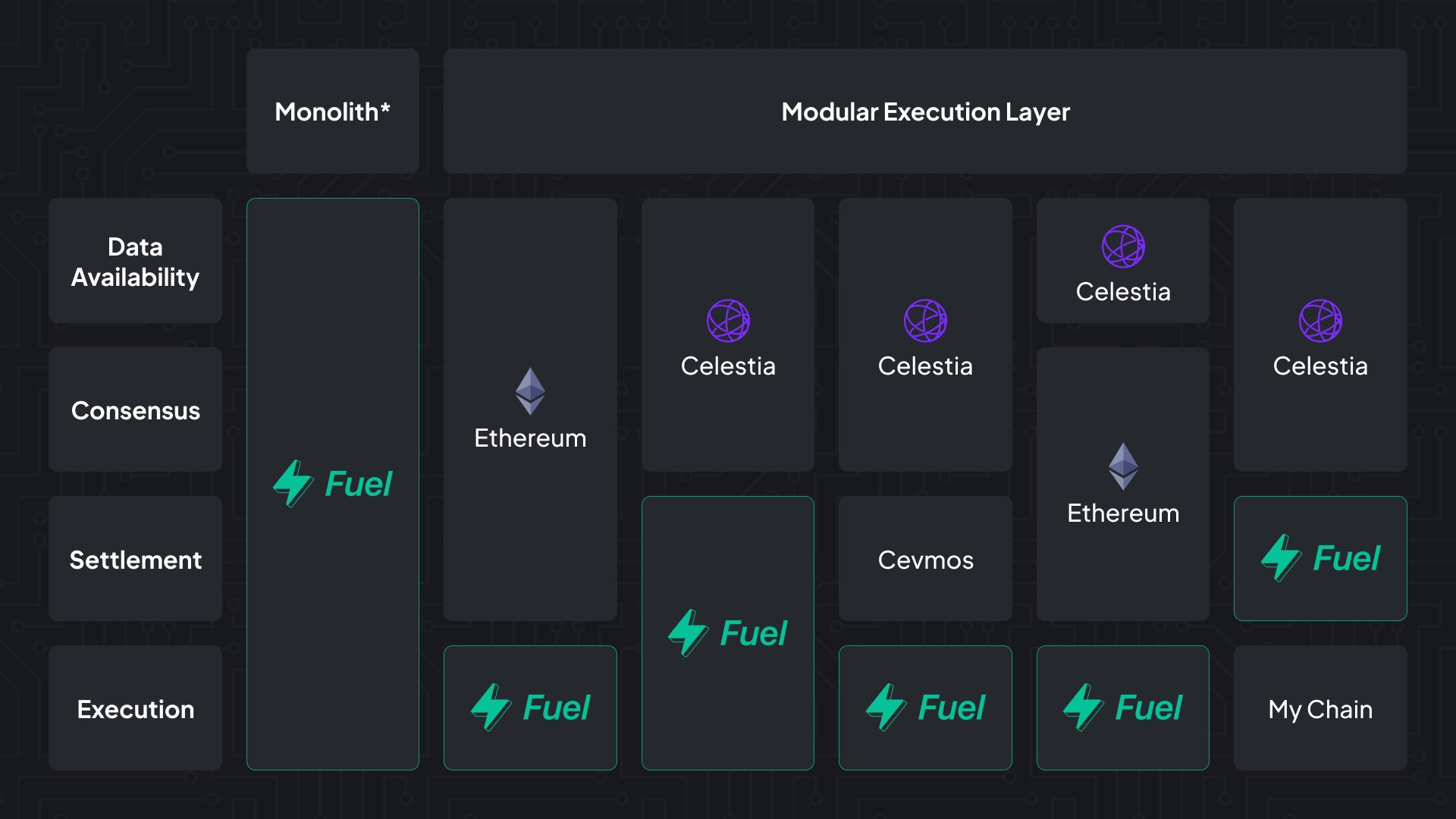

4. @fuellabs_ (Fuel).

Fuel Labs is building Fuel, the "world's fastest modular execution layer".

Modularism allows execution layers to leverage Ethereum’s security without being restricted by the limitations of the EVM.

Transactions execute on FuelVM, their virtual machine.

Fuel Labs is building Fuel, the "world's fastest modular execution layer".

Modularism allows execution layers to leverage Ethereum’s security without being restricted by the limitations of the EVM.

Transactions execute on FuelVM, their virtual machine.

Fuel can be implemented in tandem with Ethereum and Celestia.

As stated in their white paper: "As a Modular Execution Layer, Fuel can function in any one of these categories. Developers can configure Fuel as needed by switching out a few modules in the client."

As stated in their white paper: "As a Modular Execution Layer, Fuel can function in any one of these categories. Developers can configure Fuel as needed by switching out a few modules in the client."

5. @QuaiNetwork

Quai Network is a Layer 1 network of blockchains, which utilises a novel combination of merged mining and sharding.

It's a Proof-of-Work network of chains organised in a hierarchical, “pyramid" structure.

Quai Network is a Layer 1 network of blockchains, which utilises a novel combination of merged mining and sharding.

It's a Proof-of-Work network of chains organised in a hierarchical, “pyramid" structure.

A major benefit of Quai is the ease of bridging between chains.

This is due to its merge mined structure allowing cross-chain contracts and asset transfers.

It has 5 Testnets launching in the lead up to Mainnet (thus an airdrop is likely), as well as many adoption incentives.

This is due to its merge mined structure allowing cross-chain contracts and asset transfers.

It has 5 Testnets launching in the lead up to Mainnet (thus an airdrop is likely), as well as many adoption incentives.

-- LAYER 2s --

1. @zksync by @the_matter_labs

It's clear that ZK is the future of scaling Ethereum, and @zksync is at the forefront of this innovation.

Their full Mainnet hasn't even launched yet, but the ecosystem is already vast.

1. @zksync by @the_matter_labs

It's clear that ZK is the future of scaling Ethereum, and @zksync is at the forefront of this innovation.

Their full Mainnet hasn't even launched yet, but the ecosystem is already vast.

zkSync solves 3 of Ethereum's key problems, by offering:

• Much lower gas fees

• Enhanced scalability

• UX-first wallets and dApps powered by zkSync

Listen to what @hosseeb, Managing Parter at @dragonfly_xyz had to say about the ZK rollup space.

• Much lower gas fees

• Enhanced scalability

• UX-first wallets and dApps powered by zkSync

Listen to what @hosseeb, Managing Parter at @dragonfly_xyz had to say about the ZK rollup space.

2. @StarkWareLtd

StarkWare is an L2 scaling solution which utilises STARK proofs to reduce the amount of information sent to the Ethereum blockchain and alleviate blockchain congestion.

SnarkNet, like zkSync, utilises ZK-Rollup technology to achieve this.

StarkWare is an L2 scaling solution which utilises STARK proofs to reduce the amount of information sent to the Ethereum blockchain and alleviate blockchain congestion.

SnarkNet, like zkSync, utilises ZK-Rollup technology to achieve this.

3. @arbitrum

Arbitrum has seen huge growth in recent months, reaching over $1b in TVL.

Like Optimism, Arbitrum is an Optimistic rollup.

Their token is coming soon and is one of the most anticipated token releases in crypto.

Arbitrum has seen huge growth in recent months, reaching over $1b in TVL.

Like Optimism, Arbitrum is an Optimistic rollup.

Their token is coming soon and is one of the most anticipated token releases in crypto.

4. Hermez by @0xPolygon

Polygon recently acquired Hermez, a ZK rollup scaling solution.

They're merging the networks ahead of Polygon's zkEVM Mainnet launch.

The $MATIC token will be the primary beneficiary.

You can read my full $MATIC deep dive here:

Polygon recently acquired Hermez, a ZK rollup scaling solution.

They're merging the networks ahead of Polygon's zkEVM Mainnet launch.

The $MATIC token will be the primary beneficiary.

You can read my full $MATIC deep dive here:

-- INTEROPERABILITY --

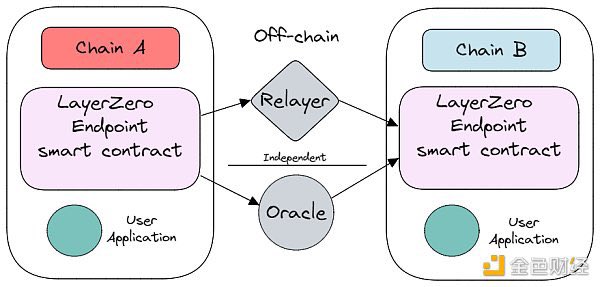

1. @LayerZero_Labs

LayerZero is an interoperability protocol designed to connect multiple chains.

This allows it to:

• Seamlessly bridge assets across multiple chains

• Achieve cross-chain composability and functionality

1. @LayerZero_Labs

LayerZero is an interoperability protocol designed to connect multiple chains.

This allows it to:

• Seamlessly bridge assets across multiple chains

• Achieve cross-chain composability and functionality

To do so, it uses the oracle and the relayer to transfer messages from Chain A to Chain B.

This is opposed to using a singular “middle” network to relay messages (less secure).

This is opposed to using a singular “middle” network to relay messages (less secure).

Think of it as the ultimate interoperability layer (a narrative which I'm quite bullish on).

The LayerZero token (rumoured to be $ZRO) is likely to launch sometime in the near future.

The LayerZero token (rumoured to be $ZRO) is likely to launch sometime in the near future.

2. @zetablockchain

ZetaChain is an L1 built for omnichain interoperability.

It enables omnichain, generic smart contracts and messaging between ANY blockchain.

ZetaChain is an L1 built for omnichain interoperability.

It enables omnichain, generic smart contracts and messaging between ANY blockchain.

Developers of existing dApps can tweak the codebase to create new omnichain DeFi products.

"Zetachain makes multichain dApps as simple as single-chain dApps."

Their Mainnet is slated to launch soon, following a successful Testnet rollout.

"Zetachain makes multichain dApps as simple as single-chain dApps."

Their Mainnet is slated to launch soon, following a successful Testnet rollout.

-- OTHER --

1. @QuadrataNetwork

Quadrata allows you to KYC on chain without publicly revealing your identity.

There's a gap in the market for effective on chain identification, and Quadrata's passport may be a much needed solution.

1. @QuadrataNetwork

Quadrata allows you to KYC on chain without publicly revealing your identity.

There's a gap in the market for effective on chain identification, and Quadrata's passport may be a much needed solution.

2. @DriftProtocol

Drift is a perpetual DEX built on Solana, which uses a Hybrid Decentralised Limit Orderbook model.

I'm always on the look out for exciting new DEXs.

They have confirmed that they will be releasing a token soon.

Drift is a perpetual DEX built on Solana, which uses a Hybrid Decentralised Limit Orderbook model.

I'm always on the look out for exciting new DEXs.

They have confirmed that they will be releasing a token soon.

-- HOW TO GET INVOLVED --

As these projects don't have tokens yet, you can't buy them on the open market.

You're early. Which is a good thing.

Here are some of the ways you can get involved (the best approach depends on the individual project). 👇

As these projects don't have tokens yet, you can't buy them on the open market.

You're early. Which is a good thing.

Here are some of the ways you can get involved (the best approach depends on the individual project). 👇

1. Airdrops.

Some projects will airdrop tokens upon launch, as we saw with $APT, $OP, $UNI etc.

This typically involves Testnet participation and ecosystem interaction.

Make sure to follow me @milesdeutscher as I'll release full airdrop guides when there's a new opportunity!

Some projects will airdrop tokens upon launch, as we saw with $APT, $OP, $UNI etc.

This typically involves Testnet participation and ecosystem interaction.

Make sure to follow me @milesdeutscher as I'll release full airdrop guides when there's a new opportunity!

2. Invest in the ecosystem/related protocols.

Projects never move in isolation. There are always related protocols that are indirect beneficiaries of a certain narrative succeeding.

These projects could be in the SAME ecosystem, or related ecosystems under a similar niche.

Projects never move in isolation. There are always related protocols that are indirect beneficiaries of a certain narrative succeeding.

These projects could be in the SAME ecosystem, or related ecosystems under a similar niche.

3. Invest in the ICO.

Usually presale rounds are reserved for VCs, funds, strategic partners, friends etc.

But some tokens DO have a public round or will giveaway tokens.

If you like an upcoming project, make sure you're following them and join the Discord to stay updated.

Usually presale rounds are reserved for VCs, funds, strategic partners, friends etc.

But some tokens DO have a public round or will giveaway tokens.

If you like an upcoming project, make sure you're following them and join the Discord to stay updated.

4. Trade the token after it launches.

This is the most obvious approach.

But before investing, make sure to:

• Extensively research the project's tokenomics.

• Don't ape in on day 1 (let price settle).

• Consider the valuation (a good project doesn't always = a good buy).

This is the most obvious approach.

But before investing, make sure to:

• Extensively research the project's tokenomics.

• Don't ape in on day 1 (let price settle).

• Consider the valuation (a good project doesn't always = a good buy).

As these projects approach launch, I'll keep you updated on the best way to gain exposure.

So make sure you're following me @milesdeutscher to stay in the loop!

Also like/retweet the 1st tweet below if you enjoyed this thread. 💙

So make sure you're following me @milesdeutscher to stay in the loop!

Also like/retweet the 1st tweet below if you enjoyed this thread. 💙

Mentions

See All

Raoul Pal @RaoulPal

·

Jan 22, 2023

Great thread. Thanks.