Thread

1/ The Future of Payments…is Red?

What could disrupt Visa/MasterCard/Amex? How might a new payments Goliath start?

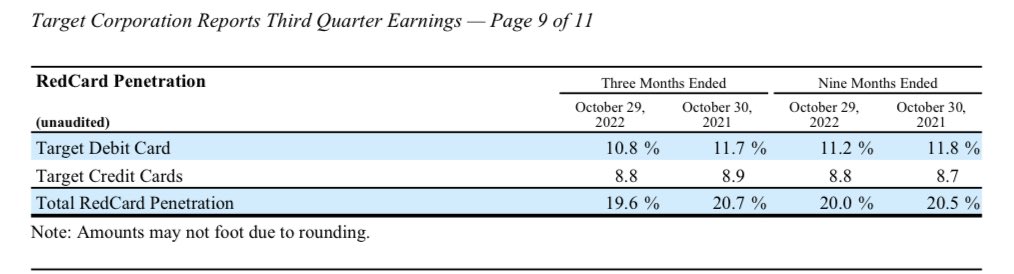

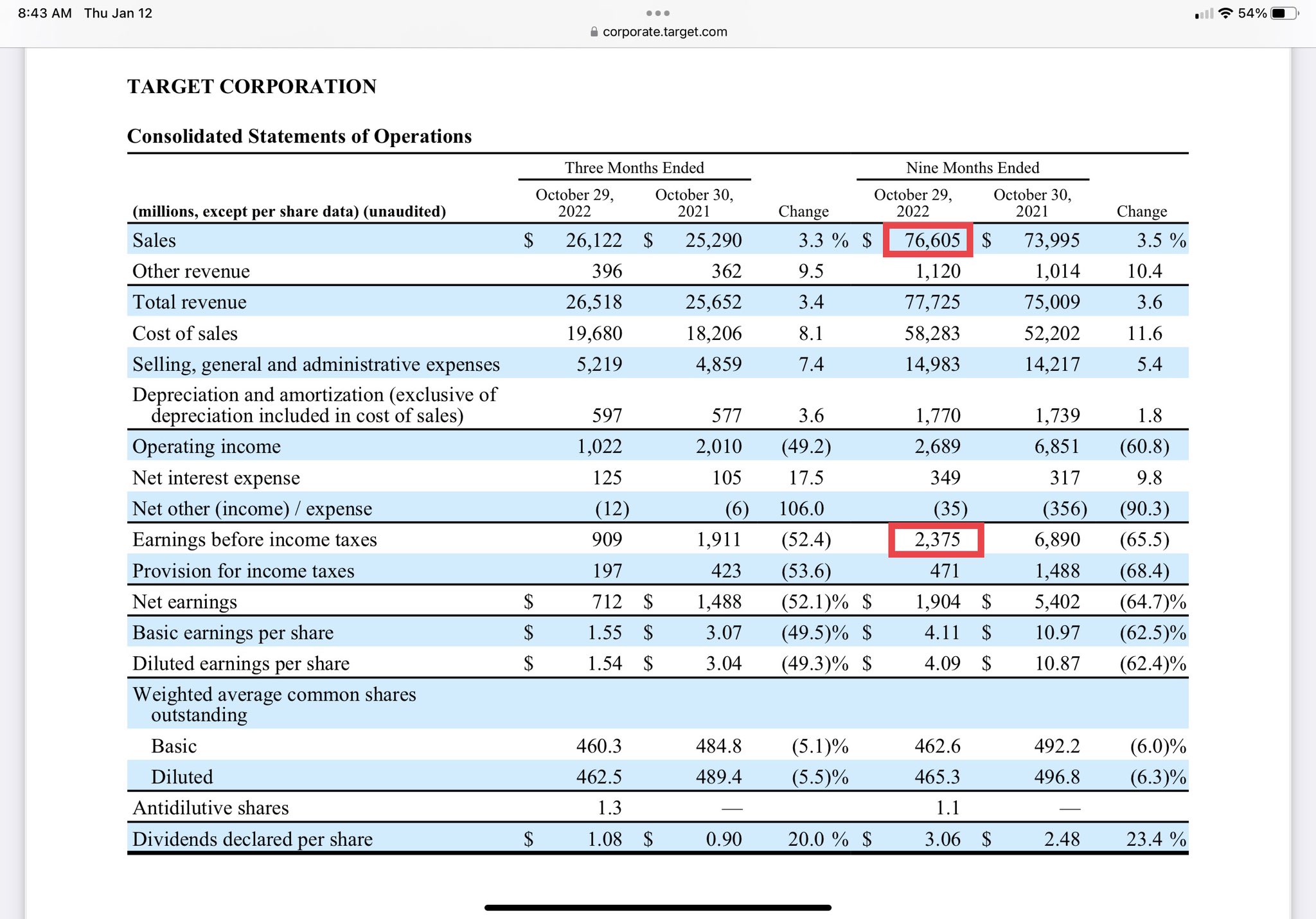

Let’s talk about the Target Red Card. Target did >$100B in revenue last year, 20% of which happened on its own cards:

What could disrupt Visa/MasterCard/Amex? How might a new payments Goliath start?

Let’s talk about the Target Red Card. Target did >$100B in revenue last year, 20% of which happened on its own cards:

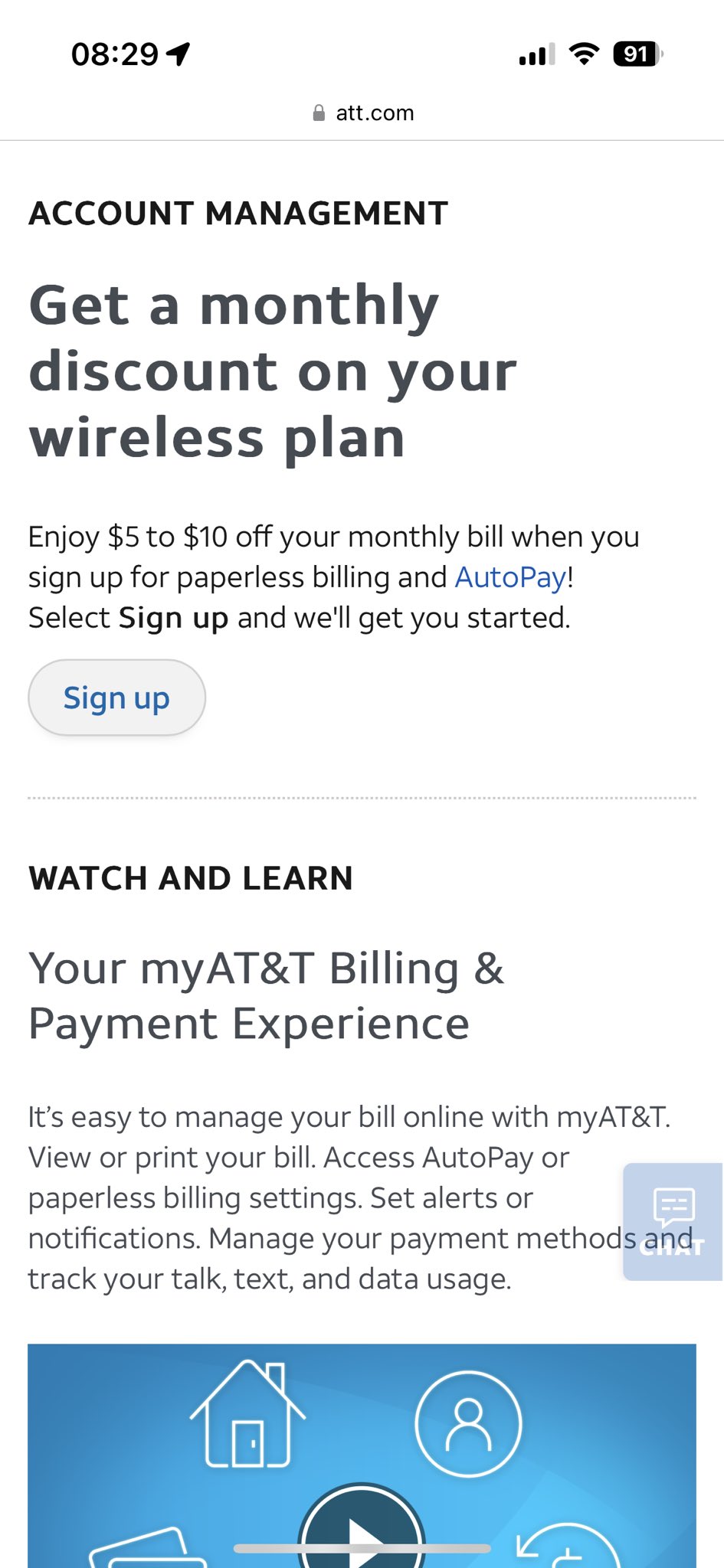

2/ You’ll see “Target Debit Card” and “Target Credit Cards” (source: Target 10Q)

Many retailers have what are known as co-branded credit cards. Target’s is issued by TD Bank; Amazon => Chase; American Airlines => Citi. Some retailers make more on cards than on their core biz!

Many retailers have what are known as co-branded credit cards. Target’s is issued by TD Bank; Amazon => Chase; American Airlines => Citi. Some retailers make more on cards than on their core biz!

3/ But what is extremely interesting, and has compelled me to scan every Target 10Q for years, is the Target Debit Card, which makes up over 11% of Target’s entire revenue. The Debit Card just pulls money directly from your bank account — allowing Target to not pay interchange.

4/ It should be self-evident why this is important. Look at Target’s Q1-Q3 revenue last year — $76.6B sales, $2.4B pretax income. Imagine every Target transaction was credit card (not the case) @ a blended 2% fee => $1.5B in incremental income if shifted to ACH, 63% more profit!

5/ Target has impressively shifted 20% of their *entire* sales to their own cards. The only “illogical” part of this is that to save 2%, they are…giving up 5%, albeit to the user directly in savings at Target, which is the primary benefit of Red Card.

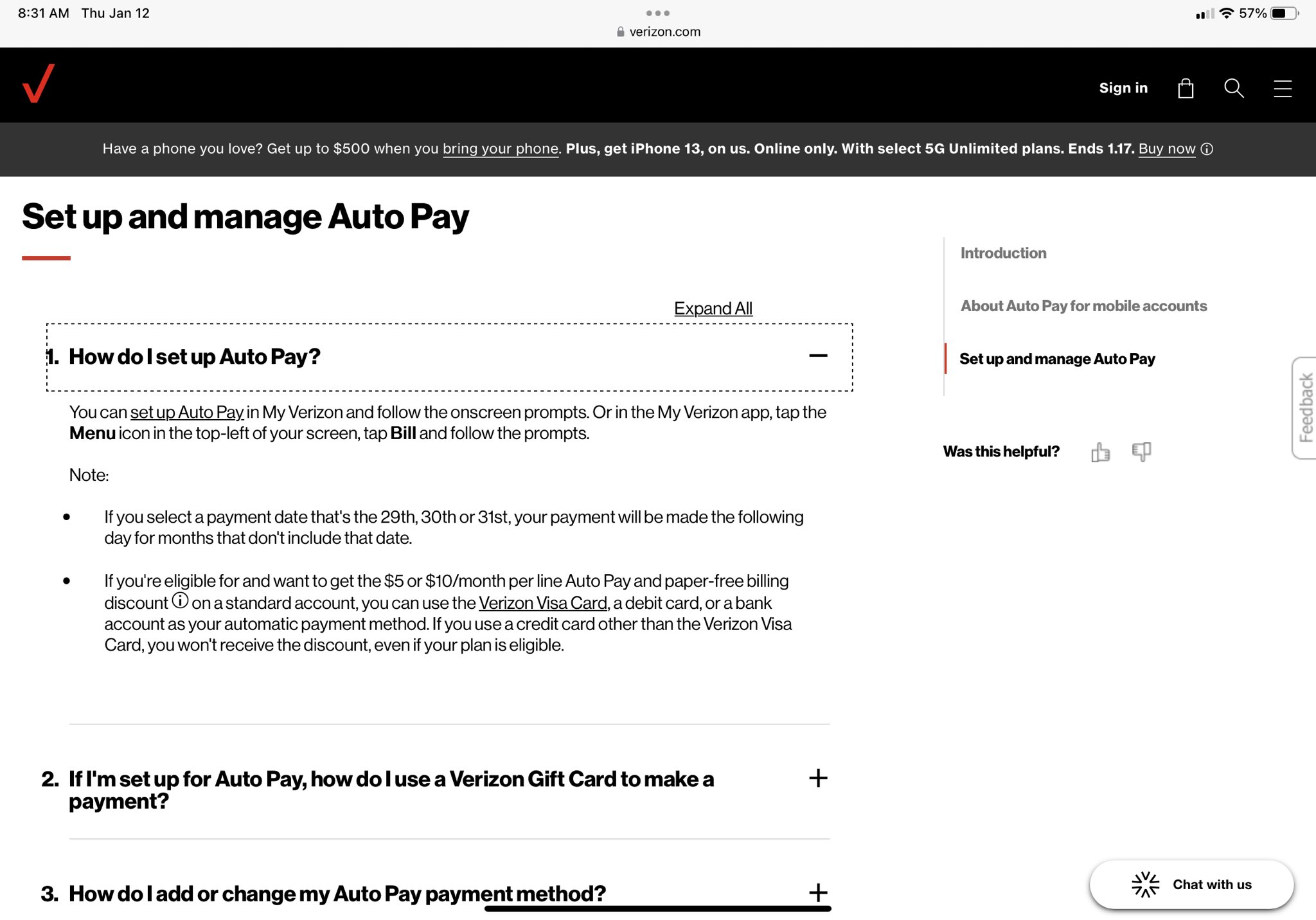

6/ Target isn’t an outlier here. Most “frequent interaction” or high frequency billing companies do the same. Here’s Verizon and AT&T, which give you substantial savings monthly for moving your bill pay off credit cards and to ACH (or sometimes debit cards, given lower avg fee)

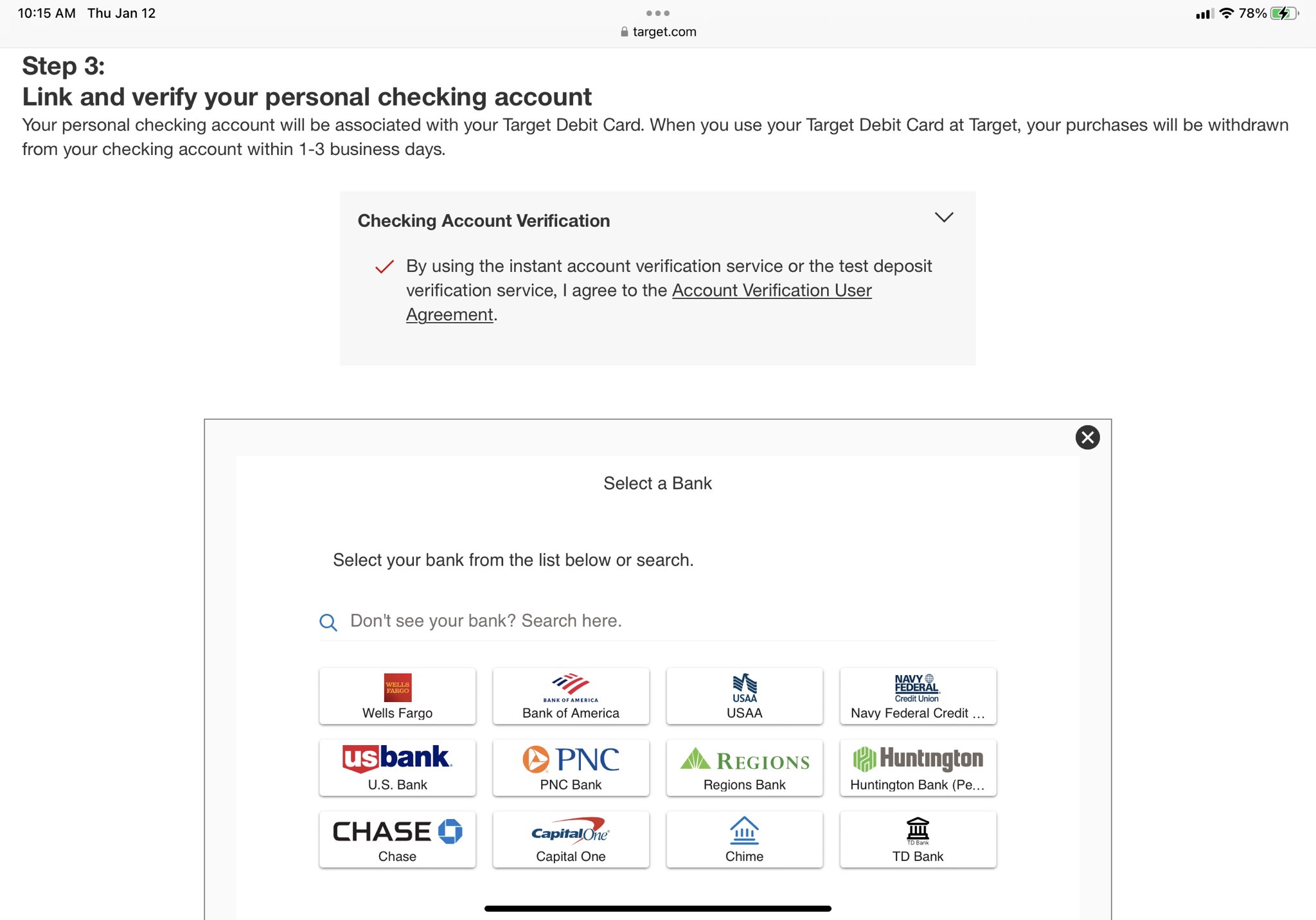

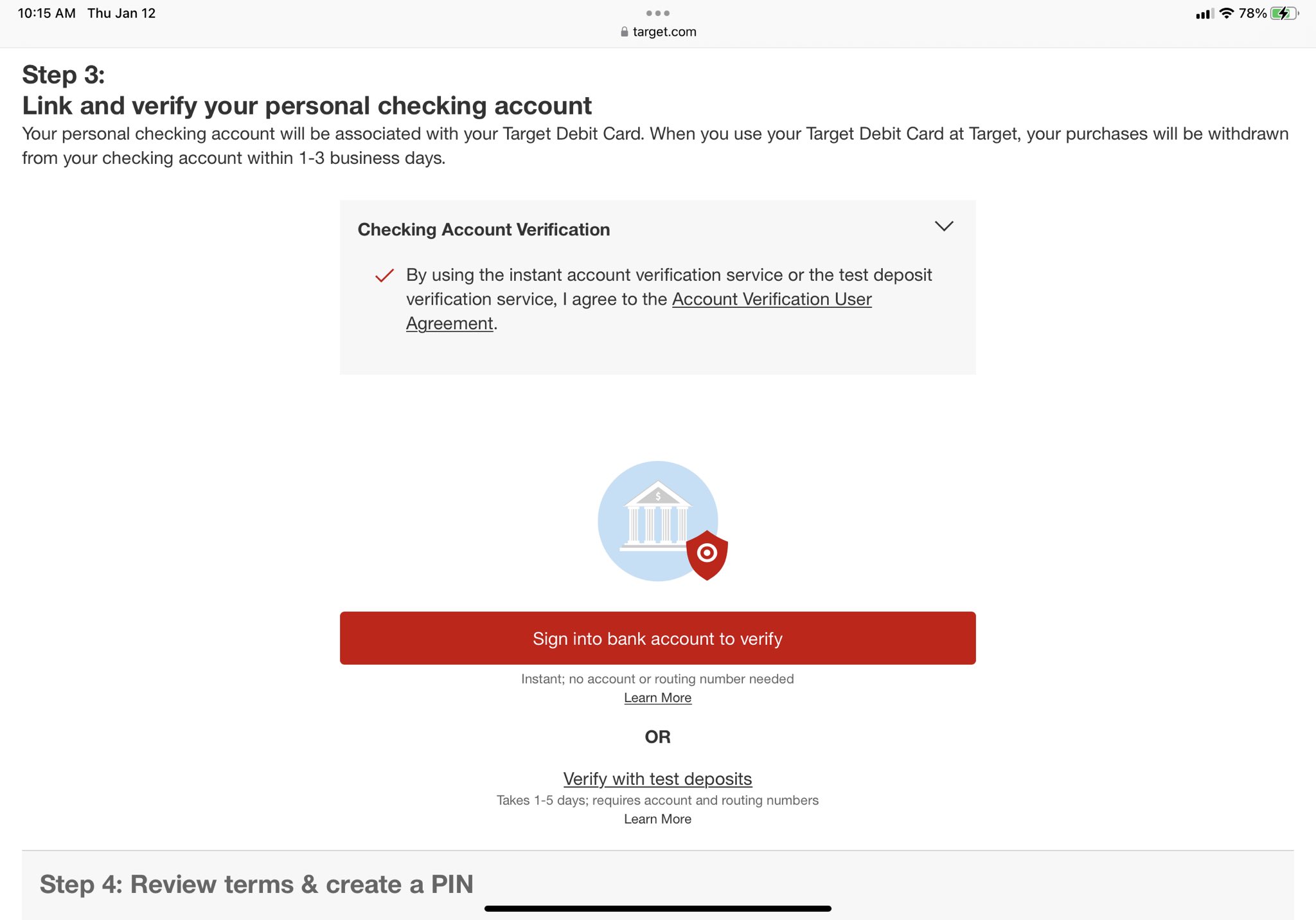

7/ When you sign up for a Red Card debit card, you link your existing bank account and let Target pull funds from it. It’s just a “router” to your existing bank account.

8/ So effectively the Debit Red Card is an abstraction layer around payments, mapping a POS transaction at a Target store to a subsequent low-cost ACH debit from an existing checking account.

9/ This is harder than it seems. For anyone in Credit/Debit payments, you might recognize the “verbs” of payments: Authorize, Capture, Settle, Void, Credit. Not to mention things like chargebacks. ACH has fundamentally different “verbs” and Red Card is a Rosetta Stone of sorts.

10/ Why is this potentially the future of payments? For one, tools like @Plaid have made the connection extraordinarily easy. You don’t have to remember your bank account number or “routing code.” Just log-in to your bank account ONCE and you’re done. Consumers are used to this.

11/ Every “high frequency biller” should be doing this, and experimenting with pricing and benefits. Albertson’s, Netflix, Walmart, Costco, Safeway, Microsoft, Disney, etc. It’s likely trillions of $ of “frequent merchant-consumer interaction” payments that *could* shift.

12/ While I think Target has been smart to roll this out, it seems paying 5% to save 2% (and justifying it by showing increased engagement, which likely reverses cause and effect / shows sampling bias!) is not smart. Better to provide one-time benefit to switch, I would think.

13/ To wit: Log-in to Netflix. See a message: “Switch to direct debit, get $2 off this month. Just click here!” -> long term savings of $100M+/year to Netflix in North America alone based on projected interchange costs.

14/ The “hard” part of this, not surprisingly, is software. What’s needed is “Red Card as a Service” for retailers — and in particular, “frequent interaction” retailers. This would likely sit alongside the existing payments stack, or maybe above it…

15/ Because ideally the one team (at the merchant) that handles dispute resolution/chargebacks, or refunds, or store credits…doesn’t care about the tender type. All of that is just abstracted away into whatever tools they already use.

16/ The other thing that’s needed is a much better onboarding experience. Frankly it’s shocking that Target is at 20% given how complex they make the onboarding and how much information they gather…better software/CX/UX would make it much more compelling.

17/ The truly magical experience would be what I would call the “Customer IQ Test.” An automatic mapping of their credit/debit card to their *existing* checking account could be done in the background…credit bureaus and other players already have this.

18/ The IQ Test would thus be: “Do you want to save $5 right now by switching your Visa Card ending in 2655 to your Bank of America account ending in 7688? Click Yes to confirm and your’e done.”

19/ Because fundamentally, the reason “Red Card as a Service” hasn’t taken off in the past is because of the twin moats protecting so much of banking. Inertia (hard to switch) and Rewards (merchant fees fund customer benefits, with banks in the middle). Inertia is now decreasing.

20/ There are other huge benefits to a “frequent interaction biller” introducing this. E.g., “Pre-pay $1000 of spend at Safeway for $950” —> ensures that that person buys all of their groceries at Safeway. Or maybe a quasi subscription.

21/ Not to mention all of the other “fintech” cross-sells available if you have a link to the customer’s checking account and a dominant/frequent relationship with them.

22/ There’s a good question of how many frequent billers does the average customer have, what merchants might this make sense for, etc. But in general, the tools are coming/exist to make this easy, fast, and low-friction…and the economic incentive for merchants is MASSIVE.