Thread

After losing $1.7M to an attacker 2 weeks ago, the Alameda liquidators have been active on-chain moving their assets to a safe multisig.

Unfortunately, a LOT of assets, and open positions, still remain in tagged Alameda wallets.

Here's what happened, and what they missed 👇

Unfortunately, a LOT of assets, and open positions, still remain in tagged Alameda wallets.

Here's what happened, and what they missed 👇

10 hours after the attack, assets began to be moved over to the central multisig at the following address:

0xF02e86D9E0eFd57aD034FaF52201B79917fE0713

Over the past 2 weeks, around $1.4M of tokens has been steadily returned to this central multisig from scattered Alameda wallets.

0xF02e86D9E0eFd57aD034FaF52201B79917fE0713

Over the past 2 weeks, around $1.4M of tokens has been steadily returned to this central multisig from scattered Alameda wallets.

The liquidators' work, however, has not been without hitches.

Arkham analysis has revealed significant 7- and 8-figure sums of capital left stranded in a number of tagged Alameda wallets.

Additionally, there were some embarrassing on-chain faux pas's committed by the operators.

Arkham analysis has revealed significant 7- and 8-figure sums of capital left stranded in a number of tagged Alameda wallets.

Additionally, there were some embarrassing on-chain faux pas's committed by the operators.

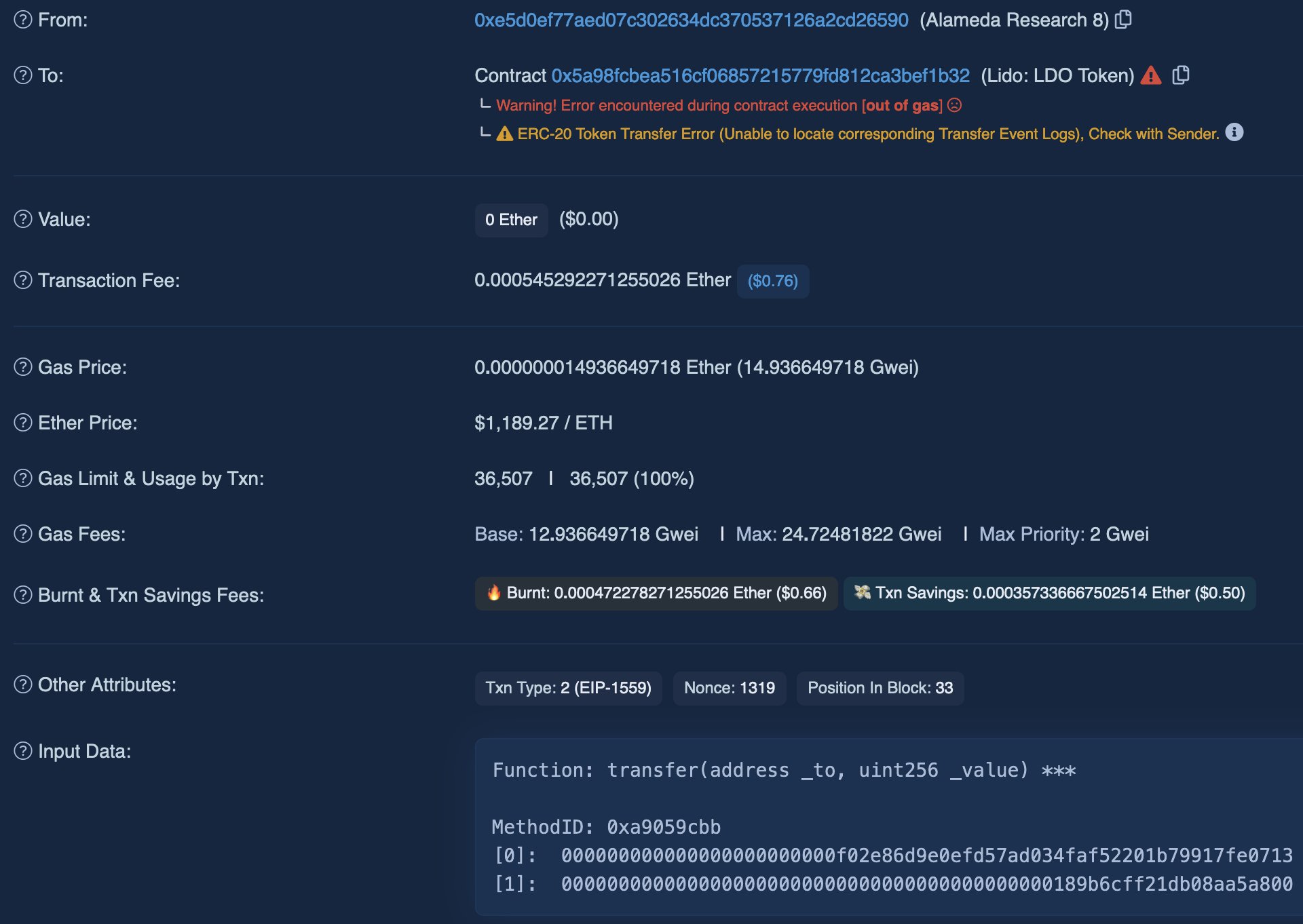

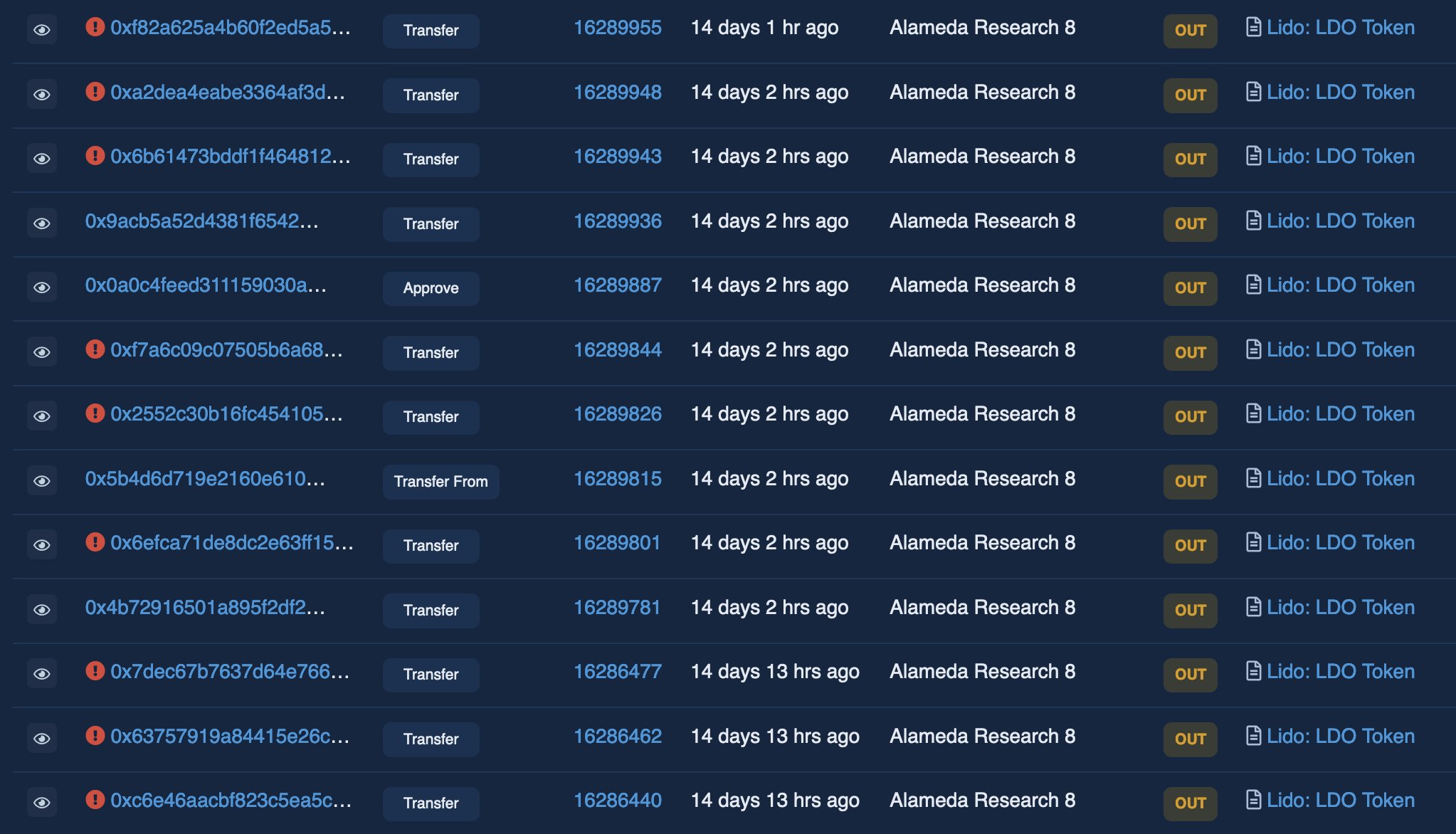

The vesting recipient 0xe5D, or "Alameda Research 8" has had a number of issues withdrawing funds.

Upon attempting to remove $1.75M in LDO from the wallet, the transaction failed.

The liquidators then attempted to remove $238K, or 250K tokens. This transaction also failed.

Upon attempting to remove $1.75M in LDO from the wallet, the transaction failed.

The liquidators then attempted to remove $238K, or 250K tokens. This transaction also failed.

The LDO tokens were still vesting, and as such the liquidators had to resort to taking out 10K LDO at a time to the central wallet.

This was, however, not before sending 9 different failed transactions.

This was, however, not before sending 9 different failed transactions.

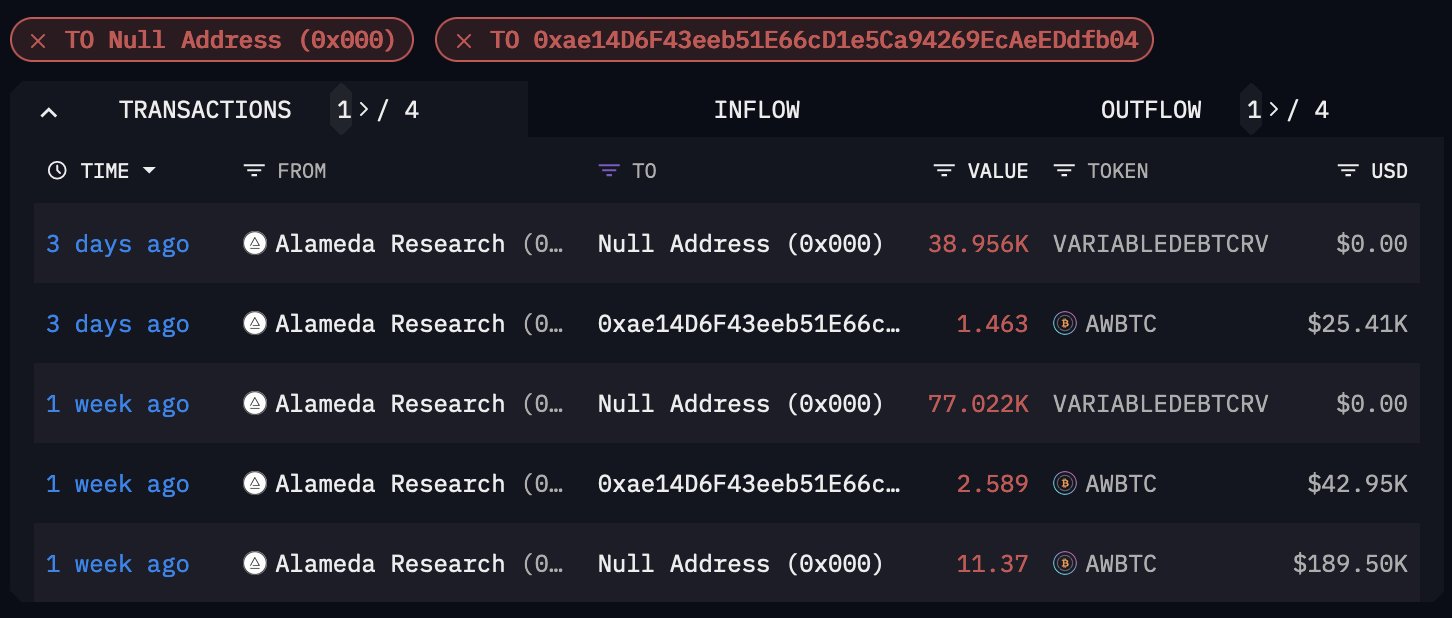

On the wallet 0x712, liquidators attempted to remove assets from a borrow position on the DeFi protocol @aaveaave.

Rather than paying back the debt to close out the position, the liquidators opted to remove all extra collateral, putting the position in danger of liquidation.

Rather than paying back the debt to close out the position, the liquidators opted to remove all extra collateral, putting the position in danger of liquidation.

This resulted in the liquidation of around 4 WBTC, $72K at current prices.

When positions are forcibly closed on AAVE, a penalty is also slashed from the liquidated collateral.

The liquidators, themselves, were liquidated. Are they in over their heads?

When positions are forcibly closed on AAVE, a penalty is also slashed from the liquidated collateral.

The liquidators, themselves, were liquidated. Are they in over their heads?

The existence of other DeFi positions still held in Alameda wallets suggests that this may be the case.

Often, these positions are on alternative L1 chains.

The screenshots below show spot assets on Ethereum, but all of these wallets hold positions on other protocols or chains.

Often, these positions are on alternative L1 chains.

The screenshots below show spot assets on Ethereum, but all of these wallets hold positions on other protocols or chains.

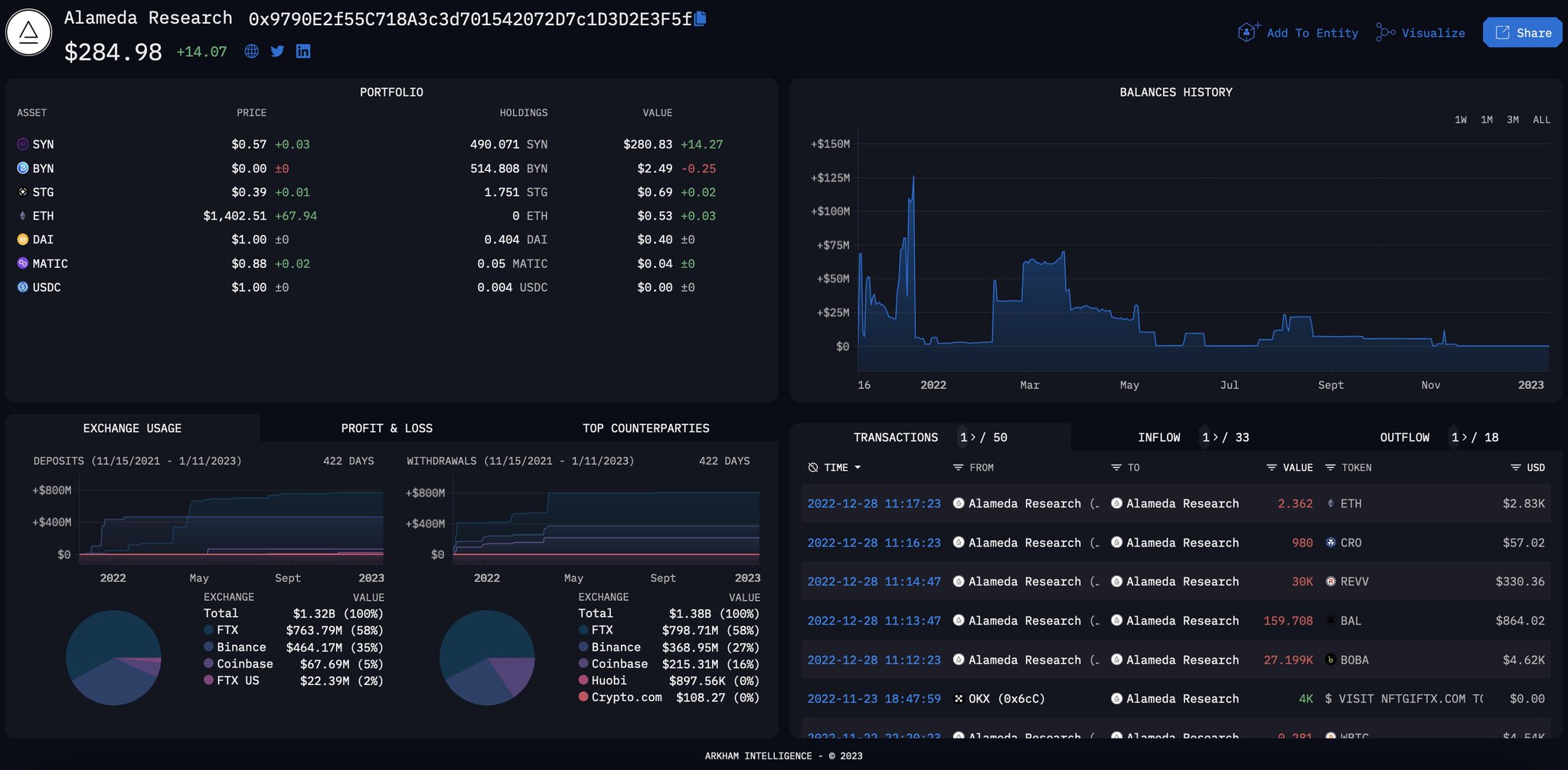

The largest wallet with assets left inside is 0x979, worth over $14M in total.

- $5.5M USDC locked in Clearpool

- over $110K of unclaimed rewards

- $4.3M in ETH on Aurora

- borrowing $2M of NEAR against $6M USDC on @BastionProtocol

- $5.5M USDC locked in Clearpool

- over $110K of unclaimed rewards

- $4.3M in ETH on Aurora

- borrowing $2M of NEAR against $6M USDC on @BastionProtocol

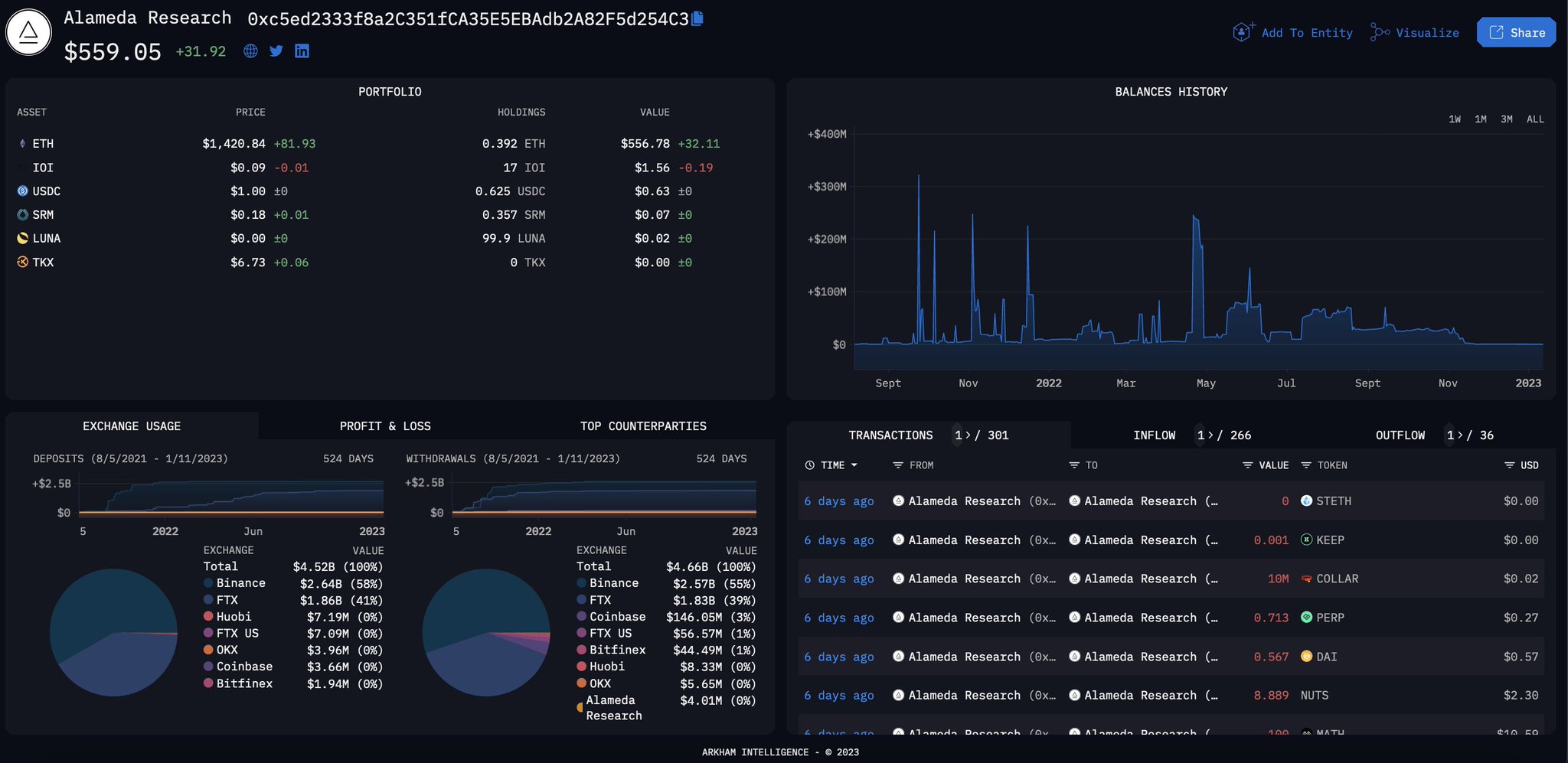

Another large wallet is 0xc5e.

This wallet has previously made 16 different transactions of tokens to the central multisig on Ethereum, including $0.6 of DAI and $0.02 COLLAR.

However, this wallet still holds 7-figures of positions on-chain across different protocols and L1's.

This wallet has previously made 16 different transactions of tokens to the central multisig on Ethereum, including $0.6 of DAI and $0.02 COLLAR.

However, this wallet still holds 7-figures of positions on-chain across different protocols and L1's.

These include:

- $700K KLAY on Klaytn

- $430K oUSDT on Klaytn

- $2M USDC+USDs LP on Uniswap (Arbitrum)

- $1.4M nETH+WETH in Synapse, $20k unclaimed SYN rewards

$965K FTT in Abracadabra

Sushiswap LP:

- $520K SRM + ETH LP

- $374K REN + ETH LP

and more: $8.9M in total.

- $700K KLAY on Klaytn

- $430K oUSDT on Klaytn

- $2M USDC+USDs LP on Uniswap (Arbitrum)

- $1.4M nETH+WETH in Synapse, $20k unclaimed SYN rewards

$965K FTT in Abracadabra

Sushiswap LP:

- $520K SRM + ETH LP

- $374K REN + ETH LP

and more: $8.9M in total.

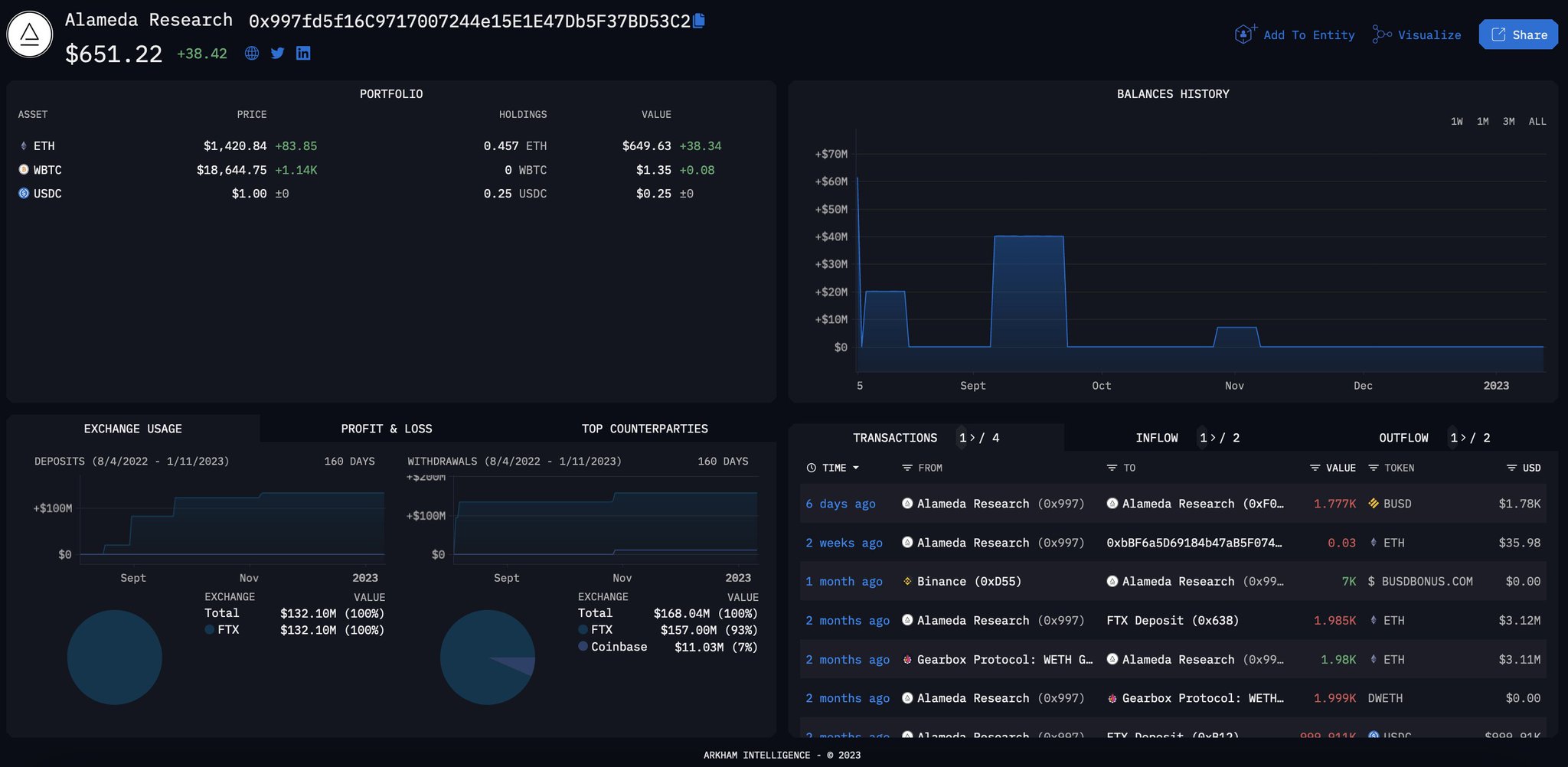

One DeFi wallet, 0x997 has around 2.6M worth of assets and open positions, mostly on BSC and Optimism networks.

The wallet is supplying 2M in USDT and DAI on @WombexFinance, and also has a $2M short ETH position against 2.6M of USDC, with liquidation just before $1825 ETH.

The wallet is supplying 2M in USDT and DAI on @WombexFinance, and also has a $2M short ETH position against 2.6M of USDC, with liquidation just before $1825 ETH.

These are just a few of the largest examples from 50+ Alameda wallets with assets still locked inside.

Arkham would suggest that effort is focused on closing out existing positions and retrieving assets from alt-chains, rather than transferring small amounts of ERC20's.

Arkham would suggest that effort is focused on closing out existing positions and retrieving assets from alt-chains, rather than transferring small amounts of ERC20's.

We hope you enjoyed the thread.

For more analysis like this, join the Arkham discord!

discord.gg/arkham

For more analysis like this, join the Arkham discord!

discord.gg/arkham