Thread by Isabel Schnabel

- Tweet

- Jan 11, 2023

- #MonetaryPolicy

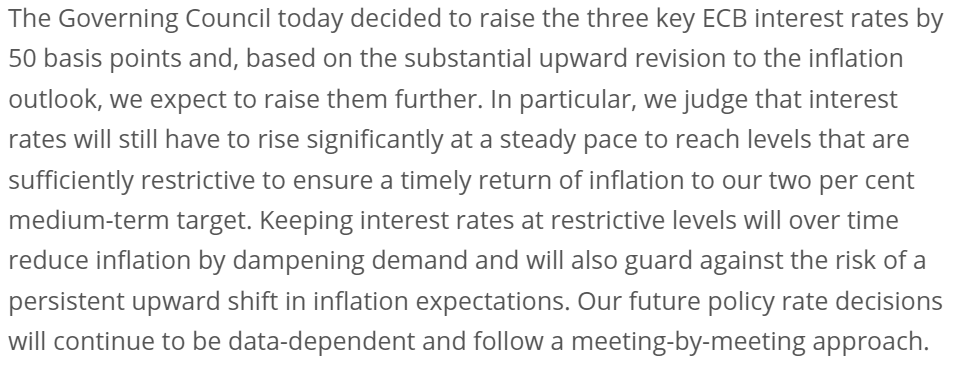

Thread

In my speech “Monetary policy tightening and the green transition” I discuss how the current macroeconomic environment, in particular painfully high inflation and rising interest rates, impacts the green transition and what this implies for monetary and fiscal policymakers. 1/17

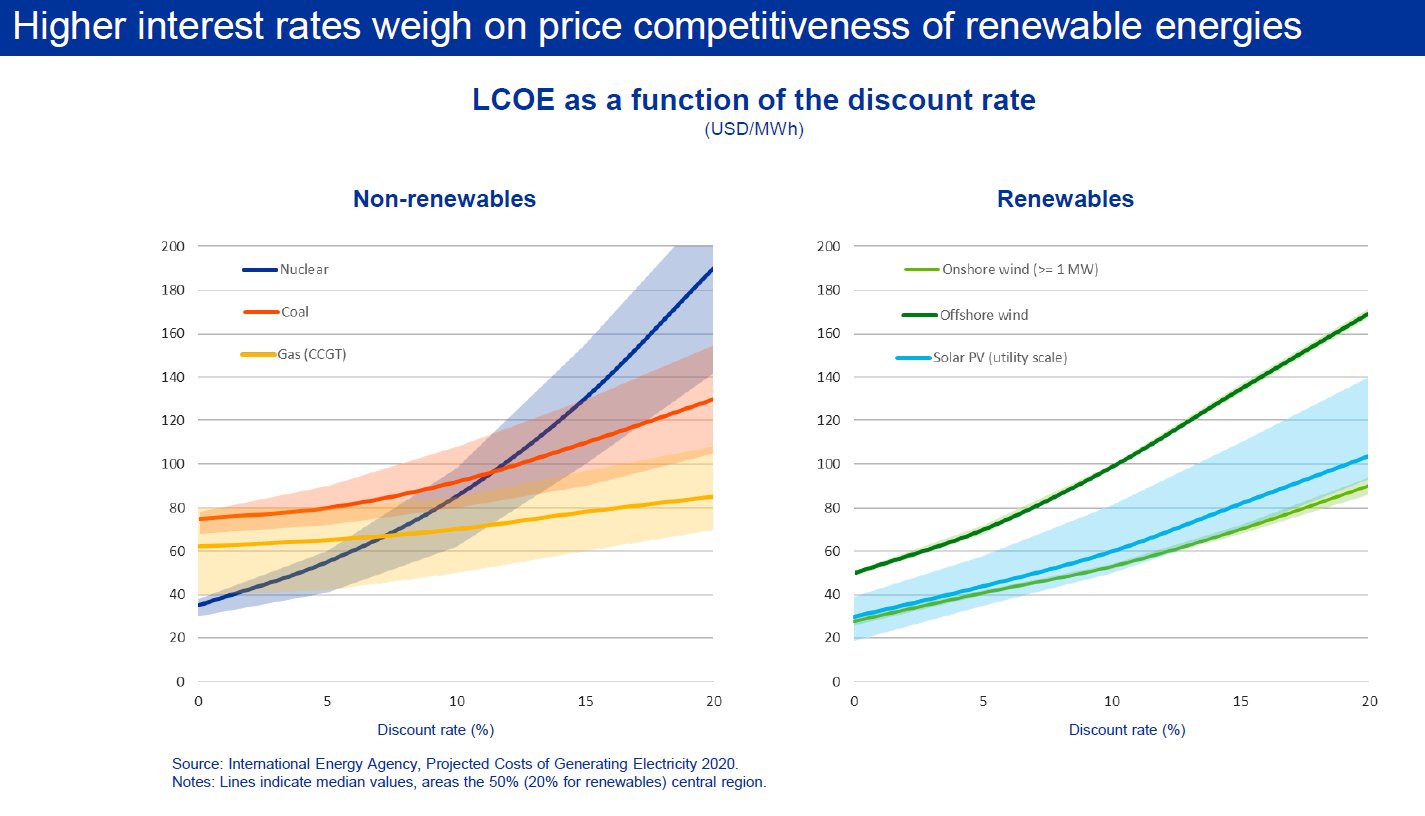

Due to large upfront costs, investments in renewable energies are particularly sensitive to changes in interest rates. A persistent rise in the cost of capital may discourage efforts to decarbonise the economy rapidly. 2/17

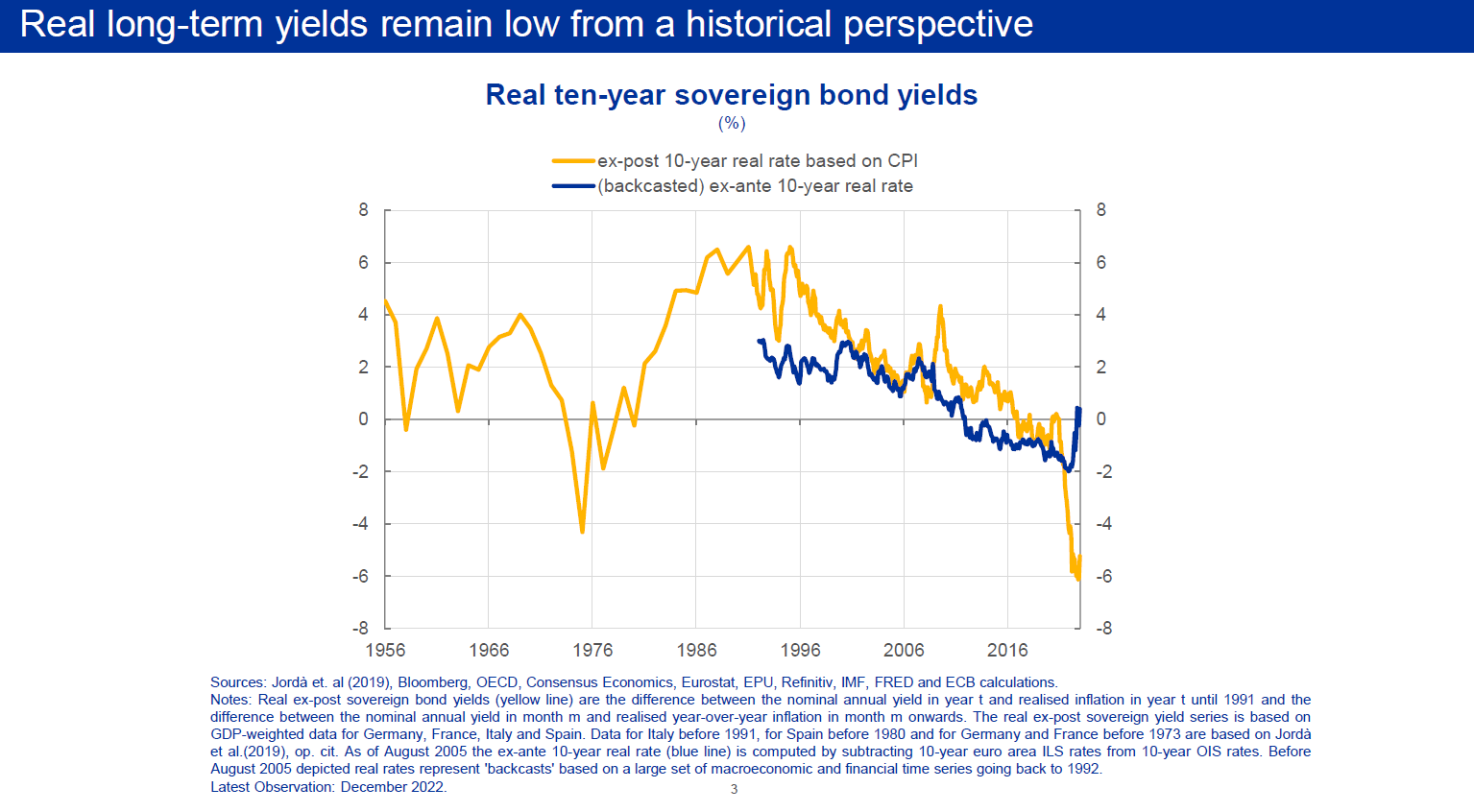

This has sparked a debate about whether the current monetary policy tightening may slow down the pace of decarbonisation. Some even argue that such tightening is inconsistent with our price stability objective as it may give rise to #climateflation and #fossilflation. 3/17

We judged that interest rates still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to our 2% medium-term target. There are three reasons why tighter financing conditions are appropriate. 4/17

First, inflation is a tax on investment, raises uncertainty and distorts price signals. Second, it won't subside by itself, as data point to a persistent build-up of underlying price pressures. Third, a too cautious policy could ultimately require an even stronger response. 5/17

A determined reaction to the risk that inflation may become entrenched not only safeguards price stability but also provides the conditions under which the green transition can thrive. Price stability is a precondition for the sustainable transformation of our economy. 6/17

Financing conditions remain favourable with real long-term interest rates still being low from a historical perspective. In a poll, a large majority of leading climate economists see only a mild impact of rising borrowing costs on the green transition. 7/17

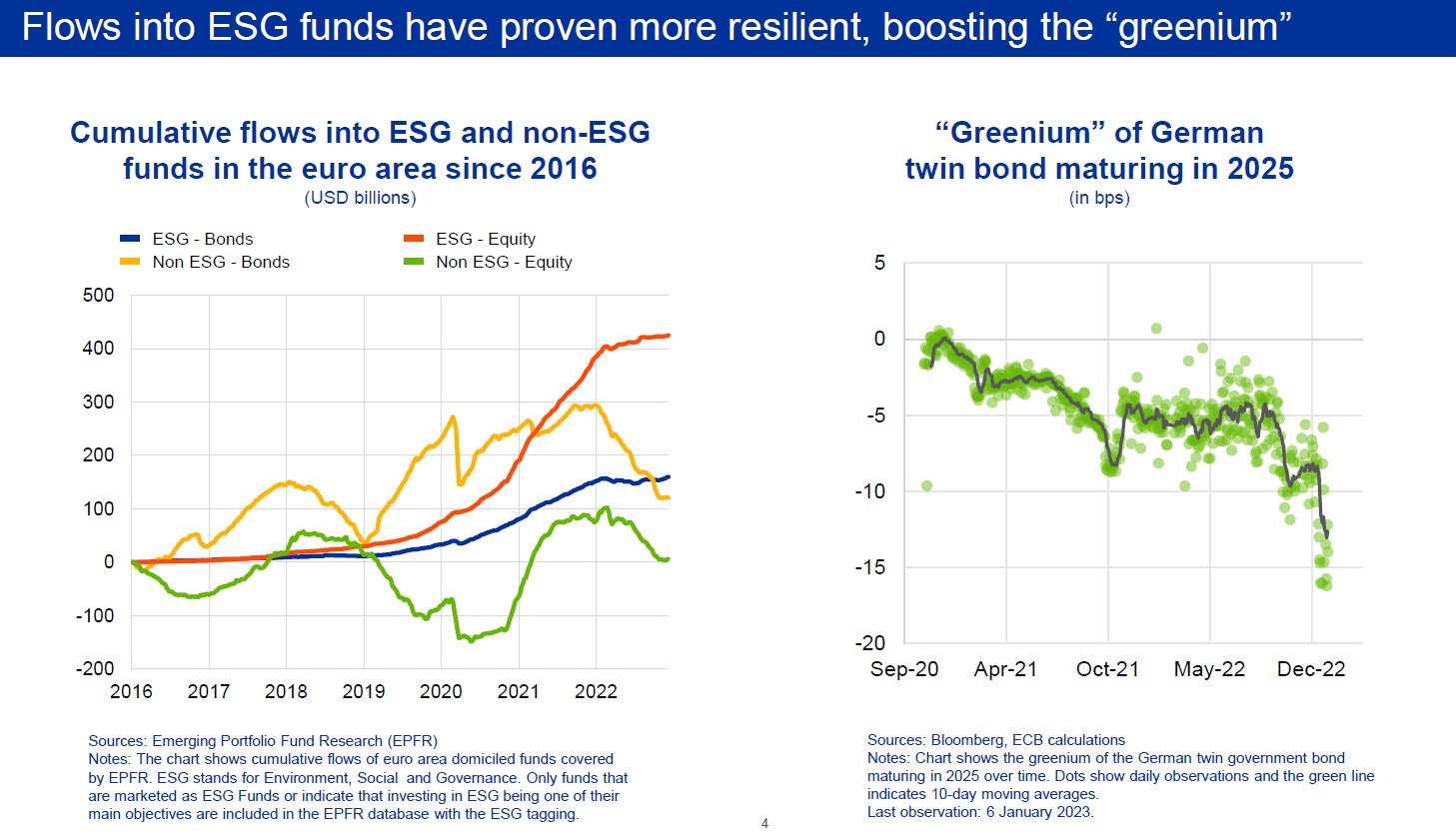

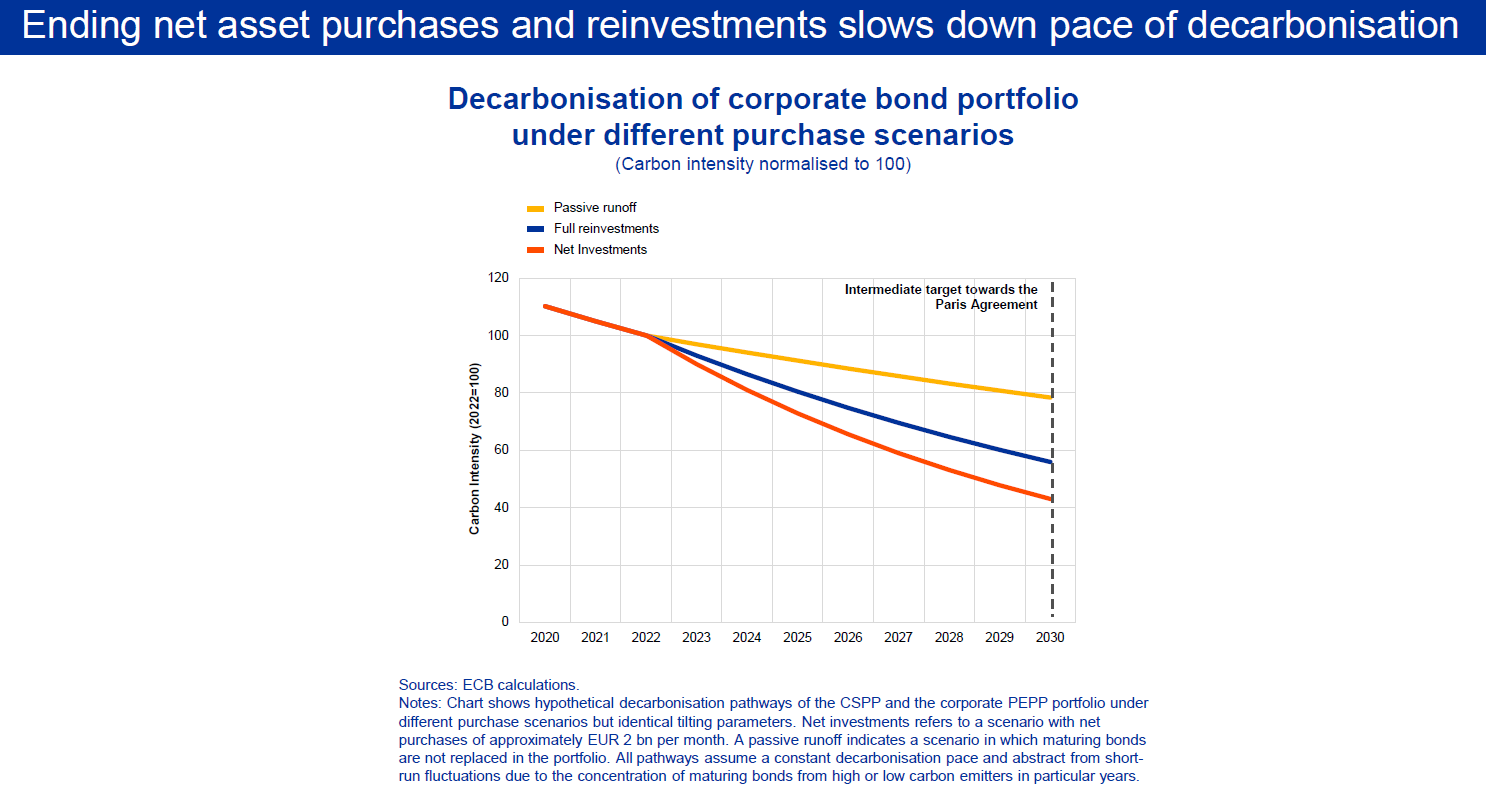

So far, there is no evidence of funding shortages for green projects. While conventional funds have experienced a sizeable decline in net inflows in 2022, the same was not true for ESG funds. The #greenium has reached record levels in absolute terms. 8/17

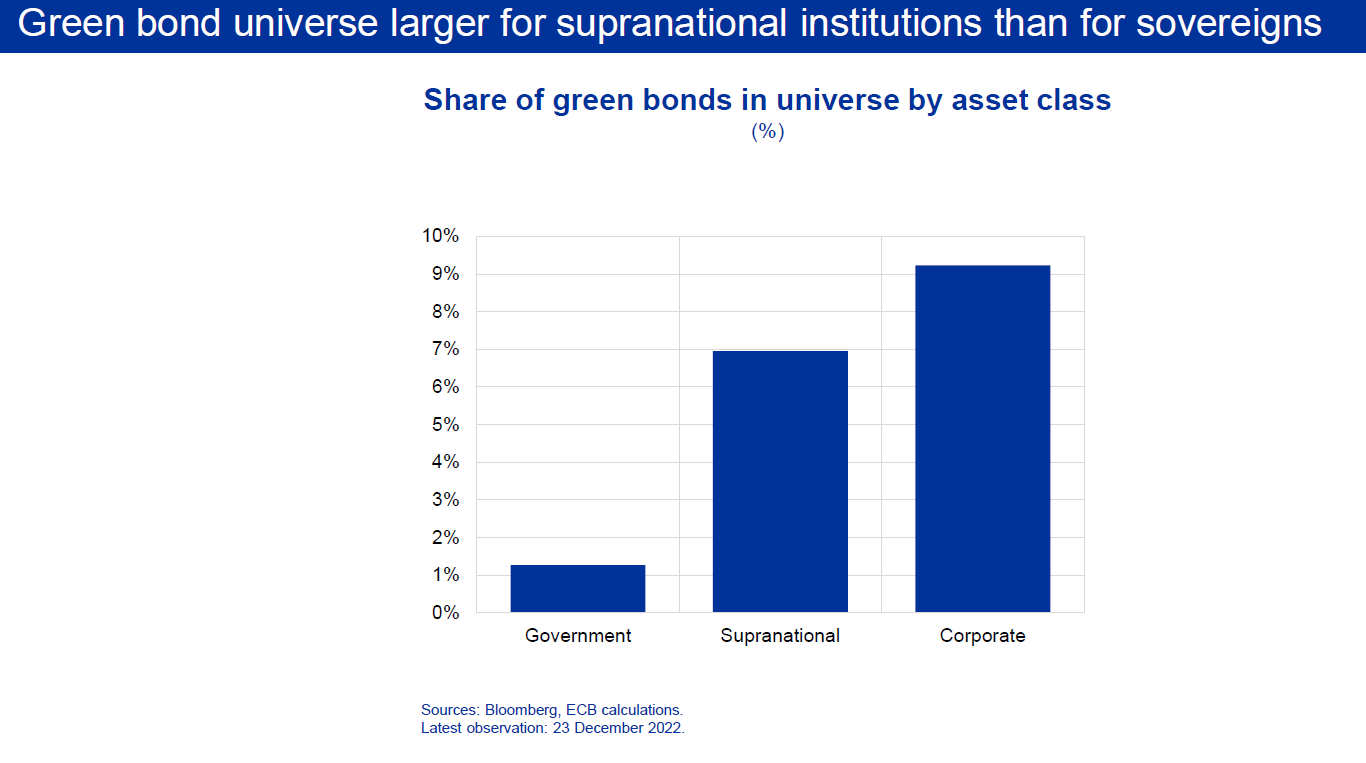

In this environment, fiscal policy needs to remain in the driving seat in the fight against climate change. Regrettably, many governments failed to use the past years of low interest rates to sufficiently accelerate investments in greener and more sustainable energy sources. 9/17

The main impediment is not the cost of capital but delays in implementing climate commitments. Governments should intensify their support of renewable energies and green technologies. By fostering the economy’s productive capacity this would help restore price stability. 10/17

The ECB also needs to review its contribution to the green transition. Without prejudice to price stability, we must ensure that our policies are aligned with the EU’s carbon neutrality objectives. Our first climate change action plan, while ambitious, is not sufficient. 11/17

First, a flow-based tilting approach on corporate bonds is insufficient when ending reinvestments. We need to move to a stock-based tilting approach for our private sector bond holdings. Actively reshuffling the portfolio towards greener issuers needs to be considered. 12/17

Second, we need to put our public sector bond holdings on a Paris-aligned path. We could increase the share of supranational institutions, which would not conflict with our capital key guidance. We could also reshuffle our sovereign portfolio towards green bonds over time. 13/17

Third, we need to intensify efforts to green our lending operations. This should include a systematic greening of the ECB’s collateral framework. Green targeted lending operations could be considered in the future when policy needs to become expansionary again. 14/17

Summing up, it would be misleading to use higher interest rates as a scapegoat for a further delay in the green transition. Restoring price stability through an appropriate monetary policy provides the conditions under which the green transition can thrive sustainably. 15/17

Governments must remain in the lead in accelerating the green transition. In line with our mandate, we also stand ready to intensify our efforts. This requires structural changes to our policy framework rather than adjustments to our reaction function. 16/17

Finally, let me thank Stefan #Ingves for his service to the central banking community and to society as a whole and @riksbanken for an interesting and perfectly organised farewell event. 17/17