Thread by The Bitcoin Layer

- Tweet

- Jan 8, 2023

- #Cryptocurrency

Thread

ICYMI

Here's a rapid-fire recap of the relevant action this week in bitcoin and macro.

Let's dive in 🔻

Here's a rapid-fire recap of the relevant action this week in bitcoin and macro.

Let's dive in 🔻

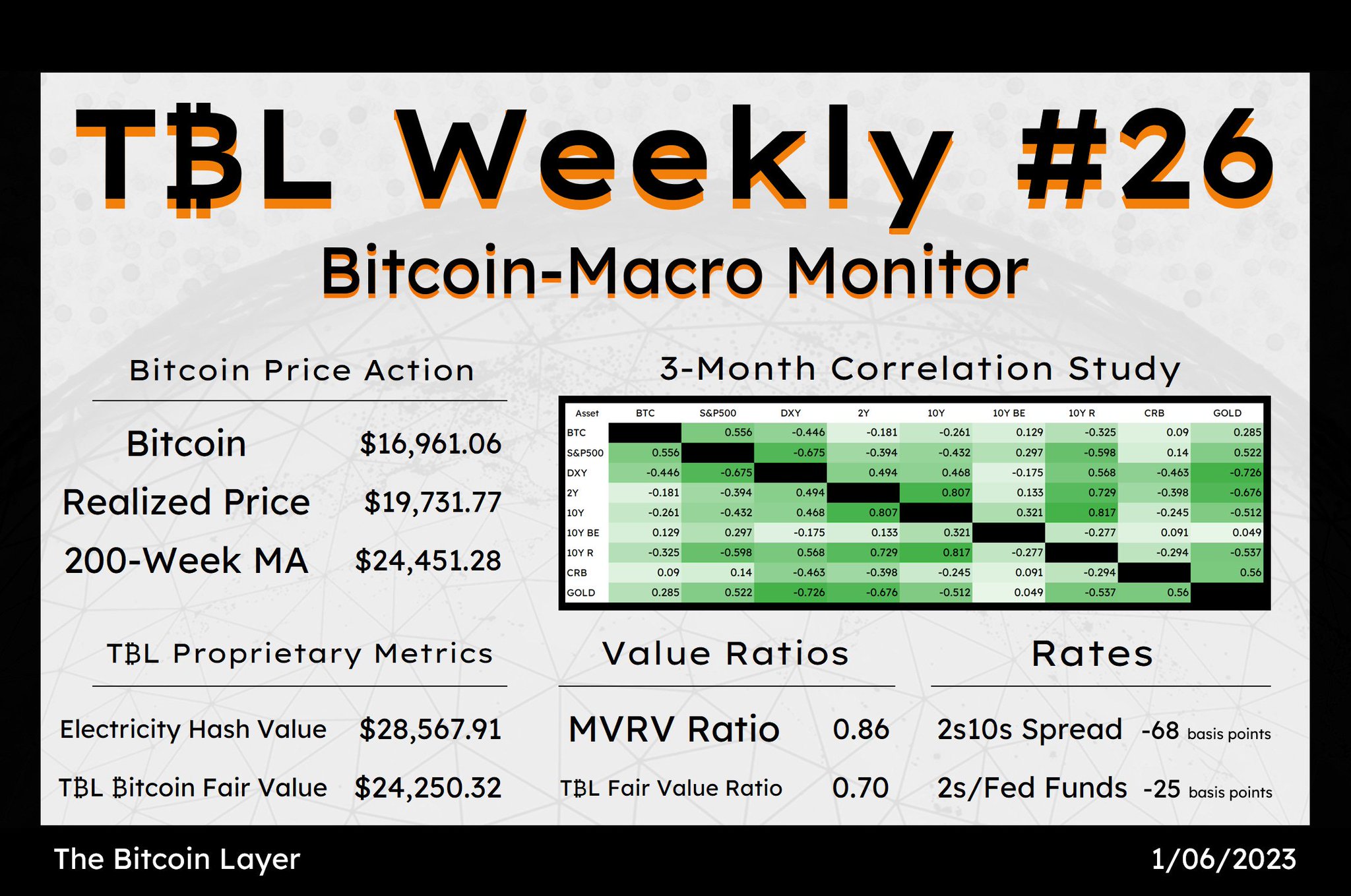

BTC ends yet another week ranging like a life-support EKG in the ~$16,500 range.

Its S&P 500 correlation has loosened as BTC sell-side has abated while firms are about to go through earnings contraction.

2s10s is flattening as investors pile into the long end of the curve.

Its S&P 500 correlation has loosened as BTC sell-side has abated while firms are about to go through earnings contraction.

2s10s is flattening as investors pile into the long end of the curve.

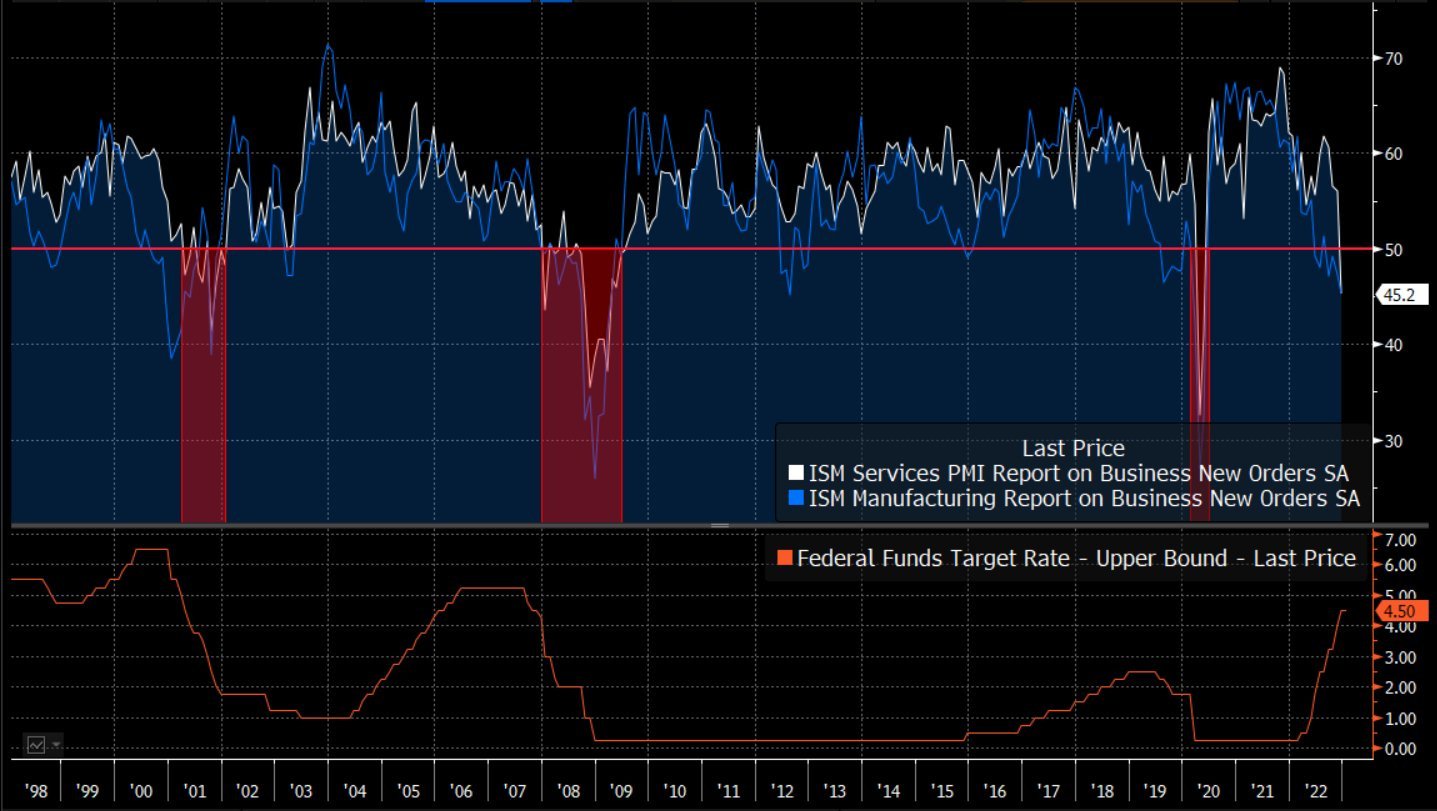

ISM Services New Orders for December absolutely fell off of a cliff to 45.2 off of 56 prior.

Every time that both Services & Manufacturing New Orders contracted simultaneously, the Fed was already cutting rates to respond to the slowdown.

Economic deterioration is upon us.

Every time that both Services & Manufacturing New Orders contracted simultaneously, the Fed was already cutting rates to respond to the slowdown.

Economic deterioration is upon us.

This time though, the Fed is sterner. It is unwavering.

But we have news for the Fed: It’s a lot more difficult to communicate where you want front-end rates to be if front-end rates start disobeying you.

In other words, the Fed is a slave to the rates market.

But we have news for the Fed: It’s a lot more difficult to communicate where you want front-end rates to be if front-end rates start disobeying you.

In other words, the Fed is a slave to the rates market.

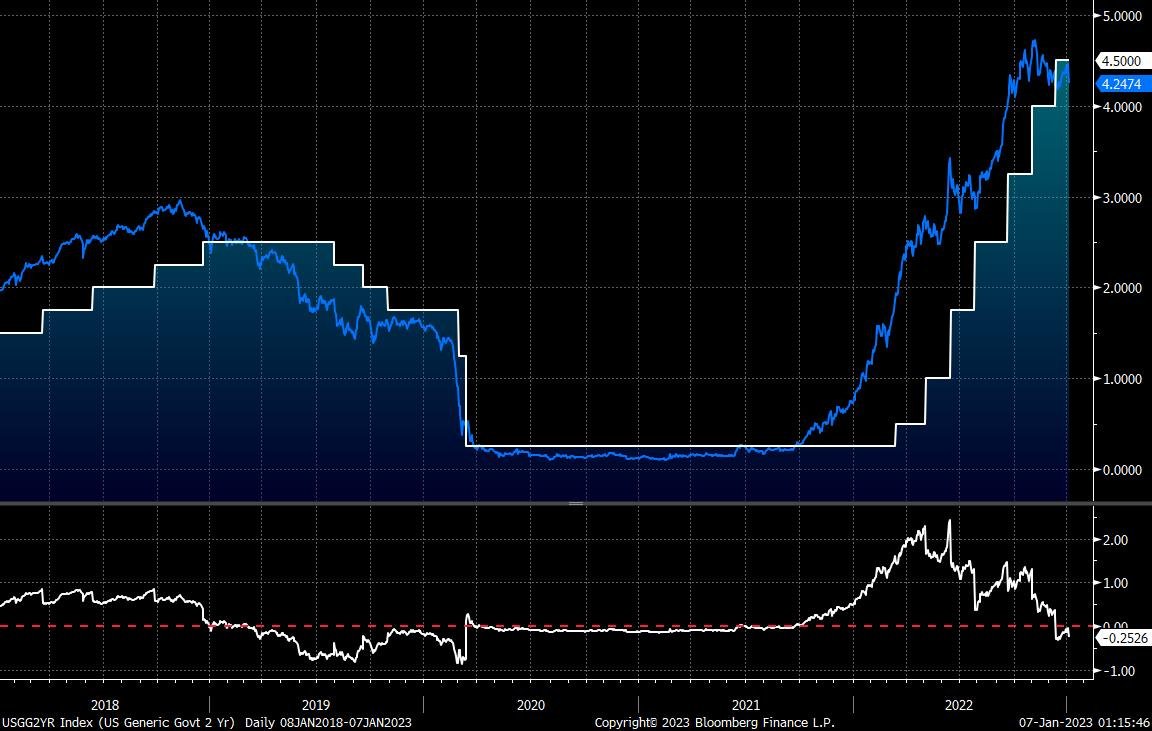

For a time, when it was market consensus that monetary conditions needed to be tightened to cool down inflation and a roaring economy, short rates and the Fed’s policy rate moved in near-perfect harmony:

As the cycle goes on, it becomes apparent to the rates market that sufficient tightening has been achieved.

The Fed, however, reaches a willful negligence during peak tightness. Its focus on inflation targeting blinds it from the damage it’s beginning to cause.

The Fed, however, reaches a willful negligence during peak tightness. Its focus on inflation targeting blinds it from the damage it’s beginning to cause.

Rates give room to hike to the Fed when an overheating market is consensus, and rates take room from the Fed to hike when investors see contractionary leading indicators that the Fed is willfully blind to.

Rates are taking away the Fed’s tightening punch bowl:

Rates are taking away the Fed’s tightening punch bowl:

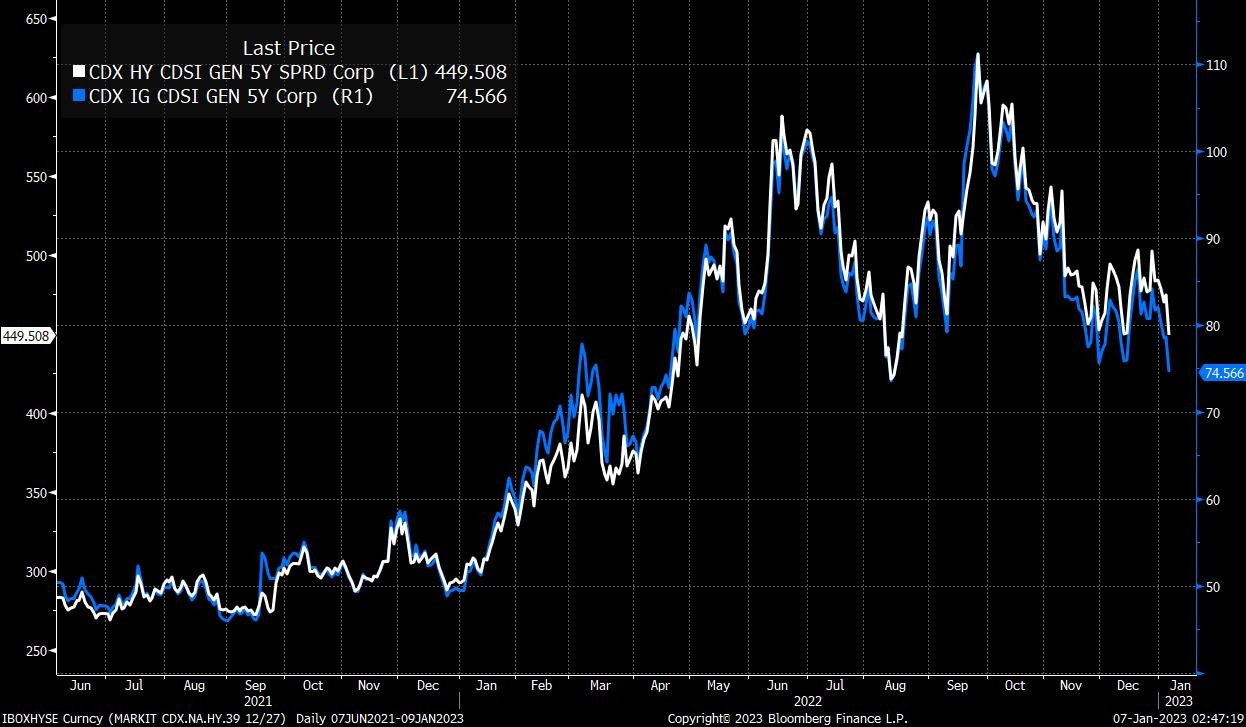

Turning our focus over to risk markets, sentiment is modestly positive and fear is low.

A soft landing (shallow 2023 recession or near-recession) is very much in the cards according to investor positioning in credit and volatility premiums.

A soft landing (shallow 2023 recession or near-recession) is very much in the cards according to investor positioning in credit and volatility premiums.

High Yield and Investment Grade spreads have tightened considerably after widening through 3Q 2022. Credit conditions are mild for now:

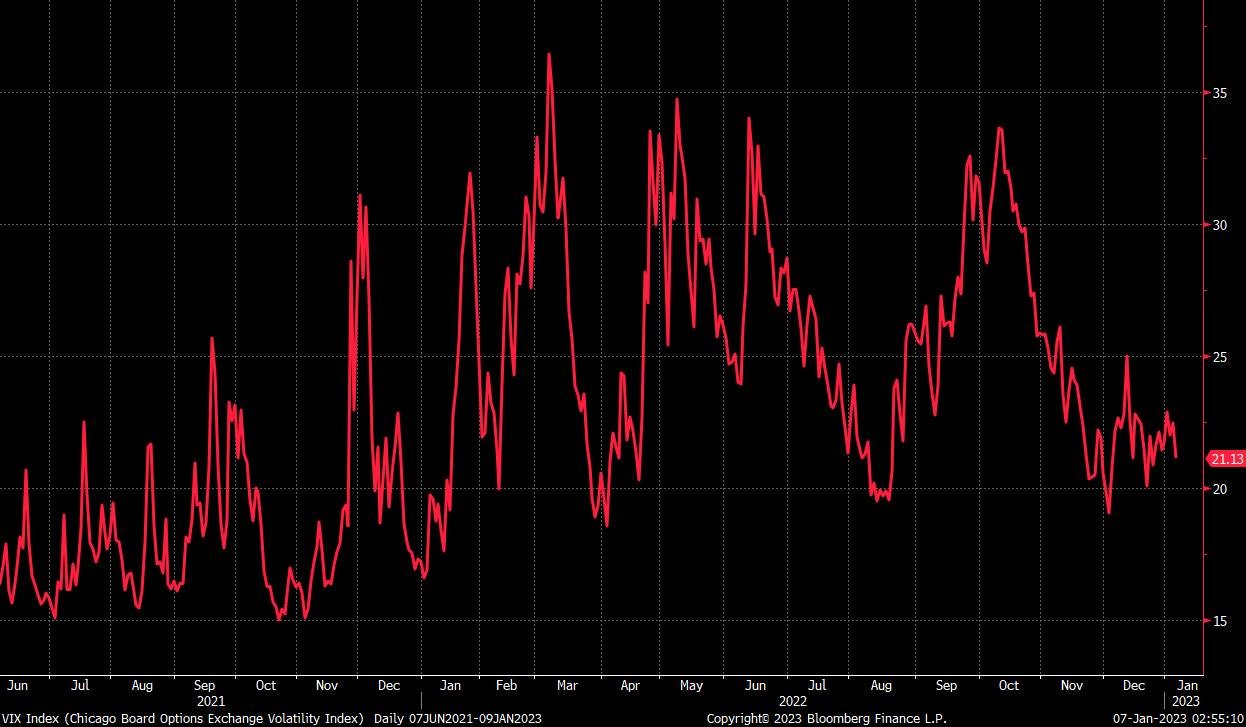

VIX remains muted at just 21.13—if markets were any less fearful, they'd be comatose.

As the rates market worries and reacts to each economic release spelling contraction, risk traders are taking the glass-half-full approach to market positioning. Fear is barely present:

As the rates market worries and reacts to each economic release spelling contraction, risk traders are taking the glass-half-full approach to market positioning. Fear is barely present: