Thread

Tech has been THE driver of the secular bull in the market since 2009

But some investors say we're up for a repeat of the Nifty Fifty / Dot Com crash

A thread

But some investors say we're up for a repeat of the Nifty Fifty / Dot Com crash

A thread

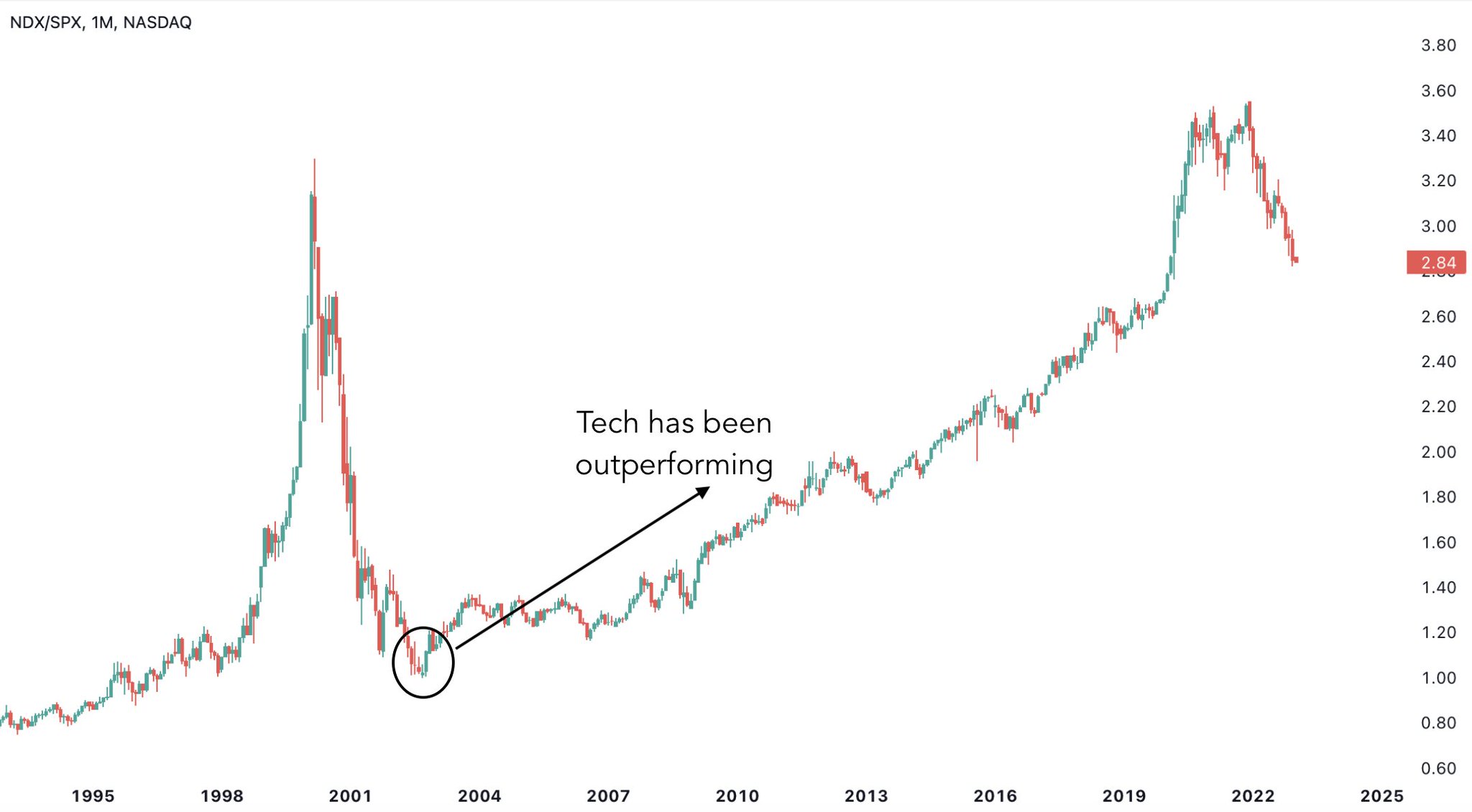

2/ Since the end of the Dot Com bust, the Technology sector has been outperforming the broader market

In fact, Big tech has fueled a large part of the run since 2009

In fact, Big tech has fueled a large part of the run since 2009

3/

3 critical factors drove this environment:

- Digitalization

- Easy monetary policy

- Low inflation

3 critical factors drove this environment:

- Digitalization

- Easy monetary policy

- Low inflation

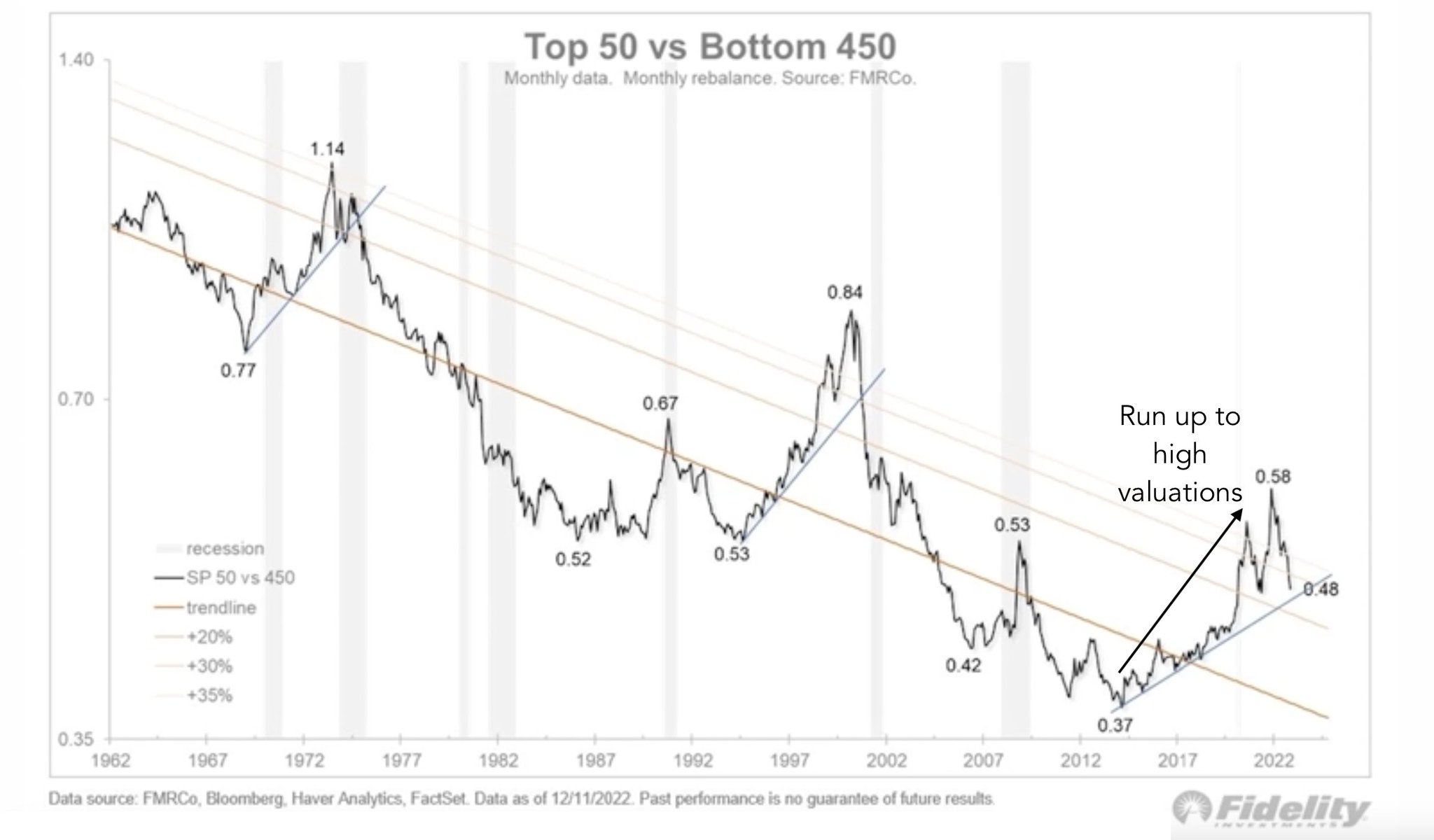

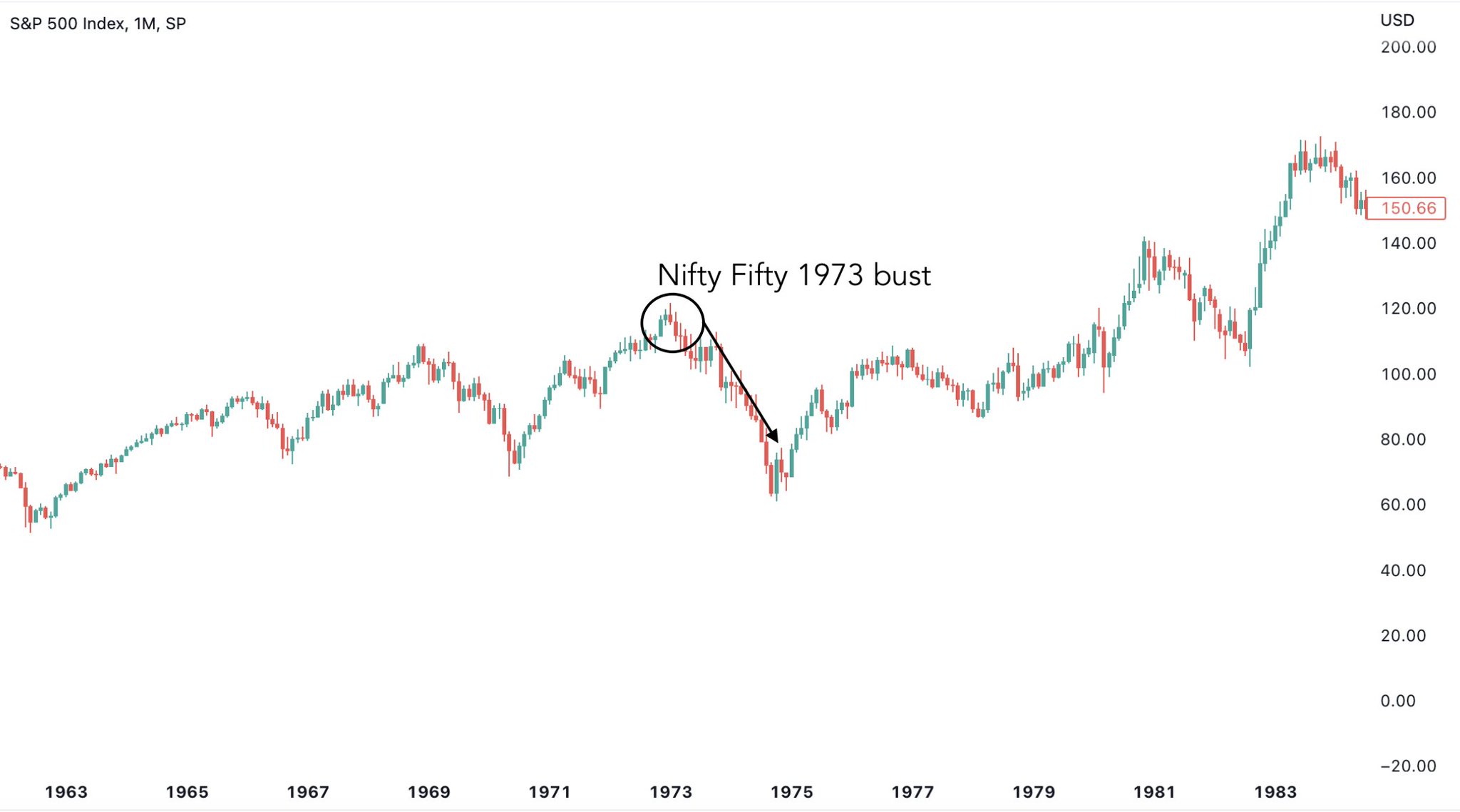

5/ But we’ve seen this type of dynamic before where a handful of big companies outperform and carry the stock market higher

- The late ‘90s leading up to the Dot Com bubble

- The late ’60s leading up to the Nifty Fifty bubble

- The late ‘90s leading up to the Dot Com bubble

- The late ’60s leading up to the Nifty Fifty bubble

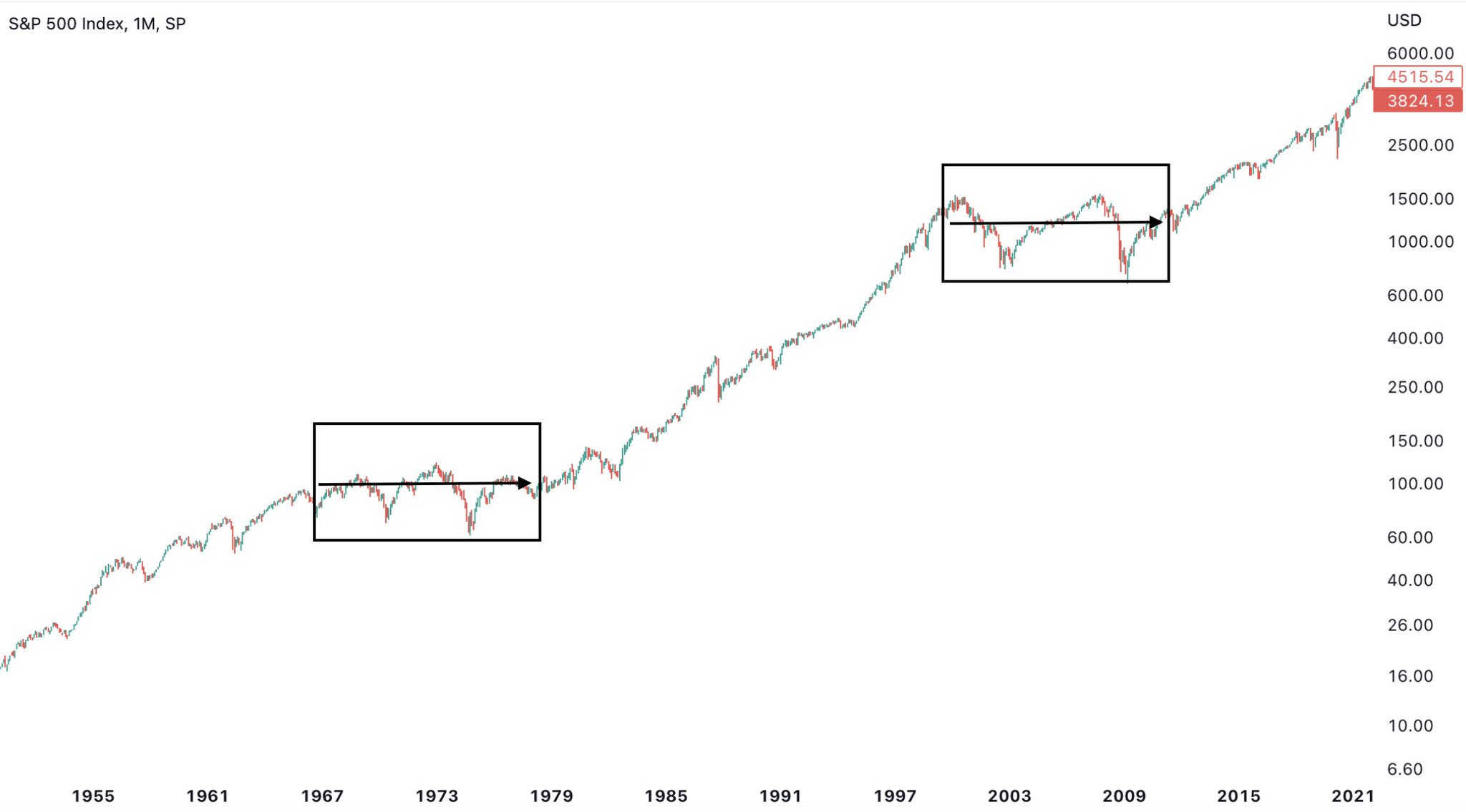

6/ Both of these episodes ended up being big tops in the market, which took almost 10 years each for the highs to be taken out

8/ The top 50 stocks performance relative to the bottom 450 is coming back to its trend support

Most of the top 50 stocks are Tech

Most of the top 50 stocks are Tech

9/

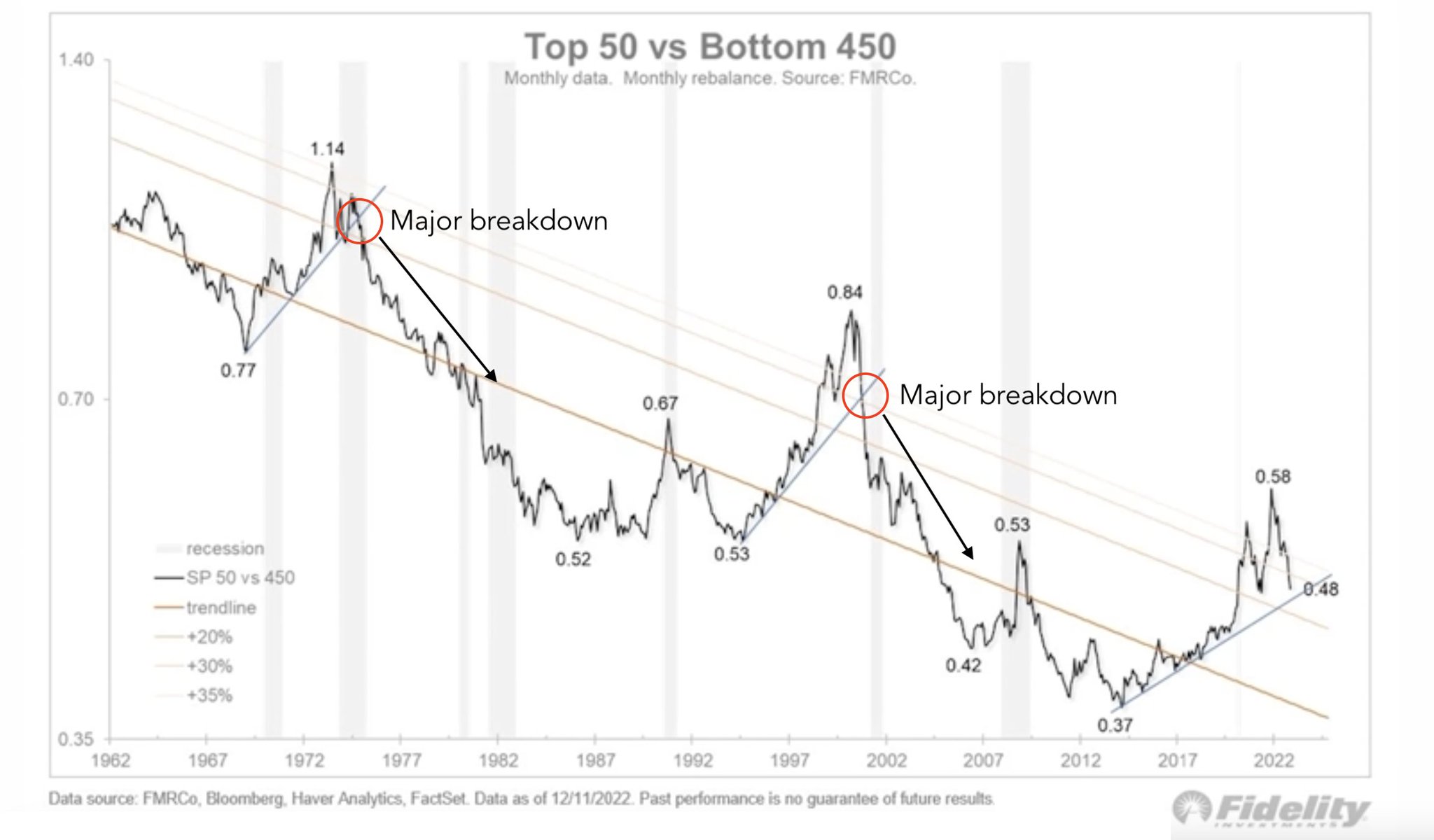

2 prominent periods where the top 50 stocks experienced a major breakdown were:

- 1973 Nifty Fifty crash

- 2000 Dot Com bubble crash

2 prominent periods where the top 50 stocks experienced a major breakdown were:

- 1973 Nifty Fifty crash

- 2000 Dot Com bubble crash

10/ Nifty Fifty was a group of 50 high quality companies that investors deemed as “too good to fail”

And we all know how those stories end

And we all know how those stories end

11/ These included stocks like American Express, General Electric, Mcdonald's and IBM

Which eventually, in ’73 ended up crashing alongside the other stocks present in the Nifty Fifty

Which eventually, in ’73 ended up crashing alongside the other stocks present in the Nifty Fifty

12/ Recently, stocks like Amazon, Google, and Apple made up a massive portion of the S&P 500 at the peak of the market

13/ So is this going to end up being another repeat of the ’73 Nifty Fifty bust?

Let’s take a look at the data

Let’s take a look at the data

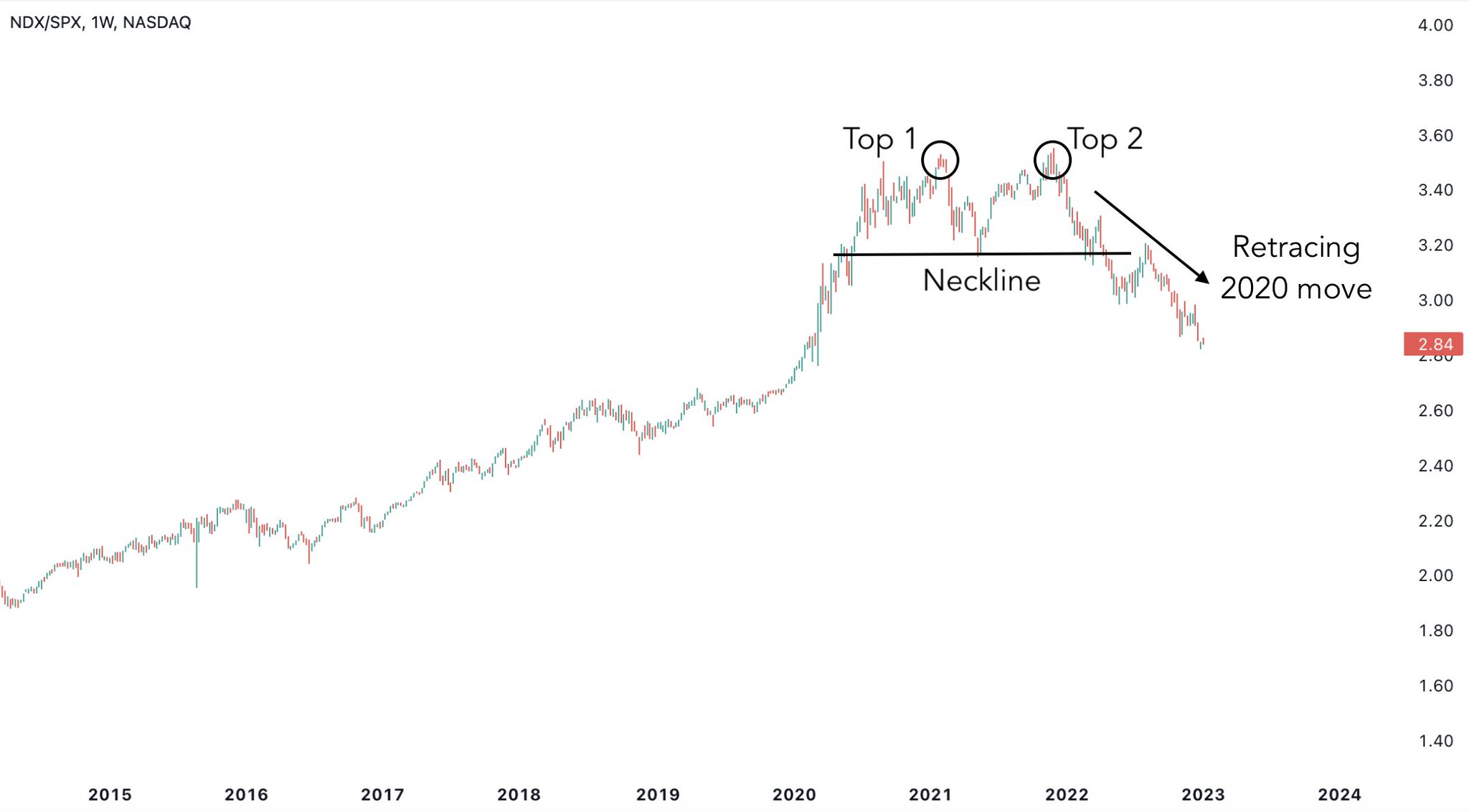

14/ $NDX had substantially outperformed the $SPX, even during the C19 crash

But since 2022, we’ve broken down below the neckline of a double top and have been retracing the 2020 rally

But since 2022, we’ve broken down below the neckline of a double top and have been retracing the 2020 rally

15/ An easy target for this ratio lies at a key support that’s about 5% below the current level

But where do we go after that?

But where do we go after that?

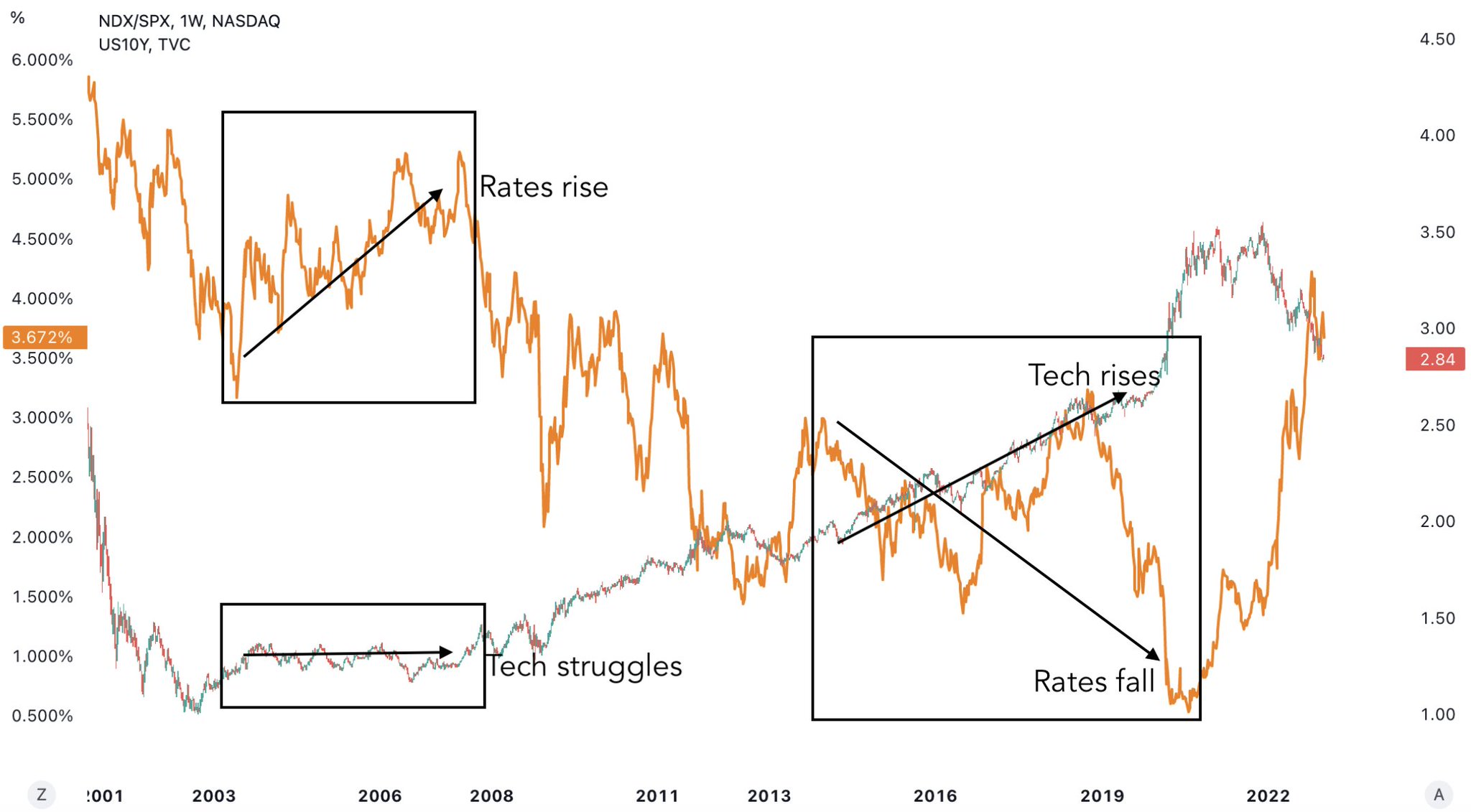

16/ A key driving factor for Tech —> interest rates

Rates up = Tech struggles

Rates down = Tech thrives

Rates up = Tech struggles

Rates down = Tech thrives

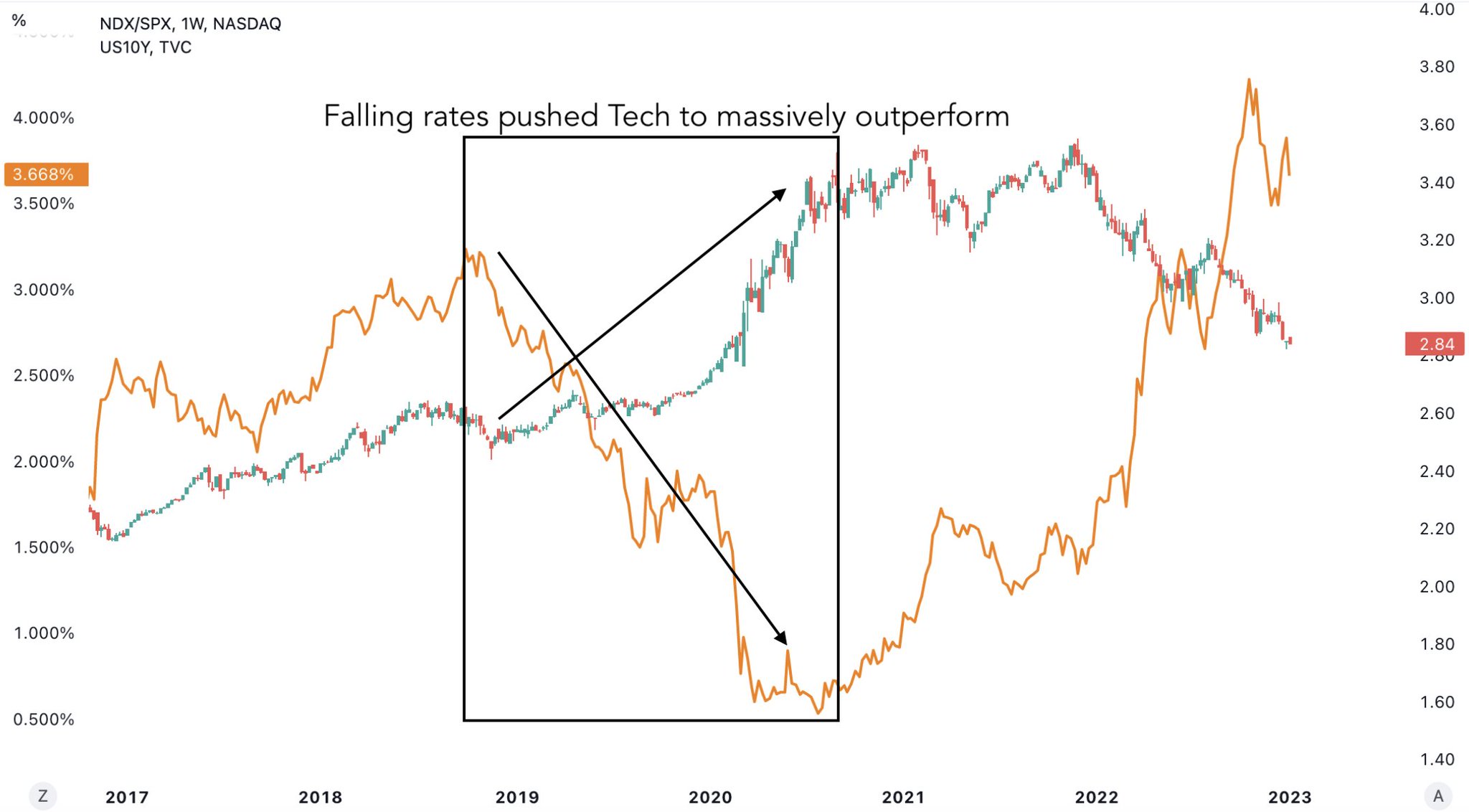

17/ Through 2019 and 2020, the massive drop in 10-year Treasury yields has propelled Tech to massively outperform and end up at very frothy valuations

And as rates started rising, Tech started underperforming

And as rates started rising, Tech started underperforming

18/ But today, there are signs of irrational behavior ongoing in the market as shown in this chart

This might be the result of extreme fear and pessimism in investor sentiment

This might be the result of extreme fear and pessimism in investor sentiment

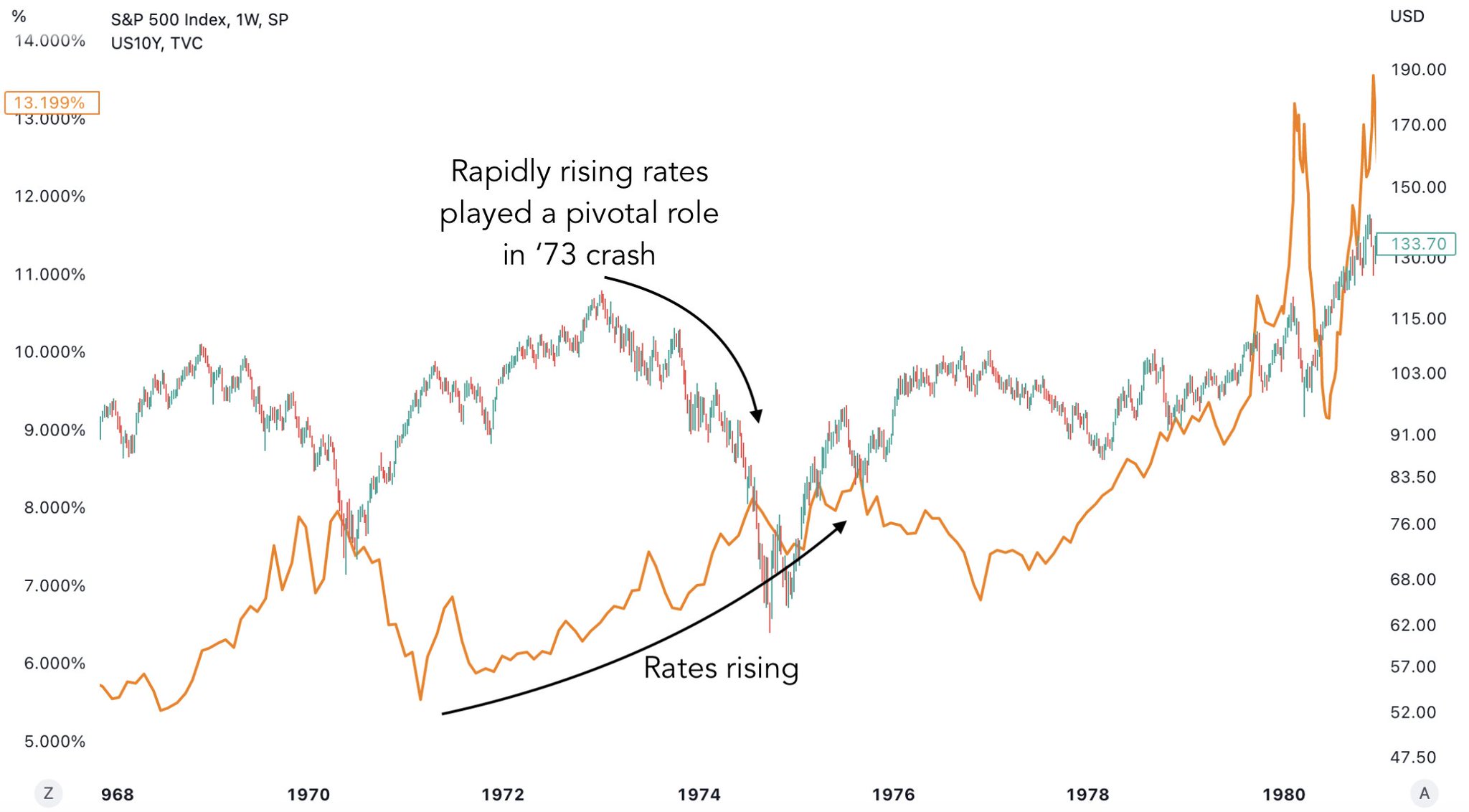

19/ Investors believe rates are going to continue rising and staying high

Just like it did during the Nifty Fifty crash

Just like it did during the Nifty Fifty crash

20/ IF rates continue rising for a prolonged period, all bets are off for Tech

But that might not be a high-probability play

But that might not be a high-probability play

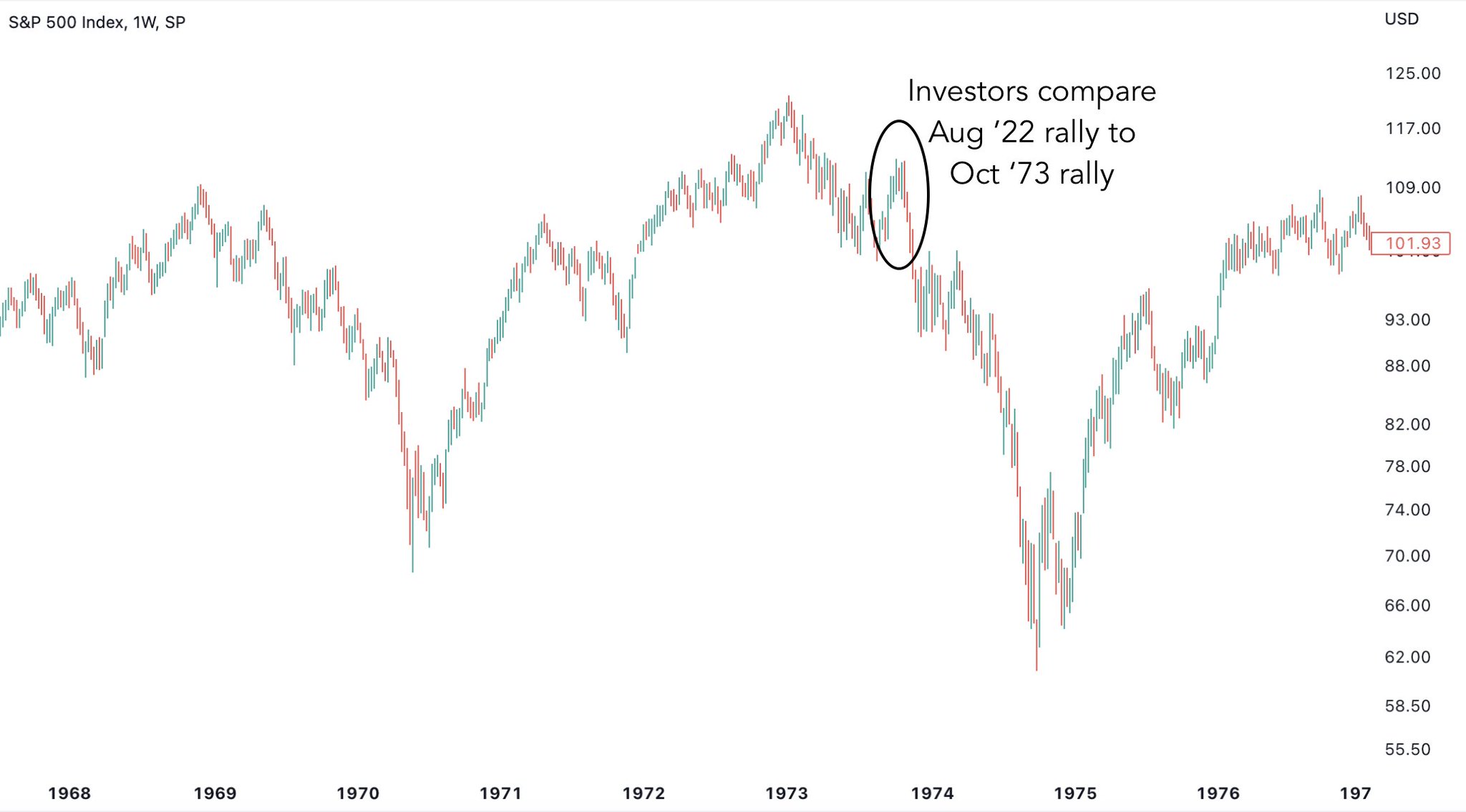

21/ A lot of people compare the recent rally since Aug 2022 to the rally we saw in Oct 1973

But there’s a caveat to this

But there’s a caveat to this

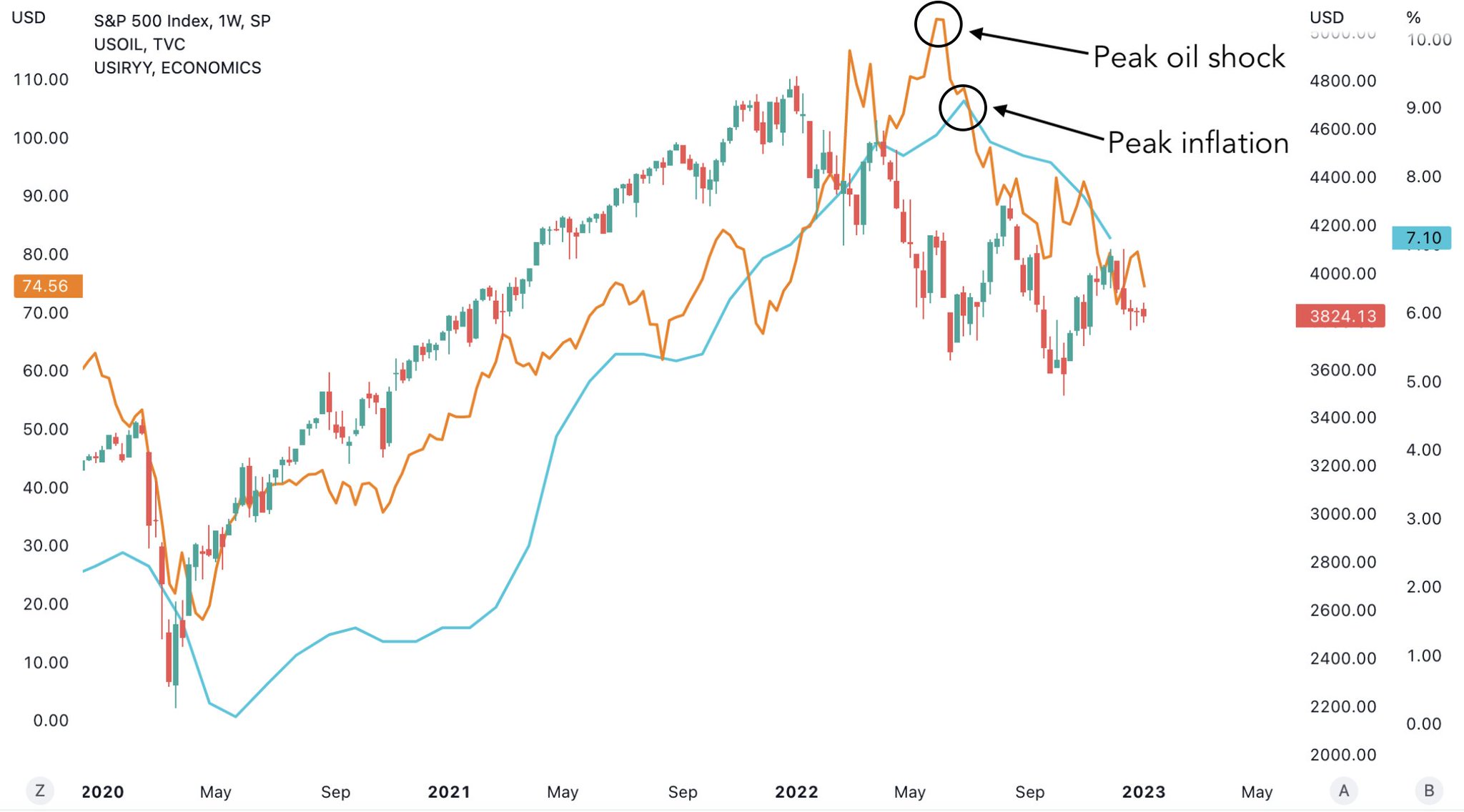

22/ Oil went from around $3.5 in June ’73 to $10 in Jan ’74

This created upwards pressure inflation and for yields in the months and years ahead

This created upwards pressure inflation and for yields in the months and years ahead

23/ But today, the oil shock is behind, with inflation having peaked in June 2022

Unless we have a second oil shock sending inflation higher, rates are poised to come down sooner rather than later

Unless we have a second oil shock sending inflation higher, rates are poised to come down sooner rather than later

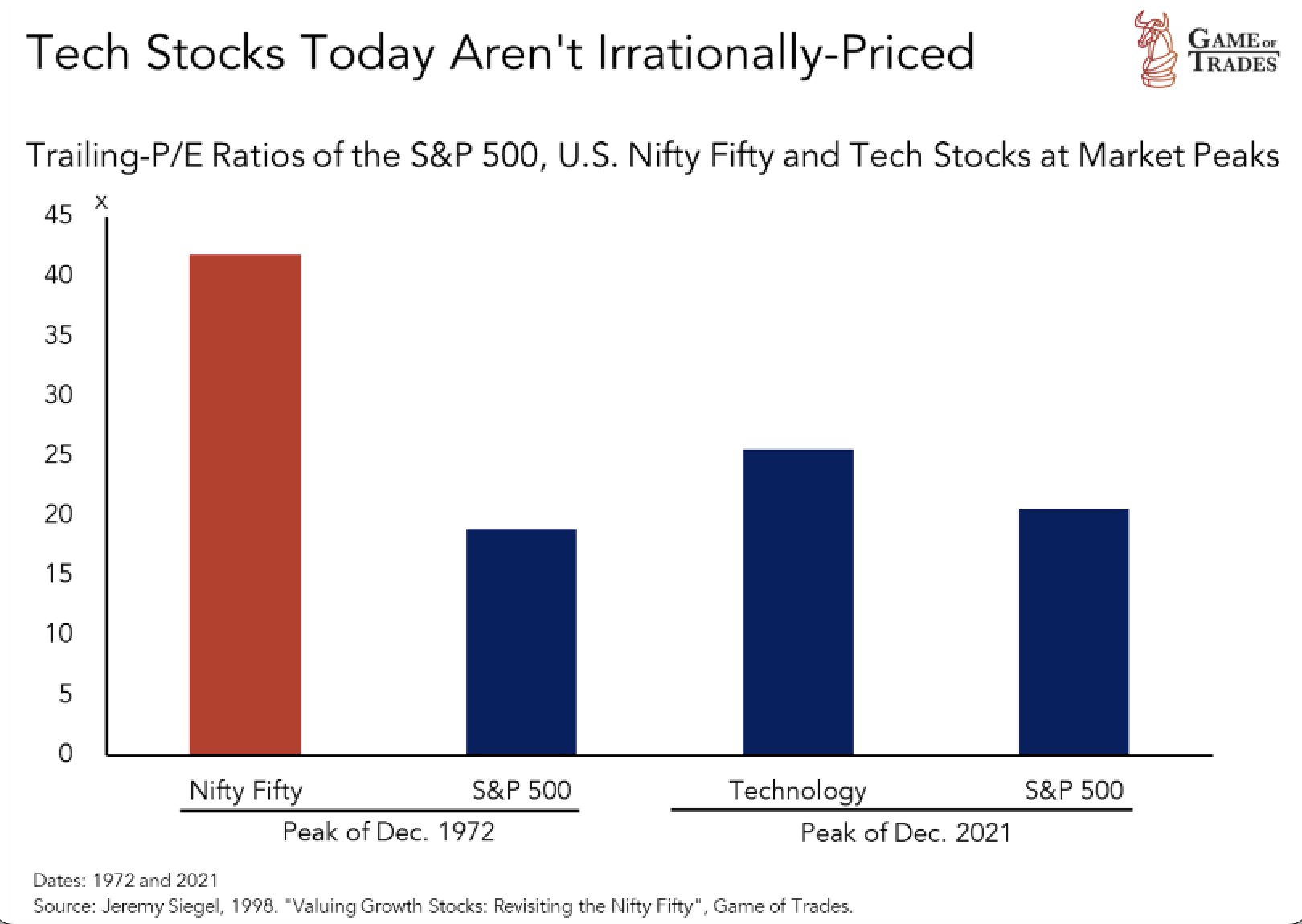

24/ Tech stocks were also a lot cheaper than the S&P 500 in the market top of Dec 2021

Especially when compared to how expensive the Nifty Fifty was relative to the S&P 500

Especially when compared to how expensive the Nifty Fifty was relative to the S&P 500

25/ Thanks for reading!

If you liked this, please like and retweet the first tweet below.

And follow @gameoftrades_ for more market insights, finance and investment strategy content.

If you liked this, please like and retweet the first tweet below.

And follow @gameoftrades_ for more market insights, finance and investment strategy content.

Mentions

See All

Raoul Pal @RaoulPal

·

Jan 8, 2023

Great thread. Thanks.