Thread

Redfin provides home value estimates for over 92 million homes in 43 states and the District of Columbia

They expect 2023 to be the slowest housing market year since 2011

Here's what that means for the value of your home...

They expect 2023 to be the slowest housing market year since 2011

Here's what that means for the value of your home...

Slowdown coming but not 2008 style

"We expect home sales to sink to their lowest level in more than a decade as high mortgage rates keep housing costs up and prevent people from moving. High homeowner equity and a resilient job market will stave off a wave of foreclosures."

"We expect home sales to sink to their lowest level in more than a decade as high mortgage rates keep housing costs up and prevent people from moving. High homeowner equity and a resilient job market will stave off a wave of foreclosures."

Affordability is the main problem thanks to higher rates and higher home prices

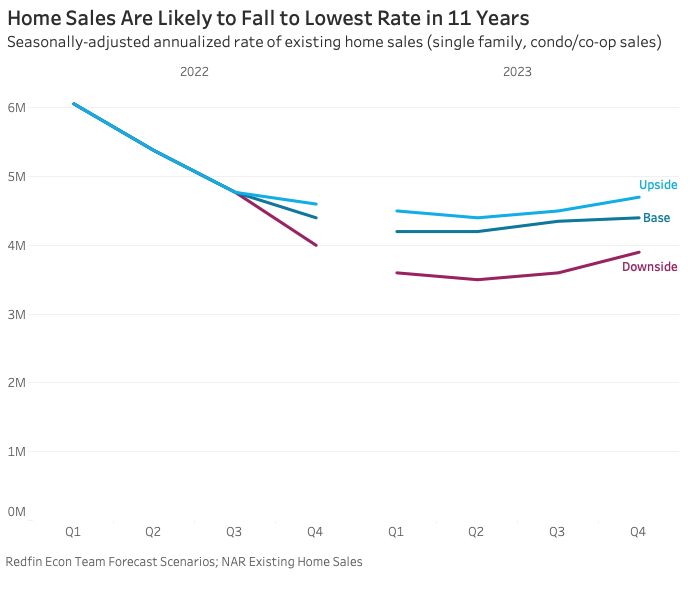

"We expect about 16% fewer existing home sales in 2023 than 2022, landing at 4.3 million, with would-be buyers pressing pause due mostly to affordability challenges"

"We expect about 16% fewer existing home sales in 2023 than 2022, landing at 4.3 million, with would-be buyers pressing pause due mostly to affordability challenges"

Crazy stat.. "lowest housing-turnover rate in 2023 since the early 1980s"

Redfin does present an upside scenario of 4.5 million sales if inflation slows and the fed slows the pace of rate hikes

Redfin does present an upside scenario of 4.5 million sales if inflation slows and the fed slows the pace of rate hikes

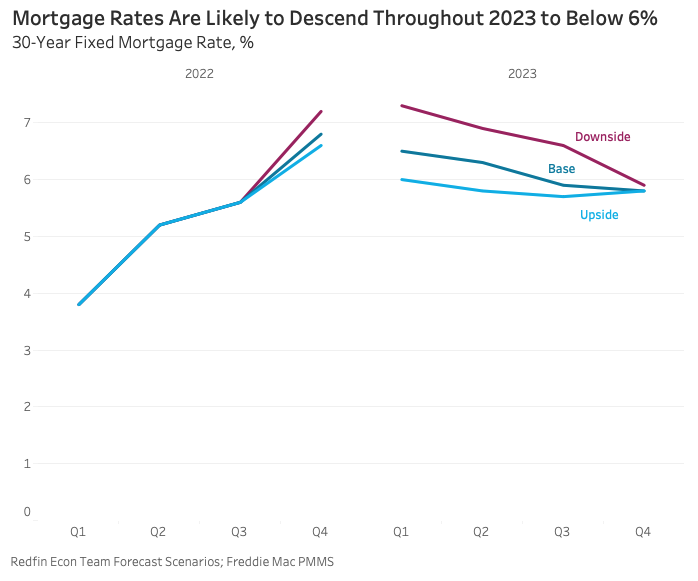

6.5% vs 5.8% rates would save a homebuyer purchasing a $400,000 home $150/month. A $2,500 monthly budget can afford a $383k home with a 6.5% rate; that same buyer could afford a $406k home with a 5.8% rate. At 3% they can afford $517k

Prediction #3: Home prices will post their first YoY decline in a decade (4%), but the U.S. will avoid a wave of foreclosures

"We expect new listings to continue declining through most of next year, keeping inventory near historic lows and preventing prices from plummeting."

"We expect new listings to continue declining through most of next year, keeping inventory near historic lows and preventing prices from plummeting."

*This prediction is a bit unnerving* the

"keeping inventory near historic lows and preventing prices from plummeting"

makes me wonder what happens if inventory does not stay near historic lows?

Things could get ugly (my take)

"keeping inventory near historic lows and preventing prices from plummeting"

makes me wonder what happens if inventory does not stay near historic lows?

Things could get ugly (my take)

The problem is that even with prices dropping, people still won't be able to afford to move because of prices increasing, inflation, unemployment rising, etc

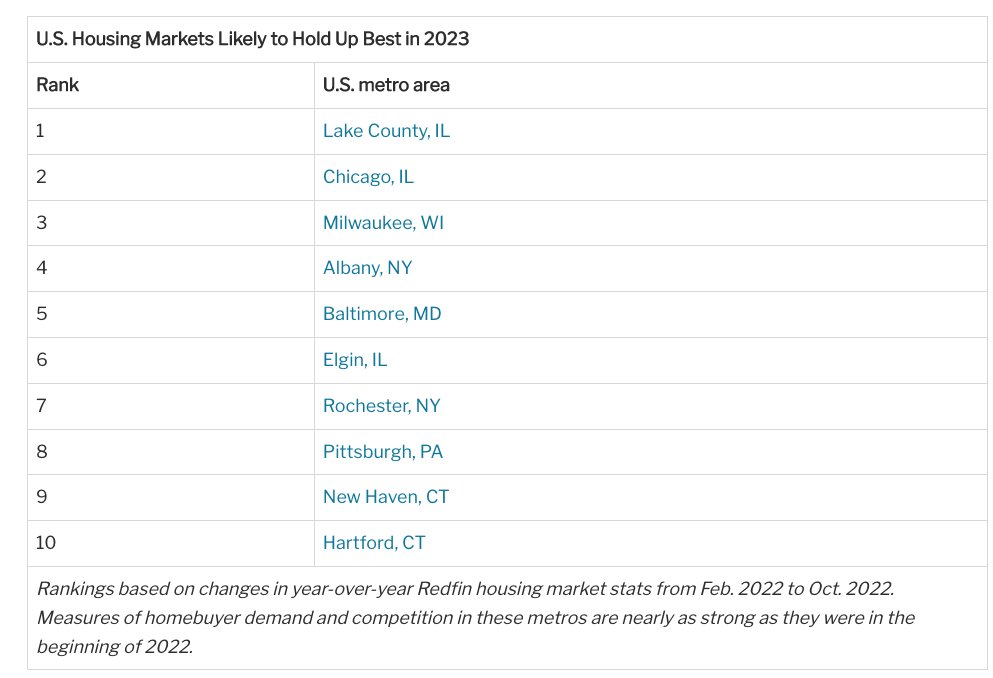

Prediction #4: Midwest, Northeast will hold up best as overall market cools.

They expect the biggest price declines in places like Austin, Boise, and Phoenix because of the increases over the last two years.

They expect the biggest price declines in places like Austin, Boise, and Phoenix because of the increases over the last two years.

Prediction #5: Rents will fall, and many Gen Zers and young millennials will continue renting indefinitely

Good news if you are renting!

Good news if you are renting!

Redfin has 7 more predictions but the top 5 were most important IMO.

I think we could be in for some nasty/scary housing market news over the next couple of years.

I don't think we're heading into a 08-09 type scenario but here's what I'm doing to prepare

I think we could be in for some nasty/scary housing market news over the next couple of years.

I don't think we're heading into a 08-09 type scenario but here's what I'm doing to prepare

#1 Cutting unnecessary expenses.

#2 Building up an extra cushion in our emergency fund.

#3 Trying increase my income & income streams

#4 Continuing to invest money in the stock market

#5 Taking care of my physical and mental health

#2 Building up an extra cushion in our emergency fund.

#3 Trying increase my income & income streams

#4 Continuing to invest money in the stock market

#5 Taking care of my physical and mental health

If this thread was helpful, I think you'll like my free newsletter. I just shared my entire investment portfolio and how I have my long-term investments set up for 2023 & beyond

open.substack.com/pub/austin/p/portfolio-changes-heading-into-2023?r=8q6q&utm_campaign=post&utm_mediu...

open.substack.com/pub/austin/p/portfolio-changes-heading-into-2023?r=8q6q&utm_campaign=post&utm_mediu...

If you learned something from this thread, you can help other people learn by liking and retweeting the top Tweet (linked below)

I appreciate you!

I appreciate you!

Here is a link to the Redfin article I referenced in the thread: www.redfin.com/news/housing-market-predictions-2023/

Mentions

See All

Blake Burge @blakeaburge

·

Jan 3, 2023

Interesting read, thanks Austin.