Thread

While there have been several financial crises in recent decades.

Resolved (temporarily) w/ low rates/QE.

A much bigger bubble has been forming.

Central bank credibility.

A result of their ability to kick the can down the road.

Adding more debt to keep the system afloat.

Resolved (temporarily) w/ low rates/QE.

A much bigger bubble has been forming.

Central bank credibility.

A result of their ability to kick the can down the road.

Adding more debt to keep the system afloat.

The omnipotent central bankers got away w/ easy money policy.

Because inflation hadn't shown up in the real economy - measured by CPI.

However, that changed in the 2020s.

And now their reputation is on the line.

Because inflation hadn't shown up in the real economy - measured by CPI.

However, that changed in the 2020s.

And now their reputation is on the line.

Coordination of monetary & fiscal policy in response to COVID has resulted in the highest inflation in 40yrs.

The Fed has been leading the charge, tightening financial conditions this yr.

Trying to resolve the problem they created w/ rate hikes & QT.

The Fed has been leading the charge, tightening financial conditions this yr.

Trying to resolve the problem they created w/ rate hikes & QT.

Wall St consensus says the Fed, which can do no wrong, will successfully defeat inflation.

Like Paul Volcker in the 80s.

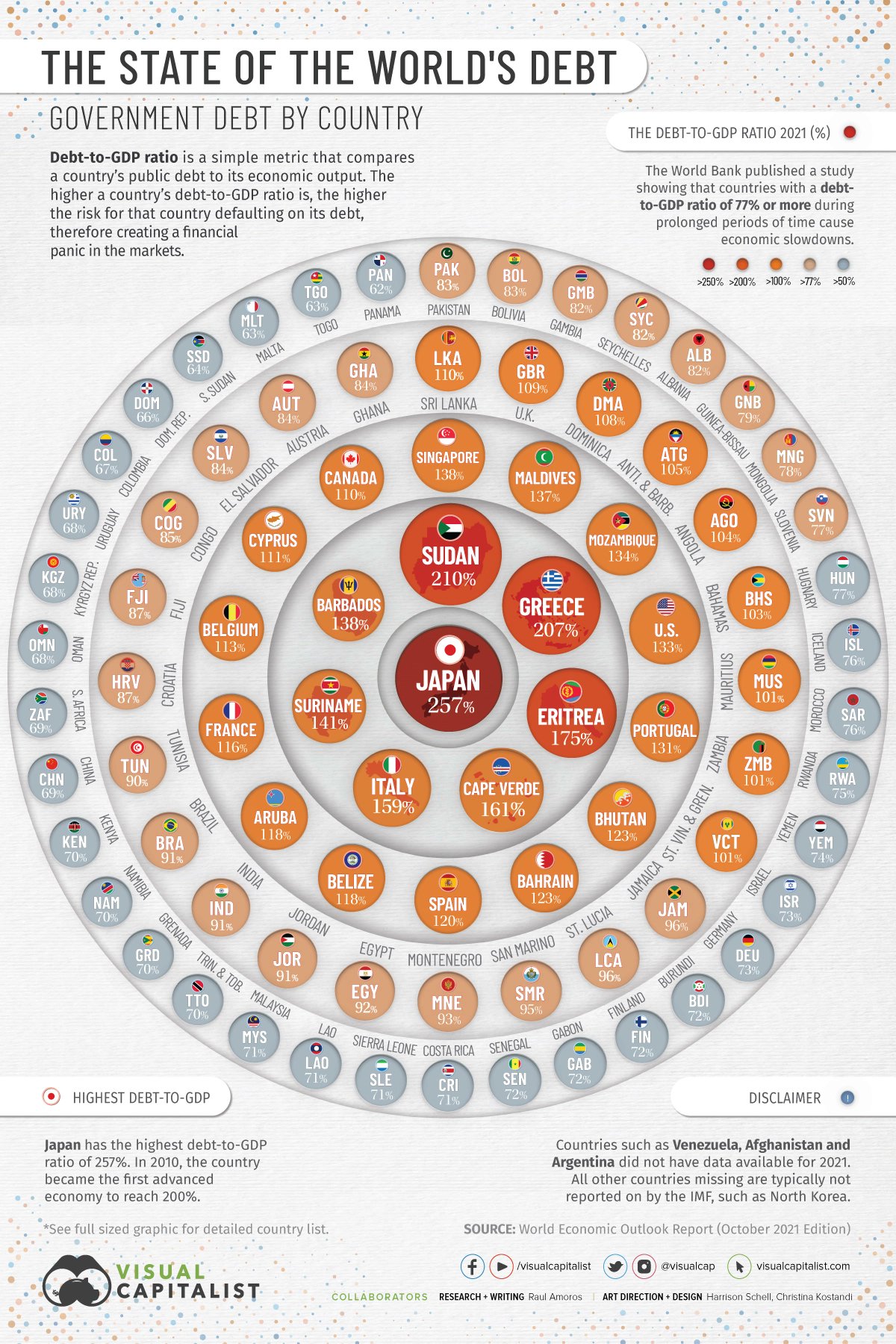

However, the egregious debt burden of the US & nation-states globally is overlooked by these analysts.

Like Paul Volcker in the 80s.

However, the egregious debt burden of the US & nation-states globally is overlooked by these analysts.

Countries around the world have saddled themselves w/ unsustainable levels of debt.

Central banks successfully avoided calamity in the past by adding more debt at lower rates.

But now they are compromised.

Central banks successfully avoided calamity in the past by adding more debt at lower rates.

But now they are compromised.

Because nation-states globally face a "Debt Spiral."

For a deeper dive into the Debt Spiral check out @jameslavish article:

jameslavish.substack.com/p/-whats-a-debt-spiral-and-is-the-us

For a deeper dive into the Debt Spiral check out @jameslavish article:

jameslavish.substack.com/p/-whats-a-debt-spiral-and-is-the-us

@jameslavish Summarizing the above, the US has $31 TRILLION of debt + $172 TRILLION of unfunded liabilities.

High interest rates = higher gov interest expense.

High inflation = higher entitlements bc of cost of living adjustment (COLA).

Gov's expenses are INCREASING.

High interest rates = higher gov interest expense.

High inflation = higher entitlements bc of cost of living adjustment (COLA).

Gov's expenses are INCREASING.

@jameslavish Simultaneously, taxes, the Gov's revenue is DECREASING.

Crashing asset values & demand (job) destruction results in less taxes.

So, expenses are increasing, revenues decreasing, meanwhile the Gov has already been running $1T+ deficits.

Crashing asset values & demand (job) destruction results in less taxes.

So, expenses are increasing, revenues decreasing, meanwhile the Gov has already been running $1T+ deficits.

@jameslavish The US Government & most governments globally are INSOLVENT.

Ultimately the fiscal position will hinder the CBs from defeating inflation.

Forced to lower interest rates and print money again.

Ultimately the fiscal position will hinder the CBs from defeating inflation.

Forced to lower interest rates and print money again.

@jameslavish If inflation remains elevated above the 2% target when central banks are forced to lower rates & print money...

That will be a humiliating loss for the central bankers.

Abandoning their fight against inflation would mean they have lost control of the financial system.

That will be a humiliating loss for the central bankers.

Abandoning their fight against inflation would mean they have lost control of the financial system.

@jameslavish The biggest bubble of them all, central bank credibility, could burst.

It would be apparent to the masses that the emperor has no clothes.

Will the CBs be able to save their credibility, or will the bubble burst?

Find out here👇:

fiatcave.substack.com/p/central-bank-credibility-the-next

It would be apparent to the masses that the emperor has no clothes.

Will the CBs be able to save their credibility, or will the bubble burst?

Find out here👇:

fiatcave.substack.com/p/central-bank-credibility-the-next

Fin/ Thank you for reading!

If you enjoyed this thread, please RT to spread the signal.

Have a fantastic day & happy new year!

If you enjoyed this thread, please RT to spread the signal.

Have a fantastic day & happy new year!