Thread by The Secret CFO

- Tweet

- Nov 18, 2022

- #Business #Accounting

Thread

Wanna know how CFOs cook the books? 🧑🍳📚

Silly question. Of course you do…

Here’s how: 👇👇👇

Silly question. Of course you do…

Here’s how: 👇👇👇

First things first.

Let’s define cooking the books.

Most people get this wrong.

Cooking the books is not the same as fraud.

Let’s define cooking the books.

Most people get this wrong.

Cooking the books is not the same as fraud.

FTX didn’t cook the books. (It sounds like they didn't even know where the books where)

They stole ordinary people’s money and used it for personal gain (allegedly).

That’s fraud. Not f*cking cool.

They stole ordinary people’s money and used it for personal gain (allegedly).

That’s fraud. Not f*cking cool.

Enron didn’t cook the books.

They built a web of lies so big it torched $74bn of shareholder value and brought down a whole audit firm. Yes, the Big 4 were once the Big 5,

That’s fraud. Not f*cking cool.

They built a web of lies so big it torched $74bn of shareholder value and brought down a whole audit firm. Yes, the Big 4 were once the Big 5,

That’s fraud. Not f*cking cool.

Whilst these are interesting and make good movies. They aren’t that common. If they were the whole economy would stop working.

Cooking the books is much more common place. But not as catastrophic

It’s still important though...

Cooking the books is much more common place. But not as catastrophic

It’s still important though...

Cooking the books is also known as ‘creative accounting.’

Creative accounting is using the accounting rules to your advantage. I.e. to get the specific answer you want

Let me explain further

Creative accounting is using the accounting rules to your advantage. I.e. to get the specific answer you want

Let me explain further

Much of accounting requires judgments. Assumptions.

- Expected value of redundant inventory

- Expectations of future warranty claims

- Future bad debt levels

- Accruals for uninvoiced costs

- Useful life of owned assets

There are just examples, there are dozens more.

- Expected value of redundant inventory

- Expectations of future warranty claims

- Future bad debt levels

- Accruals for uninvoiced costs

- Useful life of owned assets

There are just examples, there are dozens more.

These ‘known unknowns’ are part of life.

One of the critical part of the CFO’s role is to make judgments and assumptions for these known unknowns.

It’s a position of trust.

And the mandate is to report using your best independent judgment at a point in time.

One of the critical part of the CFO’s role is to make judgments and assumptions for these known unknowns.

It’s a position of trust.

And the mandate is to report using your best independent judgment at a point in time.

Each of those assumptions will be somewhere on the scale of pessimism to optimism.

And somewhere in that scale will be a reasonable range.

Creative accounting is all about selecting convenient assumptions to get the outcome you want.

And somewhere in that scale will be a reasonable range.

Creative accounting is all about selecting convenient assumptions to get the outcome you want.

But next quarter is expected to be a bit tougher.

And no-one wants to shit their pants in front of Wall Street.

And no-one wants to shit their pants in front of Wall Street.

Those ups and downs from quarter to quarter are just so … you know … inconvenient.

Wouldn’t it be easier if we could move a bit of profit out of this quarter and into next?

Well that's what happens ... A LOT.

Wouldn’t it be easier if we could move a bit of profit out of this quarter and into next?

Well that's what happens ... A LOT.

Result: Showing the nice smooth QoQ improvement that gives Wall Street a dollar shaped boner.

The issue is that assumptions are being backsolved from the answer management want.

The tail is wagging the dog.

It's not my style.

But it’s common as hell & plenty of CFOs do this.

The issue is that assumptions are being backsolved from the answer management want.

The tail is wagging the dog.

It's not my style.

But it’s common as hell & plenty of CFOs do this.

Quick side note: Can you imagine an actual dog being wagged by its tail?

Hilarious.

Tail perfectly still.

Doggo flapping side to side, slobber going everywhere. I’d love to see that.

Anyway … back to work

Hilarious.

Tail perfectly still.

Doggo flapping side to side, slobber going everywhere. I’d love to see that.

Anyway … back to work

So, how do CFOs use 'creative accounting'. Well the list is long, but I’ve captured it under 5 headings.

Let’s take each in turn

Let’s take each in turn

But before we do ...

Important disclaimer: I don't advocate using any these techniques

Manipulating reporting is 100% "small boy stuff" (c/o @ShaanVP ).

But if you are going to get better at reading or preparing financials, you've got to understand what games can be played.

Important disclaimer: I don't advocate using any these techniques

Manipulating reporting is 100% "small boy stuff" (c/o @ShaanVP ).

But if you are going to get better at reading or preparing financials, you've got to understand what games can be played.

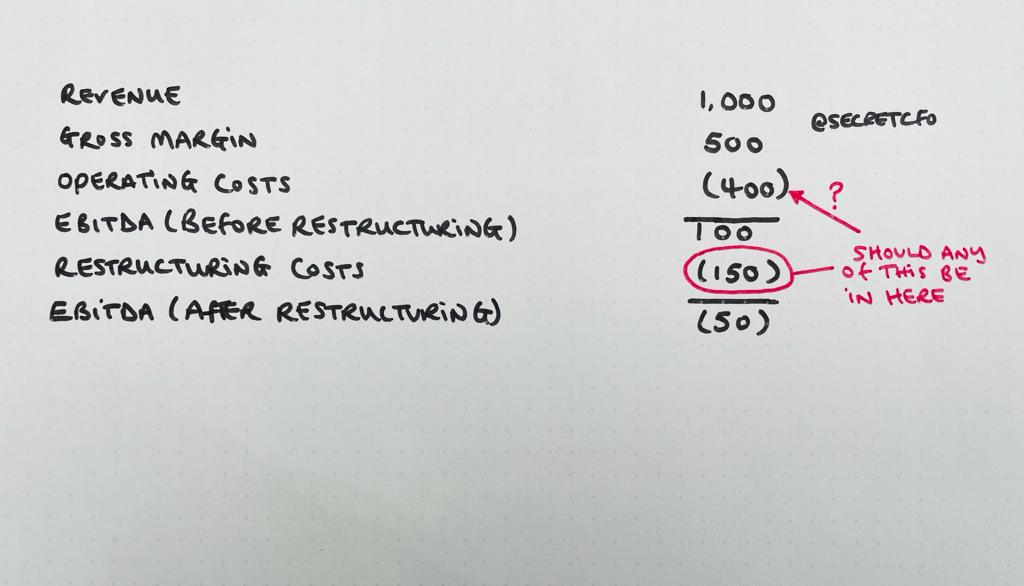

1. Convenient Classification

This refers to the classification of Income Statement and Balance Sheet items.

E.g. classifying certain costs as being ‘below EBITDA’ in the IS.

This refers to the classification of Income Statement and Balance Sheet items.

E.g. classifying certain costs as being ‘below EBITDA’ in the IS.

Management know investors will focus on EBITDA. And so, may not apply as much focus to such costs beneath EBITDA in the IS.

Or they could even be convinced to 'think about them as one-off costs'.

Or they could even be convinced to 'think about them as one-off costs'.

It’s particularly common in businesses with recent M&A.

Very easy to bury real operating costs in restructuring cost lines.

Especially when the the CEO wants that acquisition to look as good as possible.

Very easy to bury real operating costs in restructuring cost lines.

Especially when the the CEO wants that acquisition to look as good as possible.

Beware also items that are debt in substance.

But lurking outside of the debt definition on a technicality.

But lurking outside of the debt definition on a technicality.

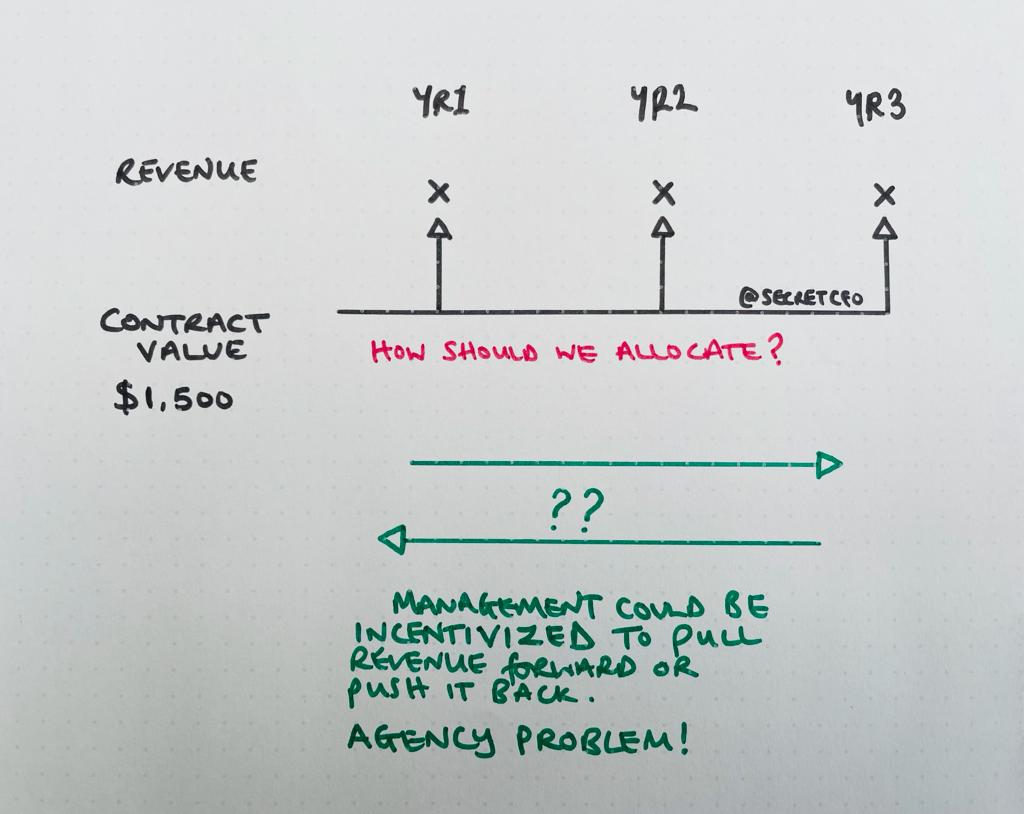

2. Revenue recognition

Measuring revenue in fast moving businesses (retail, consumer, leisure, etc) is easy. Generally speaking, it’s the total of what you rolled through the checkout, or invoiced / dispatched.

It’s factual.

Measuring revenue in fast moving businesses (retail, consumer, leisure, etc) is easy. Generally speaking, it’s the total of what you rolled through the checkout, or invoiced / dispatched.

It’s factual.

But, what about businesses where revenue is spread over more than one year

Think warranty sales, long term contracts, big manufacturing, construction, etc.

These all need assumptions on how revenue is spread over each reporting period.

Think warranty sales, long term contracts, big manufacturing, construction, etc.

These all need assumptions on how revenue is spread over each reporting period.

Isn’t it tempting to tweak the assumptions to find the profit answer you are looking for?

Not in my house.

Not in my house.

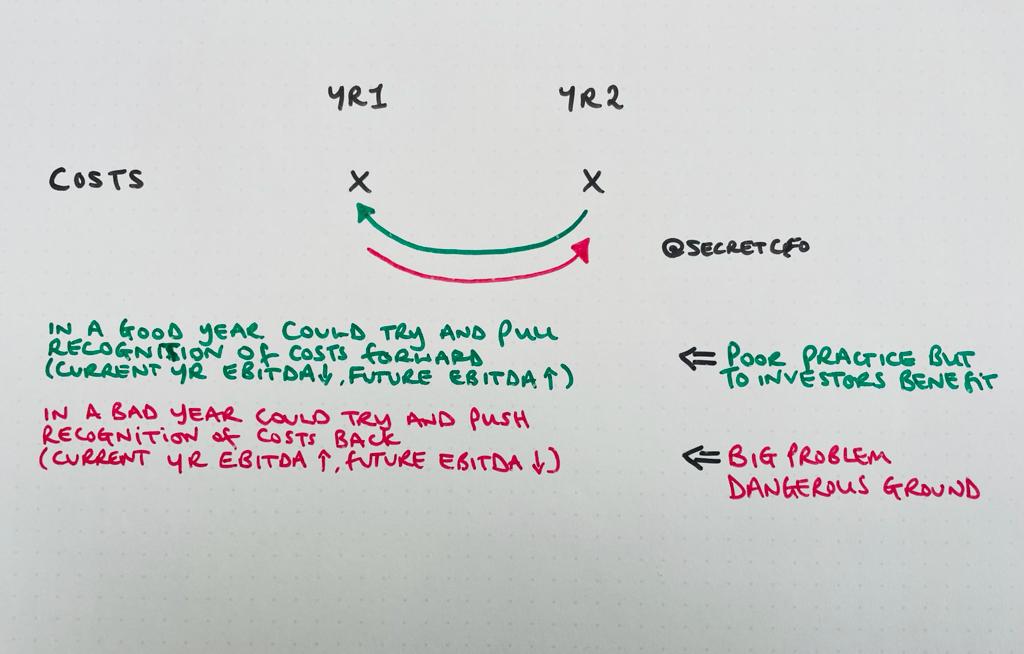

3. Expense Shifting

This is happening every day in every large business.

Accountants use prepayments and accruals to match costs to the period in which they are incurred.

This is different to the invoicing and cash payment profile.

This is happening every day in every large business.

Accountants use prepayments and accruals to match costs to the period in which they are incurred.

This is different to the invoicing and cash payment profile.

It's easy to shift costs from one period to another to suit.

This can get out of hand if the internal controls are poor.

In the worse case, it can turn into under accruals, and unsupported prepayments.

That means an Income Statement with under reported costs.

This can get out of hand if the internal controls are poor.

In the worse case, it can turn into under accruals, and unsupported prepayments.

That means an Income Statement with under reported costs.

I once walked into a business to find $25m of under reported costs. The business had been repeatedly shifting costs into ‘tomorrow’ .

And guess what, tomorrow never came…

Well it did when I showed up.

NOT IN MY HOUSE

And guess what, tomorrow never came…

Well it did when I showed up.

NOT IN MY HOUSE

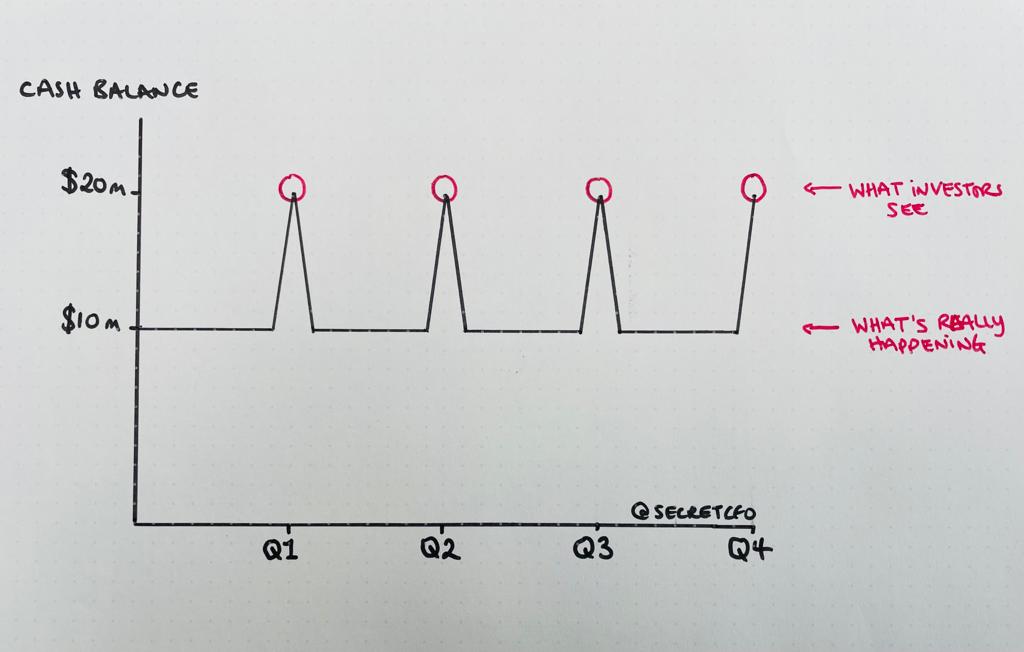

4. Cashflow manipulation

This one is a dirty secret. Sorry my CFO brothers and sisters.

For public companies. It is common to use short term working capital levers to manipulate the cash balance to the desired answer.

This one is a dirty secret. Sorry my CFO brothers and sisters.

For public companies. It is common to use short term working capital levers to manipulate the cash balance to the desired answer.

Simple example.

Let’s imagine you pay $10m of supplier payments every Friday.

But on the weekend of the year end / quarter end you make that payment on the following Monday.

So the $10m outflow falls the other side of the year end.

Let’s imagine you pay $10m of supplier payments every Friday.

But on the weekend of the year end / quarter end you make that payment on the following Monday.

So the $10m outflow falls the other side of the year end.

That means your cash is temporarily $10m higher than expected.

And it’s real cash so that’s ok right?

Well yes. But what if you do the same next quarter, and the quarter after, etc…

Aren’t you building an expectation that your cash balance is higher than it truly is by $10m?

And it’s real cash so that’s ok right?

Well yes. But what if you do the same next quarter, and the quarter after, etc…

Aren’t you building an expectation that your cash balance is higher than it truly is by $10m?

And given cash is a component of your net debt metric (and thus leverage), that’s pretty important right?

See also use of accounts receivable and accounts payable borrowing platforms.

See also use of accounts receivable and accounts payable borrowing platforms.

These are often classified as working capital items rather than debt.

Giving the impression of excellent working capital management, when in fact it's just debt funded, (and the opposite is true.)

The regulators are sleeping at the wheel here, and companies take advantage.

Giving the impression of excellent working capital management, when in fact it's just debt funded, (and the opposite is true.)

The regulators are sleeping at the wheel here, and companies take advantage.

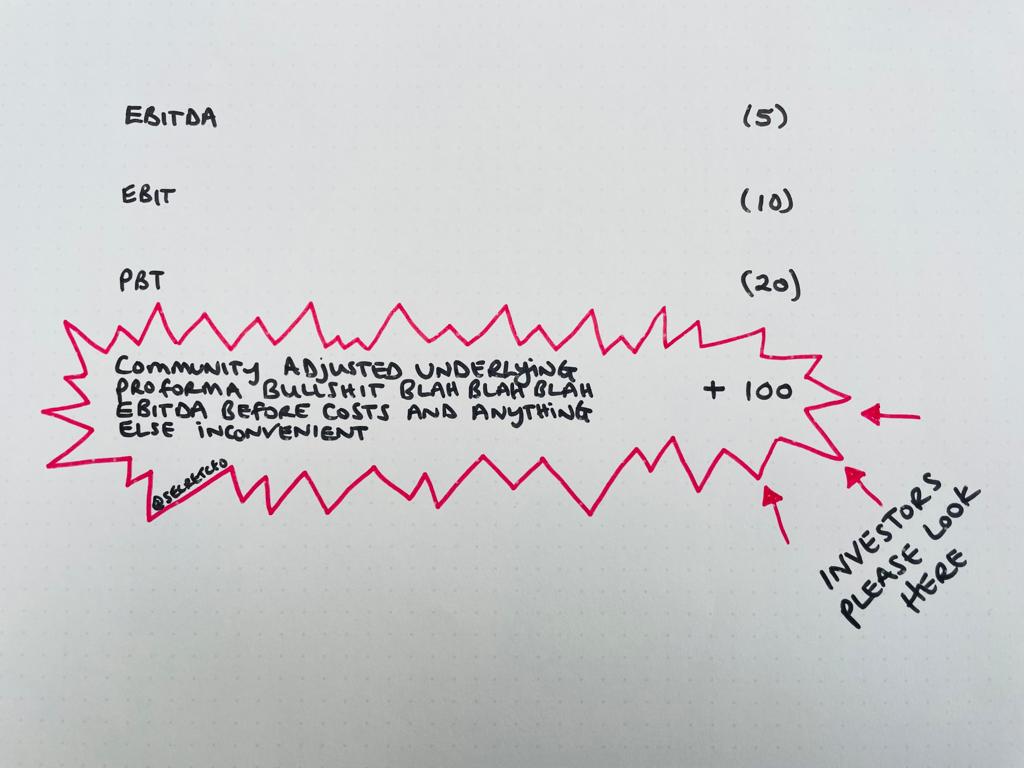

5. Metric Manipulation

Don’t like the metrics Wall Street are using to decide whether you are a winner or a loser?

Well why not make your own up!

Our very own EBITDADDY did exactly this...

Don’t like the metrics Wall Street are using to decide whether you are a winner or a loser?

Well why not make your own up!

Our very own EBITDADDY did exactly this...

Whilst the annual reports are subject to audit, the analyst presentations, etc, are not.

This is where management can go a bit 'improv jazz' on some of the metrics they use

This is where management can go a bit 'improv jazz' on some of the metrics they use

Regulators are finally waking up to this.

They are tightening up on how ‘Alternative Performance Measures’ are described in the annual reports.

This is a good thing for investors.

More transparency.

They are tightening up on how ‘Alternative Performance Measures’ are described in the annual reports.

This is a good thing for investors.

More transparency.

I’ve simplified the techniques into the 5 buckets above. But the cookbook for the budding CFO Chef is pretty large.

To be clear again, I don’t condone using the above.

But it’s important to understand these techniques. Because they can happen in different scales at any level of the organization.

But it’s important to understand these techniques. Because they can happen in different scales at any level of the organization.

But also, remember creative accounting isn’t fraud.

No good CFOs commit fraud (I do hope this is not a controversial statement).

But plenty of decent CFOs use creative accounting.

No good CFOs commit fraud (I do hope this is not a controversial statement).

But plenty of decent CFOs use creative accounting.

The best CFOs (in my view) commit to transparent reporting. and use that transparency to drive accountability back into the business.

And in turn drive business performance.

Which turns into better reported results.

This is the proper way (also the hard way).

And in turn drive business performance.

Which turns into better reported results.

This is the proper way (also the hard way).

Transparency is important for investors. So they can understand the business & make good decisions.

As CFO I work for them.

That’s right, ole uncle secret is a straight shooter.

As CFO I work for them.

That’s right, ole uncle secret is a straight shooter.

And if I spot someone who doesn’t have those same values, I get them out quickly.

Not in my house.

And if they are particularly bad...

Well, I photoshop an eggplant onto a picture of their face.

Not in my house.

And if they are particularly bad...

Well, I photoshop an eggplant onto a picture of their face.

That's cooking the books! If you liked it, please RT the tweet below to share this thread with your audience.

And follow @secretCFO for more like these (or you'll get the eggplant treatment too)

And follow @secretCFO for more like these (or you'll get the eggplant treatment too)