Thread

Some general thoughts on this recent report from @BrookingsInst 🧵

www.brookings.edu/research/debunking-the-narratives-about-cryptocurrency-and-financial-inclusion/

www.brookings.edu/research/debunking-the-narratives-about-cryptocurrency-and-financial-inclusion/

Credit to @Tonantzin_LC for noting early in the report that “it is crucial to emphasize that crypto’s current state and its potential are very different, including when it comes to financial inclusion claims.”

And credit for noting early that it is also crucial to distinguish between the unbanked, underbanked, racial, and other groups often considered when discussing financial inclusion.

These groups are swept together all too often.

These groups are swept together all too often.

However, I don't agree that FedNow, Postal Banking, and Fed Accounts as “more direct ways to address financial inclusion.”

On FedNow, the Fed has not only been slow to offer much-needed updates, but it also undermined the efforts of others to offer those updates.

www.brookings.edu/opinions/we-shouldnt-have-to-wait-for-fednow-to-have-faster-payments/

www.brookings.edu/opinions/we-shouldnt-have-to-wait-for-fednow-to-have-faster-payments/

On Postal Banking, well... people just don't actually seem to want the USPS to be their bank.

Last year's postal banking pilot program only received 6 customers across four cities.

www.cato.org/blog/only-six-people-used-postal-banking-pilot-program

Last year's postal banking pilot program only received 6 customers across four cities.

www.cato.org/blog/only-six-people-used-postal-banking-pilot-program

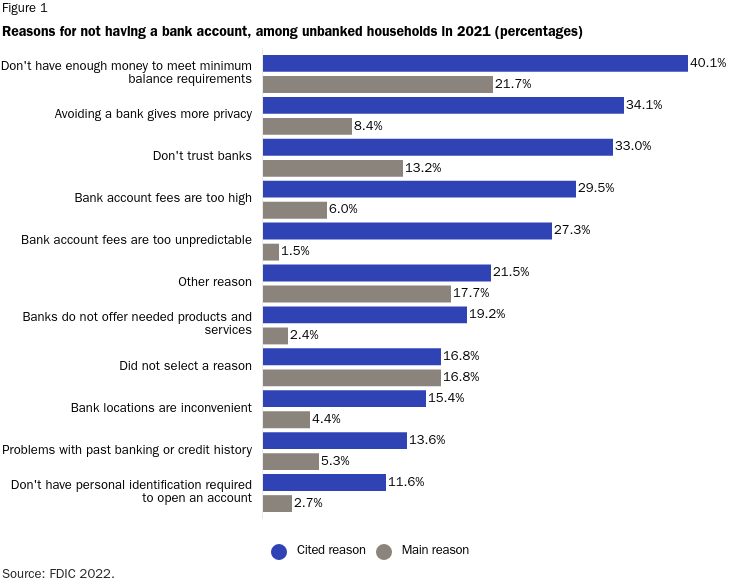

And on Fed Accounts, these are unlikely to be a solution so long as privacy and trust remain key concerns for the unbanked (see figure below) considering the federal government regularly violates financial privacy and so many Americans distrust the government.

And all of this does not even touch on how the government itself bears responsibility for the rising costs of financial services, the lack of financial privacy in this country, and even explicitly exclusionary policies like redlining.

But all of this should make it clear why the government should not be considered as the only solution for financial inclusion, if at all.

Therefore, rather than abandon the potential for cryptocurrency—as the report concludes—to solely focus on fixing the traditional financial system, Congress should seek to fix the existing system and welcome new alternatives.

For more, see my latest @CatoInstitute blog below. #CatoEcon

www.cato.org/blog/brookings-curious-case-against-financial-inclusion-cryptocurrency-0

www.cato.org/blog/brookings-curious-case-against-financial-inclusion-cryptocurrency-0