Thread

1/

There are two primary types of secured money markets:

1. Overnight Repurchase Agreements (Repo) - a Treasury-collateralized overnight borrowing market

2. FX Swap Market - a currency-collateralized borrowing market

There are two primary types of secured money markets:

1. Overnight Repurchase Agreements (Repo) - a Treasury-collateralized overnight borrowing market

2. FX Swap Market - a currency-collateralized borrowing market

2/

A report released by the BIS, Dollar debt in FX swaps and forwards: huge, missing and growing, unveiled a large and growing amount of off-balance sheet debt in the FX swap market, one of the deepest and most liquid markets for short-term dollar funding in the world.

A report released by the BIS, Dollar debt in FX swaps and forwards: huge, missing and growing, unveiled a large and growing amount of off-balance sheet debt in the FX swap market, one of the deepest and most liquid markets for short-term dollar funding in the world.

3/

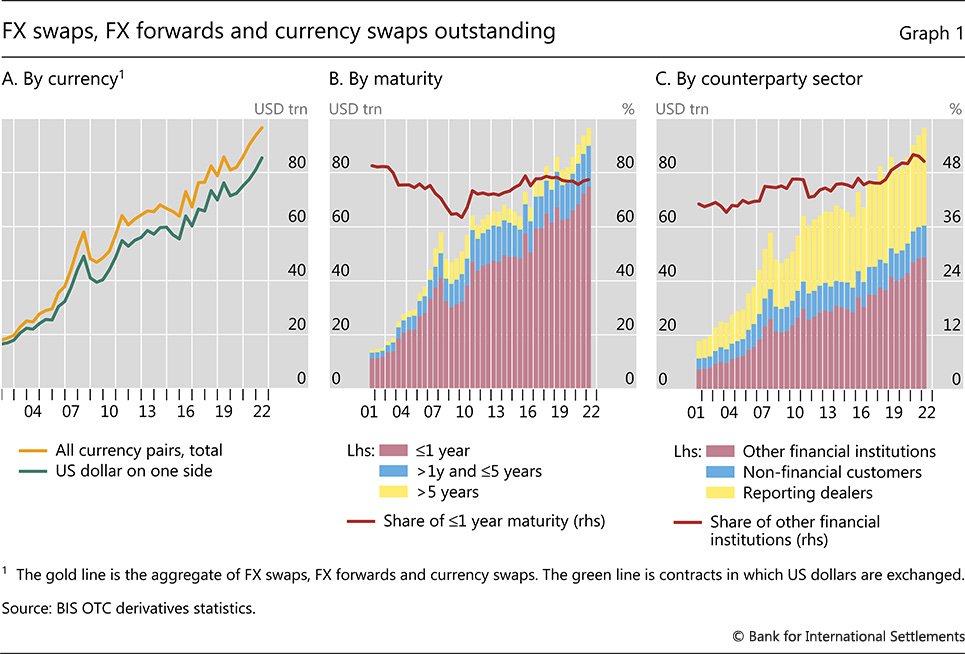

Most FX swaps have the US dollar on one side and have very short maturities; this makes FX swaps vulnerable to dollar funding squeezes. We saw this in 2008 and 2020 when market fear and a dollar shortage led to money markets seizing up.

Most FX swaps have the US dollar on one side and have very short maturities; this makes FX swaps vulnerable to dollar funding squeezes. We saw this in 2008 and 2020 when market fear and a dollar shortage led to money markets seizing up.

4/

A significant amount of derivatives activity in dollars occurs offshore, off-balance sheet, and unreported, making it difficult to calculate the scale and location of debt in the system.

A significant amount of derivatives activity in dollars occurs offshore, off-balance sheet, and unreported, making it difficult to calculate the scale and location of debt in the system.

5/

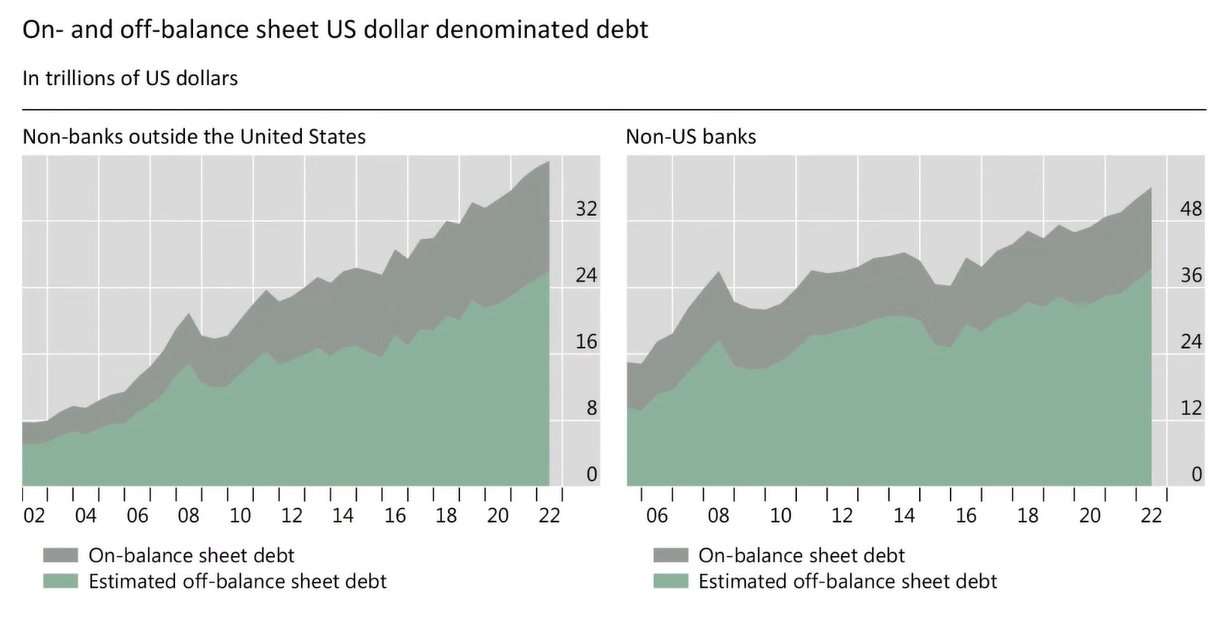

That’s the fly in the ointment detailed in the BIS report: significant amounts of unreported leverage in the FX swaps market. Banks & non-banks outside the US hold ~$65 trillion debt off-balance sheet, more than triple the $20 trillion reported on their balance sheets:

That’s the fly in the ointment detailed in the BIS report: significant amounts of unreported leverage in the FX swaps market. Banks & non-banks outside the US hold ~$65 trillion debt off-balance sheet, more than triple the $20 trillion reported on their balance sheets:

6/

Banks & non-banks outside of the US have layers of hidden debt. The FX swap market was presumed to be gargantuan, but this new estimate that includes previously undocumented leverage means the notional size of these derivatives is much larger than initially thought.

Banks & non-banks outside of the US have layers of hidden debt. The FX swap market was presumed to be gargantuan, but this new estimate that includes previously undocumented leverage means the notional size of these derivatives is much larger than initially thought.

7/

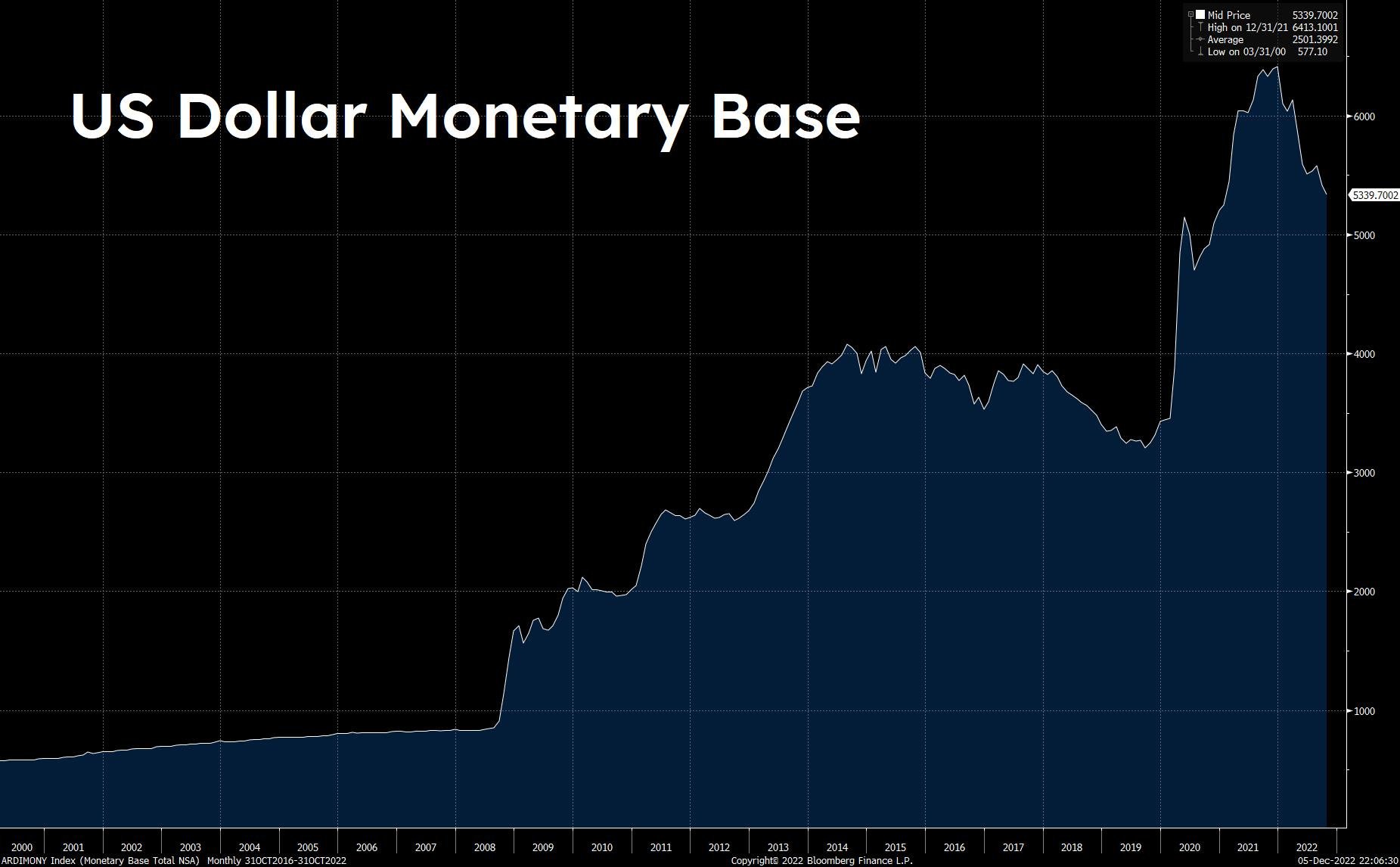

As the Fed tightens policy & pushes short-term dollar rates higher, funding stress will emerge in the larger-than-presumed FX swaps market for banks & non-banks that use it for funding & hedging purposes:

As the Fed tightens policy & pushes short-term dollar rates higher, funding stress will emerge in the larger-than-presumed FX swaps market for banks & non-banks that use it for funding & hedging purposes:

8/

The short maturity of the standard FX swap leaves financial institutions vulnerable to dollar funding squeezes. As contracts mature on a short-term basis, this leaves the market exposed to sudden funding shortfalls—in a rising rate environment:

The short maturity of the standard FX swap leaves financial institutions vulnerable to dollar funding squeezes. As contracts mature on a short-term basis, this leaves the market exposed to sudden funding shortfalls—in a rising rate environment:

9/

FX swaps are an actively traded money market that provides critical overnight funding & hedging for financial institutions; there's more leverage in the system than previously estimated, but nothing screams “imminent illiquidity” given the size and activity of this market.

FX swaps are an actively traded money market that provides critical overnight funding & hedging for financial institutions; there's more leverage in the system than previously estimated, but nothing screams “imminent illiquidity” given the size and activity of this market.

10/

That said, the FX swap market was a flashpoint in 2008 and again in 2020. If the Fed’s not careful with its aggressive stance in the face of record-high debt loads, the FX swap market may be a negative catalyst again in 2023.

That said, the FX swap market was a flashpoint in 2008 and again in 2020. If the Fed’s not careful with its aggressive stance in the face of record-high debt loads, the FX swap market may be a negative catalyst again in 2023.

11/

The Fed is aware of dollar debt globally-the size & rate at which it can be serviced are taken into account as it plans its policy. The Fed may be aware of hidden offshore dollar debt, but wasn’t aware that off-balance sheet liabilities in the FX swaps market were this size.

The Fed is aware of dollar debt globally-the size & rate at which it can be serviced are taken into account as it plans its policy. The Fed may be aware of hidden offshore dollar debt, but wasn’t aware that off-balance sheet liabilities in the FX swaps market were this size.

12/

While we’re not at a point when banks halt lending with one another, high amounts of increasingly expensive debt may eventually lead to the Fed being tapped to unclog the money markets once more.

While we’re not at a point when banks halt lending with one another, high amounts of increasingly expensive debt may eventually lead to the Fed being tapped to unclog the money markets once more.

13/

The FX swap market is larger and much more opaque than previously thought, so monitoring cross-currency basis swaps to see when these markets are experiencing outsized stress should be a useful tool for our macro framework as we approach the pinnacle of Fed tightening.

The FX swap market is larger and much more opaque than previously thought, so monitoring cross-currency basis swaps to see when these markets are experiencing outsized stress should be a useful tool for our macro framework as we approach the pinnacle of Fed tightening.

For our full research piece, find the link below ⬇️

Keep it here at The Bitcoin Layer for more markets research and analysis, covering bitcoin through a global macro lens. thebitcoinlayer.substack.com/p/public-hidden-leverage-reveals-the

BIS Report: www.bis.org/publ/qtrpdf/r_qt2212h.pdf

Keep it here at The Bitcoin Layer for more markets research and analysis, covering bitcoin through a global macro lens. thebitcoinlayer.substack.com/p/public-hidden-leverage-reveals-the

BIS Report: www.bis.org/publ/qtrpdf/r_qt2212h.pdf