Thread

Inflation might be easing for now, but we are living in an age of overlapping emergencies. More shocks are likely to come. We need economic policy preparedness for micro stabilization. But which prices matter?

A new working paper 🧵

scholarworks.umass.edu/econ_workingpaper/340/

A new working paper 🧵

scholarworks.umass.edu/econ_workingpaper/340/

Inflation used to be thought of as being ‘always and everywhere a macroeconomic phenomenon’ that macro tightening should address. However, the current inflation is the result of sectoral shocks that involve large changes in relative prices & require a micro policy response. 2/

But which of the price shocks are most important for general price stability? We propose a method to identify systemically significant prices for inflation using input output simulations. 3/

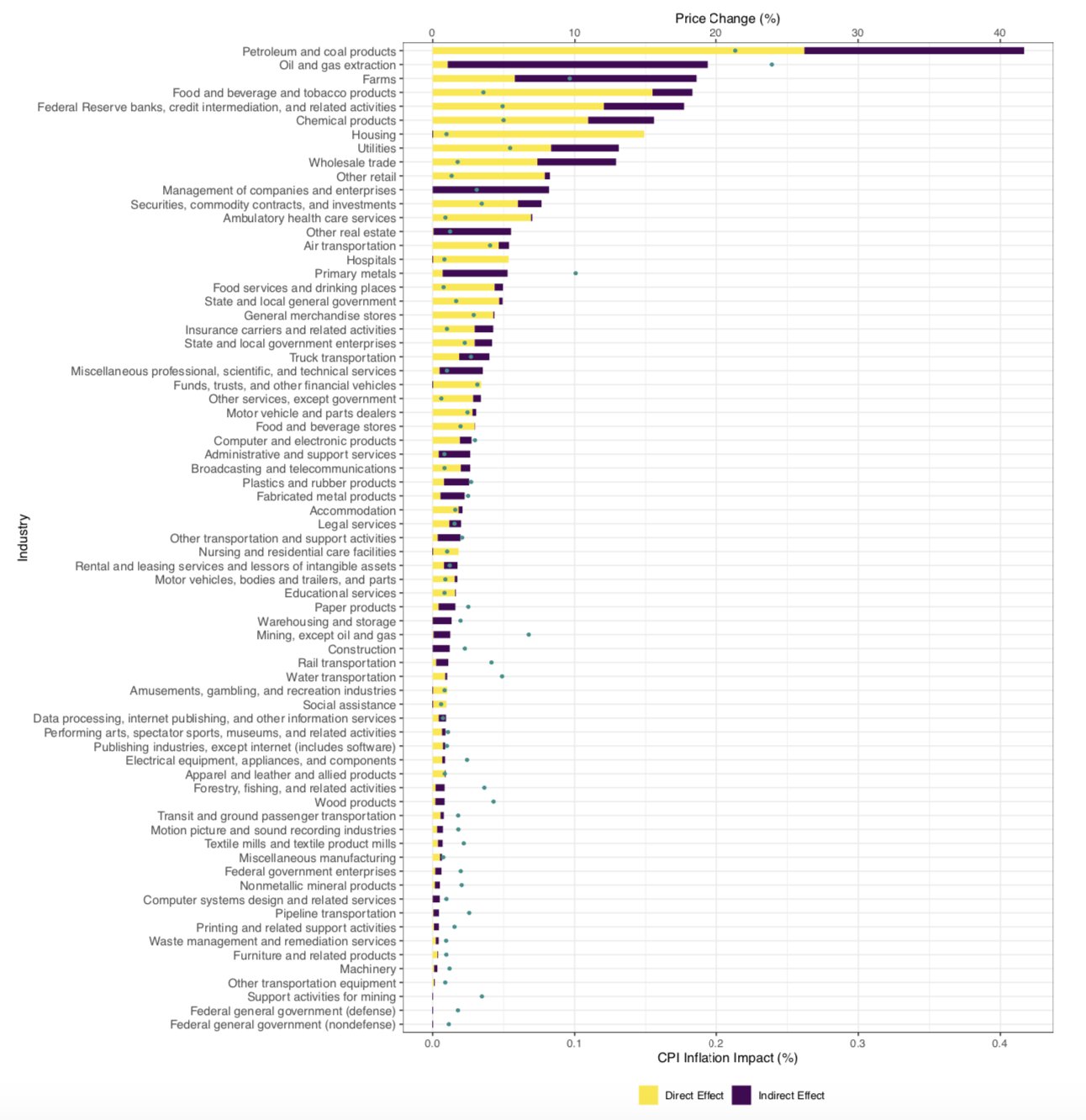

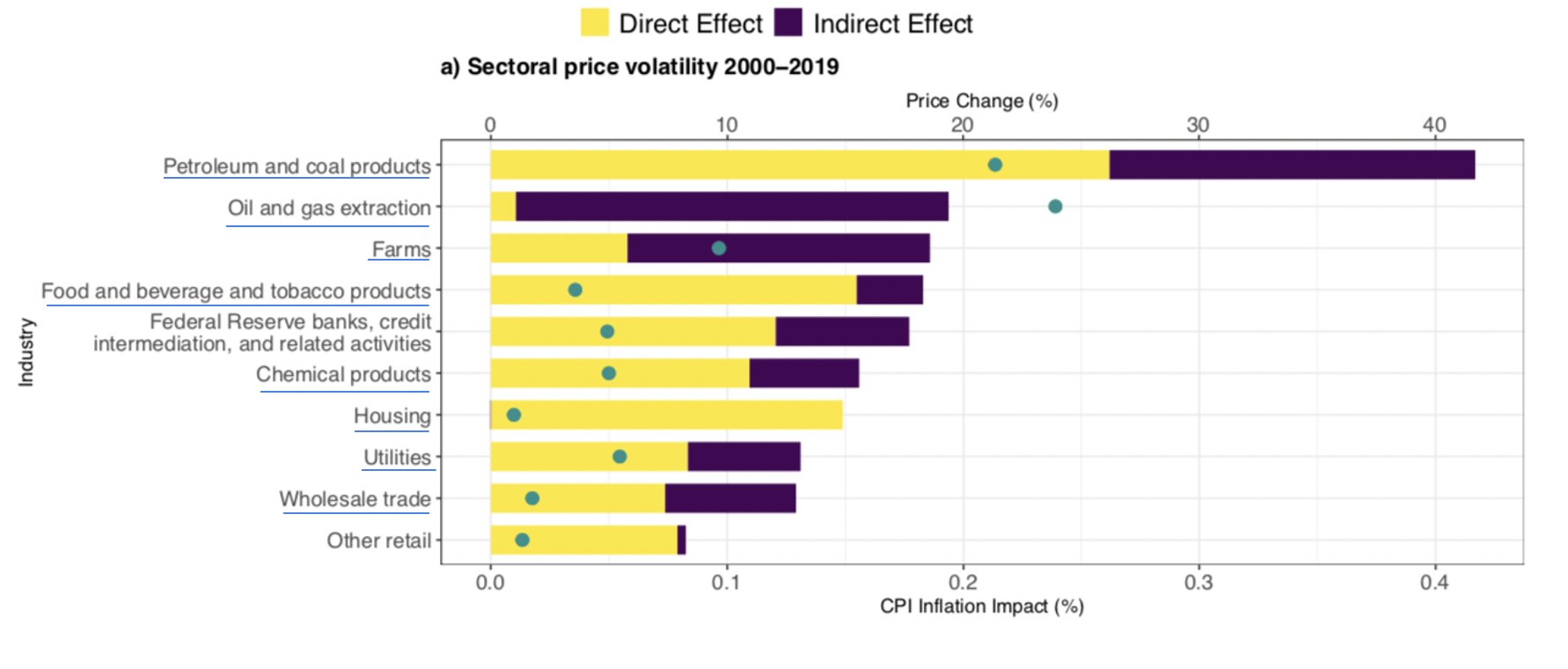

We build a Leontief price model for the US with 71 sectors to simulate price shocks. Price shocks are based on a) sectoral price volatility in 2000-2019, b) price changes in the post-shutdown inflation (Q4 2021), & c) price changes in the Ukraine war inflation (Q2 2022). 4/

Our simulations show that price shocks in about 10 sectors generate a much larger total inflation impact than all other sectors. We call these systemically significant prices. 5/

8 sectors were systemically significant before COVID & now (underlined). There are 3 groups: basic necessities, basic production inputs & basics of circulation. So, the sectors that present points of vulnerability for price stability could have been identified in advance. 6/

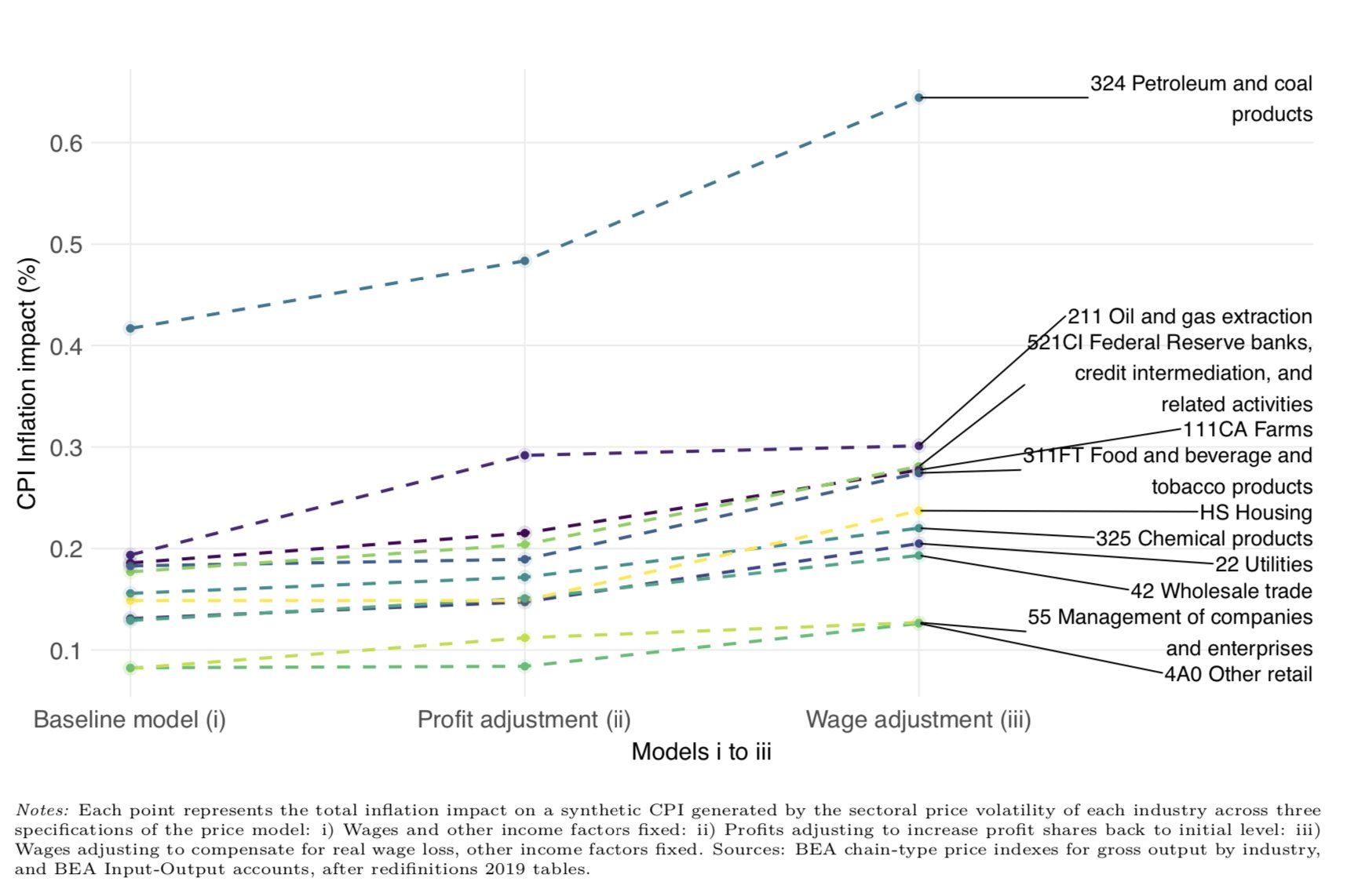

In our baseline model (i), we assume full cost passthrough. What if businesses can compensate for a decline in the profit margin that follows from higher costs (ii), or workers for losses in real wages (model iii)? We find: The same sectors remain systemically significant! 7/

We can also see from model (ii) & (iii) that price shocks in systemically significant sectors tend to hit workers harder than businesses (model iii leads to greater price adjustments to compensate for losses in real wages). An important exception: Oil and gas extraction. 8/

By far the most systemically significant sector in all our simulations is 'Petroleum and coal products'. This underscores the challenges for monetary stability in a green transition #greenflation 9/

Monitoring capacity for prices in systemically significant sectors is necessary for economic policy preparedness. Governments should be able to implement a policy response BEFORE price shocks risk broader inflation. 10/

This paper is agnostic about the specific micro policies to respond to shocks in systemically significant prices since we believe they need to be tailored to the specificities of each sector. 11/

We hope to provide a framework that can bring together the range of micro policy responses currently discussed from anti trust to windfall profit taxes, buffer stocks, regulation against financial speculation, emergency price stabilization and increased investments. 12/

Thanks to @groundwork for funding our research, to James Galbraith, @STOmarova, @Claudia_Sahm, Robert Pollin, Evan Wasner, @GregorSemieniuk, @jvtklooster for great comments. Feedback most welcome! 13/

We are presenting the paper at the PERI inflation conference tomorrow, 9.40 AM EST. Join us online! peri.umass.edu/publication/item/1664-global-inflation-today-what-is-to-be-done End/

Mentions

See All

Martin Sandbu @MESandbu

·

Dec 5, 2022

Very interesting thread. But why is this the normative conclusion, rather than "Governments should learn to let relative price shocks in systemic sectors disperse through the economy and not try to offset them (while staying vigilant against traditional generalised inflation)"?