Thread

If you've ever interacted with @SamCorcos, you know he's a very special founder.

Of his many superpowers, Sam is able to leverage his investor network unlike anything I've ever seen.

In today's post, Sam share all of his secrets for making your investors truly "value-add" 👇

Of his many superpowers, Sam is able to leverage his investor network unlike anything I've ever seen.

In today's post, Sam share all of his secrets for making your investors truly "value-add" 👇

0/ Keep reading for highlights, or jump straight into the post here:

www.lennysnewsletter.com/p/how-to-activate-your-investor-network

www.lennysnewsletter.com/p/how-to-activate-your-investor-network

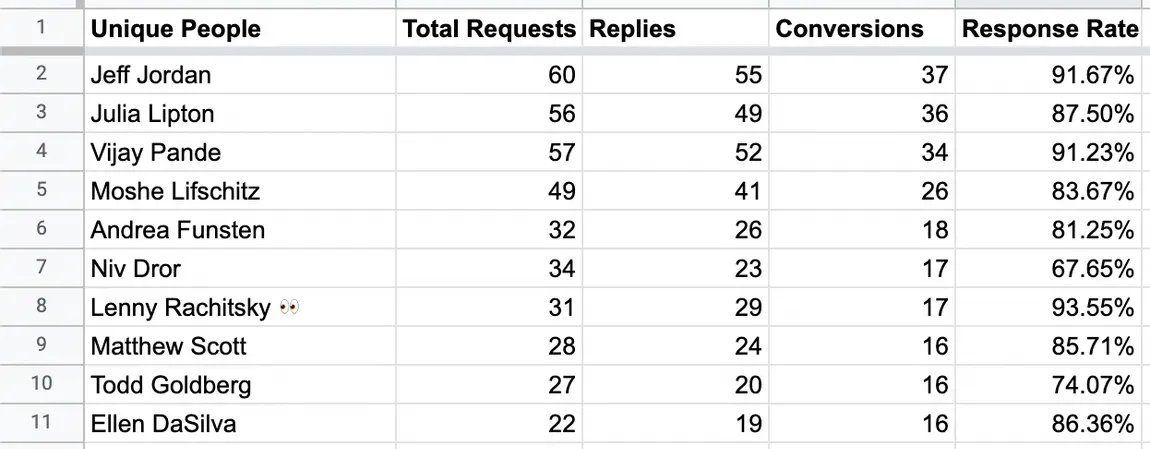

1/ Over the last ~3 years, Sam personally sent 2,626 requests to his investor network. Of those emails sent out, 1,664 received a response, and 1,151 were able to deliver on what was asked.

He keeps track.

He keeps track.

2/ As Sam puts it, "Investors have very little context into what your company is doing or what you need help with, so it’s unreasonable to expect them to proactively find ways to add value. You need to learn how to ask."

3/ How to activate your investor network

1. Build a great network by optimizing for eigenvector centrality.

2. Make good asks by keeping them targeted, time-bounded, and specific.

3. If you want someone to help you, make it as easy as possible for them.

4. Do the work.

1. Build a great network by optimizing for eigenvector centrality.

2. Make good asks by keeping them targeted, time-bounded, and specific.

3. If you want someone to help you, make it as easy as possible for them.

4. Do the work.

4/ First, build a great investor network

Start at a higher level of abstraction, and think about networks and graphs in general. The way you structure a network has significant implications for how the network performs.

Start at a higher level of abstraction, and think about networks and graphs in general. The way you structure a network has significant implications for how the network performs.

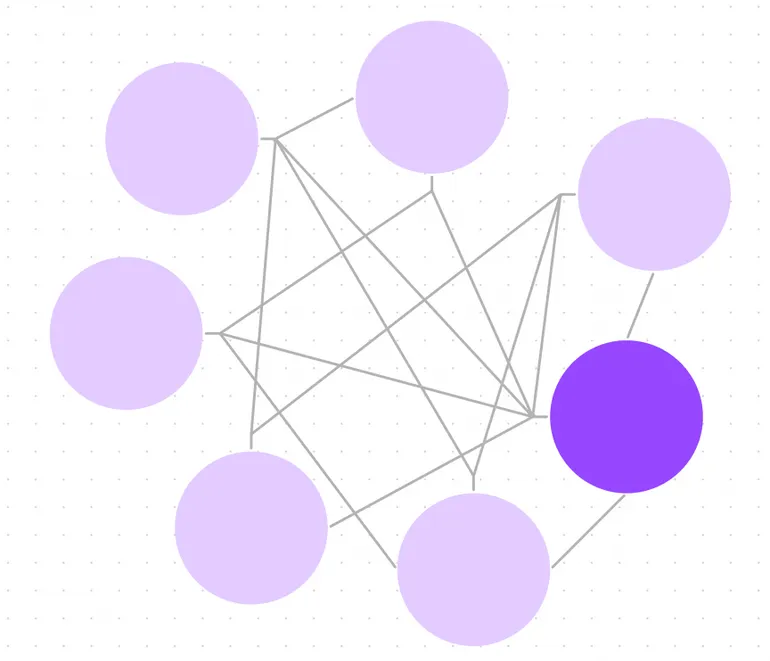

4a/ Eigenvector centrality

To build a really powerful network, you should optimize for what is known as eigenvector centrality: Eigenvector centrality is an algorithm that measures the transitive influence of nodes.

To build a really powerful network, you should optimize for what is known as eigenvector centrality: Eigenvector centrality is an algorithm that measures the transitive influence of nodes.

In other words, it’s not “how many people you know”; it’s “how many people all the people you know, know.”

Within the context of a network where everyone knows each other, they are the most connected person in that dense network:

Within the context of a network where everyone knows each other, they are the most connected person in that dense network:

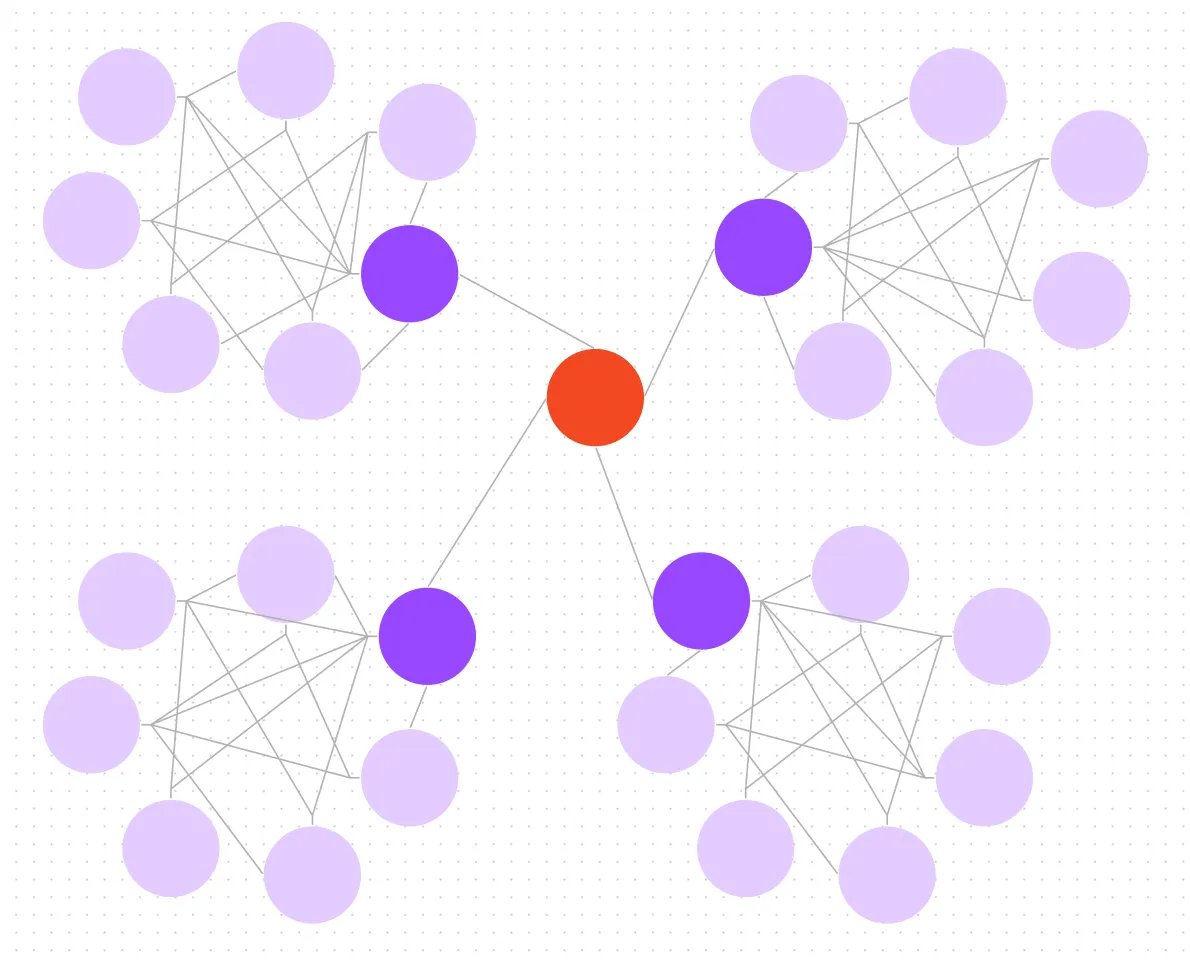

A failure mode of building a network that is optimized for degree centrality is that everyone ends up being similar, and it’s extremely limiting when you have a request that is outside of your normal area of influence.

You want to focus your attention on adding new people to the network from other dense networks that you don’t already have access to. The ideal network for a founder is one where you know the person with the highest degree centrality in each network:

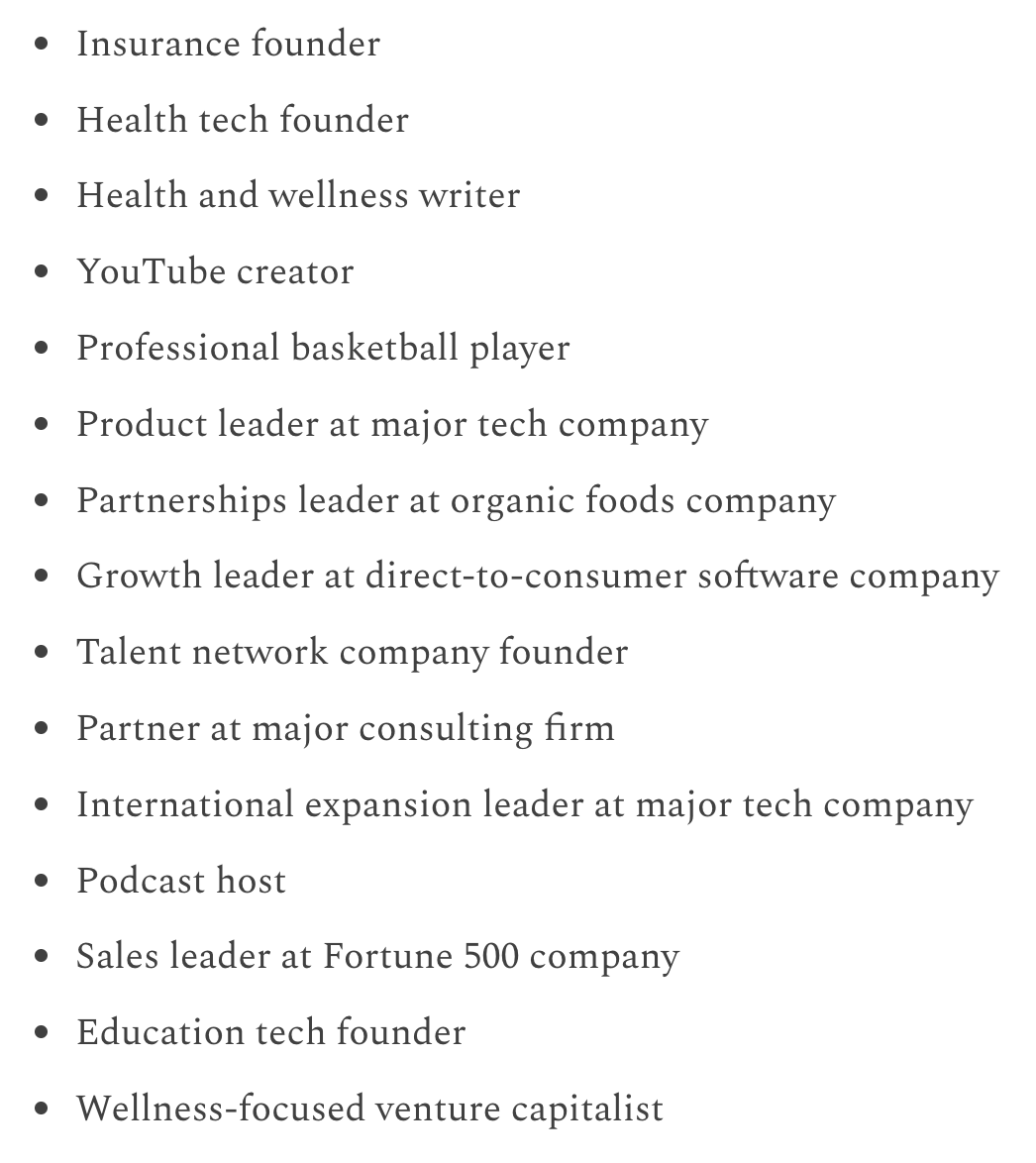

To give you a sense of the diversity of backgrounds of the people Sam optimized for when building his investor network, here are the backgrounds of the first 15 people in alphabetical order. For reference, these don’t even get beyond the letter “a” alphabetically:

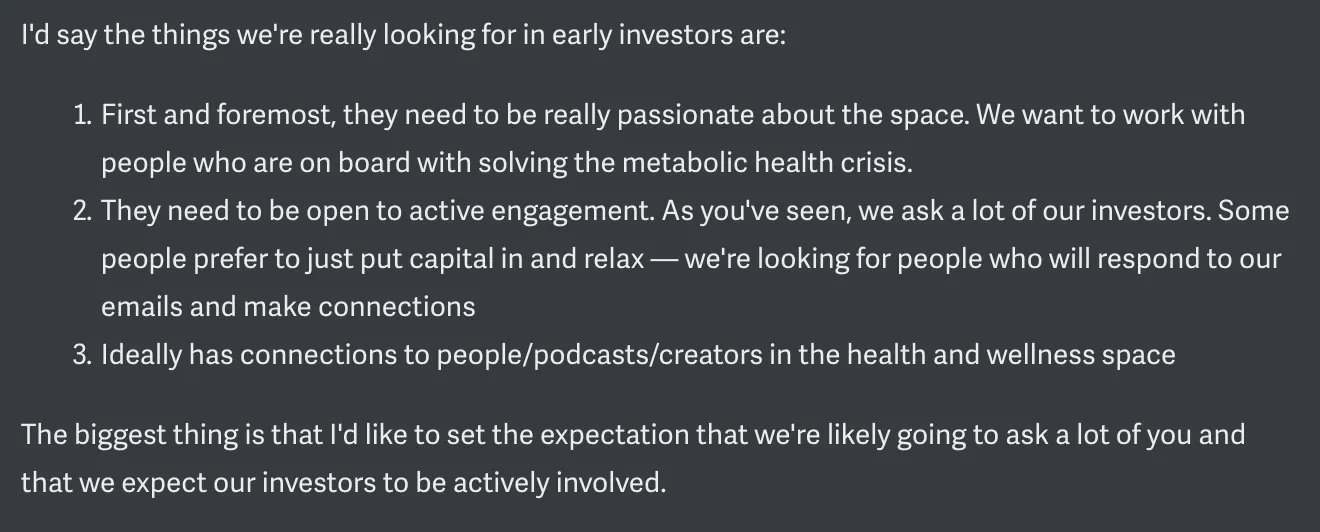

4b/ Set expectations

If you expect your investors to be actively involved, you should let them know before you accept their money. This is really important because it gives you permission to hold them accountable. Many investors will opt out (example below). That’s fine!

If you expect your investors to be actively involved, you should let them know before you accept their money. This is really important because it gives you permission to hold them accountable. Many investors will opt out (example below). That’s fine!

Here’s a conversation Sam had with a potential investor where, after setting clear expectations that we’d like them to be actively involved, they opted out because they didn’t have bandwidth. And there’s nothing wrong with that.

5/ Then, activate your network

Once you have a network of capable investors involved, you need to spend time extracting value from your cap table. Don’t expect this will happen automatically; it takes serious work, but it’s worth the effort.

Once you have a network of capable investors involved, you need to spend time extracting value from your cap table. Don’t expect this will happen automatically; it takes serious work, but it’s worth the effort.

5a/ Abundance mindset

The first thing is to remember that investor requests are not like precious gems. Many founders think you only get a certain number of “chips” to cash in with your investors (this is an analogy I’ve heard many times). This mindset is not accurate.

The first thing is to remember that investor requests are not like precious gems. Many founders think you only get a certain number of “chips” to cash in with your investors (this is an analogy I’ve heard many times). This mindset is not accurate.

In general, people like being helpful—especially investors! It’s a big part of their job. You know the joy you experience when you’re able to help out another founder? By not asking for things, you’re denying other people that joy.

5b/ How to ask

You should approach your investor asks like you would approach building a product. Think about it from the perspective of the person receiving the request. How do you make it easy for them?

You should approach your investor asks like you would approach building a product. Think about it from the perspective of the person receiving the request. How do you make it easy for them?

Your ask should be:

1. Targeted: Only send them to the people who are relevant

2. Time-bounded: Ideally, executing the request should take less than a minute

3. Specific: Be specific in your request, and limit the scope of the request (see chunking bias)

1. Targeted: Only send them to the people who are relevant

2. Time-bounded: Ideally, executing the request should take less than a minute

3. Specific: Be specific in your request, and limit the scope of the request (see chunking bias)

5c/ Examples:

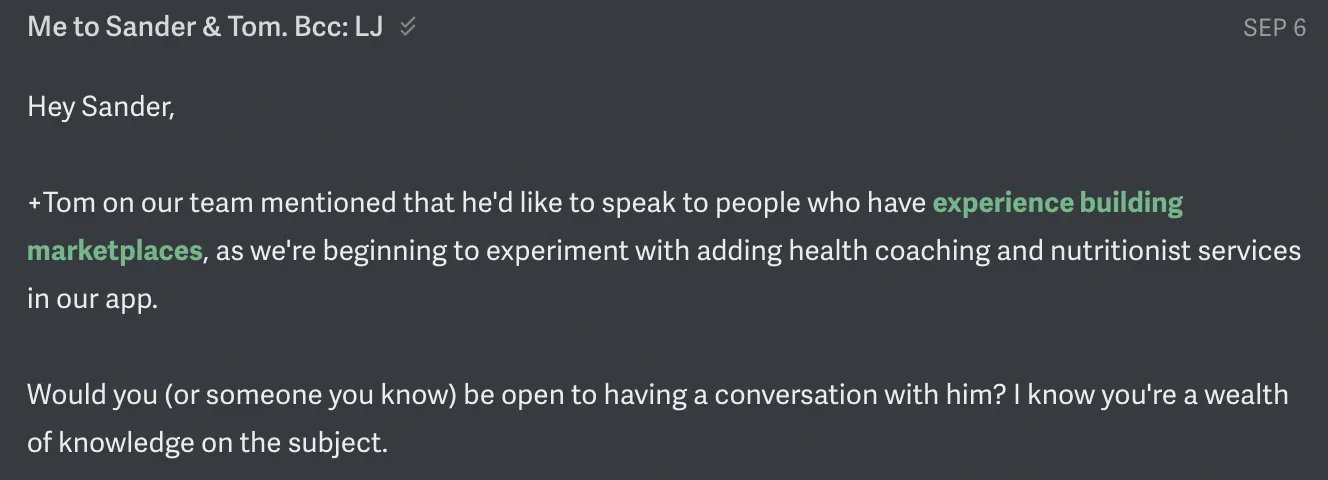

Tom, who leads Partnerships for at Levels, started working on a marketplace project.

Levels happens to have two people on our cap table who are legitimately world experts on marketplaces— @jeff_jordan and @sanderdaniels.

This is the email he sent to each of them:

Tom, who leads Partnerships for at Levels, started working on a marketplace project.

Levels happens to have two people on our cap table who are legitimately world experts on marketplaces— @jeff_jordan and @sanderdaniels.

This is the email he sent to each of them:

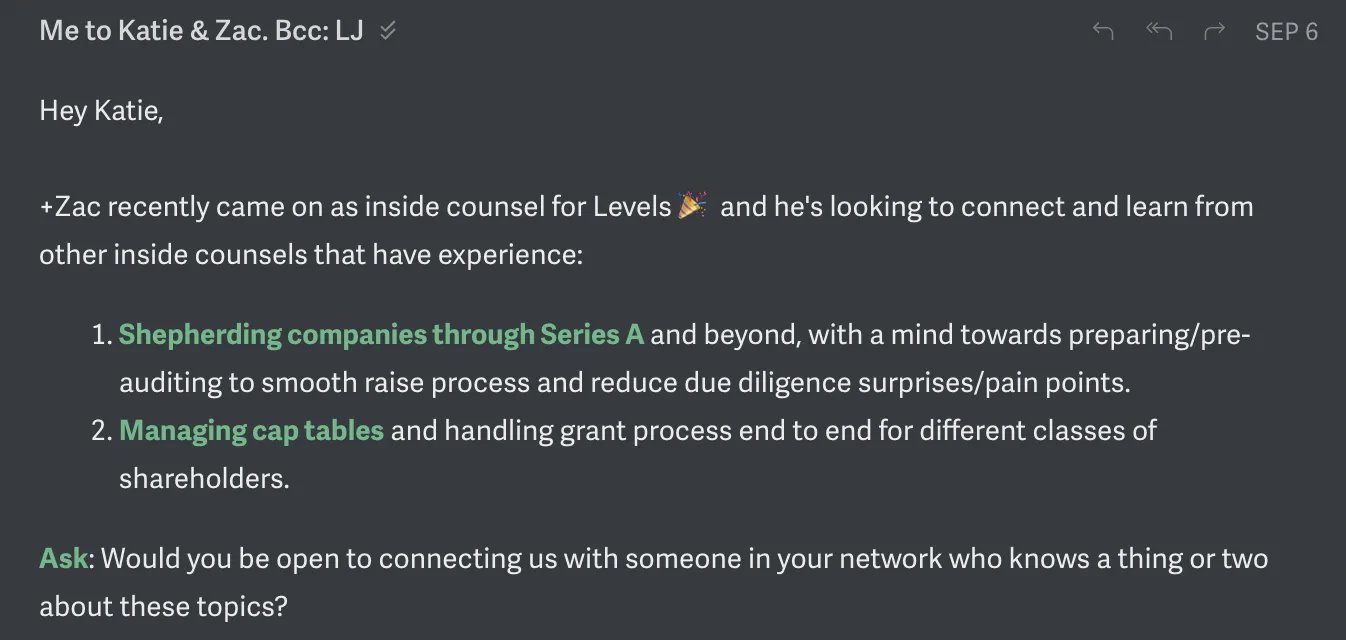

Zac, who runs Legal at Levels, was looking to connect with other people who have run legal practices within startups.

One of their investors, @katiebiber, has led legal teams at a number of tech companies and also has a strong network of other general counsels:

One of their investors, @katiebiber, has led legal teams at a number of tech companies and also has a strong network of other general counsels:

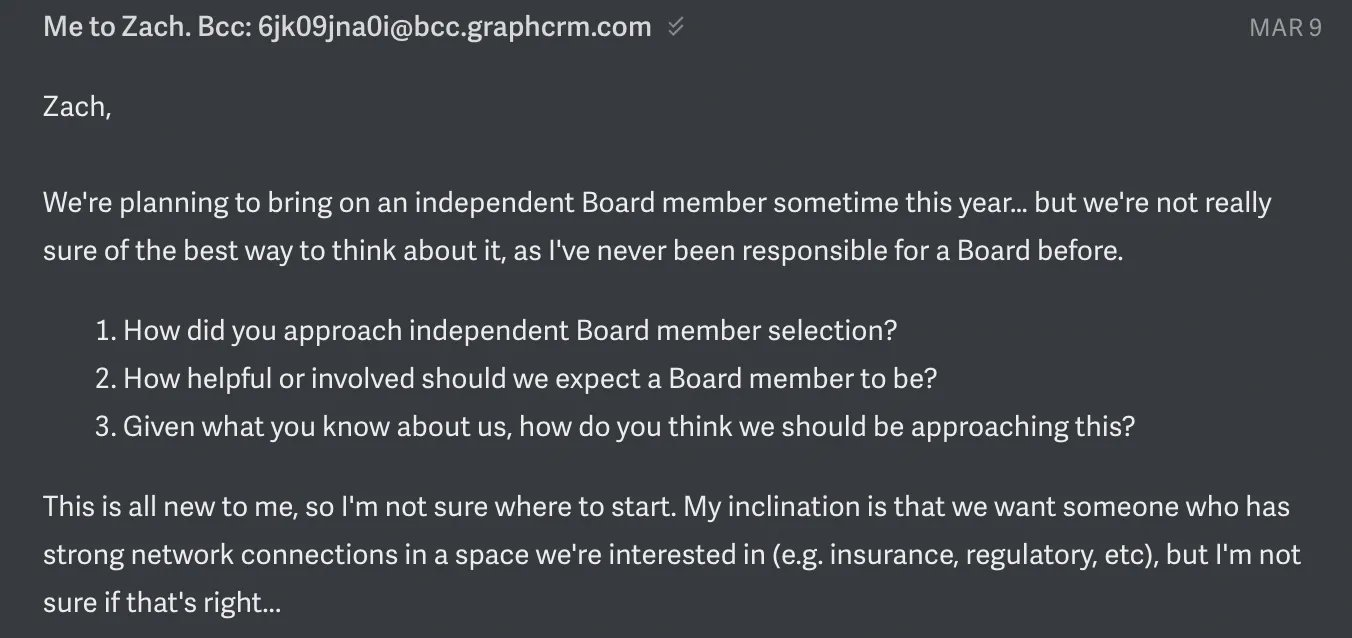

As they geared up for our next funding round, Sam wanted to learn more about independent board member selection. So we sent an email to a few investors who are currently or have been founders who work with independent board members:

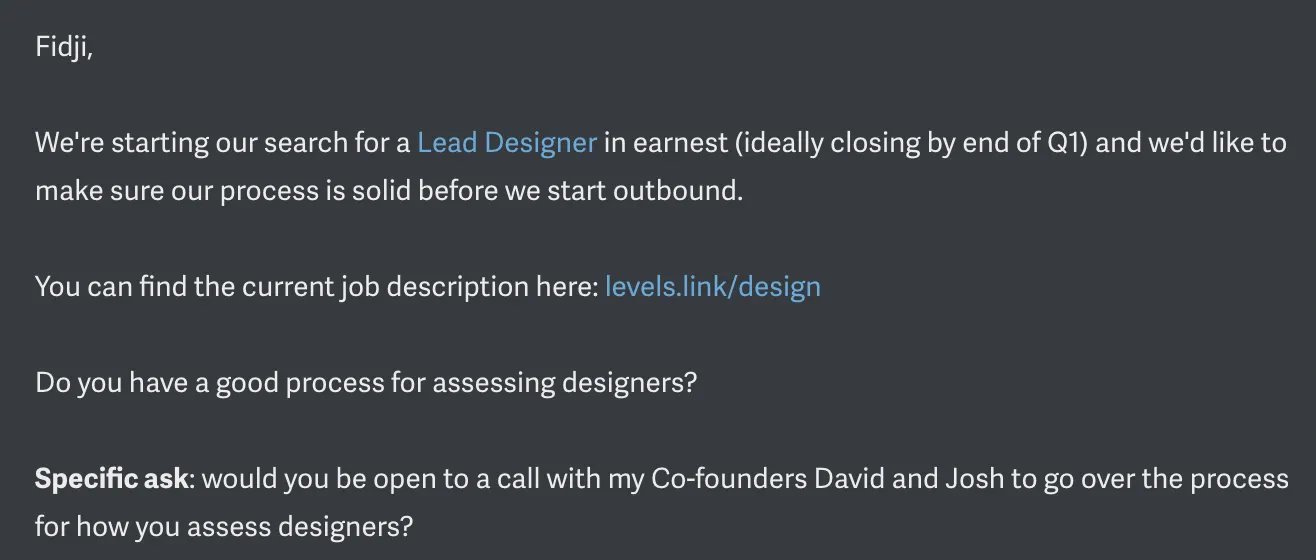

When they started the process for hiring a Lead Designer, they realized that they didn’t know how to run a process or assess the quality of the candidates. So they sent a few emails to people who have hired lead designers in the past to find out what they look for:

For many more examples, plus more from @SamCorcos, including analysis on how these requests perform, how to best follow up, and much more, don't miss the full post:

www.lennysnewsletter.com/p/how-to-activate-your-investor-network

www.lennysnewsletter.com/p/how-to-activate-your-investor-network