Thread

Ed Thorp is a trading legend with one hell of a resume:

- Godfather of quant investing

- Created the first card-counting system

- Founded the first quant hedge fund

He also crushed the market & returned ~19% CAGR for 30 years.

Here are ten of his trading principles ... 🧵

- Godfather of quant investing

- Created the first card-counting system

- Founded the first quant hedge fund

He also crushed the market & returned ~19% CAGR for 30 years.

Here are ten of his trading principles ... 🧵

Principle 1: Wait For Fat Pitches

The best traders wait for fat pitches, the proverbial "no-brainers", and go in big.

Buffett, The Chandler Brothers, Soros, and Druckenmiller all deploy a similar mindset.

Here are Thorp's best "Fat Pitch" Trades ...

The best traders wait for fat pitches, the proverbial "no-brainers", and go in big.

Buffett, The Chandler Brothers, Soros, and Druckenmiller all deploy a similar mindset.

Here are Thorp's best "Fat Pitch" Trades ...

Fat Pitch 1: 1987 Crash

Thorp captured a massive spread between the S&P futures market and the S&P index.

He bought $5M index futures and sold short $10M of assorted S&P stocks.

The result: $1M profit between the spread.

Thorp captured a massive spread between the S&P futures market and the S&P index.

He bought $5M index futures and sold short $10M of assorted S&P stocks.

The result: $1M profit between the spread.

Fat Pitch 2: Oil Tankers

This one is wild.

Thorp partnered with Bruce Kovner to buy (what was then) the largest tanker ship ever built.

They bought at scrap value which protected downside.

But it gave them a free call option on tanker demand.

The result: $17M profit (30%/yr)

This one is wild.

Thorp partnered with Bruce Kovner to buy (what was then) the largest tanker ship ever built.

They bought at scrap value which protected downside.

But it gave them a free call option on tanker demand.

The result: $17M profit (30%/yr)

Fat Pitch 3: SPACs

Thorp took advantage of the 2008-09 Recession to buy SPACs at discounts to NAV.

Most SPACs hold their trust in treasuries with small nominal yields.

During the crash, SPACs traded below the cash value in the trust. Hard to lose money.

The result: 10%/yr

Thorp took advantage of the 2008-09 Recession to buy SPACs at discounts to NAV.

Most SPACs hold their trust in treasuries with small nominal yields.

During the crash, SPACs traded below the cash value in the trust. Hard to lose money.

The result: 10%/yr

Summary: Fat Pitch Similarities

Thorp's "Fat Pitch" trades had similar characteristics:

- Rare & occurred during crises

- Highly asymmetric risk/reward ratios

- Needed to act fast

- "One of a kind" opportunities that needed some creativity

Let's dive into more Principles!

Thorp's "Fat Pitch" trades had similar characteristics:

- Rare & occurred during crises

- Highly asymmetric risk/reward ratios

- Needed to act fast

- "One of a kind" opportunities that needed some creativity

Let's dive into more Principles!

Principle 2: Gambling Is The Best Training

The best training grounds for investing/trading isn't an MBA degree.

It's gambling.

Why?

According to Thorp, "investing is gambling simplified."

Both require money management & proper understanding of Risk/Reward ratios.

The best training grounds for investing/trading isn't an MBA degree.

It's gambling.

Why?

According to Thorp, "investing is gambling simplified."

Both require money management & proper understanding of Risk/Reward ratios.

Principle 3: Find Your Trading Edge

A Trading Edge is a replicable methodology that gives you better than random odds at making money.

Thorp says traders should ONLY trade the systems which give them that edge.

But not many do.

As Ed Seykota says, some people WANT to lose.

A Trading Edge is a replicable methodology that gives you better than random odds at making money.

Thorp says traders should ONLY trade the systems which give them that edge.

But not many do.

As Ed Seykota says, some people WANT to lose.

Principle 4: Markets Are Not Efficient

Markets are generally efficient most of the time.

But according to Thorp, those with advanced knowledge can spot more inefficiencies more often.

Most people saw blackjack as a random game before Thorp introduced card counting.

Markets are generally efficient most of the time.

But according to Thorp, those with advanced knowledge can spot more inefficiencies more often.

Most people saw blackjack as a random game before Thorp introduced card counting.

Principle 5: Leverage Technical Analysis

Thorp realized that the combination of technicals + fundamentals was often better than one by itself.

He developed a trend following system to capture this alpha in futures markets, particularly agricultures.

It's where 1 + 1 = >2

Thorp realized that the combination of technicals + fundamentals was often better than one by itself.

He developed a trend following system to capture this alpha in futures markets, particularly agricultures.

It's where 1 + 1 = >2

Principle 6: Do Not Anchor On Price

Thorp's first-ever trade was in a company called Electric Autolite.

The stock fell 50% the next two years.

Instead of selling, Thorp held on, determined to get out breakeven.

Lesson: Get out when you're wrong, not when its convenient.

Thorp's first-ever trade was in a company called Electric Autolite.

The stock fell 50% the next two years.

Instead of selling, Thorp held on, determined to get out breakeven.

Lesson: Get out when you're wrong, not when its convenient.

Principle 7: Take Headlines w/ Salt

Headlines often fake traders into bad positions.

It's the ol' "buy the rumor, sell the news" theory.

Thorp says the best remedy for headline fakes is to follow price action.

Find the expected move and see how actual price action flows.

Headlines often fake traders into bad positions.

It's the ol' "buy the rumor, sell the news" theory.

Thorp says the best remedy for headline fakes is to follow price action.

Find the expected move and see how actual price action flows.

Principle 8: Avoid Highly Correlated Bets

Thorp understood correlation better than most traders.

He realized that every trading signal needed to be stress tested for correlation.

E.g., "If it wanted to go long both or short both, we would take a smaller position in each."

Thorp understood correlation better than most traders.

He realized that every trading signal needed to be stress tested for correlation.

E.g., "If it wanted to go long both or short both, we would take a smaller position in each."

Principle 9: Respect Leverage

Leverage can blow you up.

It can also create wild wealth.

Thorp's lesson: model a worst-case scenario.

If you can't tolerate it, reduce the leverage until you can.

As Munger says, "Show me where I'll die so I don't go there."

Leverage can blow you up.

It can also create wild wealth.

Thorp's lesson: model a worst-case scenario.

If you can't tolerate it, reduce the leverage until you can.

As Munger says, "Show me where I'll die so I don't go there."

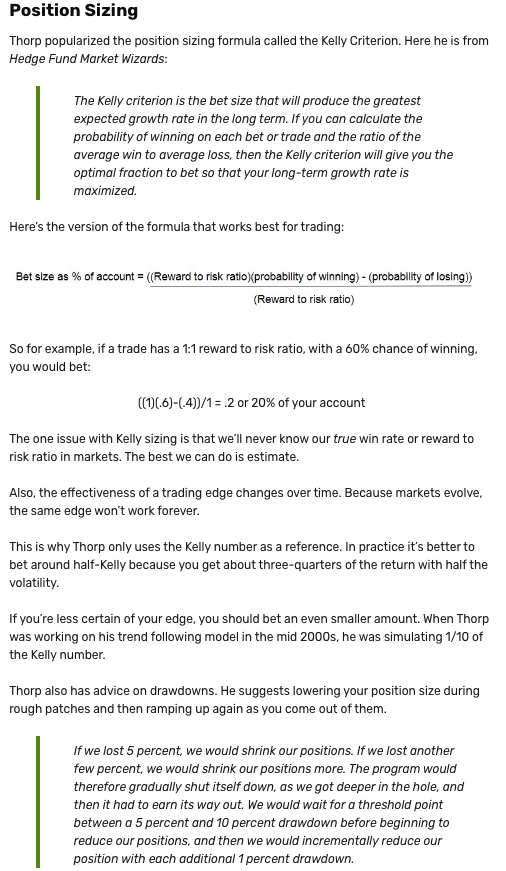

Principle 10: Master Position Sizing

Thorp popularized The Kelly Formula for trading.

He used it as a reference and often sized Half-Kelly.

Thorp cautioned traders to trade smaller during downtrends. And only ramp position sizing during hot streaks.

Druck does the same.

Thorp popularized The Kelly Formula for trading.

He used it as a reference and often sized Half-Kelly.

Thorp cautioned traders to trade smaller during downtrends. And only ramp position sizing during hot streaks.

Druck does the same.

Recap: Thorp's Ten Principles

1) Wait For Fat Pitches

2) Gambling Best Teacher

3) Find Your Edge

4) Markets Are Inefficient

5) Use Technical Analysis

6) Don't Price Anchor

7) Take Headlines w/ Salt

8) Avoid High Corr. Bets

9) Respect Leverage

10) Position Size Properly

1) Wait For Fat Pitches

2) Gambling Best Teacher

3) Find Your Edge

4) Markets Are Inefficient

5) Use Technical Analysis

6) Don't Price Anchor

7) Take Headlines w/ Salt

8) Avoid High Corr. Bets

9) Respect Leverage

10) Position Size Properly

Learn More: Trading Greats Essays

Check out our essay below to learn more about Ed Thorp and other Trading Greats.

macro-ops.com/lessons-trading-great-ed-thorp/

Check out our essay below to learn more about Ed Thorp and other Trading Greats.

macro-ops.com/lessons-trading-great-ed-thorp/

If you enjoyed this thread, please like, RT, and share with friends!

It means more than you know!

It means more than you know!