Thread

1/ On January 10, 1901, the world was changed forever. Up on Spindletop Hill, just south of Beaumont, Texas, an enormous geyser of oil exploded into the sky, much to the awe of the drillers who made it happen.

2/ The well gushed at a powerful rate of 100,000 barrels a day, far more than any oil-producing well in the country, initiating a historic economic boom that gave birth to the modern petrochemical era.

3/ Within months, the population of Beaumont increased by a factor of five, property values soared, and a classic “gold rush” mania ensued. Much of the critical petrochemical infrastructure that dots the US Gulf Coast today grew directly out of this groundbreaking discovery.

4/The success of Spindletop was significant validation of the work of Anthony Lucas, then a leading US expert on salt dome formations. Long a believer that salt domes could make for excellent natural petroleum traps, his so-called “dome theory” was initially met with derision.

5/ Today, 3D mapping of salt-bearing basins is the subject of intense technological investment in the energy sector. The challenges associated with understanding complex salt geometries are often more than offset by the huge financial rewards of successfully doing so.

6/ It wasn’t long before engineers hypothesized that salt domes could also be used to successfully store oil for long periods. After all, if these formations helped nature keep oil in place for eons, surely a purpose-formed salt cavern could work to store oil for a few decades.

7/ In addition to their exceptionally low permeability and porosity, rock salt formations quickly self-heal, making them among the cheapest and most environmentally secure long-term oil storage options available.

8/ Salt caverns are carved out of underground salt domes by a process called solution mining, which involves drilling a well into a salt formation, then injecting massive amounts of fresh water, which dissolves the salt. Once the brine is removed, oil can be stored indefinitely.

9/ The US Strategic Petroleum Reserve (SPR) was established in the years following the 1973 oil embargo. Using 60 large salt caverns spread across four sites – two in Texas and two in Louisiana – the SPR can store as much as 727 million barrels of oil.

10/ The original intent of the SPR was to insulate the US from significant oil supply shocks and to ensure requisite industries – most notably the US military – had ready access to energy resources during times of significant national emergency.

11/ Over time though, the SPR has gradually become politicized. In 2015, Congress began using it to game the Congressional Budget Office’s (CBO) score of major funding bills, mandating sales in the future to make present-day spending appear “deficit neutral.”

12/ For example, The Fixing America’s Surface Transportation Act of 2015 calls for SPR sales totaling 66 million barrels from US fiscal years 2023-2025, while the Tax Cuts and Jobs Act of 2017 calls for the sale of 7 million barrels over US fiscal years 2026 and 2027. And so on.

13/ There’s nothing strategic about such mandates, but they have served to normalize the conversion of this national insurance policy into a political piggy bank. To overturn these future sales would require offsetting budget cuts elsewhere – i.e., it’s not going to happen.

14/ In the past year, President Biden took things to the next level, draining the SPR at an unprecedented rate in a desperate, temporary attempt to keep a lid on the price of gasoline ahead of the 2022 midterm elections. With the election behind us, let’s survey the damage.

15/ In November of 2021 – long before Putin invaded Ukraine – Biden authorized the release of 50 million barrels from the SPR because he felt the price of oil was too high. In the days after Putin’s invasion, Biden authorized the release of a further 30 million barrels.

16/ Frustrated that oil remained expensive despite these transfers, on March 31st Biden went full bazooka, pledging to release 180 million barrels over the next six months. The impact on the SPR inventory has been breathtaking:

17/ With these moves (and the mandated future sales from spending bills of yesteryear waiting to be executed), the SPR inventory is set to continue its free fall. Few politicians ever want a higher oil price, making the likelihood of ever refilling the SPR close to zero.

18/ As proof, consider that when the price of oil collapsed to historically low prices in the wake of the response to the Covid-19 pandemic, President Trump directed the DOE to top off the reserves, but funding for the move was killed in the US Senate.

19/ Of course, Biden is effectively playing poker with his cards facing up. OPEC+ knows what Biden is up to, is aware of the finite amount of oil remaining in the SPR, and will play its cards accordingly.

20/ In October, OPEC+ infuriated Biden by cutting its production targets by two million barrels a day despite a direct plea from Biden’s team to hold off on any cuts until after the midterm elections. The group meets again on December 4, and further cuts are being discussed.

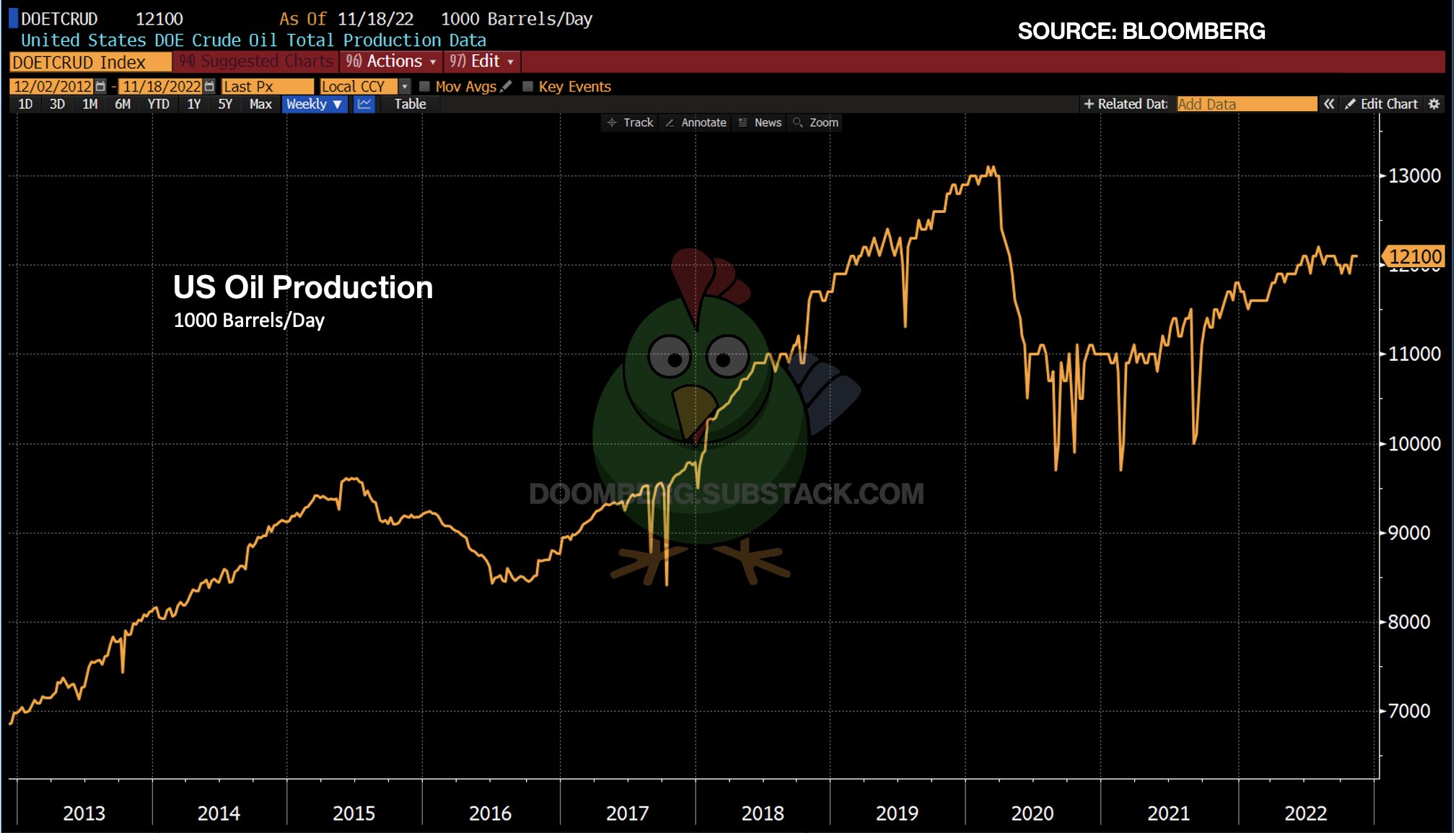

21/ US domestic oil production remains well below pre-Covid-19 highs (see chart below), while drilled but uncompleted wells (DUCs) – a measure of future potential production – are making new lows.

22/ Despite routinely admonishing “big oil” to do more to offset prices at the pump, the administration is persistent in putting the regulatory screws to the industry, thus dampening any enthusiasm to invest much-needed capital to grow supply.

23/ With few allies in industry or among the major oil-producing countries, Biden has successfully alienated the people he needs most. The SPR was created to take leverage away from OPEC, and, in draining it, the US is giving it right back. Expect them to press their advantage.

Mentions

See All

Luke Gromen @lukegromen

·

Nov 30, 2022

Great thread 👇