Thread

1/ My essay "Structural Adjustment: How the IMF and World Bank Repress Poor Countries and Funnel Their Resources to Rich Ones" is now live

The Bank and Fund claim to help poor countries develop and rescue them from crises

But what if that's not true?

bitcoinmagazine.com/culture/imf-world-bank-repress-poor-countries

The Bank and Fund claim to help poor countries develop and rescue them from crises

But what if that's not true?

bitcoinmagazine.com/culture/imf-world-bank-repress-poor-countries

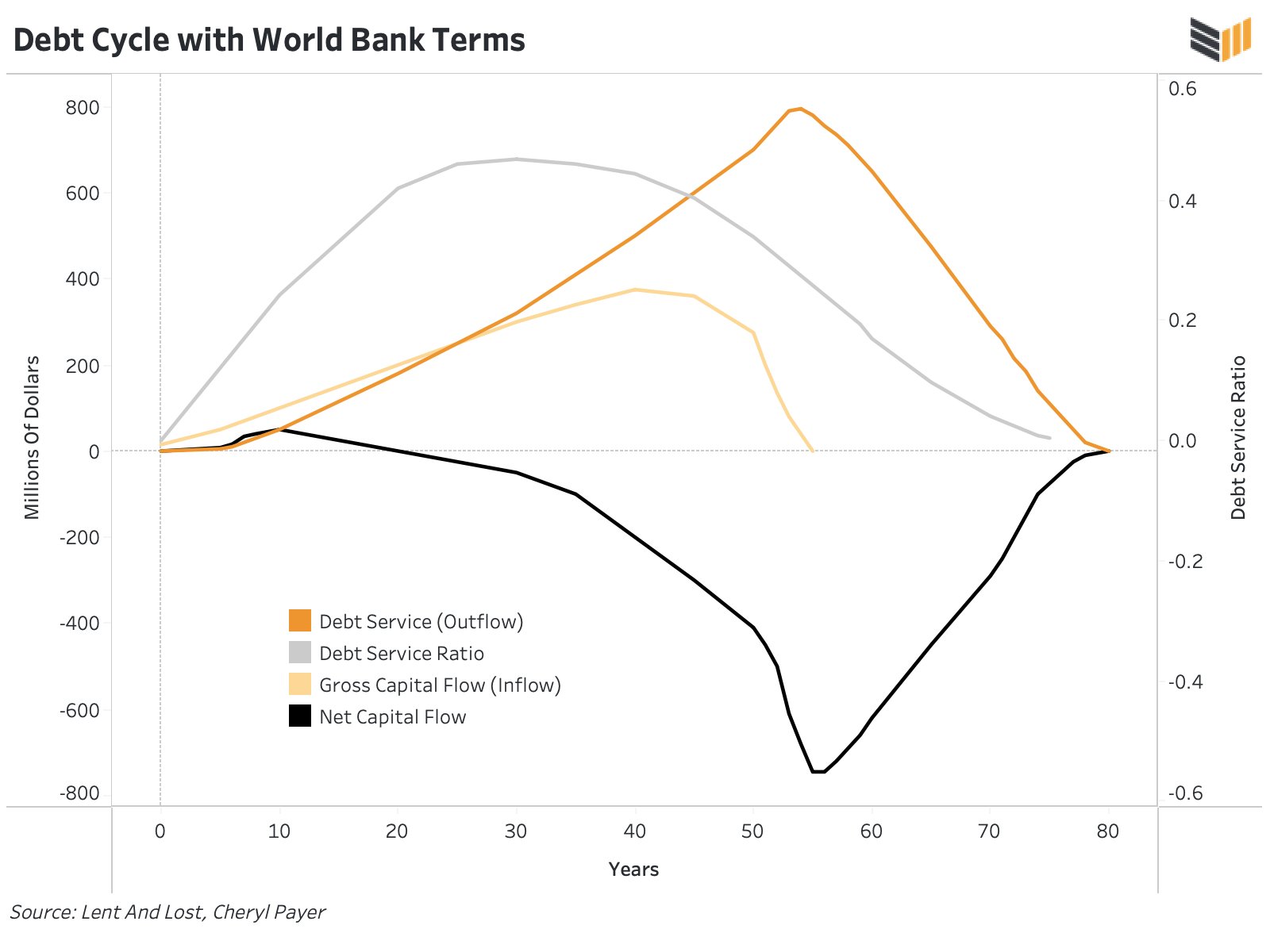

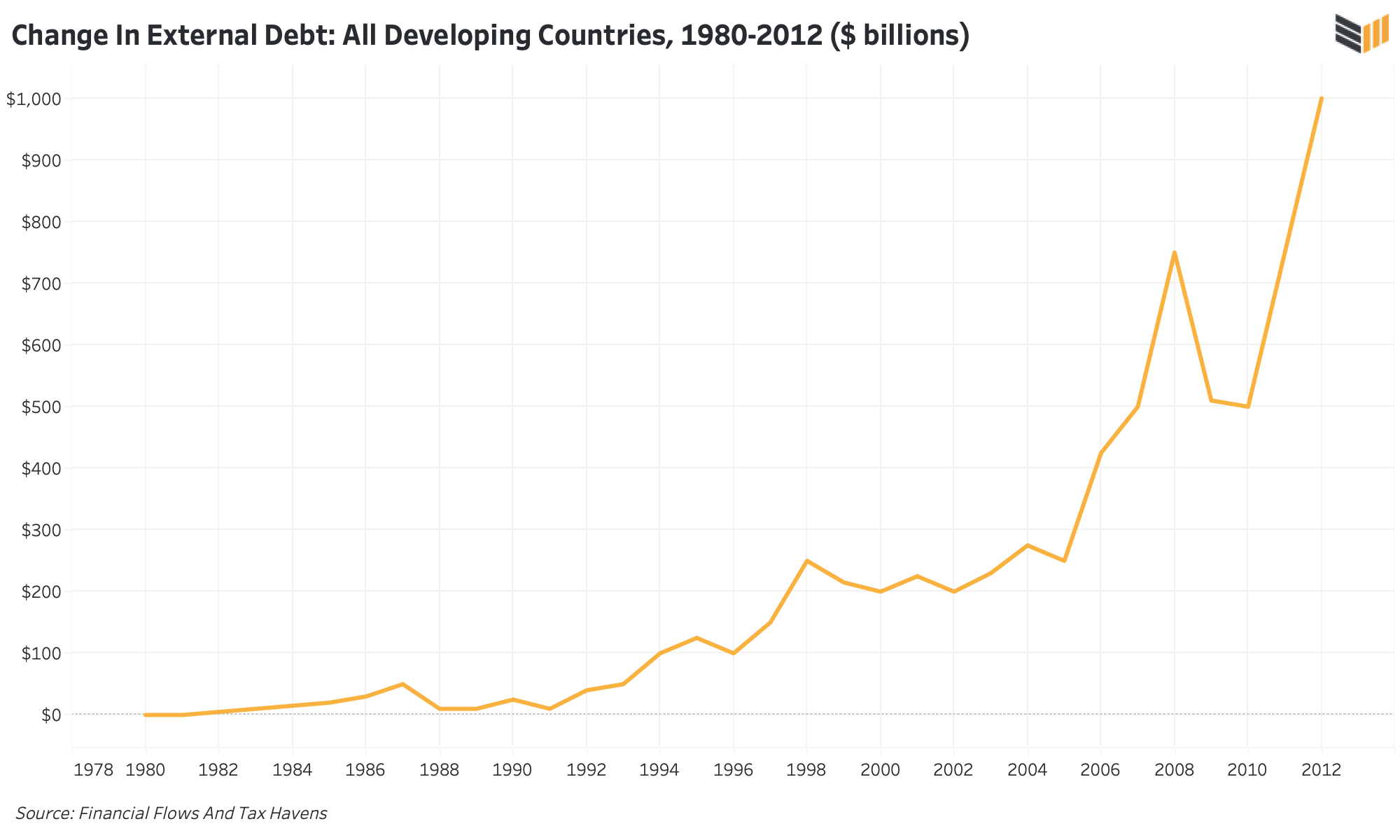

2/ As any credit card holder knows, when you borrow, you eventually need to pay back a higher sum: principal plus interest

This basic concept is forgotten when we think about development economics

But billions of dollars of loans over decades creates even more debt

This basic concept is forgotten when we think about development economics

But billions of dollars of loans over decades creates even more debt

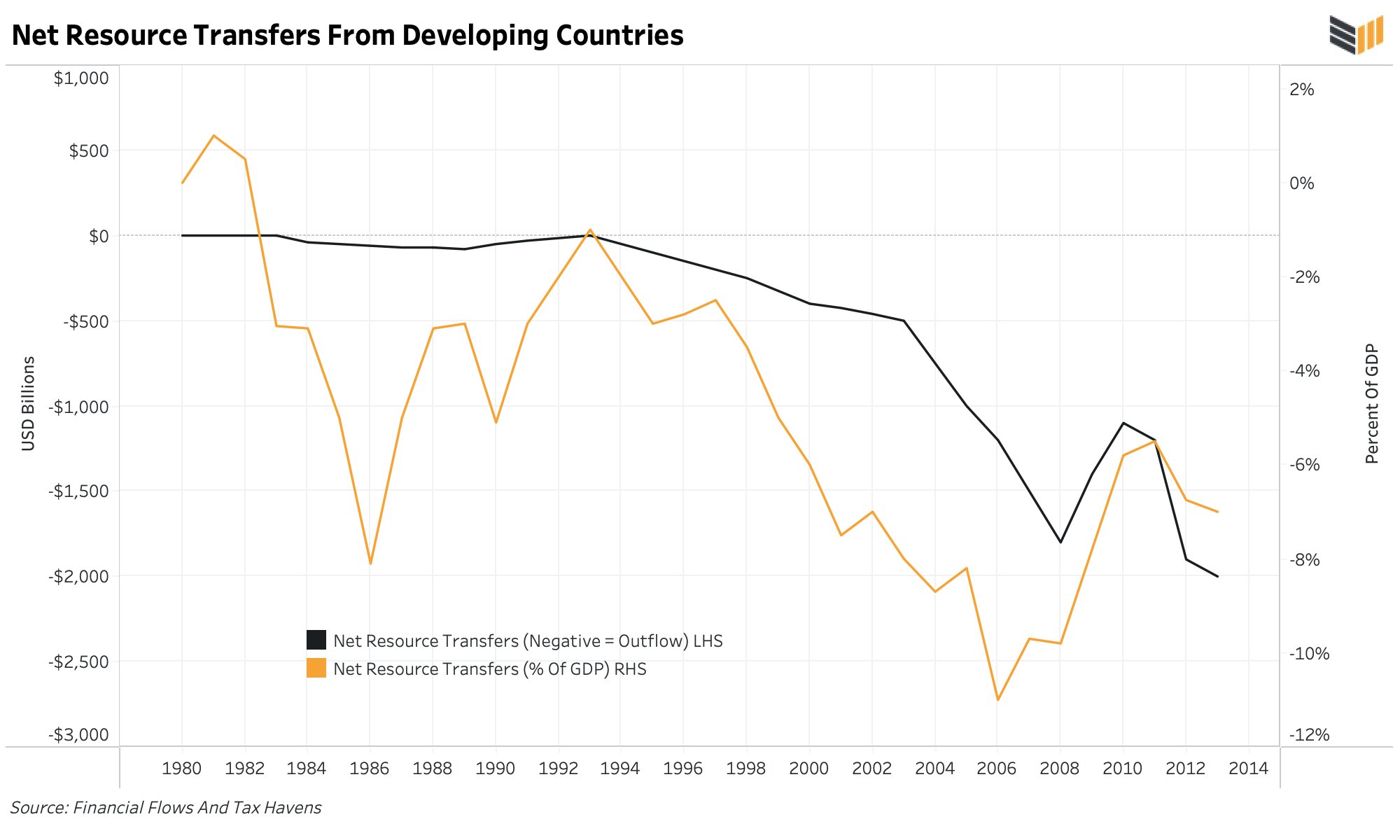

3/ In the 1960s and 1970s, this is exactly what happened

Huge credit was extended to the Third World

Eventually the amount repaid by borrowers exceeded what was given

This moment happened in 1982

Since then, the net flow of resources has been from poor countries to rich ones

Huge credit was extended to the Third World

Eventually the amount repaid by borrowers exceeded what was given

This moment happened in 1982

Since then, the net flow of resources has been from poor countries to rich ones

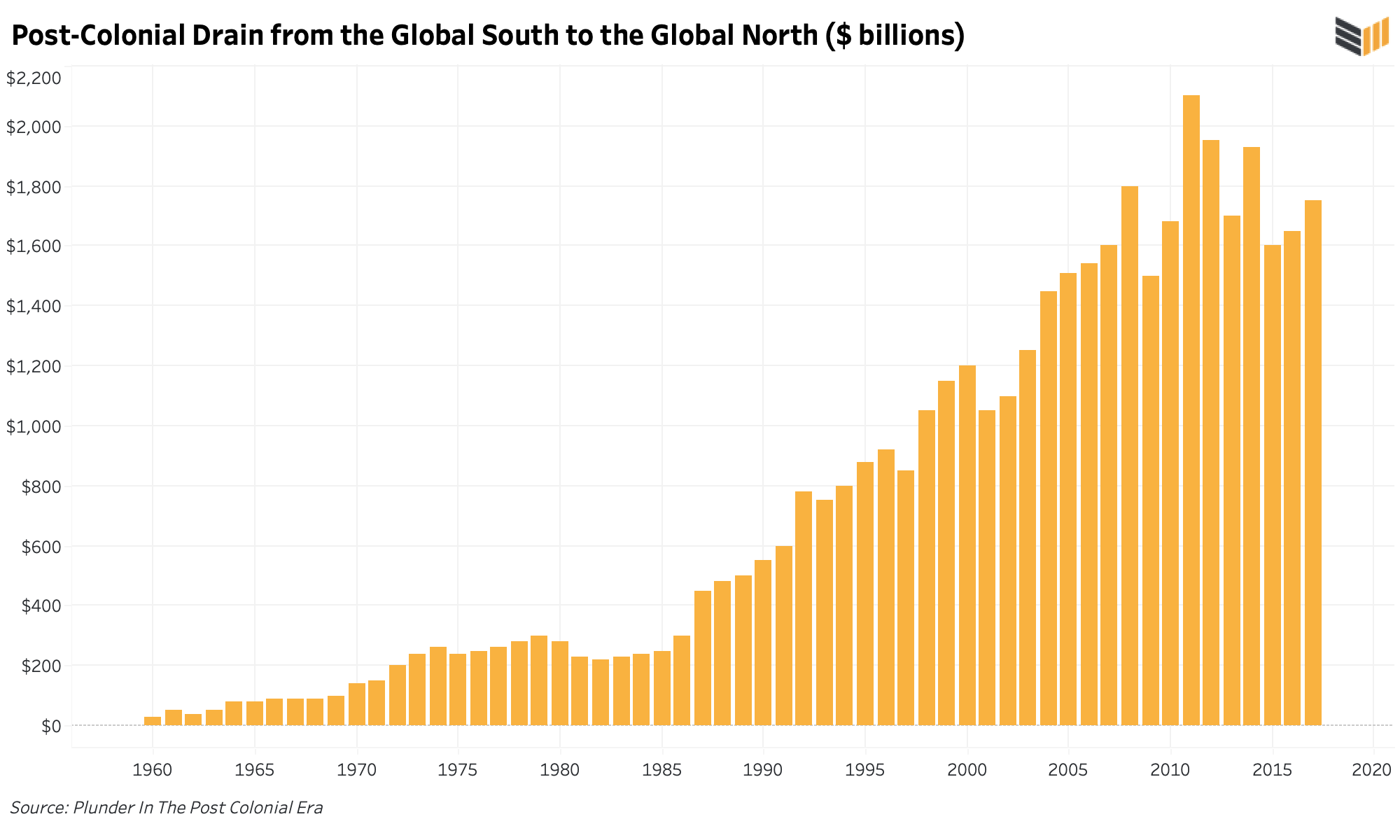

4/ In this way the IMF and World Bank have approximated the dynamics of "colonial drain"

Where imperial powers looted the periphery of the globe for hundreds of years, obtaining cheap resources and labor and selling finished goods back to markets where they had monopolies

Where imperial powers looted the periphery of the globe for hundreds of years, obtaining cheap resources and labor and selling finished goods back to markets where they had monopolies

5/ Today the difference is that the sword and gun have been replaced by weaponized debt

What was once accomplished by physical force is now accomplished by "structural adjustment":

Conditions attached to loans that dictate how borrowers can run their economies

What was once accomplished by physical force is now accomplished by "structural adjustment":

Conditions attached to loans that dictate how borrowers can run their economies

6/ The IMF — and, later, the World Bank — attached conditions to their loans that forced Third World countries to do what industrial countries like the US, UK, Japan, and Germany were never asked to do post-WWII:

Full austerity measures

Full austerity measures

7/ The structural adjustment playbook imposed on developing countries included:

-Raising taxes

-Currency devaluation

-Shrinking bank credit

-Wage ceilings

-Scrapping food + energy subsidies

-Cutting state healthcare and education

-Favorable rules for multinational corporations

-Raising taxes

-Currency devaluation

-Shrinking bank credit

-Wage ceilings

-Scrapping food + energy subsidies

-Cutting state healthcare and education

-Favorable rules for multinational corporations

8/ The goal of structural adjustment — and, in general, of the Bank and the Fund — was to view Third World countries as companies

Expenses had to be reduced, profits had to be increased

This meant domestic consumption was to be sacrificed so that exports could be maximized

Expenses had to be reduced, profits had to be increased

This meant domestic consumption was to be sacrificed so that exports could be maximized

9/ World Bank policy in particular was designed to transform the traditional consumption agriculture of Third World countries into monocrop industry to mass export (typically non-edible) goods

For example, coffee, tea, rubber, palm oil, cocoa, and cotton

For example, coffee, tea, rubber, palm oil, cocoa, and cotton

10/ World Bank policy was also designed to facilitate the extraction of minerals and other natural resources to international markets, with as little as possible being soaked up by local populations

Think: a remote hydro dam powering a mine, putting minerals on a train to a port

Think: a remote hydro dam powering a mine, putting minerals on a train to a port

11/ Export earnings did not typically benefit locals, but rather helped service foreign debt, purchase weapons, import luxury goods, fill Swiss bank accounts, and put down dissent

Historically, most Bank and Fund clients were unaccountable autocrats

Historically, most Bank and Fund clients were unaccountable autocrats

12/ The affinity of the IMF and World Bank with dictators runs deep and to their very founding

In the 1940s and 1950s, the Bank and Fund extended credit to a variety of colonial operations, including to the Dutch, British, French, and Australians

In the 1940s and 1950s, the Bank and Fund extended credit to a variety of colonial operations, including to the Dutch, British, French, and Australians

13/ World Bank support for Portuguese domination of Mozambique and South African Apartheid was so scandalous that the UN tried to force them to cancel their loans

But the Bank claimed that as a neutral organization it could not get involved with politics, so the loans were made

But the Bank claimed that as a neutral organization it could not get involved with politics, so the loans were made

14/ The World Bank and IMF rarely met a dictator they didn't like

Imperialists and right-wing regimes like the British, Pinochet, and Suharto were supported alongside left-wing or Marxist regimes like Mengistu, Tito, the CCP, and Nyerere

Imperialists and right-wing regimes like the British, Pinochet, and Suharto were supported alongside left-wing or Marxist regimes like Mengistu, Tito, the CCP, and Nyerere

15/ Suharto, Marcos, and Mobutu top the list in terms of theft and repression

Each one borrowed billions from the Bank and the Fund, only to siphon off much of it for their own personal uses

At the same time they impoverished their populations

Each one borrowed billions from the Bank and the Fund, only to siphon off much of it for their own personal uses

At the same time they impoverished their populations

16/ One would think that their debt would be considered illegitimate, as the populations of their countries did not not consent to the loans

This concept is known as "odious debt" and originated more than 100 years ago

But the Bank and Fund have never followed this precedent

This concept is known as "odious debt" and originated more than 100 years ago

But the Bank and Fund have never followed this precedent

17/ Third World countries were never allowed to go bankrupt

Instead, broke autocrats would get new loans from the Bank and Fund

By the 1970s the leaders of these sister institutions knew that Third World debt could only be repaid with more debt

It was a literal ponzi scheme

Instead, broke autocrats would get new loans from the Bank and Fund

By the 1970s the leaders of these sister institutions knew that Third World debt could only be repaid with more debt

It was a literal ponzi scheme

18/ A key point is that the Bank and Fund's creditors did not want holes on their balance sheets

They did not want countries to go bankrupt

They would prefer to extend more loans, so they could get repaid

They did not want countries to go bankrupt

They would prefer to extend more loans, so they could get repaid

19/ Again, most Bank and Fund clients were unaccountable and hugely corrupt dictators, who were happy to borrow today at the expense of the future

So the lender and borrower had every incentive to keep the system going

So the lender and borrower had every incentive to keep the system going

20/ The poor and middle classes populations of the Third World, who were impoverished and repressed by structural adjustment and its enforcers, did not have a say

There was zero democratic accountability

There was zero democratic accountability

21/ The outcome of 60 years of IMF and World Bank lending policies is staggering

Between 1960 and 2017, a staggering $62 trillion was drained from poor countries to rich ones

This is the equivalent of 620 Marshall Plans

Between 1960 and 2017, a staggering $62 trillion was drained from poor countries to rich ones

This is the equivalent of 620 Marshall Plans

22/ Against what we are led to believe, people in poor countries subsidize the way of life of people in rich countries

Not the other way around

Poor countries have paid more than $7 trillion in debt service since 1980 to their creditors

Not the other way around

Poor countries have paid more than $7 trillion in debt service since 1980 to their creditors

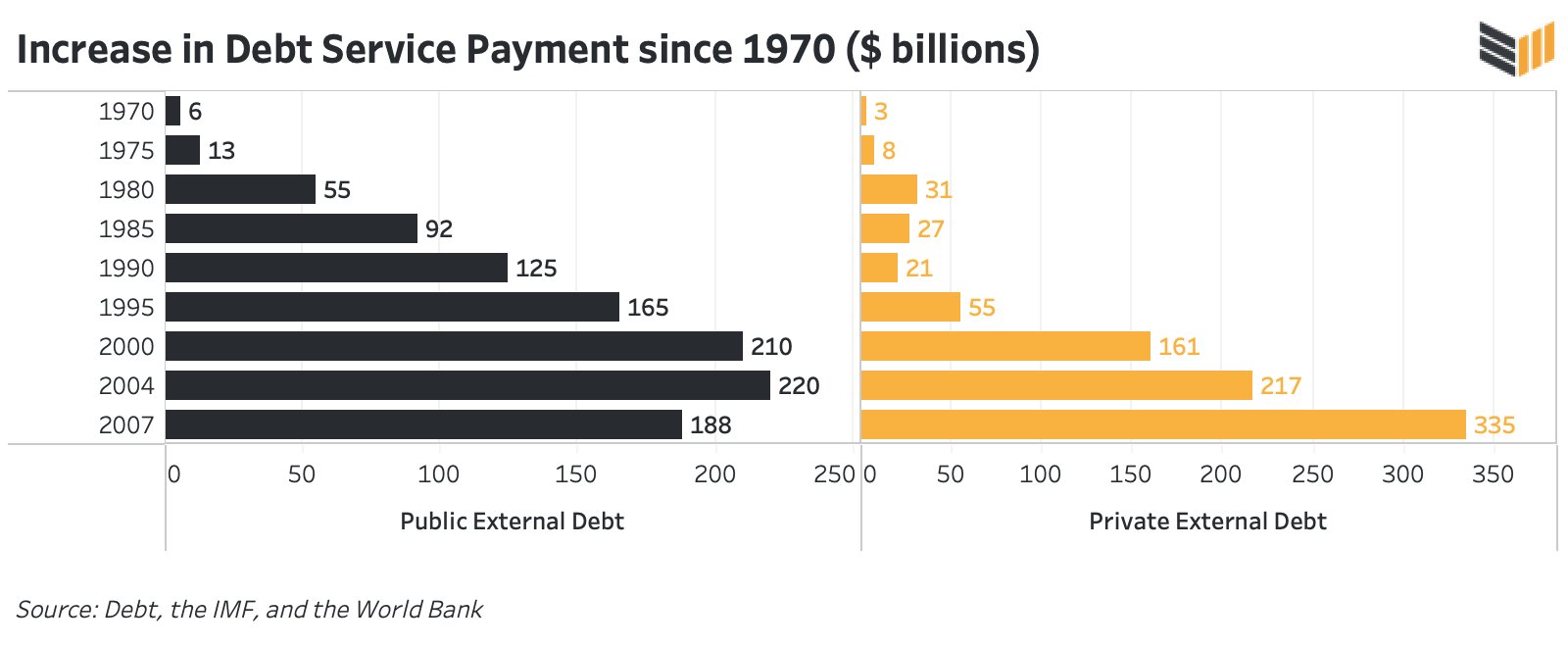

23/ Developing country debt has increased exponentially from the 1970s to today

Former colonies now owe their former colonizers 189 times more than they did in the 1970s

Former colonies now owe their former colonizers 189 times more than they did in the 1970s

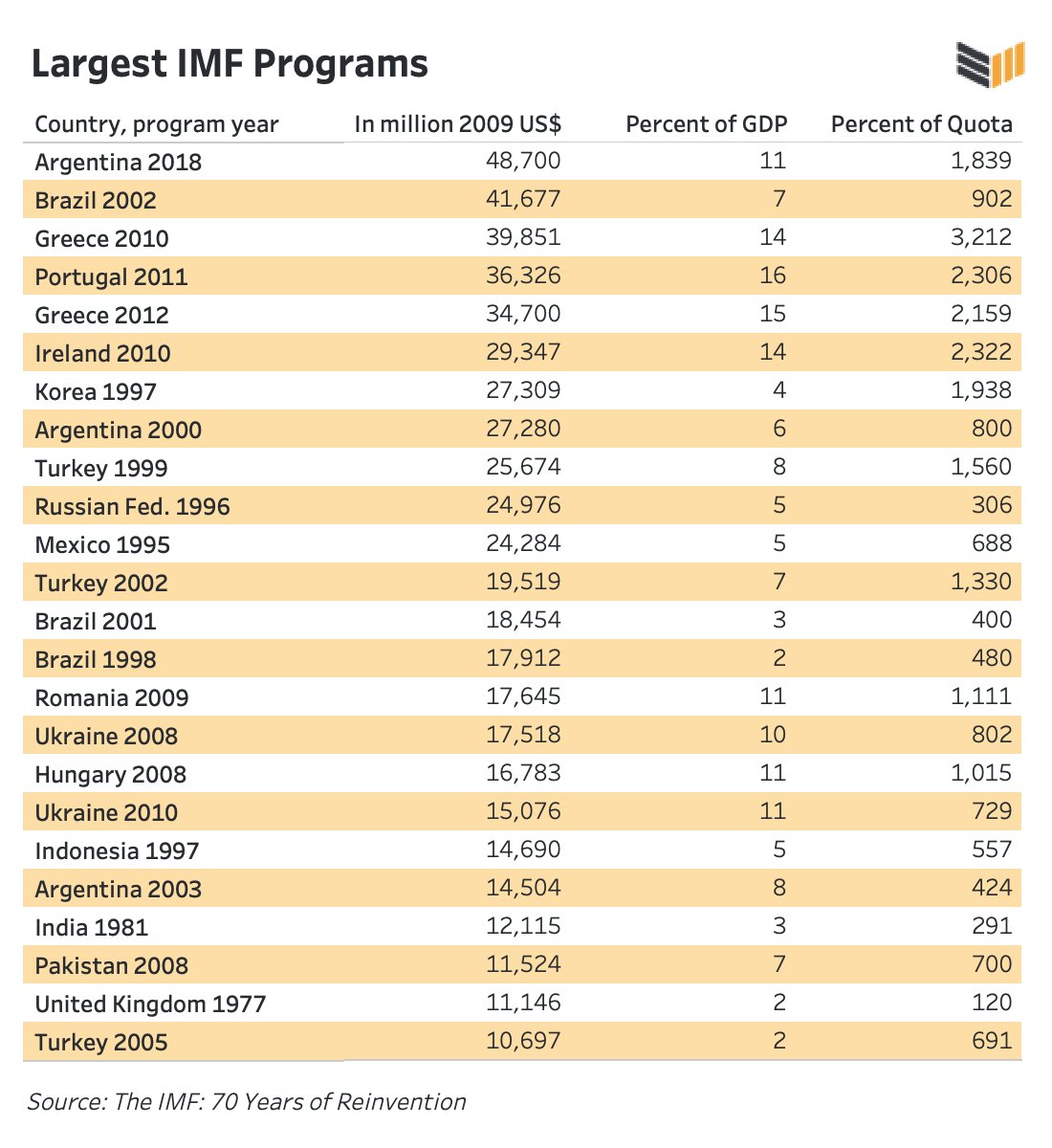

24/ The Bank and Fund have helped these countries achieve the impossible: borrow so much debt that they could never possibly pay it back

The solution is always to borrow more

The largest IMF loan in history was $57 billion, to Argentina, just 4 years ago

The solution is always to borrow more

The largest IMF loan in history was $57 billion, to Argentina, just 4 years ago

25/ Zooming out, the Bank and the Fund have not "developed" poor countries and have not "saved" them from bankruptcy

They have made poor countries dependent on rich ones for food and technology, reduced their sovereignty, and bailed them out beyond the point of financial reality

They have made poor countries dependent on rich ones for food and technology, reduced their sovereignty, and bailed them out beyond the point of financial reality

26/ Worst of all: during the 70s and 80s, the per capita income of dozens of poor countries shrunk despite their growing populations

For every 2% decline in GDP, the mortality rate increases by around 1%

This means tens of millions as a result of Bank and Fund policy

For every 2% decline in GDP, the mortality rate increases by around 1%

This means tens of millions as a result of Bank and Fund policy

27/ The Bank and Fund were, of course, never held accountable

And still aren't today

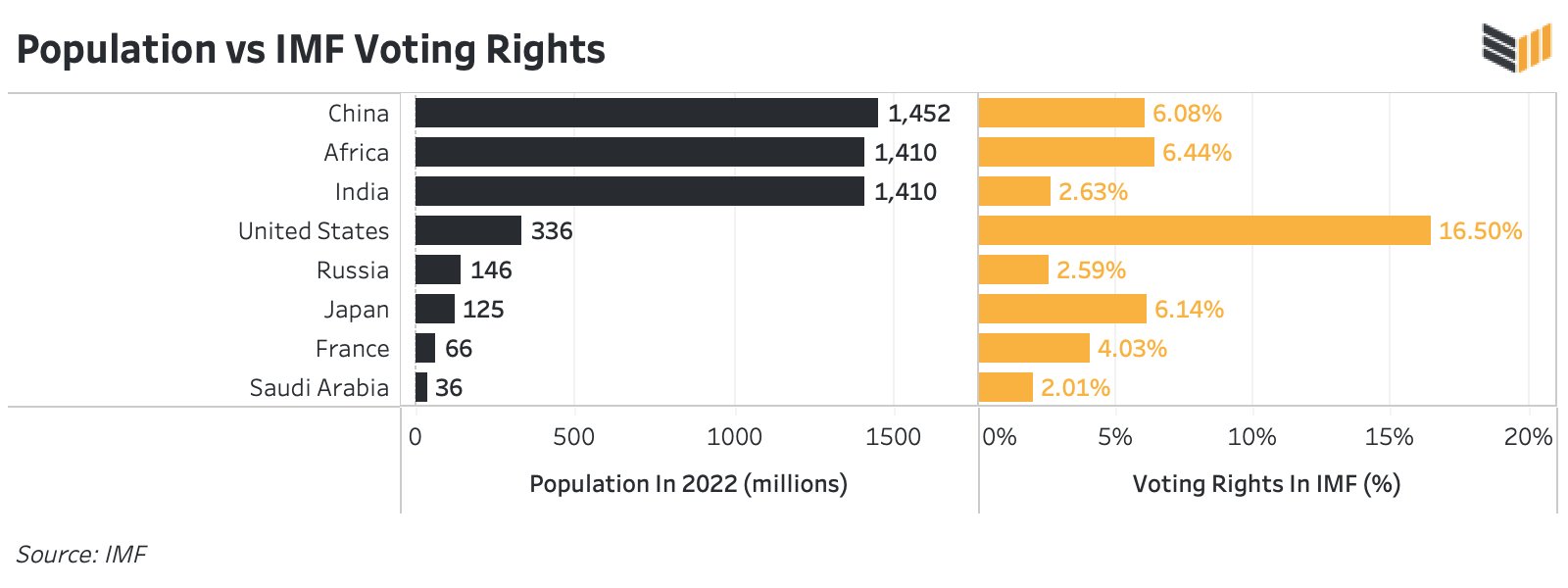

In fact their voting structure means the US, Europe, and Japan are in total control

And still aren't today

In fact their voting structure means the US, Europe, and Japan are in total control

28/ Britain has more votes at the Bank and Fund than India, despite being 20x smaller

Italy has about the same number of votes as Brazil and Nigeria

Switzerland has more votes than Pakistan, Indonesia, Bangladesh, and Ethiopia despite having 90 times fewer people

Italy has about the same number of votes as Brazil and Nigeria

Switzerland has more votes than Pakistan, Indonesia, Bangladesh, and Ethiopia despite having 90 times fewer people

29/ No one with power in this arrangement has any incentive to change the game

Creditor nations want to continue to make more and more loans, and largely corrupt and unaccountable borrowers want to take them

Only a paradigm shift could change things

Creditor nations want to continue to make more and more loans, and largely corrupt and unaccountable borrowers want to take them

Only a paradigm shift could change things

30/ The Bank and Fund in modern form are only possible due to the fiat system

The reserve currency can be printed as a political decision, allowing massive, risky loans to be extended to shaky borrowers

Everyone knows there is a "put" on sovereign debt: creditors will be repaid

The reserve currency can be printed as a political decision, allowing massive, risky loans to be extended to shaky borrowers

Everyone knows there is a "put" on sovereign debt: creditors will be repaid

31/ In a Bitcoin Standard, this ends

The structural adjustment lending ponzi will slow and then stop

The Bank and Fund will need to be more careful about loans, and may turn to co-investment

The colonial drain may finally come to an end

The structural adjustment lending ponzi will slow and then stop

The Bank and Fund will need to be more careful about loans, and may turn to co-investment

The colonial drain may finally come to an end

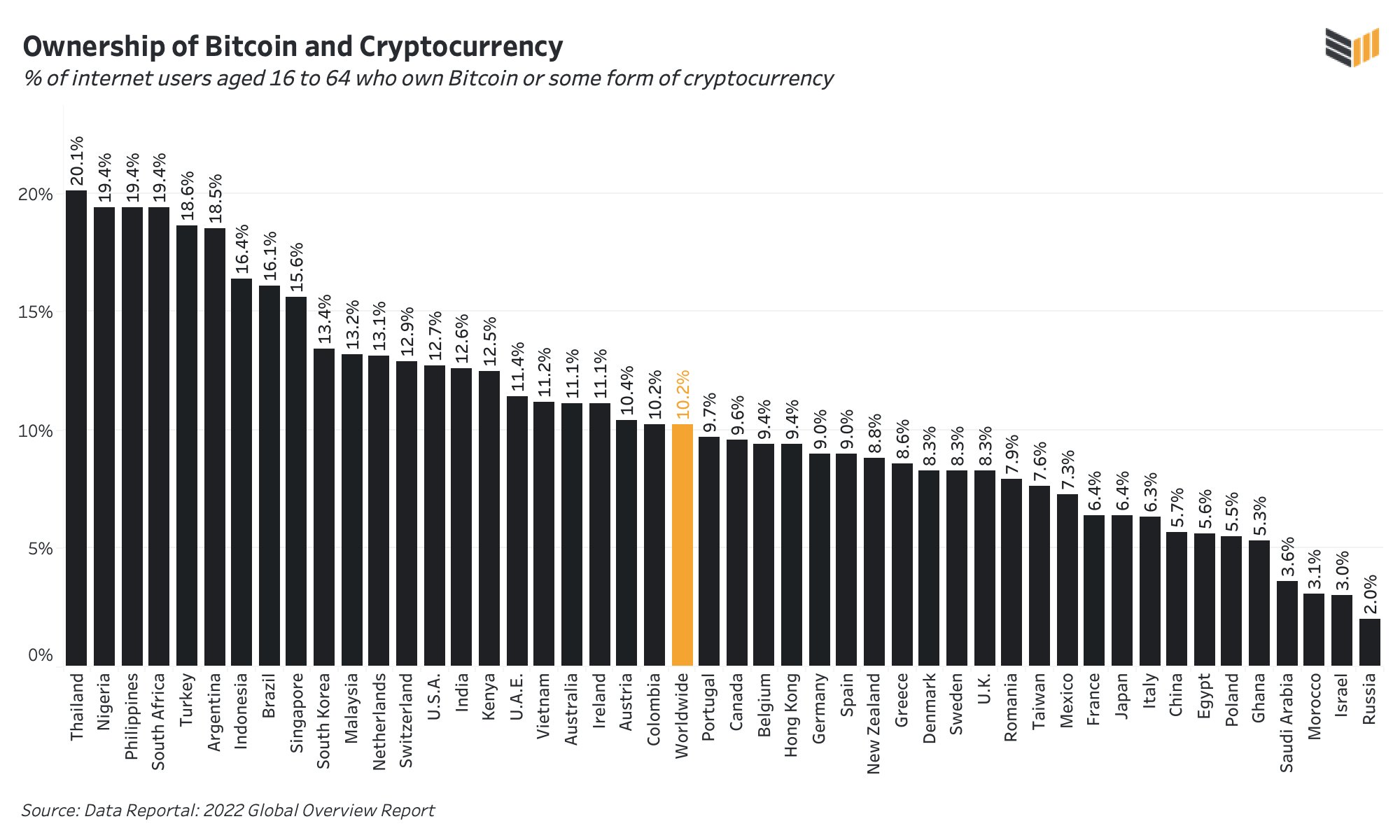

32/ Ironically, some of the countries that have been harmed most by the IMF and World Bank now have the highest levels of Bitcoin and cryptocurrency adoption

33/ Ghana's economy is once again collapsing, and the IMF recently visited to prepare to extend a 17th bailout for the country's rulers

But next week in Accra there is a different kind of event happening: afrobitcoin.org

But next week in Accra there is a different kind of event happening: afrobitcoin.org

34/ The organizers and speakers at the Africa Bitcoin Conference aren't there to extract value from Ghana and the surrounding countries, or to ensnare their governments in debt traps

They are gathering to give people open source tools to help them achieve financial freedom

They are gathering to give people open source tools to help them achieve financial freedom

35/ Despite the dark tone of this essay, the global Bitcoin movement does give me great hope

I look forward to discussing this with many of you in Accra next week!

I look forward to discussing this with many of you in Accra next week!

36/ This is the longest essay I’ve ever written and also the most jarring in the way that it made me think differently

I think it’s fair to say that after doing the research and interviews and putting this all together, I’ll never see the world the same way again

I think it’s fair to say that after doing the research and interviews and putting this all together, I’ll never see the world the same way again

37/ I hope you can find time to read the essay: this thread is just a tiny slice of what's in the full thing

Grateful for the @BitcoinMagazine team for letting me publish something so long and detailed and for helping make all the charts look so crisp 🙏

bitcoinmagazine.com/culture/imf-world-bank-repress-poor-countries

Grateful for the @BitcoinMagazine team for letting me publish something so long and detailed and for helping make all the charts look so crisp 🙏

bitcoinmagazine.com/culture/imf-world-bank-repress-poor-countries