Thread

A Mexico equities view for foreign investors. 🧵 @kittysquiddy

Mexico market as a whole have been very useless for more than a decade and probably will stay that way . But individual equities can give great investments opportunities. Mexico presents very good opportunities when things get risky. 1/8

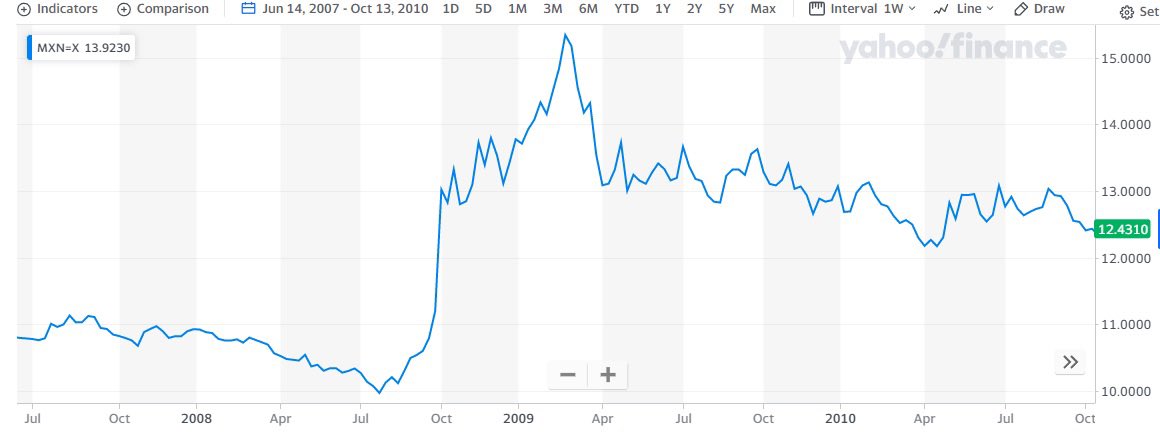

When markets get complicated risk aversion hits Mexico very hard. Capital panics out of every single asset class, specially bonds and equities. USD/MXN usually over shoots making MXN lose around 30%. This is one of the edges of investing in Mexico… more on this later. 2/8

Equity funds, ETFs, etc, sell indiscriminately, it doesn’t matter if company’s are worth 10X EBITDA or 1X EBITDA. They have to sell and usually when there’s no one buying. Prices get ridiculous, I have bought companies at .6x EBITDA that are growing yearly. 3/8

Mexico market is way slower than the US markets. Nasdaq can be already 20%-30% up from lows and individual Mexican equities just a few %s up, very close to their bottom. So equities give time to make sure bottom is in.. without paying 30% extra for it. R/R is insane. 4/8

There is a group of 5-10 companies that are loved by foreign money that have those crazy swings. When money comes back to EM the inverse happens and funds buy everything when there’s no one selling. 1x-3x are common. (In scenarios like GFC and Covid) 5/8

Then with all those flows to Mexico, MXN gets most of it’s value back. Adding an additional 20%-30% to the gains in USD terms. 6/8

To sum it up:

1) stupid cheap valuations in good companies.

2) slow reaction to macro. Lowers risk of timing.

3) currency appreciation in $ terms on top of gains. 7/8

1) stupid cheap valuations in good companies.

2) slow reaction to macro. Lowers risk of timing.

3) currency appreciation in $ terms on top of gains. 7/8

First 🧵 ever. Hope it helps the group… When the moment presents I will have a list of equities that fits this investment thesis. FIN