Thread

Bitfarms just revealed the state of its finances and operations in its latest quarterly report.

How is it going with this international bitcoin mining company? Find out in this article.

How is it going with this international bitcoin mining company? Find out in this article.

First of all, Bitfarms reduced its debt substantially in Q3, as well as minimizing costs.

The company's management is obviously laser focused on strengthening the company so that it can get through this bear market.

The company's management is obviously laser focused on strengthening the company so that it can get through this bear market.

Still, Bitfarms struggles with its bitcoin-and machine collateralized debt.

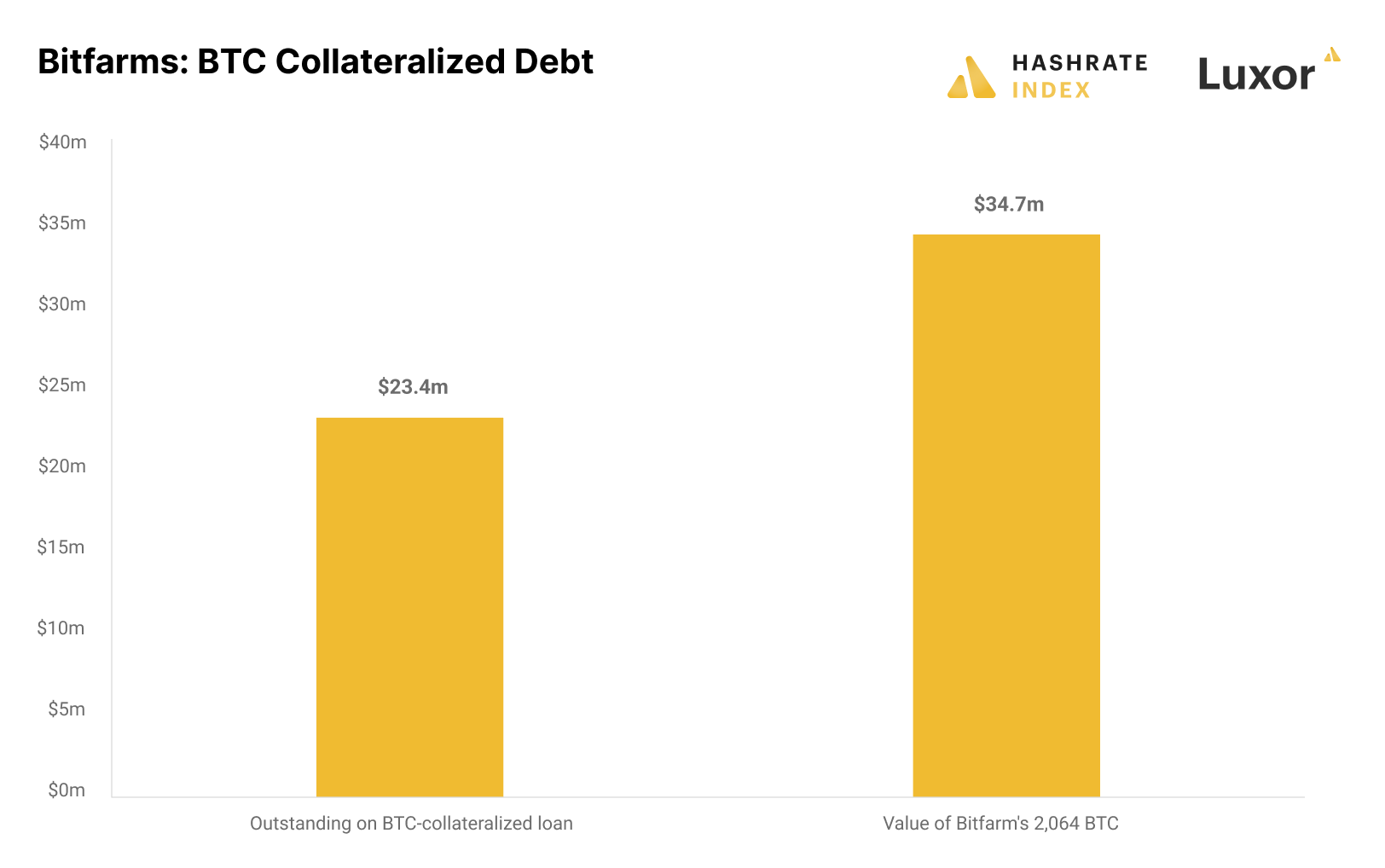

The company has $55 million outstanding in machine-collateralized loans and $23 million in bitcoin-collateralized debt.

The company has $55 million outstanding in machine-collateralized loans and $23 million in bitcoin-collateralized debt.

The company significantly reduced these debt positions in Q3 by selling more bitcoin than it produced. It generated 1,515 and sold 2,595 bitcoin.

The problem is that it now doesn't have that much bitcoin left.

The problem is that it now doesn't have that much bitcoin left.

Let’s analyze Bitfarms' liquidity. It holds $38 million of cash and 2,064 bitcoin.

The problem is that 1,724 of these bitcoin are pledged as collateral, giving the company a total unpledged liquidity of only $44 million.

The problem is that 1,724 of these bitcoin are pledged as collateral, giving the company a total unpledged liquidity of only $44 million.

Its bitcoin collateral must maintain a collateral value of 125% of the loan.

The company’s entire bitcoin stack of 2,064 equals 141%. If the bitcoin price fell by a further 16% to $14,200, the company's loan could be liquidated.

The company’s entire bitcoin stack of 2,064 equals 141%. If the bitcoin price fell by a further 16% to $14,200, the company's loan could be liquidated.

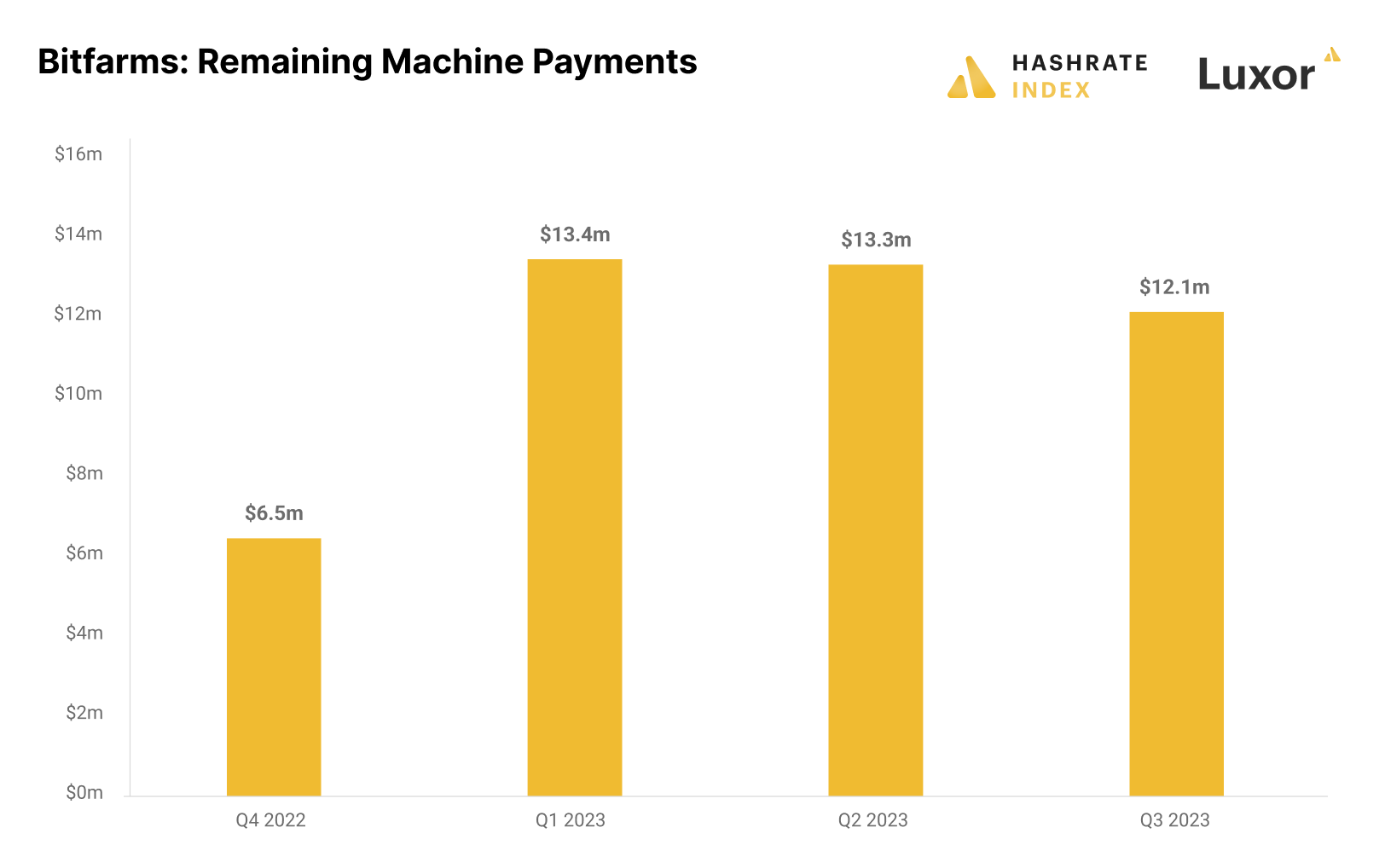

Bitfarms also has higher cash outflows than inflows.

The company must spend its saved-up liquidity and will be forced to raise external capital in the coming months.

The company must spend its saved-up liquidity and will be forced to raise external capital in the coming months.

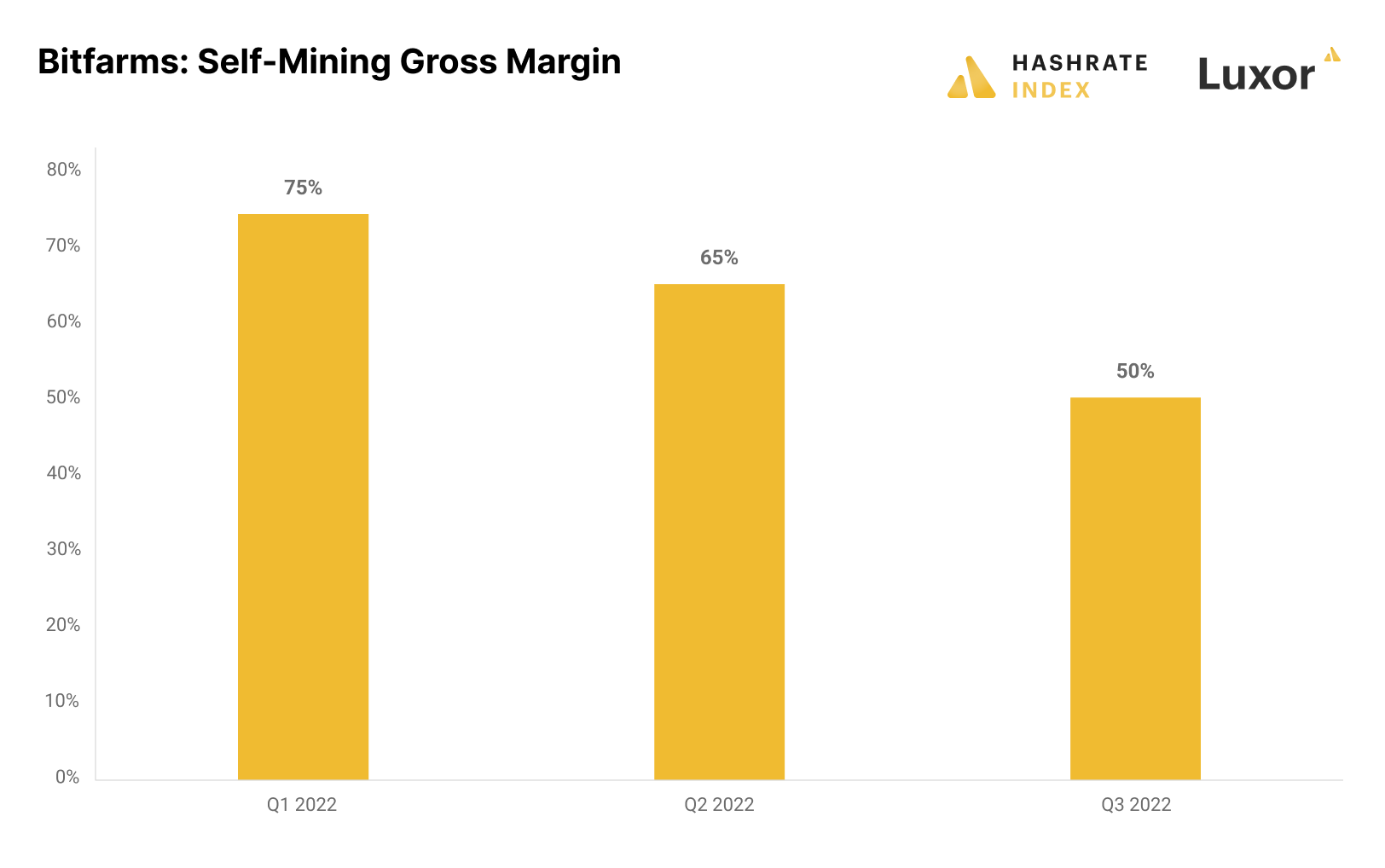

Bitfarms has been keeping its costs down during this bear market.

It has access to cheaper electricity than most other miners.

It has access to cheaper electricity than most other miners.

Due to its low electricity rates, Bitfarms has a relatively low direct bitcoin production cost.

Its gross margin was 50% in Q3, which is better than most competitors. It's likely around 40% now as the bitcoin price has fallen below $17k.

Its gross margin was 50% in Q3, which is better than most competitors. It's likely around 40% now as the bitcoin price has fallen below $17k.

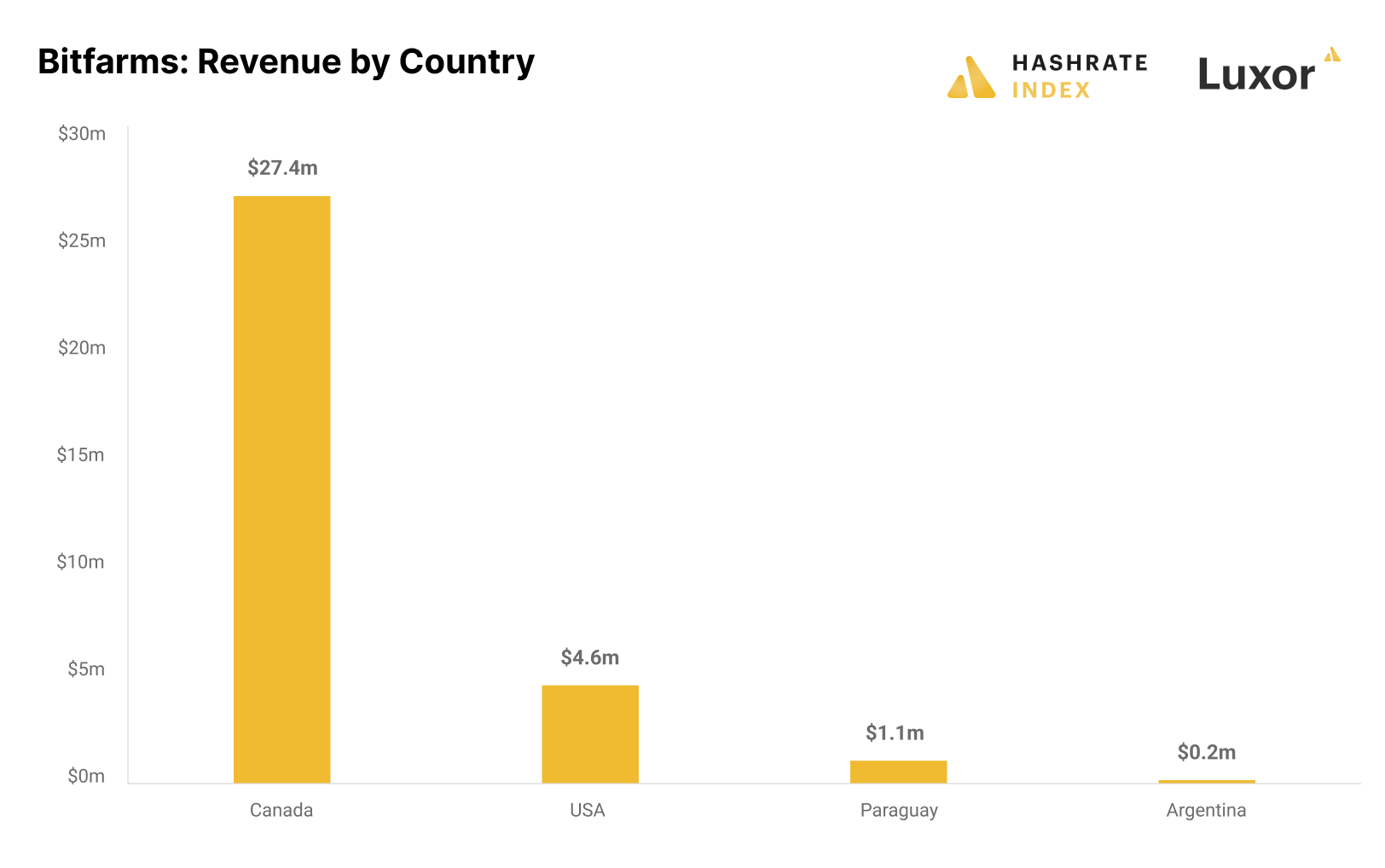

Although Bitfarms is expanding into South America, its Quebec facilities are still the company’s bread and butter, providing more than 80% of its revenue.

Bitfarms is expanding internationally but things are moving slower than expected, as the company is wrestling with the Argentine bureaucracy.

Bitfarms' expansion will require the company to obtain external funding. If the company is not able to raise money, it will in the best case have to scrap some growth plans.

Mentions

See All

Jeff Ross @VailshireCap

·

Nov 16, 2022

Nice thread, Jaran. 🤝