Thread

1/n - Why DCG and Genesis will go bankrupt - All information from public sources.

2/n - I didn't want to write another thread but seeing the media read @BarrySilbert's letter the wrong way really got to me. I dont want to see people get tricked by another @SBF_FTX

3/n - You can read the long form here.

degentrading.substack.com/p/genesis-chapter-11

degentrading.substack.com/p/genesis-chapter-11

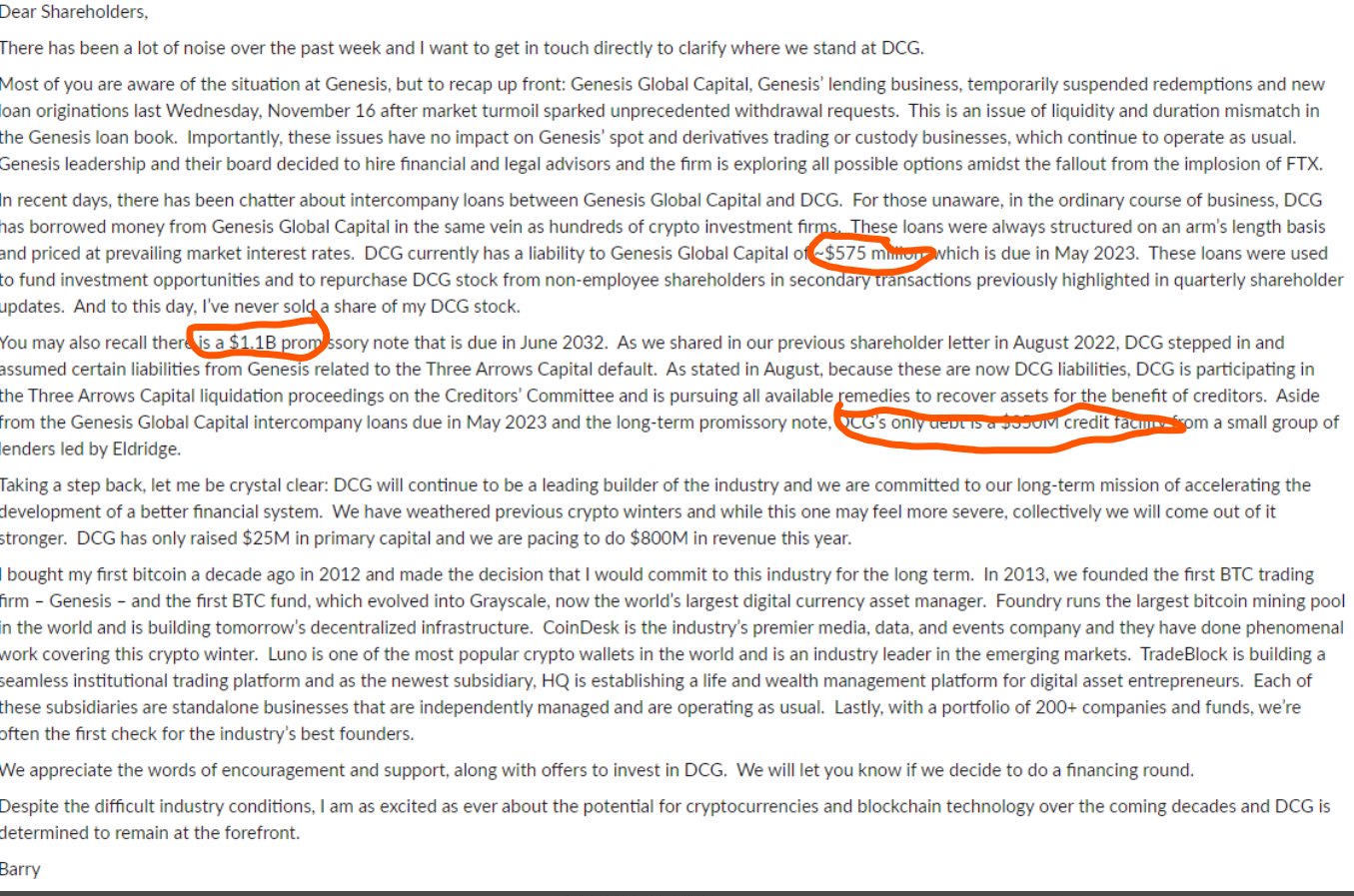

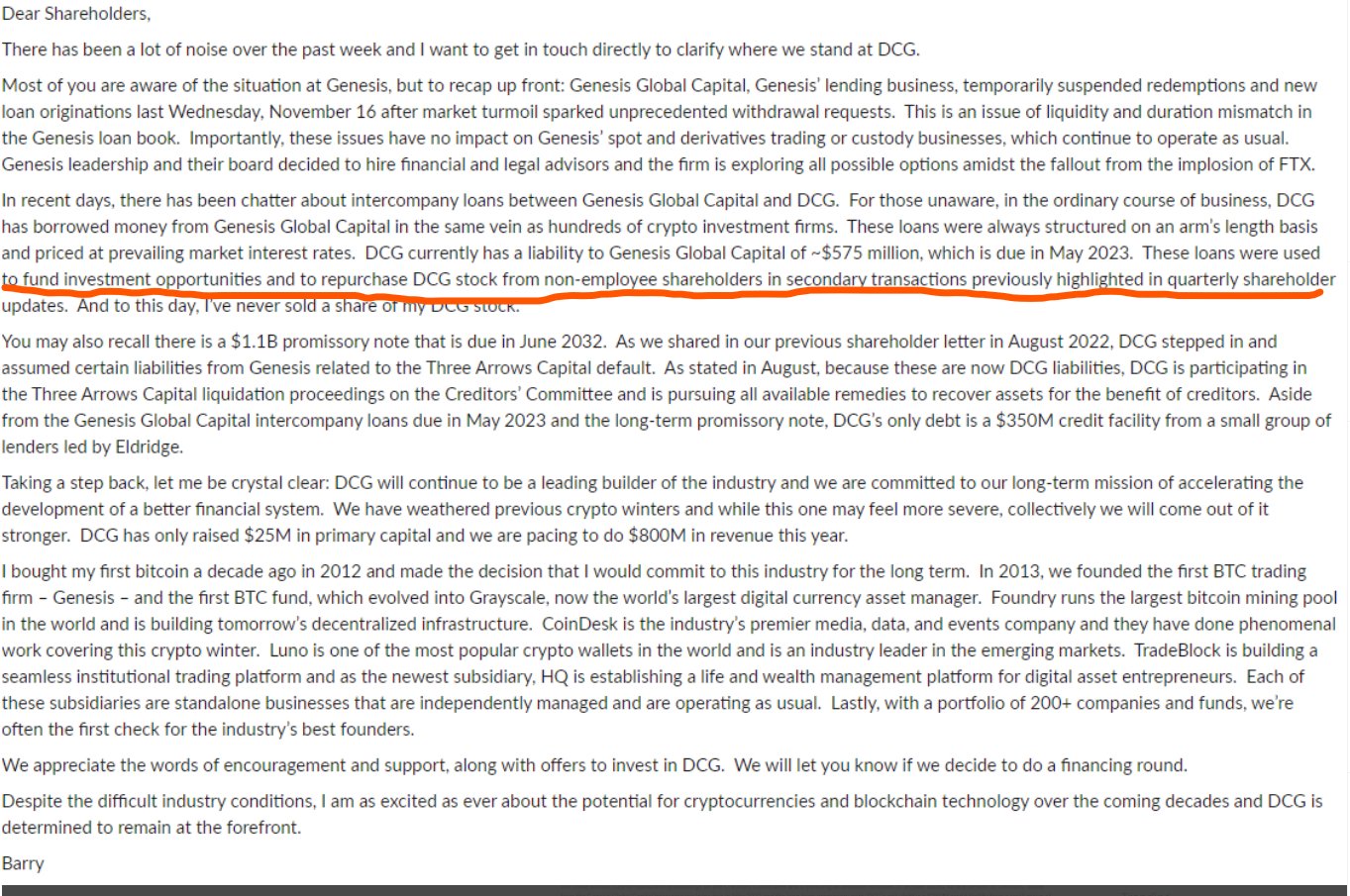

4/n - First of all, from Barry's letter himself. DCG in aggregate owes 2.025bn. 1.675bn to Genesis and 350m to external creditors.

5/n - This is way worse than i thought. I thought the hole was just 1bn. Guess i was wrong by a factor of 2.

7/n - As a lender, in accounting rules loans are "assets" and deposits are "liabilities". Genesis as a borrrower lender is mostly funded by a small amount of equity and deposits.

8/n - Post Babel, 3AC etc, we can safely assume that the entire equity has been wiped out. Since Genesis was noted to have 2.8bn of loans. We can assume there is a corresponding 2.8bn of deposits to fund the balance sheet.

9/n - Given that @BarrySilbert has admitted that DCG owes Genesis 575m and 1.1bn - that means that Genesis's balance sheet looks like this

10/n - The 1.1bn was a hole created from 3AC's default. It was used to plug the hole in the balance sheet presumably so that Genesis could avoid defaulting and being insolvent.

11/n - But as anyone with enough sense can tell you, this is just sheer financial trickery. Unless DCG pays back the money, Genesis's balance sheet looks like this

12/n - This means that depending on how much DCG has to payback Genesis, the depositors/creditors of Genesis have about a recovery of 40c on the dollar.

13/n - Also BECAUSE DCG took on the promissory note, Genesis creditors HAVE recourse to find DCG for the money. Which is why they suddenly need to raise

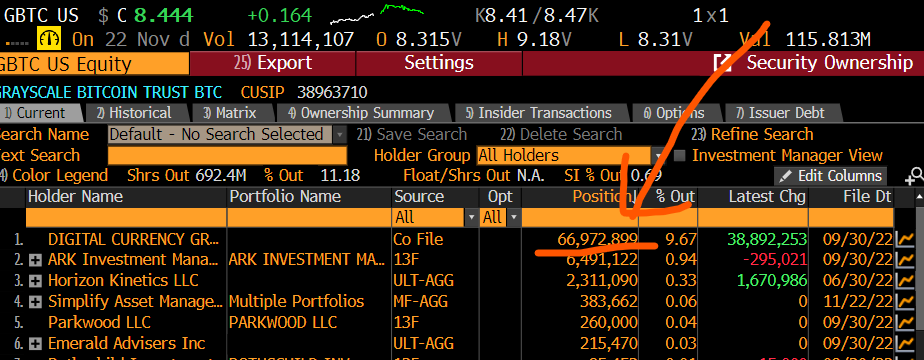

14/n - DCG's main assets at this point is (1) Their GBTC stake of 67M~ in shares (2) Value of Grayscale Biz (3) Genesis (probably worth zero)

15/n - It is unlikely that they have much cash on hand given how in the letter, Barry said that DCG took that 575m loan from Genesis to buy back stock from employees and "investment opportunities"

17/n - How much is the Grayscale biz really worth? The earnings mostly come from GBTC and ETHE. At current BTC and ETH prices, this works out to be ~280m in revenues. Given costs should be low, we can assume this to be earnings.

18/n - However, even at crypto's peak in Nov 21, DCG was only able to raise at 10bn valuation. Grayscale's run rate revenue should be about 1.1bn and Genesis was running at 1bn. i.e At it's peak, DCG was only able to command a 5x PE ratio

19/n - In a market now damaged with a crisis of confidence post FTX, Barry can probably only find buyers at 2x PE or less. Given that the earnings have crypto delta. and crypto is a dirty word now.

20/n - This means that the Grayscale biz can only fetch 560m - 840m....very short of 2.02bn.

21/n - What about the GBTC on hand? They can probably sell that into the stock mkt. However remember that they are 10% of the outstanding. There is appetite in the market for GBTC stock. Going this route probably only nets them 300m at best.

22/n - Which is why they went hat in hand to the SEC for Reg M relief. However there is close to zero chance that the SEC will allow this because the optics of it for the SEC is terrible

23/n - Doing that means that the SEC would allow DCG to redeem its BTC and dump it into the market only. Which is unfair to other investors in GBTC.

24/n - This leaves the only real way to monetize the GBTC stake as unwinding GBTC so that everybody gets out. This is the apocalyptic scenario for BTC with 633k of BTC hitting the market

25/n - The only way for sufficient dollars in the system to bid such a pile is for prices to go low enough. The last BTC will probably clear at 8k (GBTC disc applied to spot) with an avg selling price of 12k. Optimistically.

26/n This fetches him about 750m of cash. Also they get to keep ETHE and the rest of the other businesses

27/n - Regardless of what Barry does...none of these is enough to raise 2bn and to repay the hole in Genesis. This means that Genesis will collapse.

28/n - "It's gonna be a looooong week" and "That daisy chain of leverage" aint looking so good now.

29/n - As the institutional "prime broker" of the space, the collapse of Genesis will lead to even more contagion as many of the depositors are institutions vs BlockFi.

30/n - Depending on whether DCG unwinds GBTC - that leads to 633k of BTC sell pressure or just selling their own GBTC shares in the market (which will lead to 33k of equivalent spot sell pressure)

31/n BTC might go to either 8k or 12k...and we have Saylor looking very nervously below

32/n - tldr. There is no way DCG can raise enough money to return 1.675bn to Genesis. Both of the entities will collapse and go under. Contagion is assured. The only question is if we face apocalypse in the form of GBTC unwinding or not.

33/n - Add on. For those wondering why is this urgent. It's likely because the depositors to Genesis are on ST loans. Industry speak - they are "open term". Hence these depositors can demand for withdrawal back which gives the urgency for DCG to fund raise NOW.