Thread by riddles.eth

- Tweet

- Nov 23, 2022

- #Non-FungibleToken #Blockchain

Thread

The biggest threat to fungible tokens does not apply to non-fungible tokens (NFTs)

Here’s what you need to know re/

1️⃣ paper-gold & paper-#BTC

2️⃣ how “run on the bank” works

3️⃣ how NFTs are a Trojan horse for mainstream self-custody

4️⃣ how to protect yourself

🧵👇🏽 🍿

Here’s what you need to know re/

1️⃣ paper-gold & paper-#BTC

2️⃣ how “run on the bank” works

3️⃣ how NFTs are a Trojan horse for mainstream self-custody

4️⃣ how to protect yourself

🧵👇🏽 🍿

Ever wonder why gold prices haven’t really gone up in ages?

In an era of rampant money printing & rise in population, wouldn’t you think that a scarce resource like gold would be much more desirable?

See below a chart that maps gold against the fed’s balance sheet👇🏽

In an era of rampant money printing & rise in population, wouldn’t you think that a scarce resource like gold would be much more desirable?

See below a chart that maps gold against the fed’s balance sheet👇🏽

If demand goes up, and supply stays constant … then price should go up

That’s an economics FACT!

(…theory?)

But here’s the problem…

That’s an economics FACT!

(…theory?)

But here’s the problem…

Chapter 1️⃣ : Paper Gold

Simply put, paper gold is a piece of paper that says you own X amount of gold in a vault

Since the paper is yours, you have “claim” to that gold. This claim (asset) is something you can trade in the open market

Simply put, paper gold is a piece of paper that says you own X amount of gold in a vault

Since the paper is yours, you have “claim” to that gold. This claim (asset) is something you can trade in the open market

Here’s what’s 🔑

Gold is a FUNGIBLE asset — much like money, commodities, & other goods

If you have claim to 5 troy ounces of gold, it doesn’t matter which 5 troy ounces the custodian gives you… it’s the same thing

The same logic applies for money in the bank… it’s FUNGIBLE

Gold is a FUNGIBLE asset — much like money, commodities, & other goods

If you have claim to 5 troy ounces of gold, it doesn’t matter which 5 troy ounces the custodian gives you… it’s the same thing

The same logic applies for money in the bank… it’s FUNGIBLE

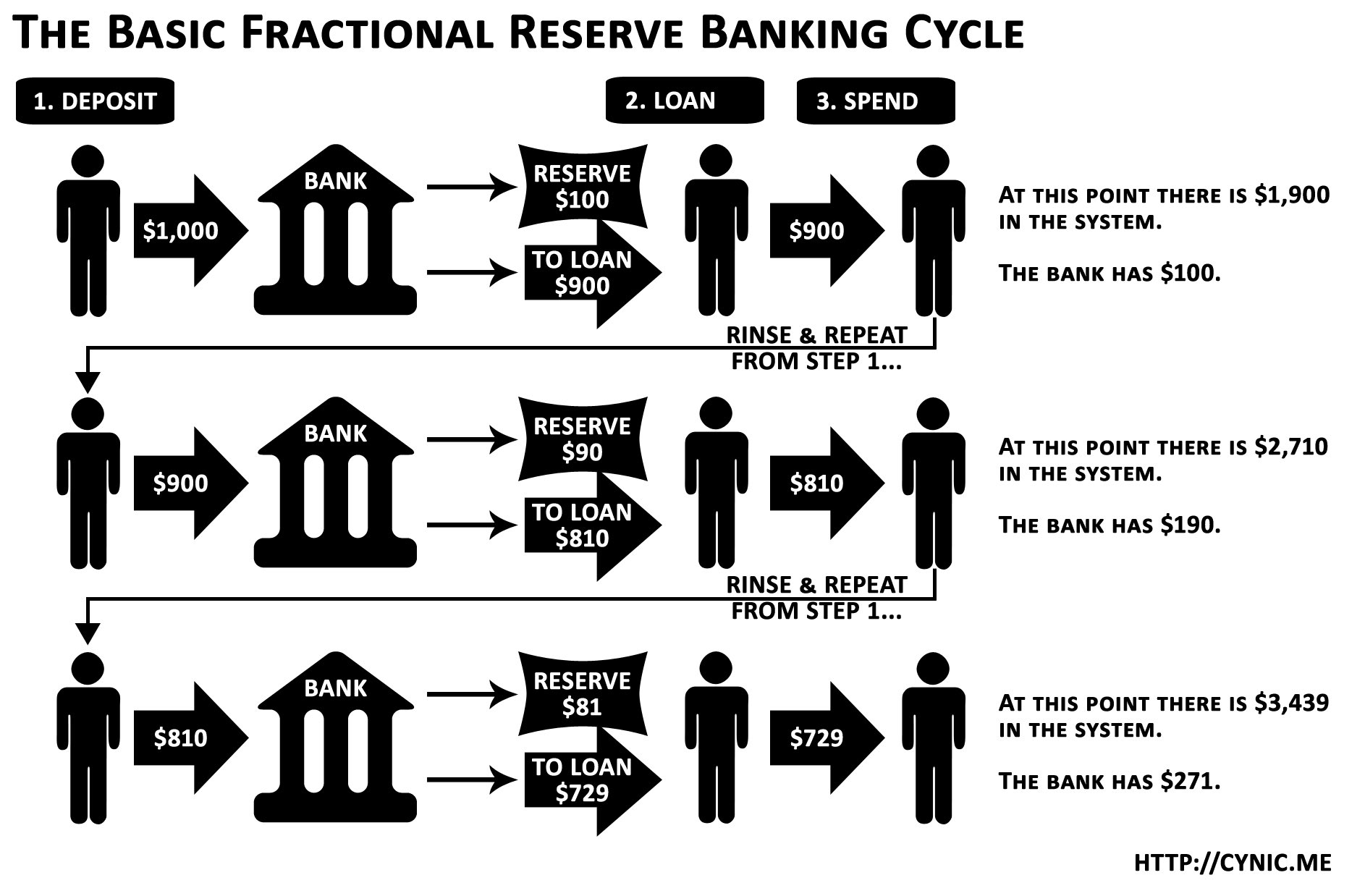

Chapter 2️⃣ : Fractional-reserve banking

Simply put, banks are required to hold only a proportion of their ‘deposit liabilities’ in ‘liquid assets’ as a reserve, & can lend the remainder to borrowers

The money they lend, can technically be loaned out over & over & over & over…

Simply put, banks are required to hold only a proportion of their ‘deposit liabilities’ in ‘liquid assets’ as a reserve, & can lend the remainder to borrowers

The money they lend, can technically be loaned out over & over & over & over…

Let’s assume:

The equilibrium demand/supply in an economy (a remote island 🏝️ ) during YEAR 1 was actually 1,000 ounces of gold @ $100 per ounce

In YEAR 2, 10x the people came into the island 🏝️

If demand 10x… in theory, the price should also ~10x, assuming the supply is same

The equilibrium demand/supply in an economy (a remote island 🏝️ ) during YEAR 1 was actually 1,000 ounces of gold @ $100 per ounce

In YEAR 2, 10x the people came into the island 🏝️

If demand 10x… in theory, the price should also ~10x, assuming the supply is same

Now in the island 🏝️, assume you can’t really mine for any more gold. Nor can you import it.

So being a sneaky person who wants to take advantage of the new added demand (based on $100/ounce prices)… what do you do?

🤔 👇🏽

So being a sneaky person who wants to take advantage of the new added demand (based on $100/ounce prices)… what do you do?

🤔 👇🏽

Instead of letting prices run up (which kills demand), you issue 9,000 pieces of “paper gold” & bet that there’s no way more than 1,000 people will come to withdraw their gold at once…

If they do… you’re fucked.

SBF-fucked. And not in an FTX Adderall orgy kind of way either…

If they do… you’re fucked.

SBF-fucked. And not in an FTX Adderall orgy kind of way either…

You simply don’t have more than 1k ounces for “redemptions” on your fake paper gold that you created out of thin air…

This is why for ages, gold & silver maxis have tried to make a “run on the bank”

This is why they urge you to hold & accumulate physical bullions

This is why for ages, gold & silver maxis have tried to make a “run on the bank”

This is why they urge you to hold & accumulate physical bullions

Chapter 3️⃣ : Digital Gold

#BTC’s biggest usecase is that it’s DESIGNED for self-custody to kill “double-spend”

Satoshi knew that the biggest issue gold & fiat had was the “double spend” issue, where having a “sufficient” reserve allowed you to create new supply out of thin air

#BTC’s biggest usecase is that it’s DESIGNED for self-custody to kill “double-spend”

Satoshi knew that the biggest issue gold & fiat had was the “double spend” issue, where having a “sufficient” reserve allowed you to create new supply out of thin air

If you issued 10 ounces of paper gold off of 1 ounce of real gold, that real gold would be “double spent” 9x

With BTC, you don’t need physical bodyguards to defend it. Nor do you need armoured trucks to transport large amounts

It’s transparent & you don’t need a “custodian” 💡

With BTC, you don’t need physical bodyguards to defend it. Nor do you need armoured trucks to transport large amounts

It’s transparent & you don’t need a “custodian” 💡

Chapter 4️⃣ : Digital Crypto Banks

There will ever only be 21 million real Bitcoin

BUT paper Bitcoin can be infinite — so long as there isn’t a “bank run”

This is what the centralized exchanges want… to create supply out of thin air, and lend it out

“Easy money” said Caroline

There will ever only be 21 million real Bitcoin

BUT paper Bitcoin can be infinite — so long as there isn’t a “bank run”

This is what the centralized exchanges want… to create supply out of thin air, and lend it out

“Easy money” said Caroline

This is exactly how the CEXes, sexed themselves… by biting off more than they can chew

There’s only so much “paper supply” you can create via constant “rehypothecation” — look it up

Sooner or later, the house of cards crumble… and boy have they ever for the crypto industry

There’s only so much “paper supply” you can create via constant “rehypothecation” — look it up

Sooner or later, the house of cards crumble… and boy have they ever for the crypto industry

Chapter 5️⃣ : Enter NFTs

Imagine a bank for your wife & kids

🔹 You drop them off (deposit)

🔹 Bank lends them out to another “borrower”

🔹 When you come back to pick them up (withdrawal), they hand you a different set of wife & kids

… & off you go!

Why wouldn’t that work? 👇🏽

Imagine a bank for your wife & kids

🔹 You drop them off (deposit)

🔹 Bank lends them out to another “borrower”

🔹 When you come back to pick them up (withdrawal), they hand you a different set of wife & kids

… & off you go!

Why wouldn’t that work? 👇🏽

Your wife and kids are NON-FUNGIBLE

Of course you can’t just “rehypothecate” them… they’re unique!

🔑 “Fractional reserve banking” / “rehypothecation” ONLY works on FUNGIBLE tokens

Meaning… the biggest risk/hurdle to fungible tokens, does not exist for NFTs!

Of course you can’t just “rehypothecate” them… they’re unique!

🔑 “Fractional reserve banking” / “rehypothecation” ONLY works on FUNGIBLE tokens

Meaning… the biggest risk/hurdle to fungible tokens, does not exist for NFTs!

If you custody your BAYC 6529 & BAYC 9059 with a “bank” / custodian… they can’t just copy-pasta clone them, loan them out, & then hand you a different set when you come back to redeem…

That wouldn’t work

This is precisely why people haven’t had any “custody issues” with NFTs

That wouldn’t work

This is precisely why people haven’t had any “custody issues” with NFTs

Most of our world is unique

And as such, NFT technology allows a better path for “tokenization” of authentication & ownership than any “fungible technologies” could ever have

NFTs actually solve the “double spend” problem even better than Satoshi’s Bitcoin

Let that sink in…

And as such, NFT technology allows a better path for “tokenization” of authentication & ownership than any “fungible technologies” could ever have

NFTs actually solve the “double spend” problem even better than Satoshi’s Bitcoin

Let that sink in…

Chapter 6️⃣ : Protect Yourself

🔑 self custody your assets

🔑 do not loan out your “non-fungible” tokens for fungible ones (I.e. crypto & fiat) — if you do, you’re a part of the problem

🔑 next time someone says “world optimization” or “effective altruism”, take ur money & run

🔑 self custody your assets

🔑 do not loan out your “non-fungible” tokens for fungible ones (I.e. crypto & fiat) — if you do, you’re a part of the problem

🔑 next time someone says “world optimization” or “effective altruism”, take ur money & run

If you enjoyed this🧵, the nicest gesture in twitter is an RT.

RT'ing the first post (shared here for your convenience) would help tremendously in getting it infront of more ppl like you.

Always appreciate our frenship ♥️

This 🧵 is brought to you by @grassverseNFT

RT'ing the first post (shared here for your convenience) would help tremendously in getting it infront of more ppl like you.

Always appreciate our frenship ♥️

This 🧵 is brought to you by @grassverseNFT

You can find all my threads here 👇🏽

Mentions

See All

Raoul Pal @RaoulPal

·

Nov 23, 2022

Great thread! Well done