Thread

🧵below on why Silvergate $SI may be in a whole heap of KYC/AML trouble with the FTX collapse

Quick background - $SI is a US bank whose customers are basicallly all crypto participants - exchanges (i.e. FTX), institutional investors (crypto hedge funds), and stablecoin issuers (Circle/USDC).

A big appeal of $SI to these crypto customers is their SEN network which allows these customers 24/7 access (important in crypto) to send money between their Silvergate accounts and other participants on the SEN network. FTX was a customer of $SI

On 11/11, $SI issued a statement that FTX and its "related" entities represented less than 10% of its $11.9bn. Let's assume its $1bn. Here's where it starts to get interesting. You want to fund your FTX.com account with a wire transfer?

No problem. FTX would direct you to send the funds to their bank Silvergate and one should expect the beneficiary account should be FTX Trading LTD (Antigua) which was the parent for FTX.com or a susidiary.

After all, you were sending funds to a US bank to fund a trading account at FTX.com. Here's the catch, a couple internet searches show the beneficiary account on the Silvergate/FTX wire instructions appear to be Alameda accounts.

It appears the accounts FTX customers were told to wire funds to appear to be the $SI bank accounts of Alameda Research Ltd and North Dimension Inc, a subsidiary of Alameda. (crowdsourced data welcomed)

www.reddit.com/r/singaporefi/comments/sgyymw/ftx_fiat_deposit_wrong_beneficiary/?utm_source=share&utm...

www.reddit.com/r/MalaysianPF/comments/sd77kc/my_experience_of_fiat_withdrawal_from_ftx_crypto/?utm_so...

www.reddit.com/r/singaporefi/comments/sgyymw/ftx_fiat_deposit_wrong_beneficiary/?utm_source=share&utm...

www.reddit.com/r/MalaysianPF/comments/sd77kc/my_experience_of_fiat_withdrawal_from_ftx_crypto/?utm_so...

more:

@phulm/ftx-banned-me-because-i-showed-it-was-a-shambles-44cae99906a1' target='_blank'>medium.com/@phulm/ftx-banned-me-because-i-showed-it-was-a-shambles-44cae99906a1

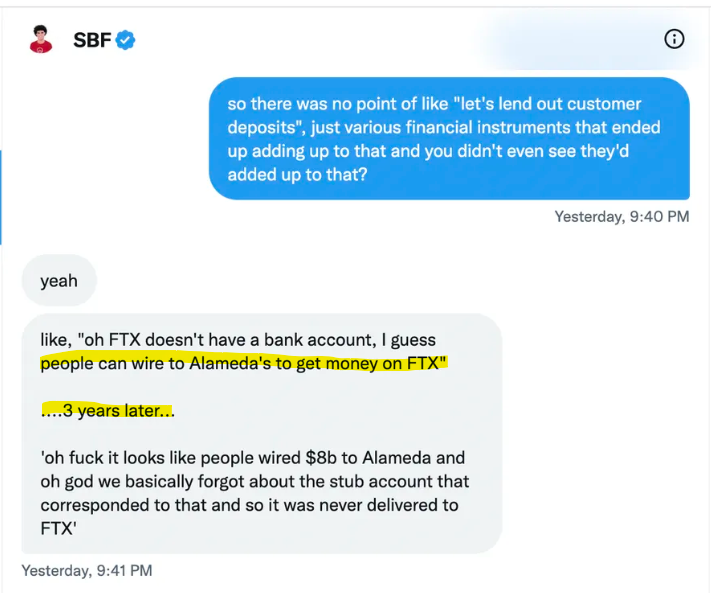

Moreover, @SBF_FTX basically confirmed this yesterday - "people can wire money to Alameda to get money on FTX"

@phulm/ftx-banned-me-because-i-showed-it-was-a-shambles-44cae99906a1' target='_blank'>medium.com/@phulm/ftx-banned-me-because-i-showed-it-was-a-shambles-44cae99906a1

Moreover, @SBF_FTX basically confirmed this yesterday - "people can wire money to Alameda to get money on FTX"

(Note: It does appear in early 2022, they did setup an FTX Digital Markets, LTD account, which was a sub of FTX Trading)

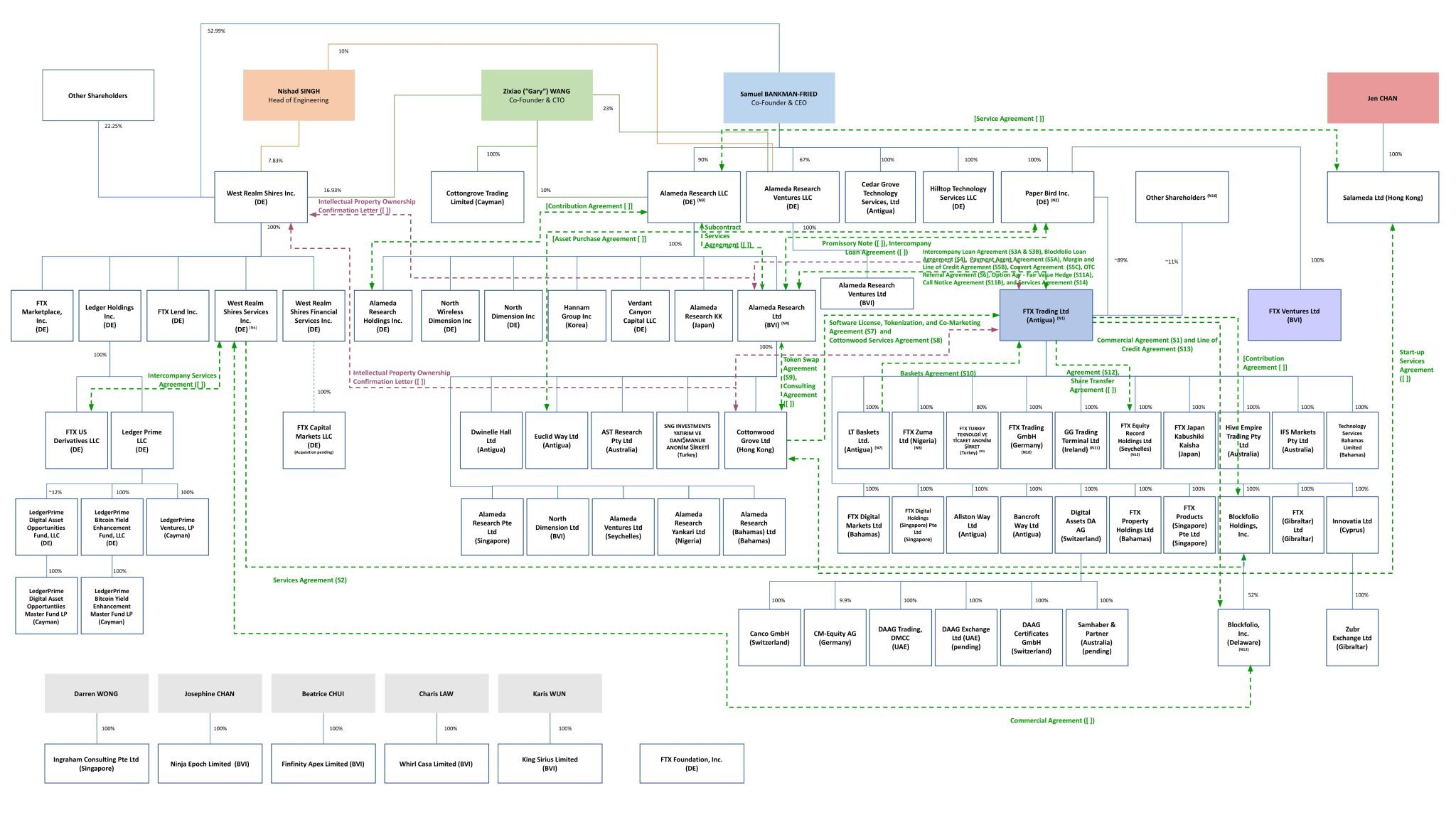

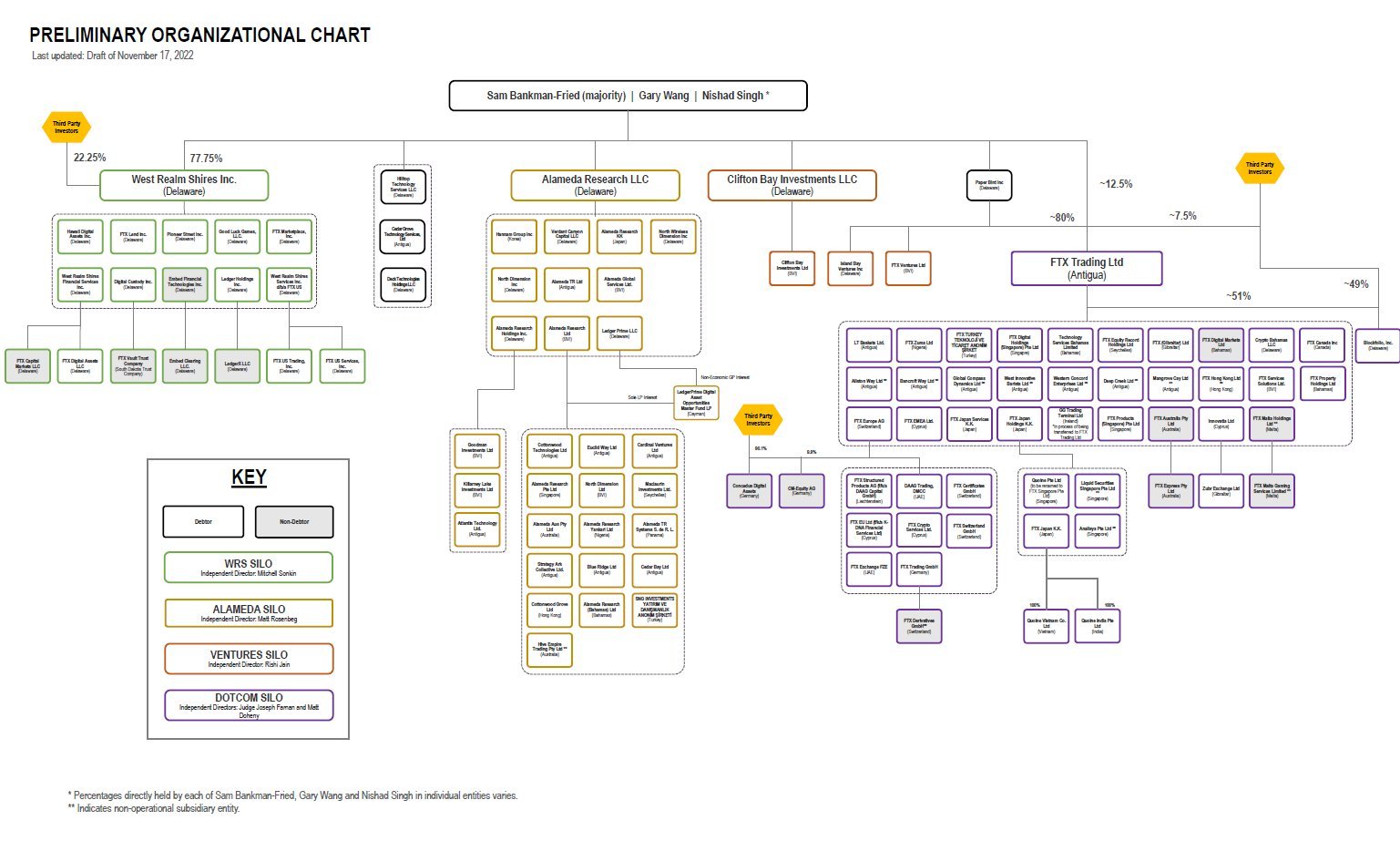

But maybe this is ok, right? Alameda and North Dimension could be subsidiary of FTX. Nope? Both structure charts provided by @SBF_FTX and new court appointed CEO John Ray show Alameda was a completely seperate company. The only commonality was SBF owned majority of both

This is a big problem for $SI who under KYC rules were required to know that Alameda and North Dimension were NOT FTX.com / FTX Trading Ltd. They were seperate companies. Yet, they were facilitating customers depositing into FTX.com thru Alameda.

And because these were $SI bank accounts, they had to see all the transfers out from Alameda to FTX and SBF. Huge red flags should have gone off. Regulators will undoubetdly start with $SI in following the cash.

Further, the wording $SI choose in its press release on exposure to "FTX and its related entities (“FTX”)" seems purposely broad. What do they mean by "related"

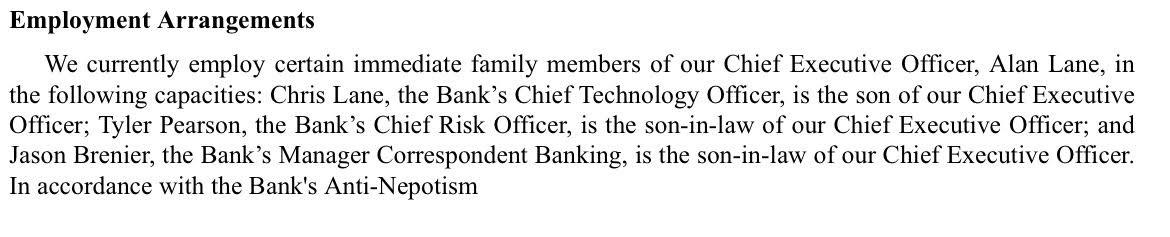

So what did $SI's risk and compliance department look like. Well, total shocker here - It was the CEO's son and son in law. The son-in-law was then replaced as chief risk officer two days after the FTX blowup

This is a big deal. Its like trying to send money to Amazon.com but Silvergate allowed you to send it to Blue Origin instead because Jeff Bezos owns both. Now you try and get your money back from Amazon, and they don't have it because...they never got it

Silvergate should have NEVER been taking FTX customer deposits into Alameda, a legally seperate company. Why would Silvergate ever enable this?

The easy answer is the deposit growth was so massive and attractive they just ignored KYC and AML requirements. Also, possible they were concerned about do biz w/ FTX directly, as it was banned in the US. So Alameda was way around that

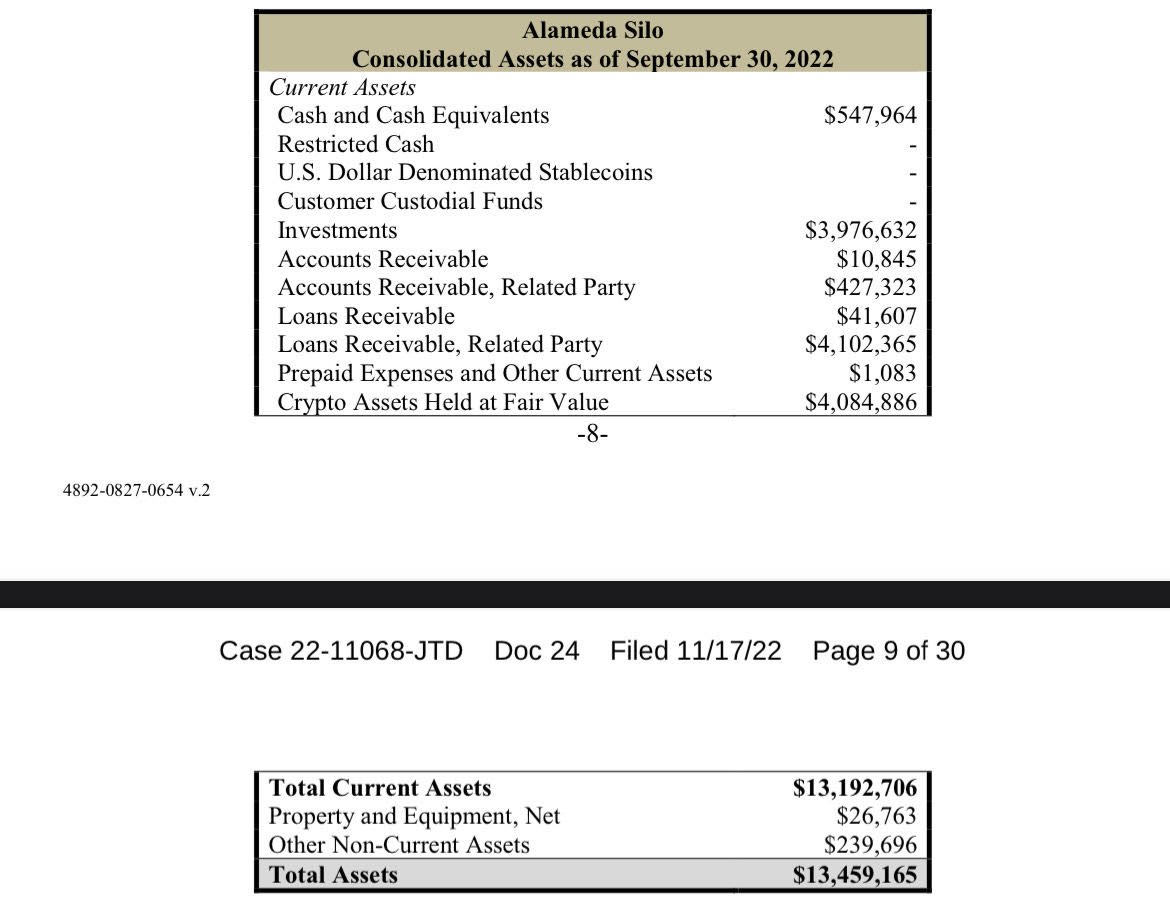

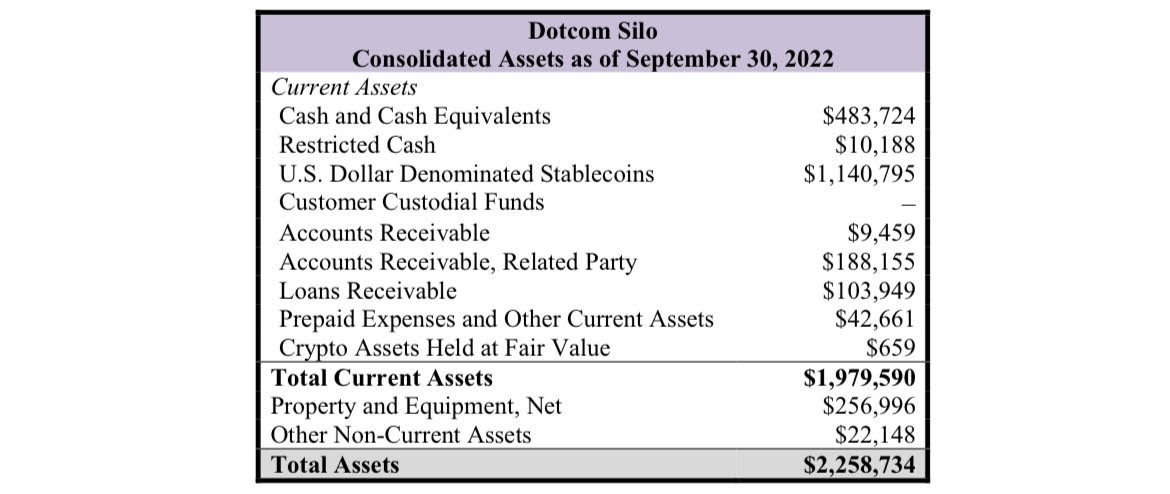

Lastly, to the ~$1bn of cash deposits of "FTX and its related entites" at Silvergate. Well new CEO John Ray identified ~$1bn of cash at the FTX and Alameda silos suggesting FTX was the only bank to these entites.

Mentions

See All

Preston Pysh @PrestonPysh

·

Nov 18, 2022

Here’s a thread worth reading…